Global Luxury Goods Market Overview

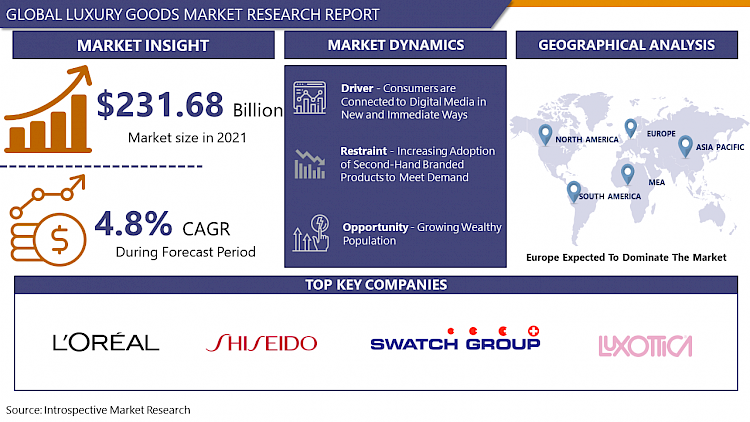

Luxury Goods Market size is projected to reach USD 321.68 Billion by 2028 from an estimated USD 231.68 Billion in 2021, growing at a CAGR of 4.8% globally.

In terms of price and quality, luxury goods are high-end items. For the most part, these items are seen as status symbols for individuals. For many years, the value of the global luxury goods business, which includes cars, jets, drinks, fashion, cosmetics, fragrances, jewelry, and handbags, has risen. Although the technical term 'luxury good' is unrelated to the quality of the items, they are often thought to be those at the top of the market in terms of both quality and price. Personal luxury goods, the second most lucrative sector, increased steadily until 2020 when the COVID-19 pandemic caused a dramatic drop.

The majority of luxury goods are sold through mono-brand boutiques, such as Tiffany & Co.'s flagship store, which was made famous in part by the classic Hollywood film Breakfast at Tiffany's. Monobrand retailers brought in the greatest money of any channel, with over 67 billion dollars. The luxury group LVMH, which encompasses companies including beverage manufacturer Mot Hennessy and fashion business Louis Vuitton, had the greatest sales. Louis Vuitton is the most valuable luxury brand in the world, with a market capitalization of about $75.7 billion in 2021. The personal luxury goods sector would be incomplete without the brand. Another important participant in this area is the Kering Group, which had revenues of almost 13 billion dollars in 2020, the majority of which came from its well-known brand Gucci. Accessories are an important aspect of any fashionable ensemble and a major market within the personal luxury goods business. The most common accessory selections are necklaces and rings. Mechanical watches, which are highly appreciated for their artistry and status, dominate the luxury watch market.

Covid-19 Impact On Luxury Goods Market

Low-income people are frequently wary of spending money on unnecessary products. Luxury items, because they are non-essential, had a drop-in demand during the epidemic, as individuals struggled to buy necessities. In the year 2020, changes in the working groups' income levels were caused by job losses and salary reductions. Similarly, stay-at-home orders reduced the necessity for such high-end items. Several fashion-related events and festivities were also canceled or postponed as a result of the lockdown, affecting demand for these goods. Furthermore, the cancellation of tours and trips had a detrimental influence on the purchase of such things while traveling, such as those purchased in duty-free stores at airports or on cruise ships. For example, according to LVMH's financial results for the first half of 2020, revenue creation from all luxury goods categories dropped in 2020 as a result of the pandemic. According to the same source, revenue from the fragrances and cosmetics segment fell by roughly 29% in the first half of 2020 compared to the same period last year, while revenue from the watches and jewelry segment fell by 38%. Due to the closure of retail outlets, however, it reported that online sales received excellent feedback from customers. As a result, the global personal luxury goods industry is expected to regain momentum through online channels shortly, with the removal of lockdown limitations boosting market growth even further.

Market Dynamics And Key Factors For Luxury Goods Market

Drivers:

The Importance of Emerging Markets

Consumer spending is rising in luxury markets such as China, Russia, and the United Arab Emirates is driving expansion in both the luxury and cosmetics sectors. This is especially true in the cosmetics business, where emerging markets are expected to account for 50% of personal care sales by 2020. Tourism in the United Arab Emirates has climbed by 7.96 percent over the last few years, according to World Bank data. The tourism industry's continued expansion can be ascribed to the continued growth of the Emirati luxury goods sector. Given the restricted overseas travel possibilities, Chinese consumers have continued to purchase largely on the mainland, according to Bain & Company. This resulted in a 48 percent growth in domestic sales of personal luxury items in 2020, and a further 36 percent increase in 2021, reaching roughly RMB 471 billion, a near-doubling in only two years.

Consumers Are Connected to Digital Media in New and Immediate Ways

Traditional media has given way to digital communication, which now includes more instantaneous ways of engaging that put the customer and the community at the center. More than 60% of purchases are affected by digital, and more than 70% of consumers interact with their favorite companies via social media. Luxury brands can leverage digital to amplify their vision and message, as well as build a personal relationship with their customers.

Restraints:

Increasing Adoption of Second-Hand Branded Products to Meet Demand

Because second-hand branded items are offered at a cheaper cost than the original price of the product, an expanding trend of acquiring second-hand branded products or renting luxury goods is expected to stifle the market for original luxury goods. Similarly, the growing counterfeiting tendency, in which products that look like premium brands are sold for less, is expected to limit the market growth.

Opportunities:

The objective and the Dynamics

The pandemic has permanently altered our purchasing habits. People have increasingly decided to consume less, but better, since consumption has shrunk considerably, particularly at the start of 2020. This necessitates the purchase of higher-quality, longer-lasting goods. As a result, the post-covid luxury market is projected to emerge from the crisis with greater purpose and dynamism. "In this new, larger area, winning brands will be those that build on their existing greatness while rethinking the future with an insurgent spirit," according to Bain & Company. Luxury players will need to think outside the box to rewrite the rules of the game, transforming their operations and redefining their purpose to meet new customer demands and stay relevant, particularly for younger generations, who are expected to drive 180 percent of the market's growth from 2019 to 2025.

Market Segmentation

Segmentation Analysis of Luxury Goods Market:

By Product Type, the clothing and footwear segment is anticipated to dominate the market for luxury goods over the forecast period. In FY 2019-2020, the number of high-performing enterprises in the top 100 surged, with double-digit YoY luxury goods sales growth and double-digit net profit margins. High performers made up four of the top eleven companies. There were four multi-luxury goods corporations, each with revenues of more than $5 billion in luxury goods. Clothing and footwear are well-represented among the top performers, with four primarily smaller firms cutting. The headquarters of half of the high-performing corporations were in France, with their operations based in the United Kingdom. Due to rising demand from both men and women end-users, as well as continuously changing fashion trends, the clothing market is likely to keep a significant position.

By End-User, the women segment is anticipated to dominate the luxury goods market over the forecast period. Women are the primary purchasers of luxury goods such as cosmetics, fragrances, handbags, necklaces, earrings, and bracelets, making them a significant market sector. Emerging male grooming trends, on the other hand, will help the men's segment flourish, as branded shirts, goggles, and high-end watches will be in higher demand. As a result, many companies are focusing on introducing goods that can meet the diverse needs of both end-users. For example, in January 2020, OMEGA debuted a new premium eyewear line that included a variety of sunglasses ideal for both men and women.

By Distribution Channel, the online segment is expected to register a significant growth rate over the forecast period. E-commerce is becoming a reality as digital adoption rises, redefining the consumer journey to purchase, shaping new user interactions, altering business models, and opening up new development opportunities for single and multi-brand luxury goods retailers across the country. Businesses are following their clients online, resulting in the gradual development of the digital ecosystem. Customers have had easy access to product-related information and costs, which has contributed to the luxury goods market's overall expansion.

Regional Analysis of Luxury Goods Market:

Europe region is anticipated to dominate the market over the forecast period. The industry in Europe is primarily driven by the presence of several luxury retail brands ranging from fashion garments to cosmetics. The increased desire for high-end clothing, accessories, footwear and other luxury items at reasonable costs is boosting the luxury goods sector in Europe even further. Furthermore, the growing popularity of limited capsule collections and fashion drops has generated scarcity for premium items, which has boosted demand for used luxury goods. Aside from that, the industry is being boosted by the changing socio-economic culture across Europe, as well as the decreasing stigma associated with buying used items. Similarly, because Europe is a fashion hotspot, a huge number of luxury fashion weeks are hosted in countries like Italy, France, and the United Kingdom, which is anticipated to boost market growth even more.

The tourist industry's continued expansion can be ascribed to the continued growth of the luxury goods sector in North America. Visitors to the country are typically from well-to-do families who frequently purchase luxury goods from outlets of various global brands. The millennial generation accounts for the majority of customers, as these individuals are heavily influenced by fashion. Because North America is an economically powerful market, prominent international brands frequently debut their premium items earlier in this region than in many other parts of the world. Tourists frequently come across items that are synonymous with North America, such as perfumes and leather goods. In the country, for example, the luxury goods brand Gucci has a product selection that includes more than 29 perfume varieties. As the country's tourism industry grows, the luxury goods market is expected to thrive, providing considerable potential for businesses to bring their items to the local market.

Since the region's middle-class population has more discretionary income, the Asia Pacific market is expected to rise quickly. Similarly, higher product consumption would result from expanded access to global luxury brands. For example, in July 2020, Burberry, a British luxury goods firm, announced the opening of its first social retail store in Shenzhen, China, in collaboration with Tencent. The store is approximately 539 sqm/5800 sqft in size, with ten rooms offering a variety of interactive and personalized retailing experiences. With their increased discretionary income, a growing number of working women in the region have accelerated the consumption of women-centric luxury items such as handbags, high-end footwear, and jewelry products.

Over the forecast period, the UAE will be the driving force behind the expansion of the luxury goods industry. The United Arab Emirates is one of the most visited countries in the world, and the tourist industry is booming thanks to the assistance of the country's regulatory organizations. Tourism in the United Arab Emirates has climbed by 7.96 percent over the last few years, according to World Bank data. The tourism industry's continued expansion can be ascribed to the continued growth of the Emirati luxury goods sector.

The Latin American market is expected to increase steadily as the urban population in nations like Brazil and Chile grows. As a result, changes in the region's standard of living are likely to boost consumer spending on luxury brands.

Players Covered In Luxury Goods Market are:

- LVMH Moët Hennessy-Louis Vuitton SA (France)

- Compagnie Financière Richemont SA (Switzerland)

- Kering SA (France)

- Chow Tai Fook Jewellery Group Limited (Hong Kong)

- The Estée Lauder Companies Inc. (U.S.)

- Luxottica Group SpA (Italy)

- The Swatch Group Ltd. (Switzerland)

- L’Oréal Group (France)

- Ralph Lauren Corporation (U.S.)

- Shiseido Company Limited (Japan) and other major players.

Key Industry Developments In Luxury Goods Market

- In April 2021, Rolex's Oyster Perpetual collection now includes a new Day-Date, Datejust, Lade-Datejust, Cosmograph Daytona, and Explorer. Each product is distinct and has its own set of design and usability measurements.

- In 2020, Gucci used AR virtual platforms in their relationship with Snapchat, allowing customers to virtually test on Gucci shoes using Snapchat filters. The Gucci/Snapchat campaign, which is available in the United Arab Emirates, Saudi Arabia, the United Kingdom, the United States, France, Italy, Australia, and Japan, illustrates the potential of AR for various e-commerce applications.

- In October 2020, LVMH declare to acquire Tiffany & Co. for USD 131.50 per share in cash. This acquisition is anticipated to strengthen the portfolio of the luxury jewelry section of LVMH.

|

Global Luxury Goods Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 231.68 Bn. |

|

Forecast Period 2022-28 CAGR: |

4.8% |

Market Size in 2028: |

USD 321.68 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By End-Users |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product Type

3.2 By End User

3.3 By Distribution Channel

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Luxury Goods Market by Product Type

5.1 Luxury Goods Market Overview Snapshot and Growth Engine

5.2 Luxury Goods Market Overview

5.3 Clothing & Footwear

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Clothing & Footwear: Grographic Segmentation

5.4 Watches & Jewelry

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Watches & Jewelry: Grographic Segmentation

5.5 Beverages

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Beverages: Grographic Segmentation

5.6 Perfumes & Cosmetics

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Perfumes & Cosmetics: Grographic Segmentation

5.7 Bags/Purses

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Bags/Purses: Grographic Segmentation

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size (2016-2028F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Grographic Segmentation

Chapter 6: Luxury Goods Market by End User

6.1 Luxury Goods Market Overview Snapshot and Growth Engine

6.2 Luxury Goods Market Overview

6.3 Men

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Men: Grographic Segmentation

6.4 Women

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Women: Grographic Segmentation

Chapter 7: Luxury Goods Market by Distribution Channel

7.1 Luxury Goods Market Overview Snapshot and Growth Engine

7.2 Luxury Goods Market Overview

7.3 Offline

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Offline: Grographic Segmentation

7.4 Online

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Online: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Luxury Goods Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Luxury Goods Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Luxury Goods Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 LVMH MOËT HENNESSY-LOUIS VUITTON SA

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 COMPAGNIE FINANCIÈRE RICHEMONT SA

8.4 KERING SA

8.5 CHOW TAI FOOK JEWELLERY GROUP LIMITED

8.6 THE ESTÉE LAUDER COMPANIES INC.

8.7 LUXOTTICA GROUP SPA

8.8 THE SWATCH GROUP LTD.

8.9 L’ORÉAL GROUP

8.10 RALPH LAUREN CORPORATION

8.11 SHISEIDO COMPANY LIMITED

8.12 OTHER MAJOR PLAYERS

Chapter 9: Global Luxury Goods Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Product Type

9.2.1 Clothing & Footwear

9.2.2 Watches & Jewelry

9.2.3 Beverages

9.2.4 Perfumes & Cosmetics

9.2.5 Bags/Purses

9.2.6 Others

9.3 Historic and Forecasted Market Size By End User

9.3.1 Men

9.3.2 Women

9.4 Historic and Forecasted Market Size By Distribution Channel

9.4.1 Offline

9.4.2 Online

Chapter 10: North America Luxury Goods Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Product Type

10.4.1 Clothing & Footwear

10.4.2 Watches & Jewelry

10.4.3 Beverages

10.4.4 Perfumes & Cosmetics

10.4.5 Bags/Purses

10.4.6 Others

10.5 Historic and Forecasted Market Size By End User

10.5.1 Men

10.5.2 Women

10.6 Historic and Forecasted Market Size By Distribution Channel

10.6.1 Offline

10.6.2 Online

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Luxury Goods Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product Type

11.4.1 Clothing & Footwear

11.4.2 Watches & Jewelry

11.4.3 Beverages

11.4.4 Perfumes & Cosmetics

11.4.5 Bags/Purses

11.4.6 Others

11.5 Historic and Forecasted Market Size By End User

11.5.1 Men

11.5.2 Women

11.6 Historic and Forecasted Market Size By Distribution Channel

11.6.1 Offline

11.6.2 Online

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Luxury Goods Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product Type

12.4.1 Clothing & Footwear

12.4.2 Watches & Jewelry

12.4.3 Beverages

12.4.4 Perfumes & Cosmetics

12.4.5 Bags/Purses

12.4.6 Others

12.5 Historic and Forecasted Market Size By End User

12.5.1 Men

12.5.2 Women

12.6 Historic and Forecasted Market Size By Distribution Channel

12.6.1 Offline

12.6.2 Online

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Luxury Goods Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product Type

13.4.1 Clothing & Footwear

13.4.2 Watches & Jewelry

13.4.3 Beverages

13.4.4 Perfumes & Cosmetics

13.4.5 Bags/Purses

13.4.6 Others

13.5 Historic and Forecasted Market Size By End User

13.5.1 Men

13.5.2 Women

13.6 Historic and Forecasted Market Size By Distribution Channel

13.6.1 Offline

13.6.2 Online

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Luxury Goods Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Product Type

14.4.1 Clothing & Footwear

14.4.2 Watches & Jewelry

14.4.3 Beverages

14.4.4 Perfumes & Cosmetics

14.4.5 Bags/Purses

14.4.6 Others

14.5 Historic and Forecasted Market Size By End User

14.5.1 Men

14.5.2 Women

14.6 Historic and Forecasted Market Size By Distribution Channel

14.6.1 Offline

14.6.2 Online

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Luxury Goods Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 231.68 Bn. |

|

Forecast Period 2022-28 CAGR: |

4.8% |

Market Size in 2028: |

USD 321.68 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By End-Users |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. LUXURY GOODS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. LUXURY GOODS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. LUXURY GOODS MARKET COMPETITIVE RIVALRY

TABLE 005. LUXURY GOODS MARKET THREAT OF NEW ENTRANTS

TABLE 006. LUXURY GOODS MARKET THREAT OF SUBSTITUTES

TABLE 007. LUXURY GOODS MARKET BY PRODUCT TYPE

TABLE 008. CLOTHING & FOOTWEAR MARKET OVERVIEW (2016-2028)

TABLE 009. WATCHES & JEWELRY MARKET OVERVIEW (2016-2028)

TABLE 010. BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 011. PERFUMES & COSMETICS MARKET OVERVIEW (2016-2028)

TABLE 012. BAGS/PURSES MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. LUXURY GOODS MARKET BY END USER

TABLE 015. MEN MARKET OVERVIEW (2016-2028)

TABLE 016. WOMEN MARKET OVERVIEW (2016-2028)

TABLE 017. LUXURY GOODS MARKET BY DISTRIBUTION CHANNEL

TABLE 018. OFFLINE MARKET OVERVIEW (2016-2028)

TABLE 019. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA LUXURY GOODS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 021. NORTH AMERICA LUXURY GOODS MARKET, BY END USER (2016-2028)

TABLE 022. NORTH AMERICA LUXURY GOODS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 023. N LUXURY GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE LUXURY GOODS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 025. EUROPE LUXURY GOODS MARKET, BY END USER (2016-2028)

TABLE 026. EUROPE LUXURY GOODS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 027. LUXURY GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC LUXURY GOODS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 029. ASIA PACIFIC LUXURY GOODS MARKET, BY END USER (2016-2028)

TABLE 030. ASIA PACIFIC LUXURY GOODS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 031. LUXURY GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA LUXURY GOODS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA LUXURY GOODS MARKET, BY END USER (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA LUXURY GOODS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 035. LUXURY GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA LUXURY GOODS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 037. SOUTH AMERICA LUXURY GOODS MARKET, BY END USER (2016-2028)

TABLE 038. SOUTH AMERICA LUXURY GOODS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 039. LUXURY GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 040. LVMH MOËT HENNESSY-LOUIS VUITTON SA: SNAPSHOT

TABLE 041. LVMH MOËT HENNESSY-LOUIS VUITTON SA: BUSINESS PERFORMANCE

TABLE 042. LVMH MOËT HENNESSY-LOUIS VUITTON SA: PRODUCT PORTFOLIO

TABLE 043. LVMH MOËT HENNESSY-LOUIS VUITTON SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. COMPAGNIE FINANCIÈRE RICHEMONT SA: SNAPSHOT

TABLE 044. COMPAGNIE FINANCIÈRE RICHEMONT SA: BUSINESS PERFORMANCE

TABLE 045. COMPAGNIE FINANCIÈRE RICHEMONT SA: PRODUCT PORTFOLIO

TABLE 046. COMPAGNIE FINANCIÈRE RICHEMONT SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. KERING SA: SNAPSHOT

TABLE 047. KERING SA: BUSINESS PERFORMANCE

TABLE 048. KERING SA: PRODUCT PORTFOLIO

TABLE 049. KERING SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. CHOW TAI FOOK JEWELLERY GROUP LIMITED: SNAPSHOT

TABLE 050. CHOW TAI FOOK JEWELLERY GROUP LIMITED: BUSINESS PERFORMANCE

TABLE 051. CHOW TAI FOOK JEWELLERY GROUP LIMITED: PRODUCT PORTFOLIO

TABLE 052. CHOW TAI FOOK JEWELLERY GROUP LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. THE ESTÉE LAUDER COMPANIES INC.: SNAPSHOT

TABLE 053. THE ESTÉE LAUDER COMPANIES INC.: BUSINESS PERFORMANCE

TABLE 054. THE ESTÉE LAUDER COMPANIES INC.: PRODUCT PORTFOLIO

TABLE 055. THE ESTÉE LAUDER COMPANIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. LUXOTTICA GROUP SPA: SNAPSHOT

TABLE 056. LUXOTTICA GROUP SPA: BUSINESS PERFORMANCE

TABLE 057. LUXOTTICA GROUP SPA: PRODUCT PORTFOLIO

TABLE 058. LUXOTTICA GROUP SPA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. THE SWATCH GROUP LTD.: SNAPSHOT

TABLE 059. THE SWATCH GROUP LTD.: BUSINESS PERFORMANCE

TABLE 060. THE SWATCH GROUP LTD.: PRODUCT PORTFOLIO

TABLE 061. THE SWATCH GROUP LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. L’ORÉAL GROUP: SNAPSHOT

TABLE 062. L’ORÉAL GROUP: BUSINESS PERFORMANCE

TABLE 063. L’ORÉAL GROUP: PRODUCT PORTFOLIO

TABLE 064. L’ORÉAL GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. RALPH LAUREN CORPORATION: SNAPSHOT

TABLE 065. RALPH LAUREN CORPORATION: BUSINESS PERFORMANCE

TABLE 066. RALPH LAUREN CORPORATION: PRODUCT PORTFOLIO

TABLE 067. RALPH LAUREN CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. SHISEIDO COMPANY LIMITED: SNAPSHOT

TABLE 068. SHISEIDO COMPANY LIMITED: BUSINESS PERFORMANCE

TABLE 069. SHISEIDO COMPANY LIMITED: PRODUCT PORTFOLIO

TABLE 070. SHISEIDO COMPANY LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 071. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 072. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 073. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. LUXURY GOODS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. LUXURY GOODS MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. CLOTHING & FOOTWEAR MARKET OVERVIEW (2016-2028)

FIGURE 013. WATCHES & JEWELRY MARKET OVERVIEW (2016-2028)

FIGURE 014. BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 015. PERFUMES & COSMETICS MARKET OVERVIEW (2016-2028)

FIGURE 016. BAGS/PURSES MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. LUXURY GOODS MARKET OVERVIEW BY END USER

FIGURE 019. MEN MARKET OVERVIEW (2016-2028)

FIGURE 020. WOMEN MARKET OVERVIEW (2016-2028)

FIGURE 021. LUXURY GOODS MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 022. OFFLINE MARKET OVERVIEW (2016-2028)

FIGURE 023. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA LUXURY GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE LUXURY GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC LUXURY GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA LUXURY GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA LUXURY GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Luxury Goods Market research report is 2022-2028.

LVMH Moët Hennessy-Louis Vuitton SA (France), Compagnie Financière Richemont SA (Switzerland), Kering SA (France), Chow Tai Fook Jewellery Group Limited (Hong Kong), The Estée Lauder Companies Inc. (U.S.), Luxottica Group SpA (Italy), The Swatch Group Ltd. (Switzerland), L’Oréal Group (France), Ralph Lauren Corporation (U.S.), Shiseido Company Limited (Japan), and other major players.

The Luxury Goods Market is segmented into Product Type, End-Users, Distribution Channel, and region. By Product Type, the market is categorized into Clothing & Footwear, Watches & Jewelry, Beverages, Perfumes & Cosmetics, Bags/Purses, and Others. By End-Users, the market is categorized into Men, Women. By Distribution Channel, the market is categorized into Offline, Online. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

In terms of price and quality, luxury goods are high-end items. For the most part, these items are seen as status symbols for individuals. For many years, the value of the global luxury goods business, which includes cars, jets, drinks, fashion, cosmetics, fragrances, jewelry, and handbags, has risen. Although the technical term 'luxury good' is unrelated to the quality of the items, they are often thought to be those at the top of the market in terms of both quality and price.

Luxury Goods Market size is projected to reach USD 321.68 Billion by 2028 from an estimated USD 231.68 Billion in 2021, growing at a CAGR of 4.8% globally.