Global Leather Goods Market Overview

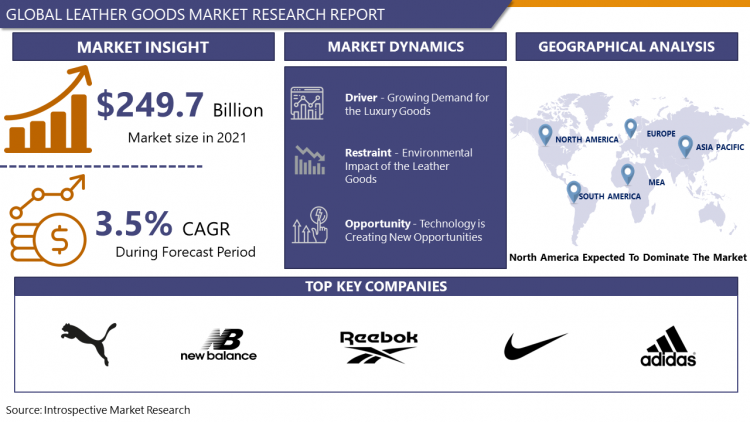

The Global Leather Goods Market size is expected to grow from USD 259.19 billion in 2022 to USD 349.30 billion by 2030, at a CAGR of 3.8% during the forecast period (2023-2030).

Leather is a tough, flexible, and long-lasting material made by chemically treating animal skins and hides to prevent decomposition. Cattle, sheep, goats, equestrian animals, buffalo, pigs and hogs, and aquatic creatures like seals and alligators are the most prevalent sources of leather. Leather is durable and may be used to produce a wide range of goods, including clothes, footwear, and purses, furniture, tools, and sports equipment. Leather has been made for over 7,000 years, and China and India are the world's biggest manufacturers of the material today. One of the primary elements driving up demand for leather items around the world is the growing population, which is combined with rising individual income levels. Furthermore, because these items are functional, pleasant, and cost-effective, they are gaining popularity around the world. Furthermore, to suit the need of affluent consumers, major manufacturers are creating innovative and stylish items. To provide variety and customized possibilities, they are incorporating new technology into their manufacturing process, such as the automated cutting process. The expanding automobile industry additionally provides attractive prospects for market players to broaden their customer base. Leather has a rich and illustrious history extending back hundreds of years. It's a $100 billion industry that manufactures leather hides and commodities all around the world. Cow, sheep, goat, and pig hides are the most common. Shoes, clothing, and upholstery are the most popular items.

Covid-19 Impact On Leather Goods Market

The COVID-19 pandemic has wreaked havoc on the leather industry as a whole, including footwear, apparel, and accessories. During the first two quarters of 2020, retailers suffered significant losses. According to a World Footwear analysis, footwear sales in the United States fell by about 32% after the first two quarters of 2020. Leather shoe sales are projected to suffer as a result of the low demand for footwear in general. Many of the market's producers have historically relied on China for finished goods as well as raw materials utilized in the production of various leather items. However, the pandemic has interrupted the supply chain, resulting in significant losses in product shipment and on-time delivery. Furthermore, COVID-19 protocols range from declaring national emergency states, enforcing stay-at-home orders, closing nonessential business operations and schools, banning public gatherings, imposing curfews, distributing digital passes, and allowing police to restrict citizen movements within a country, as well as closing international borders. With the growing vaccination rate, governments are uplifting the protocols to give a boost to the stagnant economy. Like other industries, Leather Goods Market has experienced slow down growth, however, the market is expected to bounce back as restrictions are being lifted by governments across the globe.

Market Dynamics And Factors For Leather Goods Market

Drivers:

Growing Demand for the Luxury Goods

The world's leading countries for leather goods manufacturing include China, India, Brazil, Vietnam, and Italy; some are more important for value-adding and luxury goods and others for sheer volume. The production of leather goods in Europe specifically is in a steady decline, but the countries that export the largest share are Italy, France, Belgium, and Spain. With the increase in disposable income of individuals, the demand for luxury goods has also increased. These goods often symbolize a sense of accomplishment within individuals, giving them higher self-esteem. Europeans and North Americans are known to spend most on luxury goods, owing to higher household income. An upward thrust can be seen in this matter in Asian regions as well. Leather goods form a major part of luxury goods. The luxury leather products include exclusive handbags, accessories, and shoes, which appeal to affluent individuals. In the case of the personal luxury segment, leather goods are the fastest-growing segment that attracts extravagant customers. In addition, A global shortage of leather is affecting all levels of the supply chain. Manufacturing costs are rising and margins are shrinking. As supply struggles to meet demand, costs are being passed on to consumers. One example is the luxury handbags segment, in which prices are extremely high. Many manufacturers are looking for lower-cost suppliers in developing countries. There is a growing interest among male consumers in leather fashion accessories such as 'man bags', bracelets, watch straps, and belts. The trend is most popular in the United Kingdom. A result of these factors is responsible for the growth of the market over the forecast period.

Restraints:

Environmental Impact of the Leather Goods

According to a case study published in Energy Procedia, the carbon footprint of bovine leather ranges between 65 to 150 kg CO2 per square meter. Considering that there are more than 2 billion square meters of leather produced each year, which is a devastatingly huge economic footprint. The leather industry is one of the most polluting industries. Leather processing is responsible for an unfavorable impact on the environment. The global production of leather is about 24bn m2 which presents a substantial challenge to the leather industry. The tannery effluent produces a high amount of dissolved and suspended organic and inorganic solids that are giving rise to high oxygen requirements. The unbearable smell generated from waste material and the presence of sulfide, ammonia, and other volatile compounds are associated with leather processing activities. Solid waste produced in the leather industry includes animal skin trims, animal hairs, flesh wastes, buffing dust, and keratin wastes. All of these wastes contain protein as their main component. If this protein is not utilized properly, it will responsible for dangerous pollution problems to the environment.

Opportunities:

Technology is Creating New Opportunities

Leather manufacturers are investing in advanced automated machinery and operation systems to streamline the production process and to make it faster and cheaper. Advanced processing techniques in leather manufacturing, such as digital cutting, more complex designs, or blending with textile fabrics (e.g. silk leather) are increasing the popularity and the versatility of leather consumer goods. These technologies are paving the way for new and more complex designs, more fashionable colors, and finer quality. Improved durability, softness, lightness, and smoothness have made leather garments suitable for all seasons.

Market Segmentation

Segmentation Analysis of Leather Goods Market:

By Type, the footwear segment is anticipated to register the maximum leather goods market growth rate over the forecast period. Nike, New Balance, Adidas, Puma, Reebok, Allbirds, and Converse are among the major athletic footwear brands that have ventured into leather athletic manufacturing in response to rising consumer demand for leather sports footwear. In 2017, Nike, Inc. introduced fly leather sneakers, a new material created by blending discarded leather scraps from tanneries with a polyester blend.

By Distribution Channel, the online sales channel segment is anticipated to grow with a significant growth rate over the forecast period. Due to the growing popularity of e-commerce sites, the online sales platform, which now holds a modest part of the market, is predicted to rise significantly throughout the analysis period.

Regional Analysis of Leather Goods Market:

In the worldwide leather trade, Europe is a major player. The European leather and associated goods business employs around 36,000 people and generates €48 billion in revenue. In the worldwide marketplace, the EU tanning sector is the world's largest provider of leather. In terms of leather and raw material, the EU produces some of the most valuable calfskins. According to the ministry of foreign affairs, Europe is a significant market for leather fashion accessories, with a total import value of €8.6 billion and a 5-year average growth of 7.5 percent. Carrying products are the most popular product category, followed by belts. Handbags and wallets are the most popular items in the carrying products category, with travel bags growing at the quickest rate of 15.5 percent per year. The most specialized import markets with the highest unit pricing are France and Italy. Germany, the United Kingdom, the Netherlands, and Spain are all major European leather accessory markets.

Due to increased technical innovation and promotion of the fashion industry, Asia Pacific is expected to be the second most dominant and fastest developing region. As technology advances, more people are using high-speed internet and smartphones, resulting in increased consumption of online advertisements, which in turn drives up demand for leather goods made in this region. The Indian leather industry produces around 12.93 percent of the world's hides and skins. India's leather industry has transformed from a mere provider of raw materials to a value-added product exporter. In 2019-20, India's total leather and leather products exports totaled $5.07 billion. Increased promotion of fashion events such as fashion weeks, Asia Fashion Fair, Bridal Asia, and others are also helping to boost the business in this region.

The market in North America is likely to develop at a substantial rate due to rising product popularity coupled with increasing online purchases, a growing number of athletes, and health and fitness-conscious individuals, all of which are expected to fuel market expansion throughout the forecast period. According to Statista, about half of consumers in North America made numerous purchases of luxury leather products (e.g. handbags, wallets, briefcases) in the third quarter of 2021, based on the results of a recent survey conducted among wealthy and high net worth individuals. In the same quarter, another 30.3 percent of shoppers made a single purchase of premium leather products. In North America, the percentage of luxury buyers who made numerous purchases of luxury leather products declined somewhat between the fourth quarter of 2020 and the third quarter of 2021.

During the projection period, the leather goods market in the Middle East and Africa grew steadily. Vamp leather is used by enterprises in Saudi Arabia, such as Saudi Leather Industries Company, which specializes in all leather product categories and offers a large choice of leather footwear and other safety shoes. Because of their great spending capacity and long-term need for these products that reflect their social position, consumers in the region prefer luxury goods to normal ones.

Brazil and Argentina are home to the world's greatest cow herds. Because of the nature of the raw ingredients, Latin American leathers are more roughhewn. Year after year, the luxury market in Latin America grows, frequently despite the shaky economics of some of the continent's countries, underlining the continent's importance to luxury. Despite a large number of prospective buyers, Latin countries have not made significant efforts to become luxury goods producers until recently. The numbers of local brands are now rising, presenting products with a Latin essence efficient of competing with luxury giants worldwide.

Players Covered In Leather Goods Market are:

- Adidas AG

- Nike Inc.

- Puma SE

- Fila Inc.

- New Balance Athletics Inc.

- Knoll Inc.

- Samsonite International S.A.

- VIP Industries Ltd.

- Timberland LLC

- Johnston & Murphy

- Woodland Worldwide

- Hermès International S.A.

- Louis Vuitton Malletier

- VF Corp.

- COLLAR Company

- LUCRIN Geneva

- Nappa Dori

- Saddles India Pvt. Ltd.

- Lear Corp and other major players.

Key Industry Developments In Leather Goods Market

- In October 2021, Révolutionnaire by Roots is the latest collaboration between Roots, a purpose-driven outdoor lifestyle brand with nearly 50 years of experience, and Révolutionnaire, a mission-based organization focusing on inclusivity and social justice. The "Dreams Fuel Revolutions" t-shirt kicked off the year-long cooperation in February 2021, and it continues with a line of luxury fleece in six colors, as well as limited edition leather jackets and bags.

- In March 2022, MaheTri is a luxury leather products brand originating in Rajasthan that has grown to appeal to a global audience. Through its E-commerce channels, the corporation operates all over the world. This brand showcases Indian workmanship by combining natural leather with innovative detail-oriented designs. Mahendra Singh and Trishal Lohar founded the enterprise in Udaipur, the magnificent city of lakes.

|

Global Leather Goods Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 259.19 Bn. |

|

Forecast Period 2023-30 CAGR: |

3.8 % |

Market Size in 2030: |

USD 349.30 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Distribution Channel

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Leather Goods Market by Type

5.1 Leather Goods Market Overview Snapshot and Growth Engine

5.2 Leather Goods Market Overview

5.3 Footwear

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Footwear: Grographic Segmentation

5.4 Luggage

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Luggage: Grographic Segmentation

5.5 Accessories

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Accessories: Grographic Segmentation

Chapter 6: Leather Goods Market by Distribution Channel

6.1 Leather Goods Market Overview Snapshot and Growth Engine

6.2 Leather Goods Market Overview

6.3 Offline

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Offline: Grographic Segmentation

6.4 Online

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Online: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Leather Goods Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Leather Goods Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Leather Goods Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 ADIDAS AG

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 NIKE INC.

7.4 PUMA SE

7.5 FILA INC.

7.6 NEW BALANCE ATHLETICS INC.

7.7 KNOLL INC.

7.8 SAMSONITE INTERNATIONAL S.A.

7.9 VIP INDUSTRIES LTD.

7.10 TIMBERLAND LLC

7.11 JOHNSTON & MURPHY

7.12 WOODLAND WORLDWIDE

7.13 HERMÈS INTERNATIONAL S.A.

7.14 LOUIS VUITTON MALLETIER

7.15 VF CORP.

7.16 COLLAR COMPANY

7.17 LUCRIN GENEVA

7.18 NAPPA DORI

7.19 SADDLES INDIA PVT. LTD.

7.20 LEAR CORP

7.21 OTHER MAJOR PLAYERS

Chapter 8: Global Leather Goods Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Footwear

8.2.2 Luggage

8.2.3 Accessories

8.3 Historic and Forecasted Market Size By Distribution Channel

8.3.1 Offline

8.3.2 Online

Chapter 9: North America Leather Goods Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Footwear

9.4.2 Luggage

9.4.3 Accessories

9.5 Historic and Forecasted Market Size By Distribution Channel

9.5.1 Offline

9.5.2 Online

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Leather Goods Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Footwear

10.4.2 Luggage

10.4.3 Accessories

10.5 Historic and Forecasted Market Size By Distribution Channel

10.5.1 Offline

10.5.2 Online

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Leather Goods Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Footwear

11.4.2 Luggage

11.4.3 Accessories

11.5 Historic and Forecasted Market Size By Distribution Channel

11.5.1 Offline

11.5.2 Online

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Leather Goods Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Footwear

12.4.2 Luggage

12.4.3 Accessories

12.5 Historic and Forecasted Market Size By Distribution Channel

12.5.1 Offline

12.5.2 Online

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Leather Goods Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Footwear

13.4.2 Luggage

13.4.3 Accessories

13.5 Historic and Forecasted Market Size By Distribution Channel

13.5.1 Offline

13.5.2 Online

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Leather Goods Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 259.19 Bn. |

|

Forecast Period 2023-30 CAGR: |

3.8 % |

Market Size in 2030: |

USD 349.30 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. LEATHER GOODS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. LEATHER GOODS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. LEATHER GOODS MARKET COMPETITIVE RIVALRY

TABLE 005. LEATHER GOODS MARKET THREAT OF NEW ENTRANTS

TABLE 006. LEATHER GOODS MARKET THREAT OF SUBSTITUTES

TABLE 007. LEATHER GOODS MARKET BY TYPE

TABLE 008. FOOTWEAR MARKET OVERVIEW (2016-2028)

TABLE 009. LUGGAGE MARKET OVERVIEW (2016-2028)

TABLE 010. ACCESSORIES MARKET OVERVIEW (2016-2028)

TABLE 011. LEATHER GOODS MARKET BY DISTRIBUTION CHANNEL

TABLE 012. OFFLINE MARKET OVERVIEW (2016-2028)

TABLE 013. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA LEATHER GOODS MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 016. N LEATHER GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE LEATHER GOODS MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 019. LEATHER GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC LEATHER GOODS MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 022. LEATHER GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA LEATHER GOODS MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 025. LEATHER GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA LEATHER GOODS MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 028. LEATHER GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 029. ADIDAS AG: SNAPSHOT

TABLE 030. ADIDAS AG: BUSINESS PERFORMANCE

TABLE 031. ADIDAS AG: PRODUCT PORTFOLIO

TABLE 032. ADIDAS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. NIKE INC.: SNAPSHOT

TABLE 033. NIKE INC.: BUSINESS PERFORMANCE

TABLE 034. NIKE INC.: PRODUCT PORTFOLIO

TABLE 035. NIKE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. PUMA SE: SNAPSHOT

TABLE 036. PUMA SE: BUSINESS PERFORMANCE

TABLE 037. PUMA SE: PRODUCT PORTFOLIO

TABLE 038. PUMA SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. FILA INC.: SNAPSHOT

TABLE 039. FILA INC.: BUSINESS PERFORMANCE

TABLE 040. FILA INC.: PRODUCT PORTFOLIO

TABLE 041. FILA INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. NEW BALANCE ATHLETICS INC.: SNAPSHOT

TABLE 042. NEW BALANCE ATHLETICS INC.: BUSINESS PERFORMANCE

TABLE 043. NEW BALANCE ATHLETICS INC.: PRODUCT PORTFOLIO

TABLE 044. NEW BALANCE ATHLETICS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. KNOLL INC.: SNAPSHOT

TABLE 045. KNOLL INC.: BUSINESS PERFORMANCE

TABLE 046. KNOLL INC.: PRODUCT PORTFOLIO

TABLE 047. KNOLL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. SAMSONITE INTERNATIONAL S.A.: SNAPSHOT

TABLE 048. SAMSONITE INTERNATIONAL S.A.: BUSINESS PERFORMANCE

TABLE 049. SAMSONITE INTERNATIONAL S.A.: PRODUCT PORTFOLIO

TABLE 050. SAMSONITE INTERNATIONAL S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. VIP INDUSTRIES LTD.: SNAPSHOT

TABLE 051. VIP INDUSTRIES LTD.: BUSINESS PERFORMANCE

TABLE 052. VIP INDUSTRIES LTD.: PRODUCT PORTFOLIO

TABLE 053. VIP INDUSTRIES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. TIMBERLAND LLC: SNAPSHOT

TABLE 054. TIMBERLAND LLC: BUSINESS PERFORMANCE

TABLE 055. TIMBERLAND LLC: PRODUCT PORTFOLIO

TABLE 056. TIMBERLAND LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. JOHNSTON & MURPHY: SNAPSHOT

TABLE 057. JOHNSTON & MURPHY: BUSINESS PERFORMANCE

TABLE 058. JOHNSTON & MURPHY: PRODUCT PORTFOLIO

TABLE 059. JOHNSTON & MURPHY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. WOODLAND WORLDWIDE: SNAPSHOT

TABLE 060. WOODLAND WORLDWIDE: BUSINESS PERFORMANCE

TABLE 061. WOODLAND WORLDWIDE: PRODUCT PORTFOLIO

TABLE 062. WOODLAND WORLDWIDE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. HERMÈS INTERNATIONAL S.A.: SNAPSHOT

TABLE 063. HERMÈS INTERNATIONAL S.A.: BUSINESS PERFORMANCE

TABLE 064. HERMÈS INTERNATIONAL S.A.: PRODUCT PORTFOLIO

TABLE 065. HERMÈS INTERNATIONAL S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. LOUIS VUITTON MALLETIER: SNAPSHOT

TABLE 066. LOUIS VUITTON MALLETIER: BUSINESS PERFORMANCE

TABLE 067. LOUIS VUITTON MALLETIER: PRODUCT PORTFOLIO

TABLE 068. LOUIS VUITTON MALLETIER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. VF CORP.: SNAPSHOT

TABLE 069. VF CORP.: BUSINESS PERFORMANCE

TABLE 070. VF CORP.: PRODUCT PORTFOLIO

TABLE 071. VF CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. COLLAR COMPANY: SNAPSHOT

TABLE 072. COLLAR COMPANY: BUSINESS PERFORMANCE

TABLE 073. COLLAR COMPANY: PRODUCT PORTFOLIO

TABLE 074. COLLAR COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. LUCRIN GENEVA: SNAPSHOT

TABLE 075. LUCRIN GENEVA: BUSINESS PERFORMANCE

TABLE 076. LUCRIN GENEVA: PRODUCT PORTFOLIO

TABLE 077. LUCRIN GENEVA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. NAPPA DORI: SNAPSHOT

TABLE 078. NAPPA DORI: BUSINESS PERFORMANCE

TABLE 079. NAPPA DORI: PRODUCT PORTFOLIO

TABLE 080. NAPPA DORI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. SADDLES INDIA PVT. LTD.: SNAPSHOT

TABLE 081. SADDLES INDIA PVT. LTD.: BUSINESS PERFORMANCE

TABLE 082. SADDLES INDIA PVT. LTD.: PRODUCT PORTFOLIO

TABLE 083. SADDLES INDIA PVT. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. LEAR CORP: SNAPSHOT

TABLE 084. LEAR CORP: BUSINESS PERFORMANCE

TABLE 085. LEAR CORP: PRODUCT PORTFOLIO

TABLE 086. LEAR CORP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 087. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 088. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 089. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. LEATHER GOODS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. LEATHER GOODS MARKET OVERVIEW BY TYPE

FIGURE 012. FOOTWEAR MARKET OVERVIEW (2016-2028)

FIGURE 013. LUGGAGE MARKET OVERVIEW (2016-2028)

FIGURE 014. ACCESSORIES MARKET OVERVIEW (2016-2028)

FIGURE 015. LEATHER GOODS MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 016. OFFLINE MARKET OVERVIEW (2016-2028)

FIGURE 017. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA LEATHER GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE LEATHER GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC LEATHER GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA LEATHER GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA LEATHER GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Leather Goods Market research report is 2022-2028.

Adidas AG, Nike Inc., Puma SE, Fila Inc., New Balance Athletics Inc., Knoll Inc., Samsonite International S.A., VIP Industries Ltd., imberland LLC, Johnston & Murphy, Woodland Worldwide, Hermès International S.A., Louis Vuitton Malletier, VF Corp., COLLAR Company, LUCRIN Geneva, Nappa Dori, Saddles India Pvt. Ltd., Lear Corp, and Other Major Players.

Leather Goods Market is segmented into Type, Distribution Channel, and region. By Type, the market is categorized into Footwear, Luggage, Accessories. By Distribution Channel, the market is categorized into Offline, Online. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Leather is durable and may be used to produce a wide range of goods, including clothes, footwear, and purses, furniture, tools, and sports equipment. Leather has been made for over 7,000 years, and China and India are the world's biggest manufacturers of the material today.

The Global Leather Goods Market size is expected to grow from USD 259.19 billion in 2022 to USD 349.30 billion by 2030, at a CAGR of 3.8% during the forecast period (2023-2030).