Sporting and Athletic Goods Market Synopsis

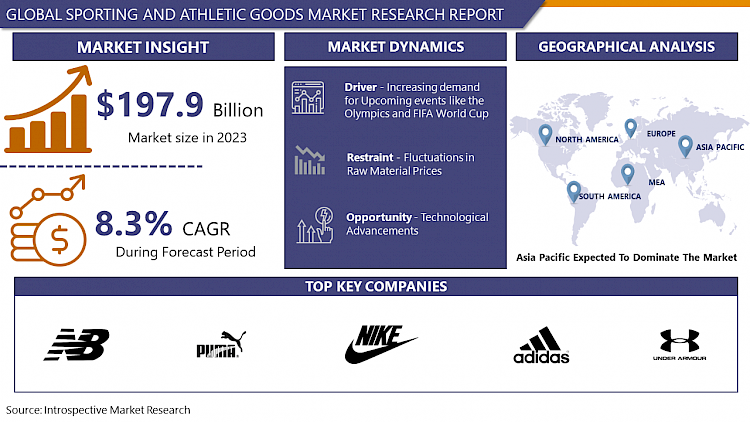

Sporting and Athletic Goods Market Size Was Valued at USD 197.9 Billion in 2023, and is Projected to Reach USD 405.6 Billion by 2032, Growing at a CAGR of 8.3% From 2024-2032.

Sporting and athletic goods encompass a broad range of products designed to enhance physical activity, performance, and enjoyment in sports and fitness activities. This category comprises a variety of athletic apparel, footwear, equipment, and accessories, including those designed for running, basketball, tennis, golf, and soccer, among others.

- Sporting and athletic products accommodate individuals of all ages and skill levels, with beginner-friendly equipment designed for recreational enthusiasts and high-tech gear intended for professional athletes. In addition to enhancing performance and preventing injuries, these products enhance the overall experience and satisfaction derived from participating in physical fitness and athletic endeavors.

- Sporting and athletic products provide essential support for an active and healthy lifestyle, whether it be specialized equipment intended to optimize technique and safety or a pair of running shoes specifically designed for speed and comfort.

- Sporting and athletic goods, at their core, comprise a wide range of merchandise designed to optimize performance, comfort, and safety throughout an assortment of fitness activities and sports. A wide range of products, including apparel, apparatus such as balls, rackets, weights, and compression wear, are available to accommodate the requirements of both athletes and enthusiasts.

- In addition to their primary function, these products frequently integrate cutting-edge designs and materials to enhance functionality, avert harm, and optimize comfort. Furthermore, sporting and athletic goods strengthen a sense of competition, personal accomplishment, and camaraderie among participants, thereby contributing to the culture and community encircling sports. These products are essential for both professional athletes aiming to achieve their maximum potential and individuals seeking leisure and recreation. They facilitate and enhance the overall experience of engaging in sports and physical activity.

Sporting and Athletic Goods Market Trend Analysis

Growing Interest in Health and Fitness

- The increasing demand for health and fitness products has become a major factor propelling the expansion of the sporting and athletic goods industry. As individuals become more cognizant of the significance of maintaining overall health through an active lifestyle, they are actively pursuing opportunities to incorporate physical activity and exercise into their daily schedules.

- A greater emphasis on health awareness has resulted in an expanding market for sporting and athletic products, as individuals purchase apparatus, clothing, and supplementary items to bolster their physical fitness pursuits.

- An assortment of products are being adopted by consumers to facilitate the pursuit of a healthier lifestyle, including wearable fitness trackers that monitor performance metrics and sophisticated sports equipment that prioritizes functionality and safety.

- Furthermore, the proliferation of social media and digital platforms has significantly contributed to the escalation of interest in health and fitness, thereby propelling the sporting and athletic products industry's expansion.

- These platforms are frequently utilized by celebrities, influencers, and fitness enthusiasts to disseminate their wellness journeys, exercise regimens, and nutritional advice, thereby motivating millions of followers to adopt comparable practices. The increased visibility on the internet not only enhances consciousness regarding the advantages of engaging in physical activity but also acts as a catalyst for product endorsements and consumer participation.

- Consequently, the convergence of digital trends and the increasing focus on health and fitness has fostered a conducive atmosphere for the growth of the sporting and athletic products industry. This expansion caters to the changing demands and inclinations of a consumer base that is increasingly health-conscious.

E-commerce Growth

- The sporting and athletic goods market stands to gain substantially from the exponential expansion of e-commerce, which provides consumers with a convenient and easily accessible platform to buy a vast array of products from the convenience of their residences. The advent of online retail channels, such as marketplace platforms, brand-owned e-commerce stores, and sports-specific websites, has provided customers with an unparalleled assortment of athletic and sporting products.

- This enhanced scope empowers enterprises to access untapped markets and demographic segments, thereby surmounting geographical limitations and connecting with prospective clients on a global scale. Furthermore, the proliferation of mobile purchasing and digital payment solutions amplifies the element of convenience, enabling consumers to effortlessly peruse, contrast, and acquire products through their smartphones or tablets. Consequently, this propels the expansion of online sporting and athletic goods sales.

- In addition, the digital environment provides retailers and brands with abundant prospects to utilize data-driven insights and personalized marketing strategies to effectively connect with consumers. Using targeted advertising, personalized product recommendations, and interactive online experiences, organizations can augment consumer engagement and cultivate brand loyalty amidst the fiercely competitive e-commerce environment.

- Moreover, by acquiring and examining customer data, organizations can acquire significant knowledge regarding consumer inclinations, buying patterns, and market developments, which empowers them to modify their product offerings and marketing approaches correspondingly. Through the utilization of e-commerce platforms, manufacturers of sporting and athletic products can not only broaden their market presence but also foster more robust customer connections, thereby facilitating sustained expansion and increased profitability within the ever-evolving digital marketplace.

Sporting and Athletic Goods Market Segment Analysis:

Sporting and Athletic Goods Market Segmented Based on Type, Materials, and Distribution Channel.

By Type, the golf equipment is expected to dominate the market during the forecast period

- In the sporting and athletic goods market, golf equipment emerges as a prevailing sector among the ones specified. Golf, renowned for its extensive international allure and varied fan base encompassing both novices and experts, has solidified its position as a profitable sector that stimulates the considerable need for associated apparatus.

- The golf equipment sector offers an extensive assortment of merchandise, including apparel, accessories, clubs, and balls, to accommodate the preferences and abilities of golfers of every level. Moreover, the enduring global appeal of golf as a recreational activity and a competitive sport, in conjunction with the expanding membership of golf aficionados, guarantees continuous expansion and advancement in the sector.

- Furthermore, technological and material advancements have contributed to the creation of high-performance golf equipment, which has increased consumer interest and bolstered sales in this market segment. In general, the prevalence of golf equipment highlights its substantial impact on the sporting and athletic products industry as a whole, attributable to its enduring popularity and extensive acceptance among consumers around the world.

By Materials, the Plastic segment held the largest share in 2023

- Plastics establish themselves as the prevailing material in the sporting and athletic products industry, among the materials enumerated. Plastics have become essential in numerous product categories within the industry due to their adaptability, resilience, and economical nature.

- Plastics accommodate the varied requirements of athletes and devotees by providing a vast array of advantages, including lightweight, impact-resistant protective gear and high-performance synthetic fabrics utilized in athletic apparel. Furthermore, progress in polymer technology has facilitated the creation of novel merchandise that possesses improved attributes including flexibility, moisture-wicking capabilities, and structural robustness.

- This has served to further propel the utilization of plastic-based materials in the production of sporting goods. Furthermore, the capacity of plastics to be molded and shaped effortlessly enables the creation of intricate designs and personalized items, granting manufacturers the adaptability to produce products that precisely meet particular performance criteria and aesthetic inclinations.

- In general, the prevalence of plastics in the market for sporting and athletic goods highlights their crucial significance in influencing the development of the sector and satisfying the changing expectations of consumers for environmentally friendly, practical, and superior products.

Sporting and Athletic Goods Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region has emerged as a dominant force in the sporting and athletic goods market due to several key factors. To begin with, the area is characterized by a substantial and heterogeneous populace, bolstered by an expanding middle class, which consequently stimulates augmented discretionary expenditures on products associated with sports and fitness.

- The increasing wealth of individuals has stimulated the desire for sporting products among diverse groups, including both professional athletes and leisure enthusiasts, thereby propelling market expansion. Additionally, accelerated urbanization and lifestyle changes have occurred in Asia-Pacific nations, including India, China, Japan, and South Korea, resulting in an increased emphasis on health, fitness, and leisure activities.

- The change in consumer preferences has resulted in increased demand for sporting and athletic products, such as apparel, footwear, and equipment, which has contributed to the expansion of the market. In addition, the region's infrastructure and manufacturing capabilities in the supply chain have established it as a pivotal manufacturing center for sporting products, facilitating economical manufacturing and worldwide distribution.

- In light of expanding consumer preferences, changing lifestyles, and strong manufacturing capacities, Asia-Pacific has established itself as the dominant region in the sporting and athletic products sector. This has propelled the industry's ongoing expansion and ingenuity.

Active Key Players in the Sporting and Athletic Goods Market

- Nike, Inc. (Beaverton, Oregon, USA)

- Adidas AG (Herzogenaurach, Germany)

- Under Armour, Inc. (Baltimore, Maryland, USA)

- Puma SE (Herzogenaurach, Germany)

- Decathlon Group (Villeneuve-d'Ascq, France)

- ASICS Corporation (Kobe, Japan)

- New Balance Athletics, Inc. (Boston, Massachusetts, USA)

- Amer Sports Corporation (Helsinki, Finland)

- VF Corporation (Denver, Colorado, USA)

- Columbia Sportswear Company (Portland, Oregon, USA), Other Key Players

Key Industry Developments in the Sporting and Athletic Goods Market:

- In January 2024, Adidas and sustainable footwear company Allbirds partnered to develop a line of high-performance footwear comprised in part of bio-based materials. This satisfies the increasing market demand for environmentally friendly sporting products.

|

Global Sporting and Athletic Goods Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 197.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.3 % |

Market Size in 2032: |

USD 405.6 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Materials |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- SEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SPORTING AND ATHLETIC GOODS MARKET BY TYPE (2017-2032)

- SPORTING AND ATHLETIC GOODS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FISHING EQUIPMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- STAKING AND SKIING EQUIPMENT

- GOLF EQUIPMENT

- OTHERS

- SPORTING AND ATHLETIC GOODS MARKET BY MATERIALS (2017-2032)

- SPORTING AND ATHLETIC GOODS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLASTICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WOOD

- METALS

- OTHERS

- SPORTING AND ATHLETIC GOODS MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- SPORTING AND ATHLETIC GOODS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ONLINE STORES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPECIALTY STORES

- CONVENIENCE STORES

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- SPORTING AND ATHLETIC GOODS Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- NIKE, INC. (BEAVERTON, OREGON, USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ADIDAS AG (HERZOGENAURACH, GERMANY)

- UNDER ARMOUR, INC. (BALTIMORE, MARYLAND, USA)

- PUMA SE (HERZOGENAURACH, GERMANY)

- DECATHLON GROUP (VILLENEUVE-D'ASCQ, FRANCE)

- ASICS CORPORATION (KOBE, JAPAN)

- NEW BALANCE ATHLETICS, INC. (BOSTON, MASSACHUSETTS, USA)

- AMER SPORTS CORPORATION (HELSINKI, FINLAND)

- VF CORPORATION (DENVER, COLORADO, USA)

- COLUMBIA SPORTSWEAR COMPANY (PORTLAND, OREGON, USA),

- COMPETITIVE LANDSCAPE

- GLOBAL SPORTING AND ATHLETIC GOODS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Materials

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Sporting and Athletic Goods Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 197.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.3 % |

Market Size in 2032: |

USD 405.6 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Materials |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SPORTING AND ATHLETIC GOODS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SPORTING AND ATHLETIC GOODS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SPORTING AND ATHLETIC GOODS MARKET COMPETITIVE RIVALRY

TABLE 005. SPORTING AND ATHLETIC GOODS MARKET THREAT OF NEW ENTRANTS

TABLE 006. SPORTING AND ATHLETIC GOODS MARKET THREAT OF SUBSTITUTES

TABLE 007. SPORTING AND ATHLETIC GOODS MARKET BY TYPE

TABLE 008. SPORTING GOODS MARKET OVERVIEW (2016-2028)

TABLE 009. ATHLETIC GOODS MARKET OVERVIEW (2016-2028)

TABLE 010. SPORTING AND ATHLETIC GOODS MARKET BY APPLICATION

TABLE 011. ONLINE RETAIL MARKET OVERVIEW (2016-2028)

TABLE 012. MARKET OVERVIEW (2016-2028)

TABLE 013. SPECIALTY & SPORTS SHOPS MARKET OVERVIEW (2016-2028)

TABLE 014. MARKET OVERVIEW (2016-2028)

TABLE 015. DEPARTMENT & DISCOUNT STORES MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA SPORTING AND ATHLETIC GOODS MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA SPORTING AND ATHLETIC GOODS MARKET, BY APPLICATION (2016-2028)

TABLE 018. N SPORTING AND ATHLETIC GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE SPORTING AND ATHLETIC GOODS MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE SPORTING AND ATHLETIC GOODS MARKET, BY APPLICATION (2016-2028)

TABLE 021. SPORTING AND ATHLETIC GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC SPORTING AND ATHLETIC GOODS MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC SPORTING AND ATHLETIC GOODS MARKET, BY APPLICATION (2016-2028)

TABLE 024. SPORTING AND ATHLETIC GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA SPORTING AND ATHLETIC GOODS MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA SPORTING AND ATHLETIC GOODS MARKET, BY APPLICATION (2016-2028)

TABLE 027. SPORTING AND ATHLETIC GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA SPORTING AND ATHLETIC GOODS MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA SPORTING AND ATHLETIC GOODS MARKET, BY APPLICATION (2016-2028)

TABLE 030. SPORTING AND ATHLETIC GOODS MARKET, BY COUNTRY (2016-2028)

TABLE 031. DECATHLON: SNAPSHOT

TABLE 032. DECATHLON: BUSINESS PERFORMANCE

TABLE 033. DECATHLON: PRODUCT PORTFOLIO

TABLE 034. DECATHLON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. CALLAWAY GOLF: SNAPSHOT

TABLE 035. CALLAWAY GOLF: BUSINESS PERFORMANCE

TABLE 036. CALLAWAY GOLF: PRODUCT PORTFOLIO

TABLE 037. CALLAWAY GOLF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. NIKE: SNAPSHOT

TABLE 038. NIKE: BUSINESS PERFORMANCE

TABLE 039. NIKE: PRODUCT PORTFOLIO

TABLE 040. NIKE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. PERFORMANCE SPORTS: SNAPSHOT

TABLE 041. PERFORMANCE SPORTS: BUSINESS PERFORMANCE

TABLE 042. PERFORMANCE SPORTS: PRODUCT PORTFOLIO

TABLE 043. PERFORMANCE SPORTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. RUSSELL: SNAPSHOT

TABLE 044. RUSSELL: BUSINESS PERFORMANCE

TABLE 045. RUSSELL: PRODUCT PORTFOLIO

TABLE 046. RUSSELL: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SPORTING AND ATHLETIC GOODS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SPORTING AND ATHLETIC GOODS MARKET OVERVIEW BY TYPE

FIGURE 012. SPORTING GOODS MARKET OVERVIEW (2016-2028)

FIGURE 013. ATHLETIC GOODS MARKET OVERVIEW (2016-2028)

FIGURE 014. SPORTING AND ATHLETIC GOODS MARKET OVERVIEW BY APPLICATION

FIGURE 015. ONLINE RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 016. MARKET OVERVIEW (2016-2028)

FIGURE 017. SPECIALTY & SPORTS SHOPS MARKET OVERVIEW (2016-2028)

FIGURE 018. MARKET OVERVIEW (2016-2028)

FIGURE 019. DEPARTMENT & DISCOUNT STORES MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA SPORTING AND ATHLETIC GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE SPORTING AND ATHLETIC GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC SPORTING AND ATHLETIC GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA SPORTING AND ATHLETIC GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA SPORTING AND ATHLETIC GOODS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Sporting and Athletic Goods Market research report is 2024-2032.

Nike, Inc., Adidas AG, Under Armour, Inc., Puma SE, Decathlon Group, ASICS Corporation, New Balance Athletics, Inc., Amer Sports Corporation, VF Corporation, Columbia Sportswear Compaand Other Major Players.

The Sporting and Athletic Goods Market is segmented into Type, materials, Distribution channel, and region. By Type, the market is categorized into Fishing Equipment, Staking and Skiing Equipment, Golf Equipment, and Others. By Materials, the market is categorized into Plastics, Wood, Metals, and Others. By Distribution Channel, the market is categorized into Online Stores, Specialty Stores, Convenience Stores, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Sporting and athletic goods encompass a diverse range of equipment, apparel, and accessories designed to support and enhance participation in sports, fitness, and recreational activities. These products cater to athletes and enthusiasts of all ages and skill levels, providing functionality, performance, and safety in various sports and physical endeavors.

Sporting and Athletic Goods Market Size Was Valued at USD 197.9 Billion in 2023, and is Projected to Reach USD 405.6 Billion by 2032, Growing at a CAGR of 8.3% From 2024-2032.