Global Regenerative Agriculture Market Overview

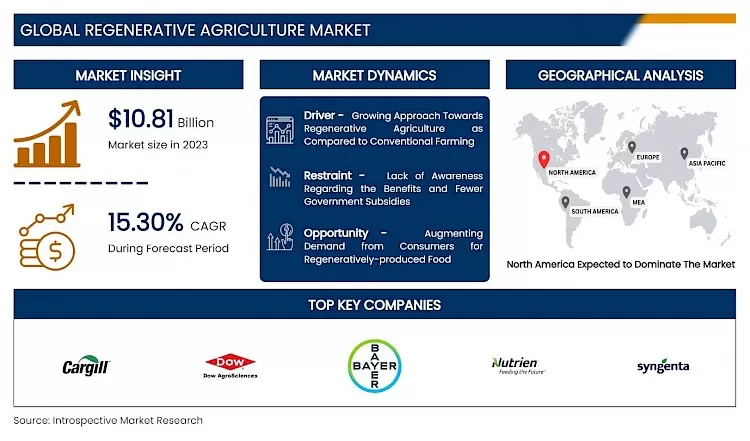

The Global Regenerative Agriculture Market is valued at USD 10.81 Billion in 2023 is projected to reach a revised size of USD 38.93 Billion by 2032, growing at a CAGR of 15.30% over the period 2024-2032.

The global regenerative agriculture market is experiencing significant growth, driven by an increasing awareness of the environmental impacts associated with conventional farming practices. As consumers become more conscious of sustainability, there is a noticeable shift towards agricultural methods that prioritize soil health, biodiversity, and the overall resilience of ecosystems. This transformation is supported by a combination of rising consumer demand for sustainably produced food, corporate investments in regenerative practices, favorable government policies, and advancements in technology. Collaborative efforts among various stakeholders also play a crucial role in promoting the adoption of regenerative agriculture practices across different regions.

Regenerative agriculture encompasses a range of practices, including agroforestry, no-till farming, and holistic grazing, all aimed at restoring and maintaining healthy ecosystems. The approach is gaining traction particularly in regions where there is a strong emphasis on improving soil health and promoting biodiversity. Beyond addressing food production challenges, regenerative agriculture is increasingly recognized for its potential to mitigate climate change by sequestering carbon in soils and enhancing the resilience of agricultural systems to adverse weather conditions. As the global population continues to grow, the demand for sustainable food production systems is expected to further drive interest and investment in regenerative agriculture practices, making it a vital component of the future of agriculture.

Market Dynamics And Factors For Regenerative Agriculture Market

Drivers:

Growing Approach Towards Regenerative Agriculture as Compared to Conventional Farming

Regenerative agriculture is an effective method of farming with practices such as livestock rotation, no-till farming, aquaculture, agroecology, crop rotation, and agroforestry when compared to the conventional method. A recent study shows that the farms with regenerative agriculture practices generated 78% more profit than those with the conventional method of farming. The regenerative agriculture market has witnessed rapid growth as it makes soil much healthier and favorable for organic cultivation, owing to the high water-holding capacity. Furthermore, the IPCC states that around 23% of the global greenhouse gas emissions are correlated with agriculture, and the implementation of regenerative agriculture makes the soil capable to sequester carbon from the atmosphere. The growth can also be attributed to other potential benefits such as gaining healthier yields, reduced soil erosion and runoff, and decreased cost when compared with the conventional farming method. Additionally, no-till farming ensures saving 30-40% more farmers’ time, and further drives rapid growth. The conventional method has negative effects on the environment, whereas through regenerative agriculture, chemical inputs are minimized and the negative impact on biodiversity is reduced, which thereby drives the market growth.

Restraints:

Lack of Awareness Regarding the Benefits and Fewer Government Subsidies

The growth of the global regenerative agriculture market can be hindered by various factors such as lack of awareness and knowledge regarding the benefits associated with the utilization of regenerative agriculture, the requirement of maintenance costs as well as high initial investments, and difficult certification processes. To practice regenerative farming, and to handle those tools and equipment, farmers need to acquire skills, especially in respect of soil management. However, many farmers in the developing regions lack those skills which further leads to the declining growth of global regenerative agriculture. Furthermore, there is very less or no additional support and encouragement from government sources, as the official bodies are very slow to provide farm subsidies. The unavailability of subsidies that can encourage the implementation of regenerative farming is further expected to restrain the market growth of regenerative agriculture in the upcoming years.

Opportunities:

Growing Demand for Nature Friendly Produced Crops

Along with the rising consumer concerns regarding emerging health diseases, there has been an increasing demand for healthy food products. Consumers all across the world are also demanding products that are cultivated regeneratively owing to their several health benefits. According to Nielsen, almost 75% of the urban population and millennials are changing their buying habits with the changing environmental conditions, and they tend to buy food products that are regeneratively produced. Such products are environmentally friendly and offer a triple-win situation, thereby creating lucrative opportunities for regenerative agriculture market growth. Moreover, owing to the rising demand from consumers, major key players opt for the utilization of regenerative agriculture to offer healthier food. For instance, Pepsico announced that it will be adopting regenerative agriculture methods on around 7 million acres of its farmland. Along with Pepsico, Cargill declared to do the same on 10 million acres of their farmland and Walmart will practice on 50 million acres. Such initiatives by major key players to meet the augmenting demand for regeneratively produced foods will create huge growth opportunities in the market.

Segmentation Analysis Of Regenerative Agriculture Market

By Practice, the Silvopasture segment dominates the market growth of regenerative agriculture owing to key factors such as the growing focus on ecological restoration as well as climate change mitigation. Silvopasture helps in effectively grazing livestock, trees, and forage on the same land improves soil conservation and water quality and reduces carbon emission. The Silvopasture segment also dominates the market growth owing to its various benefits such as forest restoration, wildlife habitat, and enhancing human health through diverse diets.

By Application, Carbon sequestration dominates the growth of the regenerative agriculture market. This growth can be attributed to the rising need and demand for carbon sequestration to decrease global climate change and the huge adoption of no-till farming, crop rotation, livestock rotation as well as composting practices. Further, carbon sequestration helps in capturing and storing atmospheric Co2 to reduce changing climatic conditions, restore degraded soil conditions, and improvise agricultural productivity which drives the growth of this segment.

Regional Analysis Of Regenerative Agriculture Market

North America, particularly the United States, is currently at the forefront of the global regenerative agriculture market. The region has a strong foundation in organic farming and sustainable agriculture practices, which have laid the groundwork for the adoption of regenerative principles. Early awareness of soil health issues and a focus on environmental sustainability have driven the growth of regenerative agriculture in the region. Additionally, the presence of influential organizations and research institutions dedicated to regenerative practices has contributed to its prominence.

While North America leads the way, other regions are rapidly gaining traction. Australia and New Zealand have made significant strides in adopting regenerative agriculture due to their focus on sustainable land management. Europe, with its emphasis on organic farming and environmental protection, is also experiencing a growing interest in regenerative practices. However, North America continues to be the dominant force in the global market.

Top Key Players Covered In Regenerative Agriculture Market

- Bayer AG

- Cargill

- Syngenta

- Dow AgroSciences

- Nutrien

- ADM (Archer Daniels Midland)

- Agri-Tech East

- Heliae Development

- Soil Capital

- Ecovative Design

- Kellogg Company

- Unilever

- Danone

- General Mills

- AgriWebb

- Pivot Bio

- Agreena

- Indigo Ag

- Regenerative Agriculture Alliance, and Other Active Players

Key Industry Development In The Regenerative Agriculture Market:

- In July 2023, PepsiCo partnered with Walmart to invest $120 million in U.S. and Canadian farmers, aiming to enhance soil health and water quality through regenerative agriculture. This initiative represents PepsiCo’s first significant strategic collaboration with a retail partner focused on sustainable agriculture.

- In July 2023, Nestlé launched a project to support wheat farms in adopting regenerative agriculture practices as part of its supply chain for the DiGiorno pizza brand. The project aims to boost biodiversity, reduce water, energy, and fertilizer use, improve soil health and fertility, and address climate change impacts.

|

Global Regenerative Agriculture Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.81 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.30% |

Market Size in 2032: |

USD 38.93 Bn. |

|

Segments Covered: |

By Practices |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Regenerative Agriculture Market by Practices (2018-2032)

4.1 Regenerative Agriculture Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Aquaculture

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Agroforestry

4.5 Pasture Cropping

4.6 Silvopasture

4.7 Others

Chapter 5: Regenerative Agriculture Market by Application (2018-2032)

5.1 Regenerative Agriculture Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Carbon Sequestration

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Nutrient Cycling

5.5 Biodiversity

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Regenerative Agriculture Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ALLIED NUTRIENTS

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SOILGENIC TECHNOLOGIES

6.4 LLC

6.5 GAVILON AGRICULTURE HOLDINGS

6.6 CO

6.7 HAIFA GROUP

6.8 EKOMPANY INTERNATIONAL B.V

6.9 ISRAEL CHEMICALS LTD. (ICL)

6.10 YARA INTERNATIONAL ASA

6.11 NUTRIEN LTD

6.12 SAVIOLIFE S.R.L

6.13 DELTACHEM GMBH

6.14 AGROLIQUID

6.15 KOCH AGRONOMIC SERVICES LLC

6.16 EUROCHEM GROUP

6.17 HELENA AGRI-ENTERPRISES LLC

6.18

Chapter 7: Global Regenerative Agriculture Market By Region

7.1 Overview

7.2. North America Regenerative Agriculture Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Practices

7.2.4.1 Aquaculture

7.2.4.2 Agroforestry

7.2.4.3 Pasture Cropping

7.2.4.4 Silvopasture

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Carbon Sequestration

7.2.5.2 Nutrient Cycling

7.2.5.3 Biodiversity

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Regenerative Agriculture Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Practices

7.3.4.1 Aquaculture

7.3.4.2 Agroforestry

7.3.4.3 Pasture Cropping

7.3.4.4 Silvopasture

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Carbon Sequestration

7.3.5.2 Nutrient Cycling

7.3.5.3 Biodiversity

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Regenerative Agriculture Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Practices

7.4.4.1 Aquaculture

7.4.4.2 Agroforestry

7.4.4.3 Pasture Cropping

7.4.4.4 Silvopasture

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Carbon Sequestration

7.4.5.2 Nutrient Cycling

7.4.5.3 Biodiversity

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Regenerative Agriculture Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Practices

7.5.4.1 Aquaculture

7.5.4.2 Agroforestry

7.5.4.3 Pasture Cropping

7.5.4.4 Silvopasture

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Carbon Sequestration

7.5.5.2 Nutrient Cycling

7.5.5.3 Biodiversity

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Regenerative Agriculture Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Practices

7.6.4.1 Aquaculture

7.6.4.2 Agroforestry

7.6.4.3 Pasture Cropping

7.6.4.4 Silvopasture

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Carbon Sequestration

7.6.5.2 Nutrient Cycling

7.6.5.3 Biodiversity

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Regenerative Agriculture Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Practices

7.7.4.1 Aquaculture

7.7.4.2 Agroforestry

7.7.4.3 Pasture Cropping

7.7.4.4 Silvopasture

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Carbon Sequestration

7.7.5.2 Nutrient Cycling

7.7.5.3 Biodiversity

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Regenerative Agriculture Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.81 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.30% |

Market Size in 2032: |

USD 38.93 Bn. |

|

Segments Covered: |

By Practices |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Regenerative Agriculture Market research report is 2024-2032.

Force of Nature (U.S), Serenity Kids. (U.S), Akua (N.Y), General Mills Inc (U.S), Cargill Inc (U.S), Danone S.A.(France), Grounded South Africa((ZA), Regen AG (Oregon), Nestlé S.A.(Switzerland), Alter Eco Americas Inc (U.S), New Leaf Tree Syrups (N.Y), Bluebird Grain Farms (USA), Soil Capital Ltd (Belgium), Heinekin (Netherland), Horizon Organic (U.S), and other major players.

The Regenerative Agriculture Market is segmented into Practices, Application, and region. By Practices, the market is categorized into Aquaculture, Agroecology, Agroforestry, Holistic Planned Grazing, Pasture Cropping, Silvopasture, and Others. By Application, the market is categorized into Carbon Sequestration, Nutrient Cycling, Biodiversity, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Regenerative agriculture is a substantial method and rehabilitation approach to farming and food systems that focuses on restoring and replenishing the water, soil, and air conditions so that the harmful effects of industrial agriculture can be overcome.

The Regenerative Agriculture Market is estimated to develop at a significant growth rate over the forecasted period 2022-2028, considering 2021 as base year.