Ready-To-Drink Market Synopsis

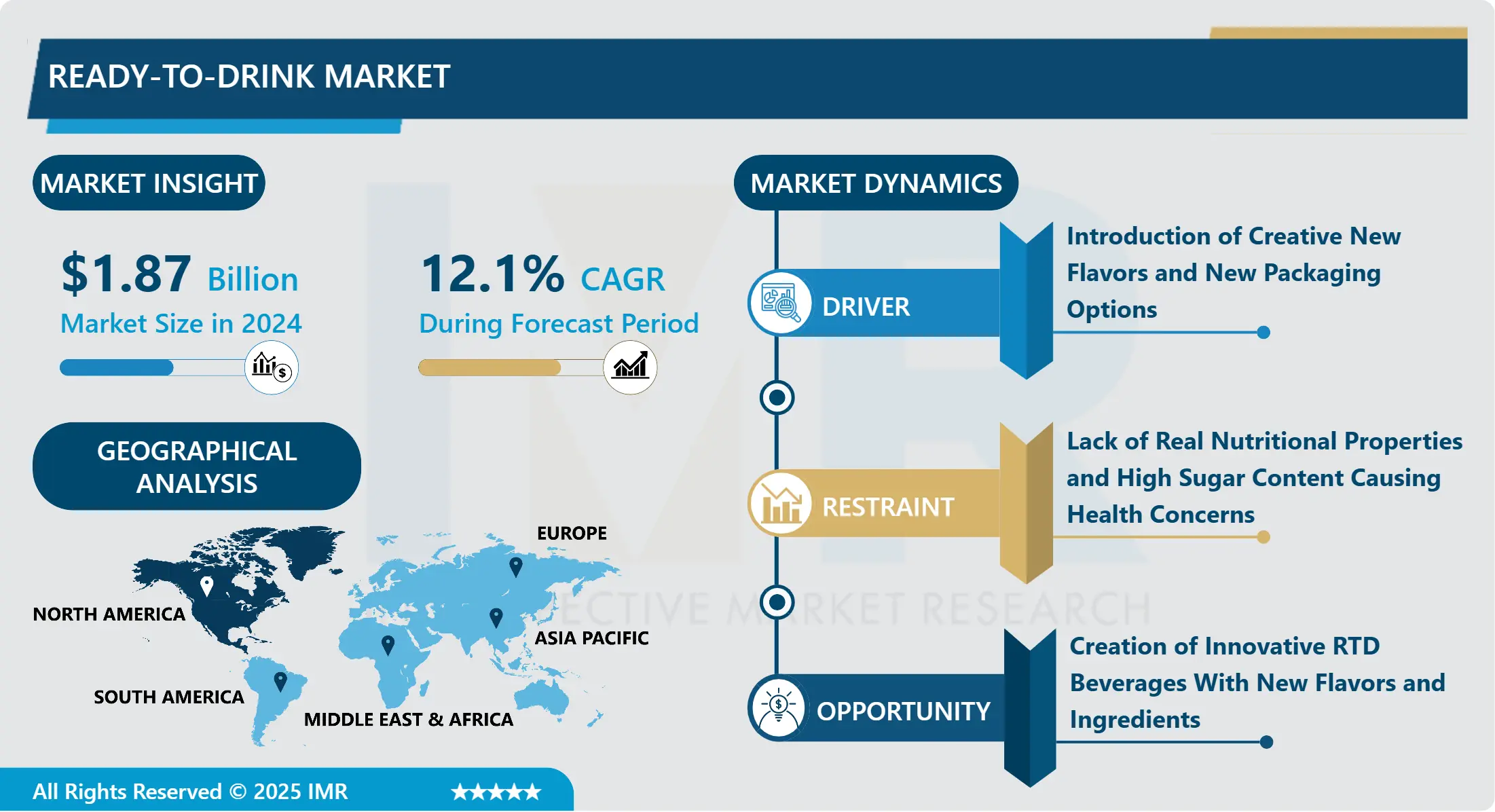

Ready-To-Drink Market Size Was Valued at USD 1.87 Billion in 2024 and is Projected to Reach USD 4.66 Billion by 2032, Growing at a CAGR of 12.1 % From 2025-2032.

Ready-to-drink beverages also called RTDs are single-use packaged beverages that are packaged and sold in a prepared form ready for immediate consumption upon purchase. Such Beverages do not need any further processing and can be consumed directly through the package. Ready-to-drink (RTD) beverages have gained a lot of popularity due to their functionality, especially in the summer. Consumers’ enjoyment of the fortified drinks and alcohols and the easiness of the product is the unique characteristic offered by the RTDs.

Ready-to-drink beverages are developed to provide immunity and fun benefits to consumers these products have even stirred up the alcoholic beverage market. Today, there is an infinite range of flavors made with several ingredients individually or by mixing them up. Many varieties like a bottled mojito, lemonades, and craft beer are available across several stores. This potentiality of consumption of ready-to-drink beverages and finished drinks will grow in the future helping the newest market players to experiment with their productions.

Currently, the market for RTDs is broader than ever, ranging from RTD iced coffees and teas to new yogurt drinks to canned whiskeys, wines and cocktails. In the past few years, the ready-to-drink (RTD) was growing in a one-sided way with not many companies entering the industry, products like White Claw in the past period addressed a number of drinkers and sold SKUs at a rapid rate. But now, with the help of innovation and development, the category has burst open, expanding right from hard seltzers to canned cocktails to niche products like non-alcoholic spritzers and port-and-tonics.

Other than alcohol-contained drinks, consumers’ demand for more non-alcoholic and organic products with contributing factors like awareness for health and wellness, demand for clean label foods and beverages, and functionality are leading the entire market towards success in achieving the market goal of becoming of more than USD 1 trillion coming 5-7 years

The Ready-To-Drink Market Trend Analysis

Introduction of Creative New Flavors and New Packaging Options

- Consumer motivation to buy the product is the primary thing that acts effectively behind the sales of RTD Beverages. Many producers today are moving towards more herbal, botanical, and organic flavors that create the taste of natural ingredients along with some health benefits. Such Creative New Flavors with colorful ready-to-drink beverages are getting perfect to satisfy the desire that is widespread in the adventure society for new and exciting taste experiences. Taste is the most important factor, according to Nielsen, today, consumers expect more than ever that products are particularly rich in flavors, and 42% of consumers worldwide say they enjoy trying new tastes.

- The fulfilling ready-to-drink creations are just the right thing for the growth of the market, other than consumers’ favorite tastes, the transformation of certain types of alcohol, and the availability of RTD Beverages at supermarkets for special offers, are also some influential growth driving factors for the Global Ready-To-Drink Market.

- Furthermore, packaging and distribution have certainly been key factors in the success of this kind of product, and many market players are continuously innovating when it comes to packaging. Sustainable packaging for healthy and organic RTD juices and ice ad coffee plus packaging of RTD cocktails in plastic balls to pouches and beyond are further driving the market growth. For instance, the Brookly-based brand St. Agrestis in 2020 released the “Negroni Fountain” product which packages a classic cocktail in a 1.75-liter bag-in-box. This product gained a great success from the very beginning. And finally, low prices and well-known brands are helping the market to achieve greater highs.

Creation of Innovative RTD Beverages With New Flavors and Ingredients

- The RTD beverage category for the last few years is growing very fast. To make the most out of the trend the brands are going to need to work effectively on their development and marketing to stand out of others and establish a strong sense of Meaningful to gain huge profits.

- Opportunity to innovate is been served by the consumers of the ever-changing world Several brands worldwide have the opportunity to innovate in themselves and innovate in a different way to grab the market attention. This is even more beneficial in times of crisis as the companies that are perceived as innovative grow at a very faster rate by figuring out creative business practices.

- Consumers nowadays are becoming health conscious and they are aware of the importance of nutritious food and beverages. Several global disorders like high blood pressure, Obesity, high blood sugar, and other disease are on the rise, forcing customers to restrict unhealthy products and switch to more healthy and nutritious foods even if it’s a snack. This provides companies with an opportunity to serve consumers the right way by providing organic and natural items that are preferred by consumers who want to live healthy lifestyles.

- Sugar-free, Organic, gluten-free, and vegan ready-to-drink beverages are now widely available across all the markets, and their popularity is continuously growing. Other than this, the convenience of an RTD with availability in single-can and carton and their low prices are expected to boost the market growth in the upcoming period.

Segmentation Analysis Of The Ready-To-Drink Market

Ready-To-Drink market segments cover the Type, Packaging Type, Sales Channel, and Region.

By Packaging Type, the Bottles segment is Expected to Dominate the Market Over the Forecast period.

- With the ever-expanding variety of RTD products both in-store and online, the packaging has an important part in the decision-making of consumers whether to buy or not the product. Packaging needs to feel more unique to the brand, should be attractive to consumers, and consequently should help to convert sales. Sustainability and innovation are two major features of packaging that are deciding factors for the sale of the product.

- In the Packaging of RTDs, Bottles made from glass or polyethylene terephthalate (PET) bottle hold the largest share of the market. The current market trend to improve conventional containers to extend the shelf-life of the products, to provide greater safety and consumer convenience, and ultimately to produce economic cost-saving packages are necessary to grab profits such benefits provide by bottle containers is the reason behind the success of the segment.

- Features like leak-proof and preventing contamination, Protecting the contents against chemical deterioration, not picking up external flavors, being hygienic and safe, economical, easy to use and dispose of, and finally good aesthetic appearance are further expected to drive the application of bottles in the packaging of the RTD Beverages. However other containers like metal tin cans, plastic pouches, aseptic cartons, and Bag-in-Box packages are gaining a lot of popularity these days, of which the Bag-in-Box System is anticipated to gain considerable growth owning to consumer preference.

Regional Analysis of The Ready-To-Drink Market

North America is Estimated to Dominate the Market During the Forecast period.

- The North American region remains the largest market for functional foods and beverages, which makes a promising point for the growth of the market in the region. North American Countries like the United States and Canada can be said to have the widest consumer base for such nutritious and functional products. Due to this, RTD beverage consumers in these countries want to buy a beverage with the purpose of healthiness which is serving as an opportunity for the RTD Beverage manufacturers. For instance, according to a consumer survey by FMCG Gurus in early 2021, 58% of US consumers indicated that they would continue to turn to beverages to boost their immune health after the pandemic, and a custom nutrient premix was demanded to offer such utility.

- Additionally, the region has the largest number of operating RTD Beverage manufacturers scattered across developed countries this influential presence with the continued growth and innovation in beverage making and packaging, the Ready-To-Drink Markets across North America are driven by the health and wellness trend. Several fortifications are gaining fame, even people have started shifting towards fortified water from soda which can provide them with added Vitamins, Minerals, Probiotics, Prebiotic fibers, Antioxidants, Natural energy boosters, and many other healthy nutrients.

- Also, taste has a very important role to play along with nutrition, which can be achieved through research and formulation of a new variety of drinks, and the development of such splendid products will cover the wide desires of the modern population residing in North America.

Top Key Players Covered in The Ready-To-Drink Market

- PepsiCo Inc.(US)

- Fuze Beverage (US)

- Nestle S.A. (Switzerland)

- The Coca-Cola Company(US)

- Jack Daniel's (US)

- Suntory Beverages & Food Ltd. (Japan)

- Kirin Brewery Company, Limited (Japan)

- Red Bull GmbH (Austria)

- Monster Beverage Corporation (US)

- NZMP (New Zealand)

- Zevia (US)

- White Claw Hard Seltzer (US)

- Southeast Bottling & Beverage (US)

- Gehl Foods LLC (US)

- Tropical Bottling Corporation (US)

- Other Active Players

Key Industry Developments

-

In January 2024: Systm Foods, a joint-venture beverage brand, acquired Humm Kombucha, a producer of zero-sugar and low kombucha and gut-health beverages. The acquisition would help Systm Foods to strengthen its position in the ready-to-drink beverage market.

- In September 2023: BODYARMOR, an American sports drink brand owned by The Coca-Cola Company, expanded and distributed its premium sports drink products internationally. The new products would be available across Canada, including in cities such as Ottawa, Vancouver, Calgary, and others.

- In September 2023: Gatorade expanded its sports drink brand by launching the new Gatorade Water. The new product is zero-calorie and unflavored alkaline water and other minerals.

|

Global Ready-To-Drink Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.87 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.1% |

Market Size in 2032: |

USD 4.66 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging Type |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ready-To-Drink Market by Type (2018-2032)

4.1 Ready-To-Drink Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Tea & Coffee

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Sports & Energy Drinks

4.5 Dairy-Based Beverages

4.6 Juices & Nectars

4.7 Fortified Water

4.8 Alcopops

4.9 Others

Chapter 5: Ready-To-Drink Market by Packaging Type (2018-2032)

5.1 Ready-To-Drink Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Bottles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cans

5.5 Cartons

5.6 Other

Chapter 6: Ready-To-Drink Market by Sales Channel (2018-2032)

6.1 Ready-To-Drink Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Supermarkets & Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Specialty Stores

6.5 Convenience Stores

6.6 Online Stores

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Ready-To-Drink Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CONAGRA BRANDS INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GENERAL MILLS INC. (US)

7.4 THE KRAFT HEINZ COMPANY (US)

7.5 KELLOGG COMPANY (US)

7.6 CAMPBELL SOUP COMPANY (US)

7.7 HORMEL FOODS CORPORATION (US)

7.8 TYSON FOODS INC. (US)

7.9 PEPSICO INC. (US)

7.10 THE HERSHEY COMPANY (US)

7.11 MARS INCORPORATED (US)

7.12 THE J.M. SMUCKER COMPANY (US)

7.13 HAIN CELESTIAL GROUP INC. (US)

7.14 MCCAIN FOODS LIMITED (CANADA)

7.15 OETKER-GRUPPE (GERMANY)

7.16 UNILEVER PLC (UK)

7.17 NESTLÉ S.A. (SWITZERLAND)

7.18 GREENCORE GROUP PLC (IRELAND)

7.19 AJ TINGYI (CAYMAN ISLANDS) HOLDING CORP. (CHINA)

7.20 INOMOTO COINC. (JAPAN)

7.21 TOYO SUISAN KAISHA LTD. (MARUCHAN) (JAPAN)

7.22 NISSIN FOODS HOLDINGS COLTD. (JAPAN)

7.23 CJ CHEILJEDANG CORPORATION (SOUTH KOREA)

7.24 INDOFOOD CBP SUKSES MAKMUR TBK PT (INDONESIA)

7.25 THAI UNION GROUP PCL (THAILAND)

7.26 GRUPO BIMBO

7.27 S.A.B. DE C.V. (MEXICO)

7.28

Chapter 8: Global Ready-To-Drink Market By Region

8.1 Overview

8.2. North America Ready-To-Drink Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Tea & Coffee

8.2.4.2 Sports & Energy Drinks

8.2.4.3 Dairy-Based Beverages

8.2.4.4 Juices & Nectars

8.2.4.5 Fortified Water

8.2.4.6 Alcopops

8.2.4.7 Others

8.2.5 Historic and Forecasted Market Size by Packaging Type

8.2.5.1 Bottles

8.2.5.2 Cans

8.2.5.3 Cartons

8.2.5.4 Other

8.2.6 Historic and Forecasted Market Size by Sales Channel

8.2.6.1 Supermarkets & Hypermarkets

8.2.6.2 Specialty Stores

8.2.6.3 Convenience Stores

8.2.6.4 Online Stores

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Ready-To-Drink Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Tea & Coffee

8.3.4.2 Sports & Energy Drinks

8.3.4.3 Dairy-Based Beverages

8.3.4.4 Juices & Nectars

8.3.4.5 Fortified Water

8.3.4.6 Alcopops

8.3.4.7 Others

8.3.5 Historic and Forecasted Market Size by Packaging Type

8.3.5.1 Bottles

8.3.5.2 Cans

8.3.5.3 Cartons

8.3.5.4 Other

8.3.6 Historic and Forecasted Market Size by Sales Channel

8.3.6.1 Supermarkets & Hypermarkets

8.3.6.2 Specialty Stores

8.3.6.3 Convenience Stores

8.3.6.4 Online Stores

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Ready-To-Drink Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Tea & Coffee

8.4.4.2 Sports & Energy Drinks

8.4.4.3 Dairy-Based Beverages

8.4.4.4 Juices & Nectars

8.4.4.5 Fortified Water

8.4.4.6 Alcopops

8.4.4.7 Others

8.4.5 Historic and Forecasted Market Size by Packaging Type

8.4.5.1 Bottles

8.4.5.2 Cans

8.4.5.3 Cartons

8.4.5.4 Other

8.4.6 Historic and Forecasted Market Size by Sales Channel

8.4.6.1 Supermarkets & Hypermarkets

8.4.6.2 Specialty Stores

8.4.6.3 Convenience Stores

8.4.6.4 Online Stores

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Ready-To-Drink Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Tea & Coffee

8.5.4.2 Sports & Energy Drinks

8.5.4.3 Dairy-Based Beverages

8.5.4.4 Juices & Nectars

8.5.4.5 Fortified Water

8.5.4.6 Alcopops

8.5.4.7 Others

8.5.5 Historic and Forecasted Market Size by Packaging Type

8.5.5.1 Bottles

8.5.5.2 Cans

8.5.5.3 Cartons

8.5.5.4 Other

8.5.6 Historic and Forecasted Market Size by Sales Channel

8.5.6.1 Supermarkets & Hypermarkets

8.5.6.2 Specialty Stores

8.5.6.3 Convenience Stores

8.5.6.4 Online Stores

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Ready-To-Drink Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Tea & Coffee

8.6.4.2 Sports & Energy Drinks

8.6.4.3 Dairy-Based Beverages

8.6.4.4 Juices & Nectars

8.6.4.5 Fortified Water

8.6.4.6 Alcopops

8.6.4.7 Others

8.6.5 Historic and Forecasted Market Size by Packaging Type

8.6.5.1 Bottles

8.6.5.2 Cans

8.6.5.3 Cartons

8.6.5.4 Other

8.6.6 Historic and Forecasted Market Size by Sales Channel

8.6.6.1 Supermarkets & Hypermarkets

8.6.6.2 Specialty Stores

8.6.6.3 Convenience Stores

8.6.6.4 Online Stores

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Ready-To-Drink Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Tea & Coffee

8.7.4.2 Sports & Energy Drinks

8.7.4.3 Dairy-Based Beverages

8.7.4.4 Juices & Nectars

8.7.4.5 Fortified Water

8.7.4.6 Alcopops

8.7.4.7 Others

8.7.5 Historic and Forecasted Market Size by Packaging Type

8.7.5.1 Bottles

8.7.5.2 Cans

8.7.5.3 Cartons

8.7.5.4 Other

8.7.6 Historic and Forecasted Market Size by Sales Channel

8.7.6.1 Supermarkets & Hypermarkets

8.7.6.2 Specialty Stores

8.7.6.3 Convenience Stores

8.7.6.4 Online Stores

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Ready-To-Drink Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.87 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.1% |

Market Size in 2032: |

USD 4.66 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging Type |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||