Radiopharmaceuticals in Nuclear Medicine Market Synopsis:

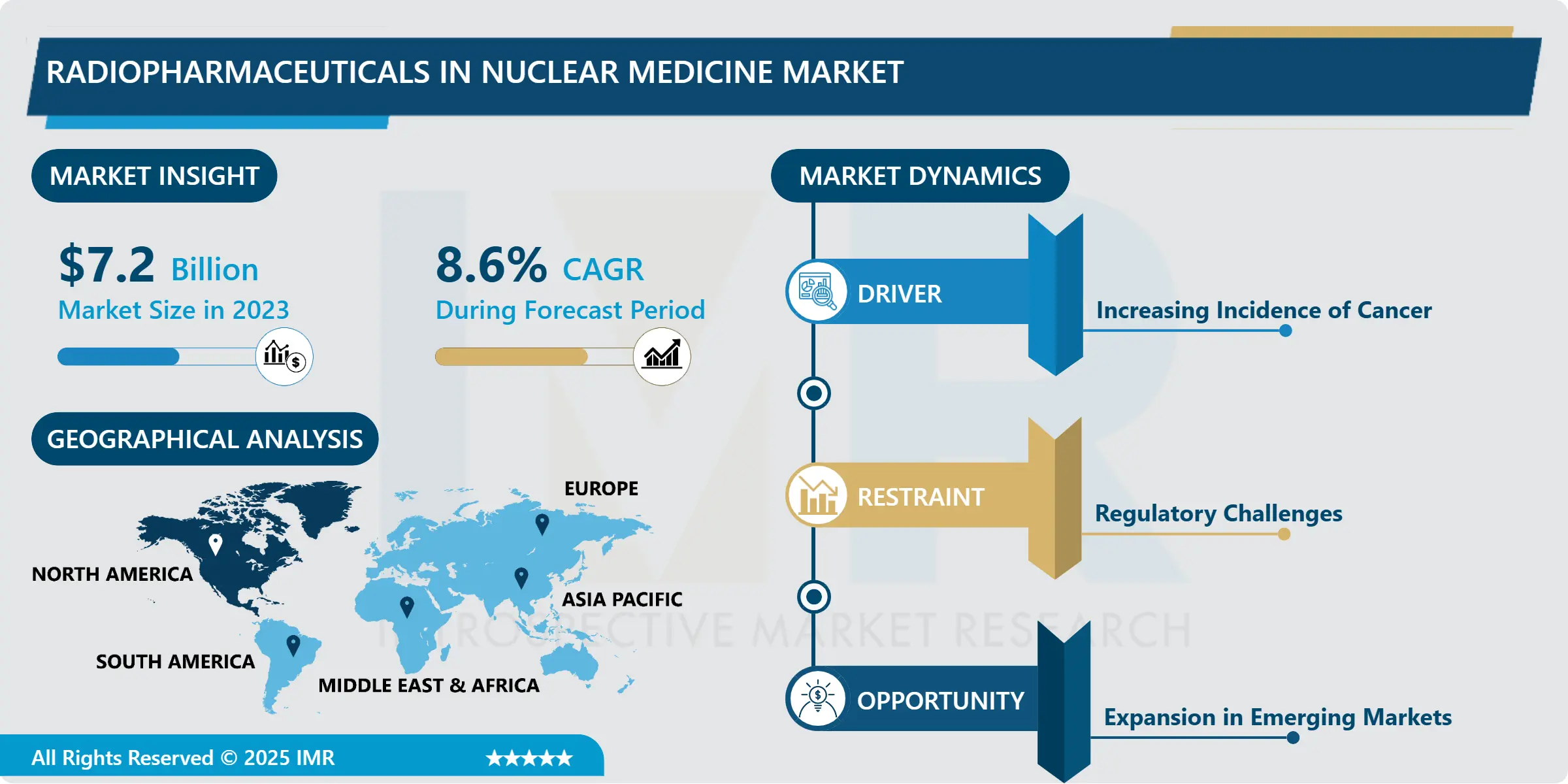

Radiopharmaceuticals in Nuclear Medicine Market Size Was Valued at USD 7.2 Billion in 2023, and is Projected to Reach USD 15.13 Billion by 2032, Growing at a CAGR of 8.6% From 2024-2032.

The radiopharmaceuticals in the nuclear medicine market encompass radioactive compounds utilized for diagnosis and treatment in various medical conditions. These specialized pharmaceuticals are designed to deliver targeted radiotherapy to tumors or to provide detailed imaging of internal organs and systems, facilitating the detection and monitoring of diseases.

The radiopharmaceuticals market in nuclear medicine has shown vast growth due to a number of factors including technological improvements as well as the growth in the incidence of chronic diseases. This market includes all kinds of radioactive drugs which can be given to patient for diagnostic and therapeutic purposes. Nuclear medicine has progressively shifted as one of the standard treatments in the global healthcare platform because of its highly efficient methods in diagnosing and treating patients, especially cancer, cardiovascular, neurological and others. In addition, there has been growing awareness and increasing number of cases of cancer and cardiovascular diseases that drives the research and development of new radiopharmaceuticals, which have prompted regulatory approvals to fuel growth.

Besides the disease rate, another driver which supports the current and future radiopharmaceuticals market is the continuous innovation in nuclear medicine research that seeks to enhance the performance of radiopharmaceuticals. Advances in imaging hugely impacted the radiopharmaceutical uses of nuclear medicine; PET and SPECT contribute to the improved diagnostic accuracy of the tests. Additionally, pharmaceutical firms, research organizations and regulatory agencies have endeavored to fast-track the availability of new radiopharmaceutical in the market. Acceptance of personalized medicine also has its role here, because in terms of patient profile, health care facilities look for individualized treatments the use of radiopharmaceutical that targets the diseases will also be high.

Radiopharmaceuticals in Nuclear Medicine Market Trend Analysis:

Advancements in Imaging Techniques

- Among the current trends pertaining to the development of the radiopharmaceuticals market, it is possible to point to rising imaging technologies as well as nuclear medicine with the artificial intelligence and machine learning instruments. They are fact rapidly changing the practice of radiopharmaceutical use for imaging diagnosis by improving image quality. It made a significant contribution to the improvement of reducible diagnostic and planning consistencies of high-quantity imaging data, compared to the algorithms frequently used before. Not only does this trend enable the earlier identification of disease but also successful treatment, making it easier to evaluate the results of therapy on a patient.

- The using of hybrid imaging is increasing in the radiopharmaceuticals industry with the help of PET/CT and SPECT/CT systems. They integrate the functional imaging features of nuclear medicine with the anatomical presentation of computed tomography (CT). Subsequently, clinicians are able to learn a number of aspects regarding the internal state of patients and identify possible deviations from normal, and therefore adjust the approach to treatment. This trend towards combinations of both approaches will only serve to buttress growth in the underlying demand for radiopharmaceuticals, particularly as healthcare providers begin to acknowledge the benefits of such fusion strategies toward increasing the accuracy of diagnostic and therapeutic interventions.

Expansion in Emerging Markets

- Another major opportunity focused on the development of growth niches in the radiopharmaceuticals market. As health facilities are enhanced and more funds are invested on medical innovations particularly in the developing world, the need for more and improved, diagnostic and therapeutic procedures is witnessed. The countries in Asia-Pacific, Latin America, and the Middle East are experiencing progressive healthcare cost and emphasis on novel therapeutic solutions: radiopharmaceuticals. This trend comes as a great opportunity for companies to at least gain market entry for these states that require solutions that solve the healthcare issues common in these territories.

- Thirdly, the rate of chronic disease such as cancer and cardiovascular diseases continues to rise in these regions partially explaining the need for radiopharmaceuticals. The increased insights about the values of early diagnosis and specific treatments which existed among healthcare providers and patients also require good radiopharmaceutical products. By using local healthcare providers and advertisement pressures in respective markets, different companies can take advantage of growth within emerging economies and increase their market standing and revenue consequently.

Radiopharmaceuticals in Nuclear Medicine Market Segment Analysis:

Radiopharmaceuticals in Nuclear Medicine Market is Segmented on the basis of Product Type, Application, End User, and Region.

By Product type, Diagnostic Nuclear Medicine segment is expected to dominate the market during the forecast period

- The radiopharmaceuticals market can be segmented into two primary categories: These sub specialties include diagnostic nuclear medicine and therapeutic nuclear medicine DNM. Nuclear medicine diagnostic mainly involves the employment of radiopharmaceutical in an attempt to obtain images of organs/tissues of human body. Some of these imaging agents are included in technetium99m and iodine123 which are used in diagnosis of many diseases such as cancers and cardiovascular diseases. Therapeutic applications of these agents have become the focus of oSeveral segments in this market due to the increased demand for accurate and non-invasive diagnostic tools.

- On the other hand therapeutic nuclear medicine concentrates on treatment of diseases through use of Radiopharmaceuticals especially cancers. Some of the agents that fall under this segment are radium-223 and lutetium-177 that release irradiation only to the tumor cells sparing the normal cells. Since cancer is on the rise, and targeted therapies are becoming increasingly popular, the enhancement in the therapeutic NM segment can be observed. The need to find qualitative treatments for patients increasingly drives health-care organizational and management activities, which shall, in turn, boost the need for advanced therapeutic radiopharmaceuticals and give way to many market players.

By Application, Oncology segment expected to held the largest share

- Radiopharmaceutical uses have been embraced in different specialties to mention a few; oncology, cardiology, neurology, endocrinology. Oncology has been the biggest application area to date since cancer rates are high around the world and radiopharmaceuticals serve as an important diagnostic and therapeutic tool. Due to the trait of radiopharmaceuticals to give accurate image information and target therapies a cancer patient cannot afford to be without them. With the development of more new radiopharmaceutical products, it is believed that more applications are expected in cancer field for improving the patient care and therapeutic quality.

- Apart from oncology, cardiology and neurology uses of radiopharmaceuticals are also emerging. In cardiology, it is used in imaging of myocardial perfusion and detection of Coronary artery disease whereas in Neurology it is used to diagnosing disease such as Alzheimer’s disease and epilepsy. Another factor behind the increase in demand for radiopharmaceuticals, apart from the steady application in nuclear medicine, is the growing knowledge about its advantages among practising physicians. In addition, innovation in the treatment options in endocrinology alongside other field will also provide basis for growth in the market.

Radiopharmaceuticals in Nuclear Medicine Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America incidentally represents the largest region in the global radiopharmaceuticals market and contributes to many factors. The area has well-developed medical equipment, a high incidence of chronic diseases, and a large amount of investment in research. The presences of some players and developed health care systems also add up to the regions confirmation of premier in taking of nuclear medicine technologies. North American markets can therefore be described as having fairly strict regulatory circumstances but within which innovative product development can quickly occur, evidenced by the rapid approval of new radiopharmaceuticals.

- The increasing importance of individualized treatment and target-based drugs is stimulating the North American market for radiopharmaceuticals. As there has been more awareness among the healthcare practitioners as well as the patients for using nuclear medicine more companies are expected to exhibit consistent growth in the use of radiopharmaceuticals in this region. This continuous partnership of various research organizations, pharmaceutical companies and healthcare services for improving the diagnostic approach and treatment therapy put North America at a conspicuous position in the global market of radiopharmaceuticals.

Active Key Players in the Radiopharmaceuticals in Nuclear Medicine Market

- GE Healthcare (USA)

- Siemens Healthineers (Germany)

- Cardinal Health (USA)

- Bayer AG (Germany)

- Bracco Imaging (Italy)

- Curium Pharma (France)

- Eczac?ba??-Monrol (Turkey)

- Philips Healthcare (Netherlands)

- Lantheus Medical Imaging (USA)

- Ion Beam Applications (IBA) (Belgium)

- Fujifilm Holdings Corporation (Japan)

- Radiopharma (Australia)

- Other Active Players

Key Industry Developments in the Radiopharmaceuticals in Nuclear Medicine Market:

- In March 2024, Ratio Therapeutics Inc. has announced an expanded manufacturing agreement with PharmaLogic to accelerate the development and commercialization of its next-generation radiotherapies. This collaboration will enhance the production of Ratio's fibroblast activation protein-alpha (FAP)-targeted radiotherapeutic candidate.

- In December 2023, Bristol Myers Squibb has announced it will acquire RayzeBio, Inc. for $62.50 per share in cash, totaling approximately US$4.1 billion or US$3.6 billion net of estimated cash acquired. The deal, approved by both companies' Boards, will enhance Bristol Myers Squibb's portfolio with RayzeBio's innovative actinium-based radiopharmaceutical therapeutics (RPTs). RayzeBio, a clinical-stage company, focuses on RPTs targeting solid tumors like GEP-NETs, small cell lung cancer, and hepatocellular carcinoma, offering potential advantages in efficacy and targeted delivery

|

Radiopharmaceuticals in Nuclear Medicine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.2 Billion |

|

Forecast Period 2024-32 CAGR: |

8.6% |

Market Size in 2032: |

USD 15.13 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Radiopharmaceuticals in Nuclear Medicine Market by Product Type

4.1 Radiopharmaceuticals in Nuclear Medicine Market Snapshot and Growth Engine

4.2 Radiopharmaceuticals in Nuclear Medicine Market Overview

4.3 Diagnostic Nuclear Medicine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Diagnostic Nuclear Medicine: Geographic Segmentation Analysis

4.4 Therapeutic Nuclear Medicine

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Therapeutic Nuclear Medicine: Geographic Segmentation Analysis

Chapter 5: Radiopharmaceuticals in Nuclear Medicine Market by Application

5.1 Radiopharmaceuticals in Nuclear Medicine Market Snapshot and Growth Engine

5.2 Radiopharmaceuticals in Nuclear Medicine Market Overview

5.3 Oncology

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Oncology: Geographic Segmentation Analysis

5.4 Cardiology

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Cardiology: Geographic Segmentation Analysis

5.5 Neurology

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Neurology: Geographic Segmentation Analysis

5.6 Endocrinology

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Endocrinology: Geographic Segmentation Analysis

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation Analysis

Chapter 6: Radiopharmaceuticals in Nuclear Medicine Market by End User

6.1 Radiopharmaceuticals in Nuclear Medicine Market Snapshot and Growth Engine

6.2 Radiopharmaceuticals in Nuclear Medicine Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Ambulatory Surgical Centers: Geographic Segmentation Analysis

6.5 Specialty Clinics

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Specialty Clinics: Geographic Segmentation Analysis

6.6 Diagnostic Centers

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Diagnostic Centers: Geographic Segmentation Analysis

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Radiopharmaceuticals in Nuclear Medicine Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 GE HEALTHCARE (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SIEMENS HEALTHINEERS (GERMANY)

7.4 CARDINAL HEALTH (USA)

7.5 BAYER AG (GERMANY)

7.6 BRACCO IMAGING (ITALY)

7.7 CURIUM PHARMA (FRANCE)

7.8 ECZACIBA?I-MONROL (TURKEY)

7.9 PHILIPS HEALTHCARE (NETHERLANDS)

7.10 LANTHEUS MEDICAL IMAGING (USA)

7.11 ION BEAM APPLICATIONS (IBA) (BELGIUM)

7.12 FUJIFILM HOLDINGS CORPORATION (JAPAN)

7.13 RADIOPHARMA (AUSTRALIA)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Radiopharmaceuticals in Nuclear Medicine Market By Region

8.1 Overview

8.2. North America Radiopharmaceuticals in Nuclear Medicine Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Diagnostic Nuclear Medicine

8.2.4.2 Therapeutic Nuclear Medicine

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Oncology

8.2.5.2 Cardiology

8.2.5.3 Neurology

8.2.5.4 Endocrinology

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Ambulatory Surgical Centers

8.2.6.3 Specialty Clinics

8.2.6.4 Diagnostic Centers

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Radiopharmaceuticals in Nuclear Medicine Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Diagnostic Nuclear Medicine

8.3.4.2 Therapeutic Nuclear Medicine

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Oncology

8.3.5.2 Cardiology

8.3.5.3 Neurology

8.3.5.4 Endocrinology

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Ambulatory Surgical Centers

8.3.6.3 Specialty Clinics

8.3.6.4 Diagnostic Centers

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Radiopharmaceuticals in Nuclear Medicine Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Diagnostic Nuclear Medicine

8.4.4.2 Therapeutic Nuclear Medicine

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Oncology

8.4.5.2 Cardiology

8.4.5.3 Neurology

8.4.5.4 Endocrinology

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Ambulatory Surgical Centers

8.4.6.3 Specialty Clinics

8.4.6.4 Diagnostic Centers

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Radiopharmaceuticals in Nuclear Medicine Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Diagnostic Nuclear Medicine

8.5.4.2 Therapeutic Nuclear Medicine

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Oncology

8.5.5.2 Cardiology

8.5.5.3 Neurology

8.5.5.4 Endocrinology

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Ambulatory Surgical Centers

8.5.6.3 Specialty Clinics

8.5.6.4 Diagnostic Centers

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Radiopharmaceuticals in Nuclear Medicine Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Diagnostic Nuclear Medicine

8.6.4.2 Therapeutic Nuclear Medicine

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Oncology

8.6.5.2 Cardiology

8.6.5.3 Neurology

8.6.5.4 Endocrinology

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Ambulatory Surgical Centers

8.6.6.3 Specialty Clinics

8.6.6.4 Diagnostic Centers

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Radiopharmaceuticals in Nuclear Medicine Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Diagnostic Nuclear Medicine

8.7.4.2 Therapeutic Nuclear Medicine

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Oncology

8.7.5.2 Cardiology

8.7.5.3 Neurology

8.7.5.4 Endocrinology

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Ambulatory Surgical Centers

8.7.6.3 Specialty Clinics

8.7.6.4 Diagnostic Centers

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Radiopharmaceuticals in Nuclear Medicine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.2 Billion |

|

Forecast Period 2024-32 CAGR: |

8.6% |

Market Size in 2032: |

USD 15.13 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||