Protein Powder Market Synopsis:

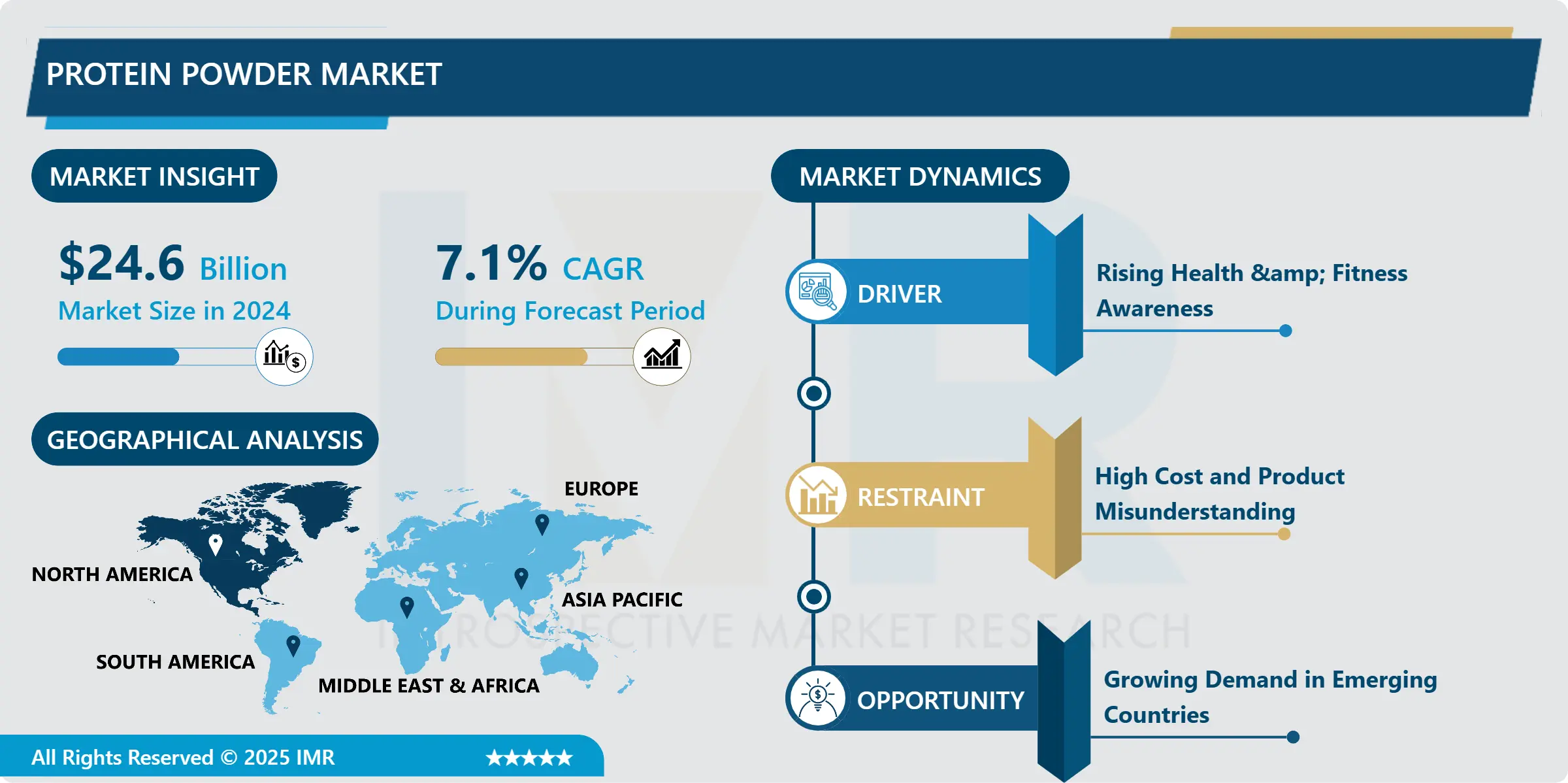

Protein Powder Market Size Was Valued at USD 24.6 Billion in 2024, and is Projected to Reach USD 52.31 Billion by 2035, Growing at a CAGR of 7.1% from 2025-2035.

The protein powder market is a growing part of the health and wellness industry. Protein powder is a popular supplement used by people of all ages to support muscle building, weight loss, and overall nutrition. While it was once mainly used by athletes and bodybuilders, it is now widely used by everyday consumers, including seniors, busy professionals, and people on plant-based diets.

Protein powders come from many sources, such as whey (a milk-based protein), soy, pea, rice, and other plants. In recent years, plant-based and vegan protein powders have become especially popular due to growing interest in sustainable and animal-free products.

The demand for protein powder is increasing as more people focus on fitness, healthy eating, and convenient nutrition. It is sold in health food stores, supermarkets, gyms, and online. Companies are also creating new Flavors and adding extra nutrients like vitamins, probiotics, and collagen to make their products stand out.

In summary, the protein powder market is expanding quickly because of changing lifestyles, rising health awareness, and new product innovations. This trend is expected to continue as more people look for easy and effective ways to stay healthy.

Protein Powder Market Growth and Trend Analysis:

Protein Powder Market Growth Driver- Rising Health & Fitness Awareness

- In recent years, more people around the world have become aware of the importance of staying healthy and fit. This growing awareness is one of the main reasons why the demand for protein powder is increasing.

- People today are more careful about what they eat and how it affects their bodies. Many are choosing to eat high-protein foods to help them stay strong, manage their weight, build muscle, or simply feel more energetic. Protein plays a big role in our health it helps repair body tissues, supports the immune system, and keeps us feeling full longer, which can help with weight control.

- This health-conscious trend isn’t just limited to athletes or gym-goers. Everyday people students, office workers, parents, and older adults are also adding more protein to their diets to stay healthy and active. Protein powders make this easy because they are convenient, quick to prepare, and can be added to smoothies, shakes, or even food recipes.

- Also, more people are joining gyms, doing home workouts, and following fitness influencers on social media. These habits encourage the use of protein supplements as part of a daily routine.

- As more people make healthier lifestyle choices, the interest in protein powders continues to rise. This has created a strong opportunity for brands to offer new and improved products that support wellness goals, whether it’s losing weight, gaining muscle, or simply living better.

Protein Powder Market Limiting Factor- High Cost and Product Misunderstanding: Key Challenges in the Protein Powder Market

- While the protein powder market is growing quickly, there are some challenges that could slow down its progress. One of the biggest limiting factors is the high cost of quality protein powders. Many protein powders, especially those made from organic or plant-based ingredients, can be quite expensive. This makes them less affordable for people with lower incomes, especially in developing countries. As a result, not everyone who wants to use protein powder can buy it regularly.

- Another challenge is lack of awareness or misunderstanding about protein supplements. Some people believe protein powder is only for bodybuilders or athletes, while others think it may have harmful side effects. This can lead to hesitation or fear around using these products. In some cases, people may not understand how much protein they actually need or how to use supplements correctly, leading to underuse or misuse.

- Also, some protein powders contain artificial ingredients, added sugars, or allergens (like dairy or soy), which may not be suitable for everyone. These concerns make people more cautious when choosing a product.

- To overcome these limits, companies need to focus on educating consumers, improving product transparency, and offering more affordable and clean-label options.

Protein Powder Market Expansion Opportunity- Growing Demand in Emerging Countries

- One of the biggest opportunities for the protein powder market is the growing demand in emerging countries like India, China, Brazil, and countries in Southeast Asia and Africa. As these economies grow, more people are becoming aware of health and fitness. Urban lifestyles, rising incomes, and better access to gyms and health products are encouraging people to try protein supplements.

- Younger generations in these countries are especially interested in building strong bodies, improving their appearance, and staying fit. Many of them follow fitness trends on social media, which helps promote the use of protein powders. Also, there is a growing demand for plant-based, organic, and affordable protein products in these markets.

- Companies have the chance to introduce new products that are tailored to local tastes, health needs, and budgets. Selling through online platforms also makes it easier to reach people in rural or remote areas.

- By focusing on education, awareness, and affordability, brands can build a strong presence in these fast-growing regions.

Protein Powder Market Challenge and Risk- Quality Concerns and Misleading Claims

- A major challenge in the protein powder market is the lack of product regulation and quality control in some areas. Not all protein powders are made to the same standard. Some products may contain low-quality ingredients, hidden sugars, banned substances, or even unsafe additives.

- There have been cases where protein powders did not match their labels, leading to consumer distrust. Misleading marketing claims such as “instant muscle gain” or “weight loss guaranteed” can also create false expectations and damage brand reputation.

- Another risk is the increasing number of unregulated or fake brands being sold online. Consumers who are unaware may buy poor-quality products that do not meet safety or health standards. This can cause health issues and reduce trust in the market as a whole.

- Additionally, some people may overuse protein powder or take it without proper guidance, leading to side effects like digestive problems or kidney strain in rare cases. To address this challenge, companies need to focus on quality assurance, transparent labelling, and educating consumers. Governments and health organizations also play a role by ensuring stricter regulations and monitoring of supplement products. Also Maintaining trust through safe and honest practices is key to long-term success in the protein powder market.

Protein Powder Market Segment Analysis:

Protein Powder Market is segmented based on Type, Application, End-Users, and Region

By Type, Protein Powder Segment is Expected to Dominate the Market During the Forecast Period

- The protein powder market is divided into two main product types: conventional and organic. Among these, conventional protein powders currently hold the largest share of the market.

- Conventional protein powders are more affordable, easily available, and are produced using standard farming and processing methods. They are commonly found in supermarkets, online stores, and gyms. Many people, especially beginners or those with a limited budget, choose conventional protein powders to support their fitness goals, weight management, and general health.

- These powders are available in various forms, including whey, casein, soy, and plant-based blends, and come in many popular flavours. Because they are priced reasonably and offer good nutritional value, they are used by a wide range of consumers from athletes to office workers to students. On the other hand, organic protein powders are made from ingredients grown without synthetic chemicals, pesticides, or artificial additives. While their market is growing, especially among health-conscious and eco-friendly consumers, they are often more expensive and less widely available than conventional products.

- Overall, conventional protein powders dominate the market today due to their accessibility and cost-effectiveness, but demand for organic options is also rising steadily as people become more aware of clean-label and natural food trends.

By Application, Protein Powder Segment Held the Largest Share in 2024

- Dietary supplements are one of the largest and most important segments in the protein powder market. Many people use protein powders as part of their daily routine to boost nutrition, support energy levels, and maintain overall health and wellness.

- In today’s fast-paced lifestyle, not everyone gets enough protein through regular meals. Protein powders offer a quick and convenient way to fill this gap. They are especially helpful for people who are busy, follow special diets, or have higher protein needs due to age, health conditions, or physical activity.

- Protein powders used as dietary supplements are not just for athletes. They are also used by older adults to prevent muscle loss, young adults for better fitness, and people recovering from illness. Some people use them as meal replacements or to support weight loss and muscle maintenance.

- This segment is growing quickly because more people are becoming health-conscious and are looking for easy ways to improve their diet. Also, the rise in online shopping and awareness about protein benefits has made protein supplements more accessible than ever.

- With a wide range of flavours, types (like whey or plant-based), and added nutrients, protein powders are becoming a trusted part of daily health routines, making the dietary supplement segment a major driver of market growth.

Protein Powder Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is the leading region in the global protein powder market, with the United States accounting for the largest share. The region’s strong position is driven by a high level of health and fitness awareness, a well-established sports nutrition industry, and a large population of active gym-goers and athletes.

- In North America, protein powders are widely used as dietary supplements, not just by bodybuilders, but also by regular people looking to maintain a healthy lifestyle, lose weight, or manage daily nutrition. Many consumers use protein shakes as meal replacements, post-workout recovery drinks, or as a quick source of energy during the day.

- Whey protein is the most popular type in this region, but there’s also fast-growing demand for plant-based proteins such as pea, soy, and rice protein, especially among vegans, vegetarians, and those with lactose intolerance. Organic and clean-label products are also gaining attention as people become more mindful about ingredients. The presence of major health supplement brands, advanced distribution channels (especially online sales), and frequent product innovation helps fuel the market.

- Overall, the North American protein powder market is expected to grow steadily, supported by changing lifestyles, increasing health goals, and a culture that strongly values fitness and well-being.

Protein Powder Market Active Players:

- Abbott Laboratories (North America)

- Amway/Nutrilite (North America)

- Ascent Protein (North America)

- Bodybuilding.com Signature (North America)

- BSN (North America)

- Dymatize Nutrition (North America)

- Garden of Life (North America)

- Glanbia Plc (Europe)

- GNC (North America)

- Herbalife Nutrition (North America)

- Isagenix (North America)

- Isopure (North America)

- Labrada Nutrition (North America)

- Musashi (Asia-Pacific)

- Muscle Milk – PepsiCo (North America)

- MusclePharm (North America)

- MuscleTech – Iovate (North America)

- Myprotein – The Hut Group (Europe)

- Nature’s Bounty (North America)

- NOW Foods (North America)

- NutraBio Labs (North America)

- Optimum Nutrition (North America)

- Orgain (North America)

- PEScience (North America)

- Puritan’s Pride (North America)

- Quest Nutrition (North America)

- Sunwarrior (North America)

- Transparent Labs (North America)

- Ultimate Nutrition (North America)

- Vega Danone (North America)

- Other Active Players

Key Industry Developments in the Protein Powder Market:

- In November 2022, Max Protein launched Tastiest Plant Protein Powder in India, this plant-based protein made with 7 grains that offer 22 grams of clean protein per serving of 50gm and a unique formulation of enzyme and probiotic that helps increase digestion and protein absorption.

- In March 2022, Muscle Pharm Corporation announced it will be expanding into the ready-to-drink protein category with the launch of its new whey protein drink line in the summer of 2022. The new high protein beverage line will be marketed under the leading Muscle Pharm brand and will contain over 20g of protein, be sugar-free, and will be available in multiple Flavors.

|

Protein Powder Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 24.6 Billion |

|

Forecast Period 2025-35 CAGR: |

7.1 % |

Market Size in 2035: |

USD 52.31 Billion.

|

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Protein Powder Market by Product Type (2018-2035)

4.1 Protein Powder Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Organic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Conventional

Chapter 5: Protein Powder Market by Application (2018-2035)

5.1 Protein Powder Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Dietary Supplements

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Food and Beverages

5.5 Sports Nutrition

5.6 Infant Food Formula

5.7 Pharmaceuticals

5.8 Others

Chapter 6: Protein Powder Market by Distribution Channel (2018-2035)

6.1 Protein Powder Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Supermarket/Hypermarket

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pharmacy Stores

6.5 Online Stores

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Protein Powder Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 ABBOTT LABORATORIES (NORTH AMERICA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 AMWAY/NUTRILITE (NORTH AMERICA)

7.4 ASCENT PROTEIN (NORTH AMERICA)

7.5 BODYBUILDING.COM SIGNATURE (NORTH AMERICA)

7.6 BSN (NORTH AMERICA)

7.7 DYMATIZE NUTRITION (NORTH AMERICA)

7.8 GARDEN OF LIFE (NORTH AMERICA)

7.9 GLANBIA PLC (EUROPE)

7.10 GNC (NORTH AMERICA)

7.11 HERBALIFE NUTRITION (NORTH AMERICA)

7.12 ISAGENIX (NORTH AMERICA)

7.13 ISOPURE (NORTH AMERICA)

7.14 LABRADA NUTRITION (NORTH AMERICA)

7.15 MUSASHI (ASIA-PACIFIC)

7.16 MUSCLE MILK – PEPSICO (NORTH AMERICA)

7.17 MUSCLEPHARM (NORTH AMERICA)

7.18 MUSCLETECH – IOVATE (NORTH AMERICA)

7.19 MYPROTEIN – THE HUT GROUP (EUROPE)

7.20 NATURE’S BOUNTY (NORTH AMERICA)

7.21 NOW FOODS (NORTH AMERICA)

7.22 NUTRABIO LABS (NORTH AMERICA)

7.23 OPTIMUM NUTRITION (NORTH AMERICA)

7.24 ORGAIN (NORTH AMERICA)

7.25 PESCIENCE (NORTH AMERICA)

7.26 PURITAN’S PRIDE (NORTH AMERICA)

7.27 QUEST NUTRITION (NORTH AMERICA)

7.28 SUNWARRIOR (NORTH AMERICA)

7.29 TRANSPARENT LABS (NORTH AMERICA)

7.30 ULTIMATE NUTRITION (NORTH AMERICA)

7.31 VEGA DANONE (NORTH AMERICA)

7.32 AND OTHER ACTIVE PLAYERS.

Chapter 8: Global Protein Powder Market By Region

8.1 Overview

8.2. North America Protein Powder Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Protein Powder Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Protein Powder Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Protein Powder Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Protein Powder Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Protein Powder Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Case Study

Chapter 12 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

|

Protein Powder Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 24.6 Billion |

|

Forecast Period 2025-35 CAGR: |

7.1 % |

Market Size in 2035: |

USD 52.31 Billion.

|

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||