Global Premium Chocolate Market Overview

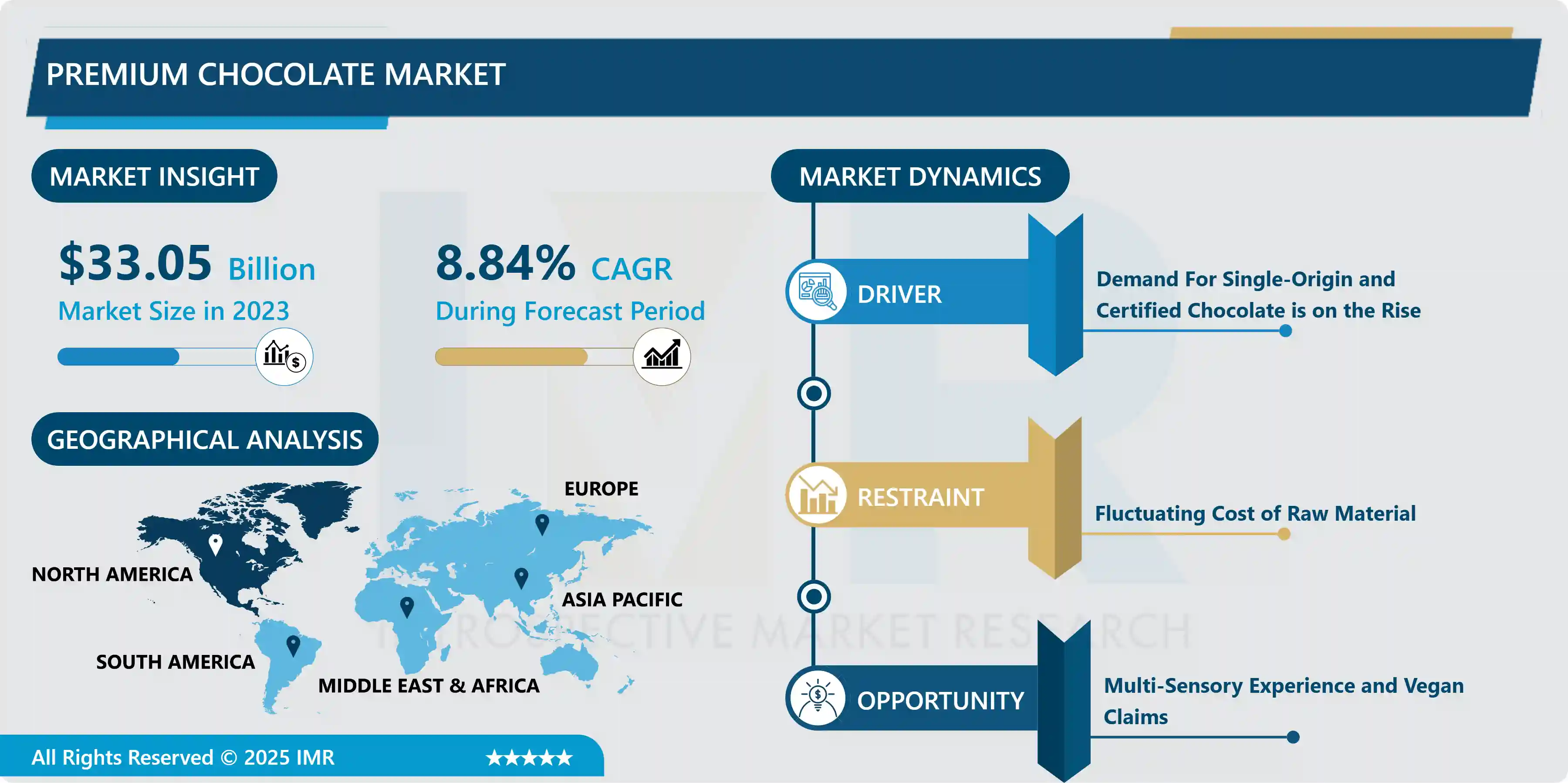

Premium Chocolate Market Size Was Valued at USD 33.05 Billion in 2023, and is Projected to Reach USD 70.84 Billion by 2032, Growing at a CAGR of 8.84% From 2024-2032.

Premium chocolate is completely different from the common candy bars sold at the register. It's a lavish treat for those who value the finer things in life. Consumers have become increasingly mindful of their health and knowledgeable about food. They are in search of high-quality ingredients, distinct flavour profiles, and responsibly sourced cocoa. High-quality chocolates satisfy the need for a more luxurious and sophisticated chocolate indulgence. Premium chocolates provide more than just a price; they promise an experience. Handcrafted skills, creative flavour mixes, and high-end packaging together enhance the exclusive sensation. High-quality chocolates are ideal for indulging yourself or pampering a loved one. They enhance the act of giving gifts during holidays and celebrations, bringing a layer of luxury to every event.

Seasonal demand is essential for the sales of high-quality chocolates. Innovative products drive the market, increasing awareness, customer engagement, and attracting a larger customer base. Another factor fuelling the market's growth is the interest in limited edition chocolate. While major manufacturers control the chocolate sector, the opportunities for premium and handcrafted chocolates are on the rise. Multiple companies introduce a selection of high-end and deluxe chocolate options with fresh Flavors and packaging options for special events like Christmas, New Year, and more. The constantly changing market includes exclusive releases, which maintain customer interest and excitement to sample the latest products. Special editions, ranging from seasonal Flavors to partnerships with luxury brands, cultivate an air of exclusivity. The surge of dark chocolate's perceived health advantages is fuelling expansion in the high-end market. Moreover, there is a growing interest in options for dietary restrictions such as vegan or sugar-free chocolates.

Market Dynamics And Factors for Premium Chocolate Market

Drivers:

Demand For Single-Origin and Certified Chocolate is On the Rise

- The demand for fine flavor cocoa is increasing rapidly in places like Europe and North America. Gourmet chocolates are made using ultra- and high-end beans, whereas standard premium chocolates are made with regular and low-fine beans, notably in nations like the United Kingdom, Brazil, the United States, China, India, the Netherlands, Germany, and Switzerland. The health trend and the need for more special products are driving this development. With sustainability certification and single origin, the premium cocoa market promotes the overall expansion of the industry analyzed. Manufacturers are introducing single-origin and premium chocolate lines in response to the rising demand. They also contribute to the local economy. These tactics aid firms in increasing profit margins and developing a more favorable brand image. Nestle; for example, built a new chocolate molding and packing line in Ecuador. This enabled the company to create value-added chocolates for export and domestic consumption using the single-origin particular variety "Arriba cocoa" beans.

Restraints:

Fluctuating Cost of Raw Material

- The market's major players are expanding their expenditure in various research and development efforts to launch higher-quality, healthier premium chocolates. However, one of the primary issues expected to slow the growth of the Premium Chocolate Market is the fluctuating price of cocoa beans.

Opportunities:

Multi-Sensory Experience and Vegan Claims

- Consumers are excited and their chocolate experiences are elevated by daring tastes, distinctive textures, and novel formats. In the confectionery aisles, hot cocoa bombs, dippable nibbles, ruby chocolate, and cross-category confections are popular. As a reference to the forthcoming 4th of July celebration, Flavorchem's team created a red, white, and berry hot cocoa bomb, as well as a mocha macaron and honey graham cake pop using our extensive array of natural chocolate flavors. Vegan claims have surfaced in 7% of all chocolate candy launched in 2020, owing to an increase in consumer interest in plant-based diets and ethical norms.

Market Segmentation

Segmentation Analysis of Premium Chocolate Market:

- By Product Type, over the forecast period, the dark premium chocolate segment is expected to dominate the market. The increased availability of dark premium chocolates and the growing demand for dark chocolates prepared with cocoa powder are both contributing to this trend. The Premium Chocolate Market is growing due to a growing preference for dark chocolate manufactured with cocoa beans in industrialized countries. Due to factors such as rising demand for skimmed milk chocolate among the youthful population and an increase in product launches of white and milk premium chocolates, the White and Milk Premium Chocolate segment had the second-largest share.

- By Distribution Channel, due to factors such as increased demand for various luxury chocolates made with cocoa powder at supermarkets and increased investment by key players, the Supermarkets/Hypermarkets segment held the highest share. The Premium Chocolate Market is growing due to the easy availability of flavor options and trustworthiness in supermarkets. With an over the projected period, the Online Channels section is expected to be the fastest-growing segment. The surge in demand for skimmed milk chocolate among the youthful population in online channels, technological improvements, and an increasing propensity towards a sedentary lifestyle are all contributing to this trend.

Regional Analysis of Premium Chocolate Market:

- North America is expected to dominate the premium chocolate market over the forecast period. In terms of chocolate consumption and production, the United States has the greatest market share in North America. The country's chocolate consumption is bolstered by consumer demand, purchasing power, and consumption patterns. Chocolate is purchased twice a week on average in the United States, with sales increasing on holidays and weekends as consumers are more likely to treat themselves and others with chocolate. People in the United States prefer to indulge themselves with bite-sized chocolates to restrict their confectionery consumption, therefore the premium chocolate business is fairly popular there as well. Dark chocolate fits in nicely with the country's 'clean eating' trend, which is supporting the chocolate industry's growth in the United States.

- The increased consumption of premium dark chocolates is driving the premium chocolate industry growth in Europe. Consumer health concerns have resulted in a shift away from traditional milk chocolates and toward premium dark chocolates. Furthermore, the increased popularity of gourmet chocolates made from ultra-fine cocoa beans is fueling market expansion. Furthermore, the introduction of organic, vegan, sugar-free, and gluten-free premium chocolates is fueling demand in Europe. Natural cocoa pulp has replaced synthetic ingredients in premium chocolates due to the significant prevalence of clean eating habits among European consumers.

- Due to consumers' increased health consciousness, developing trends such as healthy indulgence of low-fat and sugar-free chocolates are driving the premium chocolate market in the Asia Pacific region. Furthermore, the premium chocolate market is growing due to the rising demand for ethically grown cocoa and cocoa originating from a single plantation. The market's growth is aided by the premiumization trend in chocolate confectioneries in developing nations such as China and India, as well as the strong demand for higher-quality chocolates with appealing and bright packaging.

Players Covered In Premium Chocolate Market are:

- Nestle S.A.

- Chocoladefabriken Lindt & Sprüngli AG

- The Hershey Company

- Ferrero

- Mars Inc.

- Cargill Incorporated

- Vosges Haut-Chocolate

- Teuscher

- Yildiz Holding

- Hotel Chocolat

- Artisan Confections Company

- Mondelez International Inc.

- Neuhaus

- Meiji Holdings Co. Ltd.

- Guylian

- Lotte Corporation

- Cemoi

- Moonstruck Chocolate

- French Broad Chocolates

- Mast Brothers and others major players.

Key Industry Developments In Premium Chocolate Market

- JAN 19, 2024 First KitKat using cocoa from the Nestlé Income Accelerator launches in Europe Nestlé has introduced the first KitKat made with cocoa mass from beans grown by farmer families engaged in the company's income accelerator. This KitKat aims to connect consumers with the farmers in Nestlé's program and raise awareness about the sustainability of the cocoa used in the iconic bars. The innovative program was launched in January 2022 to help close the living income gap of cocoa-farming families and reduce child labour risk. At the same time, it strives to advance better agriculture practices and promote gender equality, empowering women as agents for positive change. The program incentivizes cocoa-farming families that enrol their children in school, implement good agricultural practices, engage in agroforestry activities, and diversify their incomes.

- December 13, 2023 In November, we launched the greatest combination since chocolate met peanut butter: Reese’s Caramel Big Cup. We’re so excited about the layering of chocolate, peanut butter and gooey caramel that we put together a cross-organizational campaign to promote this new product. The initiative brings together our capabilities in augmented reality and image recognition to assist retailers in making data-driven decisions that boost sales. To further assist our retail team, we’re also allowing Hershey’s non-retail employees to help with this busy launch through our Helping Hands program – the first time we’ve expanded this program for a product launch.

|

Global Premium Chocolate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 33.05 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.84 % |

Market Size in 2032: |

USD 70.84 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Premium Chocolate Market by Type (2018-2032)

4.1 Premium Chocolate Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Dark Premium Chocolate

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 White & Milk Premium Chocolate

Chapter 5: Premium Chocolate Market by Distribution Channel (2018-2032)

5.1 Premium Chocolate Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Supermarkets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Hypermarkets

5.5 Convenience Stores

5.6 Online Stores

5.7 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Premium Chocolate Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AFCO SYSTEMS (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CISCO SYSTEMS INC. (U.S.)

6.4 CYBER POWER SYSTEMS (U.S.)

6.5 EMERSON ELECTRIC CO. (U.S.)

6.6 ENLOGIC SYSTEMS LLC (U.S.)

6.7 GE INDUSTRIAL SOLUTIONS (U.S.)

6.8 HEWLETT PACKARD ENTERPRISE (U.S.)

6.9 PANDUIT CORP. (U.S.)

6.10 RARITAN INC. (U.S.)

6.11 LEVITON MANUFACTURING COINC. (U.S.)

6.12 SERVER TECHNOLOGY INC. (U.S.)

6.13 TRIPP LITE (U.S.)

6.14 RACKOM SYSTEM (U.S.)

6.15 VERTIV GROUP CORP. (U.S.)

6.16 NOVA ELECTRIC (U.S.)

6.17 LEGRAND (FRANCE)

6.18 NVENT (U.K.)

6.19 SCHNEIDER ELECTRIC (FRANCE)

6.20 SIEMENS AG (GERMANY)

6.21 SOCOMEC GROUP (FRANCE)

6.22 ELCOM INTERNATIONAL PRIVATE LIMITED (INDIA)

6.23 EATON CORPORATION (IRELAND)

6.24 ABB LTD. (SWITZERLAND)

6.25 ATEN INTERNATIONAL COLTD. (TAIWAN)

6.26 DELTA ELECTRONICS INC. (TAIWAN)

Chapter 7: Global Premium Chocolate Market By Region

7.1 Overview

7.2. North America Premium Chocolate Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Dark Premium Chocolate

7.2.4.2 White & Milk Premium Chocolate

7.2.5 Historic and Forecasted Market Size by Distribution Channel

7.2.5.1 Supermarkets

7.2.5.2 Hypermarkets

7.2.5.3 Convenience Stores

7.2.5.4 Online Stores

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Premium Chocolate Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Dark Premium Chocolate

7.3.4.2 White & Milk Premium Chocolate

7.3.5 Historic and Forecasted Market Size by Distribution Channel

7.3.5.1 Supermarkets

7.3.5.2 Hypermarkets

7.3.5.3 Convenience Stores

7.3.5.4 Online Stores

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Premium Chocolate Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Dark Premium Chocolate

7.4.4.2 White & Milk Premium Chocolate

7.4.5 Historic and Forecasted Market Size by Distribution Channel

7.4.5.1 Supermarkets

7.4.5.2 Hypermarkets

7.4.5.3 Convenience Stores

7.4.5.4 Online Stores

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Premium Chocolate Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Dark Premium Chocolate

7.5.4.2 White & Milk Premium Chocolate

7.5.5 Historic and Forecasted Market Size by Distribution Channel

7.5.5.1 Supermarkets

7.5.5.2 Hypermarkets

7.5.5.3 Convenience Stores

7.5.5.4 Online Stores

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Premium Chocolate Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Dark Premium Chocolate

7.6.4.2 White & Milk Premium Chocolate

7.6.5 Historic and Forecasted Market Size by Distribution Channel

7.6.5.1 Supermarkets

7.6.5.2 Hypermarkets

7.6.5.3 Convenience Stores

7.6.5.4 Online Stores

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Premium Chocolate Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Dark Premium Chocolate

7.7.4.2 White & Milk Premium Chocolate

7.7.5 Historic and Forecasted Market Size by Distribution Channel

7.7.5.1 Supermarkets

7.7.5.2 Hypermarkets

7.7.5.3 Convenience Stores

7.7.5.4 Online Stores

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Premium Chocolate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 33.05 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.84 % |

Market Size in 2032: |

USD 70.84 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||