Polymerase Chain Reaction Market Synopsis:

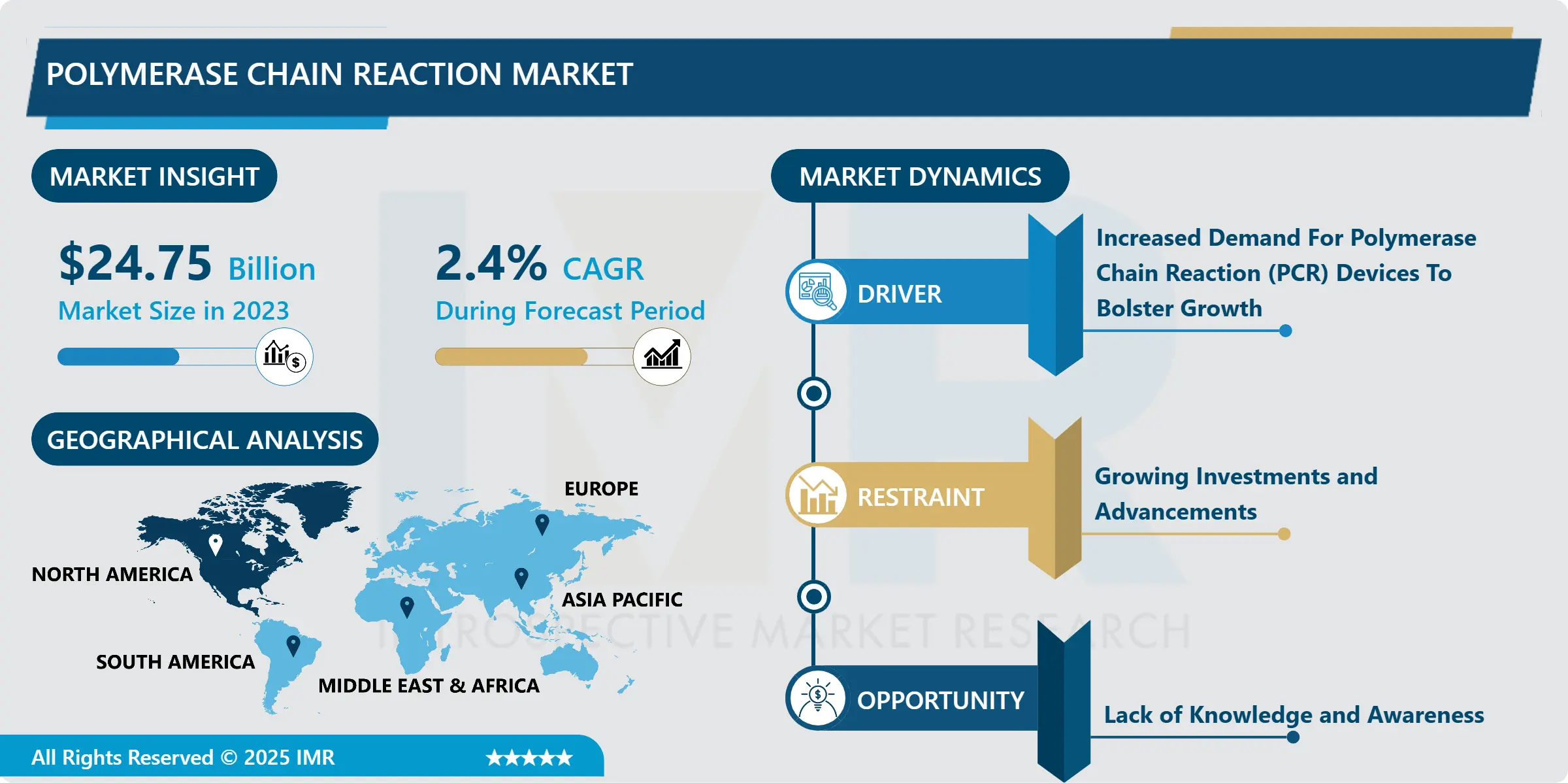

Polymerase Chain Reaction Market Size Was Valued at USD 24.75 Billion in 2023, and is Projected to Reach USD 30.64 Billion by 2032, Growing at a CAGR of 2.40% From 2024-2032.

PCR equipment, better known as a Thermal cycler, is widely used in laboratories to reproduce the segment of DNA through a procedure known as polymerase chain reaction. Applications of PCR instruments include cloning, DNA sequencing and library building, site-directed mutagenesis, and differential gene expression profiling.

The Polymerase Chain Reaction (PCR) market has become an important branch within the life sciences, resulting from the progress in molecular biology techniques, and the need for highly efficient diagnostics.. PCR The process is greatly employed to make millions of copies of a small region of DNA in order to analyze it with ease. This capability has transformed field ranging from genetics, microbiology and clinical diagnostics. The targets can include identification of infectious diseases, genetic diagnostics, forensic use, and agriculturrediagnostic and therapeutic biotechnology. The outbreak of COVID-19 has impacted the PCR industry to a very large extent because PCR became a key approach for testing the virus and this created a larger market for PCR kits, reagents and instruments.

The Polymerase Chain Reaction (PCR) market has become an important branch within the life sciences, resulting from the progress in molecular biology techniques, and the need for highly efficient diagnostics.. PCR The process is greatly employed to make millions of copies of a small region of DNA in order to analyze it with ease. This capability has transformed field ranging from genetics, microbiology and clinical diagnostics. The targets can include identification of infectious diseases, genetic diagnostics, forensic use, and agriculturrediagnostic and therapeutic biotechnology. The outbreak of COVID-19 has impacted the PCR industry to a very large extent because PCR became a key approach for testing the virus and this created a larger market for PCR kits, reagents and instruments.

Polymerase Chain Reaction Market Trend Analysis:

Trends Shaping the Polymerase Chain Reaction Market

- The rising integration of qPCR as a tool in health and life science is among the key trends emerging in the Polymerase Chain Reaction market.. It also allows the quantification of DNA and RNA in virtually any sample, with the level of accuracy and speed required when samples are used for clinical diagnosis, research and forensics. This amplification technique is preferred for its high sensitivity and specificity for the detection of genetic material in a given sample, which makes it relevant in differents areas such as oncology, infectious diseases and genetic disorders. The continued improvements in qPCR technologies are improving their functions, allowing multiplexing and incorporation with digital technologies for data management to lock the position of qPCRs in the modern diagnostic system.

- The COVID-19 has made PCR testing more relevant in the management of infectious diseases by precipitating its use.. The immensely increased need for accurate testing throughout the COVID-19 pandemic has driven investments in PCR technologies and made advances in assay and automation possible. This increase in funding has not only made the PCR testing more effective and portable but also manufactures have embarked on developing point of care testing (POCT) devices with PCR functionalities. Implementations of such progresses enable test to be conducted in different context such as hospitals and even remote areas improving the overall public health and diseases surveillance. Consequently, it is seen that the growth of PCR market continuously opens up due to the requirement in different industries for a precise diagnostic tool.

Advancements in PCR Technology

- The appearance of new methods such as digital PCR and multiplex PCR are constantly improving the performance and effectiveness of genetic analysis.. Inclusion of successful targets is much easier since digital PCR provides higher sensitivity and quantification compared to traditional qPCR. In contrast, when used in the form of Multiplex PCR, several PCR reactions are performed simultaneously, which means the elapsed time as well as the amount of reagents used, are significantly minimized while increasing the overall capacity of the test. These innovations are particularly important for such areas as personalized medicine and genomics in which many treatments are selected depending on genetic peculiarities of a patient. NHS at the present time is much more focused on the molecular level diagnostics and individual approaches to a patient, therefore, PCR, which requests long-lasting, simple, and efficient technologies, is in great demand.

Polymerase Chain Reaction Market Segment Analysis:

Polymerase Chain Reaction Market is Segmented on the basis of Technology, Product Type, Application, and Region.

By Technology, Digital PCR segment is expected to dominate the market during the forecast period

- The abbreviation dPCR stands for digital PCR, and it represents a revolutionary shift in a broad class of polymerase chain reactions techniques marked by their fidelity in determining nucleic acids quantity.. While conventional PCR procedures produce a large number of DNA copies, dPCR structures a sample into hundreds or even thousands of distinct reactions. This concept makes it possible for the discovery of low-frequency mutations and minimal level probes that are not identified by other methods. The partitions divide the sample into numerous regions; counting the number of positive reactions in each partition brings about high sensitivity and high-resolution performance in dPCR. This capability is most valuable in numerous therapeutic areas, including the field of oncology where the measurement of the circulating tumor DNA is a key factor of individualized medicine and treatment monitoring.

- The increased specification and repeatability of digital PCR make it one of the most commonly used techniques in researches and clinicians involved in analyses where accurate and precise measurement is required.. For example in oncology, since minimal residual disease can be detected, dPCR provides clues to the treatment plan according to the patient’s characteristics. Furthermore, its stability and versatility permit it to be applied for the other purpose for example pathogen detection, gene analysis, and microbial surveys just to name but a few. In spite of the currently limited application of dPCR in molecular diagnostic assays, owing to the increasing need for accurate and reproducible molecular biomarkers, dPCR will play a crucial role not only in clinical diagnosis but in molecular research as well as diagnosis and treatment of various diseases.

By End User, Hospital segment expected to held the largest share

- The rising integration of qPCR as a tool in health and life science is among the key trends emerging in the Polymerase Chain Reaction market.. It also allows the quantification of DNA and RNA in virtually any sample, with the level of accuracy and speed required when samples are used for clinical diagnosis, research and forensics. This amplification technique is preferred for its high sensitivity and specificity for the detection of genetic material in a given sample, which makes it relevant in differents areas such as oncology, infectious diseases and genetic disorders. The continued improvements in qPCR technologies are improving their functions, allowing multiplexing and incorporation with digital technologies for data management to lock the position of qPCRs in the modern diagnostic system.

- The escalating need for improving diagnostics has made healthcare stakeholders take advantage of advanced PCR technologies forcing their way into the hospital laboratory.. These characteristics make PCR a vital tool for arriving at a richer understanding of disease pathogenesis and for creating more effective patient management strategies that are based on accurate early diagnosis of diseases. Given the ongoing trend toward evidence-based medicine and disease prevention among healthcare providers, PCR technology in the hospital environment is expected to build momentum. This evolution also helps the diagnostic imaging but serves the greater purpose of elevating the care level of the patients by ranking the efficiency and accurateness of the clinical decisions.

Polymerase Chain Reaction Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North America, especially in the United States, the PCR market is in a state of growth due to the concentration of big-market players, widely developed laboratory research, and large spending on healthcare.. PCR technologies are real-time PCR or digital PCR, widely used in different areas – from the genetic testings to infectious diseases diagnosis or personalized medicine – all started in this region. This innovation has place the U.S. in a strategic place in the global PCR market, with many companies and research institution dedicating resources in the current and future PCR diagnostics. Inter alia, it is important to mention the existence of clear and stable legislation that enables the fast integration of these innovative tools into the clinical and research environment.

Active Key Players in the Polymerase Chain Reaction Market:

- Abbott (U.S.)

- bioMérieux (France)

- BD (U.S.)

- Danaher (U.S.)

- Thermo Fisher Scientific Inc (U.S.)

- Siemens (Germany)

- Agilent Technologies, Inc (U.S.)

- Merck KGaA (Germany)

- Fluidigm (U.S.)

- QIAGEN (Germany)

- Bio-Rad Laboratories, Inc (U.S.)

- Cytiva (U.S.)

- Stryker (U.S.)

- Johnson & Johnson Private Limited (U.S.)

- Smith+Nephew (U.K.)

- Bruker (U.S.)

- Other Active Players

|

Polymerase Chain Reaction Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.75 Billion |

|

Forecast Period 2024-32 CAGR: |

2.40% |

Market Size in 2032: |

USD 30.64 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Polymerase Chain Reaction Market by Technology

4.1 Polymerase Chain Reaction Market Snapshot and Growth Engine

4.2 Polymerase Chain Reaction Market Overview

4.3 Digital PCR

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Digital PCR: Geographic Segmentation Analysis

4.4 Real-time PCR

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Real-time PCR: Geographic Segmentation Analysis

Chapter 5: Polymerase Chain Reaction Market by Product Type

5.1 Polymerase Chain Reaction Market Snapshot and Growth Engine

5.2 Polymerase Chain Reaction Market Overview

5.3 Instrument

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Instrument: Geographic Segmentation Analysis

5.4 Reagent

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Reagent: Geographic Segmentation Analysis

5.5 Consumables

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Consumables: Geographic Segmentation Analysis

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Geographic Segmentation Analysis

Chapter 6: Polymerase Chain Reaction Market by Application

6.1 Polymerase Chain Reaction Market Snapshot and Growth Engine

6.2 Polymerase Chain Reaction Market Overview

6.3 Oncology

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Oncology: Geographic Segmentation Analysis

6.4 Blood Testing

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Blood Testing: Geographic Segmentation Analysis

6.5 Pathogen Detection

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Pathogen Detection: Geographic Segmentation Analysis

6.6 Research

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Research: Geographic Segmentation Analysis

6.7 Forensic

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Forensic: Geographic Segmentation Analysis

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Geographic Segmentation Analysis

Chapter 7: Polymerase Chain Reaction Market by End-User

7.1 Polymerase Chain Reaction Market Snapshot and Growth Engine

7.2 Polymerase Chain Reaction Market Overview

7.3 Hospital

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospital: Geographic Segmentation Analysis

7.4 Diagnostic Center

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Diagnostic Center: Geographic Segmentation Analysis

7.5 Pharmaceutical and Biotechnology Companies

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Pharmaceutical and Biotechnology Companies: Geographic Segmentation Analysis

7.6 Clinical Research Organizations

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Clinical Research Organizations: Geographic Segmentation Analysis

7.7 Academia

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Academia: Geographic Segmentation Analysis

7.8 Laboratories

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Laboratories : Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Polymerase Chain Reaction Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ABBOTT (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BIOMÉRIEUX (FRANCE)

8.4 BD (U.S.)

8.5 DANAHER (U.S.)

8.6 THERMO FISHER SCIENTIFIC INC (U.S.)

8.7 SIEMENS (GERMANY)

8.8 AGILENT TECHNOLOGIES INC (U.S.)

8.9 MERCK KGAA (GERMANY)

8.10 FLUIDIGM (U.S.)

8.11 QIAGEN (GERMANY)

8.12 BIO-RAD LABORATORIES INC (U.S.)

8.13 CYTIVA (U.S.)

8.14 STRYKER (U.S.)

8.15 JOHNSON & JOHNSON PRIVATE LIMITED (U.S.)

8.16 SMITH+NEPHEW (U.K.)

8.17 BRUKER (U.S.)

8.18 OTHER ACTIVE PLAYERS

Chapter 9: Global Polymerase Chain Reaction Market By Region

9.1 Overview

9.2. North America Polymerase Chain Reaction Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Technology

9.2.4.1 Digital PCR

9.2.4.2 Real-time PCR

9.2.5 Historic and Forecasted Market Size By Product Type

9.2.5.1 Instrument

9.2.5.2 Reagent

9.2.5.3 Consumables

9.2.5.4 Others

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Oncology

9.2.6.2 Blood Testing

9.2.6.3 Pathogen Detection

9.2.6.4 Research

9.2.6.5 Forensic

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size By End-User

9.2.7.1 Hospital

9.2.7.2 Diagnostic Center

9.2.7.3 Pharmaceutical and Biotechnology Companies

9.2.7.4 Clinical Research Organizations

9.2.7.5 Academia

9.2.7.6 Laboratories

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Polymerase Chain Reaction Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Technology

9.3.4.1 Digital PCR

9.3.4.2 Real-time PCR

9.3.5 Historic and Forecasted Market Size By Product Type

9.3.5.1 Instrument

9.3.5.2 Reagent

9.3.5.3 Consumables

9.3.5.4 Others

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Oncology

9.3.6.2 Blood Testing

9.3.6.3 Pathogen Detection

9.3.6.4 Research

9.3.6.5 Forensic

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size By End-User

9.3.7.1 Hospital

9.3.7.2 Diagnostic Center

9.3.7.3 Pharmaceutical and Biotechnology Companies

9.3.7.4 Clinical Research Organizations

9.3.7.5 Academia

9.3.7.6 Laboratories

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Polymerase Chain Reaction Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Technology

9.4.4.1 Digital PCR

9.4.4.2 Real-time PCR

9.4.5 Historic and Forecasted Market Size By Product Type

9.4.5.1 Instrument

9.4.5.2 Reagent

9.4.5.3 Consumables

9.4.5.4 Others

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Oncology

9.4.6.2 Blood Testing

9.4.6.3 Pathogen Detection

9.4.6.4 Research

9.4.6.5 Forensic

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size By End-User

9.4.7.1 Hospital

9.4.7.2 Diagnostic Center

9.4.7.3 Pharmaceutical and Biotechnology Companies

9.4.7.4 Clinical Research Organizations

9.4.7.5 Academia

9.4.7.6 Laboratories

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Polymerase Chain Reaction Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Technology

9.5.4.1 Digital PCR

9.5.4.2 Real-time PCR

9.5.5 Historic and Forecasted Market Size By Product Type

9.5.5.1 Instrument

9.5.5.2 Reagent

9.5.5.3 Consumables

9.5.5.4 Others

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Oncology

9.5.6.2 Blood Testing

9.5.6.3 Pathogen Detection

9.5.6.4 Research

9.5.6.5 Forensic

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size By End-User

9.5.7.1 Hospital

9.5.7.2 Diagnostic Center

9.5.7.3 Pharmaceutical and Biotechnology Companies

9.5.7.4 Clinical Research Organizations

9.5.7.5 Academia

9.5.7.6 Laboratories

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Polymerase Chain Reaction Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Technology

9.6.4.1 Digital PCR

9.6.4.2 Real-time PCR

9.6.5 Historic and Forecasted Market Size By Product Type

9.6.5.1 Instrument

9.6.5.2 Reagent

9.6.5.3 Consumables

9.6.5.4 Others

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Oncology

9.6.6.2 Blood Testing

9.6.6.3 Pathogen Detection

9.6.6.4 Research

9.6.6.5 Forensic

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size By End-User

9.6.7.1 Hospital

9.6.7.2 Diagnostic Center

9.6.7.3 Pharmaceutical and Biotechnology Companies

9.6.7.4 Clinical Research Organizations

9.6.7.5 Academia

9.6.7.6 Laboratories

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Polymerase Chain Reaction Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Technology

9.7.4.1 Digital PCR

9.7.4.2 Real-time PCR

9.7.5 Historic and Forecasted Market Size By Product Type

9.7.5.1 Instrument

9.7.5.2 Reagent

9.7.5.3 Consumables

9.7.5.4 Others

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Oncology

9.7.6.2 Blood Testing

9.7.6.3 Pathogen Detection

9.7.6.4 Research

9.7.6.5 Forensic

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size By End-User

9.7.7.1 Hospital

9.7.7.2 Diagnostic Center

9.7.7.3 Pharmaceutical and Biotechnology Companies

9.7.7.4 Clinical Research Organizations

9.7.7.5 Academia

9.7.7.6 Laboratories

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Polymerase Chain Reaction Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.75 Billion |

|

Forecast Period 2024-32 CAGR: |

2.40% |

Market Size in 2032: |

USD 30.64 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||