Plant Based Energy Drink Market Synopsis

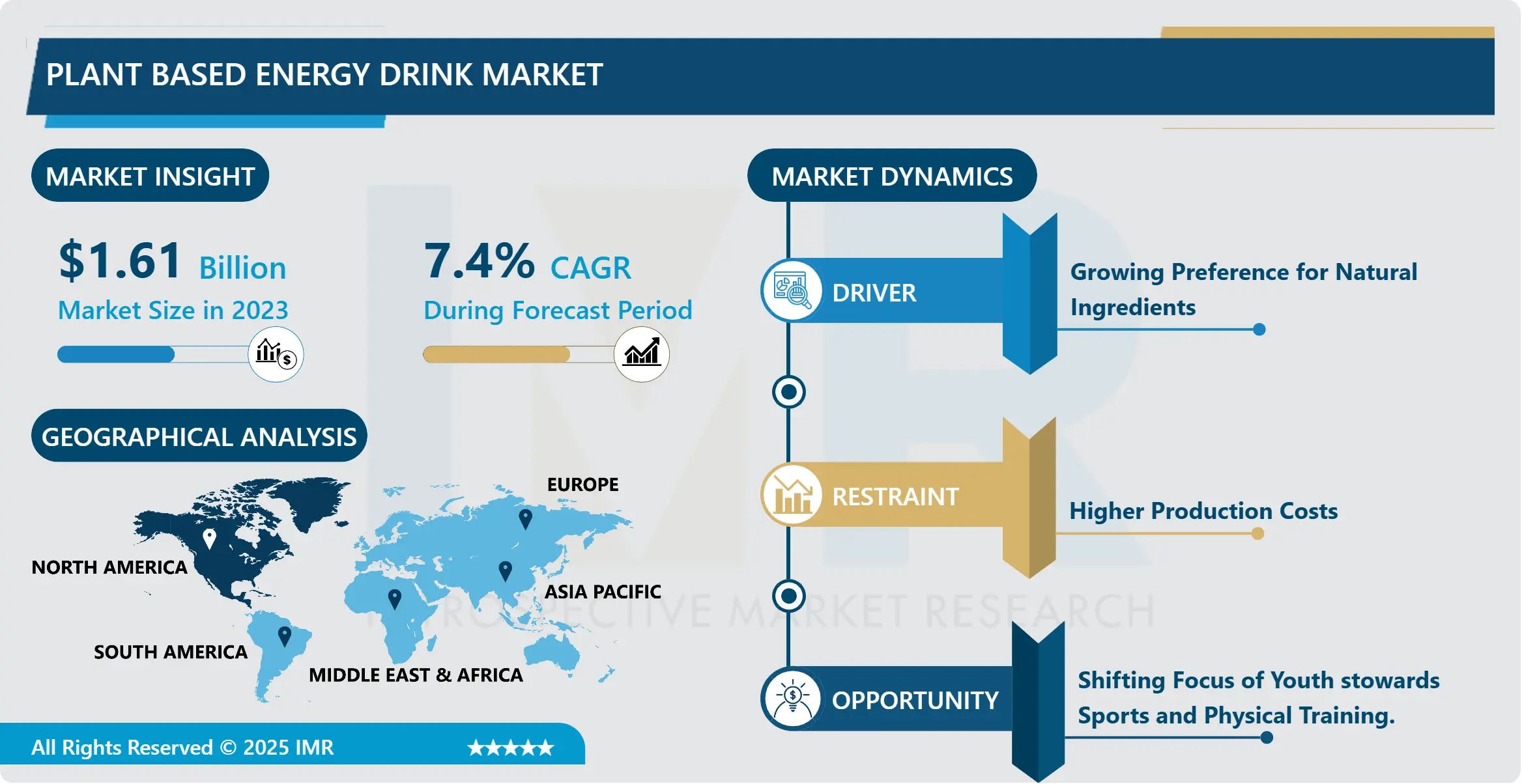

Plant Based Energy Drink Market Size Was Valued at USD 1.61 Billion in 2023, and is Projected to Reach USD 3.06 Billion by 2032, Growing at a CAGR of 7.40% From 2024-2032.

The plant based energy drink industry encompasses the drink made from natural, plant derived constituents such as ginseng, guarana and green tea for the purpose of increasing energy. Although seeming more focused on bodily health, these drinks targets two primary market segments that are healthy and socially conscious consumers who prefer eco-friendly packaging, and those who are concerned about the negative health effects that energy drinks have on their bodies.

The global plant-based energy drink industry is experiencing significant growth as consumers transition to healthier, sustainable plant-based natural products rather than alternatives to regular energy drinks. This transition is primarily due in part to increased awareness over matters of health, with many people moving away from things that have been processed, contain preservatives, and excessive amounts of sugar among other items. Energy drink companies remain adaptable with growing consumer consciousness with plant based diets as they seek to add herbal extracts, superfoods and adaptogens to the drinks. These ingredients not only give energy but have more plus points as a complementary benefit such as boosting concentration, increasing stamina and alleviating stress thus having market value to a various group of consumers/clients which includes athletes and health-oriented people.

Additional to the rising consumer trend toward fitness and well-being in international markets, more consumer spend time in exercising crossover activities. Within this trend, plant-based energy drinks are situated nicely because often time s that they are advertised as pre, or post workout boosters. Also, there is always an increased availability of these products due to advancement in e-commerce and more specifically there are more health foods stores which the consumers can buy from. Another emerging trend being witnessed among the major stakeholders in the industry is the trend towards sustainability, where there are increasing use of environmentally friendly packaging, and sustainable sourcing and supply chain management that harmonizes with consumers’ expectation. This focus on sustainability is turning into an important element of decision about purchasing, as buyers with certain ethics and health conscience aim to buy goods that fit into their values.

Regionally, America takes a large market share of plant-based energy drinks due to great importance placed on healthy living. However, Asia-Pacific is expected to ALPHA show the fastest growth during the forecasted period due to factors such as increased concern for health, urbanization and improved consumer lifestyles. In the future, the organizations are likely to increase their spending in products, marketing and collaborations as the market grows. In conclusion the plant-based energy drink market has the potential of a high growth even in the further progressing that cups consumers are inclined to healthier organic and more environmentally friendly products.

Plant Based Energy Drink Market Trend Analysis

Growth and Trends in the Plant-Based Energy Drink Market

- Due to the awareness of the health benefits of plant based products and the general dislike for the high sugar content in traditional energy drink, the plant based energy drink market occupies a healthy niche. In response to this, brands have come up with products that have added natural compounds including herbs, fruits and plant proteins. This change is in line with the shift to healthier products as the consumer grows more conscious of the ill effects of synthetic additives and high sugar content characteristic to most regular energy drinks. In this respect, products which demonstrate genuine understanding towards consumer preferences and include such indication as ‘’organic’, clean labels are trending on the market as more and more consumers are aware and pick brands accordingly.

- It is also important to note that the influx of more responsible sourced plant-based ingredients is also influencing the plant-based energy drink industry. There is the tendency of consumers to be more conscious on the brands that they are choosing, therefore we find the brands being more conscious on their products by affiliating them with natural organic non-GMO products which have been certified to be from the fair trade. This increasing focus on ethical sourcing does not only provide benefits to the environmental sensitive people but also added value to products in order to increase the consumers’ identification with brands. Therefore, the market is shifting to such consumer demands, which promotes competition and creates a high level of innovation and corporate sustainability due to the increasing popularity of energy drink products family.

Functional Benefits and Innovations in the Plant-Based Energy Drink Market

- The study also identifies other trend affecting the plant-based energy drink market which is a shift to functional benefits. Today’s consumers are going for more than energy drinks, they are looking for drinks that can deliver other benefits like focus, adequate water content, and recovery. This shift has caused brands to look for new ways to incorporate new materials, including adaptogens, superfoods, and nootropics. Innovations such as ash gandha and spirulina are slight on the market today for they were said to stimulate the brain, relieve stress, and enhance wellbeing thus a wider trend towards products that are beneficial to life.

- Several dynamics that persist in the global market contribute to the emergence of new products in the line of energy drink segment as follows: Since consumers are getting more involved in the matters of health and fitness, they are in search of things that compliment the kind of lives they lead and diet they take. This has shifted brands to extend their product portfolios and manufacture energy drinks with a niche for athletics. Consequently, the market is expect to record high growth in the coming years due to changing trends for both the enhancement of intrinsic energy and improvement of overall human health, which will also increase the availability of various plant products for consumption.

Plant Based Energy Drink Market Segment Analysis:

Plant Based Energy Drink Market Segmented based on By Product Type, By Type, By Application, By Distribution Channel.

By Product Type, Non-Alcoholic segment is expected to dominate the market during the forecast period

- Today, NA energy drinks are the largest segment within the EB industry because they can provide many benefits to a wide variety of consumers. Especially these drinks are going to improve the energy level, the concentration and the physical performance without the inconveniences of the alcohol products. It targets the clients who are fitness conscious, and its prospect target group mainly contains young people who are becoming more and more conscious about their health. With increased knowledge of the value of getting enough water and balanced energy for doing exercises, the formulation of these drinks has become natural in pre and post exercise programs because of diverse compounds they contain such as stimulants, vitamins and electricity minerals meant to improve performance and quick recovery.

- The non-GAAP segment solely relies on its creativity and adaptation of existing brands in developing new products to cater for the market. There are many different flavors and product forms which are based on natural ingredients, organic and containing additives that can improve the consumer’s brain functions or muscle recovery after a workout, for example. This evolution is supported by marketing communication that emphasizes the role of these drinks in the attainment of the active/functional designation for use during physical activities, at the workplace, and or during social activities. Therefore, non alcoholic energy drinks not only occupy most of the market share but also change in the kind of energy products that consumers prefer from those with alcohol content to healthier products.

By Ingredients, Taurine segment held the largest share in 2023

- Taurine is an amino acid found to be involved in a number of physiological roles including energy metabolism and function of the cardiovascular system a factor that attributes to its inclusion in energy drinks. In metabolic energy processes taurine plays a role in shuttle of important nutrients and also in the modulation of electrolyte to maintain the health of cells. It is used to boost exercise performance by increasing creativity and energy thus regarded as a popular supplement by athletes and body builders. Furthermore, taurine is also antioxidant in nature and helps to guard our cells against ‘oxidative damage’ – useful when the body under strain during high-intensity exercising.

- Apart from its functions in energy production, taurine has been identified to promote heart health and especially in the required operation of the heart. Scientific evidence shows that taurine has an influence on hypertension, blood flow and cardiovascular disorders. This multiple effect application makes taurine a potential supplement for energy drinks targeting the consumers who do not only seek for the performance boost but also for the health-oriented product. With more and more consumers discovering these benefits the likelihood of taurine being incorporated in energy drinks is likely to increase for this essentially confirms the position of taurine as a standard ingredient in this closely contested market.

Plant Based Energy Drink Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The market for plant-based energy drinks in North America is growing at an extraordinary rate, this is majorly brought about by many factors such as the demand for clean label products and the ever-rising popularity of plant-based diets among consumers. Thus, it can be seen that there is a shift now towards healthier lifestyles, and consumers are looking for products a lot more especially the beverage they in-take. There is a presence of numerous reputed brands whose products contain natural elements and receive organic accreditation which lasts their sustainability statements. These brands can tap virtually every demographic group, from the exercise freak to the casual consumers by presenting so many flavors and formulations with added vitamins and minerals for superior functionality. This flexibility also helps to reach more people and make people come back to the store to buy more: thus shoppers can find goods that are beneficial for their health.

- Furthermore, the conscious efforts by venues to properly market veganisms contribute towards development of the plant-based energy drink market in North America. Aggressive campaigns combined with opinion from Health personalities and specialists have increased acceptability of these drinks among the lay consumer. Brand targeting is a crucial part ofdeveloping brand strategies on social media as theseplatforms allow for relaying customer successstories and association with health and wellness issues that appeal to the contemporary consumer. Knowledge of the benefits of replacing animal proteins with plant ones will only increase in the future, thus increasing the popularity of these energy drinks and thus creating the basis for the further development of new products and competitive niches. Taking everything into consideration about the latest global trends and dietary habits, varied types of plant-based energy drinks, and excellent marketing policies, the North American market for the plant-based energy drink needs no frequent boosting.

Active Key Players in the Plant Based Energy Drink Market

- Nestlé (Switzerland)

- PepsiCo (U.S.)

- Tenzing Natural Energy Ltd (U.K.)

- Guru Energy (Canada)

- Yerbaé (U.S.)

- RIOT Energy (U.S.)

- Proper Wild, Inc. (U.S.)

- Garden of Life (U.S.)

- BA Sports Nutrition, LLC. (U.S.)

- ToroMatcha (Canada)

- Guayakí (U.S.)

- Other Key Players

Key Industry Developments in the Plant Based Energy Drink Market:

- In July 2024, Tenzing has launched what it claims as the “world’s strongest natural energy drink,” Super Natural Energy Fiery Mango. With 200mg of caffeine from green coffee and green tea, plus functional ingredients like cordyceps mushrooms and magnesium, this drink offers more caffeine per serving than Red Bull. Available on Tenzing’s website, Amazon, and in Holland & Barrett, it’s designed for those needing a powerful energy boost

- In July 2023, Hungarian company Hell Energy Drink has developed what it claims to be the world’s first energy drink entirely designed by artificial intelligence (AI). The AI selected the ingredients, formulation, and even the packaging design. The chosen flavor, “Tutti-frutti & Berry-blast,” was one of three options generated by the AI. The recipe is stored securely in the company's Hungarian factory and a Swiss vault. This innovation showcases AI's potential to revolutionize product development in the food and beverage industry

|

Global Plant Based Energy Drink Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.61 Bn. |

|

Forecast Period 2023-34 CAGR: |

7.40% |

Market Size in 2032: |

USD 3.06 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Ingredients |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Plant Based Energy Drink Market by Product Type (2018-2032)

4.1 Plant Based Energy Drink Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Non-Alcoholic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Alcoholic

Chapter 5: Plant Based Energy Drink Market by Type (2018-2032)

5.1 Plant Based Energy Drink Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Inorganic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Organic

Chapter 6: Plant Based Energy Drink Market by Application (2018-2032)

6.1 Plant Based Energy Drink Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Before Exercise

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Recovery

6.5 During Exercise

Chapter 7: Plant Based Energy Drink Market by Distribution Channel (2018-2032)

7.1 Plant Based Energy Drink Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Supermarket/Hypermarket

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 E-commerce

7.5 Grocery Stores

7.6 Convenience Stores

Chapter 8: Plant Based Energy Drink Market by Ingredients (2018-2032)

8.1 Plant Based Energy Drink Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Taurine

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Caffeine

8.5 Guarana

8.6 Vitamin B

8.7 L-Carnitine

8.8 Antioxidants

8.9 Among Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Plant Based Energy Drink Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 NESTLÉ (SWITZERLAND)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 PEPSICO (U.S.)

9.4 TENZING NATURAL ENERGY LTD (U.K.)

9.5 GURU ENERGY (CANADA)

9.6 YERBAÉ (U.S.)

9.7 RIOT ENERGY (U.S.)

9.8 PROPER WILD INC. (U.S.)

9.9 GARDEN OF LIFE (U.S.)

9.10 BA SPORTS NUTRITION

9.11 LLC. (U.S.)

9.12 TOROMATCHA (CANADA)

9.13 GUAYAKÍ (U.S.)

9.14 OTHER KEY PLAYERS

Chapter 10: Global Plant Based Energy Drink Market By Region

10.1 Overview

10.2. North America Plant Based Energy Drink Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Product Type

10.2.4.1 Non-Alcoholic

10.2.4.2 Alcoholic

10.2.5 Historic and Forecasted Market Size by Type

10.2.5.1 Inorganic

10.2.5.2 Organic

10.2.6 Historic and Forecasted Market Size by Application

10.2.6.1 Before Exercise

10.2.6.2 Recovery

10.2.6.3 During Exercise

10.2.7 Historic and Forecasted Market Size by Distribution Channel

10.2.7.1 Supermarket/Hypermarket

10.2.7.2 E-commerce

10.2.7.3 Grocery Stores

10.2.7.4 Convenience Stores

10.2.8 Historic and Forecasted Market Size by Ingredients

10.2.8.1 Taurine

10.2.8.2 Caffeine

10.2.8.3 Guarana

10.2.8.4 Vitamin B

10.2.8.5 L-Carnitine

10.2.8.6 Antioxidants

10.2.8.7 Among Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Plant Based Energy Drink Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Product Type

10.3.4.1 Non-Alcoholic

10.3.4.2 Alcoholic

10.3.5 Historic and Forecasted Market Size by Type

10.3.5.1 Inorganic

10.3.5.2 Organic

10.3.6 Historic and Forecasted Market Size by Application

10.3.6.1 Before Exercise

10.3.6.2 Recovery

10.3.6.3 During Exercise

10.3.7 Historic and Forecasted Market Size by Distribution Channel

10.3.7.1 Supermarket/Hypermarket

10.3.7.2 E-commerce

10.3.7.3 Grocery Stores

10.3.7.4 Convenience Stores

10.3.8 Historic and Forecasted Market Size by Ingredients

10.3.8.1 Taurine

10.3.8.2 Caffeine

10.3.8.3 Guarana

10.3.8.4 Vitamin B

10.3.8.5 L-Carnitine

10.3.8.6 Antioxidants

10.3.8.7 Among Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Plant Based Energy Drink Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Product Type

10.4.4.1 Non-Alcoholic

10.4.4.2 Alcoholic

10.4.5 Historic and Forecasted Market Size by Type

10.4.5.1 Inorganic

10.4.5.2 Organic

10.4.6 Historic and Forecasted Market Size by Application

10.4.6.1 Before Exercise

10.4.6.2 Recovery

10.4.6.3 During Exercise

10.4.7 Historic and Forecasted Market Size by Distribution Channel

10.4.7.1 Supermarket/Hypermarket

10.4.7.2 E-commerce

10.4.7.3 Grocery Stores

10.4.7.4 Convenience Stores

10.4.8 Historic and Forecasted Market Size by Ingredients

10.4.8.1 Taurine

10.4.8.2 Caffeine

10.4.8.3 Guarana

10.4.8.4 Vitamin B

10.4.8.5 L-Carnitine

10.4.8.6 Antioxidants

10.4.8.7 Among Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Plant Based Energy Drink Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Product Type

10.5.4.1 Non-Alcoholic

10.5.4.2 Alcoholic

10.5.5 Historic and Forecasted Market Size by Type

10.5.5.1 Inorganic

10.5.5.2 Organic

10.5.6 Historic and Forecasted Market Size by Application

10.5.6.1 Before Exercise

10.5.6.2 Recovery

10.5.6.3 During Exercise

10.5.7 Historic and Forecasted Market Size by Distribution Channel

10.5.7.1 Supermarket/Hypermarket

10.5.7.2 E-commerce

10.5.7.3 Grocery Stores

10.5.7.4 Convenience Stores

10.5.8 Historic and Forecasted Market Size by Ingredients

10.5.8.1 Taurine

10.5.8.2 Caffeine

10.5.8.3 Guarana

10.5.8.4 Vitamin B

10.5.8.5 L-Carnitine

10.5.8.6 Antioxidants

10.5.8.7 Among Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Plant Based Energy Drink Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Product Type

10.6.4.1 Non-Alcoholic

10.6.4.2 Alcoholic

10.6.5 Historic and Forecasted Market Size by Type

10.6.5.1 Inorganic

10.6.5.2 Organic

10.6.6 Historic and Forecasted Market Size by Application

10.6.6.1 Before Exercise

10.6.6.2 Recovery

10.6.6.3 During Exercise

10.6.7 Historic and Forecasted Market Size by Distribution Channel

10.6.7.1 Supermarket/Hypermarket

10.6.7.2 E-commerce

10.6.7.3 Grocery Stores

10.6.7.4 Convenience Stores

10.6.8 Historic and Forecasted Market Size by Ingredients

10.6.8.1 Taurine

10.6.8.2 Caffeine

10.6.8.3 Guarana

10.6.8.4 Vitamin B

10.6.8.5 L-Carnitine

10.6.8.6 Antioxidants

10.6.8.7 Among Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Plant Based Energy Drink Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Product Type

10.7.4.1 Non-Alcoholic

10.7.4.2 Alcoholic

10.7.5 Historic and Forecasted Market Size by Type

10.7.5.1 Inorganic

10.7.5.2 Organic

10.7.6 Historic and Forecasted Market Size by Application

10.7.6.1 Before Exercise

10.7.6.2 Recovery

10.7.6.3 During Exercise

10.7.7 Historic and Forecasted Market Size by Distribution Channel

10.7.7.1 Supermarket/Hypermarket

10.7.7.2 E-commerce

10.7.7.3 Grocery Stores

10.7.7.4 Convenience Stores

10.7.8 Historic and Forecasted Market Size by Ingredients

10.7.8.1 Taurine

10.7.8.2 Caffeine

10.7.8.3 Guarana

10.7.8.4 Vitamin B

10.7.8.5 L-Carnitine

10.7.8.6 Antioxidants

10.7.8.7 Among Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Plant Based Energy Drink Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.61 Bn. |

|

Forecast Period 2023-34 CAGR: |

7.40% |

Market Size in 2032: |

USD 3.06 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Ingredients |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||