Food Grade Alginate Market Synopsis

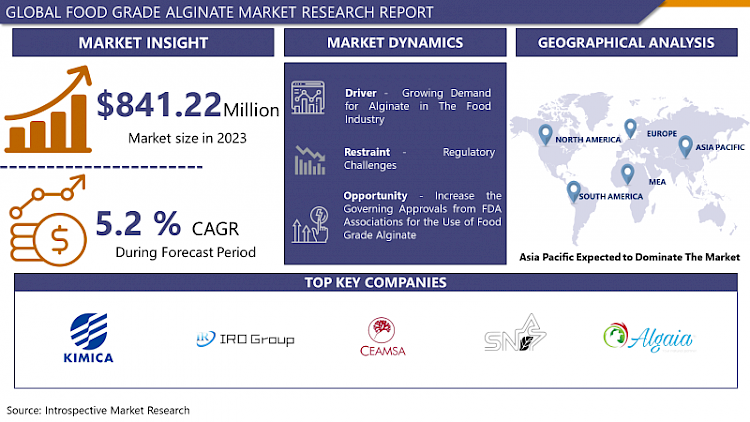

Global Food Grade Alginate Market size is expected to grow from USD 841.22 Million in 2023 to USD 1327.55 Million by 2032, at a CAGR of 5.2% during the forecast period (2024-2032)

The food-grade alginate market refers to the segment of the food industry focused on the production, distribution, and consumption of alginate, a natural polysaccharide derived primarily from seaweed. Food-grade alginate is utilized as a versatile additive, valued for its unique gelling, thickening, and stabilizing properties in a wide range of food products. It is commonly employed in food processing to enhance texture, improve mouthfeel, and extend shelf life. With its ability to form gels in the presence of calcium ions, food-grade alginate finds applications in various food products such as dairy, bakery, confectionery, and processed meats, among others. As consumer preferences for clean-label and natural ingredients continue to drive product innovation, the demand for food-grade alginate as a safe, plant-derived ingredient is expected to witness steady growth in the global food market.

- The food grade alginate market is experiencing robust growth driven by an increasing demand for natural, plant-based ingredients in the food and beverage industry. Alginate, derived from seaweed, offers a versatile solution for food manufacturers seeking alternatives to synthetic additives.

- Its unique properties, including thickening, gelling, and stabilizing capabilities, make it a valuable ingredient in various food products such as dairy, bakery, and confectionery. The market is also buoyed by growing consumer awareness regarding clean label products and health-conscious eating habits, further propelling the adoption of food grade alginate.

- Additionally, the expanding applications of alginate in the pharmaceutical and healthcare sectors contribute to the market's growth trajectory. However, challenges such as fluctuating seaweed availability and regulatory constraints may hinder market expansion to some extent.

- Overall, the food grade alginate market is poised for steady growth, driven by increasing consumer preference for natural and sustainable ingredients in food and beverage formulations.

Food Grade Alginate Market Trend Analysis

The Surging Popularity of Alginate in the Food Industry

- In recent years, there has been a discernible shift in consumer preferences towards natural and plant-based ingredients in the realm of food production. This trend stems from a growing awareness among consumers regarding the health and environmental implications of their dietary choices. As individuals become more attuned to the source and composition of the foods they consume, there has been an increasing demand for ingredients that are derived from natural sources and align with sustainable practices. In this context, alginate, extracted from seaweed, has emerged as a highly sought-after ingredient due to its natural origin and versatile functionality as a thickening and gelling agent in food products. Its inherent properties not only cater to the desire for natural ingredients but also resonate with consumers' preferences for sustainable and eco-friendly options.

- Moreover, the surge in the popularity of alginate as a food additive can be attributed to its numerous benefits and applications within the food industry. Beyond its role as a thickener and gelling agent, alginate offers functional advantages such as stability, texture enhancement, and even health benefits. Its ability to improve the mouthfeel and consistency of food products without the need for artificial additives aligns perfectly with the clean label movement, which advocates for simpler and more transparent ingredient lists. As consumers increasingly seek out products with cleaner labels and fewer synthetic additives, alginate presents itself as a natural solution that meets these evolving preferences. Thus, the growing demand for natural and plant-based ingredients has not only propelled the popularity of alginate but has also underscored its relevance and importance in meeting the changing needs of today's discerning consumers.

Alginate's Versatility Reshaping Food Industry Trends

- The versatility of alginate within the food industry is indeed a driving force behind its market growth. Alginate's unique properties make it a highly adaptable ingredient that can be seamlessly integrated into a wide array of food applications. From dairy products to bakery items, confectionery treats, and beverages, alginate offers functional benefits that enhance both the texture and shelf-life of various food products. Its ability to form stable gels without the need for heat is particularly noteworthy, as it allows for the creation of indulgent treats like gummy candies, fruit jellies, and desserts with precise texture and consistency.

- Food manufacturers are increasingly recognizing the value of alginate as a versatile ingredient that enables them to innovate and differentiate their products in a competitive market landscape. By leveraging alginate's unique properties, manufacturers can develop new formulations or improve existing recipes to meet evolving consumer preferences and market trends. Whether it's enhancing the creaminess of dairy products, improving the structure of baked goods, or creating visually appealing confectionery items, alginate offers a versatile solution that enables food manufacturers to push the boundaries of culinary creativity. As a result, the adoption of alginate across various food applications continues to rise, driving its market growth and solidifying its position as a key ingredient in the food industry's quest for innovation and differentiation.

Food Grade Alginate Market Segment Analysis:

Food Grade Alginate Market is segmented based on Form, Packaging and Application

By Form, Powders segment is expected to dominate the market during the forecast period

- Powders stand as the cornerstone of numerous industries, wielding a dominant share owing to their unparalleled versatility and convenience across diverse applications. In the realm of food and beverage, powders reign supreme as essential ingredients, flavorings, and additives, seamlessly integrating into formulations while offering extended shelf life and ease of handling. Whether it's enhancing taste profiles, fortifying nutritional content, or ensuring product consistency, powders provide a flexible canvas for innovation, driving their dominance in this sector. Likewise, in pharmaceuticals, powders emerge as indispensable components in drug formulation and manufacturing processes. Their precise dosing, easy dispersibility, and compatibility with various delivery systems make them pivotal in producing tablets, capsules, and suspensions, where accuracy and efficacy are paramount. With stringent quality standards and regulatory requirements, powders command the lion's share in pharmaceutical applications, underpinning the foundation of medicinal advancements and therapeutic breakthroughs.

- Beyond consumables, powders exert their dominance in industrial landscapes, serving as fundamental materials in manufacturing, construction, and chemical processing. From powdered metals facilitating precise casting and molding in automotive and aerospace industries to powdered polymers revolutionizing additive manufacturing and 3D printing, their adaptability fuels innovation and drives efficiency. Moreover, in chemical processing and catalyst production, powders offer unrivaled surface area and reactivity, catalyzing reactions and accelerating processes in petrochemicals, environmental remediation, and beyond. With their inherent advantages of ease of storage, handling, and transport, powders emerge as the preferred choice across industrial sectors, commanding the lion's share in material sourcing and production workflows. In essence, the dominance of powders transcends boundaries, permeating through diverse industries and applications, where their versatility and utility serve as the cornerstone of progress and innovation.

By Application, Food & Beverage segment held the largest share in 2023

- Within the global economic landscape, few sectors wield as significant a presence as the food and beverage industry, commanding the largest share of market consumption worldwide. With a burgeoning population and evolving consumer preferences, this sector stands as a cornerstone of sustenance and indulgence, catering to diverse tastes and cultural palettes across the globe. From the bustling aisles of supermarkets to the quaint corners of local eateries, the pervasive influence of the food and beverage industry underscores its dominance in the market realm. Moreover, its expansive reach extends beyond mere sustenance, encompassing a myriad of products and applications that cater to varying dietary needs, culinary preferences, and lifestyle choices.

- The allure of the food and beverage industry lies not only in its sheer volume of consumption but also in its inherent adaptability and innovation. From traditional staples to avant-garde creations, this dynamic sector continually evolves to meet the ever-changing demands of consumers, driving growth and market expansion. Whether it's the convenience of powdered additives revolutionizing food processing or the indulgence of liquid flavorings enhancing culinary experiences, the versatility of products within this category solidifies its position as the largest shareholder in the market landscape. Moreover, with the rise of health-conscious consumers and sustainability initiatives, the food and beverage industry stands poised to maintain its dominance by embracing trends such as clean labeling, plant-based alternatives, and eco-friendly packaging solutions. In essence, as a testament to its pervasive influence and enduring appeal, the food and beverage industry stands tall as the unrivaled titan of market share, navigating the complexities of global consumption with innovation, resilience, and culinary delight.

Food Grade Alginate Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- In the Asia Pacific region, the demand for food-grade alginate is propelled by several factors that collectively contribute to its dominance in the market. China, Japan, and India stand out as key players in this landscape, each experiencing rapid growth in their food and beverage industries. The rising urbanization and evolving consumer lifestyles in these countries have led to an increased preference for convenience foods, ranging from ready-to-eat meals to packaged snacks. Alginate's versatility as a stabilizer and texturizing agent makes it indispensable for manufacturers seeking to meet the demands of this burgeoning market segment. Moreover, the region's abundant seaweed resources offer a significant cost advantage for alginate production, as compared to other regions reliant on imported raw materials. This local availability not only ensures a stable supply chain but also reduces production costs, enabling manufacturers to offer competitive pricing in a highly price-sensitive market environment.

- Despite these opportunities, navigating the varied food regulations across different countries in the Asia Pacific region presents a notable challenge for market players. Each country has its own set of regulations governing food additives, labeling requirements, and permissible usage levels, necessitating a thorough understanding of local compliance standards. Managing compliance across multiple jurisdictions demands considerable resources and expertise, adding complexity to supply chain operations and product development processes. To maintain a dominant share in this diverse market landscape, companies must invest in robust regulatory affairs capabilities and establish strong partnerships with local regulatory authorities. By proactively addressing regulatory challenges and ensuring compliance with evolving standards, market leaders can sustain their competitive edge and capitalize on the immense growth potential offered by the Asia Pacific food-grade alginate market.

Active Key Players in the Food Grade Alginate Market

- KIMICA

- IRO Alginate Industry Co., Ltd.

- Ceamsa Algae

- SNAP Natural & Alginate Product Pvt. Ltd.

- Algaia

- Marine Biopolymers Limited (MBL)

- DuPont de Nemours, Inc.

- Ingredients Solutions, Inc

- Shandong Jiejing Group Corporation

- Other Key Players

|

Global Food Grade Alginate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 841.22 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.2 % |

Market Size in 2032: |

USD 1327.55 Mn. |

|

Segments Covered: |

By Form |

|

|

|

By Packaging |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Form

3.2 By Packaging

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Food Grade Alginate Market by Form

5.1 Food Grade Alginate Market Overview Snapshot and Growth Engine

5.2 Food Grade Alginate Market Overview

5.3 Powders

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Powders: Grographic Segmentation

5.4 Liquid forms

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Liquid forms: Grographic Segmentation

5.5 Crystals

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Crystals: Grographic Segmentation

Chapter 6: Food Grade Alginate Market by Packaging

6.1 Food Grade Alginate Market Overview Snapshot and Growth Engine

6.2 Food Grade Alginate Market Overview

6.3 Paper Bags

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Paper Bags: Grographic Segmentation

6.4 Fiber Drums

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Fiber Drums: Grographic Segmentation

6.5 FIBC Bulk

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 FIBC Bulk: Grographic Segmentation

6.6 Pails

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Pails: Grographic Segmentation

Chapter 7: Food Grade Alginate Market by Application

7.1 Food Grade Alginate Market Overview Snapshot and Growth Engine

7.2 Food Grade Alginate Market Overview

7.3 Food & Beverage

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Food & Beverage: Grographic Segmentation

7.4 Feed Additives

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Feed Additives: Grographic Segmentation

7.5 Pharmaceuticals

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Pharmaceuticals: Grographic Segmentation

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Food Grade Alginate Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Food Grade Alginate Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Food Grade Alginate Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 KIMICA

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 IRO ALGINATE INDUSTRY CO.LTD

8.4 CEAMSA ALGAE

8.5 SNAP NATURAL & ALGINATE PRODUCT PVT. LTD.

8.6 ALGAIA

8.7 MARINE BIOPOLYMERS LIMITED (MBL)

8.8 DUPONT DE NEMOURS

8.9 INGREDIENTS SOLUTIONS

8.10 SHANDONG JIEJING GROUP CORPORATION

8.11 OTHER MAJOR PLAYERS

Chapter 9: Global Food Grade Alginate Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Form

9.2.1 Powders

9.2.2 Liquid forms

9.2.3 Crystals

9.3 Historic and Forecasted Market Size By Packaging

9.3.1 Paper Bags

9.3.2 Fiber Drums

9.3.3 FIBC Bulk

9.3.4 Pails

9.4 Historic and Forecasted Market Size By Application

9.4.1 Food & Beverage

9.4.2 Feed Additives

9.4.3 Pharmaceuticals

9.4.4 Others

Chapter 10: North America Food Grade Alginate Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Form

10.4.1 Powders

10.4.2 Liquid forms

10.4.3 Crystals

10.5 Historic and Forecasted Market Size By Packaging

10.5.1 Paper Bags

10.5.2 Fiber Drums

10.5.3 FIBC Bulk

10.5.4 Pails

10.6 Historic and Forecasted Market Size By Application

10.6.1 Food & Beverage

10.6.2 Feed Additives

10.6.3 Pharmaceuticals

10.6.4 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Food Grade Alginate Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Form

11.4.1 Powders

11.4.2 Liquid forms

11.4.3 Crystals

11.5 Historic and Forecasted Market Size By Packaging

11.5.1 Paper Bags

11.5.2 Fiber Drums

11.5.3 FIBC Bulk

11.5.4 Pails

11.6 Historic and Forecasted Market Size By Application

11.6.1 Food & Beverage

11.6.2 Feed Additives

11.6.3 Pharmaceuticals

11.6.4 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Food Grade Alginate Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Form

12.4.1 Powders

12.4.2 Liquid forms

12.4.3 Crystals

12.5 Historic and Forecasted Market Size By Packaging

12.5.1 Paper Bags

12.5.2 Fiber Drums

12.5.3 FIBC Bulk

12.5.4 Pails

12.6 Historic and Forecasted Market Size By Application

12.6.1 Food & Beverage

12.6.2 Feed Additives

12.6.3 Pharmaceuticals

12.6.4 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Food Grade Alginate Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Form

13.4.1 Powders

13.4.2 Liquid forms

13.4.3 Crystals

13.5 Historic and Forecasted Market Size By Packaging

13.5.1 Paper Bags

13.5.2 Fiber Drums

13.5.3 FIBC Bulk

13.5.4 Pails

13.6 Historic and Forecasted Market Size By Application

13.6.1 Food & Beverage

13.6.2 Feed Additives

13.6.3 Pharmaceuticals

13.6.4 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Food Grade Alginate Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Form

14.4.1 Powders

14.4.2 Liquid forms

14.4.3 Crystals

14.5 Historic and Forecasted Market Size By Packaging

14.5.1 Paper Bags

14.5.2 Fiber Drums

14.5.3 FIBC Bulk

14.5.4 Pails

14.6 Historic and Forecasted Market Size By Application

14.6.1 Food & Beverage

14.6.2 Feed Additives

14.6.3 Pharmaceuticals

14.6.4 Others

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Food Grade Alginate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 841.22 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.2 % |

Market Size in 2032: |

USD 1327.55 Mn. |

|

Segments Covered: |

By Form |

|

|

|

By Packaging |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FOOD GRADE ALGINATE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FOOD GRADE ALGINATE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FOOD GRADE ALGINATE MARKET COMPETITIVE RIVALRY

TABLE 005. FOOD GRADE ALGINATE MARKET THREAT OF NEW ENTRANTS

TABLE 006. FOOD GRADE ALGINATE MARKET THREAT OF SUBSTITUTES

TABLE 007. FOOD GRADE ALGINATE MARKET BY FORM

TABLE 008. POWDERS MARKET OVERVIEW (2016-2028)

TABLE 009. LIQUID FORMS MARKET OVERVIEW (2016-2028)

TABLE 010. CRYSTALS MARKET OVERVIEW (2016-2028)

TABLE 011. FOOD GRADE ALGINATE MARKET BY PACKAGING

TABLE 012. PAPER BAGS MARKET OVERVIEW (2016-2028)

TABLE 013. FIBER DRUMS MARKET OVERVIEW (2016-2028)

TABLE 014. FIBC BULK MARKET OVERVIEW (2016-2028)

TABLE 015. PAILS MARKET OVERVIEW (2016-2028)

TABLE 016. FOOD GRADE ALGINATE MARKET BY APPLICATION

TABLE 017. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

TABLE 018. FEED ADDITIVES MARKET OVERVIEW (2016-2028)

TABLE 019. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 020. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA FOOD GRADE ALGINATE MARKET, BY FORM (2016-2028)

TABLE 022. NORTH AMERICA FOOD GRADE ALGINATE MARKET, BY PACKAGING (2016-2028)

TABLE 023. NORTH AMERICA FOOD GRADE ALGINATE MARKET, BY APPLICATION (2016-2028)

TABLE 024. N FOOD GRADE ALGINATE MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE FOOD GRADE ALGINATE MARKET, BY FORM (2016-2028)

TABLE 026. EUROPE FOOD GRADE ALGINATE MARKET, BY PACKAGING (2016-2028)

TABLE 027. EUROPE FOOD GRADE ALGINATE MARKET, BY APPLICATION (2016-2028)

TABLE 028. FOOD GRADE ALGINATE MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC FOOD GRADE ALGINATE MARKET, BY FORM (2016-2028)

TABLE 030. ASIA PACIFIC FOOD GRADE ALGINATE MARKET, BY PACKAGING (2016-2028)

TABLE 031. ASIA PACIFIC FOOD GRADE ALGINATE MARKET, BY APPLICATION (2016-2028)

TABLE 032. FOOD GRADE ALGINATE MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA FOOD GRADE ALGINATE MARKET, BY FORM (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA FOOD GRADE ALGINATE MARKET, BY PACKAGING (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA FOOD GRADE ALGINATE MARKET, BY APPLICATION (2016-2028)

TABLE 036. FOOD GRADE ALGINATE MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA FOOD GRADE ALGINATE MARKET, BY FORM (2016-2028)

TABLE 038. SOUTH AMERICA FOOD GRADE ALGINATE MARKET, BY PACKAGING (2016-2028)

TABLE 039. SOUTH AMERICA FOOD GRADE ALGINATE MARKET, BY APPLICATION (2016-2028)

TABLE 040. FOOD GRADE ALGINATE MARKET, BY COUNTRY (2016-2028)

TABLE 041. KIMICA: SNAPSHOT

TABLE 042. KIMICA: BUSINESS PERFORMANCE

TABLE 043. KIMICA: PRODUCT PORTFOLIO

TABLE 044. KIMICA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. IRO ALGINATE INDUSTRY CO.LTD: SNAPSHOT

TABLE 045. IRO ALGINATE INDUSTRY CO.LTD: BUSINESS PERFORMANCE

TABLE 046. IRO ALGINATE INDUSTRY CO.LTD: PRODUCT PORTFOLIO

TABLE 047. IRO ALGINATE INDUSTRY CO.LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. CEAMSA ALGAE: SNAPSHOT

TABLE 048. CEAMSA ALGAE: BUSINESS PERFORMANCE

TABLE 049. CEAMSA ALGAE: PRODUCT PORTFOLIO

TABLE 050. CEAMSA ALGAE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. SNAP NATURAL & ALGINATE PRODUCT PVT. LTD.: SNAPSHOT

TABLE 051. SNAP NATURAL & ALGINATE PRODUCT PVT. LTD.: BUSINESS PERFORMANCE

TABLE 052. SNAP NATURAL & ALGINATE PRODUCT PVT. LTD.: PRODUCT PORTFOLIO

TABLE 053. SNAP NATURAL & ALGINATE PRODUCT PVT. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. ALGAIA: SNAPSHOT

TABLE 054. ALGAIA: BUSINESS PERFORMANCE

TABLE 055. ALGAIA: PRODUCT PORTFOLIO

TABLE 056. ALGAIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. MARINE BIOPOLYMERS LIMITED (MBL): SNAPSHOT

TABLE 057. MARINE BIOPOLYMERS LIMITED (MBL): BUSINESS PERFORMANCE

TABLE 058. MARINE BIOPOLYMERS LIMITED (MBL): PRODUCT PORTFOLIO

TABLE 059. MARINE BIOPOLYMERS LIMITED (MBL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. DUPONT DE NEMOURS: SNAPSHOT

TABLE 060. DUPONT DE NEMOURS: BUSINESS PERFORMANCE

TABLE 061. DUPONT DE NEMOURS: PRODUCT PORTFOLIO

TABLE 062. DUPONT DE NEMOURS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. INGREDIENTS SOLUTIONS: SNAPSHOT

TABLE 063. INGREDIENTS SOLUTIONS: BUSINESS PERFORMANCE

TABLE 064. INGREDIENTS SOLUTIONS: PRODUCT PORTFOLIO

TABLE 065. INGREDIENTS SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. SHANDONG JIEJING GROUP CORPORATION: SNAPSHOT

TABLE 066. SHANDONG JIEJING GROUP CORPORATION: BUSINESS PERFORMANCE

TABLE 067. SHANDONG JIEJING GROUP CORPORATION: PRODUCT PORTFOLIO

TABLE 068. SHANDONG JIEJING GROUP CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 069. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 070. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 071. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FOOD GRADE ALGINATE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FOOD GRADE ALGINATE MARKET OVERVIEW BY FORM

FIGURE 012. POWDERS MARKET OVERVIEW (2016-2028)

FIGURE 013. LIQUID FORMS MARKET OVERVIEW (2016-2028)

FIGURE 014. CRYSTALS MARKET OVERVIEW (2016-2028)

FIGURE 015. FOOD GRADE ALGINATE MARKET OVERVIEW BY PACKAGING

FIGURE 016. PAPER BAGS MARKET OVERVIEW (2016-2028)

FIGURE 017. FIBER DRUMS MARKET OVERVIEW (2016-2028)

FIGURE 018. FIBC BULK MARKET OVERVIEW (2016-2028)

FIGURE 019. PAILS MARKET OVERVIEW (2016-2028)

FIGURE 020. FOOD GRADE ALGINATE MARKET OVERVIEW BY APPLICATION

FIGURE 021. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

FIGURE 022. FEED ADDITIVES MARKET OVERVIEW (2016-2028)

FIGURE 023. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA FOOD GRADE ALGINATE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE FOOD GRADE ALGINATE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC FOOD GRADE ALGINATE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA FOOD GRADE ALGINATE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA FOOD GRADE ALGINATE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Food Grade Alginate Market research report is 2024-2032.

KIMICA, IRO Alginate Industry Co.Ltd, Ceamsa Algae, SNAP Natural & Alginate Product Pvt. Ltd., Algaia, Marine Biopolymers Limited (MBL), DuPont de Nemours, Ingredients Solutions, Shandong Jiejing Group Corporation Others Major Players

The Food Grade Alginate Market is segmented into By Form, By Packaging, By Application and region. By Form, the market is categorized into Powders, Liquid forms and Crystals. By Packaging, the market is categorized into Paper Bags, Fiber Drums, FIBC Bulk and Pails. By Application, the market is categorized into Food & Beverage, Feed Additives, Pharmaceuticals and Others (such as industrial). By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The food-grade alginate market refers to the segment of the food industry focused on the production, distribution, and consumption of alginate, a natural polysaccharide derived primarily from seaweed. Food-grade alginate is utilized as a versatile additive, valued for its unique gelling, thickening, and stabilizing properties in a wide range of food products. It is commonly employed in food processing to enhance texture, improve mouthfeel, and extend shelf life. With its ability to form gels in the presence of calcium ions, food-grade alginate finds applications in various food products such as dairy, bakery, confectionery, and processed meats, among others. As consumer preferences for clean-label and natural ingredients continue to drive product innovation, the demand for food-grade alginate as a safe, plant-derived ingredient is expected to witness steady growth in the global food market.

Global Food Grade Alginate Market size is expected to grow from USD 841.22 Million in 2023 to USD 1327.55 Million by 2032, at a CAGR of 5.2% during the forecast period (2024-2032)