Global Organic Coffee Market Overview

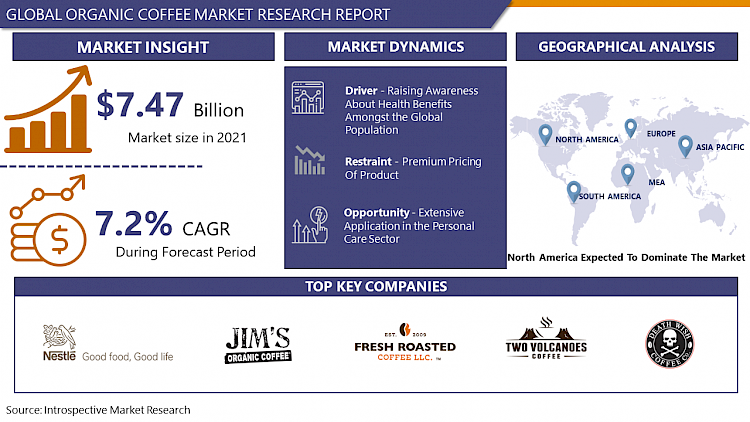

The Organic Coffee Market size was valued at USD 7.47 Billion in 2021 and is projected to reach USD 12.15 Billion by 2028, registering a CAGR of 7.2% during the forecast period.

Organic Coffee is produced under strict conditions with the presence of organic pesticides and organic fertilizers. The production of the coffee plant is strictly non-GMO and the whole production process is carried out under GMP practices decided by different regulatory bodies like Agri-food Canada and USDA. The Organic food market is already covering one-third of the organic drinks present in the market. According to Statista Consumption increased over the years and reached over 1.64 billion U.S. dollars in 2019. By 2022, the value of organic beverages consumed in the United States is expected to exceed 1.8 billion U.S. dollars. Owing to the rising trend of consumption of organic products the organic coffee market is expected to have a high growth through the forecast period. Fairtrade is giving a good amount of ethical consumer base for organic coffee products in the global organic coffee market. Additionally, Coffee is the most preferred, and popular beverage among the population showing high growth in the coffee market. Organic Coffee is consumed by people on a large scale.

Market Dynamics And Factors For Organic Coffee Market

Drivers:

Raising Awareness About Health Benefits Amongst the Global Population

The Organic Coffee Market is largely expanding due to its ability to provide many health benefits. Drinking organic coffee on regular basis reduces stress, and gives relief from pain. Organic coffee contains caffeine which helps the brain to release dopamine which helps to generate euphoria and happy feelings in the area of the brain which is responsible for the charge in moods. Additionally, organic coffee helps to increase fiber intake and protects against liver cirrhosis, which is further beneficial to lowering the risk of depression. Along with this, organic coffee lowers the risk of Type 2 Diabetes, Alzheimer’s, and various heart-related problems. People are more aware of these benefits and that helps to boost the growth of the organic coffee market.

Restraints:

Premium Pricing Of Product

The coffee market already has a huge customer base that helps to expand the coffee market in the organic segment. But the premium pricing of the product made from organic coffee is restraining the growth of the market. The entire list of the products prepared with organic coffee like skin care products, cosmetics, and food & beverages are coat high cost is not affordable by every individual or people in the low-income group which may hamper the growth of the organic coffee market during the projected period.

Opportunities:

Extensive Application in the Personal Care Sector

As Organic coffee is increasingly used in the food and beverages sector that is providing growth to the market. There is a huge opportunity for the growth of the organic coffee market in personal care products. Organic coffee is a naturally beneficial and sustainable ingredient for beauty and personal care products. Products like face wash, facial scrubs, body scrubs, oils, and face packs are made with coffee grounds which can help to clear dead skin cells and unclog the pores. The coffee beans contain chlorogenic acids that may also reduce inflammation and protect the skin against some strains of bacteria. Additionally, it is used in beauty products due to its properties which help to get instantly brighten skin, clear all the dirt on the skin, and help in the regeneration of new skin cells. Also beneficial to reduce dark spots and make even skin tone. This extensive use of organic coffee in personal care products supports the growth of the market.

Segmentation Analysis Of Organic Coffee Market

By Type, the fair trade coffee segment dominates the overall market growth of Organic Coffee in the past few years and is expected to continue its dominance over the forecast period. Fairtrade is an organization that gives certification to coffee. Fairtrade has decided on the standard process of producing coffee. Fair trade coffee is certified coffee as coffee produced to fair trade standards by fair trade organizations, to achieve greater equity in international trade. This help to maintain the quality of the product and give assurance to the customer.

By Origin, Arabica beans anticipated the highest growth in the organic coffee market during the forecasted period. Arabica beans taste better than any other coffee beans due to the high sugar level which helps to decrease the bitterness of coffee. Additionally, coffee beans contain higher levels of chlorogenic acids, choline, and trigonelline which are beneficial for the body. These factors are making Arabica a most popular and preferred type of coffee bean. For instance, the most famous coffee provider Starbucks uses 100% Arabica beans, to serve delicious and high-quality coffee. High consumption of this segment is propelling the growth of the organic coffee market.

By Distribution Channel, the hypermarkets/supermarkets segment is expected to dominate the organic coffee market share during the forecast period. Hypermarkets/supermarkets are one-stop shops and they have availability of various varieties, different brands, different prices, and package sizes. This is convenient for the customer also and helps to increase the growth of the organic coffee market during the analysis period.

By End-user, Food and beverage segment is expected to dominate the organic coffee market over the forecast period. The food and beverage sector is the primary user of organic coffee. There are several numbers of food and drinking items that are made using base materials such as coffee. This huge lineup of end products helps to contribute the largest share in the increasing growth of the organic coffee market during the projected period.

Regional Analysis Of Organic Coffee Market

The North American region is the dominant and fast-growing region for organic coffee. This market is estimated to be driven by the increasing consumption of coffee and coffee-related products. Most of the population drinks coffee several times a day in this region. The high consumer rate is propelling the growth of the market. To full fill the high demand for coffee North America import organic coffee from many other countries in a different region, for instance, United State get 25% of organic coffee, tea, and spice imports came from Peru in 2020. According to Statista, Colombia was the biggest coffee trading partner of the United States in 2020, with the U.S. importing 1.21 billion dollars’ worth of organic coffee. Coffee is an extremely popular beverage among Americans of all ages. Nearly 70% of seniors and 50% of people between 18 to 25 years have coffee. The high consumption of organic coffee supports the growth organic coffee market in this region.

Europe is the leading region in the organic coffee sector. The countries like the U.K., Germany, France, Italy and many other countries in Western Europe have high requirements for organic coffee owing to its health-related benefits. The rising understanding people in this region are getting more aware of the benefits of drinking organic coffee. Additionally, the providers are created various products which contribute to the growth of the organic coffee market like smoothly, milkshakes, ice creams, and other cold and hot beverages.

South America is contributing largely to the growth of the organic coffee market during the projected period. In the South African region the countries like in 2020, the country Colombia was the third-largest coffee grower in the world, producing 14.3 million 60-kilogram bags of coffee. Moreover, Brazil is another South American country known for its special coffee beans; it was the second number for exporting over 1.16 billion dollars of coffee to the U.S. this high production in this region is driving the growth of the market.

Asia-Pacific is one of the major dominating regions for organic coffee. Rising consumer interest and high production of organic coffee are supporting the growth of the market. India ranked seventh in the production of coffee, in 2020. In India, the highest organic coffee production was in the southern state of India in Kerala 14, with 9 thousand 60 kilogram bags in 2020. The total organic coffee production was 20.1 thousand 60-kilogram bags during the same year. Vietnam was the largest producer of beans in the Asia region. According to Statista, in the fiscal year 2020, more than 3.25 thousand tons of certified organic coffee beans were produced in Japan, representing an increase from about 2.9 thousand tons in the previous fiscal year. These factors are providing high growth to the market.

Covid-19 Impact Analysis On Organic Coffee Market

The Covid-19 pandemic had a Negative impact on the global organic coffee market in 2020. The coffee industry was under pressure during the crisis due to the low productivity, disturbed supply chain, fluctuation in coffee prices, and climate change affecting the organic coffee market worldwide. Governments apply restrictions and lockdowns, resulting in a significant drop in coffee sales around cafés, and restaurants, which ultimately impacted the global organic coffee market. However, the rapid growth in the market due to at-home coffee consumption gives a boost to the market. As a result, the market experienced a surge in growth when consumers start buying groceries and other necessities during the pandemic.

Top Key Players Covered In Organic Coffee Market

- Nestle S.A.(US)

- Java Coffee Roasters Inc. (Poland)

- Jim’s Organic Coffee (USA)

- Fresh Roasted Coffee LLC (US)

- Two Valcanoes Coffee (US)

- Shearwater Organic Coffee Roasters LLC. (US)

- Jim’s Organic Coffee (US)

- Rogers Family (US)

- Death Wish Coffee (US)

- Burke Brands (US)

- Grupo Britt (Costa Rica)

- Strictly Organic Coffee (US)

- Dean’s Beans Organic Coffee (US)

- Keurig Green Mountai (US)

- Jungle Products (UK)

- Specialty Java (US)

- Coffee Bean Direct (US)

- Allegro Coffee (US)

- Cafe Don Pablo (US)

- Oakland Coffee (US), and other major players.

Key Industry Development In Organic Coffee Market

In February 2022, a new organic coffee brand, Bolivian Cafecito, was founded. The new brand is exporting to the international market. It was founded by capacity building, quality control efforts, and strengthened partnerships amongst small farmers, the National Association of Coffee Producers, and the Bolivian government.

In June 2021, Nespresso launched new organic coffee in Malaysia to help revitalize one of the world’s most fragile farming regions. The Reviving Origins KAHAWA ya CONGO coffee from Nespresso is a smooth and fruity seasonal blend, grown on the rain-rich volcanic soils of Lake Kivu in the Democratic Republic of the Congo.

|

Global Organic Coffee Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2021: |

USD 7.47 Bn. |

|

Forecast Period 2022-28 CAGR: |

7.2 % |

Market Size in 2028: |

USD 12.15 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Origin |

|

||

|

By Distribution Channel |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Origin

3.3 By Distribution Channel

3.4 By End-Users

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Organic Coffee Market by Type

5.1 Organic Coffee Market Overview Snapshot and Growth Engine

5.2 Organic Coffee Market Overview

5.3 Fair Trade Coffee

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Fair Trade Coffee: Grographic Segmentation

5.4 Gourmet Coffee

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Gourmet Coffee: Grographic Segmentation

5.5 Coffee Pods

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Coffee Pods: Grographic Segmentation

Chapter 6: Organic Coffee Market by Origin

6.1 Organic Coffee Market Overview Snapshot and Growth Engine

6.2 Organic Coffee Market Overview

6.3 Arabica

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Arabica: Grographic Segmentation

6.4 Robusta

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Robusta: Grographic Segmentation

6.5 Other

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Other: Grographic Segmentation

Chapter 7: Organic Coffee Market by Distribution Channel

7.1 Organic Coffee Market Overview Snapshot and Growth Engine

7.2 Organic Coffee Market Overview

7.3 Supermarket/Hypermarket

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Supermarket/Hypermarket: Grographic Segmentation

7.4 Convenience Store

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Convenience Store: Grographic Segmentation

7.5 Retail

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Retail: Grographic Segmentation

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Grographic Segmentation

Chapter 8: Organic Coffee Market by End-Users

8.1 Organic Coffee Market Overview Snapshot and Growth Engine

8.2 Organic Coffee Market Overview

8.3 Food & Beverages

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Food & Beverages: Grographic Segmentation

8.4 Cosmetics

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Cosmetics: Grographic Segmentation

8.5 Others

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Others: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Organic Coffee Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Organic Coffee Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Organic Coffee Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 NESTLE S.A.

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 JAVA COFFEE ROASTERS INC.

9.4 JIM’S ORGANIC COFFEE

9.5 FRESH ROASTED COFFEE LLC

9.6 TWO VALCANOES COFFEE

9.7 SHEARWATER ORGANIC COFFEE ROASTERS LLC.

9.8 JIM’S ORGANIC COFFEE

9.9 ROGERS FAMILY

9.10 DEATH WISH COFFEE

9.11 BURKE BRANDS

9.12 GRUPO BRITT

9.13 STRICTLY ORGANIC COFFEE

9.14 DEAN’S BEANS ORGANIC COFFEE

9.15 KEURIG GREEN MOUNTAI

9.16 JUNGLE PRODUCTS

9.17 SPECIALTY JAVA

9.18 COFFEE BEAN DIRECT

9.19 ALLEGRO COFFEE

9.20 CAFE DON PABLO

9.21 OAKLAND COFFEE

9.22 OTHER MAJOR PLAYERS

Chapter 10: Global Organic Coffee Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Type

10.2.1 Fair Trade Coffee

10.2.2 Gourmet Coffee

10.2.3 Coffee Pods

10.3 Historic and Forecasted Market Size By Origin

10.3.1 Arabica

10.3.2 Robusta

10.3.3 Other

10.4 Historic and Forecasted Market Size By Distribution Channel

10.4.1 Supermarket/Hypermarket

10.4.2 Convenience Store

10.4.3 Retail

10.4.4 Others

10.5 Historic and Forecasted Market Size By End-Users

10.5.1 Food & Beverages

10.5.2 Cosmetics

10.5.3 Others

Chapter 11: North America Organic Coffee Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Fair Trade Coffee

11.4.2 Gourmet Coffee

11.4.3 Coffee Pods

11.5 Historic and Forecasted Market Size By Origin

11.5.1 Arabica

11.5.2 Robusta

11.5.3 Other

11.6 Historic and Forecasted Market Size By Distribution Channel

11.6.1 Supermarket/Hypermarket

11.6.2 Convenience Store

11.6.3 Retail

11.6.4 Others

11.7 Historic and Forecasted Market Size By End-Users

11.7.1 Food & Beverages

11.7.2 Cosmetics

11.7.3 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Organic Coffee Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Fair Trade Coffee

12.4.2 Gourmet Coffee

12.4.3 Coffee Pods

12.5 Historic and Forecasted Market Size By Origin

12.5.1 Arabica

12.5.2 Robusta

12.5.3 Other

12.6 Historic and Forecasted Market Size By Distribution Channel

12.6.1 Supermarket/Hypermarket

12.6.2 Convenience Store

12.6.3 Retail

12.6.4 Others

12.7 Historic and Forecasted Market Size By End-Users

12.7.1 Food & Beverages

12.7.2 Cosmetics

12.7.3 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Organic Coffee Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Fair Trade Coffee

13.4.2 Gourmet Coffee

13.4.3 Coffee Pods

13.5 Historic and Forecasted Market Size By Origin

13.5.1 Arabica

13.5.2 Robusta

13.5.3 Other

13.6 Historic and Forecasted Market Size By Distribution Channel

13.6.1 Supermarket/Hypermarket

13.6.2 Convenience Store

13.6.3 Retail

13.6.4 Others

13.7 Historic and Forecasted Market Size By End-Users

13.7.1 Food & Beverages

13.7.2 Cosmetics

13.7.3 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Organic Coffee Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Fair Trade Coffee

14.4.2 Gourmet Coffee

14.4.3 Coffee Pods

14.5 Historic and Forecasted Market Size By Origin

14.5.1 Arabica

14.5.2 Robusta

14.5.3 Other

14.6 Historic and Forecasted Market Size By Distribution Channel

14.6.1 Supermarket/Hypermarket

14.6.2 Convenience Store

14.6.3 Retail

14.6.4 Others

14.7 Historic and Forecasted Market Size By End-Users

14.7.1 Food & Beverages

14.7.2 Cosmetics

14.7.3 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Organic Coffee Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Fair Trade Coffee

15.4.2 Gourmet Coffee

15.4.3 Coffee Pods

15.5 Historic and Forecasted Market Size By Origin

15.5.1 Arabica

15.5.2 Robusta

15.5.3 Other

15.6 Historic and Forecasted Market Size By Distribution Channel

15.6.1 Supermarket/Hypermarket

15.6.2 Convenience Store

15.6.3 Retail

15.6.4 Others

15.7 Historic and Forecasted Market Size By End-Users

15.7.1 Food & Beverages

15.7.2 Cosmetics

15.7.3 Others

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Organic Coffee Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2021: |

USD 7.47 Bn. |

|

Forecast Period 2022-28 CAGR: |

7.2 % |

Market Size in 2028: |

USD 12.15 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Origin |

|

||

|

By Distribution Channel |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ORGANIC COFFEE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ORGANIC COFFEE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ORGANIC COFFEE MARKET COMPETITIVE RIVALRY

TABLE 005. ORGANIC COFFEE MARKET THREAT OF NEW ENTRANTS

TABLE 006. ORGANIC COFFEE MARKET THREAT OF SUBSTITUTES

TABLE 007. ORGANIC COFFEE MARKET BY TYPE

TABLE 008. FAIR TRADE COFFEE MARKET OVERVIEW (2016-2028)

TABLE 009. GOURMET COFFEE MARKET OVERVIEW (2016-2028)

TABLE 010. COFFEE PODS MARKET OVERVIEW (2016-2028)

TABLE 011. ORGANIC COFFEE MARKET BY ORIGIN

TABLE 012. ARABICA MARKET OVERVIEW (2016-2028)

TABLE 013. ROBUSTA MARKET OVERVIEW (2016-2028)

TABLE 014. OTHER MARKET OVERVIEW (2016-2028)

TABLE 015. ORGANIC COFFEE MARKET BY DISTRIBUTION CHANNEL

TABLE 016. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2028)

TABLE 017. CONVENIENCE STORE MARKET OVERVIEW (2016-2028)

TABLE 018. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 020. ORGANIC COFFEE MARKET BY END-USERS

TABLE 021. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 022. COSMETICS MARKET OVERVIEW (2016-2028)

TABLE 023. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA ORGANIC COFFEE MARKET, BY TYPE (2016-2028)

TABLE 025. NORTH AMERICA ORGANIC COFFEE MARKET, BY ORIGIN (2016-2028)

TABLE 026. NORTH AMERICA ORGANIC COFFEE MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 027. NORTH AMERICA ORGANIC COFFEE MARKET, BY END-USERS (2016-2028)

TABLE 028. N ORGANIC COFFEE MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE ORGANIC COFFEE MARKET, BY TYPE (2016-2028)

TABLE 030. EUROPE ORGANIC COFFEE MARKET, BY ORIGIN (2016-2028)

TABLE 031. EUROPE ORGANIC COFFEE MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 032. EUROPE ORGANIC COFFEE MARKET, BY END-USERS (2016-2028)

TABLE 033. ORGANIC COFFEE MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC ORGANIC COFFEE MARKET, BY TYPE (2016-2028)

TABLE 035. ASIA PACIFIC ORGANIC COFFEE MARKET, BY ORIGIN (2016-2028)

TABLE 036. ASIA PACIFIC ORGANIC COFFEE MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 037. ASIA PACIFIC ORGANIC COFFEE MARKET, BY END-USERS (2016-2028)

TABLE 038. ORGANIC COFFEE MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA ORGANIC COFFEE MARKET, BY TYPE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA ORGANIC COFFEE MARKET, BY ORIGIN (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA ORGANIC COFFEE MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA ORGANIC COFFEE MARKET, BY END-USERS (2016-2028)

TABLE 043. ORGANIC COFFEE MARKET, BY COUNTRY (2016-2028)

TABLE 044. SOUTH AMERICA ORGANIC COFFEE MARKET, BY TYPE (2016-2028)

TABLE 045. SOUTH AMERICA ORGANIC COFFEE MARKET, BY ORIGIN (2016-2028)

TABLE 046. SOUTH AMERICA ORGANIC COFFEE MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 047. SOUTH AMERICA ORGANIC COFFEE MARKET, BY END-USERS (2016-2028)

TABLE 048. ORGANIC COFFEE MARKET, BY COUNTRY (2016-2028)

TABLE 049. NESTLE S.A.: SNAPSHOT

TABLE 050. NESTLE S.A.: BUSINESS PERFORMANCE

TABLE 051. NESTLE S.A.: PRODUCT PORTFOLIO

TABLE 052. NESTLE S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. JAVA COFFEE ROASTERS INC.: SNAPSHOT

TABLE 053. JAVA COFFEE ROASTERS INC.: BUSINESS PERFORMANCE

TABLE 054. JAVA COFFEE ROASTERS INC.: PRODUCT PORTFOLIO

TABLE 055. JAVA COFFEE ROASTERS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. JIM’S ORGANIC COFFEE: SNAPSHOT

TABLE 056. JIM’S ORGANIC COFFEE: BUSINESS PERFORMANCE

TABLE 057. JIM’S ORGANIC COFFEE: PRODUCT PORTFOLIO

TABLE 058. JIM’S ORGANIC COFFEE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. FRESH ROASTED COFFEE LLC: SNAPSHOT

TABLE 059. FRESH ROASTED COFFEE LLC: BUSINESS PERFORMANCE

TABLE 060. FRESH ROASTED COFFEE LLC: PRODUCT PORTFOLIO

TABLE 061. FRESH ROASTED COFFEE LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. TWO VALCANOES COFFEE: SNAPSHOT

TABLE 062. TWO VALCANOES COFFEE: BUSINESS PERFORMANCE

TABLE 063. TWO VALCANOES COFFEE: PRODUCT PORTFOLIO

TABLE 064. TWO VALCANOES COFFEE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. SHEARWATER ORGANIC COFFEE ROASTERS LLC.: SNAPSHOT

TABLE 065. SHEARWATER ORGANIC COFFEE ROASTERS LLC.: BUSINESS PERFORMANCE

TABLE 066. SHEARWATER ORGANIC COFFEE ROASTERS LLC.: PRODUCT PORTFOLIO

TABLE 067. SHEARWATER ORGANIC COFFEE ROASTERS LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. JIM’S ORGANIC COFFEE: SNAPSHOT

TABLE 068. JIM’S ORGANIC COFFEE: BUSINESS PERFORMANCE

TABLE 069. JIM’S ORGANIC COFFEE: PRODUCT PORTFOLIO

TABLE 070. JIM’S ORGANIC COFFEE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. ROGERS FAMILY: SNAPSHOT

TABLE 071. ROGERS FAMILY: BUSINESS PERFORMANCE

TABLE 072. ROGERS FAMILY: PRODUCT PORTFOLIO

TABLE 073. ROGERS FAMILY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. DEATH WISH COFFEE: SNAPSHOT

TABLE 074. DEATH WISH COFFEE: BUSINESS PERFORMANCE

TABLE 075. DEATH WISH COFFEE: PRODUCT PORTFOLIO

TABLE 076. DEATH WISH COFFEE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. BURKE BRANDS: SNAPSHOT

TABLE 077. BURKE BRANDS: BUSINESS PERFORMANCE

TABLE 078. BURKE BRANDS: PRODUCT PORTFOLIO

TABLE 079. BURKE BRANDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. GRUPO BRITT: SNAPSHOT

TABLE 080. GRUPO BRITT: BUSINESS PERFORMANCE

TABLE 081. GRUPO BRITT: PRODUCT PORTFOLIO

TABLE 082. GRUPO BRITT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. STRICTLY ORGANIC COFFEE: SNAPSHOT

TABLE 083. STRICTLY ORGANIC COFFEE: BUSINESS PERFORMANCE

TABLE 084. STRICTLY ORGANIC COFFEE: PRODUCT PORTFOLIO

TABLE 085. STRICTLY ORGANIC COFFEE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. DEAN’S BEANS ORGANIC COFFEE: SNAPSHOT

TABLE 086. DEAN’S BEANS ORGANIC COFFEE: BUSINESS PERFORMANCE

TABLE 087. DEAN’S BEANS ORGANIC COFFEE: PRODUCT PORTFOLIO

TABLE 088. DEAN’S BEANS ORGANIC COFFEE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. KEURIG GREEN MOUNTAI: SNAPSHOT

TABLE 089. KEURIG GREEN MOUNTAI: BUSINESS PERFORMANCE

TABLE 090. KEURIG GREEN MOUNTAI: PRODUCT PORTFOLIO

TABLE 091. KEURIG GREEN MOUNTAI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. JUNGLE PRODUCTS: SNAPSHOT

TABLE 092. JUNGLE PRODUCTS: BUSINESS PERFORMANCE

TABLE 093. JUNGLE PRODUCTS: PRODUCT PORTFOLIO

TABLE 094. JUNGLE PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. SPECIALTY JAVA: SNAPSHOT

TABLE 095. SPECIALTY JAVA: BUSINESS PERFORMANCE

TABLE 096. SPECIALTY JAVA: PRODUCT PORTFOLIO

TABLE 097. SPECIALTY JAVA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. COFFEE BEAN DIRECT: SNAPSHOT

TABLE 098. COFFEE BEAN DIRECT: BUSINESS PERFORMANCE

TABLE 099. COFFEE BEAN DIRECT: PRODUCT PORTFOLIO

TABLE 100. COFFEE BEAN DIRECT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. ALLEGRO COFFEE: SNAPSHOT

TABLE 101. ALLEGRO COFFEE: BUSINESS PERFORMANCE

TABLE 102. ALLEGRO COFFEE: PRODUCT PORTFOLIO

TABLE 103. ALLEGRO COFFEE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. CAFE DON PABLO: SNAPSHOT

TABLE 104. CAFE DON PABLO: BUSINESS PERFORMANCE

TABLE 105. CAFE DON PABLO: PRODUCT PORTFOLIO

TABLE 106. CAFE DON PABLO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. OAKLAND COFFEE: SNAPSHOT

TABLE 107. OAKLAND COFFEE: BUSINESS PERFORMANCE

TABLE 108. OAKLAND COFFEE: PRODUCT PORTFOLIO

TABLE 109. OAKLAND COFFEE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 110. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 111. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 112. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ORGANIC COFFEE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ORGANIC COFFEE MARKET OVERVIEW BY TYPE

FIGURE 012. FAIR TRADE COFFEE MARKET OVERVIEW (2016-2028)

FIGURE 013. GOURMET COFFEE MARKET OVERVIEW (2016-2028)

FIGURE 014. COFFEE PODS MARKET OVERVIEW (2016-2028)

FIGURE 015. ORGANIC COFFEE MARKET OVERVIEW BY ORIGIN

FIGURE 016. ARABICA MARKET OVERVIEW (2016-2028)

FIGURE 017. ROBUSTA MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 019. ORGANIC COFFEE MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 020. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2028)

FIGURE 021. CONVENIENCE STORE MARKET OVERVIEW (2016-2028)

FIGURE 022. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 024. ORGANIC COFFEE MARKET OVERVIEW BY END-USERS

FIGURE 025. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 026. COSMETICS MARKET OVERVIEW (2016-2028)

FIGURE 027. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA ORGANIC COFFEE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE ORGANIC COFFEE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC ORGANIC COFFEE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA ORGANIC COFFEE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA ORGANIC COFFEE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Organic Coffee research report is 2022-2028.

Nestle S.A. (US), Java Coffee Roasters Inc. (Poland), Jim’s Organic Coffee (USA), Fresh Roasted Coffee LLC (US), Two Valcanoes Coffee (US), and Other Major Players.

Organic Coffee Market is segmented into Type, Origin, Distribution Channel, End-Users Payment Mode, and region. By Type, the market is categorized into Platform to Consumer Delivery and Restaurant to Consumer Delivery, By Payment Mode, the market is categorized into Online Banking, Net Banking, and Cash on Delivery. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Organic Coffee is the process that people carried out for ordering food, from a website or other mobile application.

Organic Coffee Market was valued at USD 7.47 Billion in 2021 and is projected to reach USD 12.15 Billion by 2028, growing at a CAGR of 7.2% from 2022 to 2028.