Global Phytogenic Feed Additive Market Overview

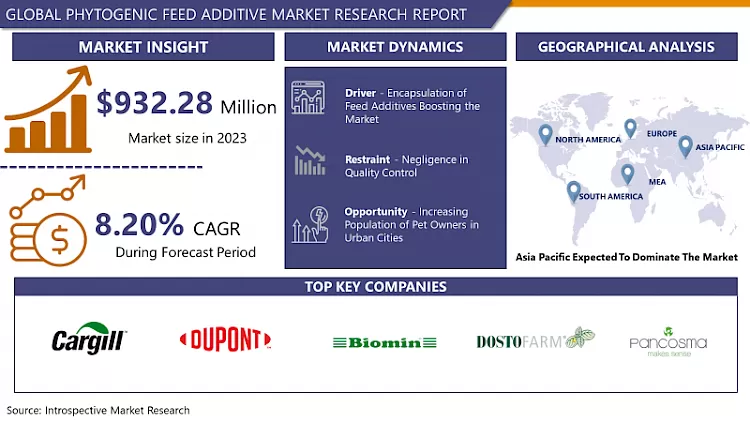

The Phytogenic Feed Additive Market estimated at USD 932.28 Million in the year 2023, is projected to reach a revised size of USD 1894.92 Million by 2032, growing at a CAGR of 8.20% over the analysis period 2024-2032

Phytogenic, Phyto-biotics or botanicals, are plant-derived products used as feed additives, to potentially increase the performance of animal husbandry. Studies have shown that photogenic, play an important role in increased feed uptake, improved gut function, anti-oxidant effects, and anti-microbial effects. Moreover, phytogenic feed additives have found increased use, over traditional feed additives as they don't have antibiotics and are 100% natural. Phytogenic additives also enhance the flavor of the feed and also aids in digestion. Moreover, using phytogenic feed additives, reduces ammonia emission from livestock, thereby reducing nitrogen pollution. The blue ridge in using phytogenic feed additives is that it suppresses the growth of harmful bacteria without the utilization of antibiotics, thereby boosting the growth of the phytogenic feed additive market during the forecast period. Globally the demand for organic meat is rising substantially, to meet this demand, the necessity of phytogenic feed additives has increased. Moreover, phytogenic feed additives are capable of reducing microbial threats and promoting intestinal health, which is a positive sign for optimal performance and profitability, thereby promoting the growth of the phytogenic feed additives market in the forecast period. According to BIOMIN, the market for phytogenic feed additives is going to increase from US$500 million in 2015 to US$2 billion by 2030, i.e., four times from its initial value in 2015.

Market Dynamics And Factors Of Phytogenic Feed Additive Market

Drivers:

Encapsulation Of Feed Additives

Phytogenic feed additives have shown positive effects on the livestock, by showing anti-microbial properties thus reducing the use of modern antibiotics and in turn reducing the cost of its purchase. Essential oils are sensitive substances, that lose their potency and efficiency, due to high temperature, significant odor, volatile, and oxidative properties. Encapsulated technology helps in the preservation of essential oils by increasing their shelf life, thereby protecting them from environmental changes. The growing need for nutritious and healthy food from livestock has driven the demand for the use of phytogenic feed additives. Moreover, there has been a significant increase in the muscle growth of livestock, used for rearing when phytogenic feed additives were used in supplementation, thereby driving the phytogenic feed additives market. Moreover, phytogenic feed additives do not interact with other supplements in the diet such as organic acids and antibiotics. The increasing population of pets is going to drive the market during the period of forecast.

Local Sourcing and Downstream Channel Network Development

Producers of feed additives obtained from various sources are drifting away from globalization trends. The world in recent times faced a lower threshold of interest for globalization and globally oriented business models. In addition, feed additives producers have also chosen a more localized strategy, wherein feed additives producers are highlighting country and region-specific sourcing of raw materials. Similarly, to shield their business from external forces and risky trade policies, most feed additives producing companies are building a local distribution network. Formerly, companies utilized to deflect sizable resources to purchase channel partners beyond a country operating limit. This market dynamic is switching and is more localized.

Restraints:

Negligence in Quality Control

Negligence in quality control is one of the factors that restrain the growth of phytogenic feed additives. Animal diet products are blended with essential oils and herbs, as essential oils cannot withstand high temperatures their use is highly restricted. Moreover, the natural raw materials used in essential oils or non-volatile extract contain differing levels of active compounds, which show inconsistent results when utilized, thus hampering the growth of the phytogenic feed additives market. Moreover, high prices of essential oils are one of the factors that have hindered the growth of the phytogenic feed additives market. The rise in global warming has affected the growth of plants which, are sources of essential oils, herbs, spices, and oleoresins, thus restraining the growth of the phytogenic feed additives market. Moreover, low awareness about phytogenic feed additives among the individual’s having livestock is restraining the growth of the phytogenic feed additives market.

Opportunities:

Increasing Population of Pet Owners

The developing economies have restricted the use of antibiotics, thereby supporting the expansion of the phytogenic feed additive market. The increase in concern of the pet owners, in the quality, safety, and source of the ingredients utilized in the manufacturing of the pet foods is providing opportunities for companies to come up with innovative feed products containing anti-microbial, anti-oxidant, and other qualities, that will help in keeping the pets healthy. Moreover, nowadays it has become a trend to keep pets, thereby increasing the population of pet owners significantly, increasing the opportunities for companies to come up with phytogenic food additives in their food segment.

Market Segmentation

Segmentation Analysis of Phytogenic Feed Additive Market

Based on the product, the essential oils segment is expected to dominate the phytogenic feed additive market during the forecast period. Essential oils find utilizations in feed for all livestock and are particularly beneficial in the large poultry feed industry. In the ruminant industry, the utilization of essential oils results in a marked reduction of nitrogen pollution by decreasing ammonia emissions. Moreover, Herbs and Spices is the second-largest phytogenic feed additive market share. Herbs and spices are utilized specially to improve the palatability of feed while improving digestibility. Better digestion enhances the overall health and weight of livestock.

Based on the livestock, the poultry segment is expected to dominate the phytogenic feed additive market throughout the projected period. With approximately 16 billion chickens across the globe and many millions of ducks and pheasants, the poultry industry is the largest in the world. The application of feed phytogenic has been shown to improve weight and decrease ammonia emissions of poultry, thereby boosting health. Broilers extremely consume phytogenic for better gut health and have a high feed conversion rate as compared to other kinds of livestock. In addition, poultry population growth, which has twice in the last two decades, as per the Food and Agriculture Organization of the United Nations (FAO), is augmenting the high growth rate of the poultry segment. Poultry in the Asia Pacific region is also observing an ever-increasing demand, as consumers in Taiwan and Indonesia are adding white meat instead of red meat to their diets.

Based on the form, the liquid segment is projected to account for the highest phytogenic feed additive market share over the forecast period. Essential oils are aromatic oily liquids, which are obtained from plant materials, such as leaves, fruits, flowers, and roots. The liquid form of phytogenic feed additives is primarily adopted, as it supports to improve feed consumption and utilization by animals, helps in the mixing of ingredients, resulting in uniformity of the final product, and offers proper dosage.

Based on the function, the phytogenic feed additive market is segmented into antimicrobial, antioxidant, palatability enhancers, insecticidal, anti-inflammatory, and improving gut function. When added to feed, they boost animal performance via major mechanisms, flavor properties that improve feed intake, a biological activity that aids digestion, and enhancing GIT health via modulation of the GIT microbiota The proposed drivers for these influences on performance are the antioxidant, anti-inflammatory and antimicrobial properties they exhibit.

Regional Analysis of Phytogenic Feed Additive Market

Asia Pacific region ex anticipated dominating the maximum phytogenic feed additive market share during the forecast period. The rising livestock sector in the Asia Pacific and the significant industrialization of the sector will turn the demand for feed phytogenic throughout the forecast period. The increasing consumer health concerns, especially in meat & dairy products, have resulted in the demand for natural feed additives in Asian countries, in turn, turning product demand and their growth rate. In addition, the rising number of feed production and feed mills, especially in emerging economies is further accelerating the industry in this region.

In Europe, the strict regulations on the application of synthetic feed additives are hastening the region's growth in the phytogenic feed additive market. Europe is expected to increase the demand for phytogenic feed additives and positively impact the growth of the industry over the projected period owing to rising applications of phytogenic feed additives in improving gut functioning to offer the meat-eating population with high-quality products.

Top Key Players Covered in Phytogenic Feed Additive Market

- Cargill Incorporated (US)

- Dupont De Nemours

- Bentoli (US)

- BIOMIN (Austria)

- DOSTOFARM Gmbh (Germany)

- Phytobiotics Futterzusatzstoffe Gmbh (Germany)

- Pancosma (Switzerland)

- The Himalaya Drug Company (India)

- Silvateam S.P.A. (Italy)

- NOR-FEED VIETNAM CO. LTD (France)

- INFOEMPRESA SL (Spain)

- Bluestar Adisseo Co. Ltd. (China)

- Natural Remedies (India)

- Delacon Biotechnik Gmbh (Austria) and other major players.

Key Industry Development in Phytogenic Feed Additive Market

- In March 2023, Indian Herbs announced the launch of a new product named HEATBEAT for poultry. This product is a combination of natural vitamin C, organic chromium complex, and mint. This launch helped the company in the expansion of its product portfolio.

|

Global Phytogenic Feed Additive Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 932.28 Mn. |

|

Forecast Period 2024-32 CAGR: |

8.20% |

Market Size in 2032: |

USD 1894.92 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Livestock |

|

||

|

By Form |

|

||

|

By Sources |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Phytogenic Feed Additive Market by Type (2018-2032)

4.1 Phytogenic Feed Additive Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Essential Oils

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Herbs

4.5 Spices

4.6 Oleoresins

Chapter 5: Phytogenic Feed Additive Market by Livestock (2018-2032)

5.1 Phytogenic Feed Additive Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Poultry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cattle

5.5 Aquatic

5.6 Swine

5.7 Other Ruminants

Chapter 6: Phytogenic Feed Additive Market by Form (2018-2032)

6.1 Phytogenic Feed Additive Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Liquid

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Dry

Chapter 7: Phytogenic Feed Additive Market by Sources (2018-2032)

7.1 Phytogenic Feed Additive Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Flower

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Fruits

7.5 Leaves

7.6 Roots

7.7 Non-Aqueous Solvents from Plant Materials

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Phytogenic Feed Additive Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MCT DAIRIES INC (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 GLANBIA PLC(US)

8.4 OLEO-FATS INCORPORATED(US)

8.5 FIT COMPANY (US)

8.6 SAPUTO DAIRY (UK)

8.7 WILMAR INTERNATIONAL LIMITED (US)

8.8 UELZENA MILCHWERKE EGMBH (GERMANY)

8.9 GLANBIA PLC (IRELAND)

8.10 KONINKLIJKE VIV BUISMAN B.V (NETHERLANDS)

8.11 FONTERRA CO-OPERATIVE GROUP LIMITED (NEW ZEALAND)

8.12 TATUA (NEW ZEALAND)

8.13 OLEO FATS (PHILIPPINES)

8.14 CORMACO (EUROPE)

8.15 FLECHARD S.A (FRANCE)

8.16 A.S. ARLA FOODS (DENMARK)

8.17 KERRY GROUP PLC (IRELAND)

8.18 FRIESLANDCAMPINA (NETHERLANDS)

8.19 THE TATUA CO-OPERATIVE DAIRY COMPANY LTD(NETHERLANDS)

8.20 ANAND MILK UNION LIMITED (INDIA)

8.21 SHANGHAI GUANGYU FOOD CO LTD. (CHINA)

8.22 UNITED DAIRY GROUP LTD. (HONG KONG)

8.23 FONTERRA JAPAN LTD. (JAPAN)

8.24 LÁCTEOS SAN MARCOS S.A.(ARGENTINA)

8.25 COOPERATIVA COLANTA (COLOMBIA)

Chapter 9: Global Phytogenic Feed Additive Market By Region

9.1 Overview

9.2. North America Phytogenic Feed Additive Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Essential Oils

9.2.4.2 Herbs

9.2.4.3 Spices

9.2.4.4 Oleoresins

9.2.5 Historic and Forecasted Market Size by Livestock

9.2.5.1 Poultry

9.2.5.2 Cattle

9.2.5.3 Aquatic

9.2.5.4 Swine

9.2.5.5 Other Ruminants

9.2.6 Historic and Forecasted Market Size by Form

9.2.6.1 Liquid

9.2.6.2 Dry

9.2.7 Historic and Forecasted Market Size by Sources

9.2.7.1 Flower

9.2.7.2 Fruits

9.2.7.3 Leaves

9.2.7.4 Roots

9.2.7.5 Non-Aqueous Solvents from Plant Materials

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Phytogenic Feed Additive Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Essential Oils

9.3.4.2 Herbs

9.3.4.3 Spices

9.3.4.4 Oleoresins

9.3.5 Historic and Forecasted Market Size by Livestock

9.3.5.1 Poultry

9.3.5.2 Cattle

9.3.5.3 Aquatic

9.3.5.4 Swine

9.3.5.5 Other Ruminants

9.3.6 Historic and Forecasted Market Size by Form

9.3.6.1 Liquid

9.3.6.2 Dry

9.3.7 Historic and Forecasted Market Size by Sources

9.3.7.1 Flower

9.3.7.2 Fruits

9.3.7.3 Leaves

9.3.7.4 Roots

9.3.7.5 Non-Aqueous Solvents from Plant Materials

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Phytogenic Feed Additive Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Essential Oils

9.4.4.2 Herbs

9.4.4.3 Spices

9.4.4.4 Oleoresins

9.4.5 Historic and Forecasted Market Size by Livestock

9.4.5.1 Poultry

9.4.5.2 Cattle

9.4.5.3 Aquatic

9.4.5.4 Swine

9.4.5.5 Other Ruminants

9.4.6 Historic and Forecasted Market Size by Form

9.4.6.1 Liquid

9.4.6.2 Dry

9.4.7 Historic and Forecasted Market Size by Sources

9.4.7.1 Flower

9.4.7.2 Fruits

9.4.7.3 Leaves

9.4.7.4 Roots

9.4.7.5 Non-Aqueous Solvents from Plant Materials

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Phytogenic Feed Additive Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Essential Oils

9.5.4.2 Herbs

9.5.4.3 Spices

9.5.4.4 Oleoresins

9.5.5 Historic and Forecasted Market Size by Livestock

9.5.5.1 Poultry

9.5.5.2 Cattle

9.5.5.3 Aquatic

9.5.5.4 Swine

9.5.5.5 Other Ruminants

9.5.6 Historic and Forecasted Market Size by Form

9.5.6.1 Liquid

9.5.6.2 Dry

9.5.7 Historic and Forecasted Market Size by Sources

9.5.7.1 Flower

9.5.7.2 Fruits

9.5.7.3 Leaves

9.5.7.4 Roots

9.5.7.5 Non-Aqueous Solvents from Plant Materials

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Phytogenic Feed Additive Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Essential Oils

9.6.4.2 Herbs

9.6.4.3 Spices

9.6.4.4 Oleoresins

9.6.5 Historic and Forecasted Market Size by Livestock

9.6.5.1 Poultry

9.6.5.2 Cattle

9.6.5.3 Aquatic

9.6.5.4 Swine

9.6.5.5 Other Ruminants

9.6.6 Historic and Forecasted Market Size by Form

9.6.6.1 Liquid

9.6.6.2 Dry

9.6.7 Historic and Forecasted Market Size by Sources

9.6.7.1 Flower

9.6.7.2 Fruits

9.6.7.3 Leaves

9.6.7.4 Roots

9.6.7.5 Non-Aqueous Solvents from Plant Materials

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Phytogenic Feed Additive Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Essential Oils

9.7.4.2 Herbs

9.7.4.3 Spices

9.7.4.4 Oleoresins

9.7.5 Historic and Forecasted Market Size by Livestock

9.7.5.1 Poultry

9.7.5.2 Cattle

9.7.5.3 Aquatic

9.7.5.4 Swine

9.7.5.5 Other Ruminants

9.7.6 Historic and Forecasted Market Size by Form

9.7.6.1 Liquid

9.7.6.2 Dry

9.7.7 Historic and Forecasted Market Size by Sources

9.7.7.1 Flower

9.7.7.2 Fruits

9.7.7.3 Leaves

9.7.7.4 Roots

9.7.7.5 Non-Aqueous Solvents from Plant Materials

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Phytogenic Feed Additive Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 932.28 Mn. |

|

Forecast Period 2024-32 CAGR: |

8.20% |

Market Size in 2032: |

USD 1894.92 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Livestock |

|

||

|

By Form |

|

||

|

By Sources |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Phytogenic Feed Additive Market research report is 2024-2032.

Cargill Incorporated, Dupont De Nemours, Bentel, BIOMIN, DOSTOFARM Gmbh, Phytobiotics Futterzusatzstoffe Gmbh, Pancosma, The Himalaya Drug Company, Silvateam S.P.A., NOR-FEED VIETNAM CO. LTD, INFOEMPRESA SL, Bluestar Adisseo Co. Ltd., Natural Remedies, Delacon Biotechnik Gmbh and Others major players.

The Phytogenic Feed Additive Market is segmented into Type, Livestock, Form, Sources and Region. By Type, the market is categorized into Essential Oils, Herbs, Spices, Oleoresins. By Livestock, the market is categorized into Poultry, Cattle, Aquatic, Swine, Other Ruminants. By Form, the market is categorized into Liquid, Dry. By Sources, the market is categorized into Flower, Fruits, Leaves, Roots, And Non-Aqueous Solvents from Plant Materials. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Phytogenic, Phyto-biotics or botanicals, are plant-derived products used as feed additives, to potentially increase the performance of animal husbandry. Studies have shown that photogenic, play an important role in increased feed uptake, improved gut function, anti-oxidant effects, and anti-microbial effects.

The Phytogenic Feed Additive Market estimated at USD 932.28 Million in the year 2023, is projected to reach a revised size of USD 1894.92 Million by 2032, growing at a CAGR of 8.20% over the analysis period 2024-2032