Medicated Feed Additives Market Synopsis

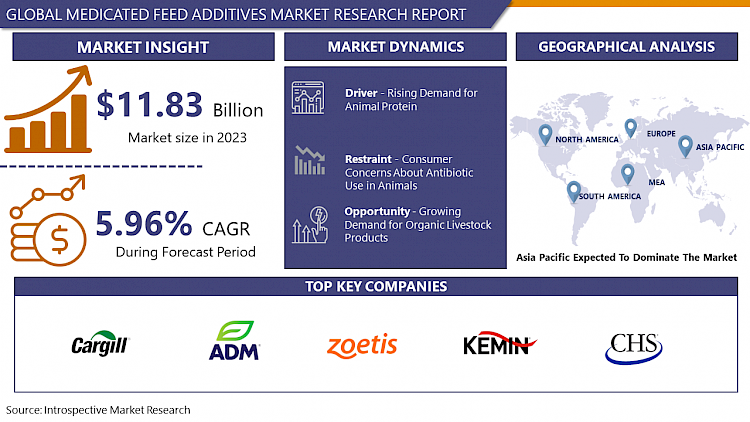

Global Medicated Feed Additives Market Size Was Valued at USD 11.83 Billion in 2023, and is Projected to Reach USD 19.92 Billion by 2032, Growing at a CAGR of 5.96 % From 2024-2032.

Medicated feed additives encompass substances incorporated into animal feed to administer targeted medications or supplements to livestock. Their vital function includes preserving animal health, averting diseases, and fostering growth. Administered via feed, these additives offer a convenient and accurate dosing method, thereby enhancing the general welfare and productivity of livestock.

- Medicated feed additives are extensively utilized in livestock farming to address diverse health issues and optimize growth and productivity. These additives administer specific medications or supplements through animal feed, targeting ailments like bacterial infections, parasitic infestations, and nutrient deficiencies. By directly incorporating medications into feed, medicated feed additives provide a convenient and efficient treatment method, ensuring consistent delivery of essential nutrients and medications to livestock.

- A significant advantage of medicated feed additives is their effectiveness in preventing and managing diseases among livestock populations. Through the inclusion of medications in feed formulations, farmers can proactively tackle health challenges and mitigate the spread of infections within their herds or flocks. Additionally, these additives contribute to enhanced growth rates and feed conversion efficiency, thereby improving overall productivity in livestock operations.

- The future demand for medicated feed additives is poised for growth as livestock producers seek efficient strategies to uphold animal health and maximize profitability. With ongoing advancements in veterinary medicine and a heightened emphasis on animal welfare, there is an increasing acknowledgment of the pivotal role played by medicated feed additives in promoting livestock health and well-being. Moreover, as the global population expands, there will be a heightened necessity for sustainable and effective livestock production methods, further propelling the demand for medicated feed additives as integral components of modern animal husbandry practices.

Medicated Feed Additives Market Trend Analysis

Rising Demand for Animal Protein

- The growing demand for animal protein emerges as a key factor driving the expansion of the medicated feed additives market. As global populations increase and dietary preferences shift towards protein-rich foods, there is a notable rise in the consumption of animal-derived products. This surge in demand necessitates the enhancement of livestock health and productivity to meet the escalating needs of the food industry.

- Medicated feed additives play a crucial role in fulfilling this demand by improving the health and performance of livestock. Through the delivery of essential medications and supplements via animal feed, these additives contribute to disease prevention, growth promotion, and overall well-being. Consequently, farmers and producers can effectively address the increasing demand for animal protein while upholding rigorous standards of animal health and welfare.

- Moreover, the utilization of medicated feed additives not only supports the heightened production of animal protein but also fosters sustainable and efficient practices in livestock farming. By proactively addressing health issues and reducing reliance on antibiotics, medicated feed additives help mitigate the risk of disease outbreaks and minimize the environmental impact of livestock production. As the demand for animal protein continues to grow, the medicated feed additives market is poised for sustained expansion, driven by the ongoing imperative to optimize livestock health and fulfill the requirements of a burgeoning global population.

Growing Demand for Organic Livestock Products

- The increasing desire for organic livestock products presents a notable opportunity for the expansion of the medicated feed additives market. As consumers prioritize organic and sustainably sourced foods, the demand for livestock products from animals raised without antibiotics or synthetic additives is on the rise. This preference for organic livestock products forms a distinct market segment, prompting the need for innovative solutions to ensure animal health and welfare while adhering to organic standards.

- Medicated feed additives provide a practical approach to address the unique challenges encountered by organic livestock producers. Although conventional antibiotics and growth promoters are restricted in organic farming, medicated feed additives can be employed to support animal health and productivity while complying with organic certification criteria. Through the delivery of essential medications and supplements via animal feed, these additives empower organic livestock producers to prevent diseases, foster growth, and enhance overall animal well-being.

- Moreover, the integration of medicated feed additives in organic livestock production aligns with the principles of sustainable agriculture. By reducing antibiotic usage and mitigating the risk of disease outbreaks, medicated feed additives promote environmentally friendly farming practices and bolster the sustainability of organic farming systems. With the increasing demand for organic livestock products fueled by consumer preferences for healthier and sustainable food choices, the medicated feed additives market is poised to seize this opportunity by providing customized solutions tailored to the specific requirements of organic livestock producers.

Medicated Feed Additives Market Segment Analysis:

Medicated Feed Additives Market Segmented on the basis of Type, Mixture Type, and Livestock.

By Type, Antibiotics segment is expected to dominate the market during the forecast period

- Antibiotics are positioned to lead the growth of the medicated feed additives market due to their extensive use in livestock farming. These substances are vital for preventing and treating bacterial infections, thereby fostering animal health and productivity. As the global demand for animal protein escalates, the utilization of antibiotics in medicated feed additives is anticipated to surge, fueled by the necessity to enhance livestock production and fulfill the increasing requirements of the food sector.

- Moreover, antibiotics offer various benefits in livestock farming, including enhanced growth rates, improved feed efficiency, and decreased mortality rates among animals. Through the integration of antibiotics into feed formulations, farmers can effectively manage bacterial infections and uphold the overall well-being of their livestock. Despite growing concerns regarding antibiotic resistance and regulatory constraints on their usage, antibiotics remain integral to medicated feed additives, serving as a critical tool for addressing health challenges in livestock populations. Consequently, antibiotics are expected to sustain their dominance in the medicated feed additives market, propelling ongoing growth and advancements in the livestock industry.

By Livestock, Poultry segment held the largest share of 44.12% in 2022

- The poultry segment stands out as the primary driver propelling the expansion of the medicated feed additives market. Holding the largest portion, poultry farming extensively relies on medicated feed additives to bolster the health and performance of poultry flocks. These additives are instrumental in preventing and managing common poultry diseases like bacterial infections and parasitic infestations, while also fostering growth and overall well-being.

- The intensive nature of poultry production and the susceptibility of poultry to various health issues contribute significantly to the dominance of the poultry segment. Medicated feed additives offer poultry farmers a convenient and efficient solution to address these challenges, ensuring the optimal health and productivity of their flocks. Furthermore, as the global demand for poultry products continues to rise, the utilization of medicated feed additives in the poultry segment is anticipated to grow, consolidating its position as a prominent market segment within the medicated feed additives industry.

Medicated Feed Additives Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is poised to lead the regional expansion of the medicated feed additives market. The region's burgeoning population and escalating demand for animal protein, particularly in emerging economies such as China and India, offer significant growth opportunities for the medicated feed additives industry. The intensive nature of livestock farming in the Asia Pacific, combined with frequent disease outbreaks, fuels the need for medicated feed additives to ensure optimal health and productivity of livestock.

- Furthermore, the increasing adoption of intensive farming methods and growing awareness among farmers regarding the advantages of medicated feed additives contribute to market growth in the region. Additionally, heightened investments in animal health and welfare initiatives by governments and regulatory bodies across the Asia Pacific are expected to promote the widespread adoption of medicated feed additives. Asia Pacific is expected to uphold its dominance in the medicated feed additives market, driving considerable growth and innovation in the livestock sector across the region.

Medicated Feed Additives Market Top Key Players:

- Phibro Animal Health Corporation (U.S.)

- Zoetis Inc. (U.S.)

- Cargill Inc. (U.S.)

- ADM (U.S.)

- CHS Inc. (U.S.)

- Purina Animal Nutrition (Land O' Lakes) (U.S.)

- Kemin Industries (U.S)

- Alltech Inc. (U.S.)

- HI-PRO Feeds (Canada)

- Adisseo France SAS (France)

- Zagro (Singapore)

- Biostadt India Limited (India)

- Provimi Animal Nutrition (India), and Other Major Players

Key Industry Developments in the Medicated Feed Additives Market:

- In October 2023, Elanco announced the expansion of its prebiotic feed additive portfolio, catering to the growing demand for gut health solutions in animal production.

- In October 2023: Nutreco Partnered with a technology startup to develop AI-powered tools for optimizing feed formulations and minimizing the use of medicated additives.

|

Global Medicated Feed Additives Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.83 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.96 % |

Market Size in 2032: |

USD 19.92 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Mixture Type |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MEDICATED FEED ADDITIVES MARKET BY TYPE (2017-2032)

- MEDICATED FEED ADDITIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ANTIOXIDANTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ANTIBIOTICS

- PROBIOTICS & PREBIOTICS

- ENZYMES

- AMINO ACIDS

- MEDICATED FEED ADDITIVES MARKET BY MIXTURE TYPE (2017-2032)

- MEDICATED FEED ADDITIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONCENTRATES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SUPPLEMENTS

- PREMIX FEEDS

- BASE MIXES

- MEDICATED FEED ADDITIVES MARKET BY LIVESTOCK (2017-2032)

- MEDICATED FEED ADDITIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RUMINANTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SWINE

- AQUACULTURE

- POULTRY

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Medicated Feed Additives Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- PHIBRO ANIMAL HEALTH CORPORATION (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ZOETIS INC. (U.S.)

- CARGILL INC. (U.S.)

- ADM (U.S.)

- CHS INC. (U.S.)

- PURINA ANIMAL NUTRITION (LAND O' LAKES) (U.S.)

- KEMIN INDUSTRIES (U.S)

- ALLTECH INC. (U.S.)

- HI-PRO FEEDS (CANADA)

- ADISSEO FRANCE SAS (FRANCE)

- ZAGRO (SINGAPORE)

- BIOSTADT INDIA LIMITED (INDIA)

- PROVIMI ANIMAL NUTRITION (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL MEDICATED FEED ADDITIVES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Mixture Type

- Historic And Forecasted Market Size By Livestock

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Medicated Feed Additives Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.83 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.96 % |

Market Size in 2032: |

USD 19.92 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Mixture Type |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MEDICATED FEED ADDITIVES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MEDICATED FEED ADDITIVES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MEDICATED FEED ADDITIVES MARKET COMPETITIVE RIVALRY

TABLE 005. MEDICATED FEED ADDITIVES MARKET THREAT OF NEW ENTRANTS

TABLE 006. MEDICATED FEED ADDITIVES MARKET THREAT OF SUBSTITUTES

TABLE 007. MEDICATED FEED ADDITIVES MARKET BY TYPE

TABLE 008. ANTIOXIDANTS MARKET OVERVIEW (2016-2028)

TABLE 009. ANTIBIOTICS MARKET OVERVIEW (2016-2028)

TABLE 010. PROBIOTICS & PREBIOTICS MARKET OVERVIEW (2016-2028)

TABLE 011. ENZYMES MARKET OVERVIEW (2016-2028)

TABLE 012. AMINO ACIDS MARKET OVERVIEW (2016-2028)

TABLE 013. MEDICATED FEED ADDITIVES MARKET BY APPLICATION

TABLE 014. RUMINANTS MARKET OVERVIEW (2016-2028)

TABLE 015. POULTRY MARKET OVERVIEW (2016-2028)

TABLE 016. PIG MARKET OVERVIEW (2016-2028)

TABLE 017. FARMED FISH MARKET OVERVIEW (2016-2028)

TABLE 018. OTHER MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA MEDICATED FEED ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA MEDICATED FEED ADDITIVES MARKET, BY APPLICATION (2016-2028)

TABLE 021. N MEDICATED FEED ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE MEDICATED FEED ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE MEDICATED FEED ADDITIVES MARKET, BY APPLICATION (2016-2028)

TABLE 024. MEDICATED FEED ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC MEDICATED FEED ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 026. ASIA PACIFIC MEDICATED FEED ADDITIVES MARKET, BY APPLICATION (2016-2028)

TABLE 027. MEDICATED FEED ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA MEDICATED FEED ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA MEDICATED FEED ADDITIVES MARKET, BY APPLICATION (2016-2028)

TABLE 030. MEDICATED FEED ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 031. SOUTH AMERICA MEDICATED FEED ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 032. SOUTH AMERICA MEDICATED FEED ADDITIVES MARKET, BY APPLICATION (2016-2028)

TABLE 033. MEDICATED FEED ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 034. ZOETIS: SNAPSHOT

TABLE 035. ZOETIS: BUSINESS PERFORMANCE

TABLE 036. ZOETIS: PRODUCT PORTFOLIO

TABLE 037. ZOETIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. CARGILL: SNAPSHOT

TABLE 038. CARGILL: BUSINESS PERFORMANCE

TABLE 039. CARGILL: PRODUCT PORTFOLIO

TABLE 040. CARGILL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. ARCHER DANIELS MIDLAND: SNAPSHOT

TABLE 041. ARCHER DANIELS MIDLAND: BUSINESS PERFORMANCE

TABLE 042. ARCHER DANIELS MIDLAND: PRODUCT PORTFOLIO

TABLE 043. ARCHER DANIELS MIDLAND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. PURINA ANIMAL NUTRITION: SNAPSHOT

TABLE 044. PURINA ANIMAL NUTRITION: BUSINESS PERFORMANCE

TABLE 045. PURINA ANIMAL NUTRITION: PRODUCT PORTFOLIO

TABLE 046. PURINA ANIMAL NUTRITION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. ADISSEO FRANCE: SNAPSHOT

TABLE 047. ADISSEO FRANCE: BUSINESS PERFORMANCE

TABLE 048. ADISSEO FRANCE: PRODUCT PORTFOLIO

TABLE 049. ADISSEO FRANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. ALLTECH: SNAPSHOT

TABLE 050. ALLTECH: BUSINESS PERFORMANCE

TABLE 051. ALLTECH: PRODUCT PORTFOLIO

TABLE 052. ALLTECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. BIOSTADT INDIA: SNAPSHOT

TABLE 053. BIOSTADT INDIA: BUSINESS PERFORMANCE

TABLE 054. BIOSTADT INDIA: PRODUCT PORTFOLIO

TABLE 055. BIOSTADT INDIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ZAGRO: SNAPSHOT

TABLE 056. ZAGRO: BUSINESS PERFORMANCE

TABLE 057. ZAGRO: PRODUCT PORTFOLIO

TABLE 058. ZAGRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. HIPRO ANIMAL NUTRTION: SNAPSHOT

TABLE 059. HIPRO ANIMAL NUTRTION: BUSINESS PERFORMANCE

TABLE 060. HIPRO ANIMAL NUTRTION: PRODUCT PORTFOLIO

TABLE 061. HIPRO ANIMAL NUTRTION: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MEDICATED FEED ADDITIVES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MEDICATED FEED ADDITIVES MARKET OVERVIEW BY TYPE

FIGURE 012. ANTIOXIDANTS MARKET OVERVIEW (2016-2028)

FIGURE 013. ANTIBIOTICS MARKET OVERVIEW (2016-2028)

FIGURE 014. PROBIOTICS & PREBIOTICS MARKET OVERVIEW (2016-2028)

FIGURE 015. ENZYMES MARKET OVERVIEW (2016-2028)

FIGURE 016. AMINO ACIDS MARKET OVERVIEW (2016-2028)

FIGURE 017. MEDICATED FEED ADDITIVES MARKET OVERVIEW BY APPLICATION

FIGURE 018. RUMINANTS MARKET OVERVIEW (2016-2028)

FIGURE 019. POULTRY MARKET OVERVIEW (2016-2028)

FIGURE 020. PIG MARKET OVERVIEW (2016-2028)

FIGURE 021. FARMED FISH MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA MEDICATED FEED ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE MEDICATED FEED ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC MEDICATED FEED ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA MEDICATED FEED ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA MEDICATED FEED ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Medicated Feed Additives Market research report is 2024-2032.

Phibro Animal Health Corporation (U.S.), Zoetis Inc. (U.S.), Cargill Inc. (U.S.), ADM (U.S.), CHS Inc. (U.S.), Purina Animal Nutrition (Land O' Lakes) (U.S.), Kemin Industries (U.S), Alltech Inc. (U.S.), HI-PRO Feeds (Canada), Adisseo France SAS (France), Zagro (Singapore), Biostadt India Limited (India), Provimi Animal Nutrition (India and Other Major Players.

The Medicated Feed Additives Market is segmented into Type, Mixture Type, Livestock, and region. By Type, the market is categorized into Antioxidants, Antibiotics, Probiotics & Prebiotics, Enzymes, and Amino acids. By Mixture Type, the market is categorized into Concentrates, Supplements, Premix Feeds, and Base Mixes. By Livestock, the market is categorized into Ruminants, Swine, Aquaculture, and Poultry. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Medicated feed additives encompass substances incorporated into animal feed to administer targeted medications or supplements to livestock. Their vital function includes preserving animal health, averting diseases, and fostering growth. Administered via feed, these additives offer a convenient and accurate dosing method, thereby enhancing the general welfare and productivity of livestock.

Global Medicated Feed Additives Market Size Was Valued at USD 11.83 Billion in 2023, and is Projected to Reach USD 19.92 Billion by 2032, Growing at a CAGR of 5.96 % From 2024-2032.