Agrochemicals Products Market Synopsis

Global Agrochemicals Products Market Size Was Valued at USD 206.39 Billion In 2021 And Is Projected to Reach USD 288.48 Billion By 2028, Growing at A CAGR of 4.6 % From 2022 To 2028.

Agrochemicals are any substance used in farming, such as synthetic fertilizers, insecticides, and herbicides. The majority are chemical mixtures made up of two or more chemicals; the active ingredients produce the desired effects, while the inert ingredients stabilize, protect, or facilitate the application of the active ingredients.

- Since the 1930s, agrochemicals have added to other improvements in technology like tractors, mechanical harvesters, and irrigation pumps to boost per-acre productivity in places like the Great Plains by 200–300%. The stability of agricultural systems that employ them as well as their long-term impacts on the environment are hotly contested topics.

- With the help of agrochemicals, farmers can grow more crops on an acre area for a longer length of time. They ensure a healthy yield by protecting crops against weeds, disease, and pests. It also benefits the environment as less land is needed to create abundant yields, which slows the rate of deforestation. In addition, the land's purity is maintained.

- Additionally, it will be profitable financially. Due to very excellent yields, the price of food and other items will decrease. Consumers can safely eat the crops because they won't have any bacterial, viral, or fungal infections. There will be a decrease in pollution percentage. Farmers may spend less time in agricultural areas while participating in other tasks as a result.

- Fertilizers enhance the quality of the crop by providing the crop and soil with essential nutrients, in contrast to pesticides, which protect crops by eliminating or controlling pests and weeds that could damage them. Given the current population situation, it is imperative to increase agricultural output on the presently accessible arable territory in order to feed the world's population. Because they enable producers to improve the quality and quantity of their crops, agrochemicals are essential to the agriculture industry.

Agrochemical Products Market Trend Analysis

An Increase In The Need For Crop Protection Chemicals To Boost Crop Output

- Farmers in the majority of nations, including India, China, Thailand, Vietnam, and South Korea, are now able to practise intensive crop management thanks to advancements in agricultural science. Pest control products are being used more frequently as a result of growing public knowledge about crop protection chemicals, which has also raised public awareness of the possibility of more lucrative opportunities with little risk. The number of patents and product registrations in the global agrochemicals market has increased, leading to greater use in agriculture, which pushes the market.

- Every year, plant pests and insects cause significant losses to farmers around the globe. According to estimates, insects destroy 15% of crops, disease pathogens, weeds, and 10% of products are damaged by pests during the postharvest time. By defending crops, boosting productivity, and keeping the quality of the produce, agrochemicals help to reduce this loss. Additionally, this reduces expenses like labour and fuel, which decreases the cost of agricultural products.

- Agrochemicals are used in a variety of other ways besides agriculture to avoid harmful effects on society. For instance, if weeds and trees are allowed to develop under power lines, it could cause power outages. The vegetation is removed with herbicides. To ensure public safety and ease, herbicides are also frequently used to control undesirable vegetation along national highways, roadsides, parks, wetlands, and public areas.

Precision Farming for The Management of Nutrients for Particular Crops

- With the aid of specialized application equipment, precision agriculture focuses on growing crops effectively and site-specifically in a way that can help them retain water and nutrients in the root zone. The process of precision agriculture can be broken down into three steps: referencing remote area information using specific sensors, analysis of data acquired through a suitable system of information processing, and adjustment of the amount applied based on the requirements of each location.

- By preventing nutrients from evaporating from the soil or building up in areas of the field where they shouldn't, precision farming can increase output and the efficiency with which nutrients are used. In advanced countries, precision farming has become more significant for effective fertigation use.

- For an accurate analysis of the nutrient needs of crops, the application rate, and the mixing ratio necessary within the fertigation system, the release patterns and coating technology of CRFs can be fed into the information system. A rising number of digital technologies are used in precision agriculture to improve crop yields and quality while increasing farming efficiency.

Segmentation Analysis Of the Agrochemical Product Market

Agrochemical Product Market segments cover the Type, Product Type, and Application. By Type, the Pesticides segment is Anticipated to Dominate the Market Over the Forecast period.

- Chemicals called insecticides are used to exterminate insects or stop them from acting in an undesirable or destructive way. Their structure and method of operation are used to categorise them.

- Insecticides are frequently employed in agricultural, public health, industrial, domestic, and commercial purposes. (e.g., control of roaches and termites). The most widely utilised pesticides are carbamates, pyrethroids, and organophosphates.

- Farmers can create safe, high-quality foods at reasonable prices thanks to pesticides. Additionally, they assist farmers in producing an abundance of year-round, nutrient-dense foods that are essential for human well-being. The necessary nutrients that come from fruits and vegetables are more widely available and less expensive. Because it is less expensive to produce food and animal feed, foods like grains, milk, and proteins all of which are essential for a child's development are more widely accessible.

Regional Analysis of the Agrochemical Product Market

Asia Pacific is Expected to Dominate the Market Over the Forecast Period.

- The majority of Asia-Pacific nations' fertiliser industries have shifted their focus away from fertiliser grade growth and towards technology advancement, management, and durability. Due to the precise and sophisticated farming systems and controlled-environment agriculture practised in Japan, the market is expected to expand at a higher rate than in other regions. Through partnerships or mergers & acquisitions, more international players in the industry are attempting to enter the Asia Pacific region. Due to rising demand from nations like China and India, the Asia-Pacific market is anticipated to expand at the fastest rate.

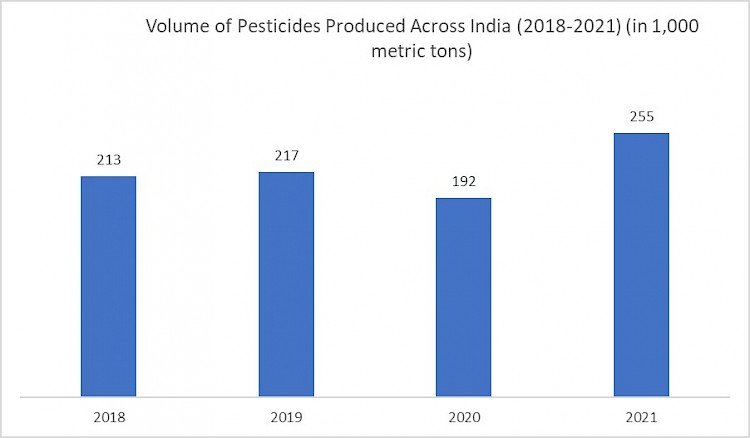

- Similar to this, a significant driver of the market's expansion is India's substantial production of cereal crops like rice and wheat. In India, pesticide usage is gradually increasing. A clear indication of the expansion of the agrochemical market in the nation and the area is the revenue of a few key pesticide and agrochemical companies as of June 2022. Majorly growth for Agrochemical is in India and that is mentioned in the below graph.

Covid-19 Impact Analysis on Agrochemical Product Market

- The demand for agrochemicals in 2020 has been impacted by the coronavirus's unfavourable effects, which are already clear on a worldwide scale. After the COVID-19 viral outbreak in December 2019, the World Health Organization declared a public health emergency. There have been a great number of deaths worldwide as a consequence of the disease's spread to over 100 countries. The global manufacturing, tourism, financial, and export-import industries have all suffered significant losses.

- The downward pressure on the world economy has once again increased, after initially showing indications of improvement. The virus pandemic has increased the already dangerous development of the global economy. The global economy is reportedly going through its most challenging period since the financial crisis, according to numerous international organisations. The availability of agri inputs, such as seeds (-9.2%), fertilisers (-11.2%), pesticides (-9.8%), fodder (-10.8%), etc., decreased by 9 to 11% as a result of limitations placed on the movement of people and materials and the closing of stores. In India overall, the supply of inputs was negatively impacted in 58% of the sample districts.

Top Key Players Covered in Agrochemical Product Market

- BASF SE

- Bayer AG

- Corteva Agriscience

- Fengro Industries Corporation

- FMC Corporation

- Heringer Fertilizers SA

- Israel Chemicals Ltd. (ICL)

- Jordan Abyad Fertilizers and Chemicals Company (Jafcco)

- K+S KALI GmbH

- Nutrien Ltd.

- OCI NV

- PJSC PhosAgro

- Saudi Arabian Fertilizer Company (SAFCO)

- Syngenta International AG

- The Mosaic Company

- WinHarvest Pty Ltd, and Other Major Players

Key Industry Developments in Agrochemical Product Market

In April 2023, BASF launched Serenade® ASO, a biofungicide based on the naturally occurring bacterium Pseudomonas fluorescensfor controlling diseases in fruits, vegetables, and ornamentals.

In May 2023, Bayer Introduced BioAct™, a new line of biocontrol products, including nematodes and insect predators, for integrated pest management (IPM) programs.

In July 2023, Corteva Agriscience announced the development of a new biopesticide based on the entomopathogenic fungus Metarhizium anisopliae, targeting corn rootworm and other soil-borne pests, with launch expected.

|

Global Agrochemical Product Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 206.39 Bn. |

|

Forecast Period 2022-28 CAGR: |

4.6 %% |

Market Size in 2028: |

USD 288.48 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Product Type

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Agrochemical Products Market by Type

5.1 Agrochemical Products Market Overview Snapshot and Growth Engine

5.2 Agrochemical Products Market Overview

5.3 Fungicides

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2030F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Fungicides: Geographic Segmentation

5.4 Herbicides

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2030F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Herbicides: Geographic Segmentation

5.5 Insecticides

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2030F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Insecticides: Geographic Segmentation

5.6 Other

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2030F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Other: Geographic Segmentation

Chapter 6: Agrochemical Products Market by Product Type

6.1 Agrochemical Products Market Overview Snapshot and Growth Engine

6.2 Agrochemical Products Market Overview

6.3 Fertilizer

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2030F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Fertilizer: Geographic Segmentation

6.4 Pesticides

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2030F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Pesticides: Geographic Segmentation

6.5 Adjuvants

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2030F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Adjuvants: Geographic Segmentation

6.6 Plant Growth Regulators

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2030F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Plant Growth Regulators: Geographic Segmentation

Chapter 7: Agrochemical Products Market by Application

7.1 Agrochemical Products Market Overview Snapshot and Growth Engine

7.2 Agrochemical Products Market Overview

7.3 Grains & Cereals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2030F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Grains & Cereals: Geographic Segmentation

7.4 Pulses & Oilseeds

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2030F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Pulses & Oilseeds: Geographic Segmentation

7.5 Fruits & Vegetables

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2030F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Fruits & Vegetables: Geographic Segmentation

7.6 Turf & Ornamental Grass

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2030F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Turf & Ornamental Grass: Geographic Segmentation

7.7 Other Non-Crop-Based

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2016-2030F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Other Non-Crop-Based: Geographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Agrochemical Products Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Agrochemical Products Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Agrochemical Products Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 BASF SE

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 BAYER AG

8.4 CORTEVA AGRISCIENCE

8.5 FENGRO INDUSTRIES CORPORATION

8.6 FMC CORPORATION

8.7 HERINGER FERTILIZERS SA

8.8 ISRAEL CHEMICALS LTD. (ICL)

8.9 JORDAN ABYAD FERTILIZERS AND CHEMICALS COMPANY (JAFCCO)

8.10 K+S KALI GMBH

8.11 NUTRIEN LTD

8.12 OCI NV

8.13 PJSC PHOSAGRO

8.14 SAUDI ARABIAN FERTILIZER COMPANY (SAFCO)

8.15 SYNGENTA INTERNATIONAL AG

8.16 THE MOSAIC COMPANY

8.17 WINHARVEST PTY LTD

8.18 OTHER MAJOR PLAYERS

Chapter 9: Global Agrochemical Products Market Analysis, Insights and Forecast, 2016-2030

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Fungicides

9.2.2 Herbicides

9.2.3 Insecticides

9.2.4 Other

9.3 Historic and Forecasted Market Size By Product Type

9.3.1 Fertilizer

9.3.2 Pesticides

9.3.3 Adjuvants

9.3.4 Plant Growth Regulators

9.4 Historic and Forecasted Market Size By Application

9.4.1 Grains & Cereals

9.4.2 Pulses & Oilseeds

9.4.3 Fruits & Vegetables

9.4.4 Turf & Ornamental Grass

9.4.5 Other Non-Crop-Based

Chapter 10: North America Agrochemical Products Market Analysis, Insights and Forecast, 2016-2030

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Fungicides

10.4.2 Herbicides

10.4.3 Insecticides

10.4.4 Other

10.5 Historic and Forecasted Market Size By Product Type

10.5.1 Fertilizer

10.5.2 Pesticides

10.5.3 Adjuvants

10.5.4 Plant Growth Regulators

10.6 Historic and Forecasted Market Size By Application

10.6.1 Grains & Cereals

10.6.2 Pulses & Oilseeds

10.6.3 Fruits & Vegetables

10.6.4 Turf & Ornamental Grass

10.6.5 Other Non-Crop-Based

10.7 Historic and Forecast Market Size by Country

10.7.1 US

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Eastern Europe Agrochemical Products Market Analysis, Insights and Forecast, 2016-2030

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Fungicides

11.4.2 Herbicides

11.4.3 Insecticides

11.4.4 Other

11.5 Historic and Forecasted Market Size By Product Type

11.5.1 Fertilizer

11.5.2 Pesticides

11.5.3 Adjuvants

11.5.4 Plant Growth Regulators

11.6 Historic and Forecasted Market Size By Application

11.6.1 Grains & Cereals

11.6.2 Pulses & Oilseeds

11.6.3 Fruits & Vegetables

11.6.4 Turf & Ornamental Grass

11.6.5 Other Non-Crop-Based

11.7 Historic and Forecast Market Size by Country

11.7.1 Bulgaria

11.7.2 The Czech Republic

11.7.3 Hungary

11.7.4 Poland

11.7.5 Romania

11.7.6 Rest of Eastern Europe

Chapter 12: Western Europe Agrochemical Products Market Analysis, Insights and Forecast, 2016-2030

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Fungicides

12.4.2 Herbicides

12.4.3 Insecticides

12.4.4 Other

12.5 Historic and Forecasted Market Size By Product Type

12.5.1 Fertilizer

12.5.2 Pesticides

12.5.3 Adjuvants

12.5.4 Plant Growth Regulators

12.6 Historic and Forecasted Market Size By Application

12.6.1 Grains & Cereals

12.6.2 Pulses & Oilseeds

12.6.3 Fruits & Vegetables

12.6.4 Turf & Ornamental Grass

12.6.5 Other Non-Crop-Based

12.7 Historic and Forecast Market Size by Country

12.7.1 Germany

12.7.2 UK

12.7.3 France

12.7.4 Netherlands

12.7.5 Italy

12.7.6 Russia

12.7.7 Spain

12.7.8 Rest of Western Europe

Chapter 13: Asia Pacific Agrochemical Products Market Analysis, Insights and Forecast, 2016-2030

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Fungicides

13.4.2 Herbicides

13.4.3 Insecticides

13.4.4 Other

13.5 Historic and Forecasted Market Size By Product Type

13.5.1 Fertilizer

13.5.2 Pesticides

13.5.3 Adjuvants

13.5.4 Plant Growth Regulators

13.6 Historic and Forecasted Market Size By Application

13.6.1 Grains & Cereals

13.6.2 Pulses & Oilseeds

13.6.3 Fruits & Vegetables

13.6.4 Turf & Ornamental Grass

13.6.5 Other Non-Crop-Based

13.7 Historic and Forecast Market Size by Country

13.7.1 China

13.7.2 India

13.7.3 Japan

13.7.4 South Korea

13.7.5 Malaysia

13.7.6 Thailand

13.7.7 Vietnam

13.7.8 The Philippines

13.7.9 Australia

13.7.10 New Zealand

13.7.11 Rest of APAC

Chapter 14: Middle East & Africa Agrochemical Products Market Analysis, Insights and Forecast, 2016-2030

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Fungicides

14.4.2 Herbicides

14.4.3 Insecticides

14.4.4 Other

14.5 Historic and Forecasted Market Size By Product Type

14.5.1 Fertilizer

14.5.2 Pesticides

14.5.3 Adjuvants

14.5.4 Plant Growth Regulators

14.6 Historic and Forecasted Market Size By Application

14.6.1 Grains & Cereals

14.6.2 Pulses & Oilseeds

14.6.3 Fruits & Vegetables

14.6.4 Turf & Ornamental Grass

14.6.5 Other Non-Crop-Based

14.7 Historic and Forecast Market Size by Country

14.7.1 Turkey

14.7.2 Bahrain

14.7.3 Kuwait

14.7.4 Saudi Arabia

14.7.5 Qatar

14.7.6 UAE

14.7.7 Israel

14.7.8 South Africa

Chapter 15: South America Agrochemical Products Market Analysis, Insights and Forecast, 2016-2030

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Fungicides

15.4.2 Herbicides

15.4.3 Insecticides

15.4.4 Other

15.5 Historic and Forecasted Market Size By Product Type

15.5.1 Fertilizer

15.5.2 Pesticides

15.5.3 Adjuvants

15.5.4 Plant Growth Regulators

15.6 Historic and Forecasted Market Size By Application

15.6.1 Grains & Cereals

15.6.2 Pulses & Oilseeds

15.6.3 Fruits & Vegetables

15.6.4 Turf & Ornamental Grass

15.6.5 Other Non-Crop-Based

15.7 Historic and Forecast Market Size by Country

15.7.1 Brazil

15.7.2 Argentina

15.7.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Agrochemical Product Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 206.39 Bn. |

|

Forecast Period 2022-28 CAGR: |

4.6 %% |

Market Size in 2028: |

USD 288.48 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AGROCHEMICAL PRODUCTS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AGROCHEMICAL PRODUCTS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AGROCHEMICAL PRODUCTS MARKET COMPETITIVE RIVALRY

TABLE 005. AGROCHEMICAL PRODUCTS MARKET THREAT OF NEW ENTRANTS

TABLE 006. AGROCHEMICAL PRODUCTS MARKET THREAT OF SUBSTITUTES

TABLE 007. AGROCHEMICAL PRODUCTS MARKET BY TYPE

TABLE 008. FUNGICIDES MARKET OVERVIEW (2016-2030)

TABLE 009. HERBICIDES MARKET OVERVIEW (2016-2030)

TABLE 010. INSECTICIDES MARKET OVERVIEW (2016-2030)

TABLE 011. OTHER MARKET OVERVIEW (2016-2030)

TABLE 012. AGROCHEMICAL PRODUCTS MARKET BY PRODUCT TYPE

TABLE 013. FERTILIZER MARKET OVERVIEW (2016-2030)

TABLE 014. PESTICIDES MARKET OVERVIEW (2016-2030)

TABLE 015. ADJUVANTS MARKET OVERVIEW (2016-2030)

TABLE 016. PLANT GROWTH REGULATORS MARKET OVERVIEW (2016-2030)

TABLE 017. AGROCHEMICAL PRODUCTS MARKET BY APPLICATION

TABLE 018. GRAINS & CEREALS MARKET OVERVIEW (2016-2030)

TABLE 019. PULSES & OILSEEDS MARKET OVERVIEW (2016-2030)

TABLE 020. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2030)

TABLE 021. TURF & ORNAMENTAL GRASS MARKET OVERVIEW (2016-2030)

TABLE 022. OTHER NON-CROP-BASED MARKET OVERVIEW (2016-2030)

TABLE 023. NORTH AMERICA AGROCHEMICAL PRODUCTS MARKET, BY TYPE (2016-2030)

TABLE 024. NORTH AMERICA AGROCHEMICAL PRODUCTS MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 025. NORTH AMERICA AGROCHEMICAL PRODUCTS MARKET, BY APPLICATION (2016-2030)

TABLE 026. N AGROCHEMICAL PRODUCTS MARKET, BY COUNTRY (2016-2030)

TABLE 027. EASTERN EUROPE AGROCHEMICAL PRODUCTS MARKET, BY TYPE (2016-2030)

TABLE 028. EASTERN EUROPE AGROCHEMICAL PRODUCTS MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 029. EASTERN EUROPE AGROCHEMICAL PRODUCTS MARKET, BY APPLICATION (2016-2030)

TABLE 030. AGROCHEMICAL PRODUCTS MARKET, BY COUNTRY (2016-2030)

TABLE 031. WESTERN EUROPE AGROCHEMICAL PRODUCTS MARKET, BY TYPE (2016-2030)

TABLE 032. WESTERN EUROPE AGROCHEMICAL PRODUCTS MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 033. WESTERN EUROPE AGROCHEMICAL PRODUCTS MARKET, BY APPLICATION (2016-2030)

TABLE 034. AGROCHEMICAL PRODUCTS MARKET, BY COUNTRY (2016-2030)

TABLE 035. ASIA PACIFIC AGROCHEMICAL PRODUCTS MARKET, BY TYPE (2016-2030)

TABLE 036. ASIA PACIFIC AGROCHEMICAL PRODUCTS MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 037. ASIA PACIFIC AGROCHEMICAL PRODUCTS MARKET, BY APPLICATION (2016-2030)

TABLE 038. AGROCHEMICAL PRODUCTS MARKET, BY COUNTRY (2016-2030)

TABLE 039. MIDDLE EAST & AFRICA AGROCHEMICAL PRODUCTS MARKET, BY TYPE (2016-2030)

TABLE 040. MIDDLE EAST & AFRICA AGROCHEMICAL PRODUCTS MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 041. MIDDLE EAST & AFRICA AGROCHEMICAL PRODUCTS MARKET, BY APPLICATION (2016-2030)

TABLE 042. AGROCHEMICAL PRODUCTS MARKET, BY COUNTRY (2016-2030)

TABLE 043. SOUTH AMERICA AGROCHEMICAL PRODUCTS MARKET, BY TYPE (2016-2030)

TABLE 044. SOUTH AMERICA AGROCHEMICAL PRODUCTS MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 045. SOUTH AMERICA AGROCHEMICAL PRODUCTS MARKET, BY APPLICATION (2016-2030)

TABLE 046. AGROCHEMICAL PRODUCTS MARKET, BY COUNTRY (2016-2030)

TABLE 047. BASF SE: SNAPSHOT

TABLE 048. BASF SE: BUSINESS PERFORMANCE

TABLE 049. BASF SE: PRODUCT PORTFOLIO

TABLE 050. BASF SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. BAYER AG: SNAPSHOT

TABLE 051. BAYER AG: BUSINESS PERFORMANCE

TABLE 052. BAYER AG: PRODUCT PORTFOLIO

TABLE 053. BAYER AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. CORTEVA AGRISCIENCE: SNAPSHOT

TABLE 054. CORTEVA AGRISCIENCE: BUSINESS PERFORMANCE

TABLE 055. CORTEVA AGRISCIENCE: PRODUCT PORTFOLIO

TABLE 056. CORTEVA AGRISCIENCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. FENGRO INDUSTRIES CORPORATION: SNAPSHOT

TABLE 057. FENGRO INDUSTRIES CORPORATION: BUSINESS PERFORMANCE

TABLE 058. FENGRO INDUSTRIES CORPORATION: PRODUCT PORTFOLIO

TABLE 059. FENGRO INDUSTRIES CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. FMC CORPORATION: SNAPSHOT

TABLE 060. FMC CORPORATION: BUSINESS PERFORMANCE

TABLE 061. FMC CORPORATION: PRODUCT PORTFOLIO

TABLE 062. FMC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. HERINGER FERTILIZERS SA: SNAPSHOT

TABLE 063. HERINGER FERTILIZERS SA: BUSINESS PERFORMANCE

TABLE 064. HERINGER FERTILIZERS SA: PRODUCT PORTFOLIO

TABLE 065. HERINGER FERTILIZERS SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. ISRAEL CHEMICALS LTD. (ICL): SNAPSHOT

TABLE 066. ISRAEL CHEMICALS LTD. (ICL): BUSINESS PERFORMANCE

TABLE 067. ISRAEL CHEMICALS LTD. (ICL): PRODUCT PORTFOLIO

TABLE 068. ISRAEL CHEMICALS LTD. (ICL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. JORDAN ABYAD FERTILIZERS AND CHEMICALS COMPANY (JAFCCO): SNAPSHOT

TABLE 069. JORDAN ABYAD FERTILIZERS AND CHEMICALS COMPANY (JAFCCO): BUSINESS PERFORMANCE

TABLE 070. JORDAN ABYAD FERTILIZERS AND CHEMICALS COMPANY (JAFCCO): PRODUCT PORTFOLIO

TABLE 071. JORDAN ABYAD FERTILIZERS AND CHEMICALS COMPANY (JAFCCO): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. K+S KALI GMBH: SNAPSHOT

TABLE 072. K+S KALI GMBH: BUSINESS PERFORMANCE

TABLE 073. K+S KALI GMBH: PRODUCT PORTFOLIO

TABLE 074. K+S KALI GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. NUTRIEN LTD: SNAPSHOT

TABLE 075. NUTRIEN LTD: BUSINESS PERFORMANCE

TABLE 076. NUTRIEN LTD: PRODUCT PORTFOLIO

TABLE 077. NUTRIEN LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. OCI NV: SNAPSHOT

TABLE 078. OCI NV: BUSINESS PERFORMANCE

TABLE 079. OCI NV: PRODUCT PORTFOLIO

TABLE 080. OCI NV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. PJSC PHOSAGRO: SNAPSHOT

TABLE 081. PJSC PHOSAGRO: BUSINESS PERFORMANCE

TABLE 082. PJSC PHOSAGRO: PRODUCT PORTFOLIO

TABLE 083. PJSC PHOSAGRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. SAUDI ARABIAN FERTILIZER COMPANY (SAFCO): SNAPSHOT

TABLE 084. SAUDI ARABIAN FERTILIZER COMPANY (SAFCO): BUSINESS PERFORMANCE

TABLE 085. SAUDI ARABIAN FERTILIZER COMPANY (SAFCO): PRODUCT PORTFOLIO

TABLE 086. SAUDI ARABIAN FERTILIZER COMPANY (SAFCO): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. SYNGENTA INTERNATIONAL AG: SNAPSHOT

TABLE 087. SYNGENTA INTERNATIONAL AG: BUSINESS PERFORMANCE

TABLE 088. SYNGENTA INTERNATIONAL AG: PRODUCT PORTFOLIO

TABLE 089. SYNGENTA INTERNATIONAL AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. THE MOSAIC COMPANY: SNAPSHOT

TABLE 090. THE MOSAIC COMPANY: BUSINESS PERFORMANCE

TABLE 091. THE MOSAIC COMPANY: PRODUCT PORTFOLIO

TABLE 092. THE MOSAIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. WINHARVEST PTY LTD: SNAPSHOT

TABLE 093. WINHARVEST PTY LTD: BUSINESS PERFORMANCE

TABLE 094. WINHARVEST PTY LTD: PRODUCT PORTFOLIO

TABLE 095. WINHARVEST PTY LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 096. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 097. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 098. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AGROCHEMICAL PRODUCTS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AGROCHEMICAL PRODUCTS MARKET OVERVIEW BY TYPE

FIGURE 012. FUNGICIDES MARKET OVERVIEW (2016-2030)

FIGURE 013. HERBICIDES MARKET OVERVIEW (2016-2030)

FIGURE 014. INSECTICIDES MARKET OVERVIEW (2016-2030)

FIGURE 015. OTHER MARKET OVERVIEW (2016-2030)

FIGURE 016. AGROCHEMICAL PRODUCTS MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 017. FERTILIZER MARKET OVERVIEW (2016-2030)

FIGURE 018. PESTICIDES MARKET OVERVIEW (2016-2030)

FIGURE 019. ADJUVANTS MARKET OVERVIEW (2016-2030)

FIGURE 020. PLANT GROWTH REGULATORS MARKET OVERVIEW (2016-2030)

FIGURE 021. AGROCHEMICAL PRODUCTS MARKET OVERVIEW BY APPLICATION

FIGURE 022. GRAINS & CEREALS MARKET OVERVIEW (2016-2030)

FIGURE 023. PULSES & OILSEEDS MARKET OVERVIEW (2016-2030)

FIGURE 024. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2030)

FIGURE 025. TURF & ORNAMENTAL GRASS MARKET OVERVIEW (2016-2030)

FIGURE 026. OTHER NON-CROP-BASED MARKET OVERVIEW (2016-2030)

FIGURE 027. NORTH AMERICA AGROCHEMICAL PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 028. EASTERN EUROPE AGROCHEMICAL PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 029. WESTERN EUROPE AGROCHEMICAL PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 030. ASIA PACIFIC AGROCHEMICAL PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 031. MIDDLE EAST & AFRICA AGROCHEMICAL PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 032. SOUTH AMERICA AGROCHEMICAL PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Agrochemical Product Market research report is 2022-2028.

BASF SE, Bayer AG, Corteva Agriscience, Fengro Industries Corporation, FMC Corporation, Heringer Fertilizers SA, Israel Chemicals Ltd. (ICL), Jordan Abyad Fertilizers and Chemicals Company (Jafcco), K+S KALI GmbH, Nutrien Ltd, OCI NV, PJSC PhosAgro, Saudi Arabian Fertilizer Company (SAFCO), Syngenta International AG, The Mosaic Company, WinHarvest Pty Ltd, and Other key players.

The Agrochemical Product Market is segmented into Type, Product Type, Application, and region. By Type, the market is categorized into Fungicides, Herbicides, Insecticides, and Others. By Product Type, the market is categorized into Fertilizers, Pesticides, Adjuvants, and Plant Growth Regulators. By Application, the market is categorized into Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Turf and Ornamental Grass, and Other Non-Crop-Based. By region, it is analyzed across North America (US, Canada, Mexico), Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Agrochemicals are any substance used in farming, such as synthetic fertilizers, insecticides, and herbicides. The majority are chemical mixtures made up of two or more chemicals; the active ingredients produce the desired effects, while the inert ingredients stabilize, protect, or facilitate the application of the active ingredients.

Global Agrochemicals Products Market Size Was Valued at USD 206.39 Billion In 2021 And Is Projected to Reach USD 288.48 Billion By 2028, Growing at A CAGR of 4.6 % From 2022 To 2028