Animal Feed Additives Market Synopsis

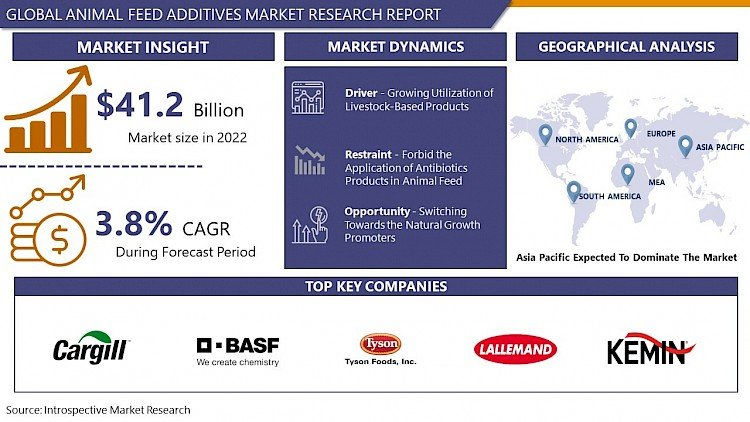

Animal Feed Additives Market Size Was Valued at USD 41.2 Billion in 2022, and is Projected to Reach USD 55.52 Billion by 2030, Growing at a CAGR of 3.8% From 2023-2030.

Animal Feed additives are substances or combinations of ingredients mixed into the basic feed mix or parts thereof to cater to the specific need. Animal Feed additives form an essential part of animal nutrition, which enhances the feed quality, yield & quality of food from animal origin, and animal health. Generally, application in microquantities requires careful handling and mixing. It is used to enhance the rate of gain, feed efficiency, prevent and control disease, prevention against untoward environmental influences. Furthermore, feed additives have main two types such as nutrient feed additives which include amino acids, minerals, and vitamins, and non-nutrient feed additives which include antibiotics, hormones, immunomodulators, enzymes, and probiotics.

- The increasing global demand for animal products, such as meat, dairy, and eggs, is fueled by a growing population and rising disposable incomes. As more people shift towards protein-rich diets, the livestock and poultry sectors are under pressure to enhance production efficiency and meet escalating demands. Animal feed additives play a pivotal role in this scenario by improving feed quality, boosting animal health, and optimizing overall performance.

- Moreover, heightened awareness about the importance of animal nutrition and health has prompted livestock producers to adopt advanced feeding practices. Feed additives are essential components that support the well-being of animals, promoting growth, disease prevention, and efficient utilization of nutrients. Antibiotic alternatives, probiotics, enzymes, and other specialty additives are gaining prominence as they address concerns related to animal welfare, antibiotic resistance, and sustainability.

- The increasing prevalence of livestock diseases and the need for preventive measures are driving the demand for feed additives with immune-boosting and disease-mitigating properties. As the industry continues to innovate and respond to changing consumer preferences and regulatory frameworks, the Animal Feed Additives market is poised for sustained growth, offering solutions that address both the productivity and health aspects of animal agriculture.

Animal Feed Additives Market Trend Analysis

Growing Utilization of Livestock-Based Products

- The increasing global population has led to a rising demand for animal-derived products such as meat, milk, and eggs. As a result, livestock producers are under pressure to enhance the efficiency of animal production to meet this growing demand. Animal feed additives play a crucial role in optimizing the nutritional value of feed, promoting animal health, and improving the overall performance of livestock, thereby supporting increased production.

- There is a growing awareness and emphasis on animal welfare and health. Livestock farmers are increasingly recognizing the importance of maintaining the well-being of their animals to ensure productivity and quality of products. Animal feed additives, including vitamins, minerals, and probiotics, contribute to the overall health of livestock, reducing the risk of diseases and enhancing their growth rates.

- Moreover, advancements in animal nutrition science have led to the development of innovative feed additives that target specific aspects of animal performance, such as growth promotion, feed efficiency, and disease prevention. This has spurred the adoption of specialized additives, driving the overall growth of the market.

Switching Towards the Natural Growth Promoters

- Switching towards natural growth promoters presents a significant opportunity in the animal feed additives market as it aligns with the growing demand for sustainable and organic solutions in livestock production. Natural growth promoters refer to feed additives derived from organic sources such as plant extracts, essential oils, prebiotics, and probiotics, as opposed to synthetic or chemical alternatives.

- The increasing consumer awareness and preference for meat and dairy products produced with minimal chemical inputs. Consumers are becoming more conscious of the environmental and health impacts associated with conventional farming practices, leading to a rising demand for products that adhere to natural and eco-friendly standards. As a result, livestock producers are seeking alternatives that can enhance animal growth and health while meeting these evolving consumer expectations.

- The opportunity for natural growth promoters in the animal feed additives market extends beyond consumer preferences. Regulatory bodies are increasingly tightening restrictions on the use of certain synthetic additives, creating a favorable environment for the adoption of natural alternatives. Livestock producers, therefore, see the shift towards natural growth promoters not only as a means of meeting consumer demands but also as a proactive response to evolving regulatory landscapes.

Animal Feed Additives Market Segment Analysis:

Animal Feed Additives Market Segmented on the basis of type, form, source, and livestock.

By Type, Amino Acids segment is expected to dominate the market during the forecast period

- Based on the Product Type, the amino acid segment accounted for the largest market during the forecast period. Increasing consumer awareness about the benefits related to the application of feed additives to overcome the prevalence of diseases has helped the demand. Amino acids are recognized as protein building blocks for livestock health. Amino acids are responsible for improving gut health, food intake, reproduction, and metabolic process, and others. Various forms of amino acids such as threonine, tryptophan, lysine, and methionine. Lysine is especially used in the pork industry, while methionine is mostly used in the poultry industry.

By Form, dry segment held the largest share of 64.7% in 2022

- Based on Form, the dry form segment is projected to dominate the market during the forecast period. They are easy to add with feed and are simple to store and handle. Its accessibility in pellet and mash forms further allows consumers to have options in terms of adding techniques, which should aid the growth of this segment.

Animal Feed Additives Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region accounted for the maximum share in the animal feed additives market over the forecasting period. The region has a large livestock population and growth rate. Furthermore, the region has witnessed growth in the number of feed mills and feed production, particularly in nations such as India and Japan. This growth in the number of feed mills in the region reflects the growth in feed production. The largest feed manufacturer, China, contributes remarkedly to the region's leading position, with Thailand and Indonesia being the developing feed-producing countries, while India and Japan demonstrate stable growth in feed production.

- North America accounted major share in terms of volume in 2019 after the Asia Pacific. Strict regulations related to meat quality are anticipated to remain the key factor turning the demand. Apart from this, the high availability of raw materials such as dextrose, maize, and corn are also expected to boost the demand during the forecast period.

Animal Feed Additives Market Top Key Players:

- BASF SE (Germany)

- Tyson Foods Inc. (USA)

- Lallemand Inc. (Canada)

- Kemin Industries (USA)

- E. I. du Pont de Nemours and Company (DuPont) (USA)

- Ajinomoto Co. Inc. (Japan)

- Koninklijke DSM N.V. (Netherlands)

- Akzo Nobel N.V. (Netherlands)

- Alltech Inc. (USA)

- Biomin GmbH (Austria)

- Cargill Inc. (USA)

- Chr. Hansen Holding A/S (Denmark)

- CP Group (Thailand)

- Evonik Industries AG (Germany)

- Norel S.A. (Spain)

- Novozymes A/S (Denmark)

- Nutreco (Netherlands)

- Phibro Animal Health Corporation (USA)

- Novus International Inc. (USA)

- Solvay Group (Belgium)

- Archer Daniels Midland Company (ADM) (USA)

- Invivo Group (France)

Key Industry Developments in the Animal Feed Additives Market:

- In March 2023, Dutch animal nutrition giant Nutreco acquired Cargill's premix and nutrition business in the Europe, Middle East, and Africa (EMEA) region. This strategic move strengthens Nutreco's presence in the EMEA market and expands its product portfolio.

- In May 2023, German chemical giant BASF acquired Veridia Nutrition, a Canadian company specializing in plant-based feed additives. This acquisition bolsters BASF's animal nutrition business and aligns with the growing demand for sustainable feed ingredients.

|

Global Animal Feed Additives Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 41.2 Bn. |

|

Forecast Period 2023-30 CAGR: |

3.8 % |

Market Size in 2030: |

USD 55.52 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Source |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ANIMAL FEED ADDITIVES MARKET BY TYPE (2016-2030)

- ANIMAL FEED ADDITIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AMINO ACIDS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ANTIBIOTICS

- FEED ENZYMES

- FEED ACIDIFIERS

- VITAMINS

- ANIMAL FEED ADDITIVES MARKET BY FORM (2016-2030)

- ANIMAL FEED ADDITIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LIQUID

- ANIMAL FEED ADDITIVES MARKET BY SOURCE (2016-2030)

- ANIMAL FEED ADDITIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SYNTHETIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NATURAL

- ANIMAL FEED ADDITIVES MARKET BY LIVESTOCK (2016-2030)

- ANIMAL FEED ADDITIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RUMINANT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SWINE

- POULTRY

- AQUACULTURE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- ANIMAL FEED ADDITIVES Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BASF SE (Germany)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- TYSON FOODS INC. (USA)

- LALLEMAND INC. (CANADA)

- KEMIN INDUSTRIES (USA)

- E. I. DU PONT DE NEMOURS AND COMPANY (DUPONT) (USA)

- AJINOMOTO CO. INC. (JAPAN)

- KONINKLIJKE DSM N.V. (NETHERLANDS)

- AKZO NOBEL N.V. (NETHERLANDS)

- ALLTECH INC. (USA)

- BIOMIN GMBH (AUSTRIA)

- CARGILL INC. (USA)

- CHR. HANSEN HOLDING A/S (DENMARK)

- CP GROUP (THAILAND)

- EVONIK INDUSTRIES AG (GERMANY)

- NOREL S.A. (SPAIN)

- NOVOZYMES A/S (DENMARK)

- NUTRECO (NETHERLANDS)

- PHIBRO ANIMAL HEALTH CORPORATION (USA)

- NOVUS INTERNATIONAL INC. (USA)

- SOLVAY GROUP (BELGIUM)

- ARCHER DANIELS MIDLAND COMPANY (ADM) (USA)

- INVIVO GROUP (FRANCE)

- COMPETITIVE LANDSCAPE

- GLOBAL ANIMAL FEED ADDITIVES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By Livestock

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Animal Feed Additives Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 41.2 Bn. |

|

Forecast Period 2023-30 CAGR: |

3.8 % |

Market Size in 2030: |

USD 55.52 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Source |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ANIMAL FEED ADDITIVES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ANIMAL FEED ADDITIVES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ANIMAL FEED ADDITIVES MARKET COMPETITIVE RIVALRY

TABLE 005. ANIMAL FEED ADDITIVES MARKET THREAT OF NEW ENTRANTS

TABLE 006. ANIMAL FEED ADDITIVES MARKET THREAT OF SUBSTITUTES

TABLE 007. ANIMAL FEED ADDITIVES MARKET BY TYPE

TABLE 008. AMINO ACIDS MARKET OVERVIEW (2016-2028)

TABLE 009. ANTIBIOTICS MARKET OVERVIEW (2016-2028)

TABLE 010. FEED ENZYMES MARKET OVERVIEW (2016-2028)

TABLE 011. FEED ACIDIFIERS MARKET OVERVIEW (2016-2028)

TABLE 012. VITAMINS MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. ANIMAL FEED ADDITIVES MARKET BY FORM

TABLE 015. DRY MARKET OVERVIEW (2016-2028)

TABLE 016. LIQUID MARKET OVERVIEW (2016-2028)

TABLE 017. ANIMAL FEED ADDITIVES MARKET BY SOURCE

TABLE 018. SYNTHETIC MARKET OVERVIEW (2016-2028)

TABLE 019. NATURAL MARKET OVERVIEW (2016-2028)

TABLE 020. ANIMAL FEED ADDITIVES MARKET BY LIVESTOCK

TABLE 021. RUMINANT MARKET OVERVIEW (2016-2028)

TABLE 022. SWINE MARKET OVERVIEW (2016-2028)

TABLE 023. POULTRY MARKET OVERVIEW (2016-2028)

TABLE 024. AQUACULTURE MARKET OVERVIEW (2016-2028)

TABLE 025. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 026. NORTH AMERICA ANIMAL FEED ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 027. NORTH AMERICA ANIMAL FEED ADDITIVES MARKET, BY FORM (2016-2028)

TABLE 028. NORTH AMERICA ANIMAL FEED ADDITIVES MARKET, BY SOURCE (2016-2028)

TABLE 029. NORTH AMERICA ANIMAL FEED ADDITIVES MARKET, BY LIVESTOCK (2016-2028)

TABLE 030. N ANIMAL FEED ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 031. EUROPE ANIMAL FEED ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 032. EUROPE ANIMAL FEED ADDITIVES MARKET, BY FORM (2016-2028)

TABLE 033. EUROPE ANIMAL FEED ADDITIVES MARKET, BY SOURCE (2016-2028)

TABLE 034. EUROPE ANIMAL FEED ADDITIVES MARKET, BY LIVESTOCK (2016-2028)

TABLE 035. ANIMAL FEED ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 036. ASIA PACIFIC ANIMAL FEED ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 037. ASIA PACIFIC ANIMAL FEED ADDITIVES MARKET, BY FORM (2016-2028)

TABLE 038. ASIA PACIFIC ANIMAL FEED ADDITIVES MARKET, BY SOURCE (2016-2028)

TABLE 039. ASIA PACIFIC ANIMAL FEED ADDITIVES MARKET, BY LIVESTOCK (2016-2028)

TABLE 040. ANIMAL FEED ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA ANIMAL FEED ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA ANIMAL FEED ADDITIVES MARKET, BY FORM (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA ANIMAL FEED ADDITIVES MARKET, BY SOURCE (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA ANIMAL FEED ADDITIVES MARKET, BY LIVESTOCK (2016-2028)

TABLE 045. ANIMAL FEED ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 046. SOUTH AMERICA ANIMAL FEED ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 047. SOUTH AMERICA ANIMAL FEED ADDITIVES MARKET, BY FORM (2016-2028)

TABLE 048. SOUTH AMERICA ANIMAL FEED ADDITIVES MARKET, BY SOURCE (2016-2028)

TABLE 049. SOUTH AMERICA ANIMAL FEED ADDITIVES MARKET, BY LIVESTOCK (2016-2028)

TABLE 050. ANIMAL FEED ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 051. BASF SE: SNAPSHOT

TABLE 052. BASF SE: BUSINESS PERFORMANCE

TABLE 053. BASF SE: PRODUCT PORTFOLIO

TABLE 054. BASF SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. TYSON FOODS INC.: SNAPSHOT

TABLE 055. TYSON FOODS INC.: BUSINESS PERFORMANCE

TABLE 056. TYSON FOODS INC.: PRODUCT PORTFOLIO

TABLE 057. TYSON FOODS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. LALLEMAND INC.: SNAPSHOT

TABLE 058. LALLEMAND INC.: BUSINESS PERFORMANCE

TABLE 059. LALLEMAND INC.: PRODUCT PORTFOLIO

TABLE 060. LALLEMAND INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. KEMIN INDUSTRIES: SNAPSHOT

TABLE 061. KEMIN INDUSTRIES: BUSINESS PERFORMANCE

TABLE 062. KEMIN INDUSTRIES: PRODUCT PORTFOLIO

TABLE 063. KEMIN INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. E. I. DU PONT DE NEMOURS AND COMPANY: SNAPSHOT

TABLE 064. E. I. DU PONT DE NEMOURS AND COMPANY: BUSINESS PERFORMANCE

TABLE 065. E. I. DU PONT DE NEMOURS AND COMPANY: PRODUCT PORTFOLIO

TABLE 066. E. I. DU PONT DE NEMOURS AND COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. AJINOMOTO CO.INC.: SNAPSHOT

TABLE 067. AJINOMOTO CO.INC.: BUSINESS PERFORMANCE

TABLE 068. AJINOMOTO CO.INC.: PRODUCT PORTFOLIO

TABLE 069. AJINOMOTO CO.INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. KONINKLIJKE DSM N.V.: SNAPSHOT

TABLE 070. KONINKLIJKE DSM N.V.: BUSINESS PERFORMANCE

TABLE 071. KONINKLIJKE DSM N.V.: PRODUCT PORTFOLIO

TABLE 072. KONINKLIJKE DSM N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. AKZO NOBEL N.V.: SNAPSHOT

TABLE 073. AKZO NOBEL N.V.: BUSINESS PERFORMANCE

TABLE 074. AKZO NOBEL N.V.: PRODUCT PORTFOLIO

TABLE 075. AKZO NOBEL N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. ALLTECH INC.: SNAPSHOT

TABLE 076. ALLTECH INC.: BUSINESS PERFORMANCE

TABLE 077. ALLTECH INC.: PRODUCT PORTFOLIO

TABLE 078. ALLTECH INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. BIOMIN GMBH: SNAPSHOT

TABLE 079. BIOMIN GMBH: BUSINESS PERFORMANCE

TABLE 080. BIOMIN GMBH: PRODUCT PORTFOLIO

TABLE 081. BIOMIN GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. CARGILL INC.: SNAPSHOT

TABLE 082. CARGILL INC.: BUSINESS PERFORMANCE

TABLE 083. CARGILL INC.: PRODUCT PORTFOLIO

TABLE 084. CARGILL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. CHR. HANSEN HOLDING A/S: SNAPSHOT

TABLE 085. CHR. HANSEN HOLDING A/S: BUSINESS PERFORMANCE

TABLE 086. CHR. HANSEN HOLDING A/S: PRODUCT PORTFOLIO

TABLE 087. CHR. HANSEN HOLDING A/S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. CP GROUP: SNAPSHOT

TABLE 088. CP GROUP: BUSINESS PERFORMANCE

TABLE 089. CP GROUP: PRODUCT PORTFOLIO

TABLE 090. CP GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. EVONIK INDUSTRIES AG: SNAPSHOT

TABLE 091. EVONIK INDUSTRIES AG: BUSINESS PERFORMANCE

TABLE 092. EVONIK INDUSTRIES AG: PRODUCT PORTFOLIO

TABLE 093. EVONIK INDUSTRIES AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. NOREL S.A.: SNAPSHOT

TABLE 094. NOREL S.A.: BUSINESS PERFORMANCE

TABLE 095. NOREL S.A.: PRODUCT PORTFOLIO

TABLE 096. NOREL S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. NOVOZYMES A/S: SNAPSHOT

TABLE 097. NOVOZYMES A/S: BUSINESS PERFORMANCE

TABLE 098. NOVOZYMES A/S: PRODUCT PORTFOLIO

TABLE 099. NOVOZYMES A/S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. NUTRECO: SNAPSHOT

TABLE 100. NUTRECO: BUSINESS PERFORMANCE

TABLE 101. NUTRECO: PRODUCT PORTFOLIO

TABLE 102. NUTRECO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. PHIBRO ANIMAL HEALTH CORPORATION: SNAPSHOT

TABLE 103. PHIBRO ANIMAL HEALTH CORPORATION: BUSINESS PERFORMANCE

TABLE 104. PHIBRO ANIMAL HEALTH CORPORATION: PRODUCT PORTFOLIO

TABLE 105. PHIBRO ANIMAL HEALTH CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. NOVUS INTERNATIONAL INC.: SNAPSHOT

TABLE 106. NOVUS INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 107. NOVUS INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 108. NOVUS INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. SOLVAY GROUP: SNAPSHOT

TABLE 109. SOLVAY GROUP: BUSINESS PERFORMANCE

TABLE 110. SOLVAY GROUP: PRODUCT PORTFOLIO

TABLE 111. SOLVAY GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 111. ARCHER DANIELS MIDLAND COMPANY: SNAPSHOT

TABLE 112. ARCHER DANIELS MIDLAND COMPANY: BUSINESS PERFORMANCE

TABLE 113. ARCHER DANIELS MIDLAND COMPANY: PRODUCT PORTFOLIO

TABLE 114. ARCHER DANIELS MIDLAND COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 114. INVIVO GROUP: SNAPSHOT

TABLE 115. INVIVO GROUP: BUSINESS PERFORMANCE

TABLE 116. INVIVO GROUP: PRODUCT PORTFOLIO

TABLE 117. INVIVO GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 117. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 118. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 119. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 120. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ANIMAL FEED ADDITIVES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ANIMAL FEED ADDITIVES MARKET OVERVIEW BY TYPE

FIGURE 012. AMINO ACIDS MARKET OVERVIEW (2016-2028)

FIGURE 013. ANTIBIOTICS MARKET OVERVIEW (2016-2028)

FIGURE 014. FEED ENZYMES MARKET OVERVIEW (2016-2028)

FIGURE 015. FEED ACIDIFIERS MARKET OVERVIEW (2016-2028)

FIGURE 016. VITAMINS MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. ANIMAL FEED ADDITIVES MARKET OVERVIEW BY FORM

FIGURE 019. DRY MARKET OVERVIEW (2016-2028)

FIGURE 020. LIQUID MARKET OVERVIEW (2016-2028)

FIGURE 021. ANIMAL FEED ADDITIVES MARKET OVERVIEW BY SOURCE

FIGURE 022. SYNTHETIC MARKET OVERVIEW (2016-2028)

FIGURE 023. NATURAL MARKET OVERVIEW (2016-2028)

FIGURE 024. ANIMAL FEED ADDITIVES MARKET OVERVIEW BY LIVESTOCK

FIGURE 025. RUMINANT MARKET OVERVIEW (2016-2028)

FIGURE 026. SWINE MARKET OVERVIEW (2016-2028)

FIGURE 027. POULTRY MARKET OVERVIEW (2016-2028)

FIGURE 028. AQUACULTURE MARKET OVERVIEW (2016-2028)

FIGURE 029. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 030. NORTH AMERICA ANIMAL FEED ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. EUROPE ANIMAL FEED ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. ASIA PACIFIC ANIMAL FEED ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. MIDDLE EAST & AFRICA ANIMAL FEED ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. SOUTH AMERICA ANIMAL FEED ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Animal Feed Additives Market research report is 2023-2030.

BASF SE (Germany), Tyson Foods Inc. (USA), Lallemand Inc. (Canada), Kemin Industries (USA), E. I. du Pont de Nemours and Company (DuPont) (USA), Ajinomoto Co. Inc. (Japan), Koninklijke DSM N.V. (Netherlands), Akzo Nobel N.V. (Netherlands), Alltech Inc. (USA), Biomin GmbH (Austria), Cargill Inc. (USA), Chr. Hansen Holding A/S (Denmark), CP Group (Thailand), Evonik Industries AG (Germany), Norel S.A. (Spain), Novozymes A/S (Denmark), Nutreco (Netherlands), Phibro Animal Health Corporation (USA), Novus International Inc. (USA), Solvay Group (Belgium), Archer Daniels Midland Company (ADM) (USA), Invivo Group (France), and Other Major Players.

Animal Feed Additives Market is segmented into Type, Form, Source, Livestock, and region. By Type, the market is categorized into Amino Acids, Antibiotics, Feed Enzymes, Feed Acidifiers, Vitamins, Others. By Form, the market is categorized into Dry, Liquid. By Source the market is categorized into Synthetic, Natural. By Livestock, the market is categorized into Ruminant, Swine, Poultry, Aquaculture, and others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Animal Feed additives are substances or combinations of ingredients mixed into the basic feed mix or parts thereof to cater to the specific need. Animal Feed additives form an essential part of animal nutrition, which enhances the feed quality, yield & quality of food from animal origin, and animal health. Generally, application in microquantities requires careful handling and mixing. It is used to enhance the rate of gain, feed efficiency, prevent and control disease, prevention against untoward environmental influences. Furthermore, feed additives have main two types such as nutrient feed additives which include amino acids, minerals, and vitamins, and non-nutrient feed additives which include antibiotics, hormones, immunomodulators, enzymes, and probiotics.

Animal Feed Additives Market Size Was Valued at USD 41.2 Billion in 2022, and is Projected to Reach USD 55.52 Billion by 2030, Growing at a CAGR of 3.8% From 2023-2030.