Global Food Additives Market Overview

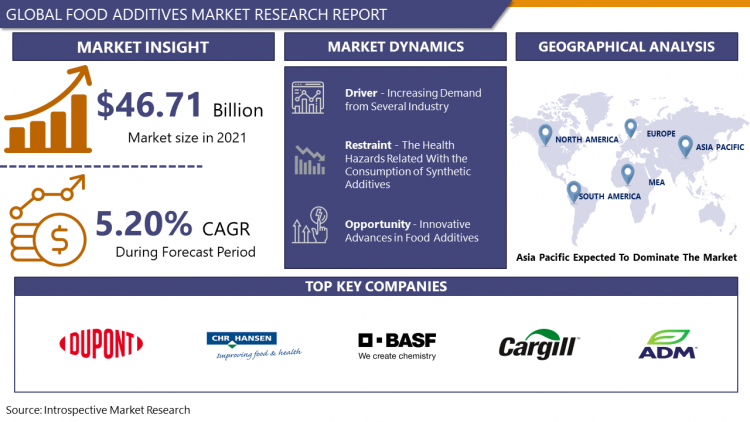

The Global Food Additives Market size is expected to grow from USD 49.14 billion in 2022 to USD 73.71 billion by 2030, at a CAGR of 5.2% during the forecast period (2023-2030).

Food additive refers to any of various natural or synthetic substances added to foods to produce specific desirable effects. Additives such as colorants, flavors, sweeteners, preservatives and others to add in food products or beverages to increase their shelf life, taste, smell, and texture. Moreover, food additives can be produced from plants, animals, minerals, or they can be synthetic and easily available at cheap cost, which gives manufacturers a cost advantage. Furthermore, natural additives require fewer processing than synthetic sources and provide nutritional benefits which leads the market growth during forecast period. For instance, about 15% of bakeries and 23% of dairy and candy are using food additives in Asia-Pacific region. However, food additives need to be checked for potential harmful effects on human health before they can be used and the Joint FAO/WHO Expert Committee on Food Additives (JECFA), is the international body accountable for evaluating the safety of food additives.

Market Dynamics And Factors

Drivers:

Rising the various range of food additives in a different application such as bakery, dairy products, meat and seafood, and others, which are being demanded by the consumers, is boosting the demand for different types of additives. In addition, there has been an increase in the number of propels demanding the processed and canned foods along with ready to eat and ready to cook varieties, which is being caused as a result of majority of the population getting busier in their work lives and have limited peace of time which leads to a spur in the market growth in projected period.

The growing consumers demand for high-value nutritional and exotic tasting products is affecting manufacturers to use ingredients that enrich the consumer experience is driving the demand for acidulated foods additives essential in the global food additive market. Rising urbanization and disposable incomes and leading a healthy lifestyle among populations are fueling the demand for the food additives market. The tendency of the individuals to spend on premium products and nutritional product due to their health benefits in order to stay fit and healthy is being facilitated and contributing to the market growth further.

Restraints:

The health hazards related with the consumption of synthetic additives, rising consumer demand for no additive food products or products with natural additives, scanty availability & high cost of naturally sourced additives, and the rising consumer shift to organic foods have resulted in hampering market growth during forecast period.

Opportunities:

Innovative advances in food additives and continuous R&D efforts are anticipated to open up growth opportunities for leading manufactures operating in the global market in upcoming years.

Market Segmentation

Regional Analysis:

In Asia Pacific region dominate the food additive market owing to high population, availability of natural food additives, growing demand for food preservatives, rising awareness of food safety and increasing consumption for food safety which leads to market growth over forecast period.

In North America, consumer preferences shifted toward healthy food ingredients in their food products. The frequency of obesity and diabetes in the region encourage the consumers to focus on an improved lifestyle. In addition, growing demand from various end-user industries, such as processed food, nutraceutical, and consumer good in the US country, is the major factor that is expected stimulate the market growth.

In European countries the high demand of functional food products, owing to their fortified, enhanced food qualities, is ultimately leading to the high demand of ingredients by in the market. Moreover, an increasing demand for retail foods attributed by the growing retail chains in the region has also fueled to the market growth over forecast period.

In Latin America, increasing health awareness regarding organic food and ingredients, rising disposal income are key factor that helps to boost market growth over forecast period. In Middle East and Africa, growing supply chain complexities in the food and beverage sector leads the market growth and expected to continue in upcoming years, but lack of raw materials and innovation in food and beverage industry in region hamper the market growth.

Players Covered in Food Additives Market are:

- DuPont

- Archer Danial Midland (ADM) Company

- CHR Hansen Holding A/S

- BASF SE

- Cargill Incorporated

- Kerry Group Plc.

- Ashland Inc.

- Tate and Lyle Inc.

- Corbion NV

- Royal DSM NV

- Red Arrow International Inc.

- McCormick and Company inc.

- Associated British Food Plc.

- International Flavors and Fragrance Inc. and other major players.

Key Industry Developments

- In February 2019, Frutarom Natural Solutions Ltd is the subdivision of International Flavors and Fragrance Inc, has received organic certification for their natural annatto color by the US Department of Agriculture and The European Organic Certifiers Council.

- In September 2020, CHR Hansen Holding A/S announced that they sell its subdivision of Natural Color Business to the EQT IX.

|

Global Food Additives Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2016 to 2021 |

Market Size in 2022: |

USD 49.14 Bn. |

|

Forecast Period 2022-30 CAGR: |

5.2% |

Market Size in 2030: |

USD 73.71 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Source |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

3.3 By Source

3.4 By Distribution Channels

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Food Additives Market by Type

5.1 Food Additives Market Overview Snapshot and Growth Engine

5.2 Food Additives Market Overview

5.3 Acidulants

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Acidulants: Grographic Segmentation

5.4 Colors

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Colors: Grographic Segmentation

5.5 Emulsifiers

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Emulsifiers: Grographic Segmentation

5.6 Flavors

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Flavors: Grographic Segmentation

5.7 Sweeteners

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Sweeteners: Grographic Segmentation

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size (2016-2028F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Grographic Segmentation

Chapter 6: Food Additives Market by Application

6.1 Food Additives Market Overview Snapshot and Growth Engine

6.2 Food Additives Market Overview

6.3 Food & Beverages

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Food & Beverages: Grographic Segmentation

6.4 Diary & Frozen Products

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Diary & Frozen Products: Grographic Segmentation

6.5 Bakery & Confectionary

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Bakery & Confectionary: Grographic Segmentation

6.6 Spices & Condiments

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Spices & Condiments: Grographic Segmentation

6.7 Sauces & Dressings

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Sauces & Dressings: Grographic Segmentation

6.8 Convenience Foods

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size (2016-2028F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Convenience Foods: Grographic Segmentation

6.9 Others

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size (2016-2028F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Others: Grographic Segmentation

Chapter 7: Food Additives Market by Source

7.1 Food Additives Market Overview Snapshot and Growth Engine

7.2 Food Additives Market Overview

7.3 Natural

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Natural: Grographic Segmentation

7.4 Synthetic

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Synthetic: Grographic Segmentation

Chapter 8: Food Additives Market by Distribution Channels

8.1 Food Additives Market Overview Snapshot and Growth Engine

8.2 Food Additives Market Overview

8.3 Specialty Store

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Specialty Store: Grographic Segmentation

8.4 Supermarket/Hypermarket

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Supermarket/Hypermarket: Grographic Segmentation

8.5 Online

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Online: Grographic Segmentation

8.6 Others

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2028F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Others: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Food Additives Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Food Additives Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Food Additives Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 DUPONT

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 ARCHER DANIAL MIDLAND (ADM) COMPANY

9.4 CHR HANSEN HOLDING A/S

9.5 BASF SE

9.6 CARGILL INCORPORATED

9.7 KERRY GROUP PLC.

9.8 ASHLAND INC.

9.9 TATE AND LYLE INC.

9.10 CORBION NV

9.11 ROYAL DSM NV

9.12 RED ARROW INTERNATIONAL INC.

9.13 MCCORMICK AND COMPANY INC.

9.14 ASSOCIATED BRITISH FOOD PLC.

9.15 INTERNATIONAL FLAVORS AND FRAGRANCE INC.

9.16 OTHER MAJOR PLAYERS

Chapter 10: Global Food Additives Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Type

10.2.1 Acidulants

10.2.2 Colors

10.2.3 Emulsifiers

10.2.4 Flavors

10.2.5 Sweeteners

10.2.6 Others

10.3 Historic and Forecasted Market Size By Application

10.3.1 Food & Beverages

10.3.2 Diary & Frozen Products

10.3.3 Bakery & Confectionary

10.3.4 Spices & Condiments

10.3.5 Sauces & Dressings

10.3.6 Convenience Foods

10.3.7 Others

10.4 Historic and Forecasted Market Size By Source

10.4.1 Natural

10.4.2 Synthetic

10.5 Historic and Forecasted Market Size By Distribution Channels

10.5.1 Specialty Store

10.5.2 Supermarket/Hypermarket

10.5.3 Online

10.5.4 Others

Chapter 11: North America Food Additives Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Acidulants

11.4.2 Colors

11.4.3 Emulsifiers

11.4.4 Flavors

11.4.5 Sweeteners

11.4.6 Others

11.5 Historic and Forecasted Market Size By Application

11.5.1 Food & Beverages

11.5.2 Diary & Frozen Products

11.5.3 Bakery & Confectionary

11.5.4 Spices & Condiments

11.5.5 Sauces & Dressings

11.5.6 Convenience Foods

11.5.7 Others

11.6 Historic and Forecasted Market Size By Source

11.6.1 Natural

11.6.2 Synthetic

11.7 Historic and Forecasted Market Size By Distribution Channels

11.7.1 Specialty Store

11.7.2 Supermarket/Hypermarket

11.7.3 Online

11.7.4 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Food Additives Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Acidulants

12.4.2 Colors

12.4.3 Emulsifiers

12.4.4 Flavors

12.4.5 Sweeteners

12.4.6 Others

12.5 Historic and Forecasted Market Size By Application

12.5.1 Food & Beverages

12.5.2 Diary & Frozen Products

12.5.3 Bakery & Confectionary

12.5.4 Spices & Condiments

12.5.5 Sauces & Dressings

12.5.6 Convenience Foods

12.5.7 Others

12.6 Historic and Forecasted Market Size By Source

12.6.1 Natural

12.6.2 Synthetic

12.7 Historic and Forecasted Market Size By Distribution Channels

12.7.1 Specialty Store

12.7.2 Supermarket/Hypermarket

12.7.3 Online

12.7.4 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Food Additives Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Acidulants

13.4.2 Colors

13.4.3 Emulsifiers

13.4.4 Flavors

13.4.5 Sweeteners

13.4.6 Others

13.5 Historic and Forecasted Market Size By Application

13.5.1 Food & Beverages

13.5.2 Diary & Frozen Products

13.5.3 Bakery & Confectionary

13.5.4 Spices & Condiments

13.5.5 Sauces & Dressings

13.5.6 Convenience Foods

13.5.7 Others

13.6 Historic and Forecasted Market Size By Source

13.6.1 Natural

13.6.2 Synthetic

13.7 Historic and Forecasted Market Size By Distribution Channels

13.7.1 Specialty Store

13.7.2 Supermarket/Hypermarket

13.7.3 Online

13.7.4 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Food Additives Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Acidulants

14.4.2 Colors

14.4.3 Emulsifiers

14.4.4 Flavors

14.4.5 Sweeteners

14.4.6 Others

14.5 Historic and Forecasted Market Size By Application

14.5.1 Food & Beverages

14.5.2 Diary & Frozen Products

14.5.3 Bakery & Confectionary

14.5.4 Spices & Condiments

14.5.5 Sauces & Dressings

14.5.6 Convenience Foods

14.5.7 Others

14.6 Historic and Forecasted Market Size By Source

14.6.1 Natural

14.6.2 Synthetic

14.7 Historic and Forecasted Market Size By Distribution Channels

14.7.1 Specialty Store

14.7.2 Supermarket/Hypermarket

14.7.3 Online

14.7.4 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Food Additives Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Acidulants

15.4.2 Colors

15.4.3 Emulsifiers

15.4.4 Flavors

15.4.5 Sweeteners

15.4.6 Others

15.5 Historic and Forecasted Market Size By Application

15.5.1 Food & Beverages

15.5.2 Diary & Frozen Products

15.5.3 Bakery & Confectionary

15.5.4 Spices & Condiments

15.5.5 Sauces & Dressings

15.5.6 Convenience Foods

15.5.7 Others

15.6 Historic and Forecasted Market Size By Source

15.6.1 Natural

15.6.2 Synthetic

15.7 Historic and Forecasted Market Size By Distribution Channels

15.7.1 Specialty Store

15.7.2 Supermarket/Hypermarket

15.7.3 Online

15.7.4 Others

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Food Additives Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2016 to 2021 |

Market Size in 2022: |

USD 49.14 Bn. |

|

Forecast Period 2022-30 CAGR: |

5.2% |

Market Size in 2030: |

USD 73.71 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Source |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FOOD ADDITIVES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FOOD ADDITIVES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FOOD ADDITIVES MARKET COMPETITIVE RIVALRY

TABLE 005. FOOD ADDITIVES MARKET THREAT OF NEW ENTRANTS

TABLE 006. FOOD ADDITIVES MARKET THREAT OF SUBSTITUTES

TABLE 007. FOOD ADDITIVES MARKET BY TYPE

TABLE 008. ACIDULANTS MARKET OVERVIEW (2016-2028)

TABLE 009. COLORS MARKET OVERVIEW (2016-2028)

TABLE 010. EMULSIFIERS MARKET OVERVIEW (2016-2028)

TABLE 011. FLAVORS MARKET OVERVIEW (2016-2028)

TABLE 012. SWEETENERS MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. FOOD ADDITIVES MARKET BY APPLICATION

TABLE 015. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 016. DIARY & FROZEN PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 017. BAKERY & CONFECTIONARY MARKET OVERVIEW (2016-2028)

TABLE 018. SPICES & CONDIMENTS MARKET OVERVIEW (2016-2028)

TABLE 019. SAUCES & DRESSINGS MARKET OVERVIEW (2016-2028)

TABLE 020. CONVENIENCE FOODS MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. FOOD ADDITIVES MARKET BY SOURCE

TABLE 023. NATURAL MARKET OVERVIEW (2016-2028)

TABLE 024. SYNTHETIC MARKET OVERVIEW (2016-2028)

TABLE 025. FOOD ADDITIVES MARKET BY DISTRIBUTION CHANNELS

TABLE 026. SPECIALTY STORE MARKET OVERVIEW (2016-2028)

TABLE 027. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2028)

TABLE 028. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 029. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 030. NORTH AMERICA FOOD ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 031. NORTH AMERICA FOOD ADDITIVES MARKET, BY APPLICATION (2016-2028)

TABLE 032. NORTH AMERICA FOOD ADDITIVES MARKET, BY SOURCE (2016-2028)

TABLE 033. NORTH AMERICA FOOD ADDITIVES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 034. N FOOD ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 035. EUROPE FOOD ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 036. EUROPE FOOD ADDITIVES MARKET, BY APPLICATION (2016-2028)

TABLE 037. EUROPE FOOD ADDITIVES MARKET, BY SOURCE (2016-2028)

TABLE 038. EUROPE FOOD ADDITIVES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 039. FOOD ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 040. ASIA PACIFIC FOOD ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 041. ASIA PACIFIC FOOD ADDITIVES MARKET, BY APPLICATION (2016-2028)

TABLE 042. ASIA PACIFIC FOOD ADDITIVES MARKET, BY SOURCE (2016-2028)

TABLE 043. ASIA PACIFIC FOOD ADDITIVES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 044. FOOD ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA FOOD ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA FOOD ADDITIVES MARKET, BY APPLICATION (2016-2028)

TABLE 047. MIDDLE EAST & AFRICA FOOD ADDITIVES MARKET, BY SOURCE (2016-2028)

TABLE 048. MIDDLE EAST & AFRICA FOOD ADDITIVES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 049. FOOD ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 050. SOUTH AMERICA FOOD ADDITIVES MARKET, BY TYPE (2016-2028)

TABLE 051. SOUTH AMERICA FOOD ADDITIVES MARKET, BY APPLICATION (2016-2028)

TABLE 052. SOUTH AMERICA FOOD ADDITIVES MARKET, BY SOURCE (2016-2028)

TABLE 053. SOUTH AMERICA FOOD ADDITIVES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 054. FOOD ADDITIVES MARKET, BY COUNTRY (2016-2028)

TABLE 055. DUPONT: SNAPSHOT

TABLE 056. DUPONT: BUSINESS PERFORMANCE

TABLE 057. DUPONT: PRODUCT PORTFOLIO

TABLE 058. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ARCHER DANIAL MIDLAND (ADM) COMPANY: SNAPSHOT

TABLE 059. ARCHER DANIAL MIDLAND (ADM) COMPANY: BUSINESS PERFORMANCE

TABLE 060. ARCHER DANIAL MIDLAND (ADM) COMPANY: PRODUCT PORTFOLIO

TABLE 061. ARCHER DANIAL MIDLAND (ADM) COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. CHR HANSEN HOLDING A/S: SNAPSHOT

TABLE 062. CHR HANSEN HOLDING A/S: BUSINESS PERFORMANCE

TABLE 063. CHR HANSEN HOLDING A/S: PRODUCT PORTFOLIO

TABLE 064. CHR HANSEN HOLDING A/S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. BASF SE: SNAPSHOT

TABLE 065. BASF SE: BUSINESS PERFORMANCE

TABLE 066. BASF SE: PRODUCT PORTFOLIO

TABLE 067. BASF SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. CARGILL INCORPORATED: SNAPSHOT

TABLE 068. CARGILL INCORPORATED: BUSINESS PERFORMANCE

TABLE 069. CARGILL INCORPORATED: PRODUCT PORTFOLIO

TABLE 070. CARGILL INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. KERRY GROUP PLC.: SNAPSHOT

TABLE 071. KERRY GROUP PLC.: BUSINESS PERFORMANCE

TABLE 072. KERRY GROUP PLC.: PRODUCT PORTFOLIO

TABLE 073. KERRY GROUP PLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. ASHLAND INC.: SNAPSHOT

TABLE 074. ASHLAND INC.: BUSINESS PERFORMANCE

TABLE 075. ASHLAND INC.: PRODUCT PORTFOLIO

TABLE 076. ASHLAND INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. TATE AND LYLE INC.: SNAPSHOT

TABLE 077. TATE AND LYLE INC.: BUSINESS PERFORMANCE

TABLE 078. TATE AND LYLE INC.: PRODUCT PORTFOLIO

TABLE 079. TATE AND LYLE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. CORBION NV: SNAPSHOT

TABLE 080. CORBION NV: BUSINESS PERFORMANCE

TABLE 081. CORBION NV: PRODUCT PORTFOLIO

TABLE 082. CORBION NV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. ROYAL DSM NV: SNAPSHOT

TABLE 083. ROYAL DSM NV: BUSINESS PERFORMANCE

TABLE 084. ROYAL DSM NV: PRODUCT PORTFOLIO

TABLE 085. ROYAL DSM NV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. RED ARROW INTERNATIONAL INC.: SNAPSHOT

TABLE 086. RED ARROW INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 087. RED ARROW INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 088. RED ARROW INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. MCCORMICK AND COMPANY INC.: SNAPSHOT

TABLE 089. MCCORMICK AND COMPANY INC.: BUSINESS PERFORMANCE

TABLE 090. MCCORMICK AND COMPANY INC.: PRODUCT PORTFOLIO

TABLE 091. MCCORMICK AND COMPANY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. ASSOCIATED BRITISH FOOD PLC.: SNAPSHOT

TABLE 092. ASSOCIATED BRITISH FOOD PLC.: BUSINESS PERFORMANCE

TABLE 093. ASSOCIATED BRITISH FOOD PLC.: PRODUCT PORTFOLIO

TABLE 094. ASSOCIATED BRITISH FOOD PLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. INTERNATIONAL FLAVORS AND FRAGRANCE INC.: SNAPSHOT

TABLE 095. INTERNATIONAL FLAVORS AND FRAGRANCE INC.: BUSINESS PERFORMANCE

TABLE 096. INTERNATIONAL FLAVORS AND FRAGRANCE INC.: PRODUCT PORTFOLIO

TABLE 097. INTERNATIONAL FLAVORS AND FRAGRANCE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 098. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 099. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 100. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FOOD ADDITIVES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FOOD ADDITIVES MARKET OVERVIEW BY TYPE

FIGURE 012. ACIDULANTS MARKET OVERVIEW (2016-2028)

FIGURE 013. COLORS MARKET OVERVIEW (2016-2028)

FIGURE 014. EMULSIFIERS MARKET OVERVIEW (2016-2028)

FIGURE 015. FLAVORS MARKET OVERVIEW (2016-2028)

FIGURE 016. SWEETENERS MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. FOOD ADDITIVES MARKET OVERVIEW BY APPLICATION

FIGURE 019. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 020. DIARY & FROZEN PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 021. BAKERY & CONFECTIONARY MARKET OVERVIEW (2016-2028)

FIGURE 022. SPICES & CONDIMENTS MARKET OVERVIEW (2016-2028)

FIGURE 023. SAUCES & DRESSINGS MARKET OVERVIEW (2016-2028)

FIGURE 024. CONVENIENCE FOODS MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. FOOD ADDITIVES MARKET OVERVIEW BY SOURCE

FIGURE 027. NATURAL MARKET OVERVIEW (2016-2028)

FIGURE 028. SYNTHETIC MARKET OVERVIEW (2016-2028)

FIGURE 029. FOOD ADDITIVES MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 030. SPECIALTY STORE MARKET OVERVIEW (2016-2028)

FIGURE 031. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2028)

FIGURE 032. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 033. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 034. NORTH AMERICA FOOD ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. EUROPE FOOD ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. ASIA PACIFIC FOOD ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 037. MIDDLE EAST & AFRICA FOOD ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 038. SOUTH AMERICA FOOD ADDITIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Food Additives Market research report is 2023-2030.

DuPont, Archer Danial Midland (ADM) Company, CHR Hansen Holding A/S, BASF SE, Cargill Incorporated, Kerry Group Plc., Ashland Inc., Tate and Lyle Inc., Corbion NV, Royal DSM NV, Red Arrow International Inc., McCormick and Company inc., Associated British Food Plc., International Flavors and Fragrance Inc, and Other Major Players.

Food Additives Market is segmented into Type, Application, Source, Distribution Channels and region. By Type, the market is categorized into Acidulants, Colors, Emulsifiers, Flavors, Sweeteners, Others. By Application, the market is categorized into Food & Beverages, Diary & Frozen Products, Bakery & Confectionary, Spices & Condiments, Sauces & Dressings, Convenience Foods, Others. By Source the market is categorized into Natural, Synthetic. By Distribution Channel, the market is categorized into Specialty Store, Supermarket/Hypermarket, Online, Others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Food additive refers to any of various natural or synthetic substances added to foods to produce specific desirable effects. Additives such as colorants, flavors, sweeteners, preservatives and others to add in food products or beverages to increase their shelf life, taste, smell, and texture.

The Global Food Additives Market size is expected to grow from USD 49.14 billion in 2022 to USD 73.71 billion by 2030, at a CAGR of 5.2% during the forecast period (2023-2030).