Physical Security Information Management Market Synopsis:

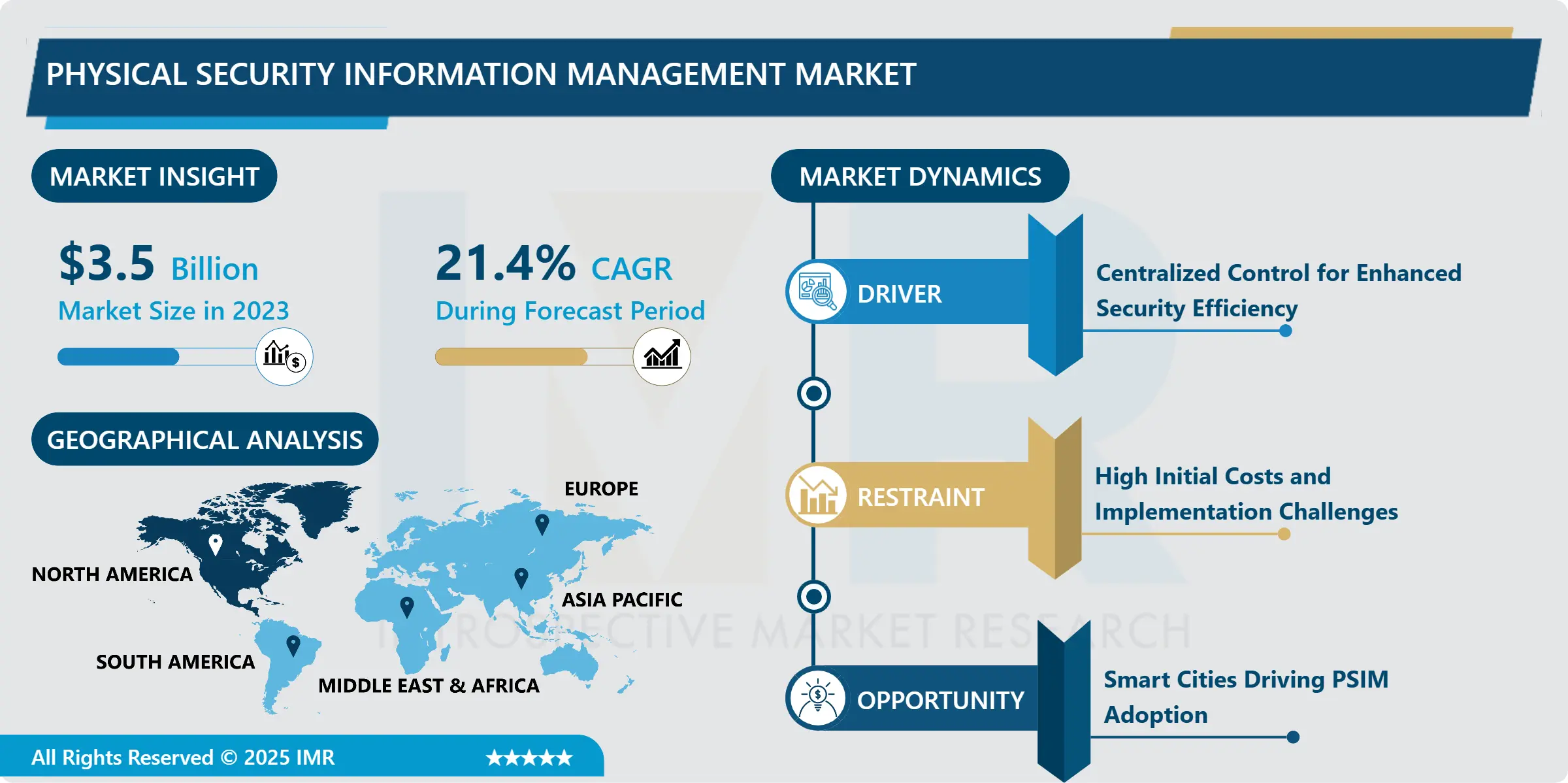

Physical Security Information Management Market Size Was Valued at USD 3.50 Billion in 2023, and is Projected to Reach USD 20.04 Billion by 2032, Growing at a CAGR of 21.40 % From 2024-2032.

Physical Security Information Management commonly known as PSIM is a software solution that allows for the control and monitoring of disparate security systems and security related devices. In other words, security information is gathered from several dissimilar security systems such as surveillance cameras, alarms, access control systems, and sensors and delivered in a coordinated and integrated structure to permit security personnel to monitor, direct, and master security events as they occur in real life.

The main cause for market growth is therefore the rising demand for PSIM that aims to organizes security systems in one central point. Organizations have begun implementing PSIM solutions to ease the execution of their security systems and procedures because it is complicated to manage many systems at the same time. The latter centralization enables better synchronization and quicker reaction in case of possible security risks, determining the best general security performance.

The fourth key force is increasing rate and increasing complexity of security threats in the context of business activity. While strategic risks are likely to increase in sophistications and diversities, the need to apply better methods and modes in security management continues to be felt. The discussed PSIM platforms extend threat founded visibility and prevent response by real time monitoring, IoT incorporation, and data analysing to guard the commercial sturdy safety.

Physical Security Information Management Market Trend Analysis:

Moving towards cloud-based solutions

-

The major trends that have been seen in the PSIM market are that most of the vendors are moving towards cloud-based solutions. These solutions are thus characterized by scalability, flexibility and most importantly are cheaper than the traditional on-premise solutions. PSIM platforms are cloud-based, which is advantageous as organizations’ security representatives can view massive quantities of data regardless of their location, with minor dependence on infrastructure, in contrast to collecting data physically. This trend is a part of a digital movement that is sweeping across the security industries.

- The use of AI and ML in PSIM solutions is on the rise recently as the increased need for comprehensive facility management. These advancement enables the functionality of the PSIM systems to handle large amount of data, flagging anomalies and even predict possible security events. AI/ML improves the overall security of an organization by taking care of mundane jobs and removing the chances of threats before they even become threats.

Effective smart city implementation

- Effective smart city implementation potential is one of the biggest drivers of growth that can be observed in the PSIM market. At the same time, trends towards adopting more IoT-integrated smart cities for real-time video control or security systems, traffic, or public safety increase the demand for reliable PSIM solutions. Such systems are capable to collect information from the different security technologies used in the city, and present it as integrated data for real time monitoring and analysis of the threats, enhancing safety and effectiveness of urban milieu.

- One of the key drivers to the growth of PSIM providers is the growing need to meet data privacy regulation requirements. As governments and organizations start to experience the effect of strictly applying various regulations, for instance GDPR, there is growing demand for PSIM systems with features like data encryption and access controls along with audit trails. PSIM platforms with these compliance features will also be in a better place to grab a bigger portion of this market especially in the areas that regulating laws on data protection are more stringent.

Physical Security Information Management Market Segment Analysis:

Physical Security Information Management Market is Segmented on the basis of Component, Application, End User, and Region.

By Component, Software segment is expected to dominate the market during the forecast period

-

The Physical Security Information Management (PSIM) market is witnessing significant growth, particularly within the software segment, which is expected to dominate throughout the forecast period. The surge in demand for integrated and intelligent security solutions is driving the adoption of advanced software platforms. These software solutions enable businesses to streamline physical security operations by integrating various security systems, such as video surveillance, access control, and intrusion detection, into a single unified platform.

- Software solutions offer real-time monitoring, data analytics, and enhanced decision-making capabilities. With increased emphasis on enhancing security operations and ensuring safety across various sectors like commercial buildings, government facilities, and critical infrastructure, the software segment is positioned to lead the market due to its scalability, flexibility, and effectiveness in managing complex security challenges. This growing preference for software-driven solutions is expected to continue, accelerating the market's growth trajectory.

By Application, Critical Infrastructure segment expected to held the largest share

-

The Critical Infrastructure segment is expected to hold the largest share in the Physical Security Information Management (PSIM) market. This growth can be attributed to the increasing need for advanced security systems to protect critical infrastructure such as energy plants, water treatment facilities, transportation hubs, and government buildings. These sectors are highly vulnerable to potential threats, ranging from cyberattacks to physical intrusions, making them prime targets for enhanced physical security solutions.

- PSIM technology integrates various security systems and data sources, providing real-time situational awareness, automated response protocols, and more efficient management of security resources. The critical nature of these infrastructures necessitates robust monitoring, surveillance, and incident response capabilities, driving the adoption of PSIM solutions within this sector. As threats evolve, these security measures are becoming indispensable in safeguarding vital assets and ensuring public safety.

Physical Security Information Management Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is expected to dominate the Physical Security Information Management (PSIM) market during the forecast period, driven by the region's high demand for advanced security solutions across various sectors. The increasing adoption of IoT, cloud computing, and AI technologies in physical security systems is contributing to this growth.

- With businesses, government organizations, and critical infrastructure facilities emphasizing the importance of enhanced security measures, there is a heightened need for integrated solutions that combine surveillance, access control, and other security technologies into a unified platform. The presence of key market players and continuous advancements in security solutions further strengthen North America's position in the global PSIM market. As a result, the region is poised to lead in terms of market share and technological innovation throughout the forecast period.

Active Key Players in the Physical Security Information Management Market:

- AxxonSoft (Russia)

- Bosch Security Systems (Germany)

- Genetec (Canada)

- Honeywell (USA)

- IBM (USA)

- Johnson Controls (USA)

- Milestone Systems (Denmark)

- Siemens (Germany)

- Thales Group (France)

- Verkada (USA),

- Other Active Players

|

Global Physical Security Information Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.50 Billion |

|

Forecast Period 2024-32 CAGR: |

21.40 % |

Market Size in 2032: |

USD 20.04 Billion |

|

Segments Covered: |

By Component |

|

|

|

Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Physical Security Information Management Market by Type

4.1 Physical Security Information Management Market Snapshot and Growth Engine

4.2 Physical Security Information Management Market Overview

4.3 Organic Pigments

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Organic Pigments: Geographic Segmentation Analysis

4.4 Inorganic Pigments

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Inorganic Pigments: Geographic Segmentation Analysis

Chapter 5: Physical Security Information Management Market by Application

5.1 Physical Security Information Management Market Snapshot and Growth Engine

5.2 Physical Security Information Management Market Overview

5.3 Paints and Coatings

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Paints and Coatings: Geographic Segmentation Analysis

5.4 Plastics

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Plastics: Geographic Segmentation Analysis

5.5 Printing Inks

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Printing Inks: Geographic Segmentation Analysis

5.6 Cosmetics

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Cosmetics: Geographic Segmentation Analysis

5.7 Textiles

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Textiles: Geographic Segmentation Analysis

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Geographic Segmentation Analysis

Chapter 6: Physical Security Information Management Market by End-User

6.1 Physical Security Information Management Market Snapshot and Growth Engine

6.2 Physical Security Information Management Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Automotive: Geographic Segmentation Analysis

6.4 Construction

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Construction: Geographic Segmentation Analysis

6.5 Consumer Goods

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Consumer Goods: Geographic Segmentation Analysis

6.6 Industrial Applications

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Industrial Applications: Geographic Segmentation Analysis

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Physical Security Information Management Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 HONEYWELL (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GENETEC (CANADA)

7.4 AXXONSOFT (RUSSIA)

7.5 BOSCH SECURITY SYSTEMS (GERMANY)

7.6 JOHNSON CONTROLS (USA)

7.7 SIEMENS (GERMANY)

7.8 MILESTONE SYSTEMS (DENMARK)

7.9 IBM (USA)

7.10 THALES GROUP (FRANCE)

7.11 VERKADA (USA)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Physical Security Information Management Market By Region

8.1 Overview

8.2. North America Physical Security Information Management Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Organic Pigments

8.2.4.2 Inorganic Pigments

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Paints and Coatings

8.2.5.2 Plastics

8.2.5.3 Printing Inks

8.2.5.4 Cosmetics

8.2.5.5 Textiles

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size By End-User

8.2.6.1 Automotive

8.2.6.2 Construction

8.2.6.3 Consumer Goods

8.2.6.4 Industrial Applications

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Physical Security Information Management Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Organic Pigments

8.3.4.2 Inorganic Pigments

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Paints and Coatings

8.3.5.2 Plastics

8.3.5.3 Printing Inks

8.3.5.4 Cosmetics

8.3.5.5 Textiles

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size By End-User

8.3.6.1 Automotive

8.3.6.2 Construction

8.3.6.3 Consumer Goods

8.3.6.4 Industrial Applications

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Physical Security Information Management Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Organic Pigments

8.4.4.2 Inorganic Pigments

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Paints and Coatings

8.4.5.2 Plastics

8.4.5.3 Printing Inks

8.4.5.4 Cosmetics

8.4.5.5 Textiles

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size By End-User

8.4.6.1 Automotive

8.4.6.2 Construction

8.4.6.3 Consumer Goods

8.4.6.4 Industrial Applications

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Physical Security Information Management Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Organic Pigments

8.5.4.2 Inorganic Pigments

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Paints and Coatings

8.5.5.2 Plastics

8.5.5.3 Printing Inks

8.5.5.4 Cosmetics

8.5.5.5 Textiles

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size By End-User

8.5.6.1 Automotive

8.5.6.2 Construction

8.5.6.3 Consumer Goods

8.5.6.4 Industrial Applications

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Physical Security Information Management Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Organic Pigments

8.6.4.2 Inorganic Pigments

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Paints and Coatings

8.6.5.2 Plastics

8.6.5.3 Printing Inks

8.6.5.4 Cosmetics

8.6.5.5 Textiles

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size By End-User

8.6.6.1 Automotive

8.6.6.2 Construction

8.6.6.3 Consumer Goods

8.6.6.4 Industrial Applications

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Physical Security Information Management Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Organic Pigments

8.7.4.2 Inorganic Pigments

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Paints and Coatings

8.7.5.2 Plastics

8.7.5.3 Printing Inks

8.7.5.4 Cosmetics

8.7.5.5 Textiles

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size By End-User

8.7.6.1 Automotive

8.7.6.2 Construction

8.7.6.3 Consumer Goods

8.7.6.4 Industrial Applications

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Physical Security Information Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.50 Billion |

|

Forecast Period 2024-32 CAGR: |

21.40 % |

Market Size in 2032: |

USD 20.04 Billion |

|

Segments Covered: |

By Component |

|

|

|

Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||