Pharmaceutical Chemicals Market Synopsis:

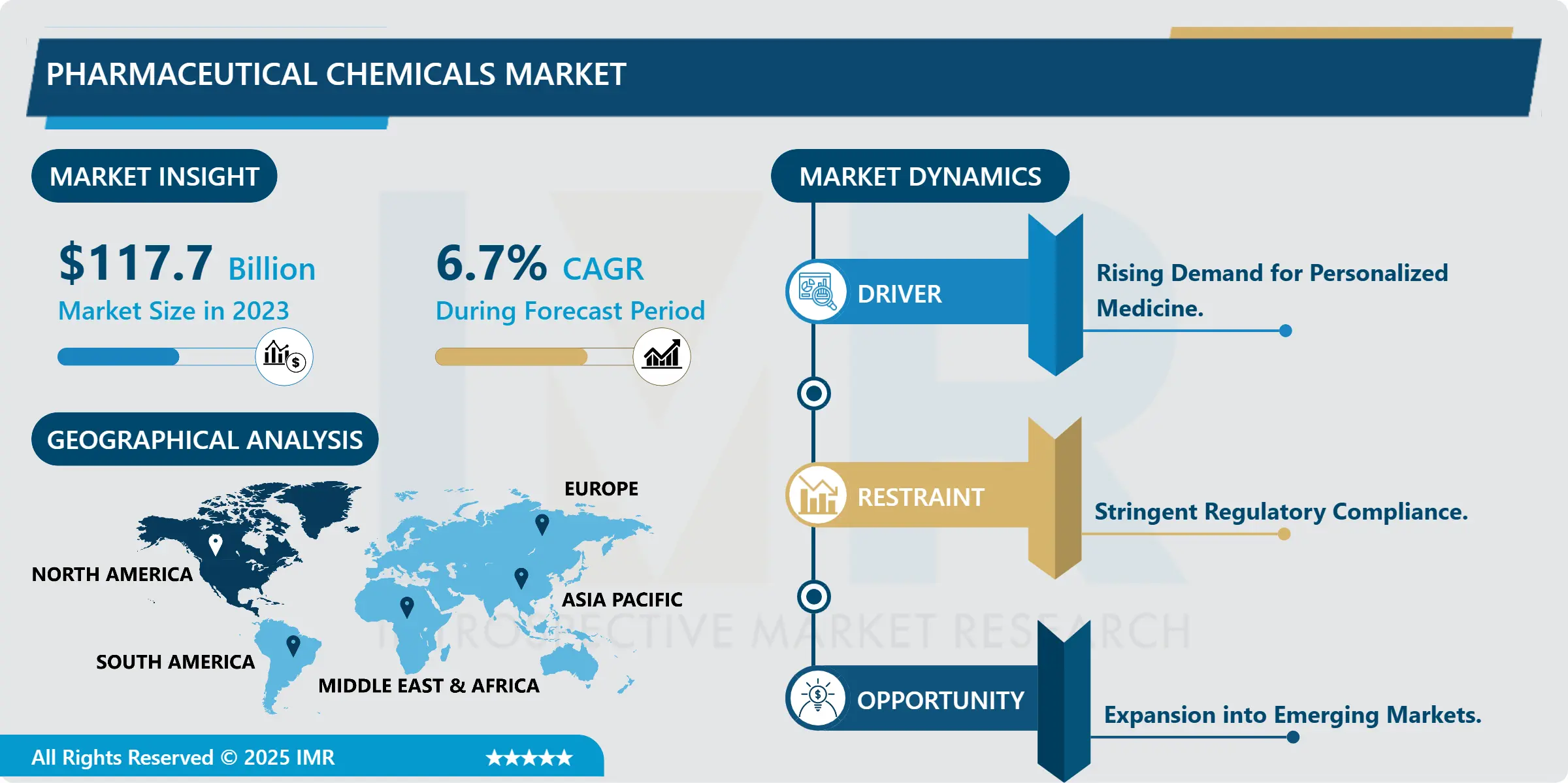

Pharmaceutical Chemicals Market Size Was Valued at USD 117.76 Billion in 2023, and is Projected to Reach USD 205.60 Billion by 2032, Growing at a CAGR of 6.7% From 2024-2032.

The Pharmaceutical Chemicals refer to the wide category of basic or chemical substances global that act as ‘active’, ‘inactive’, or intermediate structures to be incorporated or used in medicine production and, more generally, in formula synthesis. These chemicals are useful to synthesize medicine in various categories of therapeutic classifications like antibiotics, antiviral, antifungal, and anti-cancer. This segment addresses chemical manufacturing, optional product analysis and procedural conformity to the drug manufacturing and development industry offering fundamental components to pharmaceutical advancement as well as offering assurances to drug quality and effectiveness.

The Pharmaceutical Chemicals Market has been growing at a fast pace over the last decade with increasing global healthcare needs, growing incidences of chronic diseases and advancement in chemical technology for drug development. for example, increased consumption of aging population and improving access to health care is some of the leading drivers that have led to high demand of different pharmaceutical chemicals. Also, regulatory requirements call for high standards of quality and safety, which forces the various drug manufacturing companies, to obtain the highest purity chemicals for use in drug formulations.

A Development of new classes of drugs and therapies, including biologics, personalized medicines, and other complex investigative products has broadened the definition of a pharmaceutical chemical. This has scaled up the market competition in small molecule as well as the large molecule industry since firms are making an effort to research innovations that can increase drug efficiency, stability and shelf-life. Asian Pacific and Latin American countries are growing more strategic in contributing crucial portfolio, funding domestic pharma industries vigorously.

Pharmaceutical Chemicals Market Trend Analysis:

Rising Demand for Biologics and Specialty Chemicals

-

A major factor affecting the growth of the Pharmaceutical Chemical Market is the increasing focus towards biological and specialty chemicals due to the increasing inclination towards the use of modern and targeted drugs. Intermediates and biochemicals used in composing complex and protein-based biologics, derived from living cells are differed from conventional drug substances and thus need specific pharmaceutical chemicals for formulation and stabilization.

- The specialty chemicals industry consists of the chemical products which are generally used in the application-specific application, high added value including the application of the requirements such as the delayed-release drug delivery system and drug delivery system. As a result, companies are spending a lot on research and development to meet these specialty needs, stimulating growth in the market. The quick uptake of biologics and specialty chemicals, a move that can be associated with other related unique-sized-and-shaped solutions, corresponds with other patient-centred treatments.

Expansion Opportunities in Emerging Markets

-

Market opportunity by region has been analysed in this report, based on the region’s contribution to the Pharmaceutical Chemicals Market growth from the emerging markets. Some of the Asia-Pacific nations, including China and India, have been concentrating on the growth of this sector with considerable government support, proper polices for the venture and FDI. These nations provide economies of scale and resources that make such production of pharmaceutical chemicals compelling.

- Due to increased demand for affordable drugs, these companies are steadily moving in to these areas to penetrate the market more to meet the growing demand of health requirements by various countries across the globe. The growth of these related markets is anticipated to fuel the long-term growth of the market since emerging economies are set to take centre stage.

Pharmaceutical Chemicals Market Segment Analysis:

Pharmaceutical Chemicals Market is Segmented on the basis of Type, Application, and Vehicle Type.

By Type, Active Pharmaceutical Ingredients (API)segment is expected to dominate the market during the forecast period

-

The API segment is seen to have the largest share in the Pharmaceutical Chemicals Market due to the rising need for superior efficacy and quality pharmaceutical products and treatments in key therapeutic segments. APIs are the main active compounds that have therapeutic activities and have a central role in disease management.

- The increasing occurrence of chronic and lifestyle diseases plays a vital role in escalating the development of novel APIs by pharmaceutical firm, especially personalized and topical therapeutic treatments. More so, the synthetic biology and bioprocessing technologies are improving the APIs production, thus creating complex and efficiency compound. The regulatory agencies are also tightening the rules regarding the quality and safety of API, thus raising the requirement for high purity API and asserting their leading role in the market place as corporations insisted on safe and efficient cures.

By Application, Pharmaceutical Companies segment expected to held the largest share

-

The segment of the company dealing with manufacturing of Pharmaceutical Companies is predicted to have the largest market share for the Pharmaceutical Chemicals Market because of the great level of requirement for high chemical used in manufacture, testing, and formulation of drugs. Pharmaceutical industries are industry leaders who spend a lot of capital on research and innovation to develop drugs that workout different health challenges including diseases of varied complications, inherited disorder and many others.

- As these companies struggle to meet or exceed regulatory requirements while bringing new therapies to market, their demand for high-value pharmaceutical chemicals such as APIs and excipients has grown. In addition, with the advancement of personalized and precise medicines the demand for specialized chemicals for formulating precise medications has increased which cements this segment’s position in the global market. The continuous demand for growth in the healthcare sector spread across the world and the industry pushing for shorter time on drug development again contributes to the big stake that the pharmaceutical companies took in the market.

Pharmaceutical Chemicals Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

According to the data of the year 2023, the Pharmaceutical Chemicals Market was predominated by North America, as it had an advanced healthcare system, a strong pharma sector, and higher research and development investment. Especially the United States, the region share occupies a lot of the international market. This linked to conducive condition for research on drugs, numerous patient population with aggravated health complications, coupled with high set regulatory environments has positioned North America at the front line of this market. In addition, continuous advancements of drug production process and location of stakeholders enhance the region’s market demand by increasing the need for pharmaceutical chemicals.

Active Key Players in the Pharmaceutical Chemicals Market:

- Albemarle Corporation (USA)

- Arkema Group (France)

- Ashland Global Holdings Inc. (USA)

- BASF SE (Germany)

- Clariant AG (Switzerland)

- Croda International Plc (UK)

- Dow Chemical Company (USA)

- Eastman Chemical Company (USA)

- Evonik Industries AG (Germany)

- Huntsman Corporation (USA)

- Johnson Matthey (UK)

- Lonza Group (Switzerland)

- Merck KGaA (Germany)

- Solvay SA (Belgium)

- W. R. Grace & Co. (USA)

- Other Active Players

|

Global Pharmaceutical Chemicals Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 117.7 Billion |

|

Forecast Period 2024-32 CAGR: |

6.7 % |

Market Size in 2032: |

USD 205.60 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pharmaceutical Chemicals Market by Type

4.1 Pharmaceutical Chemicals Market Snapshot and Growth Engine

4.2 Pharmaceutical Chemicals Market Overview

4.3 Active Pharmaceutical Ingredients (API)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Active Pharmaceutical Ingredients (API): Geographic Segmentation Analysis

4.4 Pharmaceutical Intermediates

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Pharmaceutical Intermediates: Geographic Segmentation Analysis

4.5 Others

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Others: Geographic Segmentation Analysis

Chapter 5: Pharmaceutical Chemicals Market by Application

5.1 Pharmaceutical Chemicals Market Snapshot and Growth Engine

5.2 Pharmaceutical Chemicals Market Overview

5.3 Cardiovascular

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cardiovascular: Geographic Segmentation Analysis

5.4 Infectious Diseases

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Infectious Diseases: Geographic Segmentation Analysis

5.5 Diabetes

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Diabetes: Geographic Segmentation Analysis

5.6 Respiratory Disease

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Respiratory Disease: Geographic Segmentation Analysis

5.7 Metabolic System

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Metabolic System: Geographic Segmentation Analysis

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Geographic Segmentation Analysis

Chapter 6: Pharmaceutical Chemicals Market by Vehicle Type

6.1 Pharmaceutical Chemicals Market Snapshot and Growth Engine

6.2 Pharmaceutical Chemicals Market Overview

6.3 Pharmaceutical Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Pharmaceutical Companies: Geographic Segmentation Analysis

6.4 Biotechnology Companies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Biotechnology Companies: Geographic Segmentation Analysis

6.5 Contract Manufacturing Organizations CMO

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Contract Manufacturing Organizations CMO: Geographic Segmentation Analysis

6.6 Research and Academic Institutions

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Research and Academic Institutions: Geographic Segmentation Analysis

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pharmaceutical Chemicals Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALBEMARLE CORPORATION (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ARKEMA GROUP (FRANCE)

7.4 ASHLAND GLOBAL HOLDINGS INC. (USA)

7.5 BASF SE (GERMANY)

7.6 CLARIANT AG (SWITZERLAND)

7.7 CRODA INTERNATIONAL PLC (UK)

7.8 DOW CHEMICAL COMPANY (USA)

7.9 EASTMAN CHEMICAL COMPANY (USA)

7.10 EVONIK INDUSTRIES AG (GERMANY)

7.11 HUNTSMAN CORPORATION (USA)

7.12 JOHNSON MATTHEY (UK)

7.13 LONZA GROUP (SWITZERLAND)

7.14 MERCK KGAA (GERMANY)

7.15 SOLVAY SA (BELGIUM)

7.16 W. R. GRACE & CO. (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Pharmaceutical Chemicals Market By Region

8.1 Overview

8.2. North America Pharmaceutical Chemicals Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Active Pharmaceutical Ingredients (API)

8.2.4.2 Pharmaceutical Intermediates

8.2.4.3 Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Cardiovascular

8.2.5.2 Infectious Diseases

8.2.5.3 Diabetes

8.2.5.4 Respiratory Disease

8.2.5.5 Metabolic System

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size By Vehicle Type

8.2.6.1 Pharmaceutical Companies

8.2.6.2 Biotechnology Companies

8.2.6.3 Contract Manufacturing Organizations CMO

8.2.6.4 Research and Academic Institutions

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pharmaceutical Chemicals Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Active Pharmaceutical Ingredients (API)

8.3.4.2 Pharmaceutical Intermediates

8.3.4.3 Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Cardiovascular

8.3.5.2 Infectious Diseases

8.3.5.3 Diabetes

8.3.5.4 Respiratory Disease

8.3.5.5 Metabolic System

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size By Vehicle Type

8.3.6.1 Pharmaceutical Companies

8.3.6.2 Biotechnology Companies

8.3.6.3 Contract Manufacturing Organizations CMO

8.3.6.4 Research and Academic Institutions

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pharmaceutical Chemicals Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Active Pharmaceutical Ingredients (API)

8.4.4.2 Pharmaceutical Intermediates

8.4.4.3 Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Cardiovascular

8.4.5.2 Infectious Diseases

8.4.5.3 Diabetes

8.4.5.4 Respiratory Disease

8.4.5.5 Metabolic System

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size By Vehicle Type

8.4.6.1 Pharmaceutical Companies

8.4.6.2 Biotechnology Companies

8.4.6.3 Contract Manufacturing Organizations CMO

8.4.6.4 Research and Academic Institutions

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pharmaceutical Chemicals Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Active Pharmaceutical Ingredients (API)

8.5.4.2 Pharmaceutical Intermediates

8.5.4.3 Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Cardiovascular

8.5.5.2 Infectious Diseases

8.5.5.3 Diabetes

8.5.5.4 Respiratory Disease

8.5.5.5 Metabolic System

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size By Vehicle Type

8.5.6.1 Pharmaceutical Companies

8.5.6.2 Biotechnology Companies

8.5.6.3 Contract Manufacturing Organizations CMO

8.5.6.4 Research and Academic Institutions

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pharmaceutical Chemicals Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Active Pharmaceutical Ingredients (API)

8.6.4.2 Pharmaceutical Intermediates

8.6.4.3 Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Cardiovascular

8.6.5.2 Infectious Diseases

8.6.5.3 Diabetes

8.6.5.4 Respiratory Disease

8.6.5.5 Metabolic System

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size By Vehicle Type

8.6.6.1 Pharmaceutical Companies

8.6.6.2 Biotechnology Companies

8.6.6.3 Contract Manufacturing Organizations CMO

8.6.6.4 Research and Academic Institutions

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pharmaceutical Chemicals Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Active Pharmaceutical Ingredients (API)

8.7.4.2 Pharmaceutical Intermediates

8.7.4.3 Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Cardiovascular

8.7.5.2 Infectious Diseases

8.7.5.3 Diabetes

8.7.5.4 Respiratory Disease

8.7.5.5 Metabolic System

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size By Vehicle Type

8.7.6.1 Pharmaceutical Companies

8.7.6.2 Biotechnology Companies

8.7.6.3 Contract Manufacturing Organizations CMO

8.7.6.4 Research and Academic Institutions

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Pharmaceutical Chemicals Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 117.7 Billion |

|

Forecast Period 2024-32 CAGR: |

6.7 % |

Market Size in 2032: |

USD 205.60 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||