Pea Protein Market Synopsis

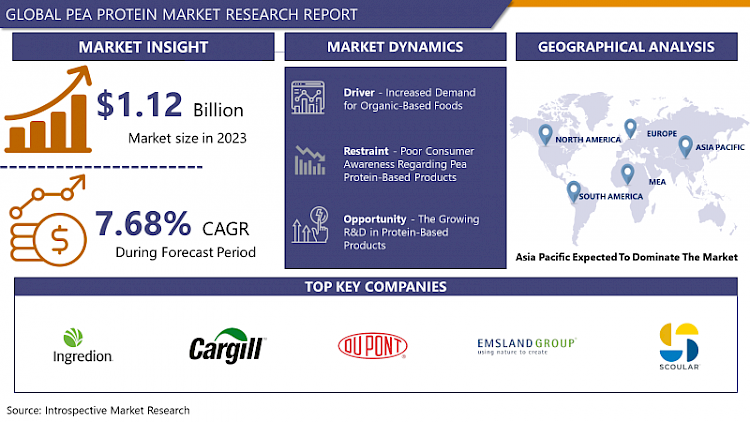

Pea Protein Market Size Was Valued at USD 1.12 Billion in 2023 and is Projected to Reach USD 2.18 Billion by 2032, Growing at a CAGR of 7.68% From 2024-2032.

Pea protein is easiest understood as a protein with superior nutritional characteristics and which is extracted from yellow peas (Pisum sativum). It is prepared by extracting the protein fraction from the peas utilizing steps like milling, hydrating, and drying that yield the protein in a fine, odorless, and tasteless powder form.

- Loaded with essential aminos acids, especially branched chain aminos acid or BCAAs that include leucine, isoleucine and valine among others, pea protein proves to be very useful in augementing nutrition especially for vegans, vegetarians and those with animal protei allergies or constraints in their diet.

- Pea protein has become widely used in the past few years owing to its flexibility in many consumption types and its health benefits to the consumer. They also claimed that it is hypoallergenic thus it can be relied on as a great protein source given that a majority of persons have some form of food allergy such as soy, dairy, or gluten. In addition to being low in allergens, pea protein is also hypocholesterolemic, non-glycemic, easy to digest, and contains essential amino acids that are valuable for building muscles and tissue repair as in the case of animal proteins.

- Additionally, its carbon footprint is reasonable as peas do not require much water and resources as compared to livestock farming methods. This protein is used in plant-based meat products as a protein source, in protein supplementations, and in other food products in general, that are on the market, in a bid to to meat the world’s growing demand for eco-friendly and healthy nutrition.

Pea Protein Market Trend Analysis

Rising demand for plant-based protein

- Some of the trends observed in the global pea protein industry have been outlined and explained as follows: The increasing need for plant proteins has proven to be the key driver in the market growth. This list is due to the fact that the consumers are becoming more conscious about the food they eat and the impact they leave on the environment, hence are moving away from products that are sourced from animals.

- This makes pea protein a promising solution of achieving the best of both worlds, as it is sustainable, nutritious, and can cater to the diverse consumer’s base of vegans, vegetarians, and flexitarians. Also, the rise of conscious consumption that took into consideration the effects of animal farming on the climate change, deforestation, emission of greenhouse gases has made consumers go for more environmentally sustainable protein sources such as pea protein that does not produce as much emissions and is produced with less resources than animal farming.

- Also, the increase in consumption of the plant-based foods and meat substitutes has also added to the growing popularity of pea protein. Today, there are more and more products produced by manufacturers based on plant proteins, which replace traditional animal counterparts, for example, meat and dairy products.

- Using pea protein is justified due to its functional characteristics, such as the ability to mimic animal-based protein products. This trend has led to the development of manufacturing plants for pea proteins and research on how to improve on the nutritive value and functionality of the protein in foods. Therefore, the pea protein market is growing at a very good pace and it is becoming a primary product for the plant based protein industry.

Growing demand in emerging economies

- The global market for pea protein has not only evolved as a major player in the global food industry but also has the potential for further expansion in the emerging economies. With economic growth and the increase of disposable income in these regions, consumers have placed more emphasis on the health and wellness of their diets and, therefore, food choices.

- Pea protein can be used most effectively in countries where people have traditionally consumed plant foods in their dishes or where people do not consume animal products due to religious prohibitions or personal preference for vegetarian or vegan food. Also, lactose intolerance and food allergy are common in some emerging economies implying a need for new protein sources within plant-based production without allergens like dairy and soy, for example, pea protein.

- Moreover, the changing consumer habits with regards to their diets and preferences, including the growing concerns for health-conscious eating and effects of climate change to food production, the global market for plant-based products is expected to expand in emerging markets. Due to knowledge about the health impacts of plant-based proteins and the benefits that come with the reduced use of animal proteins, the consumer is on the lookout for pea protein and other plant-based proteins.

- This also means that the manufacturers and suppliers can expand to new markets and offer better products and services that will meet the emerging needs of the consumers in developing economies. Pea protein market growth: To address the increasing demand and to better target the emerging markets, key players in the pea protein market should use localized promotion strategies and promote products that are aligned to local culture.

Pea Protein Market Segment Analysis:

Pea Protein Market is segmented based on Product, Source, and Application.

By Product, Isolates is expected to dominate the market during the forecast period

- As for the segments within the global pea protein market, it is worth noting that isolates are now regarded as the most popular category. Pea protein isolates are the highly standardized proteins of pea with mostly above 80 % or even more protein concentration. It is for this reason that isolates are of high value to consumers who wish to have a product with a high protein content but with zero content of carbohydrates and fats.

- Non-crystalline solids or isolates are particularly preferred in formulation processes by manufacturers of sports nutritionals, dietary supplements and functional food products. It has a good solubility profile, tasteless, and creamy and thus ideal for a number of uses such as in proteins, bars, drinks and imitation meats. The demand for high protein products is likely to remain strong in the future and this will help maintain the pea protein isolates dominant position due to its nutritional values and other functionalities.

- Pea protein concentrates also take a considerable portion of pea protein market share, though it is marginally smaller than isolates. Pea protein concentrates are produced through the less processing as compared to isolates and also contain lower amount of protein that ranges from 60% to 80%. However, concentrates have lower percentage of the pea’s inherent fiber, vitamins, and minerals to provide possible health advantages in comparison to protein supplement. This makes them attractive to the consumers especially the ones that are looking for whole-food sources of the protein with other nutritional benefits.

- Concentrates are incorporated in many food and beverages like bakery products, snack products, dairy products and pet foods. Although isolates are likely to maintain their position in specific areas owing to their higher protein content and purity, concentrates remain in demand among clients preferring natural and less processed protein, which can further prevent the saturation of the pea protein market.

By Applications, Dry segment held the largest share in 2023

- The Asia Pacific region also has a strong consumer presence of the dry form category in the pea protein market. Dry pea protein is preferred more often than wet forms, simple because of its convenience, flexibility, and storage duration. The dry pea protein is mostly marketed in a powdered form, which affords it the advantage of ease in storage, transportation, and application, especially in the food and beverages industry. It exists in a powdered form which enables easy measurement of accurate portions for a stable dosing and it is therefore ideal for use in protein powders and bars, baked goods and meat substitutes.

- Furthermore, dry pea protein is highly soluble, suggesting that it can easily dissolve in liquids without altering the feel of food that is prepared from such a product. This has helped make dry pea protein a popular choice for many industries, especially in the arena of sports nutrition, functional food products, and plant-based proteins.

- There are also wet types of pea proteins, which are also used, albeit in some specific applications; however, dry pea protein currently occupies the largest share in the market. This wet pea protein, especially in pea protein concentrates or isolates that are dispersed in water or other liquid bases, has its own advantages in formulations where it is appropriate to contain a certain level of water or where it needs to be mixed with other ingredients in advance. Wet forms may be preferred in applications where the final product is going to be a ready to drink beverage, soup, sauce or dairy substitute, where the wet form of the fiber imparts the right textural attributes, viscosity and mouthfeel in the food product.

- Although, the wet forms may have the market capped in comparison to the dry forms, they are significant in those industries that necessitate their peculiar characteristics, so the market is not dominated by the dry forms alone, maintaining the equilibrium in the market.

Pea Protein Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- The leading region that has been identified in the pea protein market is North America, due to several factors discussed below. Firstly, there is a genuine appreciation for plant-based products in the region and considerable knowledge of the health and environmental impacts of pea protein. As the global population continues to trend towards vegetarian, vegan or even flexitarian palates, the interest in plant-based proteins such as pea protein continues to rise across multiple food and beverage applications.

- Also, the North American region is a flourishing region as far as the health and wellness sector is concerned, and a huge number of manufacturers and suppliers are present in the region who are constantly focusing their research and development department on coming up with new pea protein products and formulations to meet the new trends in the market.

- Furthermore, the mature and competitively developed food and beverages market of the region, along with its strong distribution channels, facilitates the easy sale and distribution of pea protein products. This has placed pea protein in a position of high accessibility and visibility across the retail outlets, ranging from supermarkets, specialty stores and online markets thus enhancing its market strength. In addition, North America has a favorable regulatory framework for the plant-based protein market since it promotes new innovations and products.

- There are other factors which include the support by Governments of countries such as North America and Europe towards sustainable agriculture and decreased emission of carbon also challenges companies to produce pea protein which is environmentally friendly as compared to other proteins. Altogether, these circumstances make North America the most prominent region in the global pea protein market, with more development and enlargement expected in the foreseeable future.

Active Key Players in the Pea Protein Market

- A&B Ingredients (United States)

- AGT Food and Ingredients Inc. (Canada)

- Axiom Foods Inc. (United States)

- Bioway (Xian) Organic Ingredients Co., Ltd. (China)

- Burcon NutraScience Corporation (Canada)

- Cosucra Groupe Warcoing SA (Belgium)

- Emsland Group (Germany)

- Farbest Brands (United States)

- Fenchem Biotek Ltd. (China)

- Glanbia plc (Ireland)

- Ingredion Incorporated (United States)

- Kerry Group plc (Ireland)

- Norben Company, Inc. (United States)

- Nutri-Pea Limited (Canada)

- Roqberry (United Kingdom)

- Roquette Frères (France)

- Shandong Jianyuan Group (China)

- The Scoular Company (United States)

- Vestkorn Milling AS (Norway)

- Yantai Shuangta Food Co., Ltd. (China)

- Other Key Players

Key Industry Developments in the Pea Protein Market:

- In February 2024, : New products that were introduced into the market and the company’s innovations are Roquette Freres which has expanded its NUTRALYS range to include four multifunctional pea protein isolates for application in the production of various plant-based food products to boost taste and texture. The Nov, 2011 four new launches are: 1) NUTRALYS Pea F853M – An isolate 2) NUTRALYS T PEA 700 M – Textured 3) NUTRALYS H 85 – Hydrolysate 4) NUTRALYS Pea 700 FL – Textured.

- In February 2024, Louis Dreyfus, an agriculture processor with its regional base in Netherlands is the latest company to declare their intent to invest in a pea protein manufacturing factory in the North American country. This new plant is expected to come online by the end of 2025 and will give employment to almost 60 individuals.

|

Global Pea Protein Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.12 Bn. |

|

Forecast Period 2023-34 CAGR: |

7.68% |

Market Size in 2032: |

USD 2.18 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Applications |

|

||

|

By Sources |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PEA PROTEIN MARKET BY TYPE (2017-2032)

- PEA PROTEIN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ISOLATES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONCENTRATES

- TEXTURED

- HYDROLYSATES

- PEA PROTEIN MARKET BY APPLICATIONS (2017-2032)

- PEA PROTEIN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WET

- PEA PROTEIN MARKET BY SOURCES (2017-2032)

- PEA PROTEIN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- YELLOW SPLIT PEAS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OTHERS

- PEA PROTEIN MARKET BY APPLICATIONS (2017-2032)

- PEA PROTEIN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD & BEVERAGES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PERSONAL CARE & COSMETICS

- ANIMAL FEED

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- PEA PROTEIN Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- A&B INGREDIENTS (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AGT FOOD AND INGREDIENTS INC. (CANADA)

- AXIOM FOODS INC. (UNITED STATES)

- BIOWAY (XIAN) ORGANIC INGREDIENTS CO., LTD. (CHINA)

- BURCON NUTRASCIENCE CORPORATION (CANADA)

- COSUCRA GROUPE WARCOING SA (BELGIUM)

- EMSLAND GROUP (GERMANY)

- FARBEST BRANDS (UNITED STATES)

- FENCHEM BIOTEK LTD. (CHINA)

- GLANBIA PLC (IRELAND)

- INGREDION INCORPORATED (UNITED STATES)

- KERRY GROUP PLC (IRELAND)

- NORBEN COMPANY, INC. (UNITED STATES)

- NUTRI-PEA LIMITED (CANADA)

- ROQBERRY (UNITED KINGDOM)

- ROQUETTE FRÈRES (FRANCE)

- SHANDONG JIANYUAN GROUP (CHINA)

- THE SCOULAR COMPANY (UNITED STATES)

- VESTKORN MILLING AS (NORWAY)

- YANTAI SHUANGTA FOOD CO., LTD. (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL PEA PROTEIN MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Pea Protein Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.12 Bn. |

|

Forecast Period 2023-34 CAGR: |

7.68% |

Market Size in 2032: |

USD 2.18 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Applications |

|

||

|

By Sources |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PEA PROTEIN MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PEA PROTEIN MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PEA PROTEIN MARKET COMPETITIVE RIVALRY

TABLE 005. PEA PROTEIN MARKET THREAT OF NEW ENTRANTS

TABLE 006. PEA PROTEIN MARKET THREAT OF SUBSTITUTES

TABLE 007. PEA PROTEIN MARKET BY TYPE

TABLE 008. ISOLATE MARKET OVERVIEW (2016-2028)

TABLE 009. CONCENTRATE MARKET OVERVIEW (2016-2028)

TABLE 010. TEXTURED MARKET OVERVIEW (2016-2028)

TABLE 011. PEA PROTEIN MARKET BY FORM

TABLE 012. DRY MARKET OVERVIEW (2016-2028)

TABLE 013. WET MARKET OVERVIEW (2016-2028)

TABLE 014. PEA PROTEIN MARKET BY SOURCE

TABLE 015. YELLOW SPLITS PEAS MARKET OVERVIEW (2016-2028)

TABLE 016. LENTILS MARKET OVERVIEW (2016-2028)

TABLE 017. CHICKPEA MARKET OVERVIEW (2016-2028)

TABLE 018. PEA PROTEIN MARKET BY APPLICATION

TABLE 019. NUTRITION & HEALTH SUPPLEMENTS MARKET OVERVIEW (2016-2028)

TABLE 020. BAKERY & CONFECTIONERY MARKET OVERVIEW (2016-2028)

TABLE 021. MEAT PRODUCTS & ALTERNATIVES MARKET OVERVIEW (2016-2028)

TABLE 022. CEREALS & SNACKS MARKET OVERVIEW (2016-2028)

TABLE 023. BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA PEA PROTEIN MARKET, BY TYPE (2016-2028)

TABLE 025. NORTH AMERICA PEA PROTEIN MARKET, BY FORM (2016-2028)

TABLE 026. NORTH AMERICA PEA PROTEIN MARKET, BY SOURCE (2016-2028)

TABLE 027. NORTH AMERICA PEA PROTEIN MARKET, BY APPLICATION (2016-2028)

TABLE 028. N PEA PROTEIN MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE PEA PROTEIN MARKET, BY TYPE (2016-2028)

TABLE 030. EUROPE PEA PROTEIN MARKET, BY FORM (2016-2028)

TABLE 031. EUROPE PEA PROTEIN MARKET, BY SOURCE (2016-2028)

TABLE 032. EUROPE PEA PROTEIN MARKET, BY APPLICATION (2016-2028)

TABLE 033. PEA PROTEIN MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC PEA PROTEIN MARKET, BY TYPE (2016-2028)

TABLE 035. ASIA PACIFIC PEA PROTEIN MARKET, BY FORM (2016-2028)

TABLE 036. ASIA PACIFIC PEA PROTEIN MARKET, BY SOURCE (2016-2028)

TABLE 037. ASIA PACIFIC PEA PROTEIN MARKET, BY APPLICATION (2016-2028)

TABLE 038. PEA PROTEIN MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA PEA PROTEIN MARKET, BY TYPE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA PEA PROTEIN MARKET, BY FORM (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA PEA PROTEIN MARKET, BY SOURCE (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA PEA PROTEIN MARKET, BY APPLICATION (2016-2028)

TABLE 043. PEA PROTEIN MARKET, BY COUNTRY (2016-2028)

TABLE 044. SOUTH AMERICA PEA PROTEIN MARKET, BY TYPE (2016-2028)

TABLE 045. SOUTH AMERICA PEA PROTEIN MARKET, BY FORM (2016-2028)

TABLE 046. SOUTH AMERICA PEA PROTEIN MARKET, BY SOURCE (2016-2028)

TABLE 047. SOUTH AMERICA PEA PROTEIN MARKET, BY APPLICATION (2016-2028)

TABLE 048. PEA PROTEIN MARKET, BY COUNTRY (2016-2028)

TABLE 049. DUPONT: SNAPSHOT

TABLE 050. DUPONT: BUSINESS PERFORMANCE

TABLE 051. DUPONT: PRODUCT PORTFOLIO

TABLE 052. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. THE SCOULAR COMPANY: SNAPSHOT

TABLE 053. THE SCOULAR COMPANY: BUSINESS PERFORMANCE

TABLE 054. THE SCOULAR COMPANY: PRODUCT PORTFOLIO

TABLE 055. THE SCOULAR COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. EMSLAND GROUP: SNAPSHOT

TABLE 056. EMSLAND GROUP: BUSINESS PERFORMANCE

TABLE 057. EMSLAND GROUP: PRODUCT PORTFOLIO

TABLE 058. EMSLAND GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. PURIS FOODS: SNAPSHOT

TABLE 059. PURIS FOODS: BUSINESS PERFORMANCE

TABLE 060. PURIS FOODS: PRODUCT PORTFOLIO

TABLE 061. PURIS FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ROUQUETTE FRERES: SNAPSHOT

TABLE 062. ROUQUETTE FRERES: BUSINESS PERFORMANCE

TABLE 063. ROUQUETTE FRERES: PRODUCT PORTFOLIO

TABLE 064. ROUQUETTE FRERES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. CARGILL INCORPORATED: SNAPSHOT

TABLE 065. CARGILL INCORPORATED: BUSINESS PERFORMANCE

TABLE 066. CARGILL INCORPORATED: PRODUCT PORTFOLIO

TABLE 067. CARGILL INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. FENCHEM INC.: SNAPSHOT

TABLE 068. FENCHEM INC.: BUSINESS PERFORMANCE

TABLE 069. FENCHEM INC.: PRODUCT PORTFOLIO

TABLE 070. FENCHEM INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. BURCON NUTRASCIENCE: SNAPSHOT

TABLE 071. BURCON NUTRASCIENCE: BUSINESS PERFORMANCE

TABLE 072. BURCON NUTRASCIENCE: PRODUCT PORTFOLIO

TABLE 073. BURCON NUTRASCIENCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. NUTRI-PEA LTD.: SNAPSHOT

TABLE 074. NUTRI-PEA LTD.: BUSINESS PERFORMANCE

TABLE 075. NUTRI-PEA LTD.: PRODUCT PORTFOLIO

TABLE 076. NUTRI-PEA LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. INGREDIAN INC.: SNAPSHOT

TABLE 077. INGREDIAN INC.: BUSINESS PERFORMANCE

TABLE 078. INGREDIAN INC.: PRODUCT PORTFOLIO

TABLE 079. INGREDIAN INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. AXIOM FOODS INC.: SNAPSHOT

TABLE 080. AXIOM FOODS INC.: BUSINESS PERFORMANCE

TABLE 081. AXIOM FOODS INC.: PRODUCT PORTFOLIO

TABLE 082. AXIOM FOODS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. THE GREEN LABS LLC.: SNAPSHOT

TABLE 083. THE GREEN LABS LLC.: BUSINESS PERFORMANCE

TABLE 084. THE GREEN LABS LLC.: PRODUCT PORTFOLIO

TABLE 085. THE GREEN LABS LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. SOTEXPRO SA: SNAPSHOT

TABLE 086. SOTEXPRO SA: BUSINESS PERFORMANCE

TABLE 087. SOTEXPRO SA: PRODUCT PORTFOLIO

TABLE 088. SOTEXPRO SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. SHANDONG JIANYUAN GROUP: SNAPSHOT

TABLE 089. SHANDONG JIANYUAN GROUP: BUSINESS PERFORMANCE

TABLE 090. SHANDONG JIANYUAN GROUP: PRODUCT PORTFOLIO

TABLE 091. SHANDONG JIANYUAN GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. MARTIN AND PLEASANCE: SNAPSHOT

TABLE 092. MARTIN AND PLEASANCE: BUSINESS PERFORMANCE

TABLE 093. MARTIN AND PLEASANCE: PRODUCT PORTFOLIO

TABLE 094. MARTIN AND PLEASANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. COSUCRA GROUP: SNAPSHOT

TABLE 095. COSUCRA GROUP: BUSINESS PERFORMANCE

TABLE 096. COSUCRA GROUP: PRODUCT PORTFOLIO

TABLE 097. COSUCRA GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 098. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 099. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 100. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PEA PROTEIN MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PEA PROTEIN MARKET OVERVIEW BY TYPE

FIGURE 012. ISOLATE MARKET OVERVIEW (2016-2028)

FIGURE 013. CONCENTRATE MARKET OVERVIEW (2016-2028)

FIGURE 014. TEXTURED MARKET OVERVIEW (2016-2028)

FIGURE 015. PEA PROTEIN MARKET OVERVIEW BY FORM

FIGURE 016. DRY MARKET OVERVIEW (2016-2028)

FIGURE 017. WET MARKET OVERVIEW (2016-2028)

FIGURE 018. PEA PROTEIN MARKET OVERVIEW BY SOURCE

FIGURE 019. YELLOW SPLITS PEAS MARKET OVERVIEW (2016-2028)

FIGURE 020. LENTILS MARKET OVERVIEW (2016-2028)

FIGURE 021. CHICKPEA MARKET OVERVIEW (2016-2028)

FIGURE 022. PEA PROTEIN MARKET OVERVIEW BY APPLICATION

FIGURE 023. NUTRITION & HEALTH SUPPLEMENTS MARKET OVERVIEW (2016-2028)

FIGURE 024. BAKERY & CONFECTIONERY MARKET OVERVIEW (2016-2028)

FIGURE 025. MEAT PRODUCTS & ALTERNATIVES MARKET OVERVIEW (2016-2028)

FIGURE 026. CEREALS & SNACKS MARKET OVERVIEW (2016-2028)

FIGURE 027. BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA PEA PROTEIN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE PEA PROTEIN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC PEA PROTEIN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA PEA PROTEIN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA PEA PROTEIN MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Pea Protein Market research report is 2024-2032.

A&B Ingredients (United States), AGT Food and Ingredients Inc. (Canada), Axiom Foods Inc. (United States), Bioway (Xian) Organic Ingredients Co., Ltd. (China), Burcon NutraScience Corporation (Canada), Cosucra Groupe Warcoing SA (Belgium), Emsland Group (Germany), Farbest Brands (United States), Fenchem Biotek Ltd. (China), Glanbia plc (Ireland), Ingredion Incorporated (United States), Kerry Group plc (Ireland), Norben Company, Inc. (United States), Nutri-Pea Limited (Canada), Roqberry (United Kingdom) Roquette Frères (France), Shandong Jianyuan Group (China), The Scoular Company (United States), Vestkorn Milling AS (Norway), Yantai Shuangta Food Co., Ltd. (China) and Other Major Players.

The Pea Protein Market is segmented into Product, Form, Sources, Application, and region. By Product, the market is categorized into Isolates, Concentrates, Textured, Hydrolysates. By Form, the market is categorized into Dry, Wet. By Sources, the market is categorized into Yellow Split Peas,Others. By Applications, the market is categorized into Food & Beverages, Pharmaceuticals, Nutraceutical, Flavoring & Dressing, Culinar Personal Care & Cosmetics, Animal Feed, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Pea protein isolates are defined as highly purified and concentrated protein fractions derived from peas where the protein content is usually in excess of 80 per cent. These are preferred for their bland taste, and high solubility, as well as their suitability for use in many food products and in beverages. Pea protein concentrates are less processed and contain a lower protein content and may range from 60% to 80%. They contain less processed elements and additives and more of the natural pea fiber and nutrients, which makes them possibly healthier than simple protein powders.

Pea Protein Market Size Was Valued at USD 1.12 Billion in 2023 and is Projected to Reach USD 2.18 Billion by 2032, Growing at a CAGR of 7.68% From 2024-2032.