Pandan Tea Market Synopsis

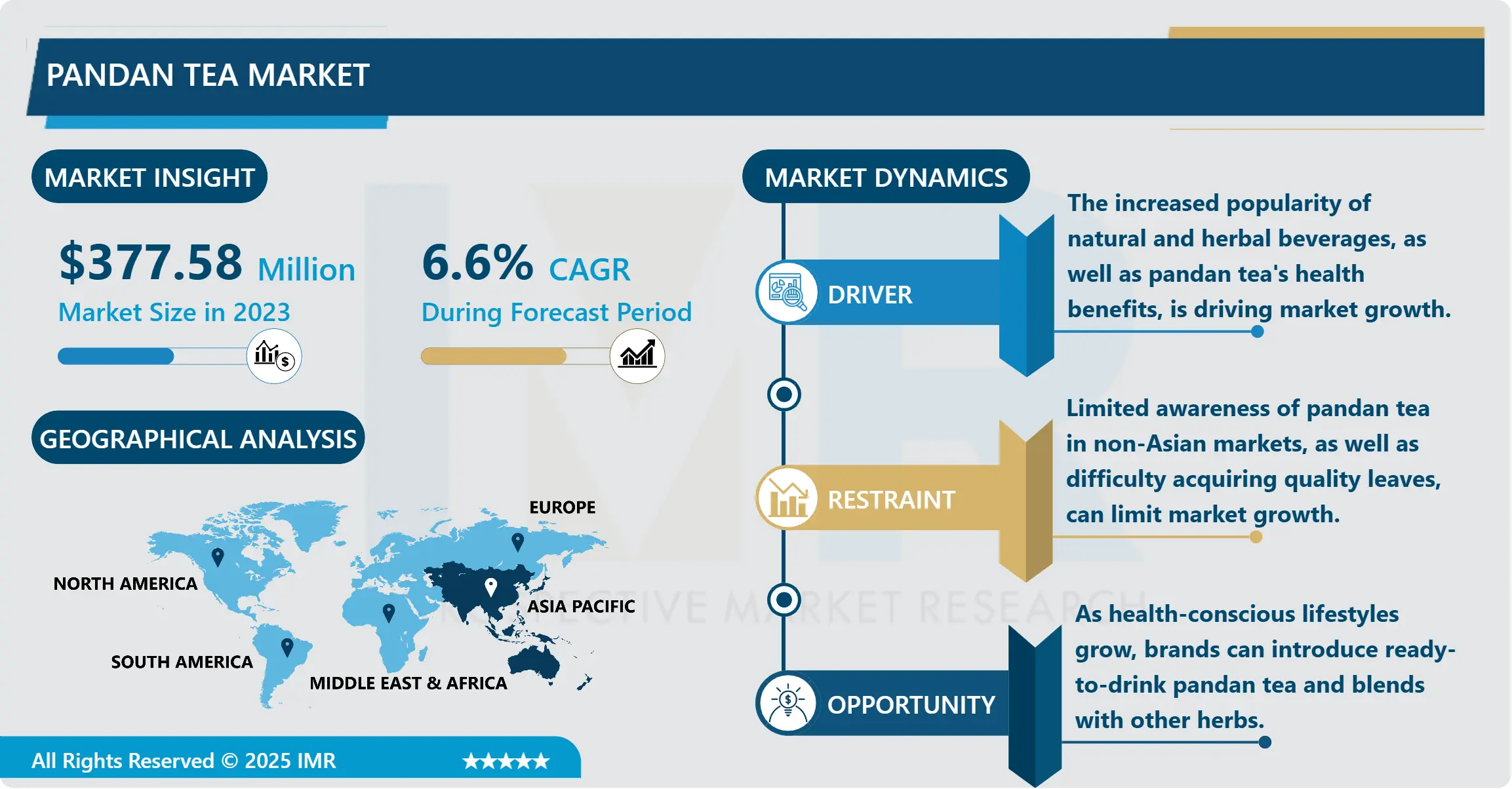

Pandan Tea Market Size is Valued at USD 377.58 Million in 2023, and is Projected to Reach USD 671.16 Million by 2032, Growing at a CAGR of 6.6% From 2024-2032.

One of the factors that continue to experience rapid expansion in the consumption of herbal and natural drinks by consumers. Most recently, incorporating pandan leaves into tea is getting widespread and famous because of the health benefits and, especially, aroma and taste of tea. Pandan leaves are used in many prepared foods by several asian countries. Pandan tea is enjoyed by consumers and has appreciated, largely due to the increased concern of consumer towards their health and a shift from coffee. This is because Georgette is a natural material that has the natural capacity to calm the soul. This is not dissimilar to the rest of the herbal tea products that have health and relaxation benefits associated with them.

Also, market is gaining from the up-trending knowledge of numerous nutritional values associated with pandan such as anti inflammatory and antioxidant.. Sub trends in the healthy and wellness sector have gone further to support the demand for pandan tea by persuading consumers to take herbal teas regularly. In addition, the increasing merchandising of various pandan tea products ranging from fresh leaves, tea sachets, canned and bottled upmarket the expansion of the market to meet a broad client base and enhance ease of access.

These threats like availability of raw materials and low awareness level of the pandan tea in other markets than Asia may affect the rate of growth of the pandan tea market. However, there are great opportunities with increasing consumption of the medicinal tea especially in regions that have not embraced this practice in their normal lives. Global market availability has increased with the rising focus on the online segment of retail sales, allowing brands to reach customers who want to find unique and tasty herbal teas. Based on the findings of this study, it is believed that quality, flavor and health improvement perspective will dictate the future development of pandan tea market.

Pandan Tea Market Trend Analysis

Rising Popularity of Herbal Teas

- The market is thus right for pandan tea due to increased consumer concern towards health and wellness drinks. The consumer awareness of the benefits of botanical teas has led to most of them changing from caffeinated beverages to natural products like pandan tea. This is due to the fact that many people are today shifting towards products that are healthy for consumption, help alleviate tension and ones that give the consumer the feelings of relaxation. As such, brands are keen on this trend where issues spiritual, nutritional and medical benefits of pandan is highlighted such as being a source of antioxidants and has probably anti-inflammatory properties that are good for people’s health.

- Different health and wellness beverages continue to experience a surge of demand and the same holds for pandan tea. The evolution of the knowledge society and the general trend of healthy consumption also cause a shift of the population from conventional coffee drinks to products containing plant extracts that have positive effects on the body. Pandan tea which is famous for its aroma and taste is gradually gaining acceptance for these uses; Stress reliever and Antioxidant. It is also fueled by the growing appreciation of the role of natural ingredients in the beverages because the consumers are going for products that help them to lead healthy lifestyles.

Innovations in Product Offerings

- Growing Specialty Tea Retailers and online selling services are helping pandan tea market strengthen in a big way. Thanks to the modern e-commerce platforms, with the help of which consumers can easily buy a wide range of herbal teas, including pandan, at home. This trend is very beneficial for brands who want to reach out more target market as it allows the brands to introduce their unique products and engage with the consumers. Specialty tea stores also play an essential role in the market promotion of pandan tea due to their provision of materials and samples to help the consumer to understand and enjoy the taste of pandan tea in order to establish market interests.

- The structure of the pandan tea market is rapidly developing due to the emergence of new diverse products that meet the needs of customers with increased health awareness. Because of this benefit, manufacturers are releasing a pandan tea assorted consume that is pandan not alone but mixes in with lemongrass, ginger or green tea, thus making the former have herbal properties of the latter and a richer taste as well. Besides, RTD Pandan tea drinks trends where consumer who busy can select healthier drink instead of heavy ingredients drinks.

Pandan Tea Market Segment Analysis:

Pandan Tea Market Segmented on the basis of By Type, By Packaging , By End-User, By Distribution Channel

By Type, Loose Leaf segment is expected to dominate the market during the forecast period

- There is a wide range of formats available in the pandan tea market, such as loose leaf, tea sachets, and instant powder, to accommodate the diverse preferences of consumers. Tea devotees who value the genuine flavors and aromas that emanate from freshly brewed leaves. This format is particularly appealing to individuals who prefer a more personalized tea experience, as it enables them to exert more control over the brewing time and intensity. Furthermore, the perceived superiority of loose leaf alternatives frequently draws consumers who prioritize premium products.

- In contrast, tea bags are a popular option among busy consumers due to their convenience and ease of use. Tea sachets are pre-packaged and prepared for brewing, enabling a rapid preparation process without compromising flavor. In the interim, instant powder pandan tea offers an even more expedited alternative, allowing consumers to ingest the beverage with only hot water. This format is particularly appealing to individuals who are seeking a portable and convenient option, thereby broadening the market and increasing the accessibility of pandan tea.

By End-User, Household segment held the largest share in 2024

- The domestic segment is the largest end-user in the pandan tea market because of the growing consumer preference for natural and herbal beverages at home. The unique flavor and soothing properties of pandan tea have made it a popular choice among families who are increasingly seeking health-conscious alternatives to traditional teas and caffeinated beverages. The demand for pandan tea in retail formats, such as tea bags and loose leaf, is on the rise as more households integrate herbal teas into their daily routines, reflecting a shift toward wellness-oriented consumption.

- Additionally, the foodservice and institutional sectors are becoming substantial end users of pandan tea. Cafés and restaurants are incorporating pandan tea into their menus due to its exotic flavor and appeal to health-conscious customers. Furthermore, schools and wellness centers are investigating the integration of pandan tea into their menus, acknowledging its potential to enhance patrons' relaxation and overall health. We expect this trend to accelerate the pandan tea market's expansion across various channels.

Pandan Tea Market Regional Insights:

Asia-Pacific is dominating the pandan tea market

- The Asia-Pacific region most of which have roots in culinary that use of pandan leaves prominently and consequently takes the largest share in the production of pandan tea.. It comes naturally that consumers of countries like Thailand, Malaysia and Indonesia shift easily to Normal pandan tea since it is used in cooking lots of foods and drinks. Local consumers are drinking more and more herbal teas for health sake and novelty and that is where pandan comes in with its familiar taste and /or smell. This solid cultural bond has given rise to a loyal customer group that drinks the beverage with an aim of improving on their health not forgetting the wakeup call that the beverage provides.

- Also, the need for pandan tea is being driven by a relatively rise in the Asia pacific region consumers adopting healthy lifestyles. Pandan tea is also well placed to benefit from the increasing palate of health-conscious drinkers rejecting high sugar or synthetic-flavored products in favor of refreshments that come with natural and botanical attributes. In addition, the availability of pandan tea through conventional stores as well as online shops strengthen the domination of the Asia-Pacific market.

Active Key Players in the Pandan Tea Market

- ETTE TEA COMPANY (Singapore)

- My Blue Tea (Australia)

- Rishi Tea & Botanicals (U.S.)

- FreshDrinkUS (U.S.)

- Dilmah Ceylon Tea Company PLC (Sri Lanka)

- Tea Too Pty Ltd. (Australia)

- Zhejiang Chunli Tea Co., Ltd. (China)

- WILD & TEA (U.S.)

- Others

Global Pandan Tea Market Scope:

|

Global Pandan Tea Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 377.58 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.6% |

Market Size in 2032: |

USD 671.16 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pandan Tea Market by Type (2018-2032)

4.1 Pandan Tea Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Loose Leaf

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Tea Bags

4.5 Instant Powder

Chapter 5: Pandan Tea Market by Packaging (2018-2032)

5.1 Pandan Tea Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Box

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Sachet

5.5 Tin

5.6 Bottle

Chapter 6: Pandan Tea Market by End-User (2018-2032)

6.1 Pandan Tea Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Household

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Foodservice

6.5 Institutional

Chapter 7: Pandan Tea Market by Distribution Channel (2018-2032)

7.1 Pandan Tea Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Supermarkets/Hypermarkets

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Specialty Stores

7.5 Online Retail

7.6 Convenience Stores

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Pandan Tea Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ETTE TEA COMPANY (SINGAPORE)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MY BLUE TEA (AUSTRALIA)

8.4 RISHI TEA & BOTANICALS (U.S.)

8.5 FRESHDRINKUS (U.S.)

8.6 DILMAH CEYLON TEA COMPANY PLC (SRI LANKA)

8.7 TEA TOO PTY LTD. (AUSTRALIA)

8.8 ZHEJIANG CHUNLI TEA COLTD. (CHINA)

8.9 WILD & TEA (U.S.)

8.10 OTHERS

8.11

Chapter 9: Global Pandan Tea Market By Region

9.1 Overview

9.2. North America Pandan Tea Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Loose Leaf

9.2.4.2 Tea Bags

9.2.4.3 Instant Powder

9.2.5 Historic and Forecasted Market Size by Packaging

9.2.5.1 Box

9.2.5.2 Sachet

9.2.5.3 Tin

9.2.5.4 Bottle

9.2.6 Historic and Forecasted Market Size by End-User

9.2.6.1 Household

9.2.6.2 Foodservice

9.2.6.3 Institutional

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Supermarkets/Hypermarkets

9.2.7.2 Specialty Stores

9.2.7.3 Online Retail

9.2.7.4 Convenience Stores

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Pandan Tea Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Loose Leaf

9.3.4.2 Tea Bags

9.3.4.3 Instant Powder

9.3.5 Historic and Forecasted Market Size by Packaging

9.3.5.1 Box

9.3.5.2 Sachet

9.3.5.3 Tin

9.3.5.4 Bottle

9.3.6 Historic and Forecasted Market Size by End-User

9.3.6.1 Household

9.3.6.2 Foodservice

9.3.6.3 Institutional

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Supermarkets/Hypermarkets

9.3.7.2 Specialty Stores

9.3.7.3 Online Retail

9.3.7.4 Convenience Stores

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Pandan Tea Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Loose Leaf

9.4.4.2 Tea Bags

9.4.4.3 Instant Powder

9.4.5 Historic and Forecasted Market Size by Packaging

9.4.5.1 Box

9.4.5.2 Sachet

9.4.5.3 Tin

9.4.5.4 Bottle

9.4.6 Historic and Forecasted Market Size by End-User

9.4.6.1 Household

9.4.6.2 Foodservice

9.4.6.3 Institutional

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Supermarkets/Hypermarkets

9.4.7.2 Specialty Stores

9.4.7.3 Online Retail

9.4.7.4 Convenience Stores

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Pandan Tea Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Loose Leaf

9.5.4.2 Tea Bags

9.5.4.3 Instant Powder

9.5.5 Historic and Forecasted Market Size by Packaging

9.5.5.1 Box

9.5.5.2 Sachet

9.5.5.3 Tin

9.5.5.4 Bottle

9.5.6 Historic and Forecasted Market Size by End-User

9.5.6.1 Household

9.5.6.2 Foodservice

9.5.6.3 Institutional

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Supermarkets/Hypermarkets

9.5.7.2 Specialty Stores

9.5.7.3 Online Retail

9.5.7.4 Convenience Stores

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Pandan Tea Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Loose Leaf

9.6.4.2 Tea Bags

9.6.4.3 Instant Powder

9.6.5 Historic and Forecasted Market Size by Packaging

9.6.5.1 Box

9.6.5.2 Sachet

9.6.5.3 Tin

9.6.5.4 Bottle

9.6.6 Historic and Forecasted Market Size by End-User

9.6.6.1 Household

9.6.6.2 Foodservice

9.6.6.3 Institutional

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Supermarkets/Hypermarkets

9.6.7.2 Specialty Stores

9.6.7.3 Online Retail

9.6.7.4 Convenience Stores

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Pandan Tea Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Loose Leaf

9.7.4.2 Tea Bags

9.7.4.3 Instant Powder

9.7.5 Historic and Forecasted Market Size by Packaging

9.7.5.1 Box

9.7.5.2 Sachet

9.7.5.3 Tin

9.7.5.4 Bottle

9.7.6 Historic and Forecasted Market Size by End-User

9.7.6.1 Household

9.7.6.2 Foodservice

9.7.6.3 Institutional

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Supermarkets/Hypermarkets

9.7.7.2 Specialty Stores

9.7.7.3 Online Retail

9.7.7.4 Convenience Stores

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Global Pandan Tea Market Scope:

|

Global Pandan Tea Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 377.58 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.6% |

Market Size in 2032: |

USD 671.16 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||