Outpatient Clinics Market Synopsis:

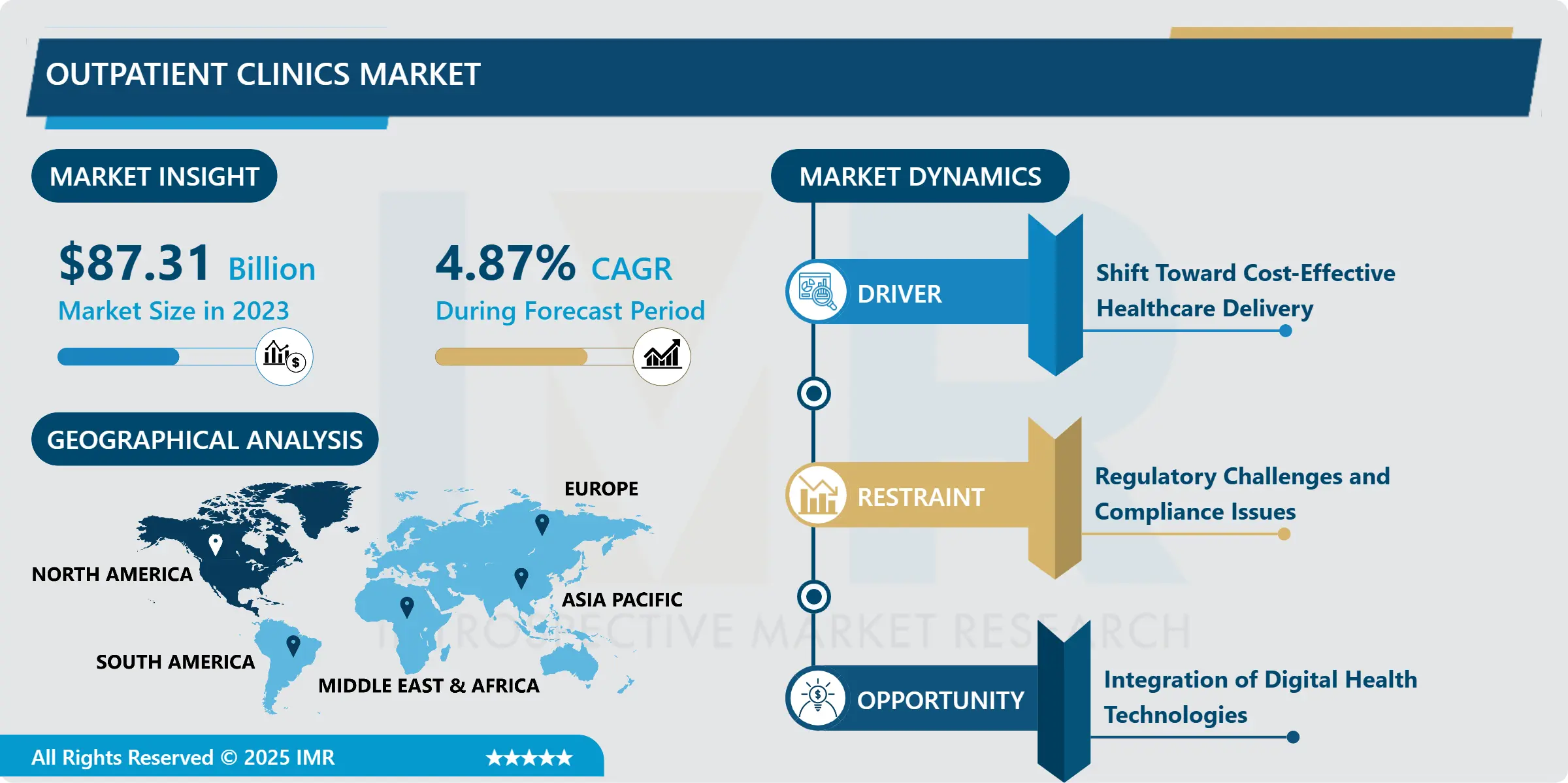

Outpatient Clinics Market Size Was Valued at USD 87.31 Billion in 2023, and is Projected to Reach USD 133.94 Billion by 2032, Growing at a CAGR of 4.87% From 2024-2032.

The Outpatient Clinics Market refers to the segment of the healthcare industry that provides medical services, diagnostic procedures, and minor treatments to patients who do not require overnight hospitalization. These clinics include general practitioner clinics, specialty clinics (e.g., dermatology, cardiology), urgent care centers, and ambulatory surgical centers, and are designed to offer cost-effective, accessible, and timely care.

The global outpatient clinics market has been witnessing steady growth due to the increasing demand for convenient, affordable, and efficient healthcare services. With healthcare systems under pressure from aging populations, chronic disease prevalence, and rising costs, outpatient clinics have emerged as a practical solution for non-emergency treatments and routine checkups. The growing shift from inpatient to outpatient care is also being driven by advancements in medical technology and minimally invasive procedures that reduce the need for hospitalization.

Another key factor contributing to market growth is the expansion of healthcare coverage and government initiatives promoting preventive care and early diagnosis. In both developed and developing regions, outpatient clinics play a vital role in decongesting hospitals while offering quality care. Additionally, the proliferation of walk-in and urgent care centers, along with increased investment in digital health infrastructure such as telemedicine and electronic health records, has enhanced service efficiency and patient satisfaction.

Despite these opportunities, the market faces challenges such as regulatory compliance, workforce shortages, and operational inefficiencies in certain regions. However, rising investments from both public and private players, coupled with innovations in clinic management and patient engagement tools, are expected to sustain the growth trajectory of outpatient clinics worldwide. Strategic partnerships, consolidation among providers, and integration of AI-driven diagnostic tools are further transforming the competitive landscape of this market.

Outpatient Clinics Market Trend Analysis

Shift Toward Cost-Effective Healthcare Delivery

-

The rising healthcare expenditure globally has made cost containment a top priority for governments, insurers, and healthcare providers. Outpatient clinics, by design, offer services that are significantly more affordable compared to inpatient or hospital-based care. With procedures like minor surgeries, diagnostic imaging, and chronic disease management increasingly being performed in outpatient settings, patients benefit from reduced costs without compromising quality. This cost-effectiveness is particularly attractive to uninsured or underinsured populations, further driving patient volumes to these facilities.

- Value-based care models and bundled payment initiatives are encouraging the transition toward outpatient services. Payers and providers are incentivized to reduce unnecessary hospital stays and prioritize efficient care settings. For example, insurers often reimburse outpatient treatments at higher rates compared to inpatient services for the same procedures, making outpatient clinics a financially viable option for healthcare providers. This paradigm shift continues to propel the demand for outpatient clinics, positioning them as key components of modern healthcare delivery systems.

Integration of Digital Health Technologies

-

The increasing adoption of digital health technologies presents a significant growth opportunity for outpatient clinics. Solutions such as telemedicine, remote patient monitoring, electronic health records (EHRs), and mobile health apps enable clinics to expand their reach, enhance patient engagement, and streamline clinical workflows. This is especially relevant post-COVID-19, as patients now expect greater convenience and flexibility in accessing care. By leveraging digital platforms, outpatient clinics can offer virtual consultations, schedule appointments, and provide follow-up care remotely—greatly enhancing service accessibility and continuity of care.

- Moreover, data-driven insights enabled by AI and analytics tools can help outpatient clinics improve diagnostics, treatment planning, and population health management. Clinics that invest in these technologies stand to gain a competitive edge by improving efficiency and patient outcomes. Integration with wearable devices and cloud-based platforms can also support chronic disease management, especially for patients needing ongoing supervision. As regulatory frameworks around telehealth mature and infrastructure investments rise, the digital transformation of outpatient care is poised to unlock new revenue streams and operational efficiencies.

Outpatient Clinics Market Segment Analysis:

Outpatient Clinics Market Segmented on the basis of By Specialty, By Medical Services, By Patient Demographics, By Ownership, By Geographic Location, By Technology Integration, Application, and Region.

By Specialty, the General Outpatient Clinics segment is expected to dominate the market during the forecast period

-

Among the specialty segments, General Outpatient Clinics hold the dominant market share due to their broad service offerings and accessibility to a wide patient population. These clinics typically serve as the first point of contact in the healthcare system, addressing a wide range of non-emergency conditions, chronic disease management, and routine checkups. Their flexibility in treating various age groups and health issues without needing a specialist makes them a critical component of primary healthcare. In both urban and rural settings, general outpatient clinics are often more abundant and easily accessible, contributing to their leading position in the market.

- Furthermore, the demand for general outpatient services is fueled by increasing healthcare awareness, rising prevalence of chronic diseases such as diabetes and hypertension, and the global push for preventive care. These clinics are also more adaptable to integration with digital health platforms, enabling teleconsultations and online appointment scheduling, which further increases patient convenience and clinic efficiency. Their scalability, cost-effectiveness, and ability to reduce the burden on hospitals make general outpatient clinics the backbone of the outpatient services ecosystem.

By Medical Services, the Diagnosis and Treatment segment expected to held the largest share

-

Within the medical services segment, Diagnosis and Treatment leads due to the fundamental role it plays across all specialties and patient needs. Most outpatient visits revolve around diagnosing new conditions or managing existing illnesses, making this the core function of outpatient clinics. Whether it's a cardiology or dermatology clinic, diagnostic services like blood tests, physical exams, and basic imaging, along with appropriate treatment plans, form the foundation of patient care.

- As diagnostic technologies become more advanced and portable, outpatient clinics are increasingly equipped with tools for rapid and accurate assessments, reducing the need for hospital visits. Coupled with treatment offerings like medication management, minor procedures, and therapy sessions, this segment continues to expand. The focus on early disease detection and faster care delivery only strengthens the dominance of diagnosis and treatment services in the outpatient clinic market.

Outpatient Clinics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America, particularly the United States, is projected to lead the outpatient clinics market during the forecast period due to its well-established healthcare infrastructure, high healthcare spending, and widespread insurance coverage. The region benefits from a mature ecosystem of outpatient facilities offering a wide range of services—from preventive care to complex diagnostic procedures—at cost-effective rates compared to inpatient care. Additionally, favorable reimbursement policies, a strong emphasis on value-based healthcare models, and an aging population with chronic disease burdens are contributing to the increased demand for outpatient services.

- Moreover, the rapid adoption of advanced technologies such as telemedicine, electronic health records (EHRs), and AI-powered diagnostics further strengthens North America's dominance. Investments by both public and private healthcare providers in expanding ambulatory care networks, along with a growing preference among patients for shorter wait times and more personalized care, are also key growth drivers. The U.S. government's push for healthcare digitization and outpatient care decentralization aligns well with market trends, making North America a frontrunner in outpatient clinic development and service innovation.

Active Key Players in the Outpatient Clinics Market

-

Aetna Inc. (USA)

- Apollo Hospitals Enterprise Ltd. (India)

- Bupa Global (UK)

- Cigna Healthcare (USA)

- Community Health Systems (USA)

- CVS Health Corporation (USA)

- DaVita Inc. (USA)

- Ethicon (Johnson & Johnson, USA)

- Fresenius Medical Care (Germany)

- HCA Healthcare (USA)

- Healthscope (Australia)

- Kaiser Permanente (USA)

- Mayo Clinic (USA)

- Mediclinic International (South Africa)

- MedStar Health (USA)

- Ramsay Santé (France)

- Sutter Health (USA)

- Tenet Healthcare (USA)

- UnitedHealth Group (USA), and Other Active Players

|

Global Outpatient Clinics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 87.31 Billion |

|

Forecast Period 2024-32 CAGR: |

4.87% |

Market Size in 2032: |

USD 133.94 Billion |

|

Segments Covered: |

By Specialty |

|

|

|

By Medical Services |

|

||

|

By Patient Demographics |

|

||

|

By Ownership |

|

||

|

By Geographic Location |

|

||

|

By Technology Integration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Outpatient Clinics Market by Specialty

4.1 Outpatient Clinics Market Snapshot and Growth Engine

4.2 Outpatient Clinics Market Overview

4.3 General Outpatient Clinics

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 General Outpatient Clinics: Geographic Segmentation Analysis

4.4 Cardiology Clinics

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Cardiology Clinics: Geographic Segmentation Analysis

4.5 Orthopedic Clinics

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Orthopedic Clinics: Geographic Segmentation Analysis

4.6 Dermatology Clinics

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Dermatology Clinics: Geographic Segmentation Analysis

4.7 Gynecology Clinics

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Gynecology Clinics: Geographic Segmentation Analysis

4.8 Pediatric Clinics

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Pediatric Clinics: Geographic Segmentation Analysis

4.9 Dental Clinics

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Dental Clinics: Geographic Segmentation Analysis

4.10 Ophthalmology Clinics

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Ophthalmology Clinics: Geographic Segmentation Analysis

4.11 Others

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.11.3 Key Market Trends, Growth Factors and Opportunities

4.11.4 Others: Geographic Segmentation Analysis

Chapter 5: Outpatient Clinics Market by Medical Services

5.1 Outpatient Clinics Market Snapshot and Growth Engine

5.2 Outpatient Clinics Market Overview

5.3 Diagnosis and Treatment

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Diagnosis and Treatment: Geographic Segmentation Analysis

5.4 Preventive Care

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Preventive Care: Geographic Segmentation Analysis

5.5 Rehabilitation Services

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Rehabilitation Services: Geographic Segmentation Analysis

5.6 Wellness Programs

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Wellness Programs: Geographic Segmentation Analysis

5.7 Laboratory Testing

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Laboratory Testing: Geographic Segmentation Analysis

5.8 Imaging Services (X-rays

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Imaging Services (X-rays: Geographic Segmentation Analysis

5.9 MRI

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 MRI: Geographic Segmentation Analysis

5.10 CT scan

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 CT scan: Geographic Segmentation Analysis

5.11 etc.)

5.11.1 Introduction and Market Overview

5.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.11.3 Key Market Trends, Growth Factors and Opportunities

5.11.4 etc.): Geographic Segmentation Analysis

5.12 Vaccination and Immunization

5.12.1 Introduction and Market Overview

5.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.12.3 Key Market Trends, Growth Factors and Opportunities

5.12.4 Vaccination and Immunization: Geographic Segmentation Analysis

5.13 Chronic Disease Management

5.13.1 Introduction and Market Overview

5.13.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.13.3 Key Market Trends, Growth Factors and Opportunities

5.13.4 Chronic Disease Management: Geographic Segmentation Analysis

5.14 Others

5.14.1 Introduction and Market Overview

5.14.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.14.3 Key Market Trends, Growth Factors and Opportunities

5.14.4 Others: Geographic Segmentation Analysis

Chapter 6: Outpatient Clinics Market by Patient Demographics

6.1 Outpatient Clinics Market Snapshot and Growth Engine

6.2 Outpatient Clinics Market Overview

6.3 Adults

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Adults: Geographic Segmentation Analysis

6.4 Pediatrics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Pediatrics: Geographic Segmentation Analysis

6.5 Geriatrics

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Geriatrics: Geographic Segmentation Analysis

6.6 Women

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Women: Geographic Segmentation Analysis

6.7 Men

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Men: Geographic Segmentation Analysis

6.8 Specific age groups or populations

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Specific age groups or populations: Geographic Segmentation Analysis

Chapter 7: Outpatient Clinics Market by Ownership

7.1 Outpatient Clinics Market Snapshot and Growth Engine

7.2 Outpatient Clinics Market Overview

7.3 Public Clinics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Public Clinics: Geographic Segmentation Analysis

7.4 Private Clinics

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Private Clinics: Geographic Segmentation Analysis

7.5 Non-profit Clinics

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Non-profit Clinics: Geographic Segmentation Analysis

7.6 Hospital-affiliated Clinics

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Hospital-affiliated Clinics: Geographic Segmentation Analysis

7.7 Independent Clinics

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Independent Clinics: Geographic Segmentation Analysis

Chapter 8: Outpatient Clinics Market by Geographic Location

8.1 Outpatient Clinics Market Snapshot and Growth Engine

8.2 Outpatient Clinics Market Overview

8.3 Urban Areas

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Urban Areas: Geographic Segmentation Analysis

8.4 Suburban Areas

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Suburban Areas: Geographic Segmentation Analysis

8.5 Rural Areas

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Rural Areas: Geographic Segmentation Analysis

8.6 Different regions or countries

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Different regions or countries: Geographic Segmentation Analysis

Chapter 9: Outpatient Clinics Market by Technology Integration

9.1 Outpatient Clinics Market Snapshot and Growth Engine

9.2 Outpatient Clinics Market Overview

9.3 Telehealth and Virtual Consultations

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.3.3 Key Market Trends, Growth Factors and Opportunities

9.3.4 Telehealth and Virtual Consultations: Geographic Segmentation Analysis

9.4 Electronic Medical Records (EMR)

9.4.1 Introduction and Market Overview

9.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.4.3 Key Market Trends, Growth Factors and Opportunities

9.4.4 Electronic Medical Records (EMR): Geographic Segmentation Analysis

9.5 Online Appointment Scheduling

9.5.1 Introduction and Market Overview

9.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.5.3 Key Market Trends, Growth Factors and Opportunities

9.5.4 Online Appointment Scheduling: Geographic Segmentation Analysis

9.6 Remote Monitoring

9.6.1 Introduction and Market Overview

9.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.6.3 Key Market Trends, Growth Factors and Opportunities

9.6.4 Remote Monitoring: Geographic Segmentation Analysis

9.7 Digital Health Tools

9.7.1 Introduction and Market Overview

9.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.7.3 Key Market Trends, Growth Factors and Opportunities

9.7.4 Digital Health Tools: Geographic Segmentation Analysis

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Outpatient Clinics Market Share by Manufacturer (2023)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 HCA HEALTHCARE (TENNESSEE)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 ASCENSION HEALTH (MISSOURI)

10.4 KAISER PERMANENTE (CALIFORNIA)

10.5 MAYO CLINIC (MINNESOTA)

10.6 CLEVELAND CLINIC (OHIO)

10.7 JOHNS HOPKINS MEDICINE (MARYLAND)

10.8 TENET HEALTHCARE CORPORATION (TEXAS)

10.9 COMMUNITY HEALTH SYSTEMS (TENNESSEE)

10.10 MOUNT SINAI HEALTH SYSTEM (NEW YORK)

10.11 UPMC (UNIVERSITY OF PITTSBURGH MEDICAL CENTER) (PENNSYLVANIA)

10.12 OTHER ACTIVE PLAYERS

Chapter 11: Global Outpatient Clinics Market By Region

11.1 Overview

11.2. North America Outpatient Clinics Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By Specialty

11.2.4.1 General Outpatient Clinics

11.2.4.2 Cardiology Clinics

11.2.4.3 Orthopedic Clinics

11.2.4.4 Dermatology Clinics

11.2.4.5 Gynecology Clinics

11.2.4.6 Pediatric Clinics

11.2.4.7 Dental Clinics

11.2.4.8 Ophthalmology Clinics

11.2.4.9 Others

11.2.5 Historic and Forecasted Market Size By Medical Services

11.2.5.1 Diagnosis and Treatment

11.2.5.2 Preventive Care

11.2.5.3 Rehabilitation Services

11.2.5.4 Wellness Programs

11.2.5.5 Laboratory Testing

11.2.5.6 Imaging Services (X-rays

11.2.5.7 MRI

11.2.5.8 CT scan

11.2.5.9 etc.)

11.2.5.10 Vaccination and Immunization

11.2.5.11 Chronic Disease Management

11.2.5.12 Others

11.2.6 Historic and Forecasted Market Size By Patient Demographics

11.2.6.1 Adults

11.2.6.2 Pediatrics

11.2.6.3 Geriatrics

11.2.6.4 Women

11.2.6.5 Men

11.2.6.6 Specific age groups or populations

11.2.7 Historic and Forecasted Market Size By Ownership

11.2.7.1 Public Clinics

11.2.7.2 Private Clinics

11.2.7.3 Non-profit Clinics

11.2.7.4 Hospital-affiliated Clinics

11.2.7.5 Independent Clinics

11.2.8 Historic and Forecasted Market Size By Geographic Location

11.2.8.1 Urban Areas

11.2.8.2 Suburban Areas

11.2.8.3 Rural Areas

11.2.8.4 Different regions or countries

11.2.9 Historic and Forecasted Market Size By Technology Integration

11.2.9.1 Telehealth and Virtual Consultations

11.2.9.2 Electronic Medical Records (EMR)

11.2.9.3 Online Appointment Scheduling

11.2.9.4 Remote Monitoring

11.2.9.5 Digital Health Tools

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Outpatient Clinics Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By Specialty

11.3.4.1 General Outpatient Clinics

11.3.4.2 Cardiology Clinics

11.3.4.3 Orthopedic Clinics

11.3.4.4 Dermatology Clinics

11.3.4.5 Gynecology Clinics

11.3.4.6 Pediatric Clinics

11.3.4.7 Dental Clinics

11.3.4.8 Ophthalmology Clinics

11.3.4.9 Others

11.3.5 Historic and Forecasted Market Size By Medical Services

11.3.5.1 Diagnosis and Treatment

11.3.5.2 Preventive Care

11.3.5.3 Rehabilitation Services

11.3.5.4 Wellness Programs

11.3.5.5 Laboratory Testing

11.3.5.6 Imaging Services (X-rays

11.3.5.7 MRI

11.3.5.8 CT scan

11.3.5.9 etc.)

11.3.5.10 Vaccination and Immunization

11.3.5.11 Chronic Disease Management

11.3.5.12 Others

11.3.6 Historic and Forecasted Market Size By Patient Demographics

11.3.6.1 Adults

11.3.6.2 Pediatrics

11.3.6.3 Geriatrics

11.3.6.4 Women

11.3.6.5 Men

11.3.6.6 Specific age groups or populations

11.3.7 Historic and Forecasted Market Size By Ownership

11.3.7.1 Public Clinics

11.3.7.2 Private Clinics

11.3.7.3 Non-profit Clinics

11.3.7.4 Hospital-affiliated Clinics

11.3.7.5 Independent Clinics

11.3.8 Historic and Forecasted Market Size By Geographic Location

11.3.8.1 Urban Areas

11.3.8.2 Suburban Areas

11.3.8.3 Rural Areas

11.3.8.4 Different regions or countries

11.3.9 Historic and Forecasted Market Size By Technology Integration

11.3.9.1 Telehealth and Virtual Consultations

11.3.9.2 Electronic Medical Records (EMR)

11.3.9.3 Online Appointment Scheduling

11.3.9.4 Remote Monitoring

11.3.9.5 Digital Health Tools

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Outpatient Clinics Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By Specialty

11.4.4.1 General Outpatient Clinics

11.4.4.2 Cardiology Clinics

11.4.4.3 Orthopedic Clinics

11.4.4.4 Dermatology Clinics

11.4.4.5 Gynecology Clinics

11.4.4.6 Pediatric Clinics

11.4.4.7 Dental Clinics

11.4.4.8 Ophthalmology Clinics

11.4.4.9 Others

11.4.5 Historic and Forecasted Market Size By Medical Services

11.4.5.1 Diagnosis and Treatment

11.4.5.2 Preventive Care

11.4.5.3 Rehabilitation Services

11.4.5.4 Wellness Programs

11.4.5.5 Laboratory Testing

11.4.5.6 Imaging Services (X-rays

11.4.5.7 MRI

11.4.5.8 CT scan

11.4.5.9 etc.)

11.4.5.10 Vaccination and Immunization

11.4.5.11 Chronic Disease Management

11.4.5.12 Others

11.4.6 Historic and Forecasted Market Size By Patient Demographics

11.4.6.1 Adults

11.4.6.2 Pediatrics

11.4.6.3 Geriatrics

11.4.6.4 Women

11.4.6.5 Men

11.4.6.6 Specific age groups or populations

11.4.7 Historic and Forecasted Market Size By Ownership

11.4.7.1 Public Clinics

11.4.7.2 Private Clinics

11.4.7.3 Non-profit Clinics

11.4.7.4 Hospital-affiliated Clinics

11.4.7.5 Independent Clinics

11.4.8 Historic and Forecasted Market Size By Geographic Location

11.4.8.1 Urban Areas

11.4.8.2 Suburban Areas

11.4.8.3 Rural Areas

11.4.8.4 Different regions or countries

11.4.9 Historic and Forecasted Market Size By Technology Integration

11.4.9.1 Telehealth and Virtual Consultations

11.4.9.2 Electronic Medical Records (EMR)

11.4.9.3 Online Appointment Scheduling

11.4.9.4 Remote Monitoring

11.4.9.5 Digital Health Tools

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Outpatient Clinics Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By Specialty

11.5.4.1 General Outpatient Clinics

11.5.4.2 Cardiology Clinics

11.5.4.3 Orthopedic Clinics

11.5.4.4 Dermatology Clinics

11.5.4.5 Gynecology Clinics

11.5.4.6 Pediatric Clinics

11.5.4.7 Dental Clinics

11.5.4.8 Ophthalmology Clinics

11.5.4.9 Others

11.5.5 Historic and Forecasted Market Size By Medical Services

11.5.5.1 Diagnosis and Treatment

11.5.5.2 Preventive Care

11.5.5.3 Rehabilitation Services

11.5.5.4 Wellness Programs

11.5.5.5 Laboratory Testing

11.5.5.6 Imaging Services (X-rays

11.5.5.7 MRI

11.5.5.8 CT scan

11.5.5.9 etc.)

11.5.5.10 Vaccination and Immunization

11.5.5.11 Chronic Disease Management

11.5.5.12 Others

11.5.6 Historic and Forecasted Market Size By Patient Demographics

11.5.6.1 Adults

11.5.6.2 Pediatrics

11.5.6.3 Geriatrics

11.5.6.4 Women

11.5.6.5 Men

11.5.6.6 Specific age groups or populations

11.5.7 Historic and Forecasted Market Size By Ownership

11.5.7.1 Public Clinics

11.5.7.2 Private Clinics

11.5.7.3 Non-profit Clinics

11.5.7.4 Hospital-affiliated Clinics

11.5.7.5 Independent Clinics

11.5.8 Historic and Forecasted Market Size By Geographic Location

11.5.8.1 Urban Areas

11.5.8.2 Suburban Areas

11.5.8.3 Rural Areas

11.5.8.4 Different regions or countries

11.5.9 Historic and Forecasted Market Size By Technology Integration

11.5.9.1 Telehealth and Virtual Consultations

11.5.9.2 Electronic Medical Records (EMR)

11.5.9.3 Online Appointment Scheduling

11.5.9.4 Remote Monitoring

11.5.9.5 Digital Health Tools

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Outpatient Clinics Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By Specialty

11.6.4.1 General Outpatient Clinics

11.6.4.2 Cardiology Clinics

11.6.4.3 Orthopedic Clinics

11.6.4.4 Dermatology Clinics

11.6.4.5 Gynecology Clinics

11.6.4.6 Pediatric Clinics

11.6.4.7 Dental Clinics

11.6.4.8 Ophthalmology Clinics

11.6.4.9 Others

11.6.5 Historic and Forecasted Market Size By Medical Services

11.6.5.1 Diagnosis and Treatment

11.6.5.2 Preventive Care

11.6.5.3 Rehabilitation Services

11.6.5.4 Wellness Programs

11.6.5.5 Laboratory Testing

11.6.5.6 Imaging Services (X-rays

11.6.5.7 MRI

11.6.5.8 CT scan

11.6.5.9 etc.)

11.6.5.10 Vaccination and Immunization

11.6.5.11 Chronic Disease Management

11.6.5.12 Others

11.6.6 Historic and Forecasted Market Size By Patient Demographics

11.6.6.1 Adults

11.6.6.2 Pediatrics

11.6.6.3 Geriatrics

11.6.6.4 Women

11.6.6.5 Men

11.6.6.6 Specific age groups or populations

11.6.7 Historic and Forecasted Market Size By Ownership

11.6.7.1 Public Clinics

11.6.7.2 Private Clinics

11.6.7.3 Non-profit Clinics

11.6.7.4 Hospital-affiliated Clinics

11.6.7.5 Independent Clinics

11.6.8 Historic and Forecasted Market Size By Geographic Location

11.6.8.1 Urban Areas

11.6.8.2 Suburban Areas

11.6.8.3 Rural Areas

11.6.8.4 Different regions or countries

11.6.9 Historic and Forecasted Market Size By Technology Integration

11.6.9.1 Telehealth and Virtual Consultations

11.6.9.2 Electronic Medical Records (EMR)

11.6.9.3 Online Appointment Scheduling

11.6.9.4 Remote Monitoring

11.6.9.5 Digital Health Tools

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Outpatient Clinics Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By Specialty

11.7.4.1 General Outpatie

|

Global Outpatient Clinics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 87.31 Billion |

|

Forecast Period 2024-32 CAGR: |

4.87% |

Market Size in 2032: |

USD 133.94 Billion |

|

Segments Covered: |

By Specialty |

|

|

|

By Medical Services |

|

||

|

By Patient Demographics |

|

||

|

By Ownership |

|

||

|

By Geographic Location |

|

||

|

By Technology Integration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||