Organic Spices Market Synopsis

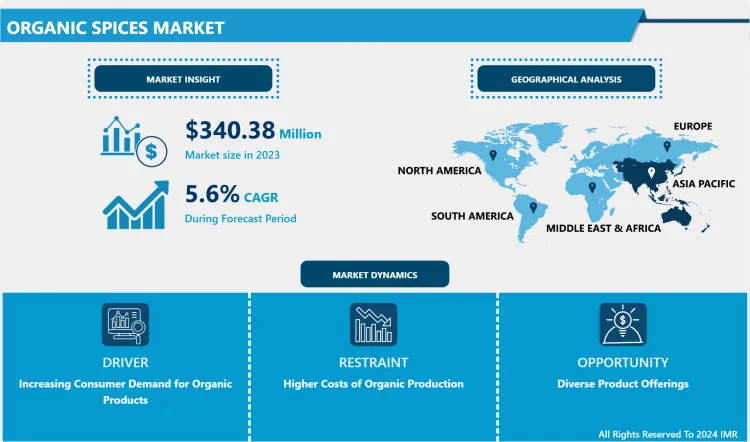

Global Organic Spices Market Size Was Valued at USD 340.38 Million in 2024, and is Projected to Reach USD 555.83 Million by 2032, Growing at a CAGR of 5.6% From 2025-2032.

Organic spices are nothing but seeds, leaves, bark, dried fruits and roots which is used for medicinal purpose and especially for cooking purpose to add the flavor, aroma and color to the food. The spices are introduced by India to the global level market which tends to boost the growth of the market in Asia Pacific region. Several spices are available in the form of powder, whole and chopped forms. Most of the used spices are Chili powder Cumin, Coriander, Cinnamon, Cardamon, Ginger, and Turmeric.

Black pepper is primarily used worldwide and accounted for the largest share in the global spice market. The modern day use of spices is limited to taste and flavor but they are extensively used for their health benefit thus influencing the growth of the organic spice market during the forecast period. For instance, Turmeric helps as internal and external application such as it is used to manage diabetes by lowering blood glucose level, reduces complications like ulcer, wounds, kidney damage and skin problems.

Spices are being used as flavoring agent, coloring agent, or as a preservative in different types of food products. Cardamom, clove, black pepper, cumin, coriander seeds, mustard seeds, fenugreek, turmeric, and saffron are some of the spices that are witnessing considerable growth in the global market. Asia-Pacific region has witnessed higher rate of consumption for these spices, owing to rise in demand and preference for spicy food in the region. Asia-Pacific is also the main producer and exporter for different types of spices.

.webp)

Organic Spices Market Trend Analysis

Increasing Consumer Demand for Organic Products

- Consumers are becoming more health-conscious and are actively seeking food products that are perceived as healthier and more natural. Organic spices, being free from synthetic pesticides and chemicals, align with the preferences of health-conscious consumers.

- Many organic spices are known to have nutritional benefits, including antioxidant properties and potential anti-inflammatory effects. Consumers are increasingly aware of these health benefits and are incorporating organic spices into their diets for both flavor and wellness.

- Consumers are more environmentally conscious and are choosing products that are produced through sustainable and eco-friendly practices. Organic farming methods, which avoid synthetic chemicals, are considered more sustainable, leading to an increased demand for organic spices.

- Organic products are often associated with higher quality and purity. Consumers perceive organic spices as being free from artificial additives and chemicals, leading to a preference for these products over conventional counterparts.

- Growing concerns about food safety, including pesticide residues in conventional products, drive consumers to choose organic options. Organic spices offer a safer alternative, as they are produced without the use of synthetic pesticides and herbicides.

Diverse Product Offerings

- Consumers have diverse culinary preferences, influenced by regional cuisines, cultural backgrounds, and personal tastes. Offering a wide range of organic spice products allows businesses to cater to this diversity and appeal to a broader customer base.

- There is a growing interest among consumers in exploring exotic and specialty spices from different parts of the world. Organic spice producers can capitalize on this trend by offering unique and hard-to-find spices, providing consumers with an opportunity to experiment with new flavors.

- Developing signature spice blends that are exclusive to a brand adds a unique selling proposition. These blends can be curated for specific dishes or cuisines, offering convenience to consumers and reinforcing brand identity.

- Diverse product offerings can include spice blends that cater to specific dietary preferences, such as low-sodium, gluten-free, or vegan options. Additionally, creating blends with health-focused ingredients can align with current wellness trends.

- Introducing seasonal or limited edition organic spice blends creates a sense of exclusivity and urgency among consumers. These offerings can coincide with holidays, festivals, or special occasions, encouraging repeat purchases.

Organic Spices Market Segment Analysis:

Organic Spices Market Segmented on the basis of Product Type, Application, Form and Distribution Channel.

By Product Type, Turmeric segment is expected to dominate the market during the forecast period

- Turmeric contains curcumin, a compound with potential health benefits, including anti-inflammatory and antioxidant properties. Increased consumer awareness of these health benefits has driven demand for organic turmeric.

- Turmeric is a staple in many global cuisines, especially in South Asian and Middle Eastern dishes. Its versatility makes it a popular choice for consumers looking to enhance the flavor and color of their dishes.

- Turmeric has a long history of use in traditional medicine, particularly in Ayurveda. The growing interest in natural remedies and traditional healing practices has contributed to the popularity of organic turmeric.

- With a rising emphasis on natural and organic products, consumers are seeking alternatives to conventional spices. Organic turmeric aligns with this trend, as it is grown without synthetic pesticides and chemicals.

- Turmeric has found its way into various functional food and beverage products, including turmeric-infused teas, lattes, and health supplements. This diversification of turmeric products has expanded its market presence.

By Form, Powder segment held the largest share of 41.17% during forecasted period

- Powdered products are often versatile and can be used in various applications. They might be easier to formulate for different purposes, making them more appealing to a broad audience.

- Powders tend to have a longer shelf life and can be more stable than some other forms, such as liquids. This can be advantageous for both consumers and manufacturers.

- Ease of Transportation and Storage: Powders are often more compact and lightweight than liquids, making transportation and storage more cost-effective. This can be particularly important for products that need to be shipped over long distances.

- Powders can be easier to customize in terms of concentration or dosage. Consumers may appreciate the ability to control the strength or amount of the product they use.

- Manufacturing processes for powders may be more efficient, leading to cost savings for producers. This efficiency can contribute to a more competitive pricing strategy.

Organic Spices Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Many countries in the Asia Pacific region have favourable climates and natural conditions for growing spices. Organic farming practices are often more easily implemented in regions where the climate is conducive to the cultivation of spices without the need for excessive synthetic inputs.

- Some countries in Asia Pacific have a long history of traditional farming practices that align with organic principles. Farmers in these regions may have been using organic methods for generations, making the transition to certified organic farming relatively seamless.

- Asia Pacific is known for its diverse and rich culinary traditions, with spices playing a crucial role in many cuisines. This cultural significance may drive both the demand for organic spices within the region and the production to meet this demand.

- As global awareness of health and environmental issues grows, there has been an increased demand for organic and sustainable products. Consumers in the Asia Pacific region may be increasingly aware of the benefits of organic spices, both in terms of personal health and environmental sustainability.

- Some countries in the Asia Pacific region, such as India and Vietnam, are major exporters of spices. The demand for organic spices in international markets, including Europe and North America, has contributed to the growth of the organic spices market in the region.

Organic Spices Market Top Key Players:

- Frontier Co-op (US)

- Organic Spices Inc. (US)

- Earthy Delights (US)

- The Spice Hunter (US)

- Organic Wise (US)

- McCormick & Company, Inc. (US)

- Naturevibe Botanicals (US)

- Rising Sun Farms (US)

- Organic Gemini (US)

- Pure Indian Foods (US)

- Mountain Rose Herbs (US)

- SunOpta Inc. (Canada)

- Simply Organic (US)

- Pacific Spice Company, Inc. (US)

- Live Organic (India)

- Earl's Organic Produce (US)

- Spice Sanctuary (Canada)

- Greenfields (UK)

- Sambavanilla (Madagascar)

- Organic Products India (India)

- Yogi Botanicals Pvt. Ltd. (India)

- Organic Tattva (India)

- BiovaGaya Biotech Pvt Ltd (India)

- Organic Spices (India)

- Sunrise Nutrachem Group (China), and Other Active Player

Key Industry Developments in the Organic Spices Market:

In October 2023, Frontier Natural Products, a leading organic spice player, expands its offerings with a new line of single-origin organic turmeric sourced directly from Indian farmers. This move aims to tap into the growing demand for ethical sourcing and traceability.

In September 2023, McAvoy Foods, a major spice distributor, announces a partnership with Organic Spices Inc. to launch a line of certified organic spice blends. This collaboration caters to the rising interest in convenience and flavor exploration among home cooks

|

Organic Spices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 2023 |

Market Size in 2025: |

USD 340.38 Mn. |

|

Forecast Period 2025-32 CAGR: |

5.6 % |

Market Size in 2032: |

USD 555.83 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Organic Spices Market by Product Type (2018-2032)

4.1 Organic Spices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Ginger

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Turmeric

4.5 Clove

4.6 Pepper

4.7 Cinnamon

4.8 Nutmeg

Chapter 5: Organic Spices Market by Application (2018-2032)

5.1 Organic Spices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Flavouring Agent

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Colouring Agent

5.5 Preservatives

Chapter 6: Organic Spices Market by Form (2018-2032)

6.1 Organic Spices Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Powder

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Granular

6.5 Extract

6.6 and Raw

Chapter 7: Organic Spices Market by Distribution Channel (2018-2032)

7.1 Organic Spices Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Direct

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Indirect

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Organic Spices Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 IMPOSSIBLE FOODS (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BEYOND MEAT (US)

8.4 MEMPHIS MEATS (US)

8.5 PERFECT DAY (US)

8.6 CLARA FOODS (US)

8.7 MYCOTECHNOLOGY (US)

8.8 TERRAMINO FOODS (US)

8.9 NOVONUTRIENTS (US)

8.10 BLUENALU (US)

8.11 BENSON HILL (US)

8.12 NEW AGE MEATS (US)

8.13 WILD TYPE (US)

8.14 EAT JUST INC. (FORMERLY HAMPTON CREEK) (US)

8.15 MOTIF FOODWORKS (US)

8.16 GELTOR (US)

8.17 CELLULAR AGRICULTURE LTD. (CANADA)

8.18 BIFTEK (CANADA)

8.19 QUORN FOODS (UK)

8.20 MOSA MEAT (NETHERLANDS)

8.21 NUTRECO (NETHERLANDS)

8.22 SOLAR FOODS (FINLAND)

8.23 BIOFOOD SYSTEMS (FRANCE)

8.24 NOTCO (CHILE)

8.25 SHIOK MEATS (SINGAPORE)

8.26 ALEPH FARMS (ISRAEL)

Chapter 9: Global Organic Spices Market By Region

9.1 Overview

9.2. North America Organic Spices Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Ginger

9.2.4.2 Turmeric

9.2.4.3 Clove

9.2.4.4 Pepper

9.2.4.5 Cinnamon

9.2.4.6 Nutmeg

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Flavouring Agent

9.2.5.2 Colouring Agent

9.2.5.3 Preservatives

9.2.6 Historic and Forecasted Market Size by Form

9.2.6.1 Powder

9.2.6.2 Granular

9.2.6.3 Extract

9.2.6.4 and Raw

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Direct

9.2.7.2 Indirect

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Organic Spices Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Ginger

9.3.4.2 Turmeric

9.3.4.3 Clove

9.3.4.4 Pepper

9.3.4.5 Cinnamon

9.3.4.6 Nutmeg

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Flavouring Agent

9.3.5.2 Colouring Agent

9.3.5.3 Preservatives

9.3.6 Historic and Forecasted Market Size by Form

9.3.6.1 Powder

9.3.6.2 Granular

9.3.6.3 Extract

9.3.6.4 and Raw

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Direct

9.3.7.2 Indirect

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Organic Spices Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Ginger

9.4.4.2 Turmeric

9.4.4.3 Clove

9.4.4.4 Pepper

9.4.4.5 Cinnamon

9.4.4.6 Nutmeg

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Flavouring Agent

9.4.5.2 Colouring Agent

9.4.5.3 Preservatives

9.4.6 Historic and Forecasted Market Size by Form

9.4.6.1 Powder

9.4.6.2 Granular

9.4.6.3 Extract

9.4.6.4 and Raw

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Direct

9.4.7.2 Indirect

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Organic Spices Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Ginger

9.5.4.2 Turmeric

9.5.4.3 Clove

9.5.4.4 Pepper

9.5.4.5 Cinnamon

9.5.4.6 Nutmeg

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Flavouring Agent

9.5.5.2 Colouring Agent

9.5.5.3 Preservatives

9.5.6 Historic and Forecasted Market Size by Form

9.5.6.1 Powder

9.5.6.2 Granular

9.5.6.3 Extract

9.5.6.4 and Raw

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Direct

9.5.7.2 Indirect

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Organic Spices Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Ginger

9.6.4.2 Turmeric

9.6.4.3 Clove

9.6.4.4 Pepper

9.6.4.5 Cinnamon

9.6.4.6 Nutmeg

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Flavouring Agent

9.6.5.2 Colouring Agent

9.6.5.3 Preservatives

9.6.6 Historic and Forecasted Market Size by Form

9.6.6.1 Powder

9.6.6.2 Granular

9.6.6.3 Extract

9.6.6.4 and Raw

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Direct

9.6.7.2 Indirect

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Organic Spices Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Ginger

9.7.4.2 Turmeric

9.7.4.3 Clove

9.7.4.4 Pepper

9.7.4.5 Cinnamon

9.7.4.6 Nutmeg

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Flavouring Agent

9.7.5.2 Colouring Agent

9.7.5.3 Preservatives

9.7.6 Historic and Forecasted Market Size by Form

9.7.6.1 Powder

9.7.6.2 Granular

9.7.6.3 Extract

9.7.6.4 and Raw

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Direct

9.7.7.2 Indirect

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Organic Spices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 2023 |

Market Size in 2025: |

USD 340.38 Mn. |

|

Forecast Period 2025-32 CAGR: |

5.6 % |

Market Size in 2032: |

USD 555.83 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||