Organic Bedding Market Synopsis

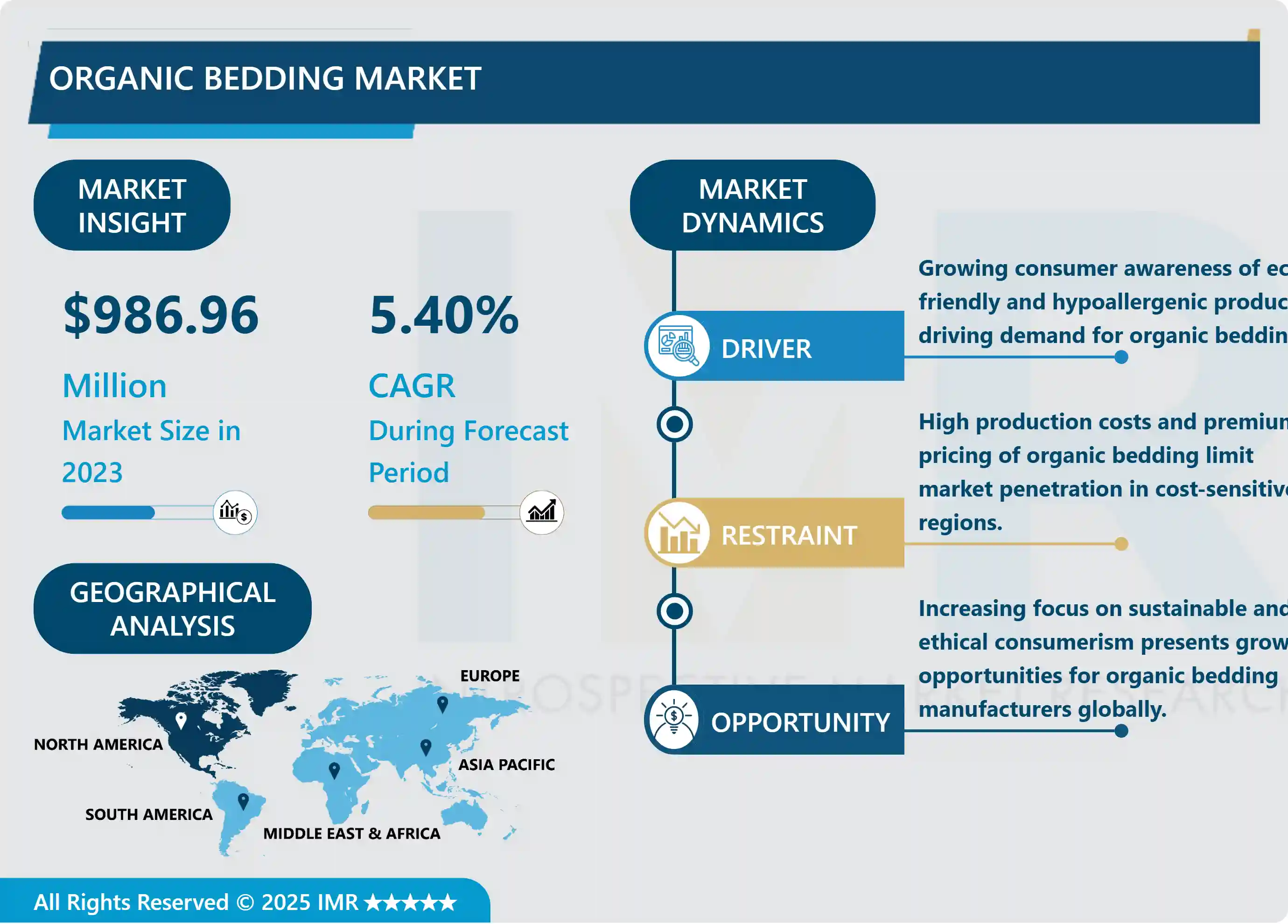

Organic Bedding Market Size is Valued at USD 986.96 Million in 2024, and is Projected to Reach USD 1503.23 Million by 2032, Growing at a CAGR of 5.4% From 2024-2032.

The market for organic bedding has been growing rapidly to influence the need to enhance the health status, wellness, and environmental concerns. Organic bedding products include sheets, pillows and mattress which are made of organic cotton, bamboo fiber and wool with no use of chemicals, pesticides and synthetic dyes. There are higher tendencies of consumer preference for ecological and non-allergic organic bedding in a healthier world today.

North America and Europe are the most significant markets, due to the increasing demand for environmentally friendly solutions for consumers aiming at sustainable living. All these regions have experienced increased production of organic bedding manufacturers who deal in quality tested and certified fabrics that conform to the International organic textile standards. Further, the market has grown due to the rising trend of sustainability in home furnishing.

Increased research on organic fabric technologies and improvement in consumer’s purchasing power are some of the reasons that is likely to see further growth. Due to the increased demand for luxury but eco-friendly products, the organic bedding market seems to spread to other regions, Asia-Pacific region inclusive.

Organic Bedding Market Trend Analysis

Increasing Demand for Hypoallergenic and Eco-Friendly Bedding

- Currently, the organic bedding market is showing a great demand for hypoallergenic and environment-oriented products due to increasing concern over health issues. Enabled bedding items, for instance, organic cotton, bamboo and wool are hypo-allergic due to their natural properties thus appropriate for use by allergic or sensitive skin persons. These materials do not have any chemicals, pesticides, and synthetic dyes, which matches the globally increasing trend of people demanding natural and chemical-free products. This is also brought about by an added concern to natural or organic living since consumers want a better quality bedding solution that will help improve sleep quality while reducing the negative effects on the environment.

- It is now noteworthy that the growth of global sales of organic bedding is due to a growing demand for hypoallergenic and environmentally friendly bedding items. Due to the marked trend towards using environmentally friendly products and health awareness people now prefer those bedding products that are made from natural, chemical free fabrics such as organic cotton, bamboo or wool. This tendency is caused by rising awareness of the harm that conventional bedding, produced from synthetic fibres and using aggressive chemicals in processing, inflicts to health and the environment. Organic bedding is a better, toxin-free choice; giving comfort together with being relevant to a green, modern lifestyle.

Rise of Sustainable and Ethical Consumerism

- Ethical consumption and organic perspectives are getting into market trend in the organic bedding due to concern of fair trade products and resourceful sourcing. The brands that are more specific on their products; labeling this as Organic certified, being very vocal about their sources of inputs and the package they use when packing their food products are being demanded. Some consumers are also special interested in the type that requires minimal water usage and carbon emission during its processing. Consequently, the manufacturing techniques are becoming significantly more environmentally friendly, and renewable resources of energy together with biodegradable packaging for organic bedding market are being provided at various companies.

- The rise of sustainable and ethical consumerism is significantly shaping the organic bedding market, as more consumers are becoming conscious of the environmental and social impact of their purchases. Shoppers are seeking out brands that prioritize sustainability in their production processes, such as using organic and renewable materials, reducing water consumption, and lowering carbon emissions. Ethical practices, including fair wages for workers and cruelty-free manufacturing, are also top considerations for consumers. This trend is driving companies to adopt greener practices and transparent sourcing, ensuring that their products not only meet consumer demands for comfort and luxury but also align with their values of sustainability and ethical responsibility.

Organic Bedding Market Segment Analysis:

Organic Bedding Market Segmented on the basis of By Product Type, By Application and Distribution Channel

By Product Type, Mattress segment is expected to dominate the market during the forecast period

- Organic bedding market by type We can categorize the organic bedding market based on product type as mattresses, bed linens, pillows and blankets, and others. From these, the organic mattresses are receiving considerable market attention because of the realization that conventional ones cause infertility, contain synthetic material and chemicals. Organic mattresses, normally sourced from natural latex, organic cotton or wool are chemical-free hence regarded as essential by conscious consumers. Other important segment is bed linens including sheets, pillowcases, and duvet covers, because it covers the skin. Organic bedding in forms of bed linen from organic cotton or bamboo are preferred because of ease of breathing, soft texture as well as being hypoallergenic.

- Pillows and blankets are also potential products to enter into the segment as consumers are becoming more conscious about natural, non toxic product. Traditional organic pillows are soft and can be made from organic cotton, wool and natural latex without the use of chemicals. Likewise, organic blankets are produced using materials that are non abrasive to the skin and are eco friendly. The ‘others’ segment in Specific Product Segment includes product like mattress toppers and comforters which are also gaining traction as the completion of organic bedding sets. Through this diversified product segmentation, the manufacturers are capable of appealing for different customers, thereby fueling market growth.

By Distribution Channel, Offline Retail segment held the largest share in 2024

- Organic bedding market by channel: Offline retail, online retail, independent retailers/exclusive stores and specialty store. The last touching point is still offline retail, and once again, specialty stores/standalone retailers remain important even though they only represent 12% of all retail sales because they offer a personal experience. Most consumers lack confidence in buying organic bedding online, but like to feel and touch the quality of the fabric and texture before buying and hence buy form specialty shops. There are usually specialist independent dealers who sell exclusive top quality organic bedding and the products are environmental friendly appealing to the conscience of the shoppers.

- Online retail on the other hand is relatively young growing strongly in organic bedding due to advancement in e-commerce. The reason why it is popular among the consumers is found in its ability to offer a wide range of products, easier comparison, and home delivery. Pulp has been a beneficiary of increased digital migration by many brands through DTC webstores and affiliations with e-tailers. This distribution channel also enable brands to get a wider client base around the world, thus increasing its market frontiers beyond the local outlets.

Organic Bedding Market Regional Insights:

Asia-Pacific is expected to dominate the market

- Asia-Pacific is also expected to be the largest market for organic bedding due to rising health consciousness and environmental consciousness together with the growing income per capita. Moreover, the public is becoming more selective with what it brings to its home and due to this; there is growing popularity of organic bedding manufactured from natural resources without application of chemicals. Nowadays, there is an increasing number of people in the countries like China, India or Japan who prefers organic bedding and other home products. The growth in the middle income earners, together with, increased urbanization is putting pressure towards the change of this culture towards healthier and sustainable practices in the region.

- However, there is evidence that the Asia-Pacific region has the upper hand when it comes to unprocessed materials especially originating from India, where the material used in manufacturing the clothes; organic cotton is in abundance. Thus, besides the growth of the local supply of raw materials and reduction in production costs, manufacturers can meet the continuing demand both domestically and internationally. Consequently, more and more global companies are continuing their growth in the Asia-Pacific area, which was once again leading the organic bedding market.

Active Key Players in the Organic Bedding Market

- Good Night Naturals (U.S.)

- Parachute Home (U.S.)

- COYUCHI (U.S.)

- L.L.Bean Inc. (U.S.)

- Boll & Branch LLC (U.S.)

- WJ Southard (U.S.)

- Plover Organic LLC (U.S.)

- Magnolia Organics (U.S.)

- Organic Mattresses, Inc. (U.S.)

- SOL Organics. (U.S.)

- Under the Canopy (U.S.)

- Others

|

Global Organic Bedding Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 986.96 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.4% |

Market Size in 2032: |

USD 1503.23 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Organic Bedding Market by Product Type (2018-2032)

4.1 Organic Bedding Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Mattress

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bed Linen

4.5 Pillows

4.6 Blankets

4.7 Others

Chapter 5: Organic Bedding Market by Application (2018-2032)

5.1 Organic Bedding Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Commercial Application

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Household Application

Chapter 6: Organic Bedding Market by Distribution Channel (2018-2032)

6.1 Organic Bedding Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Offline Retail

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Online Retail

6.5 Independent Retailers/Exclusive Stores

6.6 Specialty Stores

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Organic Bedding Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 GOOD NIGHT NATURALS (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PARACHUTE HOME (U.S.)

7.4 COYUCHI (U.S.)

7.5 L.L.BEAN INC. (U.S.)

7.6 BOLL & BRANCH LLC (U.S.)

7.7 WJ SOUTHARD (U.S.)

7.8 PLOVER ORGANIC LLC (U.S.)

7.9 MAGNOLIA ORGANICS (U.S.)

7.10 ORGANIC MATTRESSES INC. (U.S.)

7.11 SOL ORGANICS. (U.S.)

7.12 UNDER THE CANOPY (U.S.)

7.13 OTHERS

7.14

Chapter 8: Global Organic Bedding Market By Region

8.1 Overview

8.2. North America Organic Bedding Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Mattress

8.2.4.2 Bed Linen

8.2.4.3 Pillows

8.2.4.4 Blankets

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Commercial Application

8.2.5.2 Household Application

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Offline Retail

8.2.6.2 Online Retail

8.2.6.3 Independent Retailers/Exclusive Stores

8.2.6.4 Specialty Stores

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Organic Bedding Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Mattress

8.3.4.2 Bed Linen

8.3.4.3 Pillows

8.3.4.4 Blankets

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Commercial Application

8.3.5.2 Household Application

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Offline Retail

8.3.6.2 Online Retail

8.3.6.3 Independent Retailers/Exclusive Stores

8.3.6.4 Specialty Stores

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Organic Bedding Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Mattress

8.4.4.2 Bed Linen

8.4.4.3 Pillows

8.4.4.4 Blankets

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Commercial Application

8.4.5.2 Household Application

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Offline Retail

8.4.6.2 Online Retail

8.4.6.3 Independent Retailers/Exclusive Stores

8.4.6.4 Specialty Stores

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Organic Bedding Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Mattress

8.5.4.2 Bed Linen

8.5.4.3 Pillows

8.5.4.4 Blankets

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Commercial Application

8.5.5.2 Household Application

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Offline Retail

8.5.6.2 Online Retail

8.5.6.3 Independent Retailers/Exclusive Stores

8.5.6.4 Specialty Stores

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Organic Bedding Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Mattress

8.6.4.2 Bed Linen

8.6.4.3 Pillows

8.6.4.4 Blankets

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Commercial Application

8.6.5.2 Household Application

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Offline Retail

8.6.6.2 Online Retail

8.6.6.3 Independent Retailers/Exclusive Stores

8.6.6.4 Specialty Stores

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Organic Bedding Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Mattress

8.7.4.2 Bed Linen

8.7.4.3 Pillows

8.7.4.4 Blankets

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Commercial Application

8.7.5.2 Household Application

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Offline Retail

8.7.6.2 Online Retail

8.7.6.3 Independent Retailers/Exclusive Stores

8.7.6.4 Specialty Stores

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Organic Bedding Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 986.96 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.4% |

Market Size in 2032: |

USD 1503.23 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||