Bath Fittings Market Synopsis

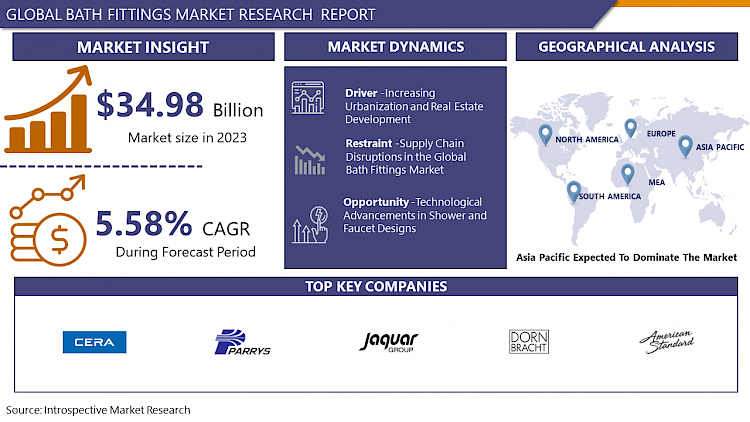

Bath Fittings Market Size Was Valued at USD 34.98 Billion in 2023, and is Projected to Reach USD 57.02 Billion by 2032, Growing at a CAGR of 5.58% From 2024-2032.

The Bath Fittings Market comprises items like the bathtub fittings, shower, taps and other related accessories fixed in bath regions. It also has residential and commercial forms due to the tendencies in the design and motivations of interiors, as well as the preservation of water. Main actors introduce intelligence technologies and sustainability materials, as well as colors to suit the various global clients’ needs. It is affected by the construction of housing units, the trends adopted in home redesign and Upgrade in a bid to offer clients comfort with specific attention to the bathroom.

- Several conditions affect the bath fittings market at a global level, and they are discussed below as follows: People of the world, especially those possessing high disposable incomes, are moving towards urban cities and thus, the need for good looking and smarter baths has grown. They opine that consumers are becoming more inclined towards comfort and convenience and therefore, there is a massive market for excellent quality bathroom fittings that are long-lasting and efficient. Further influencing new market growth, there are tendencies of home improvement and alterations to improve living conditions, and renovations which lead to faults repairs or replacement of bathroom equipment with improved appropriate modern facilities.

- Thus, with such customer requirements as the focus of consumers, materials and designs are also essential drivers of bath fittings markets. Consumers are expressing a desire for products that are environmentally sound by preserving water and energy as global sustainability goals. Moreover, smart facilities like touchless faucets and digital shower system solutions are popularizing high-tech smart home systems. All these trends suggest that the bath fittings market is a constantly evolving environment characterised by innovation and change resulting from advances in technology and new customer preferences and demands.

Bath Fittings Market Trend Analysis

From Functionality to Fashion, The Latest Trends in TREND Bath Fittings

- With respect to TREND, the bath fittings market is characterized by several trends regarding design, technology, and sustainability. TREND Bath Fittings has adopted the use of modern products as well as implementing fashionable design for take into consideration the modern taste of consumers across the globe in as much as the bathroom fittings and accessories are concerned. Their products mostly have energy saving features like water saving; they also have hard worn, low maintenance finishes, which resembles the current trend of customers’ concern for environmentally friendly home products.

- Also, TREND is putting efforts into applying smart solutions to create great experience for users, introducing such novelties as touchless faucets, temperature controllers, etc. Also, variety in finish and style ensures that it meets consumers’ preferences matching competition levels offering TREND Bath Fittings. They signify the tendencies of the functional approach and aesthetics in tandem with sustainable and technology-driven advancements in the designing of bathrooms.

Flowing Forward, Innovations Driving the Future of Bath Fittings

- The bath fittings market remains a viable market opportunity because of the following factors. For instance, growth of people’s income and a trend towards the living in big cities creates demand for lovely and practical bathroom items across the globe. Consumers are in a position to obtain aesthetics and sophisticated bath fittings that complement their homes’ design and functionality. Further continued advancement in the technical side of legislation of the material and design practices involved in construction is also allowing for the unleashing of production of fittings that are eco-friendly and equally durable in line with the rise of sustainability.

- Besides, there is market enlargement due to renovation activities for residential and commercial buildings, where installing new bathroom fittings is one of the trends. Development of smart technologies in bath fittings include; sensor faucets and water-saving shower heads which are creating more demand in the market. Increasing consumer preference for bathroom products, which focus they define as luxury and the wellness, is driving the need for better quality and more elaborate bath fittings. All in all, bath fittings market is clearly packed with opportunities for companies to meet the new demands, explored in different parts of the world, and expand their businesses.

Bath Fittings Market Segment Analysis:

Bath Fittings Market is Segmented on the basis of type, Market, and end-users.

By Type, Showers segment is expected to dominate the market during the forecast period

- The bath fittings industry involves many kinds of goods, for instance, bath tubs, faucets, showers, and other related fixtures. Bathtub is still a popular choice because of luxury and relaxation also the need for bathtub is due to the easing of stress through water, faucet however is still a necessity both in terms of functionality and style, smart and environment friendly faucet is also being introduced. Shower facility is thus becoming more preferred due to flexibility and water conservation coupled by fast growing innovations in multilateral and comfortable shower brands. Other fittings for example towel bars and soap holders are additional to the above main fittings in accordance with a market that has brought in styles, efficiency, and sustainable products as preferred by the users of the wash rooms.

By Market, Organized segment held the largest share in 2023

- The bath fittings market is divided into two main segments: amalgamated employees in the organized and the unorganized segments. The organized sector attracts the known brands and manufacturers dealing in standardized products with sound quality and customer service. On the other hand, unorganized sector is made up of smaller local producers and sellers who offer fairly cheaper brands and products but who can’t provide much assurance as to the quality of there products. These two markets show the fact that there is heterogeneity in consumers’ buying behavior where the organized sector is more strategic and standard for brand recognition and get a consistent quality product while the unorganized sector is providing cheap substitute to the price conscious consumers when it comes to bath fittings.

Bath Fittings Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The bath fittings market of Asia Pacific is exhibiting steady growth because of factors such as high growth in urbanization rates, rising disposable income, and changing trends in bathroom designs. Some of the major countries in this market are China, India, and Japan mainly due to increasing construction activities and increasing demand for premium Sanitary Ware & Bathroom Fittings.

- Technological products like smart and water saving fittings are emerging, thus fitting the region’s theme of providing solutions for sustainable living. Market players are also venturing into the development of products and services to meet the needs and wants of the various consumer segments in the residential, commercial, and industrial use. This competitive environment also reveals local manufacturers and global players that use the network cooperation and advanced marketing techniques to consolidate their positions in the Asia-Pacific region.

Active Key Players in the Bath Fittings Market

- CERA Sanitaryware Limited (India)

- Parryware Limited (India)

- Jaquar (India)

- Hindware Homes Limited (India)

- H & R Johnson (India) Ltd (India)

- American Standard (United States)

- Dornbracht (Germany)

- Kohler (United States)

- HANSA GmbH (Germany)

- Delta (United States)

- Villeroy & Boch (Germany)

- RAK Ceramics (United Arab Emirates)

- Others

|

Global Bath Fittings Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.98 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.58 % |

Market Size in 2032: |

USD 57.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Market |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BATH FITTINGS MARKET BY TYPE (2017-2032)

- BATH FITTINGS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BATHTUBS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- FAUCETS

- SHOWERS

- BATH FITTINGS MARKET BY MARKET (2017-2032)

- BATH FITTINGS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- UNORGANIZED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ORGANIZED

- BATH FITTINGS MARKET BY END USERS (2017-2032)

- BATH FITTINGS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESIDENTIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Bath Fittings Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CERA SANITARYWARE LIMITED (INDIA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- PARRYWARE LIMITED (INDIA)

- JAQUAR (INDIA)

- HINDWARE HOMES LIMITED (INDIA)

- H & R JOHNSON (INDIA) LTD (INDIA)

- AMERICAN STANDARD (UNITED STATES)

- DORNBRACHT (GERMANY)

- KOHLER (UNITED STATES)

- HANSA GMBH (GERMANY)

- DELTA (UNITED STATES)

- VILLEROY & BOCH (GERMANY)

- RAK CERAMICS (UNITED ARAB EMIRATES)

- COMPETITIVE LANDSCAPE

- GLOBAL BATH FITTINGS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By Market

- Historic And Forecasted Market Size By End Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Bath Fittings Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.98 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.58 % |

Market Size in 2032: |

USD 57.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Market |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BATH FITTINGS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BATH FITTINGS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BATH FITTINGS MARKET COMPETITIVE RIVALRY

TABLE 005. BATH FITTINGS MARKET THREAT OF NEW ENTRANTS

TABLE 006. BATH FITTINGS MARKET THREAT OF SUBSTITUTES

TABLE 007. BATH FITTINGS MARKET BY PRODUCT TYPE

TABLE 008. BATH TUBS MARKET OVERVIEW (2016-2028)

TABLE 009. FAUCETS MARKET OVERVIEW (2016-2028)

TABLE 010. SHOWERS MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. BATH FITTINGS MARKET BY MARKET

TABLE 013. UNORGANIZED MARKET OVERVIEW (2016-2028)

TABLE 014. ORGANIZED MARKET OVERVIEW (2016-2028)

TABLE 015. BATH FITTINGS MARKET BY END USER

TABLE 016. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 017. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 018. BATH FITTINGS MARKET BY DISTRIBUTION CHANNEL

TABLE 019. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

TABLE 020. EXCLUSIVE STORES MARKET OVERVIEW (2016-2028)

TABLE 021. ONLINE CHANNELS MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA BATH FITTINGS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 024. NORTH AMERICA BATH FITTINGS MARKET, BY MARKET (2016-2028)

TABLE 025. NORTH AMERICA BATH FITTINGS MARKET, BY END USER (2016-2028)

TABLE 026. NORTH AMERICA BATH FITTINGS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 027. N BATH FITTINGS MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE BATH FITTINGS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 029. EUROPE BATH FITTINGS MARKET, BY MARKET (2016-2028)

TABLE 030. EUROPE BATH FITTINGS MARKET, BY END USER (2016-2028)

TABLE 031. EUROPE BATH FITTINGS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 032. BATH FITTINGS MARKET, BY COUNTRY (2016-2028)

TABLE 033. ASIA PACIFIC BATH FITTINGS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 034. ASIA PACIFIC BATH FITTINGS MARKET, BY MARKET (2016-2028)

TABLE 035. ASIA PACIFIC BATH FITTINGS MARKET, BY END USER (2016-2028)

TABLE 036. ASIA PACIFIC BATH FITTINGS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 037. BATH FITTINGS MARKET, BY COUNTRY (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA BATH FITTINGS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA BATH FITTINGS MARKET, BY MARKET (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA BATH FITTINGS MARKET, BY END USER (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA BATH FITTINGS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 042. BATH FITTINGS MARKET, BY COUNTRY (2016-2028)

TABLE 043. SOUTH AMERICA BATH FITTINGS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 044. SOUTH AMERICA BATH FITTINGS MARKET, BY MARKET (2016-2028)

TABLE 045. SOUTH AMERICA BATH FITTINGS MARKET, BY END USER (2016-2028)

TABLE 046. SOUTH AMERICA BATH FITTINGS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 047. BATH FITTINGS MARKET, BY COUNTRY (2016-2028)

TABLE 048. CERA SANITARYWARE LIMITED: SNAPSHOT

TABLE 049. CERA SANITARYWARE LIMITED: BUSINESS PERFORMANCE

TABLE 050. CERA SANITARYWARE LIMITED: PRODUCT PORTFOLIO

TABLE 051. CERA SANITARYWARE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. PARRYWARE LIMITED: SNAPSHOT

TABLE 052. PARRYWARE LIMITED: BUSINESS PERFORMANCE

TABLE 053. PARRYWARE LIMITED: PRODUCT PORTFOLIO

TABLE 054. PARRYWARE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. JAQUAR: SNAPSHOT

TABLE 055. JAQUAR: BUSINESS PERFORMANCE

TABLE 056. JAQUAR: PRODUCT PORTFOLIO

TABLE 057. JAQUAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. HINDWARE HOMES LIMITED: SNAPSHOT

TABLE 058. HINDWARE HOMES LIMITED: BUSINESS PERFORMANCE

TABLE 059. HINDWARE HOMES LIMITED: PRODUCT PORTFOLIO

TABLE 060. HINDWARE HOMES LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. H & R JOHNSON (INDIA) LTD: SNAPSHOT

TABLE 061. H & R JOHNSON (INDIA) LTD: BUSINESS PERFORMANCE

TABLE 062. H & R JOHNSON (INDIA) LTD: PRODUCT PORTFOLIO

TABLE 063. H & R JOHNSON (INDIA) LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. AMERICAN STANDARD: SNAPSHOT

TABLE 064. AMERICAN STANDARD: BUSINESS PERFORMANCE

TABLE 065. AMERICAN STANDARD: PRODUCT PORTFOLIO

TABLE 066. AMERICAN STANDARD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. DORNBRACHT: SNAPSHOT

TABLE 067. DORNBRACHT: BUSINESS PERFORMANCE

TABLE 068. DORNBRACHT: PRODUCT PORTFOLIO

TABLE 069. DORNBRACHT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. KOHLER: SNAPSHOT

TABLE 070. KOHLER: BUSINESS PERFORMANCE

TABLE 071. KOHLER: PRODUCT PORTFOLIO

TABLE 072. KOHLER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. HANSA GMBH: SNAPSHOT

TABLE 073. HANSA GMBH: BUSINESS PERFORMANCE

TABLE 074. HANSA GMBH: PRODUCT PORTFOLIO

TABLE 075. HANSA GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. DELTA: SNAPSHOT

TABLE 076. DELTA: BUSINESS PERFORMANCE

TABLE 077. DELTA: PRODUCT PORTFOLIO

TABLE 078. DELTA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. VILLEROY & BOCH: SNAPSHOT

TABLE 079. VILLEROY & BOCH: BUSINESS PERFORMANCE

TABLE 080. VILLEROY & BOCH: PRODUCT PORTFOLIO

TABLE 081. VILLEROY & BOCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. RAK CERAMICS: SNAPSHOT

TABLE 082. RAK CERAMICS: BUSINESS PERFORMANCE

TABLE 083. RAK CERAMICS: PRODUCT PORTFOLIO

TABLE 084. RAK CERAMICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BATH FITTINGS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BATH FITTINGS MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. BATH TUBS MARKET OVERVIEW (2016-2028)

FIGURE 013. FAUCETS MARKET OVERVIEW (2016-2028)

FIGURE 014. SHOWERS MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. BATH FITTINGS MARKET OVERVIEW BY MARKET

FIGURE 017. UNORGANIZED MARKET OVERVIEW (2016-2028)

FIGURE 018. ORGANIZED MARKET OVERVIEW (2016-2028)

FIGURE 019. BATH FITTINGS MARKET OVERVIEW BY END USER

FIGURE 020. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 021. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 022. BATH FITTINGS MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 023. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

FIGURE 024. EXCLUSIVE STORES MARKET OVERVIEW (2016-2028)

FIGURE 025. ONLINE CHANNELS MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA BATH FITTINGS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE BATH FITTINGS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC BATH FITTINGS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA BATH FITTINGS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA BATH FITTINGS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Bath Fittings Market research report is 2024-2032.

CERA Sanitaryware Limited (India), Parryware Limited (India), Jaquar (India), Hindware Homes Limited (India), H & R Johnson (India) Ltd (India), American Standard (United States), Dornbracht (Germany), Kohler (United States), HANSA GmbH (Germany), Delta (United States), Villeroy & Boch (Germany), RAK Ceramics (United Arab Emirates), and Other Major Players.

The Bath Fittings Market is segmented into by Type (Bathtubs, Faucets, Showers, Others), By Market (Unorganized, Organized), End-User (Residential, Commercial). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Bath Fittings Market comprises items like the bathtub fittings, shower, taps and other related accessories fixed in bath regions. It also has residential and commercial forms due to the tendencies in the design and motivations of interiors, as well as the preservation of water. Main actors introduce intelligence technologies and sustainability materials, as well as colors to suit the various global clients’ needs. It is affected by the construction of housing units, the trends adopted in home redesign and Upgrade in a bid to offer clients comfort with specific attention to the bathroom.

Bath Fittings Market Size Was Valued at USD 34.98 Billion in 2023, and is Projected to Reach USD 57.02 Billion by 2032, Growing at a CAGR of 5.58% From 2024-2032.