Wall Beds Market Synopsis

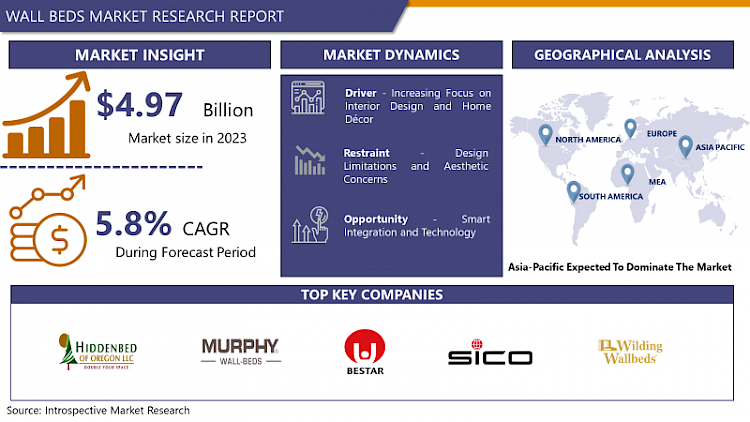

Wall Beds Market Size Was Valued at USD 4.97 Billion in 2023 and is Projected to Reach USD 8.26 Billion by 2032, Growing at a CAGR of 5.8% From 2024-2032.

Folding beds, or more commonly known as Murphy beds, are innovative furniture designs that are stored on a vertical manner by folding against the walls whenever they are not in use especially in areas where space is most certainly a concern. These beds were developed and patented in the 20th century by William Lawrence Murphy; they are generally attached at one end to the wall or an armoire and can be tilted conveniently for sleeping or raised effortlessly for storage, looking like furniture within the space. Owing to their functionality and capacity for being utilized both for sleeping and as a piece of furniture, wall beds have become a norm for apartments, small homes, and other residences where square footage is of the essence.

- Wall bed market has also expanded significantly over the past few years for various reasons, namely increased urbanization, housing space limitations, and consumer trend shifts. Despite their name, modern loft beds are very similar to those seen in Murphy beds, giving the resident the ability to have a comfortable, stylish, sleeping solution that still makes good use of limited space of studios or other small dwellings.

- Factors such as urbanization are the central contributing factors to the increased desire to own wall beds in modern societies. This is because a number of individuals continue shifting their living and working places in towns, and Crelan thus needs to make optimum utilization of the limited space it has. Wall beds are rather effective in solving this problem because during the day the bed is easily tucked away and in the evening it all becomes a comfortable size of a full-sized bed. An example being the conversion of a bedroom to a living room and home office, something that is quite common to owner-occupants of urban property, particularly in cities where the size of the living space is limited.

- In addition, the growing population of individuals who are keen on transforming their life styles and preferences towards the usage of wall beds has boosted the market. This is due to new trends in owning fewer items, which translates to more space-saving solutions to fit the few owned items and give a new meaning to efficient living. Wall beds do not only serve as solutions to space optimization but also provide a minimalist elegant design that can be integrated in the modern kind of interior design. Finally, the utility and adaptability of wall beds are also beneficial to residents, owners of apartments, houses, offices, and commercial spaces – all these factors create a high demand for this product, thus promoting market expansion.

- Also, some aspects like the design and technology of this furniture has very had a positive impact in the expansion of this wall bed to different people. There are many different features and options that advance manufacturers offer to their consumers to enhance the products and make it affordable and fitting for everyone’s specific requirements. When it comes to the technical aspects of a wall bed, technical advancements have allowed solutions to provide better integrated storage solutions, lights in the fold, flexible finishes, and materials. This innovation has continued and assisted to grow consumer’s awareness rate thus increasing the demand for wall beds.

- It is projected that the market will have even more promising future given that demand for the wall beds is likely going to increase in future due to advancements in the construction industry. The continual growth in the population coupled with the growth of the middle class and improved standards of living, particularly in the emerging countries, can be seen as potential drivers for fundamental market growth in the next couple of years. Furthermore, it is possible to note that, as acceptance of benefits derived from wall beds increases and its penetration progresses, the market will reveal more further potential for intensification in its internal and foreign segments. In general, it can be inferred that the wall beds market occupies a significant and promising niche within the furniture market, due to the constant demand for further development of sleeping-space-saving solutions for contemporary living spaces.

Wall Beds Market Trend Analysis

Space Optimization Solutions

- It is noted that the global market of Space Optimization Solutions Wall Beds Market has been constantly growing within the past few years thanks to the necessity of the peoples in the usage of the space effective sleeping places and other little used items. These wall beds sometimes referred to as Murphy beds, are more convenient and space friendly designs meant for tight living conditions especially in urban settings and limited housing accommodation spaces. As a result of the cut-down dimensions in living space this has led to an influx of compact households and micro living, there is always a demand for non-traditional full-service furniture that can bend and morph in various functions responding to the evolving needs of the consumers through time. This has in turn been met by the availability of so many stylish and fashionable wall beds in the market that it can easily fit modern home dècor trends and yet offer a comfortable sleeping area without having to take up much of the floor space.

- Innovations and improvements in technology and materials have fettered to the stronger and reliable, easier to operate, and attractive designs of the wall bed and hence, has propelling the market growth. Seeing increased amounts of urbanization and more people living in small spaces, the Space Optimization Solutions Wall Beds Market holds a strong and promising niche in the contemporary furniture demand.

Smart Integration and Technology

- The market for Smart Integration and Technology Wall Beds is currently in the growth stage and is expected to grow significantly as more people seek solutions leading to the space constraints in urban areas. Here are some of the promising features of state-of-art wall beds that can be included in the design: The operations can be performed with the help of automatic mechanisms; Additional besides the control of the process, the application of a remote control or the possibility of integration into smart home systems may be incorporated in the wall bed design. Due to the increase in the number of people living and working in limited space especially in urban areas, many need solutions that offer comfort and space-saving Universal Wall Bed Solutions are one of the advanced solutions that have been embraced due to the ability to offer convenience and versatility.

- Furthermore, product innovation in terms of the materials used as well as the design have led to better overall appearance and long-lasting nature of the related products thus boosting the market growth. Since consumers today are more conscious of their spaces and need to make the most of the room that they have without the compromise of the comfort of their beds, the global Smart Integration and Technology Wall Beds market will continue to grow with manufacturers looking for new ways to tap into the ever shifting consumer needs.

Wall Beds Market Segment Analysis:

Wall Beds Market Segmented based on By Type , By Size, By Functioning , By Application and ,By Sales Channel

By Type, Desk Wall Beds segment is expected to dominate the market during the forecast period

- The Wall Beds market offering a broad assortment of products listed majorly on the basis of type in order to fulfill the specific requirement of the end user. Plain Bed with Drawers – a practical combination of a wardrobe and a bed, Cabinet Beds are definitely worth consideration for those who need a functional bed but love stylized interiors. Desk Wall Beds are fold out beds in combination with a desk that allow people to incorporate two important items of furniture into a single piece in small flats. Library Wall Beds, combining a beauty of bookcase and functionality of the fold out bed, are perfect for style-conscious and space-challenged individuals.

- Also, the market also includes a segment of ‘Others’ which may include unique sty/,’ Dontion, style or other considerations that may appeal to consumers’’ desired space, or reach that can be attained with the piece. This segmentation highlights the dynamic use and flexibility of the Wall Beds because it encompasses pragmatic buyers who live in congested areas as well as style conscious first time homeowners which makes Wall Beds market very diverse.

By Size, King segment held the largest share in 2023

- The wall beds market can be segmented by size into four main categories: Building on the King and Queen categories, the Full subclass is analyzed in detail, followed by a discussion of other subclasses that have not been previously explored. All size categories serve various consumer purposes and expectations that are capable of flexibility for achieving maximum usage of the space as well as comfort. There are large wall beds available that are suitable for larger bedrooms so that people that are heading for sleep can have a lot of space if they are two people or just like to have more space on their beds. Queen size is the best size as it is providing ample of space and has an optimum size which can easily accommodate a couple and is suitable for most rooms in a house- the bedroom.

- The standard wall bed designs are most appropriate for the minor rooms or the guest rooms as it doesn’t claim a lot of space yet offer a perfect little space for a bed. The “Other” classification includes units with various dimensions and subtypes to fit particular conditions, including twin or customized WallBeds for different purposes. In conclusion, the stated segmentation is helpful to manufacturers and retailers in order to target the appropriate wall beds consumer groups and offer appropriate products for different living environments and customer orientations in the targeted market.

Wall Beds Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- Emerging nations of the Asia Pacific region are likely to challenge the supremacy of wall beds market throughout the forecast period. This projection is based on some assumptions such as: population growth rate, urbanization rate, changes in the socio-economic form of life etc. Due to high population density in populated towns and cities globally particularly in Asia’s countries like China, India and Japan the issue of space ad becomes very limited hence the need for space saving furniture like the wall bed. In addition, increased consumer spending and a focus on the appearance of the interior amenities are several other factors helping to boost the demand for the wall beds in the region.

- Despite this though, the growing real estate market especially in developing countries is viewed as having a positive impact on the market since developers and homeowners are looking to derive optimum use from limited space. Therefore, Asia-Pacific remains promising and is likely to dominate a global market in Wall beds and showers; the region’s growth rate is expected to be higher than any other regions in the near future.

Active Key Players in the Wall Beds Market

- Hiddenbed of Oregon LLC (US)

- Murphy Wall Beds Hardware Inc. (US)

- Bestar Inc. (Canada)

- SICO Inc. (US)

- The WallBed Company (Australia)

- Wilding Wallbeds (US)

- InovaBed (US)

- Oldham Wood (US)

- SMARTBett GmbH (Germany)

- The Bedder Way Company (US)

- Foshan Youpai Home Technology Co. Ltd. (China)

- B.O.F.F. Wall Bed (Canada)

- Bonbon Trading Limited (UK)

- FlyingBeds International (US)

- ClickBed Pl (Poland)

- Guangdong Nova Furniture Co. Limited (China)

- Foshan COOC Furniture Co. Ltd. (China)

- Other Key Players

|

Global Wall Beds Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.97 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.8% |

Market Size in 2032: |

USD 8.26 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Size |

|

||

|

By Functioning |

|

||

|

By Application |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Size

3.3 By Functioning

3.4 By Application

3.5 By Sales Channel

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Wall Beds Market by Type

5.1 Wall Beds Market Overview Snapshot and Growth Engine

5.2 Wall Beds Market Overview

5.3 Cabinet Beds

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cabinet Beds: Geographic Segmentation

5.4 Desk Wall Beds

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Desk Wall Beds: Geographic Segmentation

5.5 Library Wall Beds

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Library Wall Beds: Geographic Segmentation

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Geographic Segmentation

Chapter 6: Wall Beds Market by Size

6.1 Wall Beds Market Overview Snapshot and Growth Engine

6.2 Wall Beds Market Overview

6.3 King

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 King: Geographic Segmentation

6.4 Queen

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Queen: Geographic Segmentation

6.5 Full

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Full: Geographic Segmentation

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation

Chapter 7: Wall Beds Market by Functioning

7.1 Wall Beds Market Overview Snapshot and Growth Engine

7.2 Wall Beds Market Overview

7.3 Manual

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Manual: Geographic Segmentation

7.4 Automatic

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Automatic: Geographic Segmentation

Chapter 8: Wall Beds Market by Application

8.1 Wall Beds Market Overview Snapshot and Growth Engine

8.2 Wall Beds Market Overview

8.3 Residential

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Residential: Geographic Segmentation

8.4 Commercial

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Commercial: Geographic Segmentation

Chapter 9: Wall Beds Market by Sales Channel

9.1 Wall Beds Market Overview Snapshot and Growth Engine

9.2 Wall Beds Market Overview

9.3 Online Stores

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size (2016-2028F)

9.3.3 Key Market Trends, Growth Factors and Opportunities

9.3.4 Online Stores: Geographic Segmentation

9.4 Furniture Retail

9.4.1 Introduction and Market Overview

9.4.2 Historic and Forecasted Market Size (2016-2028F)

9.4.3 Key Market Trends, Growth Factors and Opportunities

9.4.4 Furniture Retail: Geographic Segmentation

9.5 Specialty Stores

9.5.1 Introduction and Market Overview

9.5.2 Historic and Forecasted Market Size (2016-2028F)

9.5.3 Key Market Trends, Growth Factors and Opportunities

9.5.4 Specialty Stores: Geographic Segmentation

9.6 Others

9.6.1 Introduction and Market Overview

9.6.2 Historic and Forecasted Market Size (2016-2028F)

9.6.3 Key Market Trends, Growth Factors and Opportunities

9.6.4 Others: Geographic Segmentation

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Positioning

10.1.2 Wall Beds Sales and Market Share By Players

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Wall Beds Industry Concentration Ratio (CR5 and HHI)

10.1.6 Top 5 Wall Beds Players Market Share

10.1.7 Mergers and Acquisitions

10.1.8 Business Strategies By Top Players

10.2 HIDDENBED OF OREGON LLC (US)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Operating Business Segments

10.2.5 Product Portfolio

10.2.6 Business Performance

10.2.7 Key Strategic Moves and Recent Developments

10.2.8 SWOT Analysis

10.3 MURPHY WALL BEDS HARDWARE INC. (US)

10.4 BESTAR INC. (CANADA)

10.5 SICO INC. (US)

10.6 THE WALLBED COMPANY (AUSTRALIA)

10.7 WILDING WALLBEDS (US)

10.8 INOVABED (US)

10.9 OLDHAM WOOD (US)

10.10 SMARTBETT GMBH (GERMANY)

10.11 THE BEDDER WAY COMPANY (US)

10.12 FOSHAN YOUPAI HOME TECHNOLOGY CO. LTD. (CHINA)

10.13 B.O.F.F. WALL BED (CANADA)

10.14 BONBON TRADING LIMITED (UK)

10.15 FLYINGBEDS INTERNATIONAL (US)

10.16 CLICKBED PL (POLAND)

10.17 GUANGDONG NOVA FURNITURE CO. LIMITED (CHINA)

10.18 FOSHAN COOC FURNITURE CO. LTD. (CHINA)

10.19 OTHER MAJOR PLAYERS

Chapter 11: Global Wall Beds Market Analysis, Insights and Forecast, 2016-2028

11.1 Market Overview

11.2 Historic and Forecasted Market Size By Type

11.2.1 Cabinet Beds

11.2.2 Desk Wall Beds

11.2.3 Library Wall Beds

11.2.4 Others

11.3 Historic and Forecasted Market Size By Size

11.3.1 King

11.3.2 Queen

11.3.3 Full

11.3.4 Others

11.4 Historic and Forecasted Market Size By Functioning

11.4.1 Manual

11.4.2 Automatic

11.5 Historic and Forecasted Market Size By Application

11.5.1 Residential

11.5.2 Commercial

11.6 Historic and Forecasted Market Size By Sales Channel

11.6.1 Online Stores

11.6.2 Furniture Retail

11.6.3 Specialty Stores

11.6.4 Others

Chapter 12: North America Wall Beds Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Cabinet Beds

12.4.2 Desk Wall Beds

12.4.3 Library Wall Beds

12.4.4 Others

12.5 Historic and Forecasted Market Size By Size

12.5.1 King

12.5.2 Queen

12.5.3 Full

12.5.4 Others

12.6 Historic and Forecasted Market Size By Functioning

12.6.1 Manual

12.6.2 Automatic

12.7 Historic and Forecasted Market Size By Application

12.7.1 Residential

12.7.2 Commercial

12.8 Historic and Forecasted Market Size By Sales Channel

12.8.1 Online Stores

12.8.2 Furniture Retail

12.8.3 Specialty Stores

12.8.4 Others

12.9 Historic and Forecast Market Size by Country

12.9.1 U.S.

12.9.2 Canada

12.9.3 Mexico

Chapter 13: Europe Wall Beds Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Cabinet Beds

13.4.2 Desk Wall Beds

13.4.3 Library Wall Beds

13.4.4 Others

13.5 Historic and Forecasted Market Size By Size

13.5.1 King

13.5.2 Queen

13.5.3 Full

13.5.4 Others

13.6 Historic and Forecasted Market Size By Functioning

13.6.1 Manual

13.6.2 Automatic

13.7 Historic and Forecasted Market Size By Application

13.7.1 Residential

13.7.2 Commercial

13.8 Historic and Forecasted Market Size By Sales Channel

13.8.1 Online Stores

13.8.2 Furniture Retail

13.8.3 Specialty Stores

13.8.4 Others

13.9 Historic and Forecast Market Size by Country

13.9.1 Germany

13.9.2 U.K.

13.9.3 France

13.9.4 Italy

13.9.5 Russia

13.9.6 Spain

13.9.7 Rest of Europe

Chapter 14: Asia-Pacific Wall Beds Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Cabinet Beds

14.4.2 Desk Wall Beds

14.4.3 Library Wall Beds

14.4.4 Others

14.5 Historic and Forecasted Market Size By Size

14.5.1 King

14.5.2 Queen

14.5.3 Full

14.5.4 Others

14.6 Historic and Forecasted Market Size By Functioning

14.6.1 Manual

14.6.2 Automatic

14.7 Historic and Forecasted Market Size By Application

14.7.1 Residential

14.7.2 Commercial

14.8 Historic and Forecasted Market Size By Sales Channel

14.8.1 Online Stores

14.8.2 Furniture Retail

14.8.3 Specialty Stores

14.8.4 Others

14.9 Historic and Forecast Market Size by Country

14.9.1 China

14.9.2 India

14.9.3 Japan

14.9.4 Singapore

14.9.5 Australia

14.9.6 New Zealand

14.9.7 Rest of APAC

Chapter 15: Middle East & Africa Wall Beds Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Cabinet Beds

15.4.2 Desk Wall Beds

15.4.3 Library Wall Beds

15.4.4 Others

15.5 Historic and Forecasted Market Size By Size

15.5.1 King

15.5.2 Queen

15.5.3 Full

15.5.4 Others

15.6 Historic and Forecasted Market Size By Functioning

15.6.1 Manual

15.6.2 Automatic

15.7 Historic and Forecasted Market Size By Application

15.7.1 Residential

15.7.2 Commercial

15.8 Historic and Forecasted Market Size By Sales Channel

15.8.1 Online Stores

15.8.2 Furniture Retail

15.8.3 Specialty Stores

15.8.4 Others

15.9 Historic and Forecast Market Size by Country

15.9.1 Turkey

15.9.2 Saudi Arabia

15.9.3 Iran

15.9.4 UAE

15.9.5 Africa

15.9.6 Rest of MEA

Chapter 16: South America Wall Beds Market Analysis, Insights and Forecast, 2016-2028

16.1 Key Market Trends, Growth Factors and Opportunities

16.2 Impact of Covid-19

16.3 Key Players

16.4 Key Market Trends, Growth Factors and Opportunities

16.4 Historic and Forecasted Market Size By Type

16.4.1 Cabinet Beds

16.4.2 Desk Wall Beds

16.4.3 Library Wall Beds

16.4.4 Others

16.5 Historic and Forecasted Market Size By Size

16.5.1 King

16.5.2 Queen

16.5.3 Full

16.5.4 Others

16.6 Historic and Forecasted Market Size By Functioning

16.6.1 Manual

16.6.2 Automatic

16.7 Historic and Forecasted Market Size By Application

16.7.1 Residential

16.7.2 Commercial

16.8 Historic and Forecasted Market Size By Sales Channel

16.8.1 Online Stores

16.8.2 Furniture Retail

16.8.3 Specialty Stores

16.8.4 Others

16.9 Historic and Forecast Market Size by Country

16.9.1 Brazil

16.9.2 Argentina

16.9.3 Rest of SA

Chapter 17 Investment Analysis

Chapter 18 Analyst Viewpoint and Conclusion

|

Global Wall Beds Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.97 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.8% |

Market Size in 2032: |

USD 8.26 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Size |

|

||

|

By Functioning |

|

||

|

By Application |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. WALL BEDS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. WALL BEDS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. WALL BEDS MARKET COMPETITIVE RIVALRY

TABLE 005. WALL BEDS MARKET THREAT OF NEW ENTRANTS

TABLE 006. WALL BEDS MARKET THREAT OF SUBSTITUTES

TABLE 007. WALL BEDS MARKET BY TYPE

TABLE 008. CABINET BEDS MARKET OVERVIEW (2016-2028)

TABLE 009. DESK WALL BEDS MARKET OVERVIEW (2016-2028)

TABLE 010. LIBRARY WALL BEDS MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. WALL BEDS MARKET BY SIZE

TABLE 013. KING MARKET OVERVIEW (2016-2028)

TABLE 014. QUEEN MARKET OVERVIEW (2016-2028)

TABLE 015. FULL MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. WALL BEDS MARKET BY FUNCTIONING

TABLE 018. MANUAL MARKET OVERVIEW (2016-2028)

TABLE 019. AUTOMATIC MARKET OVERVIEW (2016-2028)

TABLE 020. WALL BEDS MARKET BY APPLICATION

TABLE 021. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 022. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 023. WALL BEDS MARKET BY SALES CHANNEL

TABLE 024. ONLINE STORES MARKET OVERVIEW (2016-2028)

TABLE 025. FURNITURE RETAIL MARKET OVERVIEW (2016-2028)

TABLE 026. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

TABLE 027. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 028. NORTH AMERICA WALL BEDS MARKET, BY TYPE (2016-2028)

TABLE 029. NORTH AMERICA WALL BEDS MARKET, BY SIZE (2016-2028)

TABLE 030. NORTH AMERICA WALL BEDS MARKET, BY FUNCTIONING (2016-2028)

TABLE 031. NORTH AMERICA WALL BEDS MARKET, BY APPLICATION (2016-2028)

TABLE 032. NORTH AMERICA WALL BEDS MARKET, BY SALES CHANNEL (2016-2028)

TABLE 033. N WALL BEDS MARKET, BY COUNTRY (2016-2028)

TABLE 034. EUROPE WALL BEDS MARKET, BY TYPE (2016-2028)

TABLE 035. EUROPE WALL BEDS MARKET, BY SIZE (2016-2028)

TABLE 036. EUROPE WALL BEDS MARKET, BY FUNCTIONING (2016-2028)

TABLE 037. EUROPE WALL BEDS MARKET, BY APPLICATION (2016-2028)

TABLE 038. EUROPE WALL BEDS MARKET, BY SALES CHANNEL (2016-2028)

TABLE 039. WALL BEDS MARKET, BY COUNTRY (2016-2028)

TABLE 040. ASIA PACIFIC WALL BEDS MARKET, BY TYPE (2016-2028)

TABLE 041. ASIA PACIFIC WALL BEDS MARKET, BY SIZE (2016-2028)

TABLE 042. ASIA PACIFIC WALL BEDS MARKET, BY FUNCTIONING (2016-2028)

TABLE 043. ASIA PACIFIC WALL BEDS MARKET, BY APPLICATION (2016-2028)

TABLE 044. ASIA PACIFIC WALL BEDS MARKET, BY SALES CHANNEL (2016-2028)

TABLE 045. WALL BEDS MARKET, BY COUNTRY (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA WALL BEDS MARKET, BY TYPE (2016-2028)

TABLE 047. MIDDLE EAST & AFRICA WALL BEDS MARKET, BY SIZE (2016-2028)

TABLE 048. MIDDLE EAST & AFRICA WALL BEDS MARKET, BY FUNCTIONING (2016-2028)

TABLE 049. MIDDLE EAST & AFRICA WALL BEDS MARKET, BY APPLICATION (2016-2028)

TABLE 050. MIDDLE EAST & AFRICA WALL BEDS MARKET, BY SALES CHANNEL (2016-2028)

TABLE 051. WALL BEDS MARKET, BY COUNTRY (2016-2028)

TABLE 052. SOUTH AMERICA WALL BEDS MARKET, BY TYPE (2016-2028)

TABLE 053. SOUTH AMERICA WALL BEDS MARKET, BY SIZE (2016-2028)

TABLE 054. SOUTH AMERICA WALL BEDS MARKET, BY FUNCTIONING (2016-2028)

TABLE 055. SOUTH AMERICA WALL BEDS MARKET, BY APPLICATION (2016-2028)

TABLE 056. SOUTH AMERICA WALL BEDS MARKET, BY SALES CHANNEL (2016-2028)

TABLE 057. WALL BEDS MARKET, BY COUNTRY (2016-2028)

TABLE 058. HIDDENBED OF OREGON LLC (US): SNAPSHOT

TABLE 059. HIDDENBED OF OREGON LLC (US): BUSINESS PERFORMANCE

TABLE 060. HIDDENBED OF OREGON LLC (US): PRODUCT PORTFOLIO

TABLE 061. HIDDENBED OF OREGON LLC (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. MURPHY WALL BEDS HARDWARE INC. (US): SNAPSHOT

TABLE 062. MURPHY WALL BEDS HARDWARE INC. (US): BUSINESS PERFORMANCE

TABLE 063. MURPHY WALL BEDS HARDWARE INC. (US): PRODUCT PORTFOLIO

TABLE 064. MURPHY WALL BEDS HARDWARE INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. BESTAR INC. (CANADA): SNAPSHOT

TABLE 065. BESTAR INC. (CANADA): BUSINESS PERFORMANCE

TABLE 066. BESTAR INC. (CANADA): PRODUCT PORTFOLIO

TABLE 067. BESTAR INC. (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. SICO INC. (US): SNAPSHOT

TABLE 068. SICO INC. (US): BUSINESS PERFORMANCE

TABLE 069. SICO INC. (US): PRODUCT PORTFOLIO

TABLE 070. SICO INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. THE WALLBED COMPANY (AUSTRALIA): SNAPSHOT

TABLE 071. THE WALLBED COMPANY (AUSTRALIA): BUSINESS PERFORMANCE

TABLE 072. THE WALLBED COMPANY (AUSTRALIA): PRODUCT PORTFOLIO

TABLE 073. THE WALLBED COMPANY (AUSTRALIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. WILDING WALLBEDS (US): SNAPSHOT

TABLE 074. WILDING WALLBEDS (US): BUSINESS PERFORMANCE

TABLE 075. WILDING WALLBEDS (US): PRODUCT PORTFOLIO

TABLE 076. WILDING WALLBEDS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. INOVABED (US): SNAPSHOT

TABLE 077. INOVABED (US): BUSINESS PERFORMANCE

TABLE 078. INOVABED (US): PRODUCT PORTFOLIO

TABLE 079. INOVABED (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. OLDHAM WOOD (US): SNAPSHOT

TABLE 080. OLDHAM WOOD (US): BUSINESS PERFORMANCE

TABLE 081. OLDHAM WOOD (US): PRODUCT PORTFOLIO

TABLE 082. OLDHAM WOOD (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. SMARTBETT GMBH (GERMANY): SNAPSHOT

TABLE 083. SMARTBETT GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 084. SMARTBETT GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 085. SMARTBETT GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. THE BEDDER WAY COMPANY (US): SNAPSHOT

TABLE 086. THE BEDDER WAY COMPANY (US): BUSINESS PERFORMANCE

TABLE 087. THE BEDDER WAY COMPANY (US): PRODUCT PORTFOLIO

TABLE 088. THE BEDDER WAY COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. FOSHAN YOUPAI HOME TECHNOLOGY CO. LTD. (CHINA): SNAPSHOT

TABLE 089. FOSHAN YOUPAI HOME TECHNOLOGY CO. LTD. (CHINA): BUSINESS PERFORMANCE

TABLE 090. FOSHAN YOUPAI HOME TECHNOLOGY CO. LTD. (CHINA): PRODUCT PORTFOLIO

TABLE 091. FOSHAN YOUPAI HOME TECHNOLOGY CO. LTD. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. B.O.F.F. WALL BED (CANADA): SNAPSHOT

TABLE 092. B.O.F.F. WALL BED (CANADA): BUSINESS PERFORMANCE

TABLE 093. B.O.F.F. WALL BED (CANADA): PRODUCT PORTFOLIO

TABLE 094. B.O.F.F. WALL BED (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. BONBON TRADING LIMITED (UK): SNAPSHOT

TABLE 095. BONBON TRADING LIMITED (UK): BUSINESS PERFORMANCE

TABLE 096. BONBON TRADING LIMITED (UK): PRODUCT PORTFOLIO

TABLE 097. BONBON TRADING LIMITED (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. FLYINGBEDS INTERNATIONAL (US): SNAPSHOT

TABLE 098. FLYINGBEDS INTERNATIONAL (US): BUSINESS PERFORMANCE

TABLE 099. FLYINGBEDS INTERNATIONAL (US): PRODUCT PORTFOLIO

TABLE 100. FLYINGBEDS INTERNATIONAL (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. CLICKBED PL (POLAND): SNAPSHOT

TABLE 101. CLICKBED PL (POLAND): BUSINESS PERFORMANCE

TABLE 102. CLICKBED PL (POLAND): PRODUCT PORTFOLIO

TABLE 103. CLICKBED PL (POLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. GUANGDONG NOVA FURNITURE CO. LIMITED (CHINA): SNAPSHOT

TABLE 104. GUANGDONG NOVA FURNITURE CO. LIMITED (CHINA): BUSINESS PERFORMANCE

TABLE 105. GUANGDONG NOVA FURNITURE CO. LIMITED (CHINA): PRODUCT PORTFOLIO

TABLE 106. GUANGDONG NOVA FURNITURE CO. LIMITED (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. FOSHAN COOC FURNITURE CO. LTD. (CHINA): SNAPSHOT

TABLE 107. FOSHAN COOC FURNITURE CO. LTD. (CHINA): BUSINESS PERFORMANCE

TABLE 108. FOSHAN COOC FURNITURE CO. LTD. (CHINA): PRODUCT PORTFOLIO

TABLE 109. FOSHAN COOC FURNITURE CO. LTD. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 110. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 111. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 112. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. WALL BEDS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. WALL BEDS MARKET OVERVIEW BY TYPE

FIGURE 012. CABINET BEDS MARKET OVERVIEW (2016-2028)

FIGURE 013. DESK WALL BEDS MARKET OVERVIEW (2016-2028)

FIGURE 014. LIBRARY WALL BEDS MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. WALL BEDS MARKET OVERVIEW BY SIZE

FIGURE 017. KING MARKET OVERVIEW (2016-2028)

FIGURE 018. QUEEN MARKET OVERVIEW (2016-2028)

FIGURE 019. FULL MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. WALL BEDS MARKET OVERVIEW BY FUNCTIONING

FIGURE 022. MANUAL MARKET OVERVIEW (2016-2028)

FIGURE 023. AUTOMATIC MARKET OVERVIEW (2016-2028)

FIGURE 024. WALL BEDS MARKET OVERVIEW BY APPLICATION

FIGURE 025. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 026. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 027. WALL BEDS MARKET OVERVIEW BY SALES CHANNEL

FIGURE 028. ONLINE STORES MARKET OVERVIEW (2016-2028)

FIGURE 029. FURNITURE RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 030. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

FIGURE 031. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 032. NORTH AMERICA WALL BEDS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. EUROPE WALL BEDS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. ASIA PACIFIC WALL BEDS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. MIDDLE EAST & AFRICA WALL BEDS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. SOUTH AMERICA WALL BEDS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Wall Beds Market research report is 2024-2032.

Hiddenbed of Oregon LLC (US), Murphy Wall Beds Hardware Inc. (US), Bestar Inc. (Canada), SICO Inc. (US), The WallBed Company (Australia), Wilding Wallbeds (US), InovaBed (US), Oldham Wood (US), SMARTBett GmbH (Germany), and Other Major Players.

The Wall Beds Market is segmented into Type , Size, Functioning , Application ,By Sales Channel, and Region. By Type , the market is categorized into Cabinet Beds, Desk Wall Beds, Library Wall Beds, Others. By Size , the market is categorized into King, Queen, Full, Others. By Functioning , the market is categorized into Manual, Automatic. By Application , the market is categorized into Residential, Commercial. By Sales Channel , the market is categorized into Online Stores, Furniture Retail, Specialty Stores, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Folding beds, or more commonly known as Murphy beds, are innovative furniture designs that are stored on a vertical manner by folding against the walls whenever they are not in use especially in areas where space is most certainly a concern. These beds were developed and patented in the 20th century by William Lawrence Murphy; they are generally attached at one end to the wall or an armoire and can be tilted conveniently for sleeping or raised effortlessly for storage, looking like furniture within the space. Owing to their functionality and capacity for being utilized both for sleeping and as a piece of furniture, wall beds have become a norm for apartments, small homes, and other residences where square footage is of the essence.

Wall Beds Market Size Was Valued at USD 4.97 Billion in 2023, and is Projected to Reach USD 8.26 Billion by 2032, Growing at a CAGR of 5.8% From 2024-2032.