Electric Ovens and Cooktops Market Synopsis

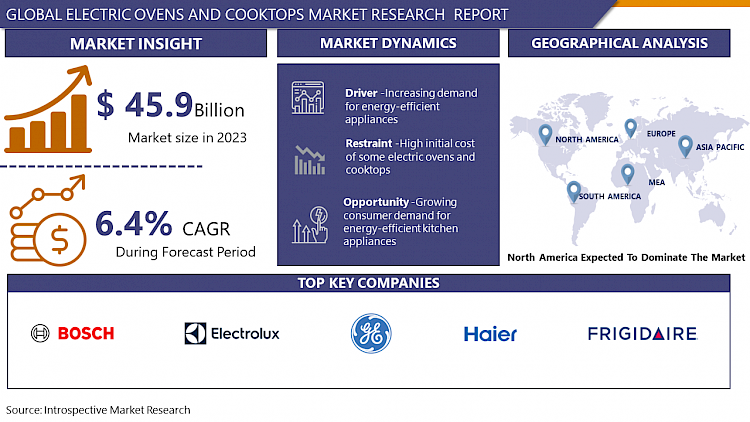

Electric Ovens and Cooktops Market Size Was Valued at USD 45.9 Billion in 2023, and is Projected to Reach USD 79.54 Billion by 2032, Growing at a CAGR of 6.4% From 2024-2032.

An electric stove, electric cooker or an electric range is stove that has an electrical appliance used for cooking and baking. Electric stoves were preferred to solid-fuel (wood or coal) stoves, which took much more effort to generate, tended, and sustained. An oven that became hot through electrical energy and also the food is heated through the energy is known as electric oven. The electric oven on the other hand utilizes electrical energy and then it utilizes heating elements in order to generate heat. Most electric ovens have more than one cooking technique because of the type of heating that is installed to the appliance and the features may include; brochure, convection fans, and control electronics. Some of the important parts of an electric oven include cabinet the heating elements, the thermostat the timer and the power regulating switch. Cooktop or electric cooktop is the part of an electric stove that includes heating components and is responsible for heating pots and pans.

- Quite a fresh segment in the kitchen appliance industry is the market of electric ovens and cooktops. Electric ovens and cook tops are the electric kitchen appliances that use electricity in heating to provide the required heat for cooking needs replacing the common gas stoves and ovens. These appliances give user convenience, ease, and efficiency, and in form, there is the freestanding, built-in and the slide-in models and this makes it easier for the consumer in choosing what will suit him/her.

- It is gradually being expanded due to the extension of people’s demands for a new, comfortable, and rational household kitchen facilities. Some of the drivers for this growth are; smart kitchen appliances are being adopted by more people, people’s income has grown, consumers are moving towards using smarter products that conserve energy. Furthermore, there are innovations incorporated in the technology of electric ovens and cooktops; features like touch control panels, voice control, and Wi-Fi integration are helping to drive the market’s growth. The self-sufficiency of people in cooking with the help of kitchen utensils has again opened up more opportunities for the market due to the COVID-19 infection. The market is also witnessing increased competition to induction cooktops due to the efficiency in cooking than traditional ranges.

Electric Ovens and Cooktops Market Trend Analysis

Growing trend towards more energy-efficient appliances

- Among all the segments in the electric ovens and cooktops market globally, there is the increased market demand for energy-efficient appliances. This shift is attributed to the growing customer awareness on the need to have energy saver kitchen appliances such as electric ovens and cook tops manufacturers have therefore shifted towards designing new and improved technologies to their existing products. Such examples are the use of efficient heaters and insulating to reduce the heat loss; the use of cooktop convection systems that improve the flow of warm air, controls on energy usage through sensing and connectivity aids for monitoring and regulating energy use from a distance. These advances in energy-saving initiatives dovetail with the need in relation to home appliances that are more energy efficient and environmentally friendly; thus, producers who are capable of incorporating these shifts into their products stand to benefit from this important shift in the marketplace.

Growing consumer demand for energy-efficient kitchen appliances

- There is promising market for the electric ovens and cooktops due to the increasing consumers’ awareness about kitchen appliance with energy efficiency. Manufacturers as a result have strived to produce ovens and cooktops that incorporate the technologies that allow conservation of energy like heating elements, insulation, sensors among others. Smart technology, awareness of damage to the environment, as well as saving on energy costs, contribute to the elevated demand in such functions. This shift of customers’ preference towards renewable home appliances means that companies should develop innovative energy-saving technologies, which should be incorporated into product designs, so that the brands that can accrue such technologies into their products will benefit from the shifting customers’ preference. This opportunity relates to the current market trends of the growing popularity of smart kitchen appliances and an increase in people’s disposable income, which will drive the need for innovative, efficient electric ovens as well as the cooktops.

Electric Ovens and Cooktops Market Segment Analysis:

Electric Ovens and Cooktops Market Segmented on the basis of type and application.

By Type, Multi-Function Type segment is expected to dominate the market during the forecast period

- The Multi-Function Type segment will also account for the largest market share in the global electric ovens and cooktops market through the forecast period expected to be between 2024 and 2032. Multi-function electric ovens are very useful and provide many different cooking methods under one appliance, thus limiting the appliance use and space taken up in the kitchen. Features that accompany such ovens include the accurate control of temperature and the option of programming and this makes them common as home use ovens and in houses, hotels, and restaurants among others. The report also mentions about the consumer trends that multi-function smart ovens are simplistic in their design and are therefore favoured. The shift in consumer trend to acquiring solutions for kitchen products that will enable them to spend more time preparing the meal is set to push the growth of this segment of the market over the forecast period through the growth in multi-function electric ovens.

By Application, Residential segment expected to held the largest share

- The residential segment applies electric ovens and cooktops in different home operations mainly for grilling, baking, and roasting. Several factors have prompted the rise in use electric ovens and cooktops in residential use as stipulated below. First and foremost, such factors as raising the popularity of working women and active position in life matters have result in the need for multifunctional and time-saving home appliances that can help in preparing meals. Electric ovens and cooktops are some of the most beautiful devices found in modern homes as they are efficient and are characterized by features such as temperatures, programs and even quick-cook options.

- Also, the increase in the global per capita income and consumption standards in the both developed and developing regions has led to consumers being in a position to purchase quality efficient energy kitchen appliances. This, in combination with the raising concern about getting to know the advantages of using electric cooking products in their household, is set to bolster the projected dominance of the segment in the electric ovens and cooktops market over the course of the estimated timeframe.

Electric Ovens and Cooktops Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America especially United States and Canada is expected to dominate the electric ovens and cooktops market throughout the above said forecast period. This dominance can be attributed to several factors Some of the factors include Hence the following factors: Firstly, there is a high dwellers and commercial buildings construction in the region, new homes, and kitchens construction and renovation, which always call for a modern and energy-efficient electric oven and cook top. Moreover, the factors such as increase in the disposable income of consumers and shift towards increased demand for easy to use and technologically advanced products in kitchen, particularly in North America region will likely boost the demand of kitchen appliances in the near future. It also notes that the key players in the market include General Electric, whirlpool, and kitchen aid among others that has a significant market base in the North America and is coming up with new models to suit the consumers’ demands.

- By and large, these end user shifts, a favourable demographic environment, and the on-going settlements of the leading players’ positions make North America primed and ready to set the pace as the dominant market for electric ovens and cooktops over the forecast years.

Active Key Players in the Electric Ovens and Cooktops Market

- ACP Solutions (United States)

- Bosch (Germany)

- Electrolux (Sweden)

- Frigidaire (United States)

- GE (United States)

- Haier (China)

- Kenmore (United States)

- KitchenAid (United States)

- Media (China)

- Merrychef (United Kingdom)

- Miele (Germany)

- Panasonic (Japan)

- SAMSUNG (South Korea)

- Siemens (Germany)

- Whirlpool Corporation (United States), and Other key Players.

|

Global Electric Ovens and Cooktops Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 45.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.4 % |

Market Size in 2032: |

USD 79.54 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC OVENS AND COOKTOPS MARKET BY TYPE (2017-2032)

- ELECTRIC OVENS AND COOKTOPS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MULTI-FUNCTION TYPE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- NORMAL TYPE

- ELECTRIC OVENS AND COOKTOPS MARKET BY APPLICATION (2017-2032)

- ELECTRIC OVENS AND COOKTOPS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESIDENTIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Electric Ovens and Cooktops Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ACP SOLUTIONS (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ACP SOLUTIONS (UNITED STATES)

- BOSCH (GERMANY)

- ELECTROLUX (SWEDEN)

- FRIGIDAIRE (UNITED STATES)

- GE (UNITED STATES)

- HAIER (CHINA)

- KENMORE (UNITED STATES)

- KITCHENAID (UNITED STATES)

- MEDIA (CHINA)

- MERRYCHEF (UNITED KINGDOM)

- MIELE (GERMANY)

- PANASONIC (JAPAN)

- SAMSUNG (SOUTH KOREA)

- SIEMENS (GERMANY)

- WHIRLPOOL CORPORATION (UNITED STATES)

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC OVENS AND COOKTOPS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Ovens and Cooktops Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 45.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.4 % |

Market Size in 2032: |

USD 79.54 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC OVENS AND COOKTOPS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC OVENS AND COOKTOPS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC OVENS AND COOKTOPS MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC OVENS AND COOKTOPS MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC OVENS AND COOKTOPS MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC OVENS AND COOKTOPS MARKET BY TYPE

TABLE 008. MULTI-FUNCTION TYPE MARKET OVERVIEW (2016-2028)

TABLE 009. NORMAL TYPE MARKET OVERVIEW (2016-2028)

TABLE 010. ELECTRIC OVENS AND COOKTOPS MARKET BY APPLICATION

TABLE 011. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 012. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA ELECTRIC OVENS AND COOKTOPS MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA ELECTRIC OVENS AND COOKTOPS MARKET, BY APPLICATION (2016-2028)

TABLE 015. N ELECTRIC OVENS AND COOKTOPS MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE ELECTRIC OVENS AND COOKTOPS MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE ELECTRIC OVENS AND COOKTOPS MARKET, BY APPLICATION (2016-2028)

TABLE 018. ELECTRIC OVENS AND COOKTOPS MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC ELECTRIC OVENS AND COOKTOPS MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC ELECTRIC OVENS AND COOKTOPS MARKET, BY APPLICATION (2016-2028)

TABLE 021. ELECTRIC OVENS AND COOKTOPS MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA ELECTRIC OVENS AND COOKTOPS MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA ELECTRIC OVENS AND COOKTOPS MARKET, BY APPLICATION (2016-2028)

TABLE 024. ELECTRIC OVENS AND COOKTOPS MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA ELECTRIC OVENS AND COOKTOPS MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA ELECTRIC OVENS AND COOKTOPS MARKET, BY APPLICATION (2016-2028)

TABLE 027. ELECTRIC OVENS AND COOKTOPS MARKET, BY COUNTRY (2016-2028)

TABLE 028. GE: SNAPSHOT

TABLE 029. GE: BUSINESS PERFORMANCE

TABLE 030. GE: PRODUCT PORTFOLIO

TABLE 031. GE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. WHIRLPOOL CORPORATION: SNAPSHOT

TABLE 032. WHIRLPOOL CORPORATION: BUSINESS PERFORMANCE

TABLE 033. WHIRLPOOL CORPORATION: PRODUCT PORTFOLIO

TABLE 034. WHIRLPOOL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. FRIGIDAIRE: SNAPSHOT

TABLE 035. FRIGIDAIRE: BUSINESS PERFORMANCE

TABLE 036. FRIGIDAIRE: PRODUCT PORTFOLIO

TABLE 037. FRIGIDAIRE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. KENMORE: SNAPSHOT

TABLE 038. KENMORE: BUSINESS PERFORMANCE

TABLE 039. KENMORE: PRODUCT PORTFOLIO

TABLE 040. KENMORE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. KITCHENAID: SNAPSHOT

TABLE 041. KITCHENAID: BUSINESS PERFORMANCE

TABLE 042. KITCHENAID: PRODUCT PORTFOLIO

TABLE 043. KITCHENAID: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. BOSCH: SNAPSHOT

TABLE 044. BOSCH: BUSINESS PERFORMANCE

TABLE 045. BOSCH: PRODUCT PORTFOLIO

TABLE 046. BOSCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. SIEMENS: SNAPSHOT

TABLE 047. SIEMENS: BUSINESS PERFORMANCE

TABLE 048. SIEMENS: PRODUCT PORTFOLIO

TABLE 049. SIEMENS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. SAMSUNG: SNAPSHOT

TABLE 050. SAMSUNG: BUSINESS PERFORMANCE

TABLE 051. SAMSUNG: PRODUCT PORTFOLIO

TABLE 052. SAMSUNG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. MEDIA: SNAPSHOT

TABLE 053. MEDIA: BUSINESS PERFORMANCE

TABLE 054. MEDIA: PRODUCT PORTFOLIO

TABLE 055. MEDIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. HAIER: SNAPSHOT

TABLE 056. HAIER: BUSINESS PERFORMANCE

TABLE 057. HAIER: PRODUCT PORTFOLIO

TABLE 058. HAIER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. PANASONIC: SNAPSHOT

TABLE 059. PANASONIC: BUSINESS PERFORMANCE

TABLE 060. PANASONIC: PRODUCT PORTFOLIO

TABLE 061. PANASONIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ELECTROLUX: SNAPSHOT

TABLE 062. ELECTROLUX: BUSINESS PERFORMANCE

TABLE 063. ELECTROLUX: PRODUCT PORTFOLIO

TABLE 064. ELECTROLUX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. MERRYCHEF: SNAPSHOT

TABLE 065. MERRYCHEF: BUSINESS PERFORMANCE

TABLE 066. MERRYCHEF: PRODUCT PORTFOLIO

TABLE 067. MERRYCHEF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. MIELE: SNAPSHOT

TABLE 068. MIELE: BUSINESS PERFORMANCE

TABLE 069. MIELE: PRODUCT PORTFOLIO

TABLE 070. MIELE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. ACP SOLUTIONS: SNAPSHOT

TABLE 071. ACP SOLUTIONS: BUSINESS PERFORMANCE

TABLE 072. ACP SOLUTIONS: PRODUCT PORTFOLIO

TABLE 073. ACP SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. ALTO-SHAAM: SNAPSHOT

TABLE 074. ALTO-SHAAM: BUSINESS PERFORMANCE

TABLE 075. ALTO-SHAAM: PRODUCT PORTFOLIO

TABLE 076. ALTO-SHAAM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. MERRYCHEF: SNAPSHOT

TABLE 077. MERRYCHEF: BUSINESS PERFORMANCE

TABLE 078. MERRYCHEF: PRODUCT PORTFOLIO

TABLE 079. MERRYCHEF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. APPLICATION COVERAGE (MARKET SIZE & FORECAST: SNAPSHOT

TABLE 080. APPLICATION COVERAGE (MARKET SIZE & FORECAST: BUSINESS PERFORMANCE

TABLE 081. APPLICATION COVERAGE (MARKET SIZE & FORECAST: PRODUCT PORTFOLIO

TABLE 082. APPLICATION COVERAGE (MARKET SIZE & FORECAST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. DIFFERENT DEMAND MARKET BY REGION: SNAPSHOT

TABLE 083. DIFFERENT DEMAND MARKET BY REGION: BUSINESS PERFORMANCE

TABLE 084. DIFFERENT DEMAND MARKET BY REGION: PRODUCT PORTFOLIO

TABLE 085. DIFFERENT DEMAND MARKET BY REGION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. MAIN CONSUMER PROFILE ETC.):: SNAPSHOT

TABLE 086. MAIN CONSUMER PROFILE ETC.):: BUSINESS PERFORMANCE

TABLE 087. MAIN CONSUMER PROFILE ETC.):: PRODUCT PORTFOLIO

TABLE 088. MAIN CONSUMER PROFILE ETC.):: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. RESIDENTIAL: SNAPSHOT

TABLE 089. RESIDENTIAL: BUSINESS PERFORMANCE

TABLE 090. RESIDENTIAL: PRODUCT PORTFOLIO

TABLE 091. RESIDENTIAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. COMMERCIAL: SNAPSHOT

TABLE 092. COMMERCIAL: BUSINESS PERFORMANCE

TABLE 093. COMMERCIAL: PRODUCT PORTFOLIO

TABLE 094. COMMERCIAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. REGION COVERAGE (REGIONAL PRODUCTION: SNAPSHOT

TABLE 095. REGION COVERAGE (REGIONAL PRODUCTION: BUSINESS PERFORMANCE

TABLE 096. REGION COVERAGE (REGIONAL PRODUCTION: PRODUCT PORTFOLIO

TABLE 097. REGION COVERAGE (REGIONAL PRODUCTION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. DEMAND & FORECAST BY COUNTRIES ETC.):: SNAPSHOT

TABLE 098. DEMAND & FORECAST BY COUNTRIES ETC.):: BUSINESS PERFORMANCE

TABLE 099. DEMAND & FORECAST BY COUNTRIES ETC.):: PRODUCT PORTFOLIO

TABLE 100. DEMAND & FORECAST BY COUNTRIES ETC.):: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. NORTH AMERICA (U.S.: SNAPSHOT

TABLE 101. NORTH AMERICA (U.S.: BUSINESS PERFORMANCE

TABLE 102. NORTH AMERICA (U.S.: PRODUCT PORTFOLIO

TABLE 103. NORTH AMERICA (U.S.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. CANADA: SNAPSHOT

TABLE 104. CANADA: BUSINESS PERFORMANCE

TABLE 105. CANADA: PRODUCT PORTFOLIO

TABLE 106. CANADA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. MEXICO): SNAPSHOT

TABLE 107. MEXICO): BUSINESS PERFORMANCE

TABLE 108. MEXICO): PRODUCT PORTFOLIO

TABLE 109. MEXICO): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. EUROPE (GERMANY: SNAPSHOT

TABLE 110. EUROPE (GERMANY: BUSINESS PERFORMANCE

TABLE 111. EUROPE (GERMANY: PRODUCT PORTFOLIO

TABLE 112. EUROPE (GERMANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. U.K.: SNAPSHOT

TABLE 113. U.K.: BUSINESS PERFORMANCE

TABLE 114. U.K.: PRODUCT PORTFOLIO

TABLE 115. U.K.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115. FRANCE: SNAPSHOT

TABLE 116. FRANCE: BUSINESS PERFORMANCE

TABLE 117. FRANCE: PRODUCT PORTFOLIO

TABLE 118. FRANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 118. ITALY: SNAPSHOT

TABLE 119. ITALY: BUSINESS PERFORMANCE

TABLE 120. ITALY: PRODUCT PORTFOLIO

TABLE 121. ITALY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 121. RUSSIA: SNAPSHOT

TABLE 122. RUSSIA: BUSINESS PERFORMANCE

TABLE 123. RUSSIA: PRODUCT PORTFOLIO

TABLE 124. RUSSIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 124. SPAIN ETC.): SNAPSHOT

TABLE 125. SPAIN ETC.): BUSINESS PERFORMANCE

TABLE 126. SPAIN ETC.): PRODUCT PORTFOLIO

TABLE 127. SPAIN ETC.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 127. ASIA-PACIFIC (CHINA: SNAPSHOT

TABLE 128. ASIA-PACIFIC (CHINA: BUSINESS PERFORMANCE

TABLE 129. ASIA-PACIFIC (CHINA: PRODUCT PORTFOLIO

TABLE 130. ASIA-PACIFIC (CHINA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 130. INDIA: SNAPSHOT

TABLE 131. INDIA: BUSINESS PERFORMANCE

TABLE 132. INDIA: PRODUCT PORTFOLIO

TABLE 133. INDIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 133. JAPAN: SNAPSHOT

TABLE 134. JAPAN: BUSINESS PERFORMANCE

TABLE 135. JAPAN: PRODUCT PORTFOLIO

TABLE 136. JAPAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 136. SOUTHEAST ASIA ETC.): SNAPSHOT

TABLE 137. SOUTHEAST ASIA ETC.): BUSINESS PERFORMANCE

TABLE 138. SOUTHEAST ASIA ETC.): PRODUCT PORTFOLIO

TABLE 139. SOUTHEAST ASIA ETC.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 139. SOUTH AMERICA (BRAZIL: SNAPSHOT

TABLE 140. SOUTH AMERICA (BRAZIL: BUSINESS PERFORMANCE

TABLE 141. SOUTH AMERICA (BRAZIL: PRODUCT PORTFOLIO

TABLE 142. SOUTH AMERICA (BRAZIL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 142. ARGENTINA ETC.): SNAPSHOT

TABLE 143. ARGENTINA ETC.): BUSINESS PERFORMANCE

TABLE 144. ARGENTINA ETC.): PRODUCT PORTFOLIO

TABLE 145. ARGENTINA ETC.): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC OVENS AND COOKTOPS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC OVENS AND COOKTOPS MARKET OVERVIEW BY TYPE

FIGURE 012. MULTI-FUNCTION TYPE MARKET OVERVIEW (2016-2028)

FIGURE 013. NORMAL TYPE MARKET OVERVIEW (2016-2028)

FIGURE 014. ELECTRIC OVENS AND COOKTOPS MARKET OVERVIEW BY APPLICATION

FIGURE 015. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 016. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA ELECTRIC OVENS AND COOKTOPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE ELECTRIC OVENS AND COOKTOPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC ELECTRIC OVENS AND COOKTOPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA ELECTRIC OVENS AND COOKTOPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA ELECTRIC OVENS AND COOKTOPS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Ovens and Cooktops Market research report is 2024-2032.

ACP Solutions (United States), Bosch (Germany), Electrolux (Sweden), Frigidaire (United States) and Other Major Players.

The Electric Ovens and Cooktops Market is segmented into Type, Application, and region. By Type, the market is categorized into Multi-Function Type, Normal Type. By Application, the market is categorized into Residential, Commercial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An electric stove, electric cooker or an electric range is stove that has an electrical appliance used for cooking and baking. Electric stoves were preferred to solid-fuel (wood or coal) stoves, which took much more effort to generate, tended, and sustained. An oven that became hot through electrical energy and also the food is heated through the energy is known as electric oven. The electric oven on the other hand utilizes electrical energy and then it utilizes heating elements in order to generate heat. Most electric ovens have more than one cooking technique because of the type of heating that is installed to the appliance and the features may include; brochure, convection fans, and control electronics. Some of the important parts of an electric oven include cabinet the heating elements, the thermostat the timer and the power regulating switch. Cooktop or electric cooktop is the part of an electric stove that includes heating components and is responsible for heating pots and pans.

Electric Ovens and Cooktops Market Size Was Valued at USD 45.9 Billion in 2023, and is Projected to Reach USD 79.54 Billion by 2032, Growing at a CAGR of 6.4% From 2024-2032.