Drip Coffee Makers Market Synopsis

Drip Coffee Makers Market Size Was Valued at USD 1.97 Billion in 2022, and is Projected to Reach USD 2.53 Billion by 2030, Growing at a CAGR of 3.20% From 2023-2030.

Drip coffee makers are popular appliances designed for the convenient and efficient brewing of coffee. They consist of a water reservoir, a heating element, a filter basket, and a carafe. The process begins with water from the reservoir being heated and then dripped over coffee grounds in the filter basket.

- These machines offer simplicity and ease of use, making them a staple in many households and offices. Users can typically control aspects such as brew strength and sometimes even the temperature. Drip coffee makers accommodate various coffee grind sizes, allowing customization based on personal preferences.

- One of the advantages of drip brewing is its ability to produce multiple cups at once, making it suitable for serving larger groups. Additionally, many modern drip coffee makers include programmable features, enabling users to set a timer for the machine to start brewing at a specific time, ensuring a fresh pot of coffee is ready when needed.

- Drip coffee makers, known for their simplicity and ease of use, continued to dominate household kitchens and workplaces. Key drivers of market growth included rising consumer awareness of specialty coffee, busy lifestyles demanding quick and efficient brewing solutions, and the affordability of drip coffee makers compared to high-end alternatives.

- Manufacturers focused on innovation, introducing features such as programmable timers, thermal carafes, and customizable brewing options to cater to diverse consumer preferences. The market also witnessed a surge in demand for smart, connected coffee makers that could be controlled via mobile apps.

Drip Coffee Makers Market Trend Analysis

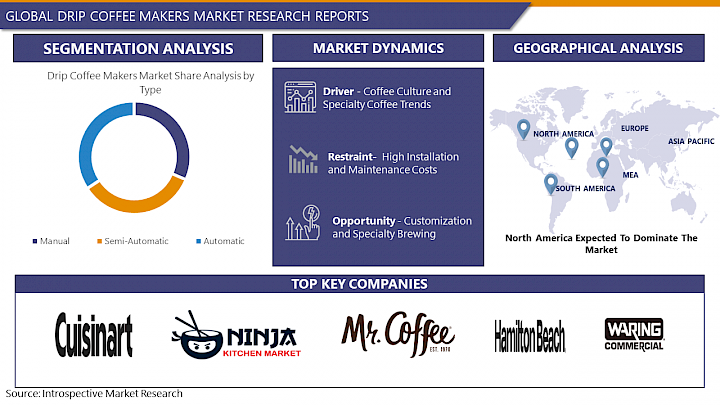

Coffee Culture and Specialty Coffee Trends

- The Drip Coffee Makers market is experiencing significant growth, primarily fueled by the evolving coffee culture and the surge in specialty coffee trends. As consumers develop a more sophisticated palate and a heightened appreciation for unique coffee flavors, the demand for high-quality brewing methods has intensified.

- Coffee culture, marked by a shift towards artisanal and specialty coffee experiences, has propelled the popularity of Drip Coffee Makers. These machines offer a convenient yet customizable brewing process, allowing users to experiment with different coffee beans and grind sizes to achieve the desired flavor profiles.

- Specialty coffee trends, characterized by an emphasis on origin, processing methods, and unique blends, have further elevated the importance of precision in brewing. Drip Coffee Makers, with their ability to control variables such as water temperature and extraction time, cater to the discerning tastes of consumers seeking a more refined coffee-drinking experience.

Customization and Specialty Brewing creates an Opportunity for Drip Coffee Makers Market

- Consumers today seek a personalized coffee experience, and customization features in drip coffee makers cater to this demand. Manufacturers can capitalize on this trend by offering adjustable settings for brewing time, temperature, and grind size, allowing users to tailor their coffee to individual preferences.

- Furthermore, the rise of specialty coffee culture presents a significant opportunity for drip coffee makers. Consumers are increasingly exploring diverse coffee beans, origins, and brewing methods. Drip coffee makers that can accommodate specialty coffee requirements, such as precise water temperature control for optimal extraction or programmable brewing profiles, can carve a niche in this expanding market.

- As consumers become more discerning about the quality of their coffee, drip coffee makers with advanced features, like integrated grinders, water filtration systems, and smart connectivity, can capture the attention of enthusiasts. Manufacturers that understand and adapt to these trends will find themselves well-positioned to thrive in the evolving landscape of the drip coffee maker market.

Drip Coffee Makers Market Segment Analysis:

Drip Coffee Makers Market Segmented on the basis of type, application, Distribution Channel and End-Use Industry.

By Type, Semi-Automatic segment is expected to dominate the market during the forecast period

- Semi-Automatic Drip Coffee Makers offer a harmonious blend of user control and convenience, striking a balance that resonates with a broad consumer base. These machines provide users with the flexibility to customize brewing parameters, such as coffee grind size and water temperature, allowing for a tailored coffee experience. The appeal of this hands-on approach appeals to coffee enthusiasts who value the art and science of brewing.

- Furthermore, the Semi-Automatic segment often boasts sleek designs and user-friendly interfaces, enhancing the overall user experience. As consumers increasingly seek premium, café-quality coffee at home, the Semi-Automatic Drip Coffee Makers align with this demand. Technological advancements within the Semi-Automatic segment, such as programmable timers and intuitive controls, contribute to its market dominance.

By Application, Commercial Use segment held the largest share of 48% in 2022

- The Commercial Use segment's ascendancy can be attributed to several factors. The proliferation of coffee culture and the surge in coffee consumption have fueled the growth of coffee-centric businesses, driving the need for technologically advanced and scalable drip coffee solutions. Moreover, the emphasis on quality and consistency in commercial settings further propels the adoption of drip coffee makers, as they offer precision and control over the brewing process.

- Advancements in technology have led to the development of innovative features in commercial drip coffee makers, such as programmable settings, multiple brewing options, and energy-efficient designs, enhancing their appeal to businesses seeking productivity and sustainability.

Drip Coffee Makers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has traditionally been a significant market for drip coffee makers, and several factors contribute to its dominance. The region has a strong coffee culture, with a high percentage of coffee drinkers and a preference for convenient home-brewed coffee. The United States, in particular, has a large consumer base that values the ease and efficiency of drip coffee makers.

- Furthermore, the North American market is characterized by a diverse range of coffee machine manufacturers offering innovative features and designs. The lifestyle and work patterns in the region often drive the demand for time-saving and user-friendly appliances, making drip coffee makers a popular choice.

- Additionally, the growing trend of specialty coffee and the increasing emphasis on premium brewing methods contribute to the sustained demand for drip coffee makers in North America. Factors such as technological advancements, product design, and marketing strategies also play a role in maintaining the region's dominance in the drip coffee makers market.

Drip Coffee Makers Market Top Key Players:

- Cuisinart (United States)

- Ninja Kitchen (United States)

- Mr. Coffee (United States)

- Hamilton Beach Brands, Inc. (United States)

- Waring Commercial (United States)

- Stagg EKG (United States)

- Fellow Industries (United States)

- OXO International (United States)

- Chemex Corporation (United States)

- Newell Brands (United States)

- Coffee Gator (United States)

- Bonavita (Canada)

- Krups GmbH (Germany)

- BSH Home Appliances Corporation (Germany)

- Groupe SEB (France)

- Moccamaster (Netherlands)

- Technivorm (Netherlands)

- Bodum (Switzerland)

- Electrolux AB (Sweden)

- De'Longhi Appliances S.r.l (Italy)

- Hario V60 (Japan)

- Kalita Wave (Japan)

- Yama Glass (Japan)

- Breville Group Ltd. (Australia)

- Barista Warrior (Australia)

Key Industry Developments in the Drip Coffee Makers Market:

In October 2023, Technivorm Moccamaster KBT Launched this coffee maker boasts thermal carafe temperature control, allowing users to choose between three warmth settings for optimal coffee enjoyment.

In September 2023, Breville Precision Brewer Thermal Released this model features PID temperature control and advanced brewing settings for precise coffee extraction, catering to coffee enthusiasts.

|

Global Drip Coffee Makers Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.97 Bn. |

|

Forecast Period 2023-30 CAGR: |

3.20 % |

Market Size in 2030: |

USD 2.53 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

Distribution Channel |

|

||

|

End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DRIP COFFEE MAKERS MARKET BY TYPE (2016-2030)

- DRIP COFFEE MAKERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MANUAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEMI-AUTOMATIC

- AUTOMATIC

- DRIP COFFEE MAKERS MARKET BY APPLICATION (2016-2030)

- DRIP COFFEE MAKERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOME USE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL USE

- OFFICE

- DRIP COFFEE MAKERS MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- DRIP COFFEE MAKERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MULTI-BRANDED STORES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPECIALTY STORES

- E-COMMERCE

- DRIP COFFEE MAKERS MARKET BY END-USE INDUSTRY (2016-2030)

- DRIP COFFEE MAKERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FAST FOOD RESTAURANTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BFAST FOOD RESTAURANTS

- CAFETERIAS

- CARRYOUT RESTAURANT

- FINE DINING RESTAURANTS

- OTHER (HOTEL AND CLUB FOODSERVICE, CASUAL DINING RESTAURANTS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- DRIP COFFEE MAKERS Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CUISINART (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- NINJA KITCHEN (UNITED STATES)

- MR. COFFEE (UNITED STATES)

- HAMILTON BEACH BRANDS, INC. (UNITED STATES)

- WARING COMMERCIAL (UNITED STATES)

- STAGG EKG (UNITED STATES)

- FELLOW INDUSTRIES (UNITED STATES)

- OXO INTERNATIONAL (UNITED STATES)

- CHEMEX CORPORATION (UNITED STATES)

- NEWELL BRANDS (UNITED STATES)

- COFFEE GATOR (UNITED STATES)

- BONAVITA (CANADA)

- KRUPS GMBH (GERMANY)

- BSH HOME APPLIANCES CORPORATION (GERMANY)

- GROUPE SEB (FRANCE)

- MOCCAMASTER (NETHERLANDS)

- TECHNIVORM (NETHERLANDS)

- BODUM (SWITZERLAND)

- ELECTROLUX AB (SWEDEN)

- DE'LONGHI APPLIANCES S.R.L (ITALY)

- COMPETITIVE LANDSCAPE

- GLOBAL DRIP COFFEE MAKERS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By End-Use Industry

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Drip Coffee Makers Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.97 Bn. |

|

Forecast Period 2023-30 CAGR: |

3.20 % |

Market Size in 2030: |

USD 2.53 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

Distribution Channel |

|

||

|

End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Drip Coffee Makers Market research report is 2023-2030.

Cuisinart (United States),Ninja Kitchen (United States),Mr. Coffee (United States),Hamilton Beach Brands, Inc. (United States),Waring Commercial (United States),Stagg EKG (United States),Fellow Industries (United States),OXO International (United States),Chemex Corporation (United States),Newell Brands (United States),Coffee Gator (United States),Bonavita (Canada),Krups GmbH (Germany),BSH Home Appliances Corporation (Germany),Groupe SEB (France),Moccamaster (Netherlands),Technivorm (Netherlands),Bodum (Switzerland),Electrolux AB (Sweden),De'Longhi Appliances S.r.l (Italy),Hario V60 (Japan),Kalita Wave (Japan),Yama Glass (Japan),Breville Group Ltd. (Australia),Barista Warrior (Australia) and Other Major Players.

The Drip Coffee Makers Market is segmented into Type, Application, Distribution Channel, End-Use Industry and region. By Type, the market is categorized into Manual, Semi-Automatic, Automatic. By Application, the market is categorized into Home Use, Commercial Use, Office. By Distribution Channel, the market is categorized into Multi-branded Stores, Specialty Stores, E-commerce. By End-Use Industry, the market is categorized into Fast Food Restaurants, Cafeterias, Carryout Restaurants, Fine Dining Restaurants, Other (Hotel and Club Foodservice, Casual Dining Restaurants). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Drip coffee makers are popular appliances designed for the convenient and efficient brewing of coffee. They consist of a water reservoir, a heating element, a filter basket, and a carafe. The process begins with water from the reservoir being heated and then dripped over coffee grounds in the filter basket.

Drip Coffee Makers Market Size Was Valued at USD 1.97 Billion in 2022, and is Projected to Reach USD 2.53 Billion by 2030, Growing at a CAGR of 3.20% From 2023-2030.