Meat Slicers Market Synopsis

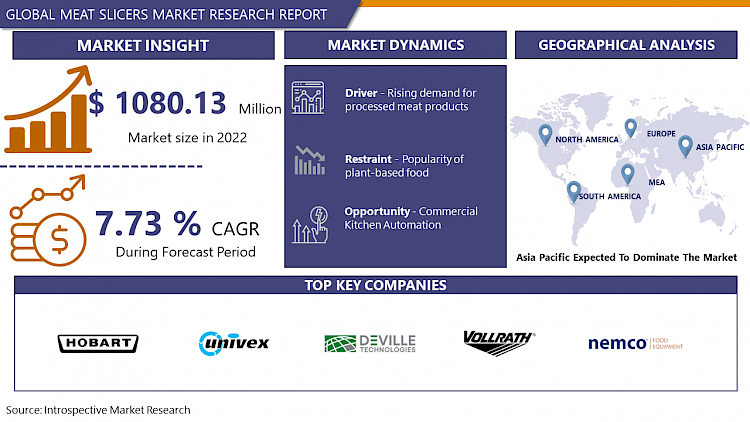

Global Meat Slicers Market Size Was Valued at USD 1080.13 Million in 2022, and is Projected to Reach USD 1959.61 Million by 2030, Growing at a CAGR of 7.73% From 2023-2030.

Meat slicers are equipment that slices meats, cheeses, sausages, and other deli items at butcher shops and delicatessens. It is also known as a slicer or deli slicer. For finely cutting and combining raw or cooked meat, fish, veggies, or similar foods, this culinary tool is well-liked. It's the mincing knife's replacement.

- Meat slicers provide a range of benefits, shaping market trends and fostering increased demand across various sectors. They streamline food preparation, saving time and ensuring consistent slice thickness, a critical factor in the presentation and quality of dishes in homes and businesses alike. Their versatility extends beyond meats to cheeses, vegetables, and bread, making them indispensable tools in diverse culinary settings. Furthermore, advancements such as automatic sharpening, programmable slicing thickness, and safety features enhance their appeal and usability.

- Market trends reflect a growing preference for automated and technologically advanced meat slicers, meeting the rising demand for convenience and consistency in food service establishments. In response to consumer interest in healthier options, there's a rising demand for meat slicers offering adjustable slicing thickness, enabling customization and portion control. Additionally, with the increasing popularity of online food delivery services and home cooking, there's a burgeoning market for residential meat slicers, driven by the desire for restaurant-quality meals at home.

Meat Slicers Market Trend Analysis

Rising demand for processed meat products

- The increasing popularity of processed meat roducts is a significant driver for the meat slicers market, driven by several factors. Processed meats such as deli and cured meats are widely favored in various culinary uses like sandwiches, charcuterie boards, and party platters. Achieving uniform thickness and presentation, crucial for these products, is efficiently facilitated by meat slicers.

- The convenience and time-saving aspects of processed meats resonate with busy consumers, spurring demand for sliced meats in both commercial and residential settings. Meat slicers enable businesses to efficiently process large meat volumes, enhancing operational efficiency and customer satisfaction.

- Furthermore, the versatility of meat slicers allows for slicing different types of processed meats, catering to diverse consumer preferences in cuts and thicknesses. Consequently, the surging popularity of processed meat products drives the increased adoption of meat slicers in both food service establishments and households, fueling market growth.

Commercial Kitchen Automation

- Commercial kitchen automation offers significant opportunities for meat slicers in the food service industry. With a growing emphasis on efficiency, consistency, and labor savings, there's an increasing demand for automated solutions that streamline food preparation processes. Meat slicers play a pivotal role in this trend by providing advanced features like programmable slicing thickness, automatic sharpening, and integrated safety mechanisms.

- By integrating meat slicers into automated kitchen setups, businesses can achieve higher levels of precision and productivity while minimizing human error and labor costs. These automated systems seamlessly combine with other kitchen equipment such as food processors, ovens, and refrigeration units, optimizing workflow and reducing downtime.

- Moreover, commercial kitchen automation improves food safety and hygiene by reducing handling and cross-contamination risks associated with manual food preparation. This not only enhances the quality and consistency of food products but also elevates the overall dining experience for customers.

Meat Slicers Market Segment Analysis:

Meat Slicers Market Segmented on the basis of Type, Blade Type, Application, and Material.

By Type, Automatic Meat Slicers segment is expected to dominate the market during the forecast period

- During the forecast period, the Automatic Meat Slicers segment is poised to lead the market due to several key factors. Automatic meat slicers provide unmatched efficiency and convenience in food preparation, especially in commercial environments like restaurants, delis, and supermarkets. These slicers streamline the slicing process by automatically adjusting the thickness, reducing labor time, and ensuring consistent slices.

- Growing demand for automation in the food service industry is propelling the adoption of automatic meat slicers. Businesses are increasingly investing in automated solutions to improve operational efficiency, minimize errors, and meet the rising demand for quality and consistency in food products.

- Furthermore, technological advancements in automatic meat slicers, including programmable slicing parameters and integrated safety features, contribute to their dominance. These innovations enhance user experience, elevate food safety standards, and address the evolving needs of the food service sector.

By Material, Stainless Steel segment is expected to dominate the market during the forecast period

- During the forecast period, the Stainless-Steel segment is anticipated to lead the market due to several key reasons. Stainless steel is renowned for its outstanding durability, resistance to corrosion, and hygienic properties, making it the preferred material for constructing meat slicers. This material ensures a prolonged lifespan and upholds food safety standards, which are critical factors in commercial food preparation environments.

- Stainless steel offers aesthetic appeal and ease of cleaning, improving the overall user experience and meeting stringent hygiene regulations in the food service sector. Its sleek appearance and smooth surface contribute to creating a professional kitchen ambiance while simplifying cleaning tasks.

- The robustness of stainless steel instills confidence in consumers regarding product quality and dependability, driving the preference for meat slicers made from this material. Consequently, the Stainless-Steel segment is expected to dominate the market, reflecting widespread acknowledgment of its superior attributes and suitability for manufacturing meat slicers, both in commercial and residential settings.

Meat Slicers Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The projection that the Asia Pacific region will dominate the meat slicers market over the forecast period is underpinned by several key factors. Rapid urbanization across countries like China, India, and Southeast Asia is fostering increased demand for processed foods, including sliced meats. This heightened demand is driven by evolving consumer lifestyles, characterized by busier schedules and a growing preference for convenient food options.

- The burgeoning food service industry in the region, encompassing restaurants, hotels, and catering services, presents significant opportunities for meat slicer manufacturers. As the food service sector expands to cater to a growing population and rising disposable incomes, there is a corresponding increase in demand for efficient food preparation equipment like meat slicers.

- Moreover, the adoption of Western culinary influences in Asia Pacific countries further amplifies the demand for meat slicers, as these appliances are essential for preparing a wide range of Western-style dishes. Taken together, these factors position the Asia Pacific region to dominate the meat slicer market in the coming years.

Meat Slicers Market Top Key Players:

- Hobart Corporation (US)

- Globe Food Equipment Company (US)

- Vollrath (US)

- Nemco Food Equipment (US)

- Anvil America (US)

- Avantco Equipment (US)

- Univex Corporation (US)

- Vevor (US)

- Deville Technologies (Canada)

- OMCAN (Canada)

- Bizerba (Germany)

- VITO AG (Germany)

- Berkel (Italy)

- Sirman (Italy)

- Omas (Italy)

- Tre Spade (Italy)

- Rheninghaus (Italy)

- FEM (Foodservice Equipment Marketing) (UK)

- AXIS (Netherlands)

- Edge Food Equipment (Australia), and Other Major Players.

Key Industry Developments in the Meat Slicers Market:

- In August 2022, Weber launched the weSLICE 4000/4500 slicers in the UK and Ireland as part of its Slicing Division within Interfood Technology. These slicers combine flexibility and versatility, building upon the success of the popular Weber 405 slicer, which featured an inline automatic loading system.

|

Global Meat Slicers Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1080.13 Mn. |

|

Forecast Period 2023-30 CAGR: |

7.73 % |

Market Size in 2030: |

USD 1959.61 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Blade Type |

|

||

|

By Application |

|

||

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MEAT SLICERS MARKET BY TYPE (2017-2030)

- MEAT SLICERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MANUAL MEAT SLICERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUTOMATIC MEAT SLICERS

- SEMI-AUTOMATIC MEAT SLICERS

- MEAT SLICERS MARKET BY BLADE TYPE (2017-2030)

- MEAT SLICERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SERRATED BLADES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMOOTH BLADES

- FROZEN MEAT BLADES

- MEAT SLICERS MARKET BY APPLICATION (2017-2030)

- MEAT SLICERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MEAT PROCESSING PLANTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FOODSERVICE INDUSTRY

- HOME USE

- MEAT SLICERS MARKET BY MATERIAL (2017-2030)

- MEAT SLICERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STAINLESS STEEL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ALUMINUM

- PLASTIC

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Meat Slicers Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- HOBART CORPORATION (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- GLOBE FOOD EQUIPMENT COMPANY (US)

- VOLLRATH (US)

- NEMCO FOOD EQUIPMENT (US)

- ANVIL AMERICA (US)

- AVANTCO EQUIPMENT (US)

- UNIVEX CORPORATION (US)

- VEVOR (US)

- DEVILLE TECHNOLOGIES (CANADA)

- OMCAN (CANADA)

- BIZERBA (GERMANY)

- VITO AG (GERMANY)

- BERKEL (ITALY)

- SIRMAN (ITALY)

- OMAS (ITALY)

- TRE SPADE (ITALY)

- RHENINGHAUS (ITALY)

- FEM (FOODSERVICE EQUIPMENT MARKETING) (UK)

- AXIS (NETHERLANDS)

- EDGE FOOD EQUIPMENT (AUSTRALIA)

- COMPETITIVE LANDSCAPE

- GLOBAL MEAT SLICERS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Blade Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Material

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Meat Slicers Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1080.13 Mn. |

|

Forecast Period 2023-30 CAGR: |

7.73 % |

Market Size in 2030: |

USD 1959.61 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Blade Type |

|

||

|

By Application |

|

||

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MEAT SLICERS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MEAT SLICERS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MEAT SLICERS MARKET COMPETITIVE RIVALRY

TABLE 005. MEAT SLICERS MARKET THREAT OF NEW ENTRANTS

TABLE 006. MEAT SLICERS MARKET THREAT OF SUBSTITUTES

TABLE 007. MEAT SLICERS MARKET BY TYPE

TABLE 008. ROTARY MEAT SLICER MARKET OVERVIEW (2016-2028)

TABLE 009. SLIDING MEAT SLICER MARKET OVERVIEW (2016-2028)

TABLE 010. PUSH MEAT SLICER MARKET OVERVIEW (2016-2028)

TABLE 011. OTHER TYPES MARKET OVERVIEW (2016-2028)

TABLE 012. MEAT SLICERS MARKET BY APPLICATION

TABLE 013. MEAT PROCESSING PLANT MARKET OVERVIEW (2016-2028)

TABLE 014. RESTAURANT MARKET OVERVIEW (2016-2028)

TABLE 015. OTHER MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA MEAT SLICERS MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA MEAT SLICERS MARKET, BY APPLICATION (2016-2028)

TABLE 018. N MEAT SLICERS MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE MEAT SLICERS MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE MEAT SLICERS MARKET, BY APPLICATION (2016-2028)

TABLE 021. MEAT SLICERS MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC MEAT SLICERS MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC MEAT SLICERS MARKET, BY APPLICATION (2016-2028)

TABLE 024. MEAT SLICERS MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA MEAT SLICERS MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA MEAT SLICERS MARKET, BY APPLICATION (2016-2028)

TABLE 027. MEAT SLICERS MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA MEAT SLICERS MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA MEAT SLICERS MARKET, BY APPLICATION (2016-2028)

TABLE 030. MEAT SLICERS MARKET, BY COUNTRY (2016-2028)

TABLE 031. GLOBE FOOD EQUIPMENT: SNAPSHOT

TABLE 032. GLOBE FOOD EQUIPMENT: BUSINESS PERFORMANCE

TABLE 033. GLOBE FOOD EQUIPMENT: PRODUCT PORTFOLIO

TABLE 034. GLOBE FOOD EQUIPMENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. ITW FOOD EQUIPMENT GROUP: SNAPSHOT

TABLE 035. ITW FOOD EQUIPMENT GROUP: BUSINESS PERFORMANCE

TABLE 036. ITW FOOD EQUIPMENT GROUP: PRODUCT PORTFOLIO

TABLE 037. ITW FOOD EQUIPMENT GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. BIRO MANUFACTURING: SNAPSHOT

TABLE 038. BIRO MANUFACTURING: BUSINESS PERFORMANCE

TABLE 039. BIRO MANUFACTURING: PRODUCT PORTFOLIO

TABLE 040. BIRO MANUFACTURING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. GROTE: SNAPSHOT

TABLE 041. GROTE: BUSINESS PERFORMANCE

TABLE 042. GROTE: PRODUCT PORTFOLIO

TABLE 043. GROTE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. TITAN SLICER: SNAPSHOT

TABLE 044. TITAN SLICER: BUSINESS PERFORMANCE

TABLE 045. TITAN SLICER: PRODUCT PORTFOLIO

TABLE 046. TITAN SLICER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. NEWBEL CATERING EQUIPMENT: SNAPSHOT

TABLE 047. NEWBEL CATERING EQUIPMENT: BUSINESS PERFORMANCE

TABLE 048. NEWBEL CATERING EQUIPMENT: PRODUCT PORTFOLIO

TABLE 049. NEWBEL CATERING EQUIPMENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. NANHAI LIHAO ELECTRIC WORKS: SNAPSHOT

TABLE 050. NANHAI LIHAO ELECTRIC WORKS: BUSINESS PERFORMANCE

TABLE 051. NANHAI LIHAO ELECTRIC WORKS: PRODUCT PORTFOLIO

TABLE 052. NANHAI LIHAO ELECTRIC WORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. DADAUX: SNAPSHOT

TABLE 053. DADAUX: BUSINESS PERFORMANCE

TABLE 054. DADAUX: PRODUCT PORTFOLIO

TABLE 055. DADAUX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. MOFFAT: SNAPSHOT

TABLE 056. MOFFAT: BUSINESS PERFORMANCE

TABLE 057. MOFFAT: PRODUCT PORTFOLIO

TABLE 058. MOFFAT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. NOAW: SNAPSHOT

TABLE 059. NOAW: BUSINESS PERFORMANCE

TABLE 060. NOAW: PRODUCT PORTFOLIO

TABLE 061. NOAW: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. BIRKO: SNAPSHOT

TABLE 062. BIRKO: BUSINESS PERFORMANCE

TABLE 063. BIRKO: PRODUCT PORTFOLIO

TABLE 064. BIRKO: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MEAT SLICERS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MEAT SLICERS MARKET OVERVIEW BY TYPE

FIGURE 012. ROTARY MEAT SLICER MARKET OVERVIEW (2016-2028)

FIGURE 013. SLIDING MEAT SLICER MARKET OVERVIEW (2016-2028)

FIGURE 014. PUSH MEAT SLICER MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHER TYPES MARKET OVERVIEW (2016-2028)

FIGURE 016. MEAT SLICERS MARKET OVERVIEW BY APPLICATION

FIGURE 017. MEAT PROCESSING PLANT MARKET OVERVIEW (2016-2028)

FIGURE 018. RESTAURANT MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA MEAT SLICERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE MEAT SLICERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC MEAT SLICERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA MEAT SLICERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA MEAT SLICERS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Meat Slicers Market research report is 2023-2030.

Hobart Corporation (US), Globe Food Equipment Company (US), Vollrath (US), Nemco Food Equipment (US), Anvil America (US), Avantco Equipment (US), Univex Corporation (US), Vevor (US), Deville Technologies (Canada), OMCAN (Canada), Bizerba (Germany), VITO AG (Germany), Berkel (Italy), Sirman (Italy), Omas (Italy), Tre Spade (Italy), Rheninghaus (Italy), FEM (Foodservice Equipment Marketing) (UK), AXIS (Netherlands), Edge Food Equipment (Australia), and Other Major Players.

The Meat Slicers Market is segmented into Type, Blade Type, Application, Material, and region. By Type, the market is categorized into Manual Meat Slicers, Automatic Meat Slicers, and Semi-automatic Meat Slicers. By Blade Type, the market is categorized into Serrated blades, Smooth blades, and Frozen meat blades. By Application, the market is categorized into Meat processing plants, the food service industry, and Home Use. By Material, the market is categorized into Stainless Steel, Aluminum, and Plastic. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Meat slicers are equipment that slices meats, cheeses, sausages, and other deli items at butcher shops and delicatessens. It is also known as a slicer or deli slicer. For finely cutting and combining raw or cooked meat, fish, veggies, or similar foods, this culinary tool is well-liked. It's the mincing knife's replacement.

Global Meat Slicers Market Size Was Valued at USD 1080.13 Million in 2022, and is Projected to Reach USD 1959.61 Million by 2030, Growing at a CAGR of 7.73% From 2023-2030.