Optocouplers Market Synopsis:

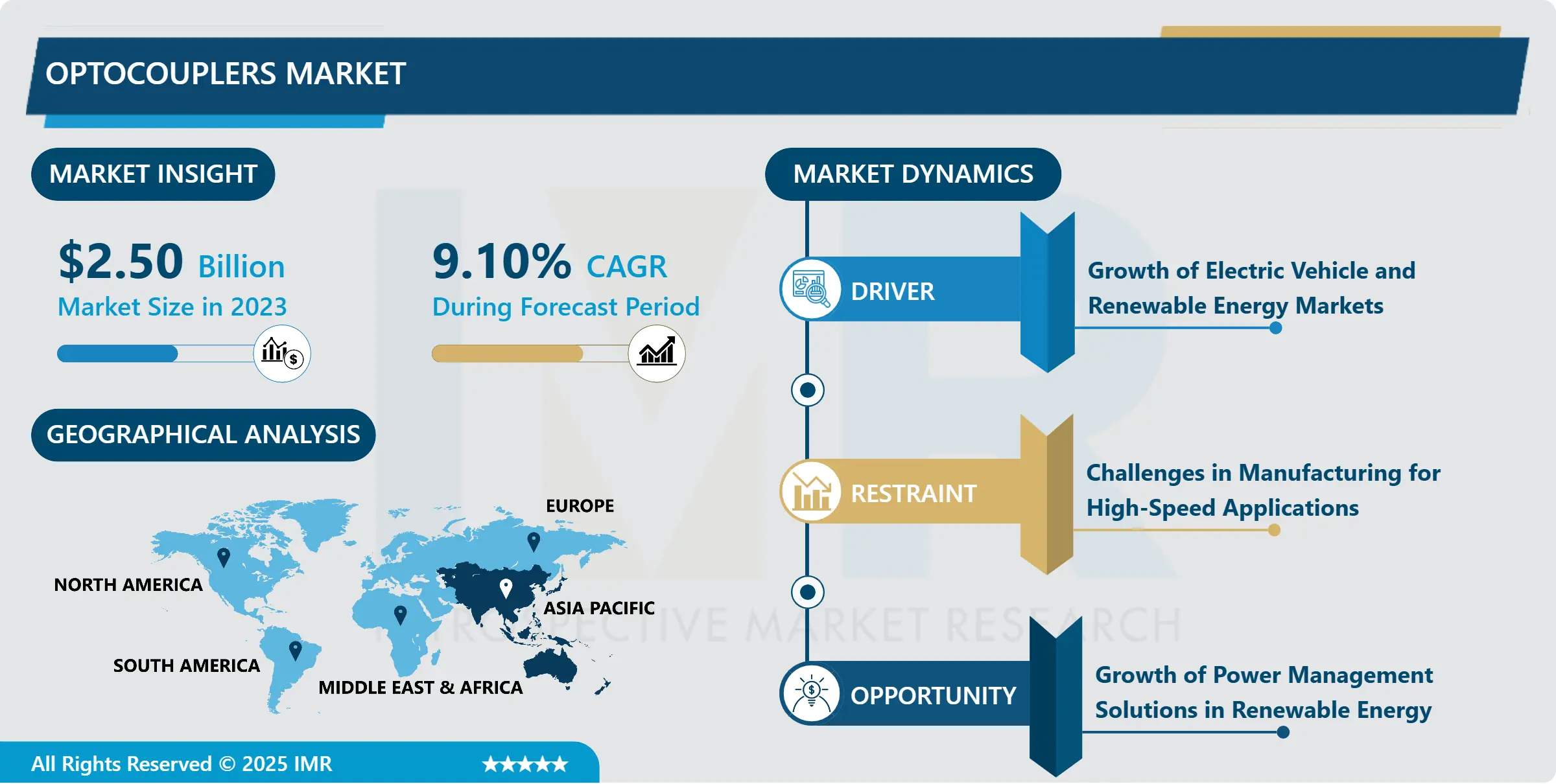

Optocouplers Market Size Was Valued at USD 2.50 Billion in 2023, and is Projected to Reach USD 5.47 Billion by 2032, Growing at a CAGR of 9.10% From 2024-2032.

Optocouplers or optoisolators are devices which transmit signals between two electric circuits using light. The set comprises of a light-emitting diode (LED) and a photosensitive component in terms of a photodiode, phototransistor or photometric detector. Optocouplers separate the control side from the power side within a circuit to shield low voltage parts from high voltage currents that may lead to destruction of circuit elements. These are widely deployed in connection with power supplies, industrial processes automation, automotive, telecoms and many others for transmitting signals safely and efficiently.

The mounting consumer electronics, automotive electronics and systems, and industrial automation is a key growth factor to the optocouplers market. Optocouplers are used to improve the performance of circuits, add electrical isolation, and guarantee high system availability. The application in power management systems including renewable energy and electric vehicles also increases rapidly; optocouplers offer safety and control in power converters and inverters.

In addition, miniaturization and low-power consumption technologies are giving a new impetus to the advancement of optocouplers. As technology continues to progress and design newer and better performing small devices and components, optocouplers are being incorporated into intimate and compact works. These devices are used widely in automotive, health care and telecommunication fields where the integrity of the system and electrical isolation are critical for the product to last.

Optocouplers Market Trend Analysis:

Shift towards the use of high-speed optocouplers

- Currently, the development of optocouplers is focused such as high speed optocouplers. These components facilitate high-speed transmission of signals, critical in telecommunication, automobile and industrial applications. As the development of 5G technology and ADAS, the need for high-speed optocouplers has been in high demand to provide a fast and accurate link between two circuits.

- Another of these trends is that photometric optocouplers are increasingly becoming common within industrial automation and power supply applications. These optocouplers are proving popular because of their efficiency and reliability to enable the control of high voltage equipment and total electrical isolation. As different sectors to work on energy saving and improved systems performance, photometric optocouplers gaining higher demand in systems which demand low power loss and high reliability.

The expanding electric vehicle (EV)

- Due to the growing market for EVs, there is a great opportunity for optocouplers on the market. With electric vehicles increasingly being adopted all over the world there is a heightened demand for efficient and effective power control systems. Optocouplers are crucial in preventing signal interference throughout electric vehicle charging systems, battery management systems and power conversion circuits, thereby triggering a steady increase in demand for the products. Players in the highly fragmentized optocoupler industry who wish to position themselves in these new opportunities basket should concentrate on developing specific products for automotive manufacturers.

- Also, increasing brittling of renewable energy systems like the use of solar and wind energy to generate electricity as a value-added technology can be noted as a promising opportunity for optocoupler production and marketing. In power supply systems to renewable energy applications, optocouplers serve as an isolation component to realize safer and more efficient power conversion. Due to progressively increasing concern of countries towards sustainability and clean energy, optocouplers will find applications in these systems and open up avenues for growth.

Optocouplers Market Segment Analysis:

Optocouplers Market is Segmented on the basis of Type, Application, End User, and Region.

By Type, Phototransistor Optocouplers segment is expected to dominate the market during the forecast period

- There is different classification of optocouplers based on the method of light transmission and type of photo sensitive element. Optocoupler phototransistors are designed for low to medium speed coupling applications and provide high current coupled/output current policies and electrical isolation. Photocoupler applied for more efficient light isolation, widely used in power supply and industrial control. Photodiode optocouplers are suitable for operation at high speed due to their short response times. High speed optocouplers normally have built-in LEDs and photodetector thus suitable for high frequency such as in telecommunication and advanced automotive systems.

By Application, Industrial Automation segment expected to held the largest share

- In industrial automation, they are applied to provide a means of disconnect between the control circuit and the power circuits in order to avoid hazards on a machine. In the consumer electronics though, optocouplers are applied to serve the function of signal isolation by being guard against interference. Optocoupler is also used in car models for electrical isolation in the control units and technical Adaptive Driving Assist Systems (ADAS). Telecommunications use optocouplers to allow data transfer at high speed, at the same time protecting it from hazards. Some of the other uses include use in power supplies; these are circuits that help regulate voltage, and other medical instruments; where electrical isolation is very important either for safety of functionality.

Optocouplers Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific plays the largest market share in the optocouplers market due to the increasing usage of electronics and industrial automation products. In Japan, China, and South Korea, optocouplers have a high level of consumption and production, caused by the strong electronics manufacturing industry and the growth of automotive and telecommunication industries. Subsequently, the automotive segment, especially electric cars and extended production, the uptake of Industrial Automation Technologies also support the region.

- Also, Asia-Pacific’s leadership in renewable energy investment in also reinforced by an equivalent commitment in renewable power generation capacity and electricity transmission networks. In this region, countries are also focally investing in green energy, when the whole world is engaged in improving efficiency and cutting emissions of energy, optocouplers are being greatly applied to guarantee the safety for power conversion systems. An extension of this is expected to place pressure on optocouplers’ demand within the area.

Active Key Players in the Optocouplers Market

- Broadcom Inc. (United States)

- Lite-On Technology Corporation (Taiwan)

- Murata Manufacturing Co., Ltd. (Japan)

- NEC Corporation (Japan)

- NXP Semiconductors N.V. (Netherlands)

- On Semiconductor (United States)

- Rohm Semiconductor (Japan)

- Sharp Corporation (Japan)

- Toshiba Corporation (Japan)

- Vishay Intertechnology, Inc. (United States)

- Other Active Players.

|

Optocouplers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.50 Billion |

|

Forecast Period 2024-32 CAGR: |

9.10 % |

Market Size in 2032: |

USD 5.47 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Optocouplers Market by Type

4.1 Optocouplers Market Snapshot and Growth Engine

4.2 Optocouplers Market Overview

4.3 Phototransistor Optocouplers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Phototransistor Optocouplers: Geographic Segmentation Analysis

4.4 Photometric Optocouplers

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Photometric Optocouplers: Geographic Segmentation Analysis

4.5 Photodiode Optocouplers

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Photodiode Optocouplers: Geographic Segmentation Analysis

4.6 High-Speed Optocouplers

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 High-Speed Optocouplers: Geographic Segmentation Analysis

Chapter 5: Optocouplers Market by Application

5.1 Optocouplers Market Snapshot and Growth Engine

5.2 Optocouplers Market Overview

5.3 Industrial Automation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Industrial Automation: Geographic Segmentation Analysis

5.4 Consumer Electronics

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Consumer Electronics: Geographic Segmentation Analysis

5.5 Automotive

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Automotive: Geographic Segmentation Analysis

5.6 Telecommunication

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Telecommunication: Geographic Segmentation Analysis

5.7 Power Supplies

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Power Supplies: Geographic Segmentation Analysis

5.8 Medical Equipment

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Medical Equipment: Geographic Segmentation Analysis

5.9 Others

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Others: Geographic Segmentation Analysis

Chapter 6: Optocouplers Market by End User

6.1 Optocouplers Market Snapshot and Growth Engine

6.2 Optocouplers Market Overview

6.3 Automotive Industry

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Automotive Industry: Geographic Segmentation Analysis

6.4 Consumer Electronics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Consumer Electronics: Geographic Segmentation Analysis

6.5 Telecommunications

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Telecommunications: Geographic Segmentation Analysis

6.6 Industrial

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Industrial: Geographic Segmentation Analysis

6.7 Healthcare

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Healthcare: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Optocouplers Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BROADCOM INC. (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TOSHIBA CORPORATION (JAPAN)

7.4 NEC CORPORATION (JAPAN)

7.5 SHARP CORPORATION (JAPAN)

7.6 VISHAY INTERTECHNOLOGY INC. (UNITED STATES)

7.7 ROHM SEMICONDUCTOR (JAPAN)

7.8 LITE-ON TECHNOLOGY CORPORATION (TAIWAN)

7.9 MURATA MANUFACTURING CO. LTD. (JAPAN)

7.10 NXP SEMICONDUCTORS N.V. (NETHERLANDS)

7.11 ON SEMICONDUCTOR (UNITED STATES)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Optocouplers Market By Region

8.1 Overview

8.2. North America Optocouplers Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Phototransistor Optocouplers

8.2.4.2 Photometric Optocouplers

8.2.4.3 Photodiode Optocouplers

8.2.4.4 High-Speed Optocouplers

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Industrial Automation

8.2.5.2 Consumer Electronics

8.2.5.3 Automotive

8.2.5.4 Telecommunication

8.2.5.5 Power Supplies

8.2.5.6 Medical Equipment

8.2.5.7 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Automotive Industry

8.2.6.2 Consumer Electronics

8.2.6.3 Telecommunications

8.2.6.4 Industrial

8.2.6.5 Healthcare

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Optocouplers Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Phototransistor Optocouplers

8.3.4.2 Photometric Optocouplers

8.3.4.3 Photodiode Optocouplers

8.3.4.4 High-Speed Optocouplers

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Industrial Automation

8.3.5.2 Consumer Electronics

8.3.5.3 Automotive

8.3.5.4 Telecommunication

8.3.5.5 Power Supplies

8.3.5.6 Medical Equipment

8.3.5.7 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Automotive Industry

8.3.6.2 Consumer Electronics

8.3.6.3 Telecommunications

8.3.6.4 Industrial

8.3.6.5 Healthcare

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Bulgaria

8.3.7.2 The Czech Republic

8.3.7.3 Hungary

8.3.7.4 Poland

8.3.7.5 Romania

8.3.7.6 Rest of Eastern Europe

8.4. Western Europe Optocouplers Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Phototransistor Optocouplers

8.4.4.2 Photometric Optocouplers

8.4.4.3 Photodiode Optocouplers

8.4.4.4 High-Speed Optocouplers

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Industrial Automation

8.4.5.2 Consumer Electronics

8.4.5.3 Automotive

8.4.5.4 Telecommunication

8.4.5.5 Power Supplies

8.4.5.6 Medical Equipment

8.4.5.7 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Automotive Industry

8.4.6.2 Consumer Electronics

8.4.6.3 Telecommunications

8.4.6.4 Industrial

8.4.6.5 Healthcare

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 Netherlands

8.4.7.5 Italy

8.4.7.6 Russia

8.4.7.7 Spain

8.4.7.8 Rest of Western Europe

8.5. Asia Pacific Optocouplers Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Phototransistor Optocouplers

8.5.4.2 Photometric Optocouplers

8.5.4.3 Photodiode Optocouplers

8.5.4.4 High-Speed Optocouplers

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Industrial Automation

8.5.5.2 Consumer Electronics

8.5.5.3 Automotive

8.5.5.4 Telecommunication

8.5.5.5 Power Supplies

8.5.5.6 Medical Equipment

8.5.5.7 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Automotive Industry

8.5.6.2 Consumer Electronics

8.5.6.3 Telecommunications

8.5.6.4 Industrial

8.5.6.5 Healthcare

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Optocouplers Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Phototransistor Optocouplers

8.6.4.2 Photometric Optocouplers

8.6.4.3 Photodiode Optocouplers

8.6.4.4 High-Speed Optocouplers

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Industrial Automation

8.6.5.2 Consumer Electronics

8.6.5.3 Automotive

8.6.5.4 Telecommunication

8.6.5.5 Power Supplies

8.6.5.6 Medical Equipment

8.6.5.7 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Automotive Industry

8.6.6.2 Consumer Electronics

8.6.6.3 Telecommunications

8.6.6.4 Industrial

8.6.6.5 Healthcare

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkey

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Optocouplers Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Phototransistor Optocouplers

8.7.4.2 Photometric Optocouplers

8.7.4.3 Photodiode Optocouplers

8.7.4.4 High-Speed Optocouplers

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Industrial Automation

8.7.5.2 Consumer Electronics

8.7.5.3 Automotive

8.7.5.4 Telecommunication

8.7.5.5 Power Supplies

8.7.5.6 Medical Equipment

8.7.5.7 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Automotive Industry

8.7.6.2 Consumer Electronics

8.7.6.3 Telecommunications

8.7.6.4 Industrial

8.7.6.5 Healthcare

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Optocouplers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.50 Billion |

|

Forecast Period 2024-32 CAGR: |

9.10 % |

Market Size in 2032: |

USD 5.47 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||