Oolong Tea Market Synopsis

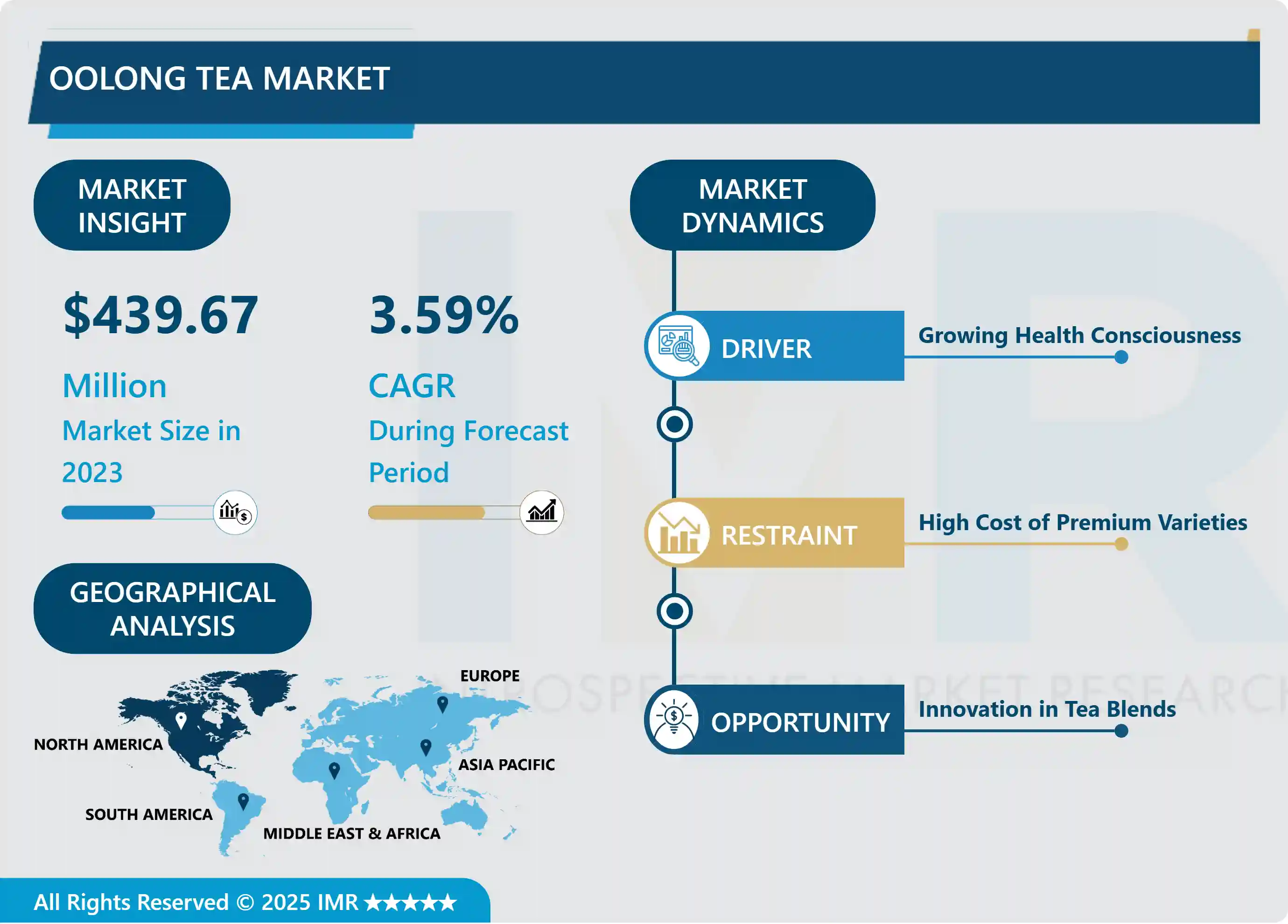

Oolong Tea Market Size Was Valued at USD 439.67 Million in 2023, and is Projected to Reach USD 603.93 million by 2032, Growing at a CAGR of 3.59% From 2024-2032

Oolong tea refers to a category of tea drifting between green and oxidized tea and indicating an intermediate level of oxidation. It is partially fermented and since its flavor characteristics can indeed vary between floral and fruity to woody and toasty depending on the level of processing and oxidation of this tea. Oolong tea has combined rich taste and smell, as well as benefits which include antioxidant and metabolic effects.

The market for Oolong tea has been on the rise for the last few years because people have realized the health benefits of taking tea. Oolong tea is one of the most popular types of tea, with a special taste and high antioxidant content, which makes it an attractive product to healthy-conscious consumers seeking for natural sources of products promoting slimming effect, enhancing digestion, and overall wellbeing. Globally, consumers are moving away from sycarated beverages and carbonated products; this shift makes the market for Oolong tea expand. Further, advancement in tea culture, mostly from western world, especially for specialty teas like Oolong makes its way into the premium food market with more and more brands and food manufacturers nowadays appearing with artisanal specialty tea production.

On a regional basis, the Asia-Pacific remains the largest consumer market, and producers of Oolong tea include China and Taiwan. The peoples of these regions continuously consume tea and tea-drinking traditions in these areas thus help develop new demand; in new sitios like North America y Europe the development of high-quality and specialty teas is increasing. Traditional and social media such as online stores and specialty tea shops are valuable strategies for expanding a store’s reach, improving consumer access to goods, and making the appropriate decision. Moreover, there are new approaches to Oolong tea promotion that introduces the peculiarities of the product, including the fact that it is semi-fermented tea with multiple tastes, to consumers.

Moreover the opportunities for Oolong tea market has found to have limitation like variability in price of raw material and existence of substitute product like green and black tea among others. Nonetheless, current R&D activities that continue to seek ways to improve the products quality and new taste development should act as a strong floater to the market growth. Sustainable sourcing and packaging are the new trends embraced by many firms in order to meet consumers’ changing expectations on green and environmentally friendly products. In a nutshell, the Oolong tea business sector remains anchored for bright prospects in light of healthier lifestyle considerations coupled with changing consumer palette and product diversification and marketing strategies.

Oolong Tea Market Trend Analysis

The Rising Popularity of Oolong Tea Flavor, Health Benefits, and Wellness Trends

- Oolong tea is a kind of Chinese tea which is most popular for its unique tastes somewhere between green and black tea. This is a semi-oxidized tea that provides an uncommon sweet and intricate subtlety of the floral and fruity flavours with full body, creamy, and velvety aftertaste. More and more consumers are becoming selective in what they drink, and oolong tea has hue richness of flavor to meet the demand of making tea a gourmet beverage. However, it should be noted that in addition to its taste, oolong tea is advocated as a medicinal beverage; several medical studies have confirmed this hypothesis. Research shows this tea helps in weight loss as it promotes increased metabolic rate and fat burning, making the tea the best option for any person willing to change his or her living habits. Further, oolong tea contains polyphenols that significantly enhance digestion hence enhance gut health thus shall be classified as functional drink.

- The growth of the wellness and organic living, continues to fuel adoption and consumption of oolong tea because the tea is healthier than most processed drinks. This transition is observed alongside an increasing recognition of the role of including foods and beverages high in nutrients. Oolong tea can be easily incorporated in this kind of lifestyle since it is associated in most products with health benefits, and solutions for different health problems. No wonder, that the Wuyi oolong tea can be consumed both hot and cold and is now used in culinary creations, often as a recently tea-based food additive used in baking and creation of alcoholic and non-alcoholic beverages. In an ever expanding global focus on advocating for healthier lifestyles, natural products are well-favored for the oolong tea market, being a traditional beverage on the global market. In response, more retailers are stocking their oolong tea options, and those convenience offered through e-sales platforms help consumers to seek more blends of the beverage, boosting its popularity.

Innovations and Trends Driving the Growth of the Oolong Tea Market

- Currently the oolong tea market a massive trend in that consumer brands are not only expanding the types of blends the create but also traverse the flavor spectrum. This shift is mostly informed by change in customer preference in which the customer demands novelty and exciting experiences in their teas. Flavoring is also introduced widely as the ooling tea is sometimes flavoured with fruits, spices and herbs as the clients may wish. It is true that it also applies to such categories as flavour enhanced still oolong tea for sparkling taste and young generation’s favourite ready to drink variants. The trend towards increased inclusion and incorporation of tea into daily life and health-related topics has gone a long way towards not only improving the attention paid to – and general appeal of – these new products, but also in inspiring creativity within the category.

- In addition, the growing popularity of specialty tea in cafes and restaurants has contributed much to the promotion of ooling tea to a wide society. It has become an Irish-restaurant staple or a trendy drink option on cafés lists and many restaurants currently offer specials and novel oolong tea options for consumers. In parallel to this development, there has been growing excitement around tea as a beverage, and specialized retail points of sale catering to niche and superior-quality teas such as different oolong types. The advancement of e-commerce platforms also allowed consumers to extended their research on and buying high quality oolong tea, products from other regions that may potentially be unavailable locally. This is due to this awareness and accessibility and the consumers’ trend today of choosing organic and sustainably sourced foods. With people increasingly developing a conscience while making their purchases, more people are purchasing quality, sustainably produced oolong tea, which is fuelling market growth and making it a mainstay of the health and wellness category.

Oolong Tea Market Segment Analysis:

Oolong Tea Market Segmented based on By Form, By Flavor and By Distribution Channel

By Form, Tea Bag segment is expected to dominate the market during the forecast period

- Tea bags are indisputably an essential element of contemporary tea drinking experience because of the unmatched usability and portability. Not requiring special brewing equipment, tea bags make consumption of tea very convenient, so that one can take a cup of tea at a go. This is especially attractive for people with a rather tight schedule, as the process of steeping the tea bag will not take long and at the same time when using only boiling water to steep the bag a superb taste of the tea is guaranteed. In addition, because tea bag portions can be well controlled, it allows for consistent tasting and concentration of the tea, a factor that is a problem with loose leaf tea. This format of packaging has also afforded tea to a wider market especially those that cannot or would not take time to prepare loose tea leaves.

- All rounded technological advancements displayed in the preparation of tea bags have been a great contributing factor in the improvements of tea bags. That is measuring the size of their containers and developing pyramid shaped teabags which give more room to the tea leaves and, in turn, develop a better steeping process to let out the flavors and aroma. Besides enhancing the quality of the brewed tea this design change also makes it more appealing to the eye. Furthermore, due to increasing customer concern with the quality of the tea consumed, many brands have innovated by developing tea bags that contain whole leaves or organic products, as well as packages specially-formulated to appeal to the health-seeker, who does not sacrifice quality for convenience. In the current world where consumers are looking for the gourmet tea experience while at the same time thinking of convenience then the tea bag market is one subsector that continues to experience growth and product innovation.

By Distribution Channel, Online Retail segment held the largest share in 2023

- The online retail channel for this product has expanded hugely and this has been driven mainly by COVID- 19 which broke out and changed consumer habits. When the lockdown measures and keeping social distance was implemented by governments around the world, customers migrated to online purchasing from physically shopping from the markets. This shift has made PXs to help tea brands to expand the market greatly enabling the consumers the chance to select from the large range of the improved specialty teas and special brands that may be out of the physical reach in the markets. Thanks to the digital world the consumer has been able to find out various blends as well as products from various other parts of the world thus enhancing their tea drinking experience.

- In addition, the virtual store platform provides several unique selling points to improve the purchasing experience of the tea consumers. The fact of being able to compare the products, read the opinions of its other buyers, and obtain access to web-only offers makes the process more attractive and well-informed one. Consumers are given descriptions, instructions and sometimes ratings from other buyers, which enables them make right decisions when making their purchases online. To this effect, companies are now focusing on their online platforms and using their marketing efforts to capture and build the consumer base. These are advertisement campaigns, social media posting and optimizing the experience of tea buyers on their sites so as to attract the expanding population of consumers interested in quality and convenience of online tea shopping.

Oolong Tea Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North American region, consumers have become aware of the health benefits affiliated with the product and thus a greater demand of oolong tea. The consumers seeking improved health are taking products with enhanced flavors which are also capable of delivering concrete heath benefits. This particular type of tea is known for its potency and strong aroma it posses, and it is known to be good for metabolism, weight control and antioxidants. Such features make it ideal to be used in a bid to replace the sweetened and caffeinated soft drinks. Besides, the focus has been placed on the natural components and organic goods, and this has placed oolong tea in an excellent location in the competition market since consumers are concerned with what they take.

- This is also quite in line with the current craze of specialty teas contributing to the high demands for oolong tea in the region. As more cafes and restaurants dedicate themselves to tea, new opportunities for consumers to try different sorts of tea – such as oolong – emerge. Such establishments claim to involve traditional or artisanal brewing methods and offer the customer educative services in the enjoyment of oolong tea. Also, a segment with the highest growth rates are millennials, who are used to pay special attention to the innovative cuisine trends and are ready to try exotic dishes. Not only are they willing to spend more money to get a package of high quality teas, but they also search for brands that support their vision of sustainable and healthy living. Consequently, the North American oolong tea market is in a privileged position to continually grow in the years that are to come due to changing consumers’ preferences and the increased choice of specialty tea products.

Active Key Players in the Oolong Tea Market

- Bigelow Tea (U.S.)

- R. Twining and Company Limited (U.K.)

- Teas and Thes (China) Ltd. (China)

- Ceylon Organic Spices (Sri Lanka)

- Unilever (U.K.)

- Arbor Teas (U.S.)

- The Republic of Tea (U.S.)

- Dilmah Ceylon Tea Company PLC. (Sri Lanka)

- Harney & Sons Fine Teas (U.S.)

- Mighty Leaf Tea (U.S.)

- Tata Consumer Products Limited (India)

- ITO EN(North America) INC. (U.S.)

- COFCO (China)

- International Coffee & Tea, LLC (U.S.)

- Harada Seicha (Japan)

- generation tea (U.S.)

- East West Tea Company, LLC (U.S.)

- Starbucks Coffee Company (U.S.)

- TETLEY (U.K.)

- Other Key Players

Key Industry Developments in the Oolong Tea Market:

- In July 2024, Nestlé China is broadening its product lineup that features white mulberry leaf extract, which has been clinically proven to lower postprandial blood sugar spikes. The newest addition to their offerings is a no-sugar Oolong tea

|

Global Oolong Tea Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 439.67 Mn. |

|

Forecast Period 2024-32 CAGR: |

3.59 % |

Market Size in 2032: |

USD 603.93 Mn. |

|

Segments Covered: |

By Form |

|

|

|

By Flavor |

|

||

|

By Distribution Channel

|

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Oolong Tea Market by Form (2018-2032)

4.1 Oolong Tea Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Loose Leaf

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Powder

4.5 Tea Bag

4.6 Others

Chapter 5: Oolong Tea Market by Flavor (2018-2032)

5.1 Oolong Tea Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Flavoured

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plain

Chapter 6: Oolong Tea Market by Distribution Channel (2018-2032)

6.1 Oolong Tea Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Direct Sales

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Online Retail

6.5 Supermarkets/Hypermarkets

6.6 Specialty Stores

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Oolong Tea Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BIGELOW TEA (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 R. TWINING AND COMPANY LIMITED (U.K.)

7.4 TEAS AND THES (CHINA) LTD. (CHINA)

7.5 CEYLON ORGANIC SPICES (SRI LANKA)

7.6 UNILEVER (U.K.)

7.7 ARBOR TEAS (U.S.)

7.8 THE REPUBLIC OF TEA (U.S.)

7.9 DILMAH CEYLON TEA COMPANY PLC. (SRI LANKA)

7.10 HARNEY & SONS FINE TEAS (U.S.)

7.11 MIGHTY LEAF TEA (U.S.)

7.12 TATA CONSUMER PRODUCTS LIMITED (INDIA)

7.13 ITO EN(NORTH AMERICA) INC. (U.S.)

7.14 COFCO (CHINA)

7.15 INTERNATIONAL COFFEE & TEA

7.16 LLC (U.S.)

7.17 HARADA SEICHA (JAPAN)

7.18 GENERATION TEA (U.S.)

7.19 EAST WEST TEA COMPANY

7.20 LLC (U.S.)

7.21 STARBUCKS COFFEE COMPANY (U.S.)

7.22 TETLEY (U.K.)

7.23 OTHER KEY PLAYERS

Chapter 8: Global Oolong Tea Market By Region

8.1 Overview

8.2. North America Oolong Tea Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Form

8.2.4.1 Loose Leaf

8.2.4.2 Powder

8.2.4.3 Tea Bag

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size by Flavor

8.2.5.1 Flavoured

8.2.5.2 Plain

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Direct Sales

8.2.6.2 Online Retail

8.2.6.3 Supermarkets/Hypermarkets

8.2.6.4 Specialty Stores

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Oolong Tea Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Form

8.3.4.1 Loose Leaf

8.3.4.2 Powder

8.3.4.3 Tea Bag

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size by Flavor

8.3.5.1 Flavoured

8.3.5.2 Plain

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Direct Sales

8.3.6.2 Online Retail

8.3.6.3 Supermarkets/Hypermarkets

8.3.6.4 Specialty Stores

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Oolong Tea Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Form

8.4.4.1 Loose Leaf

8.4.4.2 Powder

8.4.4.3 Tea Bag

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size by Flavor

8.4.5.1 Flavoured

8.4.5.2 Plain

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Direct Sales

8.4.6.2 Online Retail

8.4.6.3 Supermarkets/Hypermarkets

8.4.6.4 Specialty Stores

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Oolong Tea Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Form

8.5.4.1 Loose Leaf

8.5.4.2 Powder

8.5.4.3 Tea Bag

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size by Flavor

8.5.5.1 Flavoured

8.5.5.2 Plain

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Direct Sales

8.5.6.2 Online Retail

8.5.6.3 Supermarkets/Hypermarkets

8.5.6.4 Specialty Stores

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Oolong Tea Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Form

8.6.4.1 Loose Leaf

8.6.4.2 Powder

8.6.4.3 Tea Bag

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size by Flavor

8.6.5.1 Flavoured

8.6.5.2 Plain

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Direct Sales

8.6.6.2 Online Retail

8.6.6.3 Supermarkets/Hypermarkets

8.6.6.4 Specialty Stores

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Oolong Tea Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Form

8.7.4.1 Loose Leaf

8.7.4.2 Powder

8.7.4.3 Tea Bag

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size by Flavor

8.7.5.1 Flavoured

8.7.5.2 Plain

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Direct Sales

8.7.6.2 Online Retail

8.7.6.3 Supermarkets/Hypermarkets

8.7.6.4 Specialty Stores

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Oolong Tea Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 439.67 Mn. |

|

Forecast Period 2024-32 CAGR: |

3.59 % |

Market Size in 2032: |

USD 603.93 Mn. |

|

Segments Covered: |

By Form |

|

|

|

By Flavor |

|

||

|

By Distribution Channel

|

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||