Online Micro Transaction Market Overview

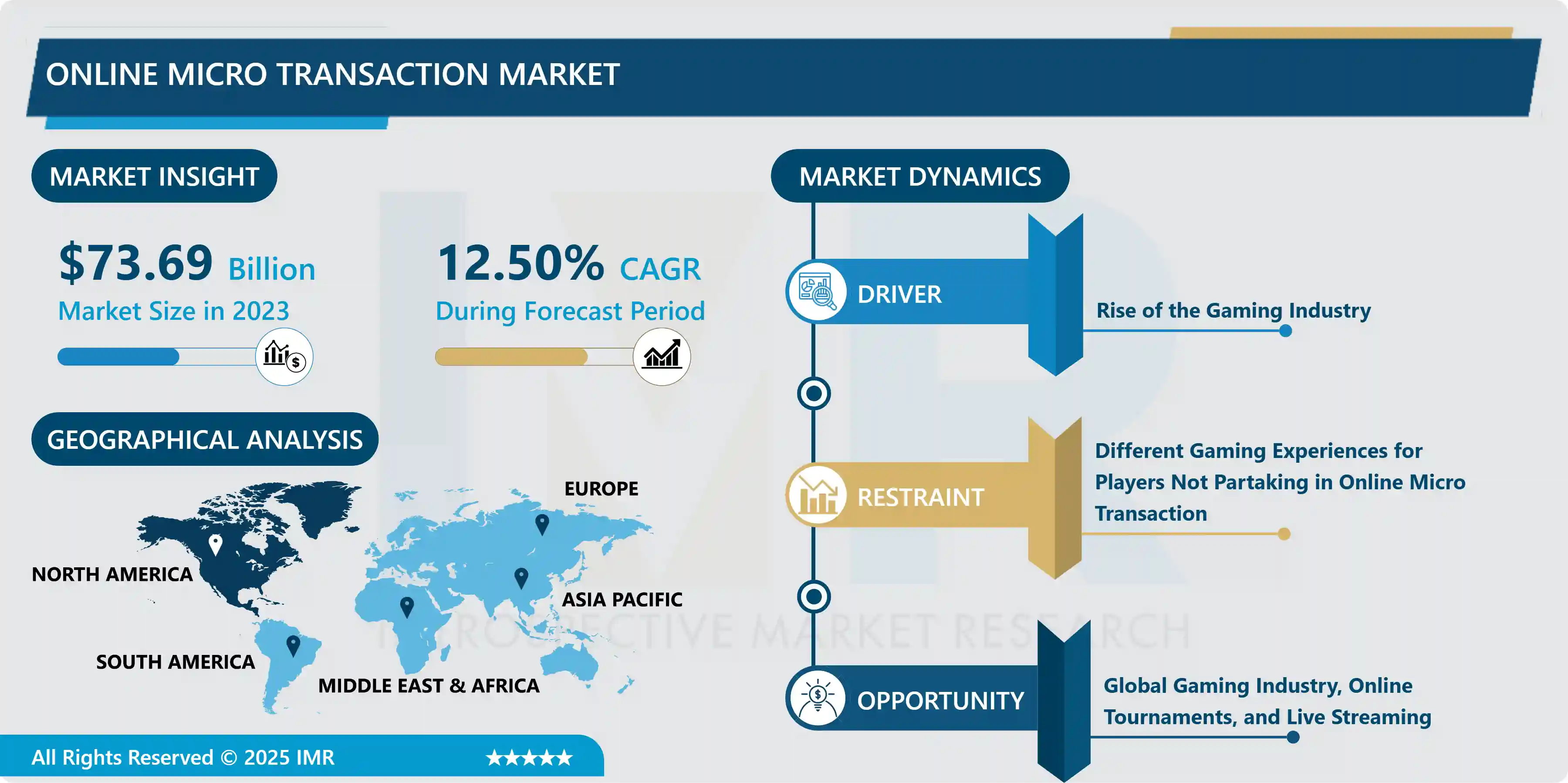

The Online Micro Transaction Market size was valued at USD 73.69 Billion in 2023 and is projected to reach USD 212.71 Billion by 2032, registering a CAGR of 12.5% from 2023 to 2032.

A Micro Transaction is a business concept in which users can pay small amounts of money for virtual things. Micro Transactions are common in free-to-play games, which means there is no charge to download the game, only to purchase virtual goods online. Micro Transactions have had the most profound impact on the video game business, which is always changing. Game creators have figured out how to make the most of this new cash stream. Micro Transactions are believed to be used by only 5 to 20% of gaming communities, and the quantities paid to vary.

- According to figures from the Entertainment Software Association (ESA) and the NPD Group, the video game industry made a record-breaking $36 billion in revenue in 2017. Riot, the corporation that owns and operates the online game "League of Legends," (LOL) earns huge profits due to the Micro Transactions. LOL is a free game that is played by tens of millions of people around the world. In-game purchases account for almost all of its revenue. The growing popularity of online gaming is expected to propel the development of the online transaction market over the forecasted timeframe.

Market Dynamics and Key Factors of Online Micro Transaction

Drivers:

Rise of the Gaming Industry.

- The concept of online connectivity transformed the gaming industry. DLC (downloadable content) has proven to be effective in encouraging gamers to pay for things after the game has been released. DLC is a forerunner to what is now known as online Micro Transactions and is an aspect of gaming's secondary market. Online Micro Transactions have had the most significant impact on the video game industry, which is constantly changing. Game developers have figured out how to make the most of this new cash stream. Only 5 to 20% of game communities are thought to engage in online Micro Transactions, and the amounts they spend varies. However, the cash earned by free-to-play games is large, this is still a significant amount. These companies' executives want to monetize the non-participating player base in the online Micro Transaction community thus, driving further growth of the online Micro Transaction market over the projected timeframe.

Restraints:

Different gaming experiences for players not partaking in online Micro Transaction.

- The Micro Transaction-based approach to generating money from video games is at the forefront of the gaming industry. This is where the trouble starts since most developers struggle to keep the balance in online Player versus Player games and end up creating pay-to-win games. Micro Transactions are used in most games to provide a better experience and content, which provides an unfair experience for those who use the default game content. Despite having strong skills, this type of DLC (downloadable content) often outclasses players with default content thus, hampering the development of the online Micro Transaction market during the projected timeframe.

Opportunities:

Gaming Industry, Online Tournaments, and Live streaming

- With much of the world adopting social distancing for much of 2020 and into 2021, interest in the multibillion-dollar online gaming industry has continued to grow, with people who have never played before taking up the hobby. Players took use of their unprecedented free time to learn new skills and tactics that could one day be shown on television as part of an esports championship as popular as the Super Bowl or the World Cup final. As the number of people who play online games grows, so does the amount of money spent on in-app purchases. Users can spend real money for features or items while playing a mobile game using online Micro Transactions or in-app purchases. Players that spend money on in-app purchases get a premium gaming experience. At the same time, it is a very valuable and popular revenue source for game developers thus, creating a profitable opportunity for the market players.

Segmentation of Online Micro Transaction Market

- By payment model, prepay segment is anticipated to dominate the growth of the online Micro Transaction market. With the prepay model, a customer authorizes the game developer to charge their card for a certain amount, which is usually converted into a virtual currency. That currency can then be used to purchase game items. Prepay transactions avoid the undesired charges that may arise in the post-pay transaction method thus, strengthening the growth of the segment.

- By type, the in-game items segment is expected to lead the development of the online Micro Transaction market during the analysis period. One can buy in-game items and pay to unlock a variety of characters, each with their own set of skills and playstyle. The most popular in-game item skins. Skins merely alter a character's appearance but provide no additional functionality. Skins, on the other hand, give the character more personality, and given the psychological investment players have made in the game, it's almost as if they're buying clothes for themselves. Gun skins are also popular among users, and popular games such as PUBG and Fortnite offer several gun skins. The growing spending on in-game items is expected to increase over the analysis period.

- By device, the smartphones segment is expected to have the highest share of the online Micro Transaction market. According to a Statista survey, 68.1 percent of respondents claimed they played games on their smartphones, making it the most popular gaming device on the globe. Mobile gaming gives players greater accessibility, gamers can play games anytime and anywhere. Moreover, mobile gaming has helped people living far apart to come together. Mobile gaming has become a trend to maintain family relations and this trend is expected to grow over the projected timeframe. Most individuals are getting exposed to games due to the growing smartphone penetration. Individuals playing the game on a smartphone are more liable to purchase in-game items and currencies thus, supporting the development of the segment.

Regional Analysis of Online Micro Transaction Market

- The Asia-Pacific region is anticipated to lead the growth of the online Micro Transaction market over the forecast period. Gamers in South Asian countries are gaining access to an ever-changing ecosystem. Users in this region are maturing in their approach to numerous genres, casual, mid-core, and paid games, owing to the increasing smartphone and internet penetration and the world's lowest data tariff. According to a PwC report, the total revenue generated by the in-game Micro Transactions accounted for one-third of the total games and esports in Australia. Moreover, the growing popularity of PlayerUnknown's Battlegrounds (PUBG) Mobile, Among Us, and Pokémon GO is expected to propel the growth of the online Micro Transaction market over the forecasted timeframe.

- The North American region is anticipated to have the second-highest share of the online Micro Transaction market during the projected timeframe. According to the latest Entertainment Software Association (ESA) report, the United States has a total of 226.6 million video game players of all ages, up nearly 6% from 214.4 million in 2020. The estimates vary depending on the source and demographics surveyed, but it is estimated that three out of every four Americans play video games on various consoles, with more than half of those playing on their mobile phones. As 4G speeds improve and core users migrate to 5G, more individuals are opting to play games on their smartphones, it is anticipated that mobile gaming will be an ongoing and major contributor to the development of the online Micro Transaction market projected timeframe.

- The online Micro Transaction market in the European region is anticipated to develop at a significant growth rate attributed to the growing popularity of gaming consoles and PC gaming. Beyond the sale of game titles and gear, the rise of subscription gaming services and cloud gaming has opened up new revenue streams. Without the assistance of a game publishing company, independent game developers can create and launch their games. Gamers, on the other hand, can make money through tournaments and social media streams. The online Micro Transaction market in the European Union is powered by the vibrant gaming markets of Germany, the United Kingdom, France, Italy, and Spain. According to Statista, the UK, Germany, France, Italy, and Spain had 46.7, 39.1, 36.5, 30.6, and 24.6 million gamers in 2021. The study also stated that mobile phones were the most popular devices to game on among UK gaming audiences. The gaming population is expected to increase over the forecasted timeframe thus, boosting the growth of the online transaction market.

Players Covered in Online Micro Transaction market are :

- Activision Blizzard Inc.

- Tencent Holdings Ltd.

- NCSoft

- Riot Games Inc.

- Nexon Co. Ltd.

- SmileGate (CrossFire)

- Wargaming.net

- NetEase Inc.

- Valve Corporation and other major players.

Recent Industry Developments in Online Micro Transaction Market

- In February 2024, following criticism from players regarding post-launch microtransactions in Tekken 8, the series' creative director clarified the necessity for ongoing funding to support modern games. The newly introduced Tekken Shop will offer DLC costumes exclusively through microtransactions, prompting dissatisfaction among fans who feel this adds to the game’s $70 price tag. Developers aim to ensure continued support and content for the game, emphasizing the challenges of maintaining player engagement without additional revenue streams

|

Online Micro Transaction Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 73.69 Bn. |

|

Forecast Period 2023-32 CAGR: |

12.5% |

Market Size in 2032: |

USD 212.71 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Device |

|

||

|

By Payment Model |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Online Micro Transaction Market by Type (2018-2032)

4.1 Online Micro Transaction Market Snapshot and Growth Engine

4.2 Market Overview

4.3 In-game Currencies

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Random Chance Purchases

4.5 In-game Items

4.6 Expiration

4.7 Others

Chapter 5: Online Micro Transaction Market by Device (2018-2032)

5.1 Online Micro Transaction Market Snapshot and Growth Engine

5.2 Market Overview

5.3 PC

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Gaming Console

5.5 Smart Phones

5.6 Others

Chapter 6: Online Micro Transaction Market by Payment Model (2018-2032)

6.1 Online Micro Transaction Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Prepay

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Post-Pay

6.5 Pay-As-You-Go

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Online Micro Transaction Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CARGILL

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 NESTLE S.ATHE KELLOGG COMPANY

7.4 AMY'S KITCHEN INCBLUE DIAMOND GROWERS

7.5 ORGANIC VALLEY

7.6 THE HAIN CELESTIAL GROUP INCPEPSICO INCPERNOD RICARD

7.7 CLIF BAR & COMPANY

Chapter 8: Global Online Micro Transaction Market By Region

8.1 Overview

8.2. North America Online Micro Transaction Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 In-game Currencies

8.2.4.2 Random Chance Purchases

8.2.4.3 In-game Items

8.2.4.4 Expiration

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Device

8.2.5.1 PC

8.2.5.2 Gaming Console

8.2.5.3 Smart Phones

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size by Payment Model

8.2.6.1 Prepay

8.2.6.2 Post-Pay

8.2.6.3 Pay-As-You-Go

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Online Micro Transaction Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 In-game Currencies

8.3.4.2 Random Chance Purchases

8.3.4.3 In-game Items

8.3.4.4 Expiration

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Device

8.3.5.1 PC

8.3.5.2 Gaming Console

8.3.5.3 Smart Phones

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size by Payment Model

8.3.6.1 Prepay

8.3.6.2 Post-Pay

8.3.6.3 Pay-As-You-Go

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Online Micro Transaction Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 In-game Currencies

8.4.4.2 Random Chance Purchases

8.4.4.3 In-game Items

8.4.4.4 Expiration

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Device

8.4.5.1 PC

8.4.5.2 Gaming Console

8.4.5.3 Smart Phones

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size by Payment Model

8.4.6.1 Prepay

8.4.6.2 Post-Pay

8.4.6.3 Pay-As-You-Go

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Online Micro Transaction Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 In-game Currencies

8.5.4.2 Random Chance Purchases

8.5.4.3 In-game Items

8.5.4.4 Expiration

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Device

8.5.5.1 PC

8.5.5.2 Gaming Console

8.5.5.3 Smart Phones

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size by Payment Model

8.5.6.1 Prepay

8.5.6.2 Post-Pay

8.5.6.3 Pay-As-You-Go

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Online Micro Transaction Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 In-game Currencies

8.6.4.2 Random Chance Purchases

8.6.4.3 In-game Items

8.6.4.4 Expiration

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Device

8.6.5.1 PC

8.6.5.2 Gaming Console

8.6.5.3 Smart Phones

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size by Payment Model

8.6.6.1 Prepay

8.6.6.2 Post-Pay

8.6.6.3 Pay-As-You-Go

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Online Micro Transaction Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 In-game Currencies

8.7.4.2 Random Chance Purchases

8.7.4.3 In-game Items

8.7.4.4 Expiration

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Device

8.7.5.1 PC

8.7.5.2 Gaming Console

8.7.5.3 Smart Phones

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size by Payment Model

8.7.6.1 Prepay

8.7.6.2 Post-Pay

8.7.6.3 Pay-As-You-Go

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Online Micro Transaction Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 73.69 Bn. |

|

Forecast Period 2023-32 CAGR: |

12.5% |

Market Size in 2032: |

USD 212.71 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Device |

|

||

|

By Payment Model |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||