Offshore Wind Market Synopsis:

Offshore Wind Market Size Was Valued at USD 44.57 Billion in 2024 and is Projected to Reach USD 109.88 Billion by 2032, Growing at a CAGR of 11.94% From 2025-2032.

Offshore wind power or offshore wind energy is the energy taken from the force of the winds out at sea, transformed into electricity, and supplied to the electricity network onshore.

The global offshore wind energy market is expanding rapidly, driven by the growing demand for clean energy, technological advancements, and government policies aimed at reducing carbon emissions. Offshore wind farms offer significant advantages, including higher energy generation potential due to faster and more consistent wind speeds compared to onshore locations. Many major cities and industrial hubs are located near coastlines, making offshore wind a strategic energy source that reduces transmission losses and meets rising electricity demands efficiently. Additionally, offshore wind farms help address land constraints, as they do not compete with agricultural or urban development, making them an attractive option for countries with limited land availability. Beyond their environmental benefits, offshore wind projects also contribute to economic growth by creating jobs in manufacturing, construction, and maintenance while supporting global decarbonization efforts.

Offshore Wind Market Growth and Trend Analysis:

Larger Turbines Lead Offshore Wind Evolution

-

The offshore wind energy sector has experienced rapid technological advancements over the past decade, with a notable trend toward larger and more powerful turbines. The industry has driven this shift owing to improved efficiency, decreased energy Levelized Costs of Energy (LCOE), and scalability solutions to address growing worldwide renewable energy needs. The turbine industry evolves due to its significant expansion in overall dimensions. The surge in turbine ratings reached 9.7 MW in 2023 versus 7.7 MW in 2022 since developers adopted 15 MW turbines in their installations.

- Companies strive for larger offshore wind farm capabilities while reducing operational expenses due to scale benefits in a global scale-up initiative. Business and technical innovation in the offshore wind industry exists in harmony with market conditions. The implementation of larger turbines requires controlled development to prevent supply chain interruptions and financial problems. The upcoming years will determine if turbine growers will stay at their current 15-megawatt sizes or keep expanding toward larger turbines during offshore wind capacity expansion worldwide. chain disruptions and financial strain. The coming years will determine whether the market settles around the current 15-MW platform or continues its trajectory toward even larger turbines as global offshore wind capacity expands.

Offshore wind faces technical and reliability challenges

-

The global offshore wind market faces several challenges. Technical obstacles exist in the prediction of hydrodynamic effects from free surface turbulence combined with inaccuracy in the p-y method analysis and foundation scour problems. Both offshore turbines and their rotor blades encounter reliability problems that stem from gearbox and generator issues together with electrical systems problems along with the lack of adequate predictive models for fiber-reinforced plastic blades.

Offshore Wind Market Drives Innovation, Efficiency, and Global Energy Sharing

-

The global offshore wind market presents significant opportunities for innovation, economic growth, and sustainability. The increased development of turbines, floating wind solutions, and predictive operating methods helps to create more efficient systems at lower costs, which enables deeper ocean wind farm implementations. Better electrical transmission systems that utilize high-voltage direct current (HVDC) technology permit efficient power distribution between countries for mutual energy sharing.

Grid Connectivity and Environmental Regulations Impede Market Growth

-

The offshore wind market encounters important difficulties from both power grid connection problems and tough environmental standards. The integration process for offshore wind farms with onshore power grids demands massive spending for transmission systems that battle with the physical and technological limitations of the infrastructure. Acquiring environmental clearances requires extended time for projects to fulfill the requirements of marine ecosystem protection laws and respond to concerns from coastal communities. The process of project approval extensions, along with heightened development expenditures caused by these factors, decreases the speed of market expansion.

Offshore Wind Market Segment Analysis:

Offshore Wind Market is segmented based on foundation type, water depth, and region

By Foundation Type, Monopile segment is expected to dominate the market during the forecast period

-

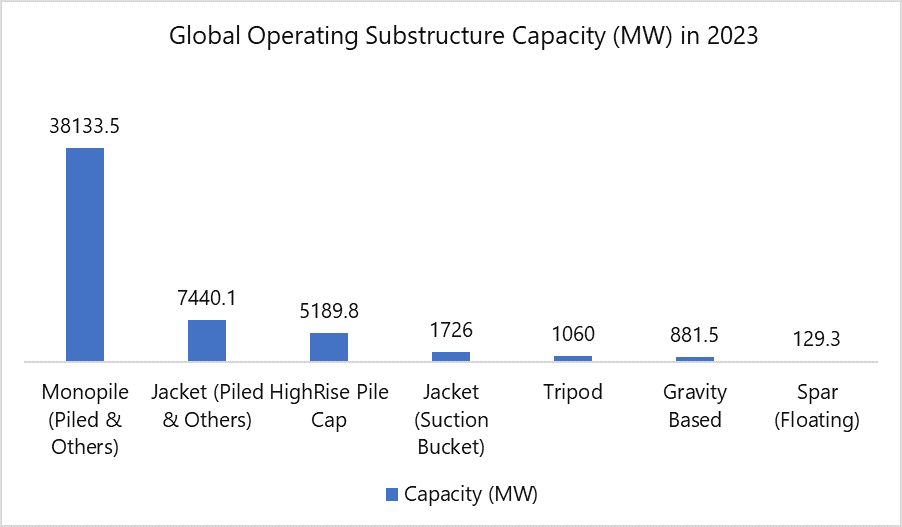

Monopiles continue to be the leading substructure type in the offshore wind market, both for existing and future projects. The installed capacity of offshore wind facilities reached 68,258 MW in 2023 where monopiles led with 55.6% domination. Among all substructure types monopiles hold the top position with a 55.6% share while jackets come in second with 13.4% pile caps at 7.6% and gravity-base and tripod together command 3.9% with an unreported number of installed devices totaling 19.9%.

- Offshore wind infrastructure projects will maintain their dependence on monopiles as indicated by projected future installations. Project developers have forecasted monopiles to represent 75.4% of the announced 72,027 MW project pipeline. The industry selects monopiles as their primary choice owing to their fundamental and inexpensive nature and their robust supply chain capabilities for standardized production across multiple operation points.

Source: National Renewable

- This bar graph represents the global offshore wind substructure market share in terms of installed capacity (MW) as of 2023. Monopiles dominate with approximately 37,950 MW, followed by jackets (7440.1 MW) and pile caps (5,189 MW). The data confirms the strong preference for monopiles due to their cost efficiency and scalability.

By Water Depth, the Shallow Water segment held the largest share of in the projected period

-

The shallow water segment dominates the offshore wind market due to its cost-effectiveness, established technology, and ease of installation and maintenance. More than 99 percent of offshore wind turbines utilize monopiles and jackets as their fixed foundations which support them in shallow water areas due to these structures producing economic benefits compared to deeper construction ventures.

- Shallow water projects enable simpler and cheaper grid connections because they occur near coastal areas. The accessibility during maintenance operations lowers operational expenses. Shallow water offshore wind retains its market dominance thanks to its advantages which are attracting substantial investments to expand worldwide renewable energy generation.

Offshore Wind Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast Period

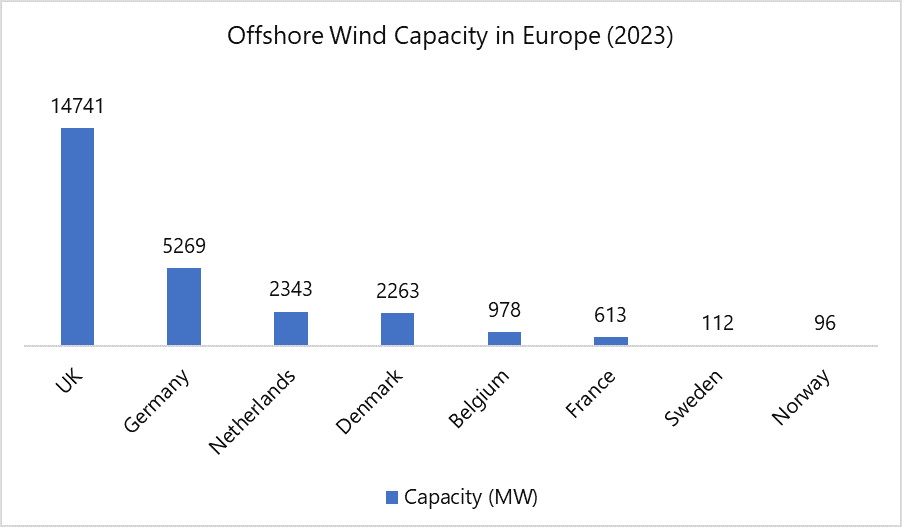

- Europe continues to dominate the offshore wind market in terms of project development, innovation, and future growth, despite China having the largest installed capacity. European offshore wind capacity is anticipated to reach 41% of total global capacity by 2032 if market growth remains high through UK and German expansions as well as Dutch and Danish and French development.

- Two major projects including 1.5 GW Hollandse Kust Zuid in the Netherlands and 1.14 GW Seagreen Wind Farm in the UK helped solidify European leadership during 2023. The largest operating floating offshore wind installation built last year exists in Norway within the Hywind Tampen project which delivers 88 MW of capacity. EU Green Deal policies and adapting tender procedures that incorporate sustainability values make the region more competitive in the market. The worldwide offshore supply chain for wind turbines is dominated by European companies led by Siemens Gamesa, Vestas, and GE.

Source: Global Offshore Wind Report

- The graph illustrates the offshore wind capacity of various European countries in megawatts (MW) as of 2023, with the exact values labeled for each country. The United Kingdom leads the region with 14,741 MW, driven by large offshore wind farms such as Seagreen and Dogger Bank. Germany follows with 5,269 MW, benefiting from long-term government support and projects like Baltic Eagle and Borkum Riffgrund.

Offshore Wind Market Active Players:

- ABB Ltd. (Switzerland)

- Adwen (Germany)

- Dong Energy A/S (Ørsted A/S) (Denmark)

- Doosan Heavy Industries & Construction (South Korea)

- EEW Group (Germany)

- ENERCON GmbH (Germany)

- Engie (France)

- Envision Energy (China)

- General Electric (US)

- Goldwind (China)

- Hitachi Ltd. (Japan)

- MHI Vestas Offshore Wind (Denmark)

- Ming Yang Smart Energy Group Co. (China)

- Nordex SE (Germany)

- Senvion S.A. (Luxembourg)

- Shanghai Electric Wind Power Equipment Co. (China)

- Siemens Gamesa Renewable Energy S.A. (Germany)

- Suzlon Energy Limited (India)

- Vestas (Denmark)

- Other Active Players

Key Industry Developments in the Offshore Wind Market:

-

In February 2025, Swaywind, a leading wind farm company specializing in the construction and management of wind energy projects, announced a strategic partnership with EcoGen Energy, a renowned renewable energy solutions provider. Together, the companies will launch 14 new offshore wind turbines, marking a significant step forward in the expansion of clean energy infrastructure investors.

- In November 2024, Belgium’s Ministry of Energy launched a new tender to procure 700 MW of offshore wind for development in the Princess Elisabeth Zone 1 (Lot 1) in the North Sea. The filing deadline and subsequent evaluation were scheduled between July and August 2025, with the results expected to be announced in December 2025. These tenders aimed to allocate up to 3.5 GW of new offshore wind capacity in Belgium, including 700 MW for PE1 and two additional tenders ranging between 1,225 MW and 1,400 MW each. The commissioning of the first wind project from these tenders was planned for the end of 2028.

|

Offshore Wind Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 44.57 Bn. |

|

Forecast Period 2025-32 CAGR: |

11.94 % |

Market Size in 2032: |

USD 109.88 Bn. |

|

Segments Covered: |

By Foundation Type |

|

|

|

By Water Depth |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Offshore Wind Market by Foundation Type

4.1 Offshore Wind Market Snapshot and Growth Engine

4.2 Offshore Wind Market Overview

4.3 Monopile

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Monopile: Geographic Segmentation Analysis

4.4 Jacket

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Jacket: Geographic Segmentation Analysis

4.5 Tripod

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Tripod: Geographic Segmentation Analysis

4.6 and Floating

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 and Floating: Geographic Segmentation Analysis

Chapter 5: Offshore Wind Market by Water Depth

5.1 Offshore Wind Market Snapshot and Growth Engine

5.2 Offshore Wind Market Overview

5.3 Shallow Water and Deep Water

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Shallow Water and Deep Water: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Offshore Wind Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 GENERAL ELECTRIC (US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SIEMENS GAMESA RENEWABLE ENERGY S.A. (GERMANY)

6.4 MHI VESTAS OFFSHORE WIND (DENMARK)

6.5 SENVION S.A. (LUXEMBOURG)

6.6 DOOSAN HEAVY INDUSTRIES & CONSTRUCTION (SOUTH KOREA)

6.7 SUZLON ENERGY LIMITED (INDIA)

6.8 DONG ENERGY A/S (ØRSTED A/S) (DENMARK)

6.9 ADWEN (GERMANY)

6.10 ABB LTD. (SWITZERLAND)

6.11 MING YANG SMART ENERGY GROUP CO. (CHINA)

6.12 NORDEX SE (GERMANY)

6.13 GOLDWIND (CHINA)

6.14 ENVISION ENERGY (CHINA)

6.15 HITACHI LTD. (JAPAN)

6.16 EEW GROUP (GERMANY)

6.17 ENERCON GMBH (GERMANY)

6.18 ENGIE (FRANCE)

6.19 VESTAS (DENMARK)

6.20 SHANGHAI ELECTRIC WIND POWER EQUIPMENT CO. (CHINA)

6.21 OTHER ACTIVE PLAYERS.

Chapter 7: Global Offshore Wind Market By Region

7.1 Overview

7.2. North America Offshore Wind Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Foundation Type

7.2.4.1 Monopile

7.2.4.2 Jacket

7.2.4.3 Tripod

7.2.4.4 and Floating

7.2.5 Historic and Forecasted Market Size By Water Depth

7.2.5.1 Shallow Water and Deep Water

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Offshore Wind Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Foundation Type

7.3.4.1 Monopile

7.3.4.2 Jacket

7.3.4.3 Tripod

7.3.4.4 and Floating

7.3.5 Historic and Forecasted Market Size By Water Depth

7.3.5.1 Shallow Water and Deep Water

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Offshore Wind Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Foundation Type

7.4.4.1 Monopile

7.4.4.2 Jacket

7.4.4.3 Tripod

7.4.4.4 and Floating

7.4.5 Historic and Forecasted Market Size By Water Depth

7.4.5.1 Shallow Water and Deep Water

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Offshore Wind Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Foundation Type

7.5.4.1 Monopile

7.5.4.2 Jacket

7.5.4.3 Tripod

7.5.4.4 and Floating

7.5.5 Historic and Forecasted Market Size By Water Depth

7.5.5.1 Shallow Water and Deep Water

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Offshore Wind Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Foundation Type

7.6.4.1 Monopile

7.6.4.2 Jacket

7.6.4.3 Tripod

7.6.4.4 and Floating

7.6.5 Historic and Forecasted Market Size By Water Depth

7.6.5.1 Shallow Water and Deep Water

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Offshore Wind Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Foundation Type

7.7.4.1 Monopile

7.7.4.2 Jacket

7.7.4.3 Tripod

7.7.4.4 and Floating

7.7.5 Historic and Forecasted Market Size By Water Depth

7.7.5.1 Shallow Water and Deep Water

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Offshore Wind Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 44.57 Bn. |

|

Forecast Period 2025-32 CAGR: |

11.94 % |

Market Size in 2032: |

USD 109.88 Bn. |

|

Segments Covered: |

By Foundation Type |

|

|

|

By Water Depth |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||