Offshore Energy Storage Market Synopsis:

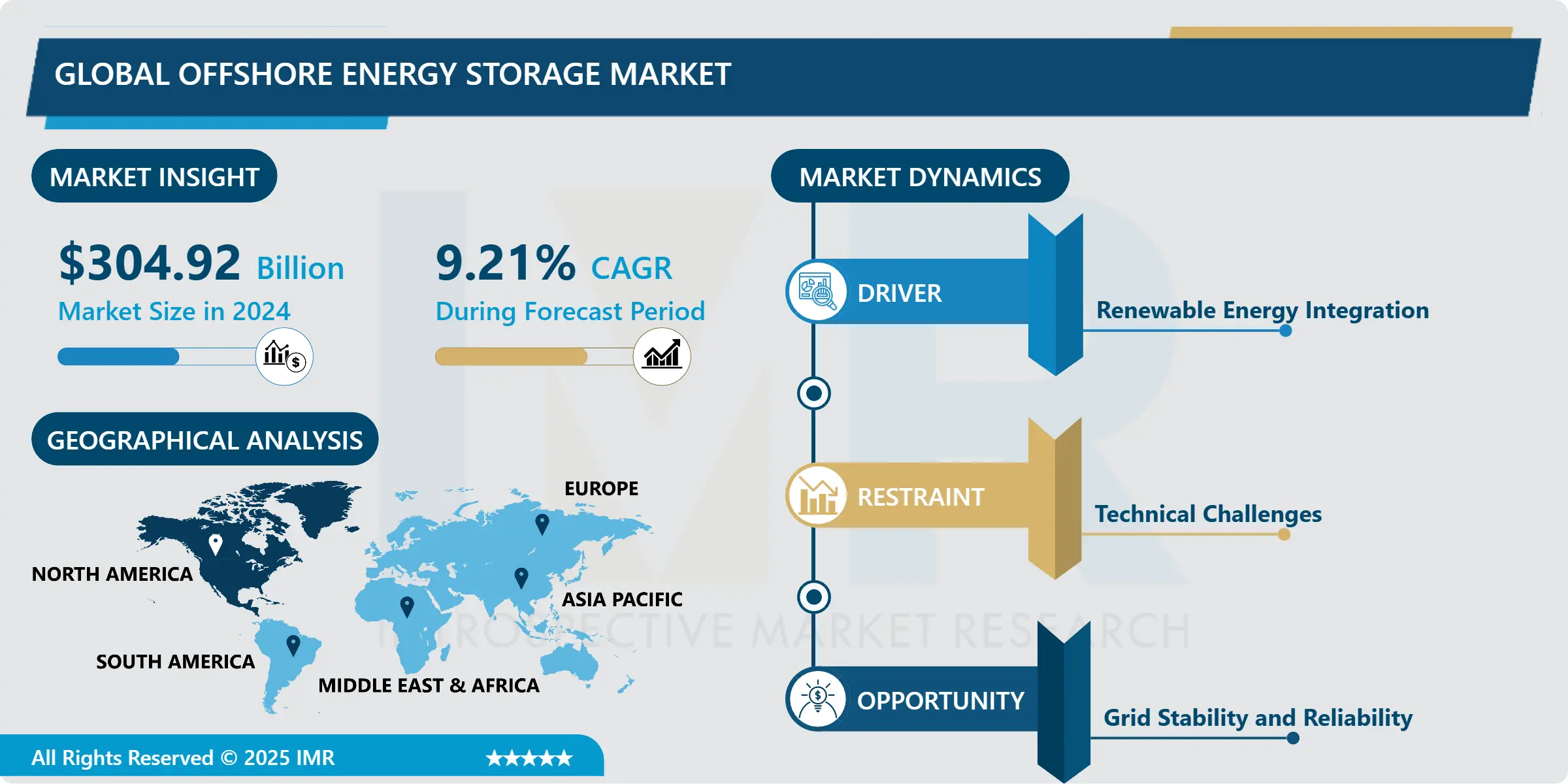

Offshore Energy Storage Market Size Was Valued at USD 304.92 Million in 2023, and is Projected to Reach USD 620.63 Million by 2032, Growing at a CAGR of 9.21% From 2025-2032.

The offshore energy storage market is an emerging niche market within the larger renewable energy industry since reducing the cost of energy storage is a critical component to achieving a successful renewable energy strategy for wind and solar energy respectively. In the next wave of electrification as the world shifts towards clean energy, the need for efficient storage solutions is anticipated to rise steeply as the system balances load demands and supply of energy. An important factor that largely exists to support the growth of offshore energy storage is the rising use of offshore wind farms. These plants are mostly situated in inaccessible terrains that also have extreme weather conditions, which makes it necessary to have energy storage systems that will enable the plants to create optimal power. The benefits associated with offshore energy storage include the following: the stations are near wind farms, the spatial requirements are relatively low, and there is also the possibility for much larger capacity than is available in onshore counterparts.

Offshore energy storage market majors are aiming at upgrading their solutions and existing technologies for market applications and meeting the requirements of offshore market that includes regular sand harsh exposures to water and salty conditions and restricted facility for regular maintenance. The batteries which they mean energy storage systems that use Li-Ion, Flow batteries among others are closing in popularity due to the higher energy density among other benefits associated with them as they become cheaper.

In addition, the adoption of smart grid technologies and the use of digitalization tools continues to make solutions and offshore energy storage more effective in terms of quality, performance, and reliability for better energy control and monitoring. These advancements have effectively reduced the cost of their operation and enhanced the general efficiency of the offshore energy storage systems.

The growth of the microgrid market is also further propelled by deployment efforts and policies implemented by governments across the world which have been targeting to encourage the integration of renewable energy into the power industries with an intention of reducing carbon emissions. This will include offsets, tax credits and feed-in tariffs which are motivating investments in offshore energy storage projects globally.

In summary, from the current analysis on the offshore energy storage market, it is anticipated to experience faster growth in the next few years as the global energy transformation continues in the form of renewable energy integration into the grid, and the importance of offshore energy storage solutions increases especially for those connected with renewable electricity generation.

Offshore Energy Storage Market Trend Analysis

Offshore Energy Storage Market Growth Drivers- Renewable Energy Integration

- Thus, the integration of new resources such as wind and solar energy into the distribution network is encouraging the search for relevant storage technologies. Energy storage in connection with offshore renewable energies hence is gradually emerging, as pumped hydro, compressed, air or batteries could in future avoid fluctuations and optimize distribution.

- Currently, there are numerous research and development activities being undertaken in the offshore energy storage industry with the purpose of improving the technical aspects of the business and increasing its storage capacities. Some new techniques like the underwater compressed air energy storage (UWCAES) and the floating battery storage systems are slowly becoming more favorable as the options for storing the excess renewable energy that could be produced offshore.

- Offshore energy storage technologies have attracted significant interest which has seen different governments as well as industry players come up with programmes and funds for research aimed at cutting on the costs of the technologies. This has encompassed; cost reduction arrangement of the manufacturing techniques, enhancement of energy conversion co-efficient factors, modulation of project planning and installation procedures enabling offshore storage to be more viable.

- The offshore energy storage market is poised for growth due in part to the coordination of energy companies, tech developers, and government bureaucracies. Strategic collaborations and partnerships as well as joint ventures are distinguishing feature of the present-day offshore storage, and they help move the offshore storage solutions, both newly built and redeployed ones forward in the important world regions in order to build stronger and superior energy infrastructure that would be more resilient to the usually harsh and unpredictable climate conditions.

Offshore Energy Storage Market Opportunities- Grid Stability and Reliability

- Battery energy storage techniques like lithium-ion and the flow battery are a result of innovations on energy storage systems. These applications grant the grid operators the capabilities to balance out the supply and consequential demand volatility, thereby bracing the grid.

- Offshore energy storage systems are being incorporated into new into existing utilities infrastructure to arrange electricity distribution for coastal regions and areas in general. This enables easier integration of a large amount of renewable generation resources into the system grid hence low dependability on the old-fashioned fossil fuel-based generation equipment.

- Offshore energy storage installations help in expansion of small scale and diverse energy networks that includes micro-grids to have less dependency on the main grid systems. Thus, distribution of energy storage assets can be regarded as a valuable means to strengthen the resilience of multiple communities and keep power supply uninterrupted during emergencies.

- To support the use of storage facilities in the energy sector, governments and power firms are investing in offshore platforms. This investment is in line with recognizing the offshore storage as the integral part of future energy storage systems which have great role in achieving climate and energy targets worldwide as well as providing the reliable electricity supply for the coastal areas.

Offshore Energy Storage Market Segment Analysis:

Offshore Energy Storage Market is segmented on the basis of Source Type and Application

By Source Type, Lithium Ion is expected to dominate the market during the forecast period.

- Offshore energy storage is an aspect of meeting the energy needs of offshore structures involving various technologies to suit the marine operations’ needs. Lithium-ion batteries, which have a high energy density, as well as a low weight, are widely applied in offshore projects, mainly for their size and performance. Stationary and portable types are used with floating and fixed platforms for offshore energy storage solution, as well as source of power to offshore oil rigs, ships and isolated renewable energy systems.

- Lead-acid batteries though relatively older technology are still used to some extent in some offshore operations because of low initial cost and very high mechanical strength. Despite the fact that they are less energy dense when compared to lithium-ion batteries, they continue to be useful in the area of utility-scale storage where the aim is cost reduction.

- Offshore sodium chemistry batteries are a viable solution with salt sodium in large supply hence a favorable and cheap solution for energy storage. They are currently undergoing further development to extend energy density and optimise its use for offshore structures.

- Vanadium flow batteries offer a bright future for offshore energy storage, primarily because of lithium-ion battery impacts. Their large power ratings and long operational cycles also enable them to have applications in massive offshore structures and structures for storage of wind energy, and marine renewable energy systems.

- Both technologies depend on certain characteristics of offshore energy storage, such as energy density, to meet general requirements in marine conditions while also considering costs and impacts on the environment at sea. With the steady progression in offshore wind and wave energy projects, there is a probable increase in the need for off- grid energy storage solutions that are suited specifically for offshore environments.

By Application, Vessels segment held the largest share in 2024

- The existing and planned offshore units such as oil supply vessels, tankers, cargo and offshore support vessels in the oil and gas Industries call for enhanced power storage mechanisms. In such vessels, energy storage systems (ESS) maintain the power demands to enhance efficiency and continuity of functioning in Offshore regions.

- Oil rigs offshore want efficient energy storage systems to supply electricity requirements for drilling, production, and servicing. Energy storage systems offer a source of power in case of power outages and improve the utilization of power during drilling, hence, taking the efficiency of the offshore drilling to another level.

- Offshore wind power plants use wind to generate electricity; however, the inconsistency of wind energy source creates problems regarding the stability of electricity grid. Storing energy in offshore installations helps developers maintain a balance between energy production and demand since energy can be stored when wind generation is at its highest and withdrawn during periods of higher demand or low winds.

- Government policies and incentives are favouring far-fetched generation and the increasing use of offshore renewable energy boosting the offshore energy storage market. L He also mentioned that the leading companies are focusing on developing quality energy storage technologies and standards specific to offshore conditions, and this we think is sparking market growth as well as innovations in energy storage systems for off-shore purposes

???????Offshore Energy Storage Market Regional Insights:

North America dominated the largest market

- Using specific aspects of key factors, North America was observed to be at the forefront of the off-shore energy storage market. First, the region had a very large area of the geographic receiving basin characterized by the long shores suitable for offshore energy storage structures for capturing wind and tidal power. Thanks to this geographical factor, North America was able to build its competitive strength based on a rich number of natural resources for generating electricity and energy storage.

- Secondly, the desire to invest in more R & D plus technology advancements helped the region’s offshore energy storage to enhance its capacity. Efficiency and Scalability, policies focusing on enhancement of these, which impacted Americas North region making it a market leader.

- Moreover, policies and regulation policies that support government, encouraged private sector, on the development of new projects on Offshore Energy Storage. Promotion in form of subsidies, tax relief, and supportive legislation provided the market appeal thus forcing organizations to venture and establish themselves in the market.

- North America enjoys an advanced infrastructure and skilled professionals for energy generation and transmission system wherein the offshore energy storage systems have been seamlessly integrated in the grids. It also added to the dependability and stability of the region’s energy systems The integration was smooth and proactively contributed to the continuous growth of the region as the largest market for offshore energy storage in 2024.

Active Key Players in the Offshore Energy Storage Market

- ABB (Switzerland)

- General Electric (U.S)

- Siemens (Germany)

- Deepwater Wind (U.S)

- Duke Energy (U.S)

- E.ON (Germany)

- LG Chem (South Korea)

- Johnson Controls (U.S)

- SolarEdge (Israel)

- Tesla (U.S)

- Toshiba corporation (Japan), and Others Active Players

Key Industry Developments in the Offshore Energy Storage Market:

- 11 February 2021, The North Sea CJ70 jack-up drilling rigs that include Maersk Intrepid and Maersk Integrator are involved in a deal with Siemens for the installation of hybrid power plants that incorporate lithium-ion energy storage. This was done under the Arise initiative where the battery was restored by BlueVault™ batteries by Siemens Energy. It is also worthy to note that they are the first jack up units to incorporate low emission integrated hybrid solutions operating on the Norwegian mainland.

|

Global Offshore Energy Storage Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 304.92 Mn. |

|

Forecast Period 2024-32 CAGR: |

9.21% |

Market Size in 2032: |

USD 620.63 Mn. |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Offshore Energy Storage Market by Source (2018-2032)

4.1 Offshore Energy Storage Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Lithium Ion

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Lead Acid

4.5 Sodium Chemistry

4.6 Flow Vanadium

Chapter 5: Offshore Energy Storage Market by Application (2018-2032)

5.1 Offshore Energy Storage Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Vessels

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Drilling Platform

5.5 Wind Power

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Offshore Energy Storage Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABB (SWITZERLAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 GENERAL ELECTRIC (U.S)

6.4 SIEMENS (GERMANY)

6.5 DEEPWATER WIND (U.S)

6.6 DUKE ENERGY (U.S)

6.7 E.ON (GERMANY)

6.8 LG CHEM (SOUTH KOREA)

6.9 JOHNSON CONTROLS (U.S)

6.10 SOLAREDGE (ISRAEL)

6.11 TESLA (U.S)

6.12 TOSHIBA CORPORATION (JAPAN)

6.13 AND OTHERS KEY PLAYERS

Chapter 7: Global Offshore Energy Storage Market By Region

7.1 Overview

7.2. North America Offshore Energy Storage Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Source

7.2.4.1 Lithium Ion

7.2.4.2 Lead Acid

7.2.4.3 Sodium Chemistry

7.2.4.4 Flow Vanadium

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Vessels

7.2.5.2 Drilling Platform

7.2.5.3 Wind Power

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Offshore Energy Storage Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Source

7.3.4.1 Lithium Ion

7.3.4.2 Lead Acid

7.3.4.3 Sodium Chemistry

7.3.4.4 Flow Vanadium

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Vessels

7.3.5.2 Drilling Platform

7.3.5.3 Wind Power

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Offshore Energy Storage Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Source

7.4.4.1 Lithium Ion

7.4.4.2 Lead Acid

7.4.4.3 Sodium Chemistry

7.4.4.4 Flow Vanadium

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Vessels

7.4.5.2 Drilling Platform

7.4.5.3 Wind Power

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Offshore Energy Storage Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Source

7.5.4.1 Lithium Ion

7.5.4.2 Lead Acid

7.5.4.3 Sodium Chemistry

7.5.4.4 Flow Vanadium

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Vessels

7.5.5.2 Drilling Platform

7.5.5.3 Wind Power

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Offshore Energy Storage Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Source

7.6.4.1 Lithium Ion

7.6.4.2 Lead Acid

7.6.4.3 Sodium Chemistry

7.6.4.4 Flow Vanadium

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Vessels

7.6.5.2 Drilling Platform

7.6.5.3 Wind Power

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Offshore Energy Storage Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Source

7.7.4.1 Lithium Ion

7.7.4.2 Lead Acid

7.7.4.3 Sodium Chemistry

7.7.4.4 Flow Vanadium

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Vessels

7.7.5.2 Drilling Platform

7.7.5.3 Wind Power

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Offshore Energy Storage Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 304.92 Mn. |

|

Forecast Period 2024-32 CAGR: |

9.21% |

Market Size in 2032: |

USD 620.63 Mn. |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||