Nutritional Supplements Market Synopsis

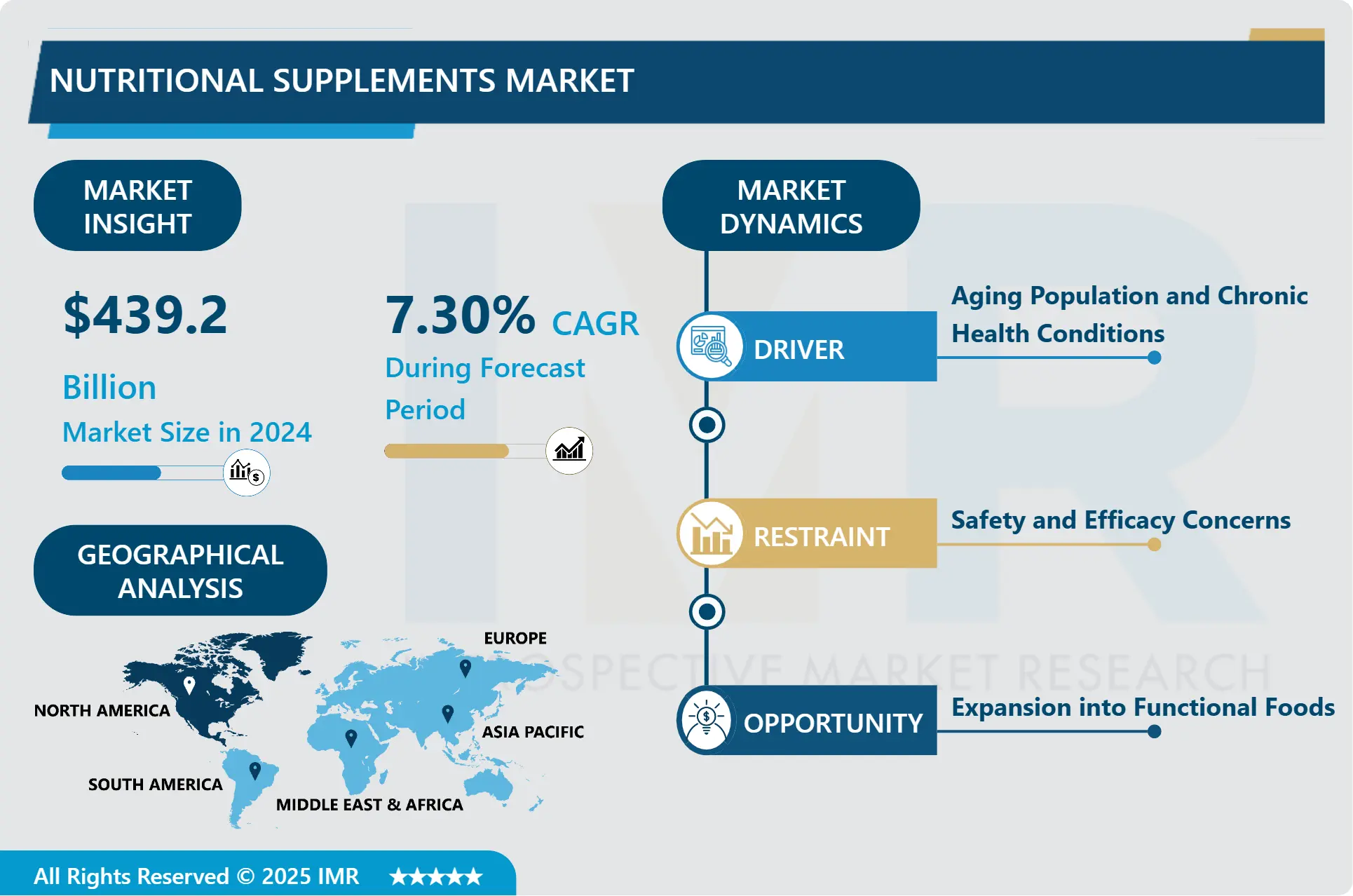

Nutritional Supplements Market Size Was Valued at USD 439.2 Billion in 2024, and is Projected to Reach USD 771.72 Billion by 2032, Growing at a CAGR of 7.30% From 2025-2032.

Dietary supplements are products that are designed to provide the human body with nutrients that may not be adequate according to the daily dietary requirements. These supplements can be classified as and may encompass vitamins, minerals, amino acids, herbs, and other botanicals, and these products may come in different forms including pills, capsules, powders, and liquids. They are designed to supply the body with nutrients alongside a balanced diet and are mostly used to treat particular ailments or to boost the body’s immunity and health. However, their correct usage and consultation with a healthcare provider is appropriate because their use in the wrong dosages or in wrong situations can be damaging to health.

There are several factors that have boosted the nutritional supplements market over the years pointing to the need for nutritional wellbeing, increased per capita income, and increased lifespan generally. Supplements can be defined as composition and preparations such as vitamins, minerals, proteins, amino acids, herbs, botanicals and sports nutrition products among others. These are products taken alongside meals or as an adjunct to diets in the hope of improving one’s own health status, to treat an existing ailment, or for the purpose of boosting performance in physical activities.

Accounting for one of the significant proportions of the nutritional supplements industry the factor that can be identified is the increasing consciousness about health and the options for preventing diseases. As costs of healthcare continue to rise prompted by concerns for healthy living, consumer shift from seeking curative measures to preventive measures such as supplementing their diet. Also, increased life expectancy in many global locations has ensured the need for supplement products dealing with age-related complications such as arthritis, dementia and heart problems.

This is in addition to distribution channels where another area that has remained a major driver of market growth. This is because nutritional supplements are no longer exclusively marketed in pharmacies, health food stores and stores for vitamins and supplements; they are also promoted in supermarkets, on the internet, and in specialized shops. Consumers prefer to use supplements and the amount of players such as manufactures and retailers have also grown wider.

Also, the tendency of individualized approach to nutrition is emerging as the market determinant of supplements. This is a new concept whereby consumers demand products that are unique to each of them depending on their health conditions and even choice. This has led to the development of lifestyle nutrition and tailored supplements products and solutions according to the needs and objectives of nutritional programs.

But it is also true that the market has certain drawbacks, such as potential governmental regulations and some issues related to the aspects of safety and effectiveness of some supplements. When it comes to food supplements, consumers and different regulatory agencies in different countries have put in place strict measures in its production and consumption. Adherence to these rules can entail significant expenses and time, for manufacturers, especially those of a small scale.

Also, there is active controversy and doubt regarding the efficacy of specific supplements because of discrepancy in research results and–possibly–falseness. Skepticism about how some supplements have been contaminated and labeled has also led to doubts regarding the integrity of the industry.

In the future the nutritional supplements are expected to provide even greater levels of growth due to the societal factors that include awareness levels, growth in distribution channels and format, and product advancements. Still, individuals in the industry shall have to come to terms with the fact that regulation is here, and will be a work in progress as more efforts are required to foster trust between market players that will be key to sustaining this form of growth in the highly competitive market. Furthermore, it is equally important to understand that the scientific progress in the sphere of biology and technopoliticking is likely to strengthen and develop the potential for the further production of high-quality nutritional supplements of various types by means of creating more and more effective supplementary products.

Nutritional Supplements Market Trend Analysis

Nutritional Supplements Growth Drivers- Sustainable and Ethical Sourcing

- Due to the current push by people towards—for ecological reasons and human tendency towards humaness—of product sourcing, nutational supplements sourcing must ensure this path is sustainable and ethical. In response, many companies are working hard to implement transparency and accountability in their supply chain management practices, supervise that the ingredients used are sustainably sourced, workers are treated fairly, and that ecosystems are preserved. This trend comprises of issues such as appropriate labour relations, appropriating locally sourced natural products, reducing negative impacts on the environment during transportation and providing support to local families.

- However, there is a gradual increase in the number of certifications such as Fair Trade and USDA Organic to ensure customer confidence in the recognized business practices when purchasing products. This shows that as the demand increases for these products that are in one way or another influencing the choice of the consumers and buyers, the business organizations are gaining awareness of the need to consider sustainable practices that will be friendly to the environment and ethical to the society.

Nutritional Supplements Opportunity- Expansion into Functional Foods

- Market penetration is a competitive business that requires due diligence based on research relating to the functional foods nutritional supplements market, an innovation in product development, marketing, and distribution channels. First and foremost, the market must be scrutinized and studied in terms of their preferences, potential trends, and competitors’ strategies. This of course brings into focus the idea that a company can create novel functional foods for precise requirements in nutrient profiles or other related issues. Depending on the desired market segment, it is possible to target nutritionists, dietitians, and food scientists to help develop products that may deliver specific health benefits.

- It is important a different focus be placed on marketing these products with reassurances of their effectiveness and that they are chemical free. Such collaborations may be with health and wellness bloggers or other fitness professionals, which can help to improve the authenticity and visibility of the company. Finally, guaranteeing access to reliable distribution channels, both, online and offline protects the interest of a wide range of consumer base and guarantees accessibility of the products. Ongoing analysis of the tendencies and consumers’ preferences results in optimizing their strategy and improving portfolio approaches, meaning steady growth and profitability in the Functional Foods & Nutritional Supplements Market.

Nutritional Supplements Market Segment Analysis:

Nutritional Supplements Market is Segmented based on Product, Consumer Group, Formulation and Sales Channel.

By Product, Sport Nutrition segment is expected to dominate the market during the forecast period

- Nutritional supplements are a vast show of products that can fit different occasion and need of the marketer. Nutrition for sporting requires specific formulas for people who engage in any sporting activities or physical exercises in order to strengthen muscles, boost performance and recover faster. Fat burners are products that are directed towards consumers who are in a lookout for solutions on how to shed off their excess weight by elevating the metabolism process of the body. Nutritional supplements are vitamin and mineral pictures that help nutrient gaps, well-being each day nourishment to different populaces intrigued by health.

- A new trend in the food and beverage industry is the functional products containing ingredients and nutrients beyond basic food values that are recovery, correction or prevention of diseases, appealing to consumers who desire a more complete way of eating and drinking as a way of avoiding sickness. The subsequent key factors exert influence over this market’s dynamics: Changes in taste and preferences shifting science and technology, regulatory impact – including transparency, efficacy, and sustainability characteristics becoming key to market development and differentiation.

By Formulation, Powder segment held the largest share in 2024

- Nutritional supplements retail market for food and beverages is also colorful since it dispenses varied formulation as per the consumer taste and requirement. Pills, coated and soft gel, encapsulated and powdered- this is probably the popular delivery systems of medicines; all of which are special in their own way. Several reasons make tablets and capsules popular; first, they are easy to ingest and carry; second, they come in accurate measurement, and third, they come in accurate measurements. Powder forms present flexibility more so through alteration of particle size and solubility and are easy to add to meals or drinks. Softgels offer better absorption and protection of liquid or oily based products through the enveloping process. Liquid conveniences come in as liquids are rapidly absorbed in the body and are suitable for patients with swallowing disorders or those who seek fast uptake of Nutrients.

- Furthermore, other novel dosage forms that are beginning to capture the market’s attention are gummy products, effervescent tablets, or chewable tablets, thus providing exciting and palatable forms to take nutritional supplements. When it comes to the product formulation, the market remains open to more diverse formulation to reach to a large number of people so that continues to fuel the growth opportunities of the market as well as pushing the innovation factors in this industry.

Nutritional Supplements Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- There are various factors which contribute towards the nutritional supplements market for North America to dominate in coming period with healthy growth rate as follows: First of all, the region is equipped with the advanced level of healthcare and high level of consumer concern in health and nutrinece, thereby creating the demand for the nutritional supplements. Further, more disposable income, and the rising elderly population specifically in countries like United States and Canada added to this demand as the need for preventive health care solutions not only to avoid diseases but also for aging related issues mounts up.

- Further, the increasing incidence of the lifestyle diseases, which include obesity, diabetes, and cardiovascular diseases, has seen consumers put more effort in improving their health, and these include the intake of the dietary supplements. In addition, the regions truly being a legal environment of quality and consumer protection regulation affect consumer confidence in the products hence promoting the market for nutritional supplements. Such factors as the continuous presence of key market players and innovations in product offerings like nutrition solutions and functional vitamins presage the continued leading market position of North America. And therefore, it can be assumed that North America will retain its leadership in the consumption of nutritional supplements in the foreseeable future.

Active Key Players in the Nutritional Supplements Market

- Abbott - United States (USA)

- Nestlé Health Science –( Switzerland)

- Herbalife International of America, Inc - United States (USA)

- Amway Corp. - (USA)

- PepsiCo - (USA)

- Clif Bar & Company - (USA)

- Science in Sport plc - (UK)

- THG PLC - (UK)

- CSN - (UK), and Other Active Players

|

Global Nutritional Supplements Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 439.2 Bn. |

|

Forecast Period 2025-32 CAGR: |

7.30% |

Market Size in 2032: |

USD 771.72 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Consumer Group |

|

||

|

By Formulation |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Nutritional Supplements Market by Product (2018-2032)

4.1 Nutritional Supplements Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Sports Nutrition

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fat Burners

4.5 Dietary Supplements

4.6 Functional Foods and Beverages

Chapter 5: Nutritional Supplements Market by Consumer Group (2018-2032)

5.1 Nutritional Supplements Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Infants

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Children

5.5 Adults

5.6 Pregnant

5.7 Geriatric

Chapter 6: Nutritional Supplements Market by Formulation (2018-2032)

6.1 Nutritional Supplements Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Tablets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Capsules

6.5 Powder

6.6 Softgels

6.7 Liquid

6.8 Others

Chapter 7: Nutritional Supplements Market by Sales Channel (2018-2032)

7.1 Nutritional Supplements Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Brick & Mortar

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 E-commerce

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Nutritional Supplements Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ABBOTT - UNITED STATES (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 NESTLÉ HEALTH SCIENCE –( SWITZERLAND)

8.4 HERBALIFE INTERNATIONAL OF AMERICA INC - UNITED STATES (USA)

8.5 AMWAY CORP. - (USA)

8.6 PEPSICO - (USA)

8.7 CLIF BAR & COMPANY - (USA)

8.8 SCIENCE IN SPORT PLC - (UK)

8.9 THG PLC - (UK)

8.10 CSN - (UK)

8.11 AND OTHER KEY PLAYERS

8.12

Chapter 9: Global Nutritional Supplements Market By Region

9.1 Overview

9.2. North America Nutritional Supplements Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product

9.2.4.1 Sports Nutrition

9.2.4.2 Fat Burners

9.2.4.3 Dietary Supplements

9.2.4.4 Functional Foods and Beverages

9.2.5 Historic and Forecasted Market Size by Consumer Group

9.2.5.1 Infants

9.2.5.2 Children

9.2.5.3 Adults

9.2.5.4 Pregnant

9.2.5.5 Geriatric

9.2.6 Historic and Forecasted Market Size by Formulation

9.2.6.1 Tablets

9.2.6.2 Capsules

9.2.6.3 Powder

9.2.6.4 Softgels

9.2.6.5 Liquid

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size by Sales Channel

9.2.7.1 Brick & Mortar

9.2.7.2 E-commerce

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Nutritional Supplements Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product

9.3.4.1 Sports Nutrition

9.3.4.2 Fat Burners

9.3.4.3 Dietary Supplements

9.3.4.4 Functional Foods and Beverages

9.3.5 Historic and Forecasted Market Size by Consumer Group

9.3.5.1 Infants

9.3.5.2 Children

9.3.5.3 Adults

9.3.5.4 Pregnant

9.3.5.5 Geriatric

9.3.6 Historic and Forecasted Market Size by Formulation

9.3.6.1 Tablets

9.3.6.2 Capsules

9.3.6.3 Powder

9.3.6.4 Softgels

9.3.6.5 Liquid

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size by Sales Channel

9.3.7.1 Brick & Mortar

9.3.7.2 E-commerce

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Nutritional Supplements Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product

9.4.4.1 Sports Nutrition

9.4.4.2 Fat Burners

9.4.4.3 Dietary Supplements

9.4.4.4 Functional Foods and Beverages

9.4.5 Historic and Forecasted Market Size by Consumer Group

9.4.5.1 Infants

9.4.5.2 Children

9.4.5.3 Adults

9.4.5.4 Pregnant

9.4.5.5 Geriatric

9.4.6 Historic and Forecasted Market Size by Formulation

9.4.6.1 Tablets

9.4.6.2 Capsules

9.4.6.3 Powder

9.4.6.4 Softgels

9.4.6.5 Liquid

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size by Sales Channel

9.4.7.1 Brick & Mortar

9.4.7.2 E-commerce

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Nutritional Supplements Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product

9.5.4.1 Sports Nutrition

9.5.4.2 Fat Burners

9.5.4.3 Dietary Supplements

9.5.4.4 Functional Foods and Beverages

9.5.5 Historic and Forecasted Market Size by Consumer Group

9.5.5.1 Infants

9.5.5.2 Children

9.5.5.3 Adults

9.5.5.4 Pregnant

9.5.5.5 Geriatric

9.5.6 Historic and Forecasted Market Size by Formulation

9.5.6.1 Tablets

9.5.6.2 Capsules

9.5.6.3 Powder

9.5.6.4 Softgels

9.5.6.5 Liquid

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size by Sales Channel

9.5.7.1 Brick & Mortar

9.5.7.2 E-commerce

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Nutritional Supplements Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product

9.6.4.1 Sports Nutrition

9.6.4.2 Fat Burners

9.6.4.3 Dietary Supplements

9.6.4.4 Functional Foods and Beverages

9.6.5 Historic and Forecasted Market Size by Consumer Group

9.6.5.1 Infants

9.6.5.2 Children

9.6.5.3 Adults

9.6.5.4 Pregnant

9.6.5.5 Geriatric

9.6.6 Historic and Forecasted Market Size by Formulation

9.6.6.1 Tablets

9.6.6.2 Capsules

9.6.6.3 Powder

9.6.6.4 Softgels

9.6.6.5 Liquid

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size by Sales Channel

9.6.7.1 Brick & Mortar

9.6.7.2 E-commerce

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Nutritional Supplements Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product

9.7.4.1 Sports Nutrition

9.7.4.2 Fat Burners

9.7.4.3 Dietary Supplements

9.7.4.4 Functional Foods and Beverages

9.7.5 Historic and Forecasted Market Size by Consumer Group

9.7.5.1 Infants

9.7.5.2 Children

9.7.5.3 Adults

9.7.5.4 Pregnant

9.7.5.5 Geriatric

9.7.6 Historic and Forecasted Market Size by Formulation

9.7.6.1 Tablets

9.7.6.2 Capsules

9.7.6.3 Powder

9.7.6.4 Softgels

9.7.6.5 Liquid

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size by Sales Channel

9.7.7.1 Brick & Mortar

9.7.7.2 E-commerce

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Nutritional Supplements Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 439.2 Bn. |

|

Forecast Period 2025-32 CAGR: |

7.30% |

Market Size in 2032: |

USD 771.72 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Consumer Group |

|

||

|

By Formulation |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||