Encapsulated Flavors and Fragrances Market Overview

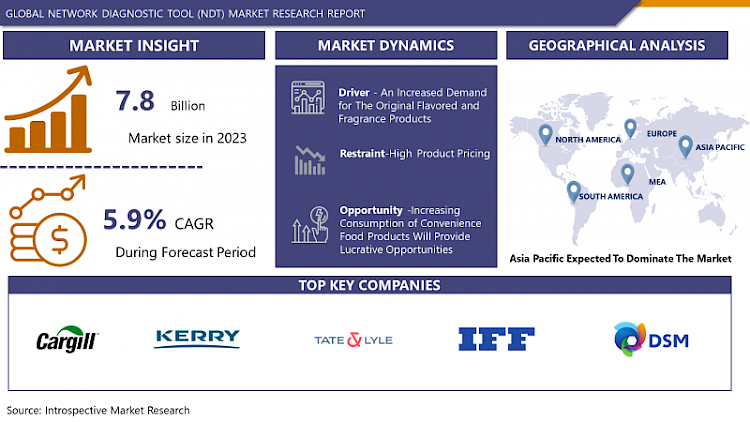

The Global Encapsulated Flavors and Fragrance Market size is expected to grow from USD 7.8 billion in 2023 to USD 13.07 billion by 2032, at a CAGR of 5.9% during the forecast period (2024-2032).

Encapsulation refers to the protection of flavoring agents or fragrance molecules by a specific envelope. Encapsulation helps to minimize the degradation or loss of flavor and fragrance during the various process and storge of the particular products. In addition, the envelope can also furnish functional properties such as controlled release of aromatic molecules in a given environment. The material that is covered is known as an active or core material, whereas the coating material is called a shell or encapsulated material. Moreover, flavors are costly and sensitive products that are utilized in food products as an additive. To perpetuate the long-term stability and integrity of the flavors present in the food products, they are encapsulated, or in other words, are protected.

Additionally, encapsulation cater uniformity, improved taste, increased shelf life, coloring, and protection of food items from harsh conditions. To protect the flavor and fragrance from the evaporation, oxidation, and moisture intake encapsulation create the barrier wall between the flavors and environment. Also, protect from other adverse effects, it assists in separating incompatible flavor constituents. Encapsulation of flavors has been commercialized by application methods such as spray drying, spray cooling, extrusion, molecular inclusion, and others.

Report Coverage:

The global market report of Encapsulated Flavors and Fragrance Market by the Introspective Market Research includes qualitative and quantitative insights. The company also offers a detailed analysis of the market size and growth rate of the possible segments. The report tracks recent developments, key players and start-up’s details that are working in the industry. The report offers surplus of information about market entry strategies, regulatory framework and reimbursement scenario.

Market Dynamics and Factors:

Drivers:

Changing the consumer lifestyles and growing demand for packaged food and beverages owing to busy and hectic schedule among the consumers leads the accelerate the market growth over period. In addition, switching consumer preferences towards the fast food, ready to eat and cook food due to time saving and fast paced life will further support the industry growth.

An increased demand for the original flavored and fragrance products is one of the major driving factors which leads to the market growth in projected period.

Technological advancement with increased R&D investments by the key players will fueled the business growth. Leading players are primarily focused on new product innovation and launches to attain market expansion is major factor to stimulate the market growth over forecast period.

Various application of encapsulate flavors and fragrance in industries such as household care, personal care, textile, will capture the market in future. Odor and flavor masking and controlled release characteristics in delivering nutrients are helps to boost the market.

Restraints:

Lack of technical assistance by the stringent government norms and rules about consumer safety, limited availability of food grade materials, high product pricing are major factors may hinder the market growth in projected period.

Opportunities:

Research and development in paper production or coating with potential developments of micro or nano system due to latest trend of renewable product will create the opportunity in upcoming years. Additionally, high quality product development, innovation in flexible food packaging’s are expected to growth for the market in projected period.

Market Segmentation

Type Insights

Based on Product, flavor blends accounted the largest share in the market due to switching consumer preferences towards the fortified food, eating habits are boost the encapsulate product demand. Furthermore, essential oils and natural extract are also fastest growing segment after flavor blend owing to increasing the health awareness and demand for natural based product by the consumers.

Based on Technology, mechanical technology segment dominates the market owing to high production capacity, economic feasibility, particle size flexibility, feedstock versatility is driving the segment in the market.

Based on Process, micro encapsulation process accounted the largest share in the market. Technological advancement benefits including precise release of the nutrients at proper place and in time are helps to boost the market.

Based on End Use, food and beverages segment dominates over the market owing to increased demand for packaged food, healthy snacks, confectionary products, and others are driving the market. In addition, increasing healthy diet pattern among the consumers smart drinks beverages helps to fueling the growth of the encapsulated flavor and fragrance market.

Based on Encapsulated Form, paste form is accounted largest demand in the market due to their unique properties such as stickiness, strong protection of flavors from environmental conditions and long shelf life with products.

Regional Analysis

Asia Pacific region accounted the major share of the market owing to rapidly growing population along with rising per capita income, an increasing growth in demand for food and beverages product, and cosmetic & personal care product are major driving factors which leads the market growth over forecast period. Rising the concern about improved product shelf life, health awareness and demand for diet food by the consumer in North America region will accelerate the market growth over forecast period.

In Europe, growing demand for packaged food product, healthy food owing to health awareness also high disposal income to spending on premium products which helps to growth of the market in projected period.

In Latina America and Middle East and Africa, growing population, high demand for cosmetics and personal care products, and significantly growing food and beverage industry with high demand by consumers and investment by the players will propel the growth in the encapsulated flavor and fragrance market during forecast period.

Players Covered in Encapsulated Flavors and Fragrances market are :

- Cargill Incorporated

- Kerry Group PLC.

- Tate and Lyle PLC.

- International Flavors and Fragrance Ltd.

- DSM

- Ingredion Incorporated

- Lycored

- Balchem Inc.

- TasteTech

- DuPont

- ABCO Laboratories Inc.

- Clextral

- Sphera Encapsulation

- Symrise

- Sensient Technologies Corporation

- Institutes of Food Technologists

- Vitasquare

- AVEKA Inc.

- BASF SE.

- Firmenich S.A.

Key Industry Developments:

- In March 2021, Ingredion Incorporated announced the partnerships with Amyris Inc., a leading synthetic biotechnology company to production of market sugar reduction and fermentation-based food ingredients.

- In May 2022, Firmenich, the world's largest privately-owned fragrance and taste company, announced it had signed a strategic partnership with ScentRealm, a leading digital scent technology pioneer based in Hangzhou, China. This collaboration brought together the expertise of a fragrance house and a sensory experience explorer, marking the first partnership of its kind in China. The alliance enabled Firmenich to enhance the fragrance and aroma experience for its customers and consumers through jointly developed digital devices.

|

Global Encapsulated Flavors and Fragrance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.8 billion. |

|

Forecast Period 2024-32 CAGR: |

5.9% |

Market Size in 2032: |

USD 13.07 billion. |

|

Segments Covered: |

By Product Type |

|

|

|

By Encapsulated Form |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product Type

3.2 By Encapsulated Form

3.3 By Technology

3.4 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Encapsulated Flavors and Fragrance Market by Product Type

5.1 Encapsulated Flavors and Fragrance Market Overview Snapshot and Growth Engine

5.2 Encapsulated Flavors and Fragrance Market Overview

5.3 Flavor Blends

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Flavor Blends: Grographic Segmentation

5.4 Fragrance Blends

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Fragrance Blends: Grographic Segmentation

5.5 Essential Oils & Natural Extracts

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Essential Oils & Natural Extracts: Grographic Segmentation

5.6 Aroma Chemicals

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Aroma Chemicals: Grographic Segmentation

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Grographic Segmentation

Chapter 6: Encapsulated Flavors and Fragrance Market by Encapsulated Form

6.1 Encapsulated Flavors and Fragrance Market Overview Snapshot and Growth Engine

6.2 Encapsulated Flavors and Fragrance Market Overview

6.3 Powder

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Powder: Grographic Segmentation

6.4 Paste

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Paste: Grographic Segmentation

6.5 Granules

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Granules: Grographic Segmentation

Chapter 7: Encapsulated Flavors and Fragrance Market by Technology

7.1 Encapsulated Flavors and Fragrance Market Overview Snapshot and Growth Engine

7.2 Encapsulated Flavors and Fragrance Market Overview

7.3 Physical Process

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Physical Process: Grographic Segmentation

7.4 Physicochemical Process

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Physicochemical Process: Grographic Segmentation

7.5 Chemical Process

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Chemical Process: Grographic Segmentation

7.6 Extrusion

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Extrusion: Grographic Segmentation

7.7 Fluid Bed

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Fluid Bed: Grographic Segmentation

7.8 Others

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Others: Grographic Segmentation

Chapter 8: Encapsulated Flavors and Fragrance Market by Application

8.1 Encapsulated Flavors and Fragrance Market Overview Snapshot and Growth Engine

8.2 Encapsulated Flavors and Fragrance Market Overview

8.3 Food & Beverages

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Food & Beverages: Grographic Segmentation

8.4 Consumer Goods

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Consumer Goods: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Encapsulated Flavors and Fragrance Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Encapsulated Flavors and Fragrance Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Encapsulated Flavors and Fragrance Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 CARGILL INCORPORATED

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 KERRY GROUP PLC.

9.4 TATE AND LYLE PLC.

9.5 INTERNATIONAL FLAVORS AND FRAGRANCE LTD.

9.6 DSM

9.7 INGREDION INCORPORATED

9.8 LYCORED

9.9 BALCHEM INC.

9.10 TASTETECH

9.11 DUPONT

9.12 ABCO LABORATORIES INC.

9.13 CLEXTRAL

9.14 SPHERA ENCAPSULATION

9.15 SYMRISE

9.16 SENSIENT TECHNOLOGIES CORPORATION

9.17 INSTITUTES OF FOOD TECHNOLOGISTS

9.18 VITASQUARE

9.19 AVEKA INC.

9.20 BASF SE.

9.21 FIRMENICH S.A.

9.22 OTHER MAJOR PLAYERS

Chapter 10: Global Encapsulated Flavors and Fragrance Market Analysis, Insights and Forecast, 2017-2032

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Product Type

10.2.1 Flavor Blends

10.2.2 Fragrance Blends

10.2.3 Essential Oils & Natural Extracts

10.2.4 Aroma Chemicals

10.2.5 Others

10.3 Historic and Forecasted Market Size By Encapsulated Form

10.3.1 Powder

10.3.2 Paste

10.3.3 Granules

10.4 Historic and Forecasted Market Size By Technology

10.4.1 Physical Process

10.4.2 Physicochemical Process

10.4.3 Chemical Process

10.4.4 Extrusion

10.4.5 Fluid Bed

10.4.6 Others

10.5 Historic and Forecasted Market Size By Application

10.5.1 Food & Beverages

10.5.2 Consumer Goods

Chapter 11: North America Encapsulated Flavors and Fragrance Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product Type

11.4.1 Flavor Blends

11.4.2 Fragrance Blends

11.4.3 Essential Oils & Natural Extracts

11.4.4 Aroma Chemicals

11.4.5 Others

11.5 Historic and Forecasted Market Size By Encapsulated Form

11.5.1 Powder

11.5.2 Paste

11.5.3 Granules

11.6 Historic and Forecasted Market Size By Technology

11.6.1 Physical Process

11.6.2 Physicochemical Process

11.6.3 Chemical Process

11.6.4 Extrusion

11.6.5 Fluid Bed

11.6.6 Others

11.7 Historic and Forecasted Market Size By Application

11.7.1 Food & Beverages

11.7.2 Consumer Goods

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Encapsulated Flavors and Fragrance Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product Type

12.4.1 Flavor Blends

12.4.2 Fragrance Blends

12.4.3 Essential Oils & Natural Extracts

12.4.4 Aroma Chemicals

12.4.5 Others

12.5 Historic and Forecasted Market Size By Encapsulated Form

12.5.1 Powder

12.5.2 Paste

12.5.3 Granules

12.6 Historic and Forecasted Market Size By Technology

12.6.1 Physical Process

12.6.2 Physicochemical Process

12.6.3 Chemical Process

12.6.4 Extrusion

12.6.5 Fluid Bed

12.6.6 Others

12.7 Historic and Forecasted Market Size By Application

12.7.1 Food & Beverages

12.7.2 Consumer Goods

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Encapsulated Flavors and Fragrance Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product Type

13.4.1 Flavor Blends

13.4.2 Fragrance Blends

13.4.3 Essential Oils & Natural Extracts

13.4.4 Aroma Chemicals

13.4.5 Others

13.5 Historic and Forecasted Market Size By Encapsulated Form

13.5.1 Powder

13.5.2 Paste

13.5.3 Granules

13.6 Historic and Forecasted Market Size By Technology

13.6.1 Physical Process

13.6.2 Physicochemical Process

13.6.3 Chemical Process

13.6.4 Extrusion

13.6.5 Fluid Bed

13.6.6 Others

13.7 Historic and Forecasted Market Size By Application

13.7.1 Food & Beverages

13.7.2 Consumer Goods

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Encapsulated Flavors and Fragrance Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Product Type

14.4.1 Flavor Blends

14.4.2 Fragrance Blends

14.4.3 Essential Oils & Natural Extracts

14.4.4 Aroma Chemicals

14.4.5 Others

14.5 Historic and Forecasted Market Size By Encapsulated Form

14.5.1 Powder

14.5.2 Paste

14.5.3 Granules

14.6 Historic and Forecasted Market Size By Technology

14.6.1 Physical Process

14.6.2 Physicochemical Process

14.6.3 Chemical Process

14.6.4 Extrusion

14.6.5 Fluid Bed

14.6.6 Others

14.7 Historic and Forecasted Market Size By Application

14.7.1 Food & Beverages

14.7.2 Consumer Goods

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Encapsulated Flavors and Fragrance Market Analysis, Insights and Forecast, 2017-2032

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Product Type

15.4.1 Flavor Blends

15.4.2 Fragrance Blends

15.4.3 Essential Oils & Natural Extracts

15.4.4 Aroma Chemicals

15.4.5 Others

15.5 Historic and Forecasted Market Size By Encapsulated Form

15.5.1 Powder

15.5.2 Paste

15.5.3 Granules

15.6 Historic and Forecasted Market Size By Technology

15.6.1 Physical Process

15.6.2 Physicochemical Process

15.6.3 Chemical Process

15.6.4 Extrusion

15.6.5 Fluid Bed

15.6.6 Others

15.7 Historic and Forecasted Market Size By Application

15.7.1 Food & Beverages

15.7.2 Consumer Goods

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Encapsulated Flavors and Fragrance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.8 billion. |

|

Forecast Period 2024-32 CAGR: |

5.9% |

Market Size in 2032: |

USD 13.07 billion. |

|

Segments Covered: |

By Product Type |

|

|

|

By Encapsulated Form |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET COMPETITIVE RIVALRY

TABLE 005. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET THREAT OF NEW ENTRANTS

TABLE 006. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET THREAT OF SUBSTITUTES

TABLE 007. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET BY PRODUCT TYPE

TABLE 008. FLAVOR BLENDS MARKET OVERVIEW (2016-2028)

TABLE 009. FRAGRANCE BLENDS MARKET OVERVIEW (2016-2028)

TABLE 010. ESSENTIAL OILS & NATURAL EXTRACTS MARKET OVERVIEW (2016-2028)

TABLE 011. AROMA CHEMICALS MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET BY ENCAPSULATED FORM

TABLE 014. POWDER MARKET OVERVIEW (2016-2028)

TABLE 015. PASTE MARKET OVERVIEW (2016-2028)

TABLE 016. GRANULES MARKET OVERVIEW (2016-2028)

TABLE 017. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET BY TECHNOLOGY

TABLE 018. PHYSICAL PROCESS MARKET OVERVIEW (2016-2028)

TABLE 019. PHYSICOCHEMICAL PROCESS MARKET OVERVIEW (2016-2028)

TABLE 020. CHEMICAL PROCESS MARKET OVERVIEW (2016-2028)

TABLE 021. EXTRUSION MARKET OVERVIEW (2016-2028)

TABLE 022. FLUID BED MARKET OVERVIEW (2016-2028)

TABLE 023. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 024. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET BY APPLICATION

TABLE 025. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 026. CONSUMER GOODS MARKET OVERVIEW (2016-2028)

TABLE 027. NORTH AMERICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 028. NORTH AMERICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY ENCAPSULATED FORM (2016-2028)

TABLE 029. NORTH AMERICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY TECHNOLOGY (2016-2028)

TABLE 030. NORTH AMERICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY APPLICATION (2016-2028)

TABLE 031. N ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY COUNTRY (2016-2028)

TABLE 032. EUROPE ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 033. EUROPE ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY ENCAPSULATED FORM (2016-2028)

TABLE 034. EUROPE ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY TECHNOLOGY (2016-2028)

TABLE 035. EUROPE ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY APPLICATION (2016-2028)

TABLE 036. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY COUNTRY (2016-2028)

TABLE 037. ASIA PACIFIC ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 038. ASIA PACIFIC ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY ENCAPSULATED FORM (2016-2028)

TABLE 039. ASIA PACIFIC ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY TECHNOLOGY (2016-2028)

TABLE 040. ASIA PACIFIC ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY APPLICATION (2016-2028)

TABLE 041. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY COUNTRY (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY ENCAPSULATED FORM (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY TECHNOLOGY (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY APPLICATION (2016-2028)

TABLE 046. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY COUNTRY (2016-2028)

TABLE 047. SOUTH AMERICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 048. SOUTH AMERICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY ENCAPSULATED FORM (2016-2028)

TABLE 049. SOUTH AMERICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY TECHNOLOGY (2016-2028)

TABLE 050. SOUTH AMERICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY APPLICATION (2016-2028)

TABLE 051. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET, BY COUNTRY (2016-2028)

TABLE 052. CARGILL INCORPORATED: SNAPSHOT

TABLE 053. CARGILL INCORPORATED: BUSINESS PERFORMANCE

TABLE 054. CARGILL INCORPORATED: PRODUCT PORTFOLIO

TABLE 055. CARGILL INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. KERRY GROUP PLC.: SNAPSHOT

TABLE 056. KERRY GROUP PLC.: BUSINESS PERFORMANCE

TABLE 057. KERRY GROUP PLC.: PRODUCT PORTFOLIO

TABLE 058. KERRY GROUP PLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. TATE AND LYLE PLC.: SNAPSHOT

TABLE 059. TATE AND LYLE PLC.: BUSINESS PERFORMANCE

TABLE 060. TATE AND LYLE PLC.: PRODUCT PORTFOLIO

TABLE 061. TATE AND LYLE PLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. INTERNATIONAL FLAVORS AND FRAGRANCE LTD.: SNAPSHOT

TABLE 062. INTERNATIONAL FLAVORS AND FRAGRANCE LTD.: BUSINESS PERFORMANCE

TABLE 063. INTERNATIONAL FLAVORS AND FRAGRANCE LTD.: PRODUCT PORTFOLIO

TABLE 064. INTERNATIONAL FLAVORS AND FRAGRANCE LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. DSM: SNAPSHOT

TABLE 065. DSM: BUSINESS PERFORMANCE

TABLE 066. DSM: PRODUCT PORTFOLIO

TABLE 067. DSM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. INGREDION INCORPORATED: SNAPSHOT

TABLE 068. INGREDION INCORPORATED: BUSINESS PERFORMANCE

TABLE 069. INGREDION INCORPORATED: PRODUCT PORTFOLIO

TABLE 070. INGREDION INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. LYCORED: SNAPSHOT

TABLE 071. LYCORED: BUSINESS PERFORMANCE

TABLE 072. LYCORED: PRODUCT PORTFOLIO

TABLE 073. LYCORED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. BALCHEM INC.: SNAPSHOT

TABLE 074. BALCHEM INC.: BUSINESS PERFORMANCE

TABLE 075. BALCHEM INC.: PRODUCT PORTFOLIO

TABLE 076. BALCHEM INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. TASTETECH: SNAPSHOT

TABLE 077. TASTETECH: BUSINESS PERFORMANCE

TABLE 078. TASTETECH: PRODUCT PORTFOLIO

TABLE 079. TASTETECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. DUPONT: SNAPSHOT

TABLE 080. DUPONT: BUSINESS PERFORMANCE

TABLE 081. DUPONT: PRODUCT PORTFOLIO

TABLE 082. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. ABCO LABORATORIES INC.: SNAPSHOT

TABLE 083. ABCO LABORATORIES INC.: BUSINESS PERFORMANCE

TABLE 084. ABCO LABORATORIES INC.: PRODUCT PORTFOLIO

TABLE 085. ABCO LABORATORIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. CLEXTRAL: SNAPSHOT

TABLE 086. CLEXTRAL: BUSINESS PERFORMANCE

TABLE 087. CLEXTRAL: PRODUCT PORTFOLIO

TABLE 088. CLEXTRAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. SPHERA ENCAPSULATION: SNAPSHOT

TABLE 089. SPHERA ENCAPSULATION: BUSINESS PERFORMANCE

TABLE 090. SPHERA ENCAPSULATION: PRODUCT PORTFOLIO

TABLE 091. SPHERA ENCAPSULATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. SYMRISE: SNAPSHOT

TABLE 092. SYMRISE: BUSINESS PERFORMANCE

TABLE 093. SYMRISE: PRODUCT PORTFOLIO

TABLE 094. SYMRISE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. SENSIENT TECHNOLOGIES CORPORATION: SNAPSHOT

TABLE 095. SENSIENT TECHNOLOGIES CORPORATION: BUSINESS PERFORMANCE

TABLE 096. SENSIENT TECHNOLOGIES CORPORATION: PRODUCT PORTFOLIO

TABLE 097. SENSIENT TECHNOLOGIES CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. INSTITUTES OF FOOD TECHNOLOGISTS: SNAPSHOT

TABLE 098. INSTITUTES OF FOOD TECHNOLOGISTS: BUSINESS PERFORMANCE

TABLE 099. INSTITUTES OF FOOD TECHNOLOGISTS: PRODUCT PORTFOLIO

TABLE 100. INSTITUTES OF FOOD TECHNOLOGISTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. VITASQUARE: SNAPSHOT

TABLE 101. VITASQUARE: BUSINESS PERFORMANCE

TABLE 102. VITASQUARE: PRODUCT PORTFOLIO

TABLE 103. VITASQUARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. AVEKA INC.: SNAPSHOT

TABLE 104. AVEKA INC.: BUSINESS PERFORMANCE

TABLE 105. AVEKA INC.: PRODUCT PORTFOLIO

TABLE 106. AVEKA INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. BASF SE.: SNAPSHOT

TABLE 107. BASF SE.: BUSINESS PERFORMANCE

TABLE 108. BASF SE.: PRODUCT PORTFOLIO

TABLE 109. BASF SE.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. FIRMENICH S.A.: SNAPSHOT

TABLE 110. FIRMENICH S.A.: BUSINESS PERFORMANCE

TABLE 111. FIRMENICH S.A.: PRODUCT PORTFOLIO

TABLE 112. FIRMENICH S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 113. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 114. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 115. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. FLAVOR BLENDS MARKET OVERVIEW (2016-2028)

FIGURE 013. FRAGRANCE BLENDS MARKET OVERVIEW (2016-2028)

FIGURE 014. ESSENTIAL OILS & NATURAL EXTRACTS MARKET OVERVIEW (2016-2028)

FIGURE 015. AROMA CHEMICALS MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET OVERVIEW BY ENCAPSULATED FORM

FIGURE 018. POWDER MARKET OVERVIEW (2016-2028)

FIGURE 019. PASTE MARKET OVERVIEW (2016-2028)

FIGURE 020. GRANULES MARKET OVERVIEW (2016-2028)

FIGURE 021. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET OVERVIEW BY TECHNOLOGY

FIGURE 022. PHYSICAL PROCESS MARKET OVERVIEW (2016-2028)

FIGURE 023. PHYSICOCHEMICAL PROCESS MARKET OVERVIEW (2016-2028)

FIGURE 024. CHEMICAL PROCESS MARKET OVERVIEW (2016-2028)

FIGURE 025. EXTRUSION MARKET OVERVIEW (2016-2028)

FIGURE 026. FLUID BED MARKET OVERVIEW (2016-2028)

FIGURE 027. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 028. ENCAPSULATED FLAVORS AND FRAGRANCE MARKET OVERVIEW BY APPLICATION

FIGURE 029. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 030. CONSUMER GOODS MARKET OVERVIEW (2016-2028)

FIGURE 031. NORTH AMERICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. EUROPE ENCAPSULATED FLAVORS AND FRAGRANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. ASIA PACIFIC ENCAPSULATED FLAVORS AND FRAGRANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. MIDDLE EAST & AFRICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. SOUTH AMERICA ENCAPSULATED FLAVORS AND FRAGRANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Encapsulated Flavors And Fragrance Market research report is 2024-2032.

Cargill Incorporated, Kerry Group PLC., Tate and Lyle PLC., International Flavors and Fragrance Ltd., DSM, Ingredion Incorporated, Lycored, Balchem Inc., TasteTech, DuPont, ABCO Laboratories Inc., Clextral, Sphera Encapsulation, Symrise, Sensient Technologies Corporation, Institutes of Food Technologists, Vitasquare, AVEKA Inc., BASF SE., Firmenich S.A. and other major players.

Encapsulation refers to the protection of flavoring agents or fragrance molecules by a specific envelope. Encapsulation helps to minimize the degradation or loss of flavor and fragrance during the various process and storage of the particular products.

The Global Encapsulated Flavors and Fragrance Market size is expected to grow from USD 7.8 billion in 2023 to USD 13.07 billion by 2032, at a CAGR of 5.9% during the forecast period (2024-2032).