Processed Fruits and Vegetables Market Synopsis

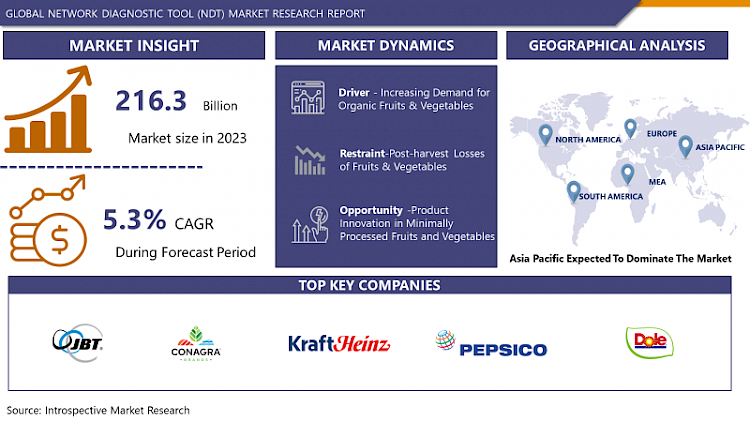

Processed Fruits and Vegetables Market Size Was Valued at USD 216.3 Billion in 2023, and is Projected to Reach USD 344.28 Billion by 2032, Growing at a CAGR of 5.3% From 2024-2032.

Processed fruits and vegetables are agricultural products that undergo preservation methods like freezing, canning, drying, pickling, and juicing to extend shelf life, enhance convenience, and retain nutritional value. They offer year-round access to a variety of produce in frozen, canned, dried, and pickled forms, making them popular for cooking, snacking, and food preparation, providing convenient and nutritious options for healthy dietary choices.

- Processed fruits and vegetables offer numerous advantages, fueling substantial demand and usage across multiple sectors. Processing methods like freezing, canning, and drying elongate the shelf life of perishable produce, mitigating food waste and ensuring constant availability. These processed products also retain vital nutrients, vitamins, and antioxidants, contributing to a balanced diet.

- The demand for processed fruits and vegetables is steadily rising due to evolving consumer lifestyles, urbanization, and heightened health awareness. Convenience is pivotal as processed items provide quick, ready-to-eat solutions for busy individuals seeking efficient meal options. Additionally, they cater to various dietary preferences such as vegetarian, vegan, and gluten-free diets, further enhancing their appeal.

- Processed fruits and vegetables find applications across diverse industries, including food and beverage, retail, food service, and food manufacturing. They serve as essential ingredients in soups, sauces, salads, baked goods, snacks, and beverages, enriching products with flavor, texture, and nutritional content.

- Contemporary trends in the processed fruits and vegetables market encompass the growing popularity of organic and natural offerings, transparent labeling practices, and innovative packaging solutions to preserve product freshness and attractiveness. there's a burgeoning interest in plant-based diets, fostering the development of novel plant-based meat substitutes and meatless meal alternatives that incorporate processed fruits and vegetables. Processed fruits and vegetables are indispensable in meeting consumer demand for convenient, wholesome, and delicious food selections in today's dynamic marketplace.

Processed Fruits and Vegetables Market Trend Analysis

Increasing Demand for Organic Fruits & Vegetables

- The surge in demand for organic fruits and vegetables stands as a pivotal driver within the processed fruits and vegetables market. Consumers are increasingly opting for organic produce due to heightened health awareness and apprehensions regarding the potential risks associated with pesticides and artificial additives found in conventionally grown counterparts. Organically cultivated fruits and vegetables are grown using natural farming methods, eschewing synthetic pesticides, fertilizers, and genetically modified organisms (GMOs), rendering them perceived as healthier and safer choices.

- The organic food movement resonates with wider trends favoring sustainable and eco-conscious consumption patterns. Consumers are placing greater emphasis on products sourced ethically, promoting environmental sustainability, and supporting local farming communities.

- Demand for processed organic fruits and vegetables is witnessing an upsurge, compelling manufacturers and retailers to diversify their offerings with organic alternatives. This trend has spurred the development of a broad array of processed organic options, spanning frozen produce, canned goods, and dehydrated snacks. Overall, the escalating desire for organic fruits and vegetables significantly propels the expansion and diversification of the processed fruits and vegetables market.

Product Innovation In Minimally Processed Fruits And Vegetables

- Innovating products within the minimally processed fruits and vegetables sector represents a significant opportunity in the processed fruits and vegetables market. As consumers increasingly prioritize health and wellness, there's a rising demand for minimally processed or lightly processed food choices that maintain the natural taste, texture, and nutritional value of produce.

- Opportunities for product innovation abound, including advancements in packaging technologies aimed at extending shelf life while minimizing the need for preservatives or additives. Techniques like modified atmosphere packaging (MAP) and vacuum packaging are utilized to preserve freshness and prolong storage life without compromising quality.

- There's potential for innovation in processing methods designed to safeguard the nutritional content and sensory characteristics of fruits and vegetables. Approaches such as high-pressure processing (HPP), pulsed electric field (PEF) processing, and minimal thermal processing (MTP) offer gentle preservation techniques that retain the natural color, flavor, and nutrients of produce.

- Embracing product innovation in minimally processed fruits and vegetables, manufacturers can meet the growing consumer demand for healthier, convenient, and natural food options, thus driving growth and differentiation in the processed fruits and vegetables market.

Processed Fruits and Vegetables Market Segment Analysis:

Processed Fruits and Vegetables Market Segmented based on Type, Product, Processing Equipment, and End User.

By Type, Vegetables segment is expected to dominate the market during the forecast period

- The dominance of the vegetable segment in the processed fruits and vegetables market can be attributed to several factors. Firstly, vegetables have gained prominence due to their perceived health benefits and adaptability in various culinary uses. With consumers increasingly prioritizing health, there's a rising demand for processed vegetables, including frozen, canned, and fresh-cut options, as they offer convenience without compromising nutritional value.

- Vegetables serve as crucial components in a wide array of food products, spanning soups, sauces, salads, and ready-to-eat meals, contributing to their widespread consumption across diverse demographics and dietary preferences. They are also integral to many global cuisines, further bolstering their demand in both retail and food service sectors.

- The surge in plant-based diets and vegetarian/vegan lifestyles has fueled the demand for processed vegetables as substitutes for meat-based products. Vegetable-based alternatives like meat substitutes, plant-based burgers, and veggie snacks cater to this growing consumer trend, propelling further growth in the vegetable segment of the processed fruits and vegetables market. Overall, the vegetable segment is poised for dominance due to its nutritional value, culinary versatility, and alignment with evolving consumer dietary preferences.

By Product, Canned Fruits and Vegetables segment is expected to dominate the market during the forecast period

- The dominance of the canned fruits and vegetables segment in the processed fruits and vegetables market is expected due to several factors. Primarily, canned products offer an extended shelf life, providing consumers with convenient long-term storage options while preserving freshness and nutritional value. This durability reduces food waste and ensures a continuous supply of fruits and vegetables throughout the year, thereby boosting demand.

- The canning process effectively preserves essential nutrients, vitamins, and minerals, maintaining the nutritional integrity of the fruits and vegetables. This makes canned products a convenient and nutritious choice for consumers seeking both convenience and health benefits. Canned fruits and vegetables are versatile ingredients suitable for various culinary applications, including soups, salads, and side dishes, further driving their popularity among households, restaurants, and food manufacturers.

- The widespread availability of canned products in supermarkets, grocery stores, and online platforms contributes to their dominance in the market. Overall, the combination of convenience, shelf life, nutrition, and versatility positions canned fruits and vegetables as a leading segment in the processed fruits and vegetables market.

Processed Fruits and Vegetables Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is anticipated to lead the processed fruits and vegetables market due to several compelling factors propelling its growth and prominence in the sector. Firstly, the region hosts a sizable population experiencing rising disposable incomes and evolving dietary preferences, resulting in increased demand for processed food items, notably fruits and vegetables.

- Asia Pacific boasts numerous key producers of fruits and vegetables, benefitting from ample agricultural resources and favorable climate conditions for cultivation. This abundance of raw materials offers a competitive edge to processed fruit and vegetable manufacturers in the region, enabling them to produce a wide array of high-quality products at competitive prices.

- Rapid urbanization and the expansion of the middle-class populace in nations like China, India, and Southeast Asian countries drive the need for convenient, ready-to-eat food alternatives, including processed fruits and vegetables. Additionally, growing health consciousness among consumers fuels the inclination towards nutritious, convenient food selections, further amplifying the demand for processed fruits and vegetables.

Processed Fruits and Vegetables Market Top Key Players:

- JBT Corporation (US)

- Conagra Brands (US)

- The Kraft Heinz Company (US)

- PepsiCo Inc. (US)

- Dole Food (US)

- SVZ International B.V. (US)

- GEA Group AG (Germany)

- Syntegon Technology GmbH (Germany)

- Krones AG (Germany)

- FENCO Food Machinery S.R. L. (Italy)

- Diana Group S.A.S.(France)

- Bonduelle (France)

- Finis (Netherlands)

- Nestlé S.A (Switzerland)

- Bühler (Switzerland)

- Alfa Laval (Sweden)

- Heat and Control, Inc. (Sweden)

- Greencore Group (Ireland)

- Marel (Iceland)

- AGRANA Group (Austria)

- ANKO FOOD MACHINE CO.LTD (Taiwan)

- Olam International (Singapore)

- Sahyadri Farms (India)

- RAJE AGRO FOODS PRIVET LIMITED (India)

- Bigtem Makine A.S.(Turkey), and Other Major Players.

Key Industry Developments in the Processed Fruits and Vegetables Market:

- In October 2023, PepsiCo and Beyond Meat disclosed a collaborative partnership focused on the development and introduction of a fresh line of plant-based snack offerings.

- In February 2023, Dole plc revealed its acquisition of AM Fresh Holding Company, a prominent vertically integrated entity within the packaged salads sector in North America.

|

Global Processed Fruits and Vegetables Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 216.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.3 % |

Market Size in 2032: |

USD 344.28 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Processing Equipment |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PROCESSED FRUITS AND VEGETABLES MARKET BY TYPE (2017-2032)

- PROCESSED FRUITS AND VEGETABLES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FRUITS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- VEGETABLES

- PROCESSED FRUITS AND VEGETABLES MARKET BY PRODUCT (2017-2032)

- PROCESSED FRUITS AND VEGETABLES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FRESH-CUT FRUITS AND VEGETABLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CANNED FRUITS AND VEGETABLES

- FROZEN FRUITS AND VEGETABLES

- DRIED FRUITS AND VEGETABLES

- JUICES AND NECTARS

- PROCESSED FRUITS AND VEGETABLES MARKET BY PROCESSING EQUIPMENT (2017-2032)

- PROCESSED FRUITS AND VEGETABLES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PRE-PROCESSING EQUIPMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PROCESSING EQUIPMENT

- FILLING AND PACKAGING EQUIPMENT

- PROCESSED FRUITS AND VEGETABLES MARKET BY END USER (2017-2032)

- PROCESSED FRUITS AND VEGETABLES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RETAIL CONSUMERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FOOD SERVICE INDUSTRY

- FOOD MANUFACTURERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Processed Fruits and Vegetables Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- JBT CORPORATION (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CONAGRA BRANDS (US)

- THE KRAFT HEINZ COMPANY (US)

- PEPSICO INC. (US)

- DOLE FOOD (US)

- SVZ INTERNATIONAL B.V. (US)

- GEA GROUP AG (GERMANY)

- SYNTEGON TECHNOLOGY GMBH (GERMANY)

- KRONES AG (GERMANY)

- FENCO FOOD MACHINERY S.R. L. (ITALY)

- DIANA GROUP S.A.S.(FRANCE)

- BONDUELLE (FRANCE)

- FINIS (NETHERLANDS)

- NESTLÉ S.A (SWITZERLAND)

- BÜHLER (SWITZERLAND)

- ALFA LAVAL (SWEDEN)

- HEAT AND CONTROL, INC. (SWEDEN)

- GREENCORE GROUP (IRELAND)

- MAREL (ICELAND)

- AGRANA GROUP (AUSTRIA)

- ANKO FOOD MACHINE CO.LTD (TAIWAN)

- OLAM INTERNATIONAL (SINGAPORE)

- SAHYADRI FARMS (INDIA)

- RAJE AGRO FOODS PRIVET LIMITED (INDIA)

- BIGTEM MAKINE A.S.(TURKEY)

- COMPETITIVE LANDSCAPE

- GLOBAL PROCESSED FRUITS AND VEGETABLES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Processing Equipment

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Processed Fruits and Vegetables Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 216.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.3 % |

Market Size in 2032: |

USD 344.28 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Processing Equipment |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PROCESSED FRUITS AND VEGETABLES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PROCESSED FRUITS AND VEGETABLES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PROCESSED FRUITS AND VEGETABLES MARKET COMPETITIVE RIVALRY

TABLE 005. PROCESSED FRUITS AND VEGETABLES MARKET THREAT OF NEW ENTRANTS

TABLE 006. PROCESSED FRUITS AND VEGETABLES MARKET THREAT OF SUBSTITUTES

TABLE 007. PROCESSED FRUITS AND VEGETABLES MARKET BY PRODUCT TYPE

TABLE 008. FRESH MARKET OVERVIEW (2016-2028)

TABLE 009. FROZEN MARKET OVERVIEW (2016-2028)

TABLE 010. DRIED & DEHYDRATED MARKET OVERVIEW (2016-2028)

TABLE 011. FRESH CUT MARKET OVERVIEW (2016-2028)

TABLE 012. CANNED MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. PROCESSED FRUITS AND VEGETABLES MARKET BY APPLICATION

TABLE 015. FOOD SERVICE INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 016. DIRECT CONSUMPTION MARKET OVERVIEW (2016-2028)

TABLE 017. PROCESSED FRUITS AND VEGETABLES MARKET BY PROCESSING EQUIPMENT

TABLE 018. PRE-PROCESSING MARKET OVERVIEW (2016-2028)

TABLE 019. PROCESSING MARKET OVERVIEW (2016-2028)

TABLE 020. WASHING MARKET OVERVIEW (2016-2028)

TABLE 021. FILLING MARKET OVERVIEW (2016-2028)

TABLE 022. SEASONING MARKET OVERVIEW (2016-2028)

TABLE 023. PACKAGING MARKET OVERVIEW (2016-2028)

TABLE 024. PROCESSED FRUITS AND VEGETABLES MARKET BY DISTRIBUTION CHANNEL

TABLE 025. SPECIALTY STORE MARKET OVERVIEW (2016-2028)

TABLE 026. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2028)

TABLE 027. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 028. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 029. NORTH AMERICA PROCESSED FRUITS AND VEGETABLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 030. NORTH AMERICA PROCESSED FRUITS AND VEGETABLES MARKET, BY APPLICATION (2016-2028)

TABLE 031. NORTH AMERICA PROCESSED FRUITS AND VEGETABLES MARKET, BY PROCESSING EQUIPMENT (2016-2028)

TABLE 032. NORTH AMERICA PROCESSED FRUITS AND VEGETABLES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 033. N PROCESSED FRUITS AND VEGETABLES MARKET, BY COUNTRY (2016-2028)

TABLE 034. EUROPE PROCESSED FRUITS AND VEGETABLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 035. EUROPE PROCESSED FRUITS AND VEGETABLES MARKET, BY APPLICATION (2016-2028)

TABLE 036. EUROPE PROCESSED FRUITS AND VEGETABLES MARKET, BY PROCESSING EQUIPMENT (2016-2028)

TABLE 037. EUROPE PROCESSED FRUITS AND VEGETABLES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 038. PROCESSED FRUITS AND VEGETABLES MARKET, BY COUNTRY (2016-2028)

TABLE 039. ASIA PACIFIC PROCESSED FRUITS AND VEGETABLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 040. ASIA PACIFIC PROCESSED FRUITS AND VEGETABLES MARKET, BY APPLICATION (2016-2028)

TABLE 041. ASIA PACIFIC PROCESSED FRUITS AND VEGETABLES MARKET, BY PROCESSING EQUIPMENT (2016-2028)

TABLE 042. ASIA PACIFIC PROCESSED FRUITS AND VEGETABLES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 043. PROCESSED FRUITS AND VEGETABLES MARKET, BY COUNTRY (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA PROCESSED FRUITS AND VEGETABLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA PROCESSED FRUITS AND VEGETABLES MARKET, BY APPLICATION (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA PROCESSED FRUITS AND VEGETABLES MARKET, BY PROCESSING EQUIPMENT (2016-2028)

TABLE 047. MIDDLE EAST & AFRICA PROCESSED FRUITS AND VEGETABLES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 048. PROCESSED FRUITS AND VEGETABLES MARKET, BY COUNTRY (2016-2028)

TABLE 049. SOUTH AMERICA PROCESSED FRUITS AND VEGETABLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 050. SOUTH AMERICA PROCESSED FRUITS AND VEGETABLES MARKET, BY APPLICATION (2016-2028)

TABLE 051. SOUTH AMERICA PROCESSED FRUITS AND VEGETABLES MARKET, BY PROCESSING EQUIPMENT (2016-2028)

TABLE 052. SOUTH AMERICA PROCESSED FRUITS AND VEGETABLES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 053. PROCESSED FRUITS AND VEGETABLES MARKET, BY COUNTRY (2016-2028)

TABLE 054. GEA GROUP: SNAPSHOT

TABLE 055. GEA GROUP: BUSINESS PERFORMANCE

TABLE 056. GEA GROUP: PRODUCT PORTFOLIO

TABLE 057. GEA GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. CONAGRO BRANDS INC.: SNAPSHOT

TABLE 058. CONAGRO BRANDS INC.: BUSINESS PERFORMANCE

TABLE 059. CONAGRO BRANDS INC.: PRODUCT PORTFOLIO

TABLE 060. CONAGRO BRANDS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. DOLE FOOD COMPANY INC.: SNAPSHOT

TABLE 061. DOLE FOOD COMPANY INC.: BUSINESS PERFORMANCE

TABLE 062. DOLE FOOD COMPANY INC.: PRODUCT PORTFOLIO

TABLE 063. DOLE FOOD COMPANY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. THE KROGER COMPANY: SNAPSHOT

TABLE 064. THE KROGER COMPANY: BUSINESS PERFORMANCE

TABLE 065. THE KROGER COMPANY: PRODUCT PORTFOLIO

TABLE 066. THE KROGER COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. OLAM INTERNATIONAL: SNAPSHOT

TABLE 067. OLAM INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 068. OLAM INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 069. OLAM INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. THE KRAFT HEINZ COMPANY: SNAPSHOT

TABLE 070. THE KRAFT HEINZ COMPANY: BUSINESS PERFORMANCE

TABLE 071. THE KRAFT HEINZ COMPANY: PRODUCT PORTFOLIO

TABLE 072. THE KRAFT HEINZ COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. GREENCORE GROUP: SNAPSHOT

TABLE 073. GREENCORE GROUP: BUSINESS PERFORMANCE

TABLE 074. GREENCORE GROUP: PRODUCT PORTFOLIO

TABLE 075. GREENCORE GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. NESTLE S.A.: SNAPSHOT

TABLE 076. NESTLE S.A.: BUSINESS PERFORMANCE

TABLE 077. NESTLE S.A.: PRODUCT PORTFOLIO

TABLE 078. NESTLE S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. BOSCH: SNAPSHOT

TABLE 079. BOSCH: BUSINESS PERFORMANCE

TABLE 080. BOSCH: PRODUCT PORTFOLIO

TABLE 081. BOSCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. BUHLER: SNAPSHOT

TABLE 082. BUHLER: BUSINESS PERFORMANCE

TABLE 083. BUHLER: PRODUCT PORTFOLIO

TABLE 084. BUHLER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. JBT CORPORATION: SNAPSHOT

TABLE 085. JBT CORPORATION: BUSINESS PERFORMANCE

TABLE 086. JBT CORPORATION: PRODUCT PORTFOLIO

TABLE 087. JBT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. CRONES: SNAPSHOT

TABLE 088. CRONES: BUSINESS PERFORMANCE

TABLE 089. CRONES: PRODUCT PORTFOLIO

TABLE 090. CRONES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 091. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 092. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 093. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PROCESSED FRUITS AND VEGETABLES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PROCESSED FRUITS AND VEGETABLES MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. FRESH MARKET OVERVIEW (2016-2028)

FIGURE 013. FROZEN MARKET OVERVIEW (2016-2028)

FIGURE 014. DRIED & DEHYDRATED MARKET OVERVIEW (2016-2028)

FIGURE 015. FRESH CUT MARKET OVERVIEW (2016-2028)

FIGURE 016. CANNED MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. PROCESSED FRUITS AND VEGETABLES MARKET OVERVIEW BY APPLICATION

FIGURE 019. FOOD SERVICE INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 020. DIRECT CONSUMPTION MARKET OVERVIEW (2016-2028)

FIGURE 021. PROCESSED FRUITS AND VEGETABLES MARKET OVERVIEW BY PROCESSING EQUIPMENT

FIGURE 022. PRE-PROCESSING MARKET OVERVIEW (2016-2028)

FIGURE 023. PROCESSING MARKET OVERVIEW (2016-2028)

FIGURE 024. WASHING MARKET OVERVIEW (2016-2028)

FIGURE 025. FILLING MARKET OVERVIEW (2016-2028)

FIGURE 026. SEASONING MARKET OVERVIEW (2016-2028)

FIGURE 027. PACKAGING MARKET OVERVIEW (2016-2028)

FIGURE 028. PROCESSED FRUITS AND VEGETABLES MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 029. SPECIALTY STORE MARKET OVERVIEW (2016-2028)

FIGURE 030. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2028)

FIGURE 031. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 032. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 033. NORTH AMERICA PROCESSED FRUITS AND VEGETABLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. EUROPE PROCESSED FRUITS AND VEGETABLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. ASIA PACIFIC PROCESSED FRUITS AND VEGETABLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. MIDDLE EAST & AFRICA PROCESSED FRUITS AND VEGETABLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 037. SOUTH AMERICA PROCESSED FRUITS AND VEGETABLES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Processed Fruits and Vegetables Market research report is 2024-2032.

JBT Corporation (US), Conagra Brands (US), The Kraft Heinz Company (US), PepsiCo Inc. (US), Dole Food (US), SVZ International B.V. (US), GEA Group AG (Germany), Syntegon Technology GmbH (Germany), Krones AG (Germany), FENCO Food Machinery S.R. L. (Italy), Diana Group S.A.S.(France), Bonduelle (France), Finis (Netherlands), Nestlé S.A (Switzerland), Bühler (Switzerland), Alfa Laval (Sweden), Heat and Control, Inc. (Sweden), Greencore Group (Ireland), Marel (Iceland), AGRANA Group (Austria), ANKO FOOD MACHINE CO.LTD (Taiwan), Olam International (Singapore), Sahyadri Farms (India), RAJE AGRO FOODS PRIVET LIMITED (India), Bigtem Makine A.S.(Turkey), and Other Major Players.

The Processed Fruits and Vegetables Market is segmented into Type, Product, Processing Equipment, End User, and region. By Type, the market is categorized into Fruits, Vegetables. By Product, the market is categorized into Fresh-Cut Fruits and Vegetables, Canned Fruits and Vegetables, Frozen Fruits and Vegetables, Dried Fruits and Vegetables, Juices and Nectars. By Processing Equipment, the market is categorized into Pre-processing Equipment, Processing Equipment, Filling, and Packaging Equipment. By End User, the market is categorized into Retail Consumers, Food Service Industry, and Food Manufacturers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Processed fruits and vegetables are agricultural products that undergo preservation methods like freezing, canning, drying, pickling, and juicing to extend shelf life, enhance convenience, and retain nutritional value. They offer year-round access to a variety of produce in frozen, canned, dried, and pickled forms, making them popular for cooking, snacking, and food preparation, providing convenient and nutritious options for healthy dietary choices.

Processed Fruits and Vegetables Market Size Was Valued at USD 216.3 Billion in 2023, and is Projected to Reach USD 344.28 Billion by 2032, Growing at a CAGR of 5.3% From 2024-2032.