Night Vision System Market Synopsis

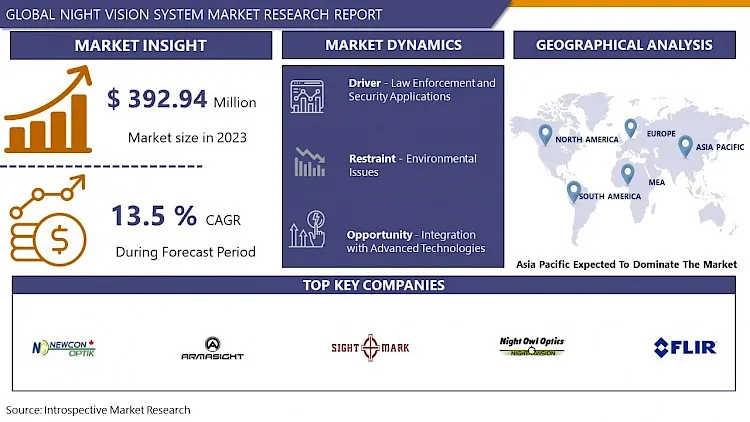

Night Vision System Market Size Was Valued at USD 392.94 Million in 2024 and is Projected to Reach USD 1082.16 Million by 2032, Growing at a CAGR of 13.5% From 2025 to 2032.

The night vision system can be defined as a device that enables one to see objects in low-light conditions, one can see an object with the help of a night-vision device in very low light or no-light conditions. Night Vision Technology was first developed by the US Defense Department with the sole purpose of defense. But as technology advanced, night vision devices started to be used in day-to-day life. Night Vision can work with Image enhancement and Thermal Imaging.

In Image Enhancement, a Collection of tiny amounts of light including the lower portion of the infrared light spectrum are done which are further amplified to the point that one can easily observe the image. On the other hand, Thermal Imaging is the technology that captures the upper portion of the infrared light spectrum, which is in the form of heat emitted by objects instead of reflected light. Hotter objects, emit more of this light. The device collects infrared radiation from objects using a heat sensor in the scene and creates an electronic image based on information about the temperature differences captured by the sensor.

Initially, when the Night Vision System was introduced in the market majorly for automotive purposes, it remained unpopular, but eventually, people started to find confidence in its operation as the night vision system was able to show images of high quality even under low-light situations which are challenging for drivers’ eyes. Further improvements in technology such as the quality of the displayed image and saturation-free image with good preserved contrast as well as a high-resolution uninterrupted image, temperature-stable, and low-noise image could work as favorable factors for the prevalence of Night Vision Systems.

Night Vision System Market Trend Analysis

Law Enforcement and Security Applications

- The expanding use of Night Vision Systems (NVS) in law enforcement and security applications is a significant driver of the NVS market. Law enforcement agencies are increasingly adopting these systems for a range of critical tasks, particularly in urban environments where night-time activities pose unique challenges. NVS tools are instrumental in enhancing surveillance capabilities, allowing officers to monitor areas with limited or no light. This is crucial in preventing crimes and gathering evidence that would be otherwise difficult to obtain under low visibility conditions.

- In search and rescue operations, NVS proves invaluable. It enables rescue teams to operate efficiently in darkness, drastically improving the chances of finding missing persons or navigating through challenging terrains at night. Moreover, night vision technology aids in ensuring public safety during night-time events and gatherings, where maintaining order and safety is essential.

- The integration of NVS into law enforcement not only augments operational effectiveness but also offers a tactical advantage in crime prevention and response. The technology's ability to provide clear imagery in low-light conditions empowers officers to act swiftly and accurately, thereby enhancing overall public safety and security. This increasing reliance on NVS by law enforcement agencies significantly propels the growth and development of the night vision system market.

Integration With Advanced Technologies

- The opportunity for integrating Night Vision Systems (NVS) with advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) represents a significant stride in enhancing the capabilities and efficiency of NVS. This integration paves the way for the creation of smarter systems that can autonomously analyze and interpret visual data, even in low-light or obscured visibility conditions.

- AI and ML algorithms can be employed to add advanced features like automatic threat detection to NVS. These systems can learn to identify potential threats or anomalies in real time, thereby providing faster and more accurate responses in critical situations. This is particularly relevant for security and defense operations, where rapid threat identification can be life-saving.

- Object recognition is another area where AI integration can greatly benefit NVS. By accurately identifying objects in various lighting conditions, these systems can be used in a wide range of applications from wildlife monitoring to search and rescue missions, where distinguishing objects or individuals quickly can be crucial.

- Moreover, incorporating IoT connectivity with NVS can lead to better data collection and analysis. IoT-enabled NVS can connect with other devices and sensors to gather comprehensive environmental data, leading to more informed decision-making. This connectivity could enhance coordinated responses in security operations, disaster management, or even in smart city infrastructures, where different systems need to work together seamlessly.

- The integration of NVS with these cutting-edge technologies not only broadens their application scope but also significantly boosts their operational efficiency, making them invaluable tools in various fields ranging from security and defense to wildlife conservation and urban planning.

Night Vision System Market Segment Analysis:

Night Vision System Market Segmented based on Type, Technology, Components, Application, and Region.

By Type, Passive System segment is expected to dominate the market during the forecast period

- In the Night Vision System (NVS) market, the Passive System segment is anticipated to dominate during the forecast period. Passive night vision systems operate by amplifying existing light, such as starlight, moonlight, or ambient light from distant sources, without the need for an additional light source. This reliance on ambient light makes them particularly appealing for various applications.

- One of the key reasons for the dominance of passive systems is their stealth capability. Since they don't emit light, they enable users to observe without revealing their position, a crucial advantage in military and surveillance operations. Additionally, passive systems are typically more cost-effective and less complex to manufacture and maintain compared to active systems, which require additional infrared illuminators.

- Furthermore, technological advancements in image intensification have significantly improved the performance of passive night vision devices. Modern passive NVS offers clearer, brighter images, even in extremely low-light conditions. This enhancement in image quality, coupled with reductions in size, weight, and power consumption, makes passive systems increasingly attractive for both professional and recreational uses.

- The continued development and refinement of passive NVS technologies, along with growing demand in both military and civilian sectors, are key factors driving the segment's expected dominance in the NVS market.

By Application, the Middle and Top-Grade Cars segment held the largest share in 2024

- This substantial market share reflects the growing integration of NVS in the automotive sector, especially in mid-range and luxury vehicles, as a key safety and luxury feature. The incorporation of NVS in middle and top-grade cars is primarily driven by the increasing emphasis on vehicle safety and the growing demand for advanced driver assistance systems (ADAS). NVS in these vehicles enhances driver visibility during night-time or in poor weather conditions, thereby reducing the risk of accidents. These systems detect pedestrians, animals, and other obstacles beyond the reach of standard headlights, providing critical visual information to the driver and, in some cases, triggering automatic safety responses like braking.

- The high adoption rate in this segment is also due to the rising consumer expectations for safety and comfort features in mid-range and luxury cars. As automotive technology advances, features once reserved for high-end models, like NVS, are becoming more accessible and are increasingly expected by consumers in mid-range vehicles.

- Additionally, regulatory bodies in various regions are emphasizing enhanced safety features in vehicles. This regulatory push, combined with the advancements in NVS technology, which have made it more compact and cost-effective, has facilitated its broader integration in middle and top-grade cars. Moreover, as autonomous and semi-autonomous vehicles continue to evolve, the role of NVS is expected to become even more critical, further solidifying its importance in the automotive sector. This trend is likely to continue, supporting the dominant share of NVS in this segment of the market.

Night Vision System Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia-Pacific dominates the market Global Night Vision System Market and is expected to witness the same trend in the forthcoming years. China is the leading company when it comes to the automotive industry may it be the manufacturing of vehicles, advancement in technology, or sales. The country's growing demand for luxury vehicles and fully automated vehicles contributes significantly to the Night Vision System Market. Several key players in the Night Vision System Market are also from the Asia Pacific region and are coming up with new strategies to maximize their revenue.

- Also, the automotive industry in China is growing enormously with China holding more than half of the electric vehicle market share globally and selling more than 140 percent of electric and hybrid cars in the year 2021 as compared to 2020. The Asia Pacific regional market is pushing its limits to integrate Advanced Driver-Assistance Systems (ADAS) such as Night Vision Systems to reduce the number of car accidents. It is anticipated that the region will show huge growth and will aid in taking the automotive market to the next level with the launch of the latest vehicles and devices with advanced night vision systems.

Night Vision System Market Top Key Players:

- FLIR Systems, Inc. (US)

- Armasight Inc. (US)

- Sightmark (US)

- Night Owl Optics (US)

- Newcon Optik (Canada)

- Northrop Grumman Corporation (US)

- Lockheed Martin Corporation (US)

- Bushnell Corporation (US)

- American Technologies Network Corp. (US)

- Pulsar (US)

- General Starlight Company Inc. (Canada)

- Nivisys Industries, LLC (US)

- L3Harris Technologies, Inc. (US)

- Raytheon Technologies Corporation (US)

- Elbit Systems Ltd. (Israel)

- Leonardo S.p.A. (Italy)

- ATN Corporation (US)

- Bharat Electronics Limited (BEL) (India)

- Thermoteknix Systems Ltd. (UK)

- Yukon Advanced Optics (Lithuania)

- BAE Systems (UK)

- Safran Group (France)

- Thales Group (France)

- Photonis Technologies (France)

- Dedal-NV (Russia)

- Other Active Players.

Key Industry Developments in the Night Vision System Market:

- In May 2024, Kopin Corporation received a new Defense contract to integrate OLED microdisplays with low-latency digital night vision sensors for advanced warfighter visual systems. This technology aims to replace analog night vision goggles, providing enhanced situational awareness and reducing system size and power consumption.

- In February 2024, Skylab UA, a Ukrainian tech firm, unveiled the Shoolika Mk6 combat drone that is resistant to electronic warfare and equipped with night vision capabilities. The drone has received positive feedback from the Defense Forces for its effectiveness in tactical operations, especially at night.

|

Global Night Vision System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 392.94 Mn. |

|

Forecast Period 2024-32 CAGR: |

13.5% |

Market Size in 2032: |

USD 1082.16 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Component |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Night Vision System Market by Type (2018-2032)

4.1 Night Vision System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Active System

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Passive System

Chapter 5: Night Vision System Market by Technology (2018-2032)

5.1 Night Vision System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Ultrasonic Sensor

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Lidar Sensor

5.5 Radar Sensor

5.6 Others

Chapter 6: Night Vision System Market by Component (2018-2032)

6.1 Night Vision System Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Display Unit

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Controlling Unit

6.5 Sensor

Chapter 7: Night Vision System Market by Application (2018-2032)

7.1 Night Vision System Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Middle and Top-Grade Cars

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Sports Cars

7.5 Luxury Cars

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Night Vision System Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BEYOND MEAT (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 GENERAL MILLS (US)

8.4 TYSON FOODS (US)

8.5 KELLOGG COMPANY (US)

8.6 ARCHER DANIELS MIDLAND (US)

8.7 PEPSICO (US)

8.8 CARGILL (US)

8.9 CAMPBELL SOUP COMPANY (US)

8.10 HAIN CELESTIAL GROUP (US)

8.11 THE COCA-COLA COMPANY (US)

8.12 ORGANIC VALLEY (US)

8.13 WHITEWAVE FOODS (US)

8.14 CONAGRA BRANDS (US)

8.15 MARS INCORPORATED (US)

8.16 KRAFT HEINZ COMPANY (US)

8.17 MONDELEZ INTERNATIONAL (US)

8.18 APPLEGATE FARMS (US)

8.19 DEAN FOODS (US)

8.20 AMY'S KITCHEN (US)

8.21 BLUE APRON HOLDINGS (US)

8.22 MAPLE LEAF FOODS (CANADA)

8.23 DANONE (FRANCE)

8.24 NESTLÉ (SWITZERLAND)

8.25 UNILEVER (UK)

8.26 AND OTHER MAJOR PLAYER

Chapter 9: Global Night Vision System Market By Region

9.1 Overview

9.2. North America Night Vision System Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Active System

9.2.4.2 Passive System

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 Ultrasonic Sensor

9.2.5.2 Lidar Sensor

9.2.5.3 Radar Sensor

9.2.5.4 Others

9.2.6 Historic and Forecasted Market Size by Component

9.2.6.1 Display Unit

9.2.6.2 Controlling Unit

9.2.6.3 Sensor

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Middle and Top-Grade Cars

9.2.7.2 Sports Cars

9.2.7.3 Luxury Cars

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Night Vision System Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Active System

9.3.4.2 Passive System

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 Ultrasonic Sensor

9.3.5.2 Lidar Sensor

9.3.5.3 Radar Sensor

9.3.5.4 Others

9.3.6 Historic and Forecasted Market Size by Component

9.3.6.1 Display Unit

9.3.6.2 Controlling Unit

9.3.6.3 Sensor

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Middle and Top-Grade Cars

9.3.7.2 Sports Cars

9.3.7.3 Luxury Cars

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Night Vision System Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Active System

9.4.4.2 Passive System

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 Ultrasonic Sensor

9.4.5.2 Lidar Sensor

9.4.5.3 Radar Sensor

9.4.5.4 Others

9.4.6 Historic and Forecasted Market Size by Component

9.4.6.1 Display Unit

9.4.6.2 Controlling Unit

9.4.6.3 Sensor

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Middle and Top-Grade Cars

9.4.7.2 Sports Cars

9.4.7.3 Luxury Cars

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Night Vision System Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Active System

9.5.4.2 Passive System

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 Ultrasonic Sensor

9.5.5.2 Lidar Sensor

9.5.5.3 Radar Sensor

9.5.5.4 Others

9.5.6 Historic and Forecasted Market Size by Component

9.5.6.1 Display Unit

9.5.6.2 Controlling Unit

9.5.6.3 Sensor

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Middle and Top-Grade Cars

9.5.7.2 Sports Cars

9.5.7.3 Luxury Cars

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Night Vision System Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Active System

9.6.4.2 Passive System

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 Ultrasonic Sensor

9.6.5.2 Lidar Sensor

9.6.5.3 Radar Sensor

9.6.5.4 Others

9.6.6 Historic and Forecasted Market Size by Component

9.6.6.1 Display Unit

9.6.6.2 Controlling Unit

9.6.6.3 Sensor

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Middle and Top-Grade Cars

9.6.7.2 Sports Cars

9.6.7.3 Luxury Cars

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Night Vision System Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Active System

9.7.4.2 Passive System

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 Ultrasonic Sensor

9.7.5.2 Lidar Sensor

9.7.5.3 Radar Sensor

9.7.5.4 Others

9.7.6 Historic and Forecasted Market Size by Component

9.7.6.1 Display Unit

9.7.6.2 Controlling Unit

9.7.6.3 Sensor

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Middle and Top-Grade Cars

9.7.7.2 Sports Cars

9.7.7.3 Luxury Cars

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Night Vision System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 392.94 Mn. |

|

Forecast Period 2024-32 CAGR: |

13.5% |

Market Size in 2032: |

USD 1082.16 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Component |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||