Neuropathic Pain Market Synopsis:

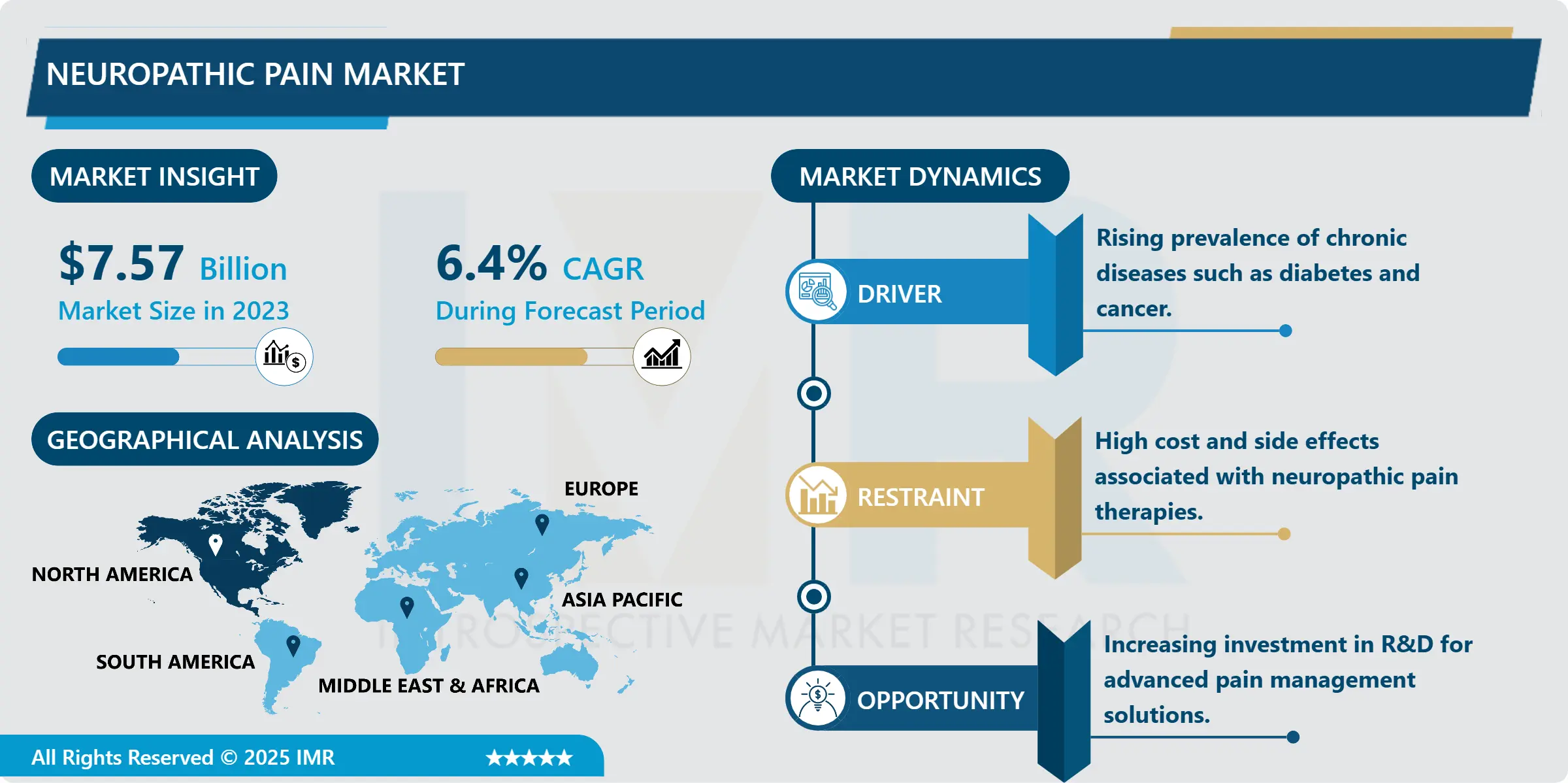

Neuropathic Pain Market Size Was Valued at USD 7.57 Billion in 2023, and is Projected to Reach USD 13.23 Billion by 2032, Growing at a CAGR of 6.4 % From 2024-2032.

Neuropathic Pain Market has been defined as the global market for the management products and services that address the pain signaling a damaged or dysfunctional nervous system. Chronic and often incapacitating neuropathic pain occurs with diabetic neuropathy, multiple sclerosis, chemotherapy-induced peripheral neuropathy (CIPN) and post-herpetic neuralgia. This market involves drugs, equipment and supplements that treat the actual peripheral nerve damage and alleviate the symptoms.

The neuropathic pain market has expanded rapidly because of the increasing incidence of chronic diseases like diabetes and cancer, which accompany neuropathic pain. Newer drug delivery systems of various classes of drugs such as local anaesthetic, antiepileptic and antidepressent have brought extra dimensions to treatment opportunities. The availability of information regarding neuropathic diseases and their effect on the quality of has put pressure on health care providers to diagnose neuropathic diseases early and promote better interventions for neuropathic disorders. Additionally, developments in the field of targeted drug delivery systems and pain control equipment, which are considered market factors, provide patients with less risky and more accurate treatment.

Lack of proper courses, increased use of combination therapies together with other treatment methods such as TENS and CBT is foreseen to continue fueling the market growth. State and health care facilities continue to fund trials aimed at increasing knowledge of neuropathic pain and its treatment, whereas OEs are discovering higher availability of sophisticated neuropathic pain care systems. However, some hurdles still persist and include; high costs of therapy, side effects of drugs and limit achievement of current drugs.

Neuropathic Pain Market Trend Analysis:

Increasing Adoption of Targeted Drug Delivery Systems

- An emerging and significant trend in the neuropathic pain market is the increasing adoption of targeted drug delivery systems, which are proving to be a transformative approach in therapy. These systems are specifically designed to administer medication directly to the site of nerve injury, thereby maximizing the therapeutic impact while minimizing systemic side effects commonly associated with traditional treatments. This targeted approach enhances the drug’s effectiveness & also provides patients with prolonged relief, making it particularly valuable for those suffering from chronic and debilitating pain.

- The integration of advanced medical technologies such as intrathecal pumps and long-acting drug formulations has further strengthened the appeal of this strategy. As pharmaceutical companies continue to invest in the research and development of novel drug formulations tailored for precision delivery, targeted therapy is positioned to redefine the standards of care in neuropathic pain management.

Growing Prevalence of Diabetic Neuropathy

- The global rise in diabetes cases presents a significant growth opportunity in the neuropathic pain treatment market, particularly for managing diabetic neuropathy. As more patients suffer from complications such as peripheral nerve damage, there is an urgent demand for therapies that not only alleviate pain but also improve overall quality of life. This need has driven innovation in both pharmacological treatments and noninvasive medical technologies, including advanced drug formulations and novel device-based interventions.

- Such developments offer more effective symptom management with fewer side effects. Simultaneously, increased support from governments and research institutions through funding, policy initiatives, and public health programs further accelerates advancements in this area. Together, these factors are shaping a robust and dynamic landscape for the development of new solutions aimed at combating diabetes-related neuropathic pain on a global scale.

Neuropathic Pain Market Segment Analysis:

Neuropathic Pain Market is Segmented on the basis of Drug Class, Indication, Distribution Channel, and Region.

By Drug Class, Local Anaesthesia segment is expected to dominate the market during the forecast period

- The neuropathic pain market is significantly driven by the increasing adoption of local anesthetics, which are expected to dominate the market during the forecast period. Local anesthetics are particularly effective in managing neuropathic pain as they work by blocking pain signals at the source, providing targeted relief. Medications like lidocaine patches and injections have gained prominence due to their demonstrated efficacy and minimal systemic absorption, making them preferable for both patients and healthcare providers.

- The development and popularity of advanced topical formulations and long-acting anesthetic preparations are fueling market expansion. These innovations offer sustained pain relief while reducing the risk of adverse effects, improving compliance and quality of life. The focus on non-opioid alternatives for chronic pain treatment also contributes to the growing demand for local anesthetics in the neuropathic pain management segment.

By Indication, the Chemotherapy-induced Peripheral neuropathy segment expected to held the largest share

- The chemotherapy-induced peripheral neuropathy (CIPN) segment is anticipated to hold the dominant share in the neuropathic pain market due to the increasing global incidence of cancer and the widespread use of neurotoxic chemotherapeutic agents. As more patients undergo chemotherapy, the prevalence of CIPN rises, posing significant challenges in pain management and overall treatment adherence. This has led to an urgent demand for more effective pain relief solutions that do not compromise cancer therapy outcomes.

- Advancements in neuroprotective drug development and symptom-targeting pharmacological approaches have propelled this segment’s growth. Heightened awareness among healthcare providers and improvements in diagnostic protocols have enhanced the identification and management of CIPN, further boosting its market demand. Pharmaceutical companies are increasingly investing in R&D to innovate targeted therapies, making CIPN a focal point in neuropathic pain treatment strategies.

Neuropathic Pain Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is anticipated to account for the largest proportion of neuropathic pain over the forecast period through the increased healthcare expenditure and increased rate of diseases such as diabetes, cancer, and multiple sclerosis that cause neuropathic pain. Particularly the United States has a very mature and well-developed market for selling pharmaceutical and biotechnology products facilitating management of pain therapies. Moreover, increasing prevalence of complicated medical equipment and treatment, along with insurance, has taken the market in the mentioned abovementioned locale forward.

- The above facts that augmented pressure towards R & D along with clinical trials for launch of new treatment also boost the region’s dominance. Government reforms in the agencies along with the involvement of the private sector increases the patient’s opportunity to receive neuropathic pain novelties. However, the various campaigns being made to send out information about the possibilities of early diagnosis and early intervention that is available in the market are usable.

Active Key Players in the Neuropathic Pain Market:

- Abbott Laboratories (United States)

- Astellas Pharma Inc. (Japan)

- AstraZeneca (United Kingdom)

- Biogen (United States)

- Eli Lilly and Company (United States)

- GlaxoSmithKline plc (United Kingdom)

- Grünenthal GmbH (Germany)

- Johnson & Johnson (United States)

- Merck & Co., Inc. (United States)

- Novartis AG (Switzerland)

- Pfizer Inc. (United States)

- Sanofi S.A. (France)

- Sun Pharmaceutical Industries Ltd. (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Vertex Pharmaceuticals Incorporated (United States), and Other Active Players

|

Global Neuropathic Pain Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.57 Billion |

|

Forecast Period 2024-32 CAGR: |

6.4 % |

Market Size in 2032: |

USD 13.23 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Indication |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Neuropathic Pain Market by Drug Class

4.1 Neuropathic Pain Market Snapshot and Growth Engine

4.2 Neuropathic Pain Market Overview

4.3 Tricyclic Anti-Depressant Anticonvulsant Local Anaesthesia Opioids Steroids Others

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Tricyclic Anti-Depressant Anticonvulsant Local Anaesthesia Opioids Steroids Others: Geographic Segmentation Analysis

Chapter 5: Neuropathic Pain Market by Indication

5.1 Neuropathic Pain Market Snapshot and Growth Engine

5.2 Neuropathic Pain Market Overview

5.3 Diabetic neuropathy Chemotherapy-induced Peripheral neuropathy Other

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Diabetic neuropathy Chemotherapy-induced Peripheral neuropathy Other: Geographic Segmentation Analysis

Chapter 6: Neuropathic Pain Market by Distribution Channel

6.1 Neuropathic Pain Market Snapshot and Growth Engine

6.2 Neuropathic Pain Market Overview

6.3 Retail Pharmacies Drug Store Online Pharmacies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Retail Pharmacies Drug Store Online Pharmacies: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Neuropathic Pain Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ASTELLAS PHARMA INC. (JAPAN)

7.4 ASTRAZENECA (UNITED KINGDOM)

7.5 BIOGEN (UNITED STATES)

7.6 ELI LILLY AND COMPANY (UNITED STATES)

7.7 GLAXOSMITHKLINE PLC (UNITED KINGDOM)

7.8 GRÜNENTHAL GMBH (GERMANY)

7.9 JOHNSON & JOHNSON (UNITED STATES)

7.10 MERCK & CO. INC. (UNITED STATES)

7.11 NOVARTIS AG (SWITZERLAND)

7.12 PFIZER INC. (UNITED STATES)

7.13 SANOFI S.A. (FRANCE)

7.14 SUN PHARMACEUTICAL INDUSTRIES LTD. (INDIA)

7.15 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

7.16 VERTEX PHARMACEUTICALS INCORPORATED (UNITED STATES)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Neuropathic Pain Market By Region

8.1 Overview

8.2. North America Neuropathic Pain Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Drug Class

8.2.4.1 Tricyclic Anti-Depressant Anticonvulsant Local Anaesthesia Opioids Steroids Others

8.2.5 Historic and Forecasted Market Size By Indication

8.2.5.1 Diabetic neuropathy Chemotherapy-induced Peripheral neuropathy Other

8.2.6 Historic and Forecasted Market Size By Distribution Channel

8.2.6.1 Retail Pharmacies Drug Store Online Pharmacies

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Neuropathic Pain Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Drug Class

8.3.4.1 Tricyclic Anti-Depressant Anticonvulsant Local Anaesthesia Opioids Steroids Others

8.3.5 Historic and Forecasted Market Size By Indication

8.3.5.1 Diabetic neuropathy Chemotherapy-induced Peripheral neuropathy Other

8.3.6 Historic and Forecasted Market Size By Distribution Channel

8.3.6.1 Retail Pharmacies Drug Store Online Pharmacies

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Neuropathic Pain Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Drug Class

8.4.4.1 Tricyclic Anti-Depressant Anticonvulsant Local Anaesthesia Opioids Steroids Others

8.4.5 Historic and Forecasted Market Size By Indication

8.4.5.1 Diabetic neuropathy Chemotherapy-induced Peripheral neuropathy Other

8.4.6 Historic and Forecasted Market Size By Distribution Channel

8.4.6.1 Retail Pharmacies Drug Store Online Pharmacies

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Neuropathic Pain Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Drug Class

8.5.4.1 Tricyclic Anti-Depressant Anticonvulsant Local Anaesthesia Opioids Steroids Others

8.5.5 Historic and Forecasted Market Size By Indication

8.5.5.1 Diabetic neuropathy Chemotherapy-induced Peripheral neuropathy Other

8.5.6 Historic and Forecasted Market Size By Distribution Channel

8.5.6.1 Retail Pharmacies Drug Store Online Pharmacies

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Neuropathic Pain Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Drug Class

8.6.4.1 Tricyclic Anti-Depressant Anticonvulsant Local Anaesthesia Opioids Steroids Others

8.6.5 Historic and Forecasted Market Size By Indication

8.6.5.1 Diabetic neuropathy Chemotherapy-induced Peripheral neuropathy Other

8.6.6 Historic and Forecasted Market Size By Distribution Channel

8.6.6.1 Retail Pharmacies Drug Store Online Pharmacies

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Neuropathic Pain Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Drug Class

8.7.4.1 Tricyclic Anti-Depressant Anticonvulsant Local Anaesthesia Opioids Steroids Others

8.7.5 Historic and Forecasted Market Size By Indication

8.7.5.1 Diabetic neuropathy Chemotherapy-induced Peripheral neuropathy Other

8.7.6 Historic and Forecasted Market Size By Distribution Channel

8.7.6.1 Retail Pharmacies Drug Store Online Pharmacies

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Neuropathic Pain Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.57 Billion |

|

Forecast Period 2024-32 CAGR: |

6.4 % |

Market Size in 2032: |

USD 13.23 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Indication |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||