Network Monitoring Market Synopsis

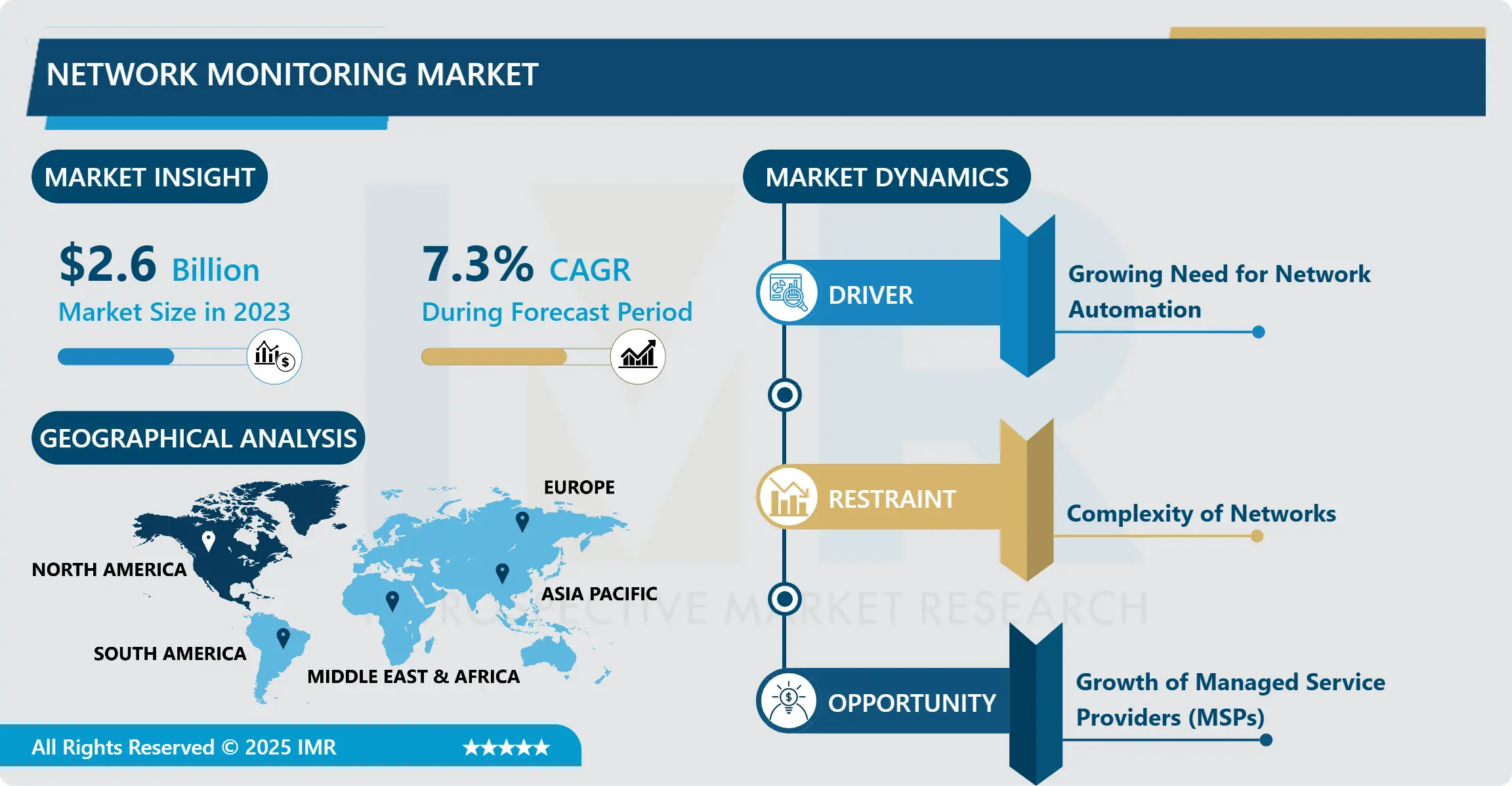

Network Monitoring Market Size Was Valued at USD 2.6 Billion in 2023 and is Projected to Reach USD 4.9 Billion by 2032, Growing at a CAGR of 7.3% From 2024-2032.

Network monitoring can be described as the process that revolves around the industrial provision of products, programs, and services aimed at helping organizations supervise and control their computer networks. It covers the current status identification, optimization, protection, and diagnostics of network assets. Focused for IT, telecommunications, healthcare, and finance industries as the importance of the secure and high-quality network for the business growth and functioning is known. Major vendors in this market have a portfolio consisting of network monitoring software, hardware device, and cloud solutions to cater to customers’ requirements. Indeed, with the increase of network traffic and the globalization, the field of network monitoring is expanding and developing constantly.

Due to the increased reliance on the accurate, efficient, and high-performance networks, there has also been the rising need for efficient network monitoring solutions. Customers desire a smooth connection and quality experience and the tools for network monitoring make it possible by providing a stable connection.

Most vendors for network monitoring hold trials for their software solution where the prospecting customer can use the solution before buying it. This makes the market entry point for the product easy and ensures the customers have a feel of the product.

Some vendors also offer the freemium model for network monitoring software where a basic version of the software is available for free but with reduced capabilities. This goes a long way in ensuring the customers begin to use the product without having to make initial orders.

Modern AI-based solutions for network monitoring can apply machine learning techniques that allow filtering out network anamolies or any other behavior deviating from the standard. Thus, they get to know when there are signs of a problem or a security breach before it becomes major. The analytical functions of those solutions can estimate future loads and performance degradations on the network, thus helping their customers better schedule the upgrades and expansions.

Network Monitoring Market Trend Analysis

Surge in internet usage

- With the increase in the number of internet users equally for the use of bandwidth consuming applications such as video streaming, online gaming and cloud computing services, there has been a lot of pressure on the networks. With users demanding more data and expectations of uninterrupted network access, the requirement for Network monitoring tools has tremendously risen.

- The software required when building such data intense networks, for the confirmation of their dependability, flexibility, and safeguard are evidently the network monitoring tools. These solutions allow the IT teams to monitor the network traffic, bandwidth usage, and the performance of the applications into the network and much more in real-time, thus making them to be able to identify the slow moving or hitting areas, or areas that require more data handling and ensure that the network is well optimized to handle the increasing loads of data.

- Besides, people have spent considerably more time at home recently due to the COVID-19 pandemic and have actively used data and voice packages, which have attracted customers through attractive purchase offers from internet service providers. Social media, networking, streaming, and other online activities have found a common place in consumers’ daily routines due to cheaper and better looking internet services. This has in turn created a corresponding need to adequately monitor the various networks to ensure that the quality of experience is maintained as well as attaining the stability of the network systems.

Increasing adoption of cloud-based services and growing popularity of over-the-top (OTT) media platforms

- The implementation of new or enhanced cloud environments and the change in the traditional models of work have also created more significant demands for efficient network monitoring solutions. With more people and devices getting on to the company’s network from different places, the network managers have to be able to detect and manage activities on the distributed network.

- A rapidly increasing usage of over-the-top (OTT) media platforms, video on-demand services, and live streaming applications has also contributed to the growth of the network monitoring market. Since these services necessitate efficient end-user experiences, they consequently depend on dependable and high-quality networks. These tools aid service providers and IT departments in constantly monitoring various network resources, identifying signs that a network is degrading, or down right developing problems that will affect the network performance and end-users.

Network Monitoring Market Segment Analysis:

Network Monitoring Market Segmented based on Component, Enterprise Size, Network Speed, and Application.

By Component, network monitoring switches segment is expected to dominate the market during the forecast period

- Depending upon Component, the market is classified into Monitoring Equipment, Software Platform, and Service. The market is expected to grow fastest in the network monitoring equipment for network monitoring switches (network packet brokers) in the forecast period. Network packet brokers’ development has received investments because of a rise in efficient network demand, this is expected to fuel international demand for them. Thus, the trends such as automated and simplified data centers, growth in the cloud services, increase in utilization of bare metal switches, along with increase in bandwidth demands in the data centers, advancement in NPBs, increase in multimedia content and web applications across the globe is fueling the network data providers and is expected to drive the Network Packet Broker market in the forecast period. Currently, the leading players are focused on the research and development of the new innovative network packet broker solutions, which find a wide application in various industries of the end-users.

By Enterprise Size, telecommunications industry segment held the largest share in 2023

- With regards to the Enterprise Size, the market can be divided into Small and Medium Enterprises (SMEs) and Large Enterprises, Telecommunication Organizations, Government Entities and Cloud Solution Providers. During the projection period, the market size of network monitoring for telecommunications industry will continue to dominate by having a big share. Much growth in the global telecommunications industry is one of the key issues that can be attributed to the network monitoring market. The rising necessity for granular visibility in Network Infrastructure also driving the market growth. As there is high demand for data connection, most of the telecommunications structures have evolved in the recent past. These systems have become increasingly sufficiently to maintain both in regard to architecture and work and in relation to the spectrum of their activity. Network monitoring enables one keep track on the telecom infrastructure and note the hardware anomalies that may lead to a loss making company.

Network Monitoring Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America constitutes the largest share and therewith, given increasing demands on IT capacities and the implementation of new data center solutions, the tendency is to remain steady. The market in the United States is expected to grow since most; companies now prefer subscribing to cloud services to escape the capital-intensive requirement of putting up new data centers in case of disruptions. In 2019, Asia Pacific owned about 20 percent of the total Network Monitoring Market share all over the world. Ease on the consumer’s pocket due to higher disposable income and growth of IoT and cloud computing technologies are some of the factors boosting the market.

Active Key Players in the Network Monitoring Market:

- Gigamon (U.S.)

- NETSCOUT (U.S.)

- Keysight Technologies (U.S.)

- VIAVI Solutions Inc. (U.S.)

- APCON (Switzerland)

- Garland Technology (U.S.)

- Riverbed Technology (U.S.)

- SevOne (U.S.)

- Broadcom (U.S.)

- Juniper Networks, Inc. (U.S.)

- Arista Networks, Inc. (U.S.)

- Zenoss Inc. (U.S.)

- IBM (U.S.)

- Pico Quantitative Trading LLC (U.S.)

- CALIENT Technologies (U.S.)

- NETGEAR (U.S.)

- Cisco Systems, Inc. (U.S.)

- Other Key Players

Key Industry Developments in the Network Monitoring Market:

- In June 2022, Arista Networks introduced the 7130 Series, an integrated solution with sub-processor microseconds of latency and the highest limit of configuration. This new product line will improve the customers’ flexibility by replacing several devices multiplies the customers’ complications, expenses, and power demands. of the new series of products, 7130 has two new models that incorporate sophisticated engineered attributes like L2/L3 switching, open programmability, and high-speed L1 connectivity.

|

Network Monitoring Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.3% |

Market Size in 2032: |

USD 4.9 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Enterprise Size |

|

||

|

By Network Speed |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Network Monitoring Market by Component (2018-2032)

4.1 Network Monitoring Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Monitoring Equipment

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Network Monitoring Switch

4.5 Network Terminal Access Point (TAP)

4.6 Software Platform

4.7 Service

4.8 Professional Services

4.9 Managed Services

Chapter 5: Network Monitoring Market by Enterprise Size (2018-2032)

5.1 Network Monitoring Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Enterprises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Telecommunications Industry

5.5 Government Organisations

5.6 Cloud Service Providers

Chapter 6: Network Monitoring Market by Network Speed (2018-2032)

6.1 Network Monitoring Market Snapshot and Growth Engine

6.2 Market Overview

6.3 1 and 10 Gbps

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 40 Gbps

6.5 100 Gbps

6.6 400 Gbps

Chapter 7: Network Monitoring Market by Application (2018-2032)

7.1 Network Monitoring Market Snapshot and Growth Engine

7.2 Market Overview

7.3 IT & Telecom

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 BFSI

7.5 Healthcare

7.6 Energy & Utility

7.7 Government

7.8 Retail

7.9 Industrial

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Network Monitoring Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 GIGAMON (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 NETSCOUT (U.S.)

8.4 KEYSIGHT TECHNOLOGIES (U.S.)

8.5 VIAVI SOLUTIONS INC. (U.S.)

8.6 APCON (SWITZERLAND)

8.7 GARLAND TECHNOLOGY (U.S.)

8.8 RIVERBED TECHNOLOGY (U.S.)

8.9 SEVONE (U.S.)

8.10 BROADCOM (U.S.)

8.11 JUNIPER NETWORKS INC. (U.S.)

8.12 ARISTA NETWORKS INC. (U.S.)

8.13 ZENOSS INC. (U.S.)

8.14 IBM (U.S.)

8.15 PICO QUANTITATIVE TRADING LLC (U.S.)

8.16 CALIENT TECHNOLOGIES (U.S.)

8.17 NETGEAR (U.S.)

8.18 CISCO SYSTEMS INC. (U.S.)

8.19 OTHER KEY PLAYERS

Chapter 9: Global Network Monitoring Market By Region

9.1 Overview

9.2. North America Network Monitoring Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Component

9.2.4.1 Monitoring Equipment

9.2.4.2 Network Monitoring Switch

9.2.4.3 Network Terminal Access Point (TAP)

9.2.4.4 Software Platform

9.2.4.5 Service

9.2.4.6 Professional Services

9.2.4.7 Managed Services

9.2.5 Historic and Forecasted Market Size by Enterprise Size

9.2.5.1 Enterprises

9.2.5.2 Telecommunications Industry

9.2.5.3 Government Organisations

9.2.5.4 Cloud Service Providers

9.2.6 Historic and Forecasted Market Size by Network Speed

9.2.6.1 1 and 10 Gbps

9.2.6.2 40 Gbps

9.2.6.3 100 Gbps

9.2.6.4 400 Gbps

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 IT & Telecom

9.2.7.2 BFSI

9.2.7.3 Healthcare

9.2.7.4 Energy & Utility

9.2.7.5 Government

9.2.7.6 Retail

9.2.7.7 Industrial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Network Monitoring Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Component

9.3.4.1 Monitoring Equipment

9.3.4.2 Network Monitoring Switch

9.3.4.3 Network Terminal Access Point (TAP)

9.3.4.4 Software Platform

9.3.4.5 Service

9.3.4.6 Professional Services

9.3.4.7 Managed Services

9.3.5 Historic and Forecasted Market Size by Enterprise Size

9.3.5.1 Enterprises

9.3.5.2 Telecommunications Industry

9.3.5.3 Government Organisations

9.3.5.4 Cloud Service Providers

9.3.6 Historic and Forecasted Market Size by Network Speed

9.3.6.1 1 and 10 Gbps

9.3.6.2 40 Gbps

9.3.6.3 100 Gbps

9.3.6.4 400 Gbps

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 IT & Telecom

9.3.7.2 BFSI

9.3.7.3 Healthcare

9.3.7.4 Energy & Utility

9.3.7.5 Government

9.3.7.6 Retail

9.3.7.7 Industrial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Network Monitoring Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Component

9.4.4.1 Monitoring Equipment

9.4.4.2 Network Monitoring Switch

9.4.4.3 Network Terminal Access Point (TAP)

9.4.4.4 Software Platform

9.4.4.5 Service

9.4.4.6 Professional Services

9.4.4.7 Managed Services

9.4.5 Historic and Forecasted Market Size by Enterprise Size

9.4.5.1 Enterprises

9.4.5.2 Telecommunications Industry

9.4.5.3 Government Organisations

9.4.5.4 Cloud Service Providers

9.4.6 Historic and Forecasted Market Size by Network Speed

9.4.6.1 1 and 10 Gbps

9.4.6.2 40 Gbps

9.4.6.3 100 Gbps

9.4.6.4 400 Gbps

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 IT & Telecom

9.4.7.2 BFSI

9.4.7.3 Healthcare

9.4.7.4 Energy & Utility

9.4.7.5 Government

9.4.7.6 Retail

9.4.7.7 Industrial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Network Monitoring Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Component

9.5.4.1 Monitoring Equipment

9.5.4.2 Network Monitoring Switch

9.5.4.3 Network Terminal Access Point (TAP)

9.5.4.4 Software Platform

9.5.4.5 Service

9.5.4.6 Professional Services

9.5.4.7 Managed Services

9.5.5 Historic and Forecasted Market Size by Enterprise Size

9.5.5.1 Enterprises

9.5.5.2 Telecommunications Industry

9.5.5.3 Government Organisations

9.5.5.4 Cloud Service Providers

9.5.6 Historic and Forecasted Market Size by Network Speed

9.5.6.1 1 and 10 Gbps

9.5.6.2 40 Gbps

9.5.6.3 100 Gbps

9.5.6.4 400 Gbps

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 IT & Telecom

9.5.7.2 BFSI

9.5.7.3 Healthcare

9.5.7.4 Energy & Utility

9.5.7.5 Government

9.5.7.6 Retail

9.5.7.7 Industrial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Network Monitoring Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Component

9.6.4.1 Monitoring Equipment

9.6.4.2 Network Monitoring Switch

9.6.4.3 Network Terminal Access Point (TAP)

9.6.4.4 Software Platform

9.6.4.5 Service

9.6.4.6 Professional Services

9.6.4.7 Managed Services

9.6.5 Historic and Forecasted Market Size by Enterprise Size

9.6.5.1 Enterprises

9.6.5.2 Telecommunications Industry

9.6.5.3 Government Organisations

9.6.5.4 Cloud Service Providers

9.6.6 Historic and Forecasted Market Size by Network Speed

9.6.6.1 1 and 10 Gbps

9.6.6.2 40 Gbps

9.6.6.3 100 Gbps

9.6.6.4 400 Gbps

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 IT & Telecom

9.6.7.2 BFSI

9.6.7.3 Healthcare

9.6.7.4 Energy & Utility

9.6.7.5 Government

9.6.7.6 Retail

9.6.7.7 Industrial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Network Monitoring Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Component

9.7.4.1 Monitoring Equipment

9.7.4.2 Network Monitoring Switch

9.7.4.3 Network Terminal Access Point (TAP)

9.7.4.4 Software Platform

9.7.4.5 Service

9.7.4.6 Professional Services

9.7.4.7 Managed Services

9.7.5 Historic and Forecasted Market Size by Enterprise Size

9.7.5.1 Enterprises

9.7.5.2 Telecommunications Industry

9.7.5.3 Government Organisations

9.7.5.4 Cloud Service Providers

9.7.6 Historic and Forecasted Market Size by Network Speed

9.7.6.1 1 and 10 Gbps

9.7.6.2 40 Gbps

9.7.6.3 100 Gbps

9.7.6.4 400 Gbps

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 IT & Telecom

9.7.7.2 BFSI

9.7.7.3 Healthcare

9.7.7.4 Energy & Utility

9.7.7.5 Government

9.7.7.6 Retail

9.7.7.7 Industrial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Network Monitoring Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.3% |

Market Size in 2032: |

USD 4.9 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Enterprise Size |

|

||

|

By Network Speed |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||