Motorhome Market Synopsis:

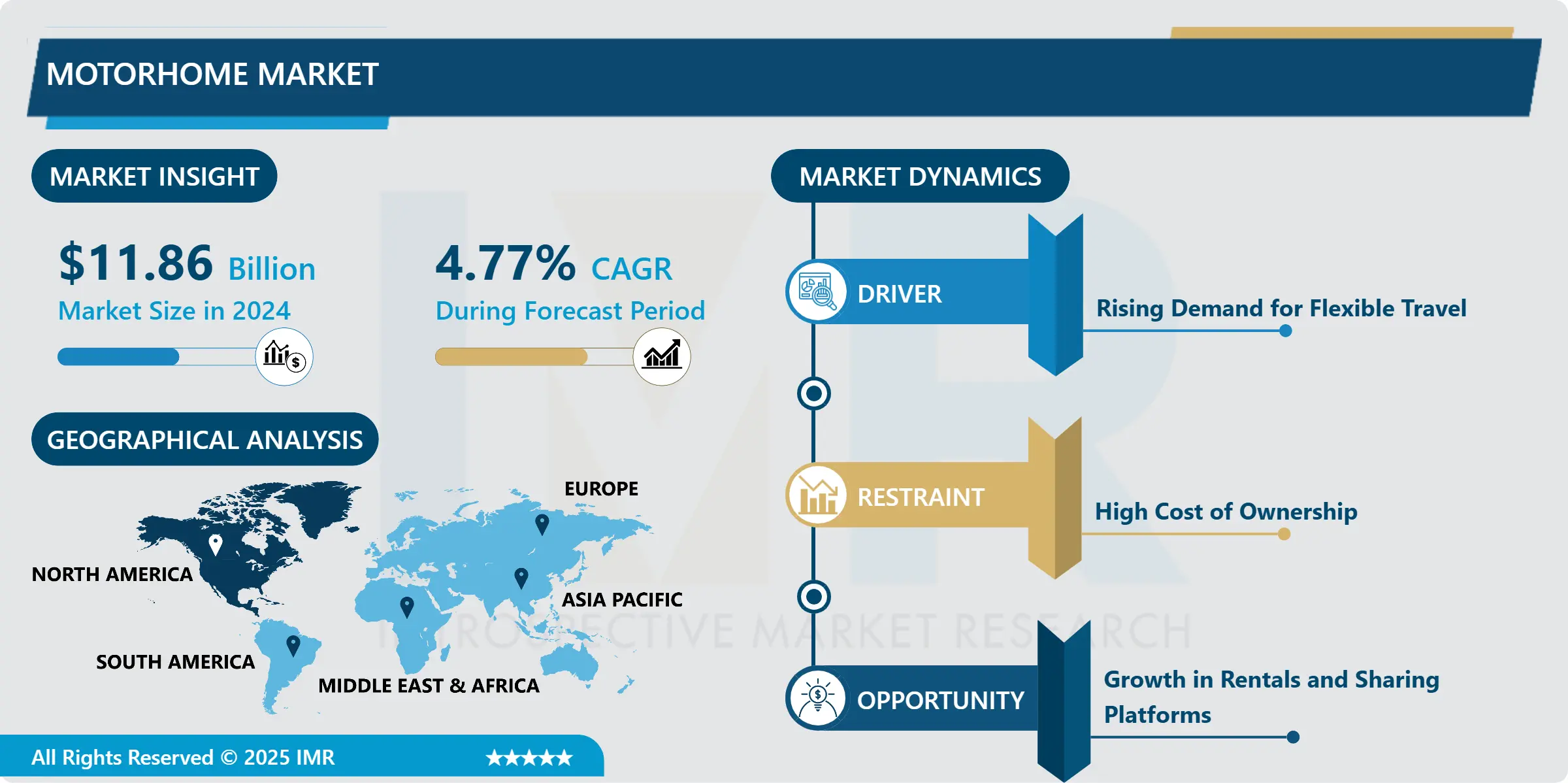

Motorhome Market Size Was Valued at USD 11.86 billion in 2024, and is Projected to Reach USD 19.8 billion by 2035, Growing at a CAGR of 4.77% from 2025-2035.

The motorhome market is growing as more people look for new and flexible ways to travel. A motorhome is a vehicle that also acts as a small home, with sleeping areas, kitchens, bathrooms, and living space. This makes it perfect for road trips, camping, and long-distance travel without needing hotels. More families, retirees, and young travellers are choosing motorhomes to enjoy nature and explore at their own pace. After the COVID-19 pandemic, many people prefer safer and more private travel options, and motorhomes offer just that.

Motorhomes come in different sizes and styles some are compact like vans (Class B), while others are larger and more luxurious (Class A and Class C). They are used for personal travel, vacations, and even for business purposes like mobile offices or rental services. Technology is also changing the market. New motorhomes now include smart features like Wi-Fi, solar panels, and energy-efficient systems. Eco-friendly models and electric motorhomes are also becoming more popular.

Another big trend is renting motorhomes instead of buying them. Rental services and apps make it easier for people to try the motorhome lifestyle without a big investment. Overall, the motorhome market is expected to keep growing, supported by lifestyle changes, travel trends, and demand for freedom and comfort on the road.

Motorhome Market Growth and Trend Analysis:

Motorhome Market Growth Driver - Rising Demand for Flexible Travel

-

One of the main reasons the motorhome market is growing is because more people want flexible and comfortable ways to travel. In the past, most vacations were planned around hotels, flights, and fixed schedules. But today, many travellers prefer more freedom and control over their trips. Motorhomes make this possible by combining transport and living space into one vehicle. With a motorhome, people can go wherever they want, whenever they want, without worrying about hotel bookings or restaurant stops. Everything they need like a bed, bathroom, and kitchen is right there with them.

- This makes it easy to take road trips, explore nature, or travel for long periods. This type of travel is especially popular with families, retirees, and young digital nomads. Families enjoy the space and comfort, retirees enjoy the relaxed pace, and younger travellers like the adventure and the ability to work remotely from the road. Since the COVID-19 pandemic, people have also become more focused on safe and private travel options. Motorhomes allow them to stay away from crowds and have more control over their environment. Whether it’s a short weekend trip or a cross-country journey, motorhomes offer the flexibility and convenience that today’s travellers are looking for. As more people discover these benefits, the demand for motorhomes continues to rise, making flexible travel one of the biggest drivers of growth in the motorhome market.

Motorhome Market Limiting Factor - High Cost of Ownership

-

One of the biggest things holding back the motorhome market is the high cost of ownership. While many people like the idea of traveling in a motorhome and enjoying the freedom it offers, the reality is that buying one can be very expensive. Larger motorhomes with full features like bathrooms, kitchens, and sleeping areas cost a lot of money upfront. Even smaller models can still be costly for the average person. But the expense doesn’t stop after buying the motorhome. Owners also have to pay for things like insurance, fuel, regular maintenance, and repairs.

- If the motorhome isn’t used often, it may also need to be stored somewhere, which adds another cost. All of these extra expenses make it hard for many people especially young buyers, students, or families on a tight budget to afford a motorhome. Because of this, even if people are interested in the motorhome lifestyle, they may choose other, more affordable ways to travel. This limits the number of new customers entering the market. As a result, the overall growth of the motorhome market can slow down. To solve this problem, companies might need to offer cheaper models, better financing options, or promote rental services to make motorhome travel more affordable for a wider range of people.

Motorhome Market Expansion Opportunity - Growth in Rentals and Sharing Platforms

-

A big opportunity for the motorhome market is the growth of rental services and sharing platforms. Buying a motorhome can be expensive, and not everyone wants to make that big investment. But many people still like the idea of traveling in one for a weekend or a short vacation. That’s where renting comes in. More and more companies and websites are now offering motorhome rentals, making it easy for people to enjoy the experience without owning one.

- Some platforms even allow people to rent motorhomes directly from other owners like Airbnb, but for motorhomes. This kind of service is very helpful for first-time users who want to try the motorhome lifestyle before deciding if they want to buy one. It also helps motorhome owners earn extra income when they’re not using their vehicles. As more people discover how fun and flexible motorhome travel can be, they may become interested in buying their own in the future. Rental options make motorhomes more accessible to younger people, families, and travellers who may not have considered it before. Overall, rental and sharing platforms are opening up the market to a much larger group of customers. This not only brings in more users but also helps increase awareness and long-term interest in motorhomes, making it a key growth opportunity for the industry.

Motorhome Market Challenge and Risk - Fuel Prices and Environmental Concerns

-

One of the biggest challenges facing the motorhome market is its dependence on fuel and the impact on the environment. Motorhomes are large vehicles that usually use a lot of gas or diesel, which makes them expensive to run especially when fuel prices go up. For many people, the high cost of fuel can make long trips in a motorhome too expensive. This can lead some travellers to choose cheaper and more fuel-efficient ways to travel instead. At the same time, more people are becoming concerned about the environment and the effects of vehicle emissions on climate change.

- Governments around the world are also creating stricter rules about pollution and fuel efficiency. These changes put pressure on motorhome makers to design cleaner, greener vehicles such as electric or hybrid models. However, switching to new technologies takes time and can be costly for manufacturers. If the motorhome industry doesn't adapt quickly, it could face serious problems, like lower demand or being forced to meet tough legal standards. People who care about the environment might avoid motorhomes altogether if they’re seen as harmful to nature. So, while motorhomes offer freedom and adventure, their impact on the environment and high fuel use are big concerns that the industry needs to address. Solving these problems is important for the long-term success of the market.

Motorhome Market Segment Analysis:

Motorhome Market is segmented based on Type, Application, End-Users, and Region

By Type, Motorhome Segment is Expected to Dominate the Market During the Forecast Period

-

Class C motorhomes are one of the most popular types of RVs, especially for families. They are medium-sized and fall between Class A (the largest) and Class B (the smallest) motorhomes in terms of size, price, and features. One of the most noticeable features of a Class C motorhome is the over-cab sleeping area a bed space above the driver's cabin. This extra sleeping area makes it ideal for families or groups, as it allows more people to sleep comfortably.

- Class C motorhomes are built on a truck or van chassis, making them easier to drive than Class A motorhomes but more spacious than Class B camper vans. They often include essential features like a small kitchen, bathroom, seating area, and storage space offering a good balance of comfort and convenience.

- Because of their practical size and affordable pricing, Class C motorhomes are a popular choice for first-time buyers, families with kids, and road trip enthusiasts. They are also commonly used by rental companies, since they suit a wide range of travellers and are not too difficult to operate. In short, Class C motorhomes offer a great mix of space, comfort, and cost-effectiveness. They provide most of the key features of larger models while being easier to handle and park, which makes them an ideal choice for people who want to enjoy the motorhome lifestyle without going too big or spending too much.

By Application, Motorhome Segment Held the Largest Share in 2024

-

Fleet owners are companies or businesses that own and operate multiple motorhomes for commercial purposes. Instead of buying a motorhome for personal use, many people now prefer to rent one for a short period, like a weekend trip or a vacation. This has created a growing demand for rental services, and fleet owners are stepping in to meet that need.

- Rental companies make it easy for travellers to enjoy the motorhome experience without the high cost of ownership. These companies offer different types and sizes of motorhomes, allowing customers to choose what fits their needs best — whether it’s a compact camper van for a couple or a larger motorhome for a family. Rentals are especially attractive to people who want to try motorhome travel for the first time or those who only travel occasionally.

- Because of this shift in customer behaviour, the fleet owner segment is expanding quickly. More businesses are investing in motorhomes, and some private owners are even renting out their vehicles through sharing platforms, much like Airbnb. This allows motorhomes to be used more efficiently and helps owners earn extra income.

- Overall, fleet owners play an important role in the motorhome market by making these vehicles more accessible, affordable, and convenient for a wider range of people. As interest in travel and road trips continues to rise, the fleet segment is expected to grow even more in the coming years.

Motorhome Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

-

North America is one of the largest and most important markets for motorhomes in the world. Americans have a long-standing love for road trips, camping, and outdoor travel. The country has wide open roads, scenic landscapes, and many national parks, which make it ideal for motorhome adventures. Because of this, traveling in a motorhome is a popular choice for both families and retirees.

- Motorhomes in the U.S. are used for vacations, weekend getaways, and even full-time living by some people. Many Americans enjoy the freedom of traveling without the need to book hotels or follow strict schedules. This flexible travel style has grown more popular after the COVID-19 pandemic, as people looked for safer and more private travel options. The U.S. also has a well-developed RV (recreational vehicle) industry. Major companies like Thor Industries, Winnebago Industries, and Forest River are based in the U.S. These companies offer a wide range of motorhomes, from affordable models to luxury ones with high-end features.

- In addition, rental platforms and RV-sharing services have grown, allowing more people to experience motorhome travel without buying one. With strong demand from both older adults and younger travellers, the motorhome market in the U.S. is expected to keep growing in the coming years.

Motorhome Market Active Players:

- Adria Mobil d.o.o. (Slovenia)

- Apollo Tourism & Leisure Ltd. (Australia)

- Auto-Trail VR Ltd. (United Kingdom)

- Benimar S.A.U. (Spain)

- Bürstner Australia (Australia)

- Bürstner GmbH & Co. KG (Germany)

- CI Caravans International S.r.l. (Italy)

- Coachmen RV (United States)

- Dethleffs GmbH & Co. KG (Germany)

- Elnagh S.r.l. (Italy)

- Forest River Inc. (United States)

- Gulf Stream Coach, Inc. (United States)

- Hymer GmbH & Co. KG (Germany)

- Jayco Inc. (United States)

- Knaus Tabbert AG (Germany)

- Laika Caravans S.p.A. (Italy)

- Lunar Campers Ltd. (United Kingdom)

- Newmar Corporation (United States)

- Niesmann+Bischoff GmbH (Germany)

- Pilote Group (France)

- Pleasure-Way Industries Ltd. (Canada)

- Rapido Group (France)

- REV Group, Inc. (United States)

- Roadtrek Inc. (Canada)

- Sunlight GmbH (Germany)

- Thor Industries, Inc. (United States)

- Tiffin Motorhomes, Inc. (United States)

- Trigano S.A. (France)

- Wilderness Motorhomes (New Zealand)

- Winnebago Industries, Inc. (United States)

- Other Active Players

|

Motorhome Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 11.86 billion |

|

Forecast Period 2025-35 CAGR: |

4.77 % |

Market Size in 2035: |

USD 19.8 billion |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Motorhome Market by Type (2018-2035)

4.1 Motorhome Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Class A

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Class B

4.5 Class C

Chapter 5: Motorhome Market by Application (2018-2035)

5.1 Motorhome Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Direct Buyer

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Fleet Owners

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Motorhome Market Share by Manufacturer/Service Provider(2024)

6.1.3 Industry BCG Matrix

6.1.4 PArtnerships, Mergers & Acquisitions

6.2 ADRIA MOBIL D.O.O. (SLOVENIA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Recent News & Developments

6.2.10 SWOT Analysis

6.3 APOLLO TOURISM & LEISURE LTD. (AUSTRALIA)

6.4 AUTO-TRAIL VR LTD. (UNITED KINGDOM)

6.5 BENIMAR S.A.U. (SPAIN)

6.6 BÜRSTNER AUSTRALIA (AUSTRALIA)

6.7 BÜRSTNER GMBH & CO. KG (GERMANY)

6.8 CI CARAVANS INTERNATIONAL S.R.L. (ITALY)

6.9 COACHMEN RV (UNITED STATES)

6.10 DETHLEFFS GMBH & CO. KG (GERMANY)

6.11 ELNAGH S.R.L. (ITALY)

6.12 FOREST RIVER INC. (UNITED STATES)

6.13 GULF STREAM COACH

6.14 INC. (UNITED STATES)

6.15 HYMER GMBH & CO. KG (GERMANY)

6.16 JAYCO INC. (UNITED STATES)

6.17 KNAUS TABBERT AG (GERMANY)

6.18 LAIKA CARAVANS S.P.A. (ITALY)

6.19 LUNAR CAMPERS LTD. (UNITED KINGDOM)

6.20 NEWMAR CORPORATION (UNITED STATES)

6.21 NIESMANN+BISCHOFF GMBH (GERMANY)

6.22 PILOTE GROUP (FRANCE)

6.23 PLEASURE-WAY INDUSTRIES LTD. (CANADA)

6.24 RAPIDO GROUP (FRANCE)

6.25 REV GROUP

6.26 INC. (UNITED STATES)

6.27 ROADTREK INC. (CANADA)

6.28 SUNLIGHT GMBH (GERMANY)

6.29 THOR INDUSTRIES

6.30 INC. (UNITED STATES)

6.31 TIFFIN MOTORHOMES

6.32 INC. (UNITED STATES)

6.33 TRIGANO S.A. (FRANCE)

6.34 WILDERNESS MOTORHOMES (NEW ZEALAND)

6.35 AND WINNEBAGO INDUSTRIES

6.36 INC. (UNITED STATES)

Chapter 7: Global Motorhome Market By Region

7.1 Overview

7.2. North America Motorhome Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecast Market Size by Country

7.2.4.1 US

7.2.4.2 Canada

7.2.4.3 Mexico

7.3. Eastern Europe Motorhome Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecast Market Size by Country

7.3.4.1 Russia

7.3.4.2 Bulgaria

7.3.4.3 The Czech Republic

7.3.4.4 Hungary

7.3.4.5 Poland

7.3.4.6 Romania

7.3.4.7 Rest of Eastern Europe

7.4. Western Europe Motorhome Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecast Market Size by Country

7.4.4.1 Germany

7.4.4.2 UK

7.4.4.3 France

7.4.4.4 The Netherlands

7.4.4.5 Italy

7.4.4.6 Spain

7.4.4.7 Rest of Western Europe

7.5. Asia Pacific Motorhome Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecast Market Size by Country

7.5.4.1 China

7.5.4.2 India

7.5.4.3 Japan

7.5.4.4 South Korea

7.5.4.5 Malaysia

7.5.4.6 Thailand

7.5.4.7 Vietnam

7.5.4.8 The Philippines

7.5.4.9 Australia

7.5.4.10 New Zealand

7.5.4.11 Rest of APAC

7.6. Middle East & Africa Motorhome Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecast Market Size by Country

7.6.4.1 Turkiye

7.6.4.2 Bahrain

7.6.4.3 Kuwait

7.6.4.4 Saudi Arabia

7.6.4.5 Qatar

7.6.4.6 UAE

7.6.4.7 Israel

7.6.4.8 South Africa

7.7. South America Motorhome Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecast Market Size by Country

7.7.4.1 Brazil

7.7.4.2 Argentina

7.7.4.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

Chapter 9 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 10 Case Study

Chapter 11 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

Motorhome Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 11.86 billion |

|

Forecast Period 2025-35 CAGR: |

4.77 % |

Market Size in 2035: |

USD 19.8 billion |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||