Mobile Runtime Application Self-Protection Market Synopsis:

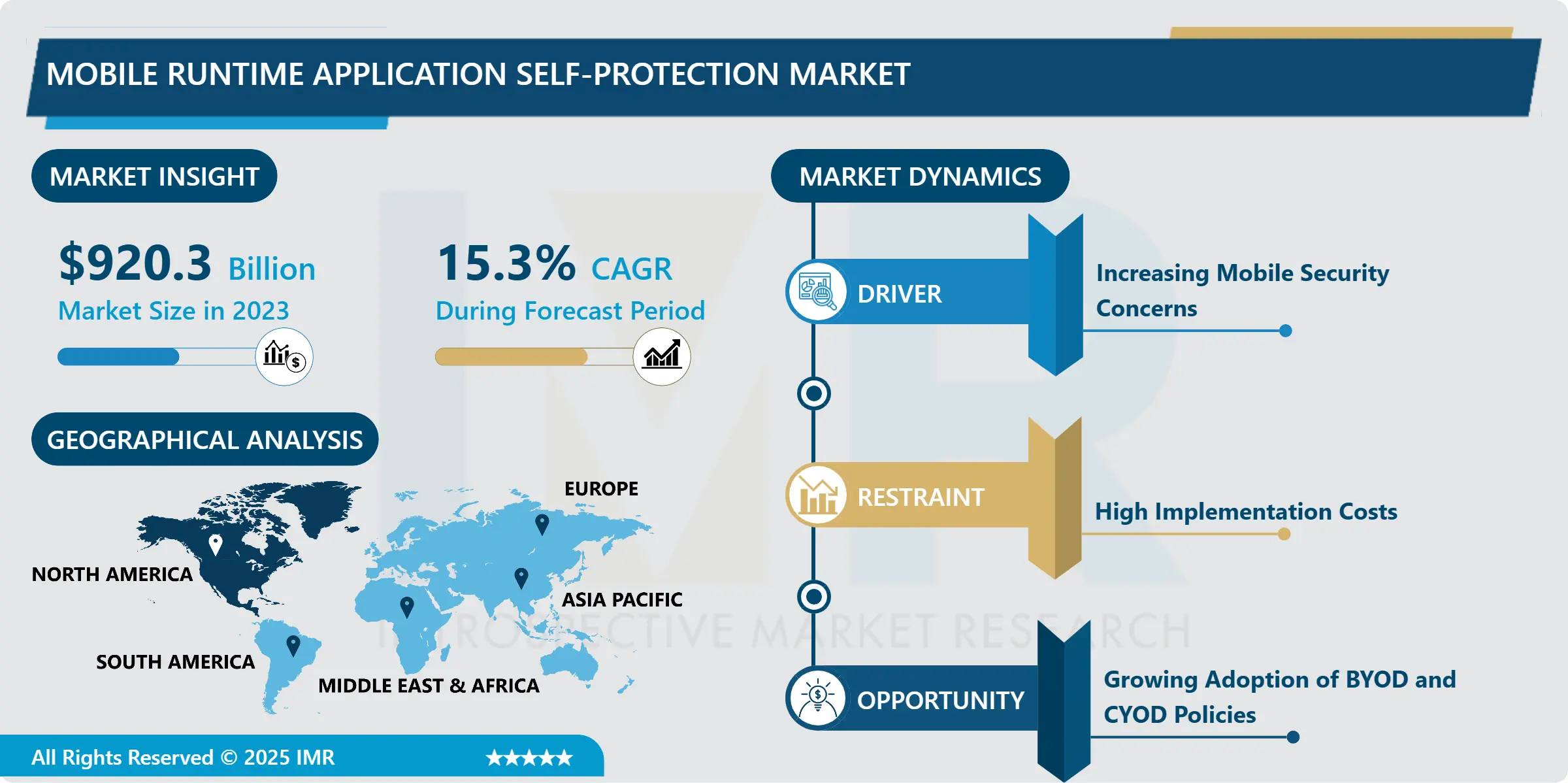

Mobile Runtime Application Self-Protection Market Size Was Valued at USD 920.3 Billion in 2023 and is Projected to Reach USD 3314.3 Billion by 2032, Growing at a CAGR of 15.3% From 2024-2032.

The Mobile Runtime Application Self-Protection (RASP) market is the category of the cybersecurity industry specializing in the provision of solutions, developed to be embedded into the application, to detect and counter the threats in real-time during the application runtime. These solutions improve application protection by observing utilization, managing flow, and preventing numerous attacks, including code manipulation, reverse code engineering, malware insertion, and unauthorized infiltration. RASP technology works on the application level and it provides security even working in hostile environment and it does not need additional layers of security. This market meets the need for strong and flexible solutions protecting applications in various industries – banking, e-commerce, health care, entertainment industries, etc. due to the higher rate of cyber threats and new regulations.

The Mobile Runtime Application Self-Protection (RASP) market continues to grow at a rapid rate because of the rising adoption of these security solutions for protecting applications from the rising number of threats. The Mobile RASP solutions are developed and embedded in the application for the protection against new and advanced threats like code modification, reverse engineering, and others. The constant increase in the use of various mobile applications, including in the fields of banking, retail, healthcare, and entertainment industries, is a significant growth factor since organizations pay particular attention to the protection of users’ personal information and with whom they share this information. Besides, the increased geographic dispersion of the workforce and the rising practice of using personal devices at work have intensified the demand for the protection of mobile applications, which promotes the implementation of RASP solutions.

Regionally, North America is the most significant market since it has well-developed technology infrastructure, high levels of advanced cybersecurity solutions’ acceptance, and RASP’s leading suppliers. However, Asia-Pacific is expected to show the highest CAGR owing to the progressive and rapid advancement in the digital landscape along with the growing adoption of smartphones, and an understanding of the threats related to application security. It is noted that the competition is rather high while the companies engage in the constant development, using artificial intelligence and machine learning to improve threat identification and counteraction. Mobile application threats are constantly changing and as the threats change so does the market for Mobile RASP which has the opportunity for constant growth, meaning it is extremely important for building and maintaining secure mobile applications.

Mobile Runtime Application Self-Protection Market Trend Analysis:

Adoption of RASP Technologies Driven by Evolving Threats and Agile Security Needs

-

Businesses from all sectors are now transitioning to Runtime Application Self-Protection (RASP) solutions to monitor the risks coming from mobile applications. Because mobile apps are emerging as fi rst-order threats in the cyber world, companies feel the necessity of innovative security solutions that can safeguard them from highly-sophisticated threats. Hence, the evolving adoption of the bring-your-own-device (BYOD) policy and a remote work environment have even more highlighted the significance of shielded applications. There is the big drive in market by such solutions since end users are developing higher standards of security expectations or requirements, where RASP solutions as a sub-set in specific provide the real time protection, naturally, right inside the application.

- The rising trends of cloud-based deployment solutions and an increase in mobile banking have made a huge positive reinforcement on the need to secure the mobile application. Since most of these platforms use and process personal user information, more organisations employ RASP technologies to mitigate hackers and thefts. Moreover, RASP solutions are increasingly integrated into DevSecOps practices so that security is active, and its processes remain coherent with Auto DevOps solutions. This integration does not only improve the security level of the application but also contributes to the improvement of the speed of the cycles of deployment, and this is why today, the RASP solutions are considered to be mandatory for creating an adequate strategy of protection against cyber threats.

Growing Adoption of Mobile Applications and Regulatory Compliance Driving RASP Demand

-

Mobile applications for consumers as well as enterprises are being widely adopted, greatly escalating the protection of applications requirements. Mobile banking, healthcare, e-commerce, and similar industries are in the lead of this trend because large numbers of customers share their personal data, financial operations, and other sensitive information with companies and organizations on a daily basis. The upward trend in the use of mobile applications has thus created more demand for real time protection such as Runtime Application Self-Protection (RASP) which protects against unauthorized access, reverse engineering and code tampering. The visualization of RASP solutions enables enterprise applications and their users to be protected from prevailing cyber threats at the same time promoting trust and confidence with its uptake.

- The rising demand for better compliance with specific rules and regulation among various sectors is forcing organization to implement security frameworks, which feature RASP. This consistencies with data protection act for instance General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and compliance specific to industries and sectors. Violation of these regulations attracts serious legal and financial consequences. As these compliance needs are specifically associated with real-time monitoring and threat mitigation, these features tie perfectly into the picture with organizations that wish to shield their applications and safeguard their suit with appropriate global and regional standards and norms related to data protection. The first advantage as a threat solution and the second as a regulatory solution puts RASP at the center stage in the ever-advancing digitization.

Mobile Runtime Application Self-Protection Market Segment Analysis:

Mobile Runtime Application Self-Protection Market is Segmented on the basis of Deployment Type, Enterprise Size, Operating System, Industry Vertical, and Region.

By Deployment Type, On-Premises segment is expected to dominate the market during the forecast period

-

Style of application deployment entails running the software on the firm’s infrastructure hence allowing full control of the data. Companies choosing on-premise deployment usually need some intense customization, so that they could link the software tightly to the existing processes and frameworks. It is especially useful for industries as BFSI and Health where data protection and the agility to meet regulations are essential. The benefit derived from keeping corporate data local is that such information cannot be exposed to any risk likely to be posed by third party cloud service providers. The advantage of on-premises deployment is that the service provider instance is located within the company’s infrastructure to enable full control of the access and security rules that govern the customer data to ensure compliance with the regulation laws.

- The established plan or the on-premise model also has its disadvantages, as observed henceforth. It is understood that the capital input to construct the appropriate hardware and software platforms may be expensive more so for the large scale organizations. This first time cost may be prohibitive for many a small non profit organization and SME. Furthermore, costs such as software maintenance, upgrades, patches and software monitoring might just be ongoing expenses that can be costly for which IT professionals are required. These costs can be recurrent and are often known to affect company expenditure and mother, so for companies such as the ones below; Nevertheless, the on-premises deployment has many consequences in the business world, especially in those sectors where data security and compliance with the standards are critical to the business’s success, such as BFSI and Healthcare, where higher control over data completely defeats the cost.

By Enterprise Size, Large Enterprises segment expected to held the largest share

-

Enterprise application requirements include security, compliance, integration with other applications, for which on-premises deployment is usually preferred. These organizations demand high customization and control over data and this is achieved through installation of the software on the organization’s local servers which is offered by on-premises. Such level of control is even more required in such fields as healthcare, and any field within the sector of banking, financial services, and insurance where data security measures and compliance are sacrosanct. Storing all the data within large enterprises’ perimeter allows to keep all the enterprise’s data secure from various cyber criminals and hackers who can breach a company’s data threatening losses in terms of customers’ trust and meeting particular industry regulations.

- Large enterprise are also considering more and more solutions that will embrace both on-premise and cloud environments. It gives the organisation the capability to leverage the full benefits of the cloud computing, including high scalability, and reasonable cost, while keeping sensitive data in-house for better security and performance. This hybrid model has flexibility that allows large organizations to adapt optimality in their IT assets and personnel. These include the healthcare and the business and finance software industry where firms retain sensitive information while simultaneously gaining the advantage of elasticity in the cloud. Large enterprises can bear the initial disaster of on-premises deployment that makes them superior to other organizations concerning systems control, performance, and integration.

Mobile Runtime Application Self-Protection Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

The Mobile Runtime Application Self-Protection (RASP) market in North America is growing day by day owing to the high penetration of technological solutions and increased emphasis on security standards for data privacy. In the financial sphere, health care, and retail, in particular, companies invest in RASP solutions to guard their applications against cyber threats. Currently, the United States plays a special role as the top market in demand for RASP technologies. The growing incidences of threats and risks in mobile application developments have made organizations to look for important securities to enhance their protection and this have make RASP an important security tool. Continued regulatory scrutiny and the necessity of laws such as the CCPA and GDPR concerning cross-border processing of data put pressure on North American enterprises to adopt RASP to evade fines and commence data protection for valuable customer information.

- The necessity for mobile RASP solutions in North America is driven not only by the increasing use of smartphone and mobile applications in business activities and customer interaction. The transformation of industries towards digital has lead to development of more mobile applications for use which in turn becomes an easy target to hackers. To reduce such risks, firms have turned towards the adoption of RASP technologies in protection of their mobile applications from data leakage. The North American RASP market is expected to grow at a considerable rate due to strong technology maturity, and the presence of a large number of enterprises in the United States. Because the region focuses on Innovations and security standards it is a good market for the RASP vendors that seeks to benefit from the increasing necessity of protecting Mobile applications.

Active Key Players in the Mobile Runtime Application Self-Protection Market:

- Imperva

- Micro Focus

- Veracode

- Contrast Security

- GuardSquare

- Pradeo

- Arxan Technologies (now part of Digital.ai)

- Data Theorem

- Runtime Application Self-Protection (RASP) by Checkmarx

- Promon, and Other Active Players

|

Global Mobile Runtime Application Self-Protection Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 920.3 Billion |

|

Forecast Period 2024-32 CAGR: |

15.3% |

Market Size in 2032: |

USD 3314.3 Billion |

|

|

By Deployment Type |

|

|

|

By Enterprise Size |

|

||

|

By Operating System |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Mobile Runtime Application Self-Protection Market by Deployment Type

4.1 Mobile Runtime Application Self-Protection Market Snapshot and Growth Engine

4.2 Mobile Runtime Application Self-Protection Market Overview

4.3 On-Premises and Cloud-Based

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 On-Premises and Cloud-Based: Geographic Segmentation Analysis

Chapter 5: Mobile Runtime Application Self-Protection Market by Enterprise Size

5.1 Mobile Runtime Application Self-Protection Market Snapshot and Growth Engine

5.2 Mobile Runtime Application Self-Protection Market Overview

5.3 Small and Medium Enterprises (SMEs) and Large Enterprises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Small and Medium Enterprises (SMEs) and Large Enterprises: Geographic Segmentation Analysis

Chapter 6: Mobile Runtime Application Self-Protection Market by Operating System

6.1 Mobile Runtime Application Self-Protection Market Snapshot and Growth Engine

6.2 Mobile Runtime Application Self-Protection Market Overview

6.3 Android

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Android: Geographic Segmentation Analysis

6.4 iOS and Others (Windows

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 iOS and Others (Windows: Geographic Segmentation Analysis

6.5 Cross-Platform)

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Cross-Platform): Geographic Segmentation Analysis

Chapter 7: Mobile Runtime Application Self-Protection Market by Industry Vertical

7.1 Mobile Runtime Application Self-Protection Market Snapshot and Growth Engine

7.2 Mobile Runtime Application Self-Protection Market Overview

7.3 BFSI (Banking

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 BFSI (Banking: Geographic Segmentation Analysis

7.4 Financial Services

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Financial Services: Geographic Segmentation Analysis

7.5 and Insurance

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 and Insurance: Geographic Segmentation Analysis

7.6 Healthcare

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Healthcare : Geographic Segmentation Analysis

7.7 Retail and E-commerce

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Retail and E-commerce: Geographic Segmentation Analysis

7.8 IT and Telecom and Others (Gaming

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 IT and Telecom and Others (Gaming: Geographic Segmentation Analysis

7.9 Education

7.9.1 Introduction and Market Overview

7.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.9.3 Key Market Trends, Growth Factors and Opportunities

7.9.4 Education: Geographic Segmentation Analysis

7.10 etc.)

7.10.1 Introduction and Market Overview

7.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.10.3 Key Market Trends, Growth Factors and Opportunities

7.10.4 etc.): Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Mobile Runtime Application Self-Protection Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 IMPERVA

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MICRO FOCUS

8.4 VERACODE

8.5 CONTRAST SECURITY

8.6 GUARDSQUARE

8.7 PRADEO

8.8 ARXAN TECHNOLOGIES (NOW PART OF DIGITAL.AI)

8.9 DATA THEOREM

8.10 RUNTIME APPLICATION SELF-PROTECTION (RASP) BY CHECKMARX

8.11 PROMON

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Mobile Runtime Application Self-Protection Market By Region

9.1 Overview

9.2. North America Mobile Runtime Application Self-Protection Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Deployment Type

9.2.4.1 On-Premises and Cloud-Based

9.2.5 Historic and Forecasted Market Size By Enterprise Size

9.2.5.1 Small and Medium Enterprises (SMEs) and Large Enterprises

9.2.6 Historic and Forecasted Market Size By Operating System

9.2.6.1 Android

9.2.6.2 iOS and Others (Windows

9.2.6.3 Cross-Platform)

9.2.7 Historic and Forecasted Market Size By Industry Vertical

9.2.7.1 BFSI (Banking

9.2.7.2 Financial Services

9.2.7.3 and Insurance

9.2.7.4 Healthcare

9.2.7.5 Retail and E-commerce

9.2.7.6 IT and Telecom and Others (Gaming

9.2.7.7 Education

9.2.7.8 etc.)

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Mobile Runtime Application Self-Protection Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Deployment Type

9.3.4.1 On-Premises and Cloud-Based

9.3.5 Historic and Forecasted Market Size By Enterprise Size

9.3.5.1 Small and Medium Enterprises (SMEs) and Large Enterprises

9.3.6 Historic and Forecasted Market Size By Operating System

9.3.6.1 Android

9.3.6.2 iOS and Others (Windows

9.3.6.3 Cross-Platform)

9.3.7 Historic and Forecasted Market Size By Industry Vertical

9.3.7.1 BFSI (Banking

9.3.7.2 Financial Services

9.3.7.3 and Insurance

9.3.7.4 Healthcare

9.3.7.5 Retail and E-commerce

9.3.7.6 IT and Telecom and Others (Gaming

9.3.7.7 Education

9.3.7.8 etc.)

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Mobile Runtime Application Self-Protection Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Deployment Type

9.4.4.1 On-Premises and Cloud-Based

9.4.5 Historic and Forecasted Market Size By Enterprise Size

9.4.5.1 Small and Medium Enterprises (SMEs) and Large Enterprises

9.4.6 Historic and Forecasted Market Size By Operating System

9.4.6.1 Android

9.4.6.2 iOS and Others (Windows

9.4.6.3 Cross-Platform)

9.4.7 Historic and Forecasted Market Size By Industry Vertical

9.4.7.1 BFSI (Banking

9.4.7.2 Financial Services

9.4.7.3 and Insurance

9.4.7.4 Healthcare

9.4.7.5 Retail and E-commerce

9.4.7.6 IT and Telecom and Others (Gaming

9.4.7.7 Education

9.4.7.8 etc.)

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Mobile Runtime Application Self-Protection Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Deployment Type

9.5.4.1 On-Premises and Cloud-Based

9.5.5 Historic and Forecasted Market Size By Enterprise Size

9.5.5.1 Small and Medium Enterprises (SMEs) and Large Enterprises

9.5.6 Historic and Forecasted Market Size By Operating System

9.5.6.1 Android

9.5.6.2 iOS and Others (Windows

9.5.6.3 Cross-Platform)

9.5.7 Historic and Forecasted Market Size By Industry Vertical

9.5.7.1 BFSI (Banking

9.5.7.2 Financial Services

9.5.7.3 and Insurance

9.5.7.4 Healthcare

9.5.7.5 Retail and E-commerce

9.5.7.6 IT and Telecom and Others (Gaming

9.5.7.7 Education

9.5.7.8 etc.)

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Mobile Runtime Application Self-Protection Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Deployment Type

9.6.4.1 On-Premises and Cloud-Based

9.6.5 Historic and Forecasted Market Size By Enterprise Size

9.6.5.1 Small and Medium Enterprises (SMEs) and Large Enterprises

9.6.6 Historic and Forecasted Market Size By Operating System

9.6.6.1 Android

9.6.6.2 iOS and Others (Windows

9.6.6.3 Cross-Platform)

9.6.7 Historic and Forecasted Market Size By Industry Vertical

9.6.7.1 BFSI (Banking

9.6.7.2 Financial Services

9.6.7.3 and Insurance

9.6.7.4 Healthcare

9.6.7.5 Retail and E-commerce

9.6.7.6 IT and Telecom and Others (Gaming

9.6.7.7 Education

9.6.7.8 etc.)

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Mobile Runtime Application Self-Protection Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Deployment Type

9.7.4.1 On-Premises and Cloud-Based

9.7.5 Historic and Forecasted Market Size By Enterprise Size

9.7.5.1 Small and Medium Enterprises (SMEs) and Large Enterprises

9.7.6 Historic and Forecasted Market Size By Operating System

9.7.6.1 Android

9.7.6.2 iOS and Others (Windows

9.7.6.3 Cross-Platform)

9.7.7 Historic and Forecasted Market Size By Industry Vertical

9.7.7.1 BFSI (Banking

9.7.7.2 Financial Services

9.7.7.3 and Insurance

9.7.7.4 Healthcare

9.7.7.5 Retail and E-commerce

9.7.7.6 IT and Telecom and Others (Gaming

9.7.7.7 Education

9.7.7.8 etc.)

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Mobile Runtime Application Self-Protection Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 920.3 Billion |

|

Forecast Period 2024-32 CAGR: |

15.3% |

Market Size in 2032: |

USD 3314.3 Billion |

|

|

By Deployment Type |

|

|

|

By Enterprise Size |

|

||

|

By Operating System |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||