Microcontroller Market Synopsis

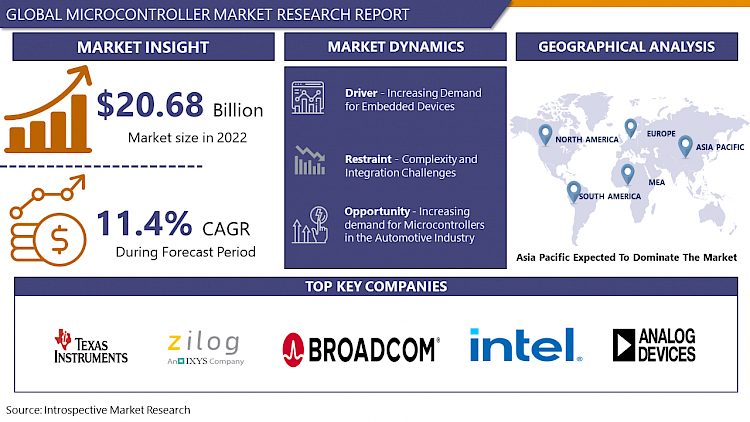

Microcontroller Market Size Was Valued at USD 20.68 Billion in 2022, and is Projected to Reach USD 49.05 Billion by 2030, Growing at a CAGR of 11.4% From 2023-2030.

A microcontroller is a compact integrated circuit that combines the functions of a microprocessor, memory, and input/output peripherals within a single chip. It serves as the brain of embedded systems, efficiently executing predefined tasks and controlling devices in various applications. Unlike general-purpose microprocessors, microcontrollers are specifically designed for dedicated tasks, making them suitable for applications such as robotics, automotive control systems, consumer electronics, and industrial automation.

- Microcontrollers execute tasks in real-time, responding to inputs from sensors and interacting with external devices. Their versatility and low power consumption make microcontrollers indispensable in modern electronics, enabling the development of smart and responsive systems across a wide range of industries.

- As the demand for connected and intelligent devices continues to rise, microcontrollers play a pivotal role in enabling seamless communication and control in IoT applications. Moreover, the automotive industry has been a major contributor to the market growth, with the integration of advanced driver-assistance systems (ADAS), infotainment systems, and in-vehicle networking relying heavily on microcontrollers.

- Continued innovation in the field, including the development of low-power and high-performance microcontrollers, is expected to drive future market growth. Additionally, the rise of edge computing and the deployment of smart sensors in various industries are likely to create new opportunities for microcontroller applications. As the world becomes more interconnected, the microcontroller market is poised to play a crucial role in shaping the future of technology and driving advancements in diverse sectors.

- Looking ahead, the microcontroller market is poised for further growth as emerging technologies, such as 5G and artificial intelligence, continue to shape the landscape of connected devices. Additionally, the ongoing trend towards miniaturization and energy efficiency will likely spur innovations in microcontroller design and functionality, ensuring their continued relevance in the evolving world of electronics.

Microcontroller Market Trend Analysis

Increasing Demand for Embedded Devices

- The increasing demand for embedded devices is a prominent trend in the microcontroller market, driven by the growing prevalence of smart technologies and the Internet of Things (IoT). Embedded devices are specialized computing systems that are integrated into a larger system or product to perform specific functions. Microcontrollers, as the core components of embedded systems, play a pivotal role in this trend.

- As more devices become interconnected to enhance automation, efficiency, and data-driven decision-making, the need for microcontrollers embedded within these devices has surged. IoT applications span a wide range of sectors, including smart homes, industrial automation, healthcare, agriculture, and transportation. Microcontrollers enable these devices to collect, process, and transmit data, facilitating seamless communication and interaction between devices.

- Furthermore, the trend toward edge computing has propelled the demand for microcontrollers in embedded systems. Edge computing involves processing data closer to the source rather than relying solely on centralized cloud servers. Microcontrollers are well-suited for edge computing applications, offering low power consumption, compact form factors, and cost-effectiveness.

- In industrial settings, the adoption of embedded devices is driven by the need for intelligent and connected solutions. Microcontrollers enable the development of sophisticated control systems, monitoring devices, and automation solutions, contributing to improved operational efficiency and reduced downtime.

Increasing demand for microcontrollers in the automotive industry creates an opportunity for Microcontroller Market

- The automotive industry is undergoing a rapid transformation towards electric and hybrid vehicles, as well as the integration of advanced driver assistance systems (ADAS) and autonomous driving technologies. These innovations heavily rely on sophisticated electronics, sensors, and control systems, all of which are powered and managed by microcontrollers. As vehicles become more intelligent and connected, the demand for microcontrollers with higher processing power, enhanced capabilities, and energy-efficient designs is on the rise.

- The push for enhanced safety features in vehicles, such as collision avoidance systems, adaptive cruise control, and lane-keeping assistance, contributes to the growing need for advanced microcontrollers. These safety systems require real-time processing of data from various sensors, and microcontrollers play a pivotal role in executing complex algorithms to ensure rapid decision-making and response.

- The increasing consumer demand for in-vehicle infotainment systems, connectivity, and other smart features amplifies the need for powerful and efficient microcontrollers. These controllers enable seamless integration of entertainment, navigation, and communication systems, providing a more enjoyable and connected driving experience.

- The automotive industry is witnessing a trend towards lightweight design and fuel efficiency. Microcontrollers contribute to achieving these goals by optimizing the performance of various vehicle components, such as engine control units and powertrain systems.

Microcontroller Market Segment Analysis:

Microcontroller Market Segmented on the basis of type and application.

By Type, 32-Bit Microcontroller segment is expected to dominate the market during the forecast period

- As technology evolves, there is a growing demand for microcontrollers that can handle intricate tasks, process large datasets, and support sophisticated algorithms, which 32-bit microcontrollers are better equipped to handle compared to their 8-bit or 16-bit counterparts. Furthermore, the expanding capabilities of modern applications, such as IoT devices, smart appliances, automotive electronics, and industrial automation systems, require microcontrollers with enhanced performance, memory, and connectivity features. 32-bit microcontrollers offer a balance between computational power and energy efficiency, making them suitable for a wide range of applications where multitasking, real-time processing, and connectivity are essential.

By Application, Consumer Electronics & Telecom segment held the largest share of xx% in 2022

- The increasing proliferation of smart devices and the Internet of Things (IoT) has driven the demand for microcontrollers in consumer electronics. These tiny yet powerful integrated circuits play a crucial role in powering a wide range of devices such as smartphones, smart TVs, wearables, and home automation systems. The expanding consumer electronics market, coupled with the integration of advanced features and functionalities, has led to a surge in the adoption of microcontrollers. The telecommunications sector is undergoing significant advancements with the deployment of 5G technology. Microcontrollers are essential components in the development of telecommunications infrastructure, providing the necessary processing power for networking equipment, base stations, and communication devices. As 5G networks continue to roll out globally, the demand for microcontrollers in the telecom sector is expected to grow substantially.

Microcontroller Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to assert its dominance in the microcontroller market, exhibiting robust growth and influencing global trends. With a burgeoning demand for electronic devices and the rapid expansion of industries such as automotive, consumer electronics, and industrial automation, the region is positioned as a key player in the microcontroller market. The escalating adoption of smart technologies and the Internet of Things (IoT) further fuel the demand for microcontrollers, integral components in these advanced systems.

- Additionally, the region's emphasis on technological innovation, research and development, and the presence of major semiconductor manufacturers contribute to its dominance. As a manufacturing hub for electronics, Asia Pacific benefits from a robust supply chain and economies of scale, making it a focal point for microcontroller production and consumption.

Microcontroller Market Top Key Players

- Texas Instruments Incorporated (U.S.)

- Zilog, Inc. (U.S.)

- Broadcom (U.S.)

- Cypress Semiconductor Corporation (U.S.)

- Intel Corporation (U.S.)

- Analog Devices, Inc. (U.S.)

- ON Semiconductor (U.S.)

- Silicon Laboratories (U.S.)

- Diodes Incorporated (U.S.)

- Lattice Semiconductor (U.S.)

- Intersil Corporation (U.S.)

- Pericom Semiconductor Corporation (U.S.)

- Infineon Technologies AG (Germany)

- Fujitsu Semiconductor Limited (Japan)

- Microchip Technology Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Renesas Electronics Corporation (Japan)

- STMicroelectronics (Switzerland)

- TE Connectivity Ltd. (Switzerland)

- Toshiba Electronic Devices & Storage Corporation (Japan)

- Yamaichi Electronics Co., Ltd. (Japan)

- ROHM CO., LTD. (Japan)

- Panasonic Corporation (Japan)

Key Industry Developments in the Microcontroller Market:

- In May 2022, NXP Semiconductors' Multi-Protocol i. MX RT crossover microcontroller, featuring an integrated time-sensitive switch for networking, unifies Industrial IoT Communication. NXP Semiconductors announced its new i. MX RT1180 crossover microcontroller. It is the first microcontroller with an integrated Gb time-sensitive networking (TSN) switch, allowing both industrial real-time and time-sensitive communications, supporting multiple communications protocols. It aims to bridge the gap between existing industrial and Industry 4.0 systems. The i.MX RT1180 provides the required connectivity, supporting multiple protocols. To accomplish this, driving a unified and safe industrial IoT communication environment at all edges of the plant.

- In April 2022, STMicroelectronics, an international semiconductor provider, is serving customers across the electronics applications industry. Seong Ji Industrial, a global one-stop supplier of enterprise-grade wireless connectivity solutions, announced the LSM module series from SeongJi powered by ST's STM32WL for sub-GHz LPWAN. The solution marks the world's first Sigfox and LoRa System-on-Chip (SoC). The LSM100A, LSM110A, and LSM200A modules, powered by STM32WL, combine low power consumption, small size, and cost efficiency to optimize sub-GHz wireless connectivity catering to a broad spectrum of industrial and consumer applications. The modules support both Sigfox and LoRa LPWAN technologies.

|

Global Microcontroller Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 20.68 Bn. |

|

Forecast Period 2023-30 CAGR: |

11.4% |

Market Size in 2030: |

USD 49.05 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MICROCONTROLLER MARKET BY TYPE (2016-2030)

- MICROCONTROLLER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- 8-BIT MICROCONTROLLER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- 16-BIT MICROCONTROLLER

- 32-BIT MICROCONTROLLER

- MICROCONTROLLER MARKET BY APPLICATION (2016-2030)

- MICROCONTROLLER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSUMER ELECTRONICS & TELECOM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUTOMOTIVE, INDUSTRIAL

- MEDICAL DEVICES

- AEROSPACE & DEFENSE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- MICROCONTROLLER Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- Texas Instruments Incorporated (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- COMPANYB Zilog, Inc. (U.S.)

- Broadcom (U.S.)

- Cypress Semiconductor Corporation (U.S.)

- Intel Corporation (U.S.)

- Analog Devices, Inc. (U.S.)

- ON Semiconductor (U.S.)

- Silicon Laboratories (U.S.)

- Diodes Incorporated (U.S.)

- Lattice Semiconductor (U.S.)

- Intersil Corporation (U.S.)

- Pericom Semiconductor Corporation (U.S.)

- Infineon Technologies AG (Germany)

- Fujitsu Semiconductor Limited (Japan)

- Microchip Technology Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Renesas Electronics Corporation (Japan)

- STMicroelectronics (Switzerland)

- TE Connectivity Ltd. (Switzerland)

- Toshiba Electronic Devices & Storage Corporation (Japan)

- COMPETITIVE LANDSCAPE

- GLOBAL MICROCONTROLLER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

Potential Market Strategies

|

Global Microcontroller Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 20.68 Bn. |

|

Forecast Period 2023-30 CAGR: |

11.4% |

Market Size in 2030: |

USD 49.05 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Microcontroller Market research report is 2023-2030.

Texas Instruments Incorporated (U.S.), Zilog, Inc. (U.S.), Broadcom (U.S.), Cypress Semiconductor Corporation (U.S.), Intel Corporation (U.S.), Analog Devices, Inc. (U.S.), ON Semiconductor (U.S.), Silicon Laboratories (U.S.), Diodes Incorporated (U.S.), Lattice Semiconductor (U.S.), Intersil Corporation (U.S.), Pericom Semiconductor Corporation (U.S.), Infineon Technologies AG (Germany), Fujitsu Semiconductor Limited (Japan), Microchip Technology Inc. (U.S.), NXP Semiconductors (Netherlands), Renesas Electronics Corporation (Japan), STMicroelectronics (Switzerland), TE Connectivity Ltd. (Switzerland), Toshiba Electronic Devices & Storage Corporation (Japan), Yamaichi Electronics Co., Ltd. (Japan), ROHM CO., LTD. (Japan), Panasonic Corporation (Japan), and Other Major Players.

The Microcontroller Market is segmented into Type, Application, and region. By Type, the market is categorized into 8-Bit Microcontroller, 16-Bit Microcontroller, and 32-Bit Microcontroller. By Application, the market is categorized into Consumer Electronics & Telecom, Automotive, Industrial, Medical Devices, Aerospace & Defense. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A microcontroller is a compact integrated circuit that combines the functions of a microprocessor, memory, and input/output peripherals within a single chip. It serves as the brain of embedded systems, efficiently executing predefined tasks and controlling devices in various applications. Unlike general-purpose microprocessors, microcontrollers are specifically designed for dedicated tasks, making them suitable for applications such as robotics, automotive control systems, consumer electronics, and industrial automation.

Microcontroller Market Size Was Valued at USD 20.68 Billion in 2022, and is Projected to Reach USD 49.05 Billion by 2030, Growing at a CAGR of 11.4% From 2023-2030.