Micro Data Center Market Synopsis

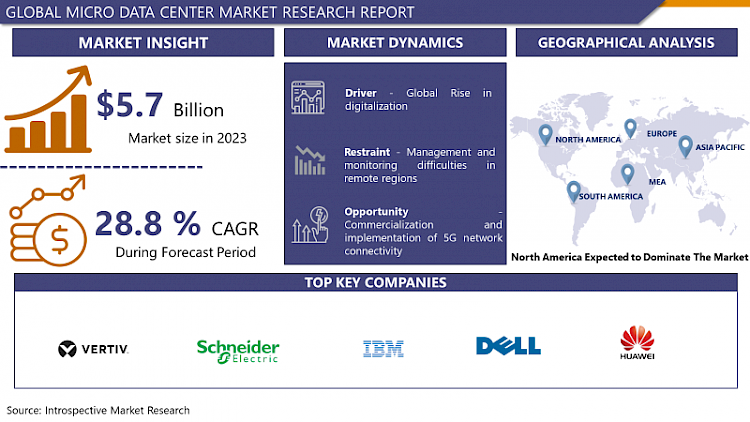

Micro Data Center Market Size Was Valued at USD 5.7 Billion in 2023, and is Projected to Reach USD 55.3 Billion by 2032, Growing at a CAGR of 28.8% From 2024-2032.

A micro data center consists of an independent, self-contained, secure “box” containing the fundamental building blocks necessary to provide the heat dissipation, power, rack, and uninterruptible power supply for all of the necessary Critical IT components together with any Management and Monitoing Software. Micro data centers allows industries to reduce their capital expenditures, the size of real estate while using only the required amount of energy as well as they can quickly deploy the systems. With the help of micro facilities that are mobile and efficient in terms of cost-effective network deployments, connectivity and power efficiency, more organizations are encouraged to adopt micro data centers in remote areas. Hence, not only speedy provisioning, but also infrastructure agility as containers or microdata centers can be quickly up for organizations to increase the business activities is enabled during computing demand booms. Changing of the location of conventional IT facilities at network sites needs more than a month of time, but the installation of micro data centers at the final facilities may take only a week. In addition to being an industry facilitator, they also initiate the growth of this market.

- Also in places that are traditionally considered remote or where the infrastructure seems to warrant small data storage centers, a modern approach allowing you to benefit from capabilities of the full-blown data centers is widely available. A standalone data center provides vendors with an excellent possibility to anonymous to any spot and at any corner of the world, regardless of the network’s abilities. The backup data centers therefore receive the positive characteristics which consequently increase their rate on the international market. Usually they are crammed with an entire package of power unit, ventilation systems, and network infrastructure that permit installation as well as maintenance to take place with ease and comfort.

- The strong growth of cloud services in various business sectors and the technological breakthroughs that pave the way for continued demand for micro mobile data centers are the driving media for the market. Further development of an array of such kinds of factors too, cyber security for industrial applications, energy efficiency of data centers and peripheral computing devices, will help to the market keep on growing.

Micro Data Center Market Trend Analysis

Organizations are increasingly adopting micro data centers.

- One the most important way to mitigate the environmental issues caused by space exploration is by making the architecture and technology as energy-efficient as possible. To do that, organizations have to implement modular solutions that could be used at the network periphery in order to decrease the latency and improve the connection for transferring and processing data. Micro facilities leave businesses to opt for mobility and deployment of micro data center solutions across peripheral locations in which their headquarters are located due to the many benefits they bring—mobility, cost effectiveness, improved networking and connectivity, and power efficiency. Moreover, the quick setup process of a Micro Data Centre helps clients across the board grow their operations on-demand to fit the spikes in their computing when necessary, and hence consequently this stimulates the Micro Data Centre market.

The communications industry's growing demand for microdata centers

- Provider of data transmission must have designs which are capable of low latency and scaling to help upgrade networks connectivity provided to customers. As 5G technology adoption become popular, the main issue is to keep happy the internet bandwidth and networking connectivity. Telecom companies are spending about 40% of the total cost to buy new cellular site/tower and install new 5G compatible network infrastructure. The application of the top-notch computing solutions will give a possibility to the organizations to make their network connection villagers much closer while reducing the issue of latency; such a scenario will stimulate the increase of demand of micro data center among business owners over the next years.

Micro Data Center Market Segment Analysis:

Micro Data Center Market is Segmented based on Component, and Application.

By Application, IT and telecommunications segment is expected to dominate the market during the forecast period

- This market of micro data center is represented as carbon dioxide emission into atmosphere consider BFSI, colocation, energy, government, healthcare, industrial, IT and telecom and other sectors. The IT and Telecommunication sector became undoubtedly the biggest part-holder in the year of 2022. The providers of telecommunications companies are, in this newly changed environment with smartphones and internet connectivity proliferative, more likely to invest heavily and use new solutions to upgrade their services. This is mainly attributed to the huge resident population among other countries and more bandwidth utilization which makes China and India the major nations in the field of internet penetration and telecom muscle. Via micro data centers telecom providers can enhance the : (a) broader application of compute functions (b) reduced network congestion and latency. As 5G network infrastructure is installed in rapid pace, telecommunication companies have concentrated on upgrading networks reliability and performance.

By Component, Solution segment held the largest share in 2023

- The micro data center market is segmented into complimentary services & solutions based on macro data constituent part belonging to them. According to forecasts, the solutions sector will expand its market share from 32% of the current estimated share of 2022 to 37% by 2032. The marketing of power solutions for a diverse range of requirements are rapidly improving with the developments of the new UPS series. Designed to instantly meet specific needs of micro data centers, the UPS systems provide improved efficiency, expandability, and adaptability thanks to these features. The examples the iCube 2 brings to my mind are the electronic library or an electronic classroom. and for the 9PX lithium-ion UPS, Eaton, which is one of the leading global companies for power management solutions, released them as part of the 9PX UPS series and the micro data center line in June 2021.

- Keeping Asian organizations to make their data center infrastructures last for the long term in view, these offerings were purposefully developed so they address unique needs and concerns of the Asia. The unceasing progress of UPS inventions in refueling the micro data center industry to get better is key for the industry to keep competitive while edge computing becomes mainstream.

Micro Data Center Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In 2021, the leadership in global micro data centers was taken by North America, which took approximately 37% share. U. S. -based telecommunications firms are building microdata centers to provide infrastructure and aid for improving 5G coverage. Small data centers are distributed directly or via proximity to network aggregation pools or cellular towers to provide boost network processing and considerably reduce latency. Telecom modernization in the European Union is closely related to changes in the same field in the United States. Severe toll +1 country code proposed with final result number 459. A total of it 48 million connections in 2021. A total of 361. Relatively speaking to the 66 million of them which of course are mobile phones, and each grasping an average of one unit. 1 mobile phones. This through this will make it possible for network towers to have base stations sites which operate in microdata centers.

Active Key Players in the Micro Data Center Market

- Vertiv Co

- Schneider Electric SE

- IBM Corporation

- Dell Inc

- Huawei Technologies Co. Ltd

- Hewlett Packard Enterprise Company

- Eaton Corporation

- Other Key Players

Key Industry Developments in the Micro Data Center Market:

- Dell Inc. integrated liquid cooling technology into the Dell Micro 815 data center in June 2023. It is asserted by the company that its liquid cooling technology accomplishes an energy conservation of 40-50%.

- Supermicro, Inc., an all-encompassing provider of IT solutions for storage, 5G/edge, and cloud and AI/ML applications, expanded its data center offerings in May 2023 with the introduction of liquid-cooled NVIDIA HGX H100 rack-scale solutions. By implementing measures to improve energy efficiency and decrease refrigeration expenses, the organization enhances the suitability of micro data centers for businesses seeking to decrease their environmental impact and operational costs.

Global Micro Data Center Market Scope:

|

Global Micro Data Center Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

28.8 % |

Market Size in 2032: |

USD 55.3 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MICRO DATA CENTERS MARKET BY COMPONENT (2017-2032)

- MICRO DATA CENTERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLUTIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICE

- MICRO DATA CENTERS MARKET BY APPLICATION (2017-2032)

- MICRO DATA CENTERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BFSI

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COLOCATION

- ENERGY

- GOVERNMENT

- HEALTHCARE

- INDUSTRIAL

- IT & TELECOM

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- MICRO DATA CENTERs Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- VERTIV CO

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SCHNEIDER ELECTRIC SE

- IBM CORPORATION

- DELL INC

- HUAWEI TECHNOLOGIES CO. LTD

- HEWLETT PACKARD ENTERPRISE COMPANY

- EATON CORPORATION

- COMPETITIVE LANDSCAPE

- GLOBAL MICRO DATA CENTERS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

Global Micro Data Center Market Scope:

|

Global Micro Data Center Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

28.8 % |

Market Size in 2032: |

USD 55.3 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MICRO DATA CENTER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MICRO DATA CENTER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MICRO DATA CENTER MARKET COMPETITIVE RIVALRY

TABLE 005. MICRO DATA CENTER MARKET THREAT OF NEW ENTRANTS

TABLE 006. MICRO DATA CENTER MARKET THREAT OF SUBSTITUTES

TABLE 007. MICRO DATA CENTER MARKET BY SOLUTION

TABLE 008. POWER MARKET OVERVIEW (2016-2028)

TABLE 009. NETWORKING MARKET OVERVIEW (2016-2028)

TABLE 010. COOLING MARKET OVERVIEW (2016-2028)

TABLE 011. RACK & ENCLOSUREE MARKET OVERVIEW (2016-2028)

TABLE 012. MICRO DATA CENTER MARKET BY RACK UNIT

TABLE 013. UP TO 25 RU MARKET OVERVIEW (2016-2028)

TABLE 014. 25-40 RU MARKET OVERVIEW (2016-2028)

TABLE 015. ABOVE 40 RU MARKET OVERVIEW (2016-2028)

TABLE 016. MICRO DATA CENTER MARKET BY INDUSTRY

TABLE 017. BANKING MARKET OVERVIEW (2016-2028)

TABLE 018. FINANCIAL SERVICES & INSURANCE MARKET OVERVIEW (2016-2028)

TABLE 019. TELECOM & INFORMATION TECHNOLOGY MARKET OVERVIEW (2016-2028)

TABLE 020. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 021. CONSTRUCTION MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA MICRO DATA CENTER MARKET, BY SOLUTION (2016-2028)

TABLE 023. NORTH AMERICA MICRO DATA CENTER MARKET, BY RACK UNIT (2016-2028)

TABLE 024. NORTH AMERICA MICRO DATA CENTER MARKET, BY INDUSTRY (2016-2028)

TABLE 025. N MICRO DATA CENTER MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE MICRO DATA CENTER MARKET, BY SOLUTION (2016-2028)

TABLE 027. EUROPE MICRO DATA CENTER MARKET, BY RACK UNIT (2016-2028)

TABLE 028. EUROPE MICRO DATA CENTER MARKET, BY INDUSTRY (2016-2028)

TABLE 029. MICRO DATA CENTER MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC MICRO DATA CENTER MARKET, BY SOLUTION (2016-2028)

TABLE 031. ASIA PACIFIC MICRO DATA CENTER MARKET, BY RACK UNIT (2016-2028)

TABLE 032. ASIA PACIFIC MICRO DATA CENTER MARKET, BY INDUSTRY (2016-2028)

TABLE 033. MICRO DATA CENTER MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA MICRO DATA CENTER MARKET, BY SOLUTION (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA MICRO DATA CENTER MARKET, BY RACK UNIT (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA MICRO DATA CENTER MARKET, BY INDUSTRY (2016-2028)

TABLE 037. MICRO DATA CENTER MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA MICRO DATA CENTER MARKET, BY SOLUTION (2016-2028)

TABLE 039. SOUTH AMERICA MICRO DATA CENTER MARKET, BY RACK UNIT (2016-2028)

TABLE 040. SOUTH AMERICA MICRO DATA CENTER MARKET, BY INDUSTRY (2016-2028)

TABLE 041. MICRO DATA CENTER MARKET, BY COUNTRY (2016-2028)

TABLE 042. SCHNEIDER ELECTRIC SE: SNAPSHOT

TABLE 043. SCHNEIDER ELECTRIC SE: BUSINESS PERFORMANCE

TABLE 044. SCHNEIDER ELECTRIC SE: PRODUCT PORTFOLIO

TABLE 045. SCHNEIDER ELECTRIC SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. HEWLETT PACKARD ENTERPRISE (HPE) COMPANY: SNAPSHOT

TABLE 046. HEWLETT PACKARD ENTERPRISE (HPE) COMPANY: BUSINESS PERFORMANCE

TABLE 047. HEWLETT PACKARD ENTERPRISE (HPE) COMPANY: PRODUCT PORTFOLIO

TABLE 048. HEWLETT PACKARD ENTERPRISE (HPE) COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. HITACHI LTD: SNAPSHOT

TABLE 049. HITACHI LTD: BUSINESS PERFORMANCE

TABLE 050. HITACHI LTD: PRODUCT PORTFOLIO

TABLE 051. HITACHI LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. HUAWEI TECHNOLOGIES CO LTD: SNAPSHOT

TABLE 052. HUAWEI TECHNOLOGIES CO LTD: BUSINESS PERFORMANCE

TABLE 053. HUAWEI TECHNOLOGIES CO LTD: PRODUCT PORTFOLIO

TABLE 054. HUAWEI TECHNOLOGIES CO LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. VERTIV GROUP CORP: SNAPSHOT

TABLE 055. VERTIV GROUP CORP: BUSINESS PERFORMANCE

TABLE 056. VERTIV GROUP CORP: PRODUCT PORTFOLIO

TABLE 057. VERTIV GROUP CORP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. DELL INC: SNAPSHOT

TABLE 058. DELL INC: BUSINESS PERFORMANCE

TABLE 059. DELL INC: PRODUCT PORTFOLIO

TABLE 060. DELL INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ADVANCED FACILITIES INC: SNAPSHOT

TABLE 061. ADVANCED FACILITIES INC: BUSINESS PERFORMANCE

TABLE 062. ADVANCED FACILITIES INC: PRODUCT PORTFOLIO

TABLE 063. ADVANCED FACILITIES INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ATTOM TECHNOLOGY: SNAPSHOT

TABLE 064. ATTOM TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 065. ATTOM TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 066. ATTOM TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. ALTRON: SNAPSHOT

TABLE 067. ALTRON: BUSINESS PERFORMANCE

TABLE 068. ALTRON: PRODUCT PORTFOLIO

TABLE 069. ALTRON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. CANNON TECHNOLOGIES LTD: SNAPSHOT

TABLE 070. CANNON TECHNOLOGIES LTD: BUSINESS PERFORMANCE

TABLE 071. CANNON TECHNOLOGIES LTD: PRODUCT PORTFOLIO

TABLE 072. CANNON TECHNOLOGIES LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. CANOVATE GROUP: SNAPSHOT

TABLE 073. CANOVATE GROUP: BUSINESS PERFORMANCE

TABLE 074. CANOVATE GROUP: PRODUCT PORTFOLIO

TABLE 075. CANOVATE GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. DELTA ELECTRONICS INC: SNAPSHOT

TABLE 076. DELTA ELECTRONICS INC: BUSINESS PERFORMANCE

TABLE 077. DELTA ELECTRONICS INC: PRODUCT PORTFOLIO

TABLE 078. DELTA ELECTRONICS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. EATON CORPORATION: SNAPSHOT

TABLE 079. EATON CORPORATION: BUSINESS PERFORMANCE

TABLE 080. EATON CORPORATION: PRODUCT PORTFOLIO

TABLE 081. EATON CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. FUJITSU LTD: SNAPSHOT

TABLE 082. FUJITSU LTD: BUSINESS PERFORMANCE

TABLE 083. FUJITSU LTD: PRODUCT PORTFOLIO

TABLE 084. FUJITSU LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. IBM CORPORATION: SNAPSHOT

TABLE 085. IBM CORPORATION: BUSINESS PERFORMANCE

TABLE 086. IBM CORPORATION: PRODUCT PORTFOLIO

TABLE 087. IBM CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. PANDUIT CORPORATION: SNAPSHOT

TABLE 088. PANDUIT CORPORATION: BUSINESS PERFORMANCE

TABLE 089. PANDUIT CORPORATION: PRODUCT PORTFOLIO

TABLE 090. PANDUIT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. RITTAL GMBH & CO KG: SNAPSHOT

TABLE 091. RITTAL GMBH & CO KG: BUSINESS PERFORMANCE

TABLE 092. RITTAL GMBH & CO KG: PRODUCT PORTFOLIO

TABLE 093. RITTAL GMBH & CO KG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. STULZ GMBH: SNAPSHOT

TABLE 094. STULZ GMBH: BUSINESS PERFORMANCE

TABLE 095. STULZ GMBH: PRODUCT PORTFOLIO

TABLE 096. STULZ GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. AXELLIO: SNAPSHOT

TABLE 097. AXELLIO: BUSINESS PERFORMANCE

TABLE 098. AXELLIO: PRODUCT PORTFOLIO

TABLE 099. AXELLIO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. COMPASS DATACENTRES: SNAPSHOT

TABLE 100. COMPASS DATACENTRES: BUSINESS PERFORMANCE

TABLE 101. COMPASS DATACENTRES: PRODUCT PORTFOLIO

TABLE 102. COMPASS DATACENTRES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. DARTPOINTS: SNAPSHOT

TABLE 103. DARTPOINTS: BUSINESS PERFORMANCE

TABLE 104. DARTPOINTS: PRODUCT PORTFOLIO

TABLE 105. DARTPOINTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 106. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 107. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 108. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MICRO DATA CENTER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MICRO DATA CENTER MARKET OVERVIEW BY SOLUTION

FIGURE 012. POWER MARKET OVERVIEW (2016-2028)

FIGURE 013. NETWORKING MARKET OVERVIEW (2016-2028)

FIGURE 014. COOLING MARKET OVERVIEW (2016-2028)

FIGURE 015. RACK & ENCLOSUREE MARKET OVERVIEW (2016-2028)

FIGURE 016. MICRO DATA CENTER MARKET OVERVIEW BY RACK UNIT

FIGURE 017. UP TO 25 RU MARKET OVERVIEW (2016-2028)

FIGURE 018. 25-40 RU MARKET OVERVIEW (2016-2028)

FIGURE 019. ABOVE 40 RU MARKET OVERVIEW (2016-2028)

FIGURE 020. MICRO DATA CENTER MARKET OVERVIEW BY INDUSTRY

FIGURE 021. BANKING MARKET OVERVIEW (2016-2028)

FIGURE 022. FINANCIAL SERVICES & INSURANCE MARKET OVERVIEW (2016-2028)

FIGURE 023. TELECOM & INFORMATION TECHNOLOGY MARKET OVERVIEW (2016-2028)

FIGURE 024. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 025. CONSTRUCTION MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA MICRO DATA CENTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE MICRO DATA CENTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC MICRO DATA CENTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA MICRO DATA CENTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA MICRO DATA CENTER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Micro Data Center Market research report is 2024-2032.

Vertiv Co Schneider Electric SE IBM Corporation Dell Inc Huawei Technologies Co. Ltd Hewlett Packard Enterprise Company Eaton Corporation, and Other Major Players.

The Micro Data Center Market is segmented into component, application, and region. By component, the market is categorized into Solutions, and Service. By application, the market is categorized into (BFSI, Colocation, Energy, Government, Healthcare, Industrial, IT & Telecom, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A micro data center is a scaled-down, modular iteration of conventional data centers that is purpose-built to manage particularized computations or fulfill smaller, regionalized requirements. In general, these facilities contain a reduced number of servers and infrastructure components, integrating storage, networking, and computational resources into a streamlined, self-contained unit. Due to their portability, energy efficiency, and rapid deployment, micro data centers are ideally suited for peripheral computing applications, remote locations, and environments with limited space. They provide assistance for an extensive range of applications, spanning from network periphery data processing to swift deployment in disaster recovery situations.

Micro Data Center Market Size Was Valued at USD 5.7 Billion in 2023, and is Projected to Reach USD 55.3 Billion by 2032, Growing at a CAGR of 28.8% From 2024-2032.