Metabolism Drugs Market Synopsis:

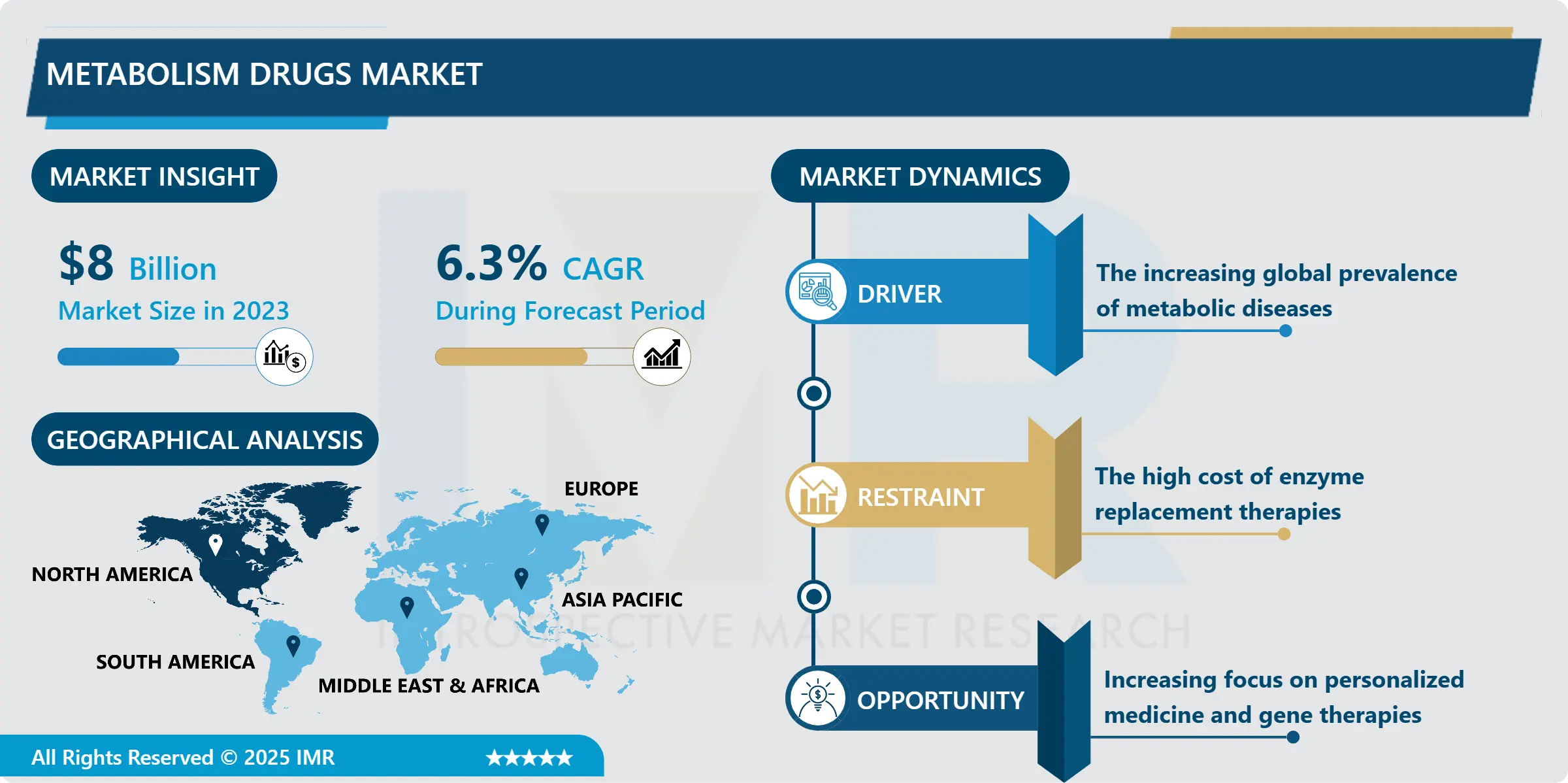

Metabolism Drugs Market Size Was Valued at USD 8.0 Billion in 2023, and is Projected to Reach USD 13.8 Billion by 2032, Growing at a CAGR of 6.3% From 2024-2032.

Metabolism Drugs Market as a business sector addresses the development, manufacturing, and distribution of drugs for the treatment of metabolic diseases, which affect the body’s capacity of converting nutrients into energy. Some of these disorders are metabolic disorders, the other ones include; disorders affecting the metabolism of lipids, carbohydrate and proteins for instance diabetes, obesity, glycogen storage diseases and enzyme deficiency or production diseases. Medications found in this market could work to restore levels of enzymes, affect insulin sensitivity, manage lipid homeostasis as well as metabolic disturbances in the liver, pancreas and skeletal muscles. It ranges from Enzyme replacement therapy /Orphan Medical to Insulin /Diabetes to Metabolic Disorders /Genzyme. Due to ever increasing incidences of metabolic disorders caused by factors such as ageing populations, diet changes and genetic profiling new specialised drugs are anticipated to flood the market, thus placing this market as a core aspect of the worldwide pharma market.

The Metabolism Drugs Market has remained fairly constant over the years due to rising global prevalence of metabolic conditions including diabetes and obesity. Recent statistics show that the instances of type 2 diabetes have been increasing steadily and at a quick pace and the reasons for this development includes low ability to engage in routined exercises, and nutritional resistance. Other metabolic disorders such as lipid disorders and other hereditary metabolic disorders, which consist of glycogen storage disorders and Fabry disease have also contributed to the rise in such treatment needs. Development in the metabolism therapeutic sector is centered mainly on Enzyme replacement therapy & replacement therapy, insulin analog, and antidiabetic, anticholesterol, and antiglycemic agents. That is why the growth of the metabolic diseases market can be boosted by the aging population of the global population.

In addition to the factors above, the Metabolism Drugs Market has other features such as: Raising the investments in the research and development (R&D). The pharmaceutical industry has increased its pursuit of better, longer acting, and targeted therapeutic approaches for metabolic disorders. This includes the use of new therapies including genetic therapies and therapies based on an individual’s genetic makeup. Effective diagnosis of the disease and their standard biomarkers together with the urge for discovery of new biomarkers to speed up the development of probable drug are contributing the growth of the market. The opportunities for market growth in the near term are seen in the development of ration therapy and drugs for rare diseases and orphan drug indication for genetic metabolic diseases.

Metabolism Drugs Market Trend Analysis:

Rising Prevalence of Lifestyle-Related Metabolic Disorders

-

The increasing prevalence of metabolic diseases mainly attributed to a sedentary lifestyle and improper diet are a powerful trend of growth influencing Metabolism Drugs Market. The leading causes of diseases that include type two diabetes, metabolic syndromes, and obesity are unhealthy eating habits, compounded bad eating habits, with more people consuming more processed foods and engaging in sedentary activities most of the time.

- Conditions are not only existing in adults but in children and adolescents thus expanding the population for drug companies to sell to. The same applies to further growth in consumption of insulin, GLP-1 receptor agonists, products based on weight loss and the promotion of insulin resistance. The advent of drugs to control these illnesses coupled with research for drugs that can prevent the progression of these diseases are some of the factors that is contributing to the high growth of this market.

Increasing Investment in Personalized Medicine

-

One of the major opportunities for the Metabolism Drugs Market is the increasing focus towards the development of personalized medicines. These breakthrough in genomics and biotechnology allow for the delivery of therapies that will be unique to a given individuals’ genotype and this leads to an enhanced effectiveness of treatments with less or no side effects associated with the same.

- Due to the nature of metabolic diseases, it is especially for genetic disorders including glycogen storage diseases that called for precise treatment course. Those that can incorporate personalized medicine into their product mix, are likely to provide better treatment options, that were designed to be more effective, and less toxic for patients. With the advancement of precision medicine, drug makers have can look for ways of providing precise solutions for metabolic diseases.

Metabolism Drugs Market Segment Analysis:

Metabolism Drugs Market is Segmented on the basis of Type, Application, Distribution Channel, and Region.

By Type, Enzyme Replacement Therapy segment is expected to dominate the market during the forecast period

-

This segment, namely Enzyme Replacement Therapy (ERT) is expected to be the leading segment of the metabolisms drugs market also in the future years mainly because of its indispensable role in treating rare metabolic disorders. Enzyme replacement therapies seek to introduce or substitute the deficient enzymes in patients with genetic diseases affecting the usual metabolic process.

- The enzyme replacement therapy products have progressed well for some diseases including Gaucher disease, Fabry disease, and Pompe disease with products including Imiglucerase, Agalsidase beta and Alglucosidase alfa. These therapies play a significant role in enhancing patient’s quality of living, avoids progression of diseases, and minimized organ transplant interventions. Owing to these enhancements in understanding these disorders, more therapies are expected to come into the market stamped a boost to this segment.

By Application, Glycogen Metabolism Disease segment expected to held the largest share

-

The segment primarily expected to contribute the most is the Glycogen Metabolism Disease segment since GSD has many effect on the patient and has the treatment. GSD is a very rare inherited Metabolic disease associated with abnormal metabolism of glycogen which causes severe problems such as liver disease , muscle wastage and low blood sugar.

- Coupled with the rising awareness level of GSD and the arrival of specific treatments are boosting the market for glycogen metabolism disease treatments. The treatment options are as follows: enzymes replacement, changes in diet and occasionally a liver transplant. Because the glycogen metabolism disease segment has not yet become common, its market share will increase as people become more aware of such diseases and the number of treatment approaches available increases.

Metabolism Drugs Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is expected to account for the highest proportion of the Metabolism Drugs Market in 2023 because of a growing incidence of metabolic diseases, including diabetes, obesity, and genetic metabolic disorders. High end healthcare infrastructure, robust and efficient health care delivery systems, and high health care expenditure on medicines as well as Research and Development. Currently, North America especially the United States is a region that hosts many pharma businesses that are engaging in the research of new metabolism products.

- An increase in spending on type 2 diabetes care also drives the growth of this market in North America, along with the larger emphasis on managing rare diseases. The global chemical that enhances oil recovery market is consolidated and has been led by North America. This is expected to remain so stagnant while expecting marginal yearly growth in future due to increasing cases of diseases of ideology and developing treatment options.

Active Key Players in the Metabolism Drugs Market:

- Amgen (USA)

- AstraZeneca (UK)

- Biomarin Pharmaceutical Inc. (USA)

- Bristol Myers Squibb (USA)

- Eli Lilly and Co. (USA)

- GSK (UK)

- Horizon Therapeutics (Ireland)

- Merck & Co. (USA)

- Novo Nordisk (Denmark)

- Pfizer (USA)

- Sanofi (France)

- Shire Pharmaceuticals (Ireland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Vertex Pharmaceuticals Inc. (USA)

- Zealand Pharma A/S (Denmark), and Other Active Players

|

Global Metabolism Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.0 Billion |

|

Forecast Period 2024-32 CAGR: |

6.3% |

Market Size in 2032: |

USD 13.8 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Metabolism Drugs Market by Type

4.1 Metabolism Drugs Market Snapshot and Growth Engine

4.2 Metabolism Drugs Market Overview

4.3 Enzyme Replacement Therapy

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Enzyme Replacement Therapy: Geographic Segmentation Analysis

4.4 Substrate Reduction Therapy

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Substrate Reduction Therapy: Geographic Segmentation Analysis

4.5 Small Molecule Drugs

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Small Molecule Drugs: Geographic Segmentation Analysis

4.6 Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Others: Geographic Segmentation Analysis

Chapter 5: Metabolism Drugs Market by Application

5.1 Metabolism Drugs Market Snapshot and Growth Engine

5.2 Metabolism Drugs Market Overview

5.3 Glycogen Metabolism Disease

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Glycogen Metabolism Disease: Geographic Segmentation Analysis

5.4 Lipid Metabolism Disease

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Lipid Metabolism Disease: Geographic Segmentation Analysis

5.5 Amino Acid Metabolism Disease

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Amino Acid Metabolism Disease: Geographic Segmentation Analysis

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Geographic Segmentation Analysis

Chapter 6: Metabolism Drugs Market by Distribution Channel

6.1 Metabolism Drugs Market Snapshot and Growth Engine

6.2 Metabolism Drugs Market Overview

6.3 Hospital Pharmacies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospital Pharmacies: Geographic Segmentation Analysis

6.4 Retail Pharmacies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Retail Pharmacies: Geographic Segmentation Analysis

6.5 Online Pharmacies

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Online Pharmacies: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Metabolism Drugs Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMGEN (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ASTRAZENECA (UK)

7.4 BIOMARIN PHARMACEUTICAL INC. (USA)

7.5 BRISTOL MYERS SQUIBB (USA)

7.6 ELI LILLY AND CO. (USA)

7.7 GSK (UK)

7.8 HORIZON THERAPEUTICS (IRELAND)

7.9 MERCK & CO. (USA)

7.10 NOVO NORDISK (DENMARK)

7.11 PFIZER (USA)

7.12 SANOFI (FRANCE)

7.13 SHIRE PHARMACEUTICALS (IRELAND)

7.14 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

7.15 VERTEX PHARMACEUTICALS INC. (USA)

7.16 ZEALAND PHARMA A/S (DENMARK)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Metabolism Drugs Market By Region

8.1 Overview

8.2. North America Metabolism Drugs Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Enzyme Replacement Therapy

8.2.4.2 Substrate Reduction Therapy

8.2.4.3 Small Molecule Drugs

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Glycogen Metabolism Disease

8.2.5.2 Lipid Metabolism Disease

8.2.5.3 Amino Acid Metabolism Disease

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size By Distribution Channel

8.2.6.1 Hospital Pharmacies

8.2.6.2 Retail Pharmacies

8.2.6.3 Online Pharmacies

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Metabolism Drugs Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Enzyme Replacement Therapy

8.3.4.2 Substrate Reduction Therapy

8.3.4.3 Small Molecule Drugs

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Glycogen Metabolism Disease

8.3.5.2 Lipid Metabolism Disease

8.3.5.3 Amino Acid Metabolism Disease

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size By Distribution Channel

8.3.6.1 Hospital Pharmacies

8.3.6.2 Retail Pharmacies

8.3.6.3 Online Pharmacies

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Metabolism Drugs Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Enzyme Replacement Therapy

8.4.4.2 Substrate Reduction Therapy

8.4.4.3 Small Molecule Drugs

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Glycogen Metabolism Disease

8.4.5.2 Lipid Metabolism Disease

8.4.5.3 Amino Acid Metabolism Disease

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size By Distribution Channel

8.4.6.1 Hospital Pharmacies

8.4.6.2 Retail Pharmacies

8.4.6.3 Online Pharmacies

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Metabolism Drugs Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Enzyme Replacement Therapy

8.5.4.2 Substrate Reduction Therapy

8.5.4.3 Small Molecule Drugs

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Glycogen Metabolism Disease

8.5.5.2 Lipid Metabolism Disease

8.5.5.3 Amino Acid Metabolism Disease

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size By Distribution Channel

8.5.6.1 Hospital Pharmacies

8.5.6.2 Retail Pharmacies

8.5.6.3 Online Pharmacies

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Metabolism Drugs Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Enzyme Replacement Therapy

8.6.4.2 Substrate Reduction Therapy

8.6.4.3 Small Molecule Drugs

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Glycogen Metabolism Disease

8.6.5.2 Lipid Metabolism Disease

8.6.5.3 Amino Acid Metabolism Disease

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size By Distribution Channel

8.6.6.1 Hospital Pharmacies

8.6.6.2 Retail Pharmacies

8.6.6.3 Online Pharmacies

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Metabolism Drugs Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Enzyme Replacement Therapy

8.7.4.2 Substrate Reduction Therapy

8.7.4.3 Small Molecule Drugs

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Glycogen Metabolism Disease

8.7.5.2 Lipid Metabolism Disease

8.7.5.3 Amino Acid Metabolism Disease

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size By Distribution Channel

8.7.6.1 Hospital Pharmacies

8.7.6.2 Retail Pharmacies

8.7.6.3 Online Pharmacies

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Metabolism Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.0 Billion |

|

Forecast Period 2024-32 CAGR: |

6.3% |

Market Size in 2032: |

USD 13.8 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||