Medical Drones Market Overview

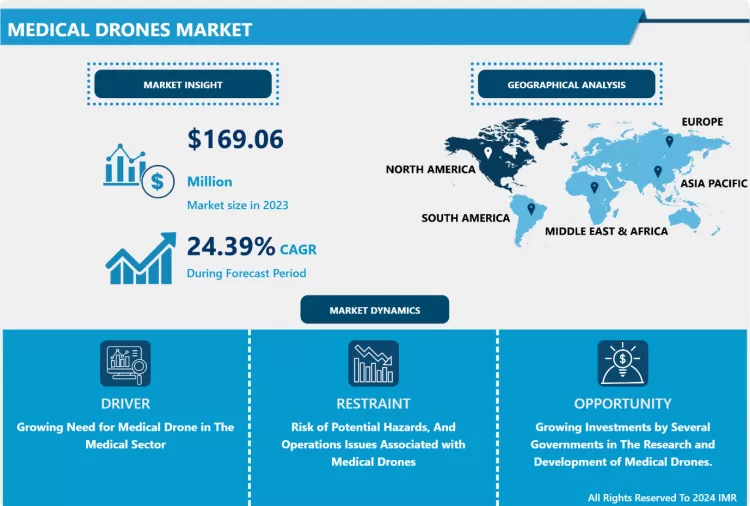

Medical Drones Market size is expected to grow from USD 169.06 Million in 2023 to USD 1,205.34 Million by 2032, at a CAGR of 24.39% during the forecast period (2024-2032).

Drones are often known as unmanned aerial vehicles (UAV). This term was first coined in the 1980s to describe remotely controlled, or autonomous, multi-use aerial vehicles. The well-known public term drone was first coined due to the resemblance of the loud and rhythmical sound of old military unmanned target aircraft to that of a male bee. In 1942, the Navy established a radio-controlled drone that carried a torpedo. The origins of UAVs can be dated back to World War I, almost 100 years back. While UAVs were initially created for the military, they are now being utilized for a wide variety of applications. Recently, the US military force used a drone controlled by the USA to selectively terminate an Iranian General in Baghdad. The recent advancement in technology has revolutionized the perspective towards drones. Drones have significantly proven their worth in the healthcare and medical sector. The drones used in this field can be referred to as medical drones. Medical drones are used to supply medical equipment, blood, organs, and pharmacy products. Drones are widely praised for their capacity to overcome the challenges faced by the healthcare delivery system that previously hindered access to healthcare services, for people particularly those living in remote or hard-to-reach areas. Drones are dignified to ramp up the retrieval and delivery of life-saving products such as vaccines or blood packs and increase access of people living in hard-to-reach rural and remote communities to a range of healthcare supplies, expertise, and procedures. Recently, Goldman Sachs an American multinational investment bank and financial services company, predicted that the total global spending on drones over the next coming years to be around US$100 billion.

COVID-19 Impact on Medical Drones Market

COVID-19 swept through the world in early 2020, technology companies struggled to withstand the financial burden and to repurpose their products to fight the pandemic. This repurposing was especially evident in the civilian drone industry, whose companies forecasted that the COVID- 19 would prove the worth of their delivery technology, inspection, and map-making in remote as well as in urban areas. Due to COVID-19 drones were getting adapted for everything from monitoring social-distance requirements to delivering medical supplies. In this pandemic era, drone delivery programs have shown promising results for the potential of using flying robots as a delivery mechanism, then also it is not evident that they have made a significant impact in fighting COVID-19. The best example of drones making a clear and direct impact on battling the virus is seen in Ghana where drones are used to deliver vaccines. Furthermore, restrictions imposed by governments of several countries on the import and export of supplies resulted in the shortage of raw materials required for manufacturing drones. Moreover, gatherings of workers in large numbers were banned to curb the spread of the SARS CoV-2 Virus, which resulted in the low production of drones. With WHO making an urgent plea to scale up the testing of COVID-19, drones were designed to carry the self-test kits to potentially infected individuals. Additionally, drones can be used to carry other essential goods to the infected person without the need for direct human contact, thus reducing infection risks among involved people. To summarize the COVID-19, the pandemic has boosted the demand for drones thus promoting the growth of the medical drone market.

Market Dynamics And Factors Of Medical Drones Market

Drivers:

The rising necessity of the medical community to move pharmaceuticals, lab tests, diagnostics, blood, and small medical devices, instantly, from point A to point B is the man driving force for the medical drone markets in the period of forecast. The speed and versatility of UAV technology offer virtually extensive opportunities to deliver vital medical supplies and assistance to individuals residing in remote or dangerous locations. Medical Drones can even connect doctors to patients in a more efficient manner. Moreover, victims of natural disasters or emergencies could be administered life-saving care by good Samaritan bystanders who are guided remote instruction on treatment administration.

A recent Johns Hopkins study reported that usage of medical drones resulted in a logistics cost savings of up to US$0.21 per dose of vaccine when compared to the traditional delivery system thus, stimulating the medical drone market development. Medical Drones increased the availability of vaccines and decreased costs over a wide range of settings provided they are utilized constantly to overcome initial capital costs of installation and maintenance hence driving the medical drone market growth. Medical drones are deployed to drop Automated external defibrillators (AED) to emergency locations where bystanders would be guided through the drone on how to perform CPR and start using the automatic defibrillator until the emergency services arrive. Furthermore, medical drones could transport medications and supplies to patients being cared for in the home instead of a hospital-based setting. Moreover, blood samples collected at home could be delivered to the lab through a drone thus, consolidating the expansion of the medical drone's market.

For instance, in 2017, Tanzania, declared its plans to adapt the Zipline drone delivery system to enhance access to essential medicines as well as basic surgical supplies. With this drone delivery system, up to 2,000 deliveries per day are planned to fly to more than 1,000 health facilities and 10 million people across the country. Additionally, in 2014, Médecins Sans Frontières demonstrated the use of drones for transporting sputum samples of tuberculosis for diagnosis in Papua New Guinea. Drones offer fast, cost-effective access to important diagnostic laboratory tests thus, promoting the expansion of the medical drones' market during the period of forecast.

Restraints:

Extreme weather conditions or differences in ambient temperatures may adversely affect drones to lose their functionality thus, hampering the growth of the medical drones' market during the period of forecast. Nowadays the drone is all set to be a major disruptive force in transportation due to the rapid usage of drones by hospitals as well as by some locals which is posing a threat to airway transportation. Moreover, the initial high cost required for the installation and maintenance of medical drones and the size of batteries is one of the major factors hindering the expansion of the medical drones' market in the period of forecast.

Furthermore, a big restrain to the usage of the medical drone is that there is still a social rejection due to the repurposed military usage of drones initially declared as humanitarian tools, as many instances have happened in various African countries thus, restricting the medical drone market growth. In addition, even though drones for the transportation of health materials are proved to be time-efficient in emergency scenarios in good weather conditions, their potential remains limited by their size and design hence hindering the medical drones market development.

Opportunities:

Drones could be a gamechanger in states that are geographically difficult to traverse. The growing investments by several governments in the research and development of medical drones for their usage in various important activities is a big opportunity for the market players to manufacture UAVs according to the need. Moreover, Medical drone usage offers the opportunity of enhancing healthcare, particularly in remote areas by decreasing lab testing turnaround times, enabling just-in-time lifesaving medical supply or medical device delivery, and decreasing the costs of routine prescription care in rural areas. Furthermore, Medical drones present a tremendous opportunity to address supply chain shortcomings in the healthcare sector thus, reducing stockouts and wastage. In addition, the integration of advanced analytics for improving the delivery of medical supplies are factors anticipated to create new opportunities for players operating in the medical drone market.

Challenges:

Every service provider wanting to deploy drones needs to overcome challenges ranging from payload capacity, safety, battery life, and of course, regulations. Flight paths need to be provided and drones managed to ensure that the right package is transported in the right conditions at the right temperature to the right location.

Market Segmentation

Global Medical Drones Market Research report comprises of Porter's five forces analysis to do the detail study about its each segmentation like Product segmentation, End user/application segment analysis and Major key players analysis mentioned as below;

Segmentation Analysis of Medical Drones Market:

Depending on Wing Type, the multi-rotor segment is anticipated to have the highest share of the medical drone market in the period of forecast. The qualities such as hovering at one place for a longer time and moving in random directions swiftly are some of the main factors driving the growth of the multi-rotor segment. Moreover, the efficiency in virtual take-off and landing (VTOL) ability, greater maneuverability, compact design, ease of use, cost-effective design, and increased payload capacity are some major factors driving the development of this segment in the medical drone market.

Depending on Technology Used, the semi-autonomous segment is forecasted to lead the market. Semi-autonomous or remotely controlled medical drones' growth is attributed to the high adoption rate for several medical operations. Usage of semi-autonomous medical drones eliminates the risk involved in the crash or delivery to an unidentified location thus driving the growth of this segment.

Depending on carrying capacity, the micro-segment is predicted to dominate the medical drone market. The approvals given by several countries for medical drones having a carrying capacity of 2 kg or less is the main factor driving the growth of this expansion. Moreover, the power required by micro-segment medical drones is comparatively less as compared to other types. The mini segment is predicted to grow at the highest growth rate.

Depending on Applications, the blood delivery segment is forecasted to dominate the medical drone market. The development of this segment is attributed to the rise in the demand for blood by various hospitals. The pandemic has further escalated the demand for blood and plasma for COVID-19 infected patients thus fueling the growth of the blood delivery segment in the medical drone market.

Depending on End-Users, emergency medical services are expected to have the highest share of the medical drone market. The capability of medical drones to reach an emergency in less time as compared to the ambulance is the main factor stimulating the expansion of this segment. Emergency medical services comprise various elements such as emergency blood requirements, AED services, and others.

Regional Analysis of Medical Drones Market:

The North American region is forecasted to have the highest share of the medical drone market. The advancement in technology and the ready adoption nature of the consumers is the major factor supporting the expansion of the medical drones' market in this region. The growing number of manufacturers and the presence of top leading companies is further propelling the medical drone market development in the North American region. The United States of America, and Canada are the major contributors to the development of the medical drone market.

Europe region is predicted to have the second-highest share of the medical drone market. The rise in the fundings for the development of medical drones and the extensive adoption of medical drones by healthcare providers are some of the major factors driving the growth of the medical drone market in this region. Furthermore, the supportive government regulations for the deployment of medical drones in regions such as the UK, Germany, France, and Italy are the important factor strengthening the expansion of the medical drone market in this region.

Asia-Pacific region is anticipated to have the highest growth rate in the medical drone market throughout the forecast. The supportive rules and regulations for the adoption of medical drones across the healthcare sector by governments such as India, China, Japan, and Australia are stimulating the expansion of the medical drone market. Moreover, the growing advancement in technology and the rise in the necessity to administer medical drones for transportation of blood and other vital medical supplies are fueling the growth of the medical drone market.

The Middle East and Africa region are expected to have a significant growth in the medical drone market owing to the growing fundings by UN and UNICEF to provide people living in these regions with all the necessary medical facilities in a short period. For instance, Johnsons and Johnsons company is supporting an innovative program that utilizes medical drones to deliver HIV treatments and medications for people living in Uganda.

The South American region is expected to have a steady growth rate in the medical drone market. The rising awareness of the beneficial effects of medical drones is propelling the growth of the medical drone market in this region.

Players Covered in Medical Drones Market are :

- Flirtey (US)

- Zipline (US)

- DJI (China)

- Volocopter GmbH (Germany)

- Wingcopter (Germany)

- Everdrone AB (Sweden)

- Flytrex Inc (Israel)

- Skyfarer LTD (UK)

- MATTERNET (US)

- ANA HOLDINGS INC. (Japan)

- EMBENTION (Spain)

- SkyLark Drones (India)

- Grene Robotics (India)

- ideaForge (India)

- Freefly Systems (US) and others Major Players.

Key Industry Developments In Medical Drones Market

- In August 2023, OhioHealth announced a collaboration with Ziplinein to integrate Zipline’s fully electric drone delivery into OhioHealth’s network for drone delivery of medications, lab work and supplies.

- In September 2023, Cipla launched drone-based delivery capabilities in India for critical medicines. This move will enable the company to send important medications to difficult to reach places and improve company reach.

- In May 2023, RigiTech, a Swiss UAV medical drone delivery specialist, announced a strategic partnership with Spright, a U.S.-based healthcare transport company. The partnership was initiated to aid expansion across Europe and the world.

|

Global Medical Drones Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2017 to 2030 |

Market Size in 2021: |

USD 136.01 Mn. |

|

Forecast Period 2022-28 CAGR: |

24.3% |

Market Size in 2028: |

USD 775.06 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Carrying Capacity |

|

||

|

By Applications |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Drones Market by Type (2018-2032)

4.1 Medical Drones Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fixed-Wing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Multi-Rotor

4.5 Single-Rotor Helicopter

4.6 Hybrid

4.7 Others

Chapter 5: Medical Drones Market by Technology (2018-2032)

5.1 Medical Drones Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Autonomous

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Semi-Autonomous

Chapter 6: Medical Drones Market by Carrying Capacity (2018-2032)

6.1 Medical Drones Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Micro (Up To 2 Kilos)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Mini (2 To 20 Kilos)

6.5 Small (21-150 Kilos)

6.6 Large (Exceeding 150)

Chapter 7: Medical Drones Market by Applications (2018-2032)

7.1 Medical Drones Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Blood Delivery

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Vaccine Delivery

7.5 Drug Delivery

7.6 Aerial Disinfection

7.7 Monitoring and Warning

7.8 Telehealth

7.9 Others

Chapter 8: Medical Drones Market by End-Users (2018-2032)

8.1 Medical Drones Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Emergency Medical Services

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Blood Banks

8.5 Virological Labs

8.6 Pathological Labs

8.7 Hospital

8.8 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Medical Drones Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 AMAZON (US)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 APPLE (US)

9.4 LEAPFROG (US)

9.5 CTL (US)

9.6 GOOGLE (US)

9.7 MICROSOFT (US)

9.8 NABI (US)

9.9 FIRE HD 10 KIDS PRO (US)

9.10 KOBO (CANADA)

9.11 ALCATEL (FRANCE)

9.12 YOTO DEVICES (UK)

9.13 SAMSUNG (SOUTH KOREA)

9.14 LENOVO (CHINA)

9.15 VTECH (HONG KONG)

9.16 DRAGON TOUCH (CHINA)

9.17 HUAWEI (CHINA)

9.18 CHUWI (CHINA)

9.19 TECLAST (CHINA)

9.20 ALLDOCUBE (CHINA)

9.21 ACER (TAIWAN)

Chapter 10: Global Medical Drones Market By Region

10.1 Overview

10.2. North America Medical Drones Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Fixed-Wing

10.2.4.2 Multi-Rotor

10.2.4.3 Single-Rotor Helicopter

10.2.4.4 Hybrid

10.2.4.5 Others

10.2.5 Historic and Forecasted Market Size by Technology

10.2.5.1 Autonomous

10.2.5.2 Semi-Autonomous

10.2.6 Historic and Forecasted Market Size by Carrying Capacity

10.2.6.1 Micro (Up To 2 Kilos)

10.2.6.2 Mini (2 To 20 Kilos)

10.2.6.3 Small (21-150 Kilos)

10.2.6.4 Large (Exceeding 150)

10.2.7 Historic and Forecasted Market Size by Applications

10.2.7.1 Blood Delivery

10.2.7.2 Vaccine Delivery

10.2.7.3 Drug Delivery

10.2.7.4 Aerial Disinfection

10.2.7.5 Monitoring and Warning

10.2.7.6 Telehealth

10.2.7.7 Others

10.2.8 Historic and Forecasted Market Size by End-Users

10.2.8.1 Emergency Medical Services

10.2.8.2 Blood Banks

10.2.8.3 Virological Labs

10.2.8.4 Pathological Labs

10.2.8.5 Hospital

10.2.8.6 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Medical Drones Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Fixed-Wing

10.3.4.2 Multi-Rotor

10.3.4.3 Single-Rotor Helicopter

10.3.4.4 Hybrid

10.3.4.5 Others

10.3.5 Historic and Forecasted Market Size by Technology

10.3.5.1 Autonomous

10.3.5.2 Semi-Autonomous

10.3.6 Historic and Forecasted Market Size by Carrying Capacity

10.3.6.1 Micro (Up To 2 Kilos)

10.3.6.2 Mini (2 To 20 Kilos)

10.3.6.3 Small (21-150 Kilos)

10.3.6.4 Large (Exceeding 150)

10.3.7 Historic and Forecasted Market Size by Applications

10.3.7.1 Blood Delivery

10.3.7.2 Vaccine Delivery

10.3.7.3 Drug Delivery

10.3.7.4 Aerial Disinfection

10.3.7.5 Monitoring and Warning

10.3.7.6 Telehealth

10.3.7.7 Others

10.3.8 Historic and Forecasted Market Size by End-Users

10.3.8.1 Emergency Medical Services

10.3.8.2 Blood Banks

10.3.8.3 Virological Labs

10.3.8.4 Pathological Labs

10.3.8.5 Hospital

10.3.8.6 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Medical Drones Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Fixed-Wing

10.4.4.2 Multi-Rotor

10.4.4.3 Single-Rotor Helicopter

10.4.4.4 Hybrid

10.4.4.5 Others

10.4.5 Historic and Forecasted Market Size by Technology

10.4.5.1 Autonomous

10.4.5.2 Semi-Autonomous

10.4.6 Historic and Forecasted Market Size by Carrying Capacity

10.4.6.1 Micro (Up To 2 Kilos)

10.4.6.2 Mini (2 To 20 Kilos)

10.4.6.3 Small (21-150 Kilos)

10.4.6.4 Large (Exceeding 150)

10.4.7 Historic and Forecasted Market Size by Applications

10.4.7.1 Blood Delivery

10.4.7.2 Vaccine Delivery

10.4.7.3 Drug Delivery

10.4.7.4 Aerial Disinfection

10.4.7.5 Monitoring and Warning

10.4.7.6 Telehealth

10.4.7.7 Others

10.4.8 Historic and Forecasted Market Size by End-Users

10.4.8.1 Emergency Medical Services

10.4.8.2 Blood Banks

10.4.8.3 Virological Labs

10.4.8.4 Pathological Labs

10.4.8.5 Hospital

10.4.8.6 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Medical Drones Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Fixed-Wing

10.5.4.2 Multi-Rotor

10.5.4.3 Single-Rotor Helicopter

10.5.4.4 Hybrid

10.5.4.5 Others

10.5.5 Historic and Forecasted Market Size by Technology

10.5.5.1 Autonomous

10.5.5.2 Semi-Autonomous

10.5.6 Historic and Forecasted Market Size by Carrying Capacity

10.5.6.1 Micro (Up To 2 Kilos)

10.5.6.2 Mini (2 To 20 Kilos)

10.5.6.3 Small (21-150 Kilos)

10.5.6.4 Large (Exceeding 150)

10.5.7 Historic and Forecasted Market Size by Applications

10.5.7.1 Blood Delivery

10.5.7.2 Vaccine Delivery

10.5.7.3 Drug Delivery

10.5.7.4 Aerial Disinfection

10.5.7.5 Monitoring and Warning

10.5.7.6 Telehealth

10.5.7.7 Others

10.5.8 Historic and Forecasted Market Size by End-Users

10.5.8.1 Emergency Medical Services

10.5.8.2 Blood Banks

10.5.8.3 Virological Labs

10.5.8.4 Pathological Labs

10.5.8.5 Hospital

10.5.8.6 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Medical Drones Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Fixed-Wing

10.6.4.2 Multi-Rotor

10.6.4.3 Single-Rotor Helicopter

10.6.4.4 Hybrid

10.6.4.5 Others

10.6.5 Historic and Forecasted Market Size by Technology

10.6.5.1 Autonomous

10.6.5.2 Semi-Autonomous

10.6.6 Historic and Forecasted Market Size by Carrying Capacity

10.6.6.1 Micro (Up To 2 Kilos)

10.6.6.2 Mini (2 To 20 Kilos)

10.6.6.3 Small (21-150 Kilos)

10.6.6.4 Large (Exceeding 150)

10.6.7 Historic and Forecasted Market Size by Applications

10.6.7.1 Blood Delivery

10.6.7.2 Vaccine Delivery

10.6.7.3 Drug Delivery

10.6.7.4 Aerial Disinfection

10.6.7.5 Monitoring and Warning

10.6.7.6 Telehealth

10.6.7.7 Others

10.6.8 Historic and Forecasted Market Size by End-Users

10.6.8.1 Emergency Medical Services

10.6.8.2 Blood Banks

10.6.8.3 Virological Labs

10.6.8.4 Pathological Labs

10.6.8.5 Hospital

10.6.8.6 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Medical Drones Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Fixed-Wing

10.7.4.2 Multi-Rotor

10.7.4.3 Single-Rotor Helicopter

10.7.4.4 Hybrid

10.7.4.5 Others

10.7.5 Historic and Forecasted Market Size by Technology

10.7.5.1 Autonomous

10.7.5.2 Semi-Autonomous

10.7.6 Historic and Forecasted Market Size by Carrying Capacity

10.7.6.1 Micro (Up To 2 Kilos)

10.7.6.2 Mini (2 To 20 Kilos)

10.7.6.3 Small (21-150 Kilos)

10.7.6.4 Large (Exceeding 150)

10.7.7 Historic and Forecasted Market Size by Applications

10.7.7.1 Blood Delivery

10.7.7.2 Vaccine Delivery

10.7.7.3 Drug Delivery

10.7.7.4 Aerial Disinfection

10.7.7.5 Monitoring and Warning

10.7.7.6 Telehealth

10.7.7.7 Others

10.7.8 Historic and Forecasted Market Size by End-Users

10.7.8.1 Emergency Medical Services

10.7.8.2 Blood Banks

10.7.8.3 Virological Labs

10.7.8.4 Pathological Labs

10.7.8.5 Hospital

10.7.8.6 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Medical Drones Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2017 to 2030 |

Market Size in 2021: |

USD 136.01 Mn. |

|

Forecast Period 2022-28 CAGR: |

24.3% |

Market Size in 2028: |

USD 775.06 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Carrying Capacity |

|

||

|

By Applications |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Medical Drones Market research report is 2024-2032.

Flirtey (US), Zipline (US), DJI (China), Volocopter GmbH (Germany), Wingcopter (Germany), Everdrone AB (Sweden), Flytrex Inc (Israel), Skyfarer LTD (UK), MATTERNET (US), ANA HOLDINGS INC. (Japan), EMBENTION (Spain), SkyLark Drones (India), Grene Robotics (India), ideaForge (India), Freefly Systems (US), and others major players.

The Medical Drones Market is segmented into Type, Technology, Carrying Capacity, Application, End Users and Region. By Type the market is categorized into Fixed-Wing, Multi-Rotor, Single-Rotor Helicopter, Hybrid, And Others. By Technology the market is categorized into Autonomous And Semi-Autonomous. By Carrying Capacity the market is categorized into Micro {Up To 2 Kilos}, Mini {2 To 20 Kilos}, Small {21-150 Kilos}, And Large {Exceeding 150}. By Applications the market is categorized into Blood Delivery, Vaccine Delivery, Drug Delivery, Aerial Disinfection, Monitoring And Warning, Telehealth, And Others. By End-Users the market is categorized into Emergency Medical Services, Blood Banks, Virological Labs, Pathological Labs, Hospital, And Others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

Drones are often known as unmanned aerial vehicles (UAV). This term was first coined in the 1980s to describe remotely controlled, or autonomous, multi-use aerial vehicles. The well-known public term drone was first coined due to the resemblance of the loud and rhythmical sound of old military unmanned target aircraft to that of a male bee. In 1942, the Navy established a radio-controlled drone that carried a torpedo.

Medical Drones Market size is expected to grow from USD 169.06 Million in 2023 to USD 1,205.34 Million by 2032, at a CAGR of 24.39% during the forecast period (2024-2032).