Medical Device Engineering Services Market Synopsis:

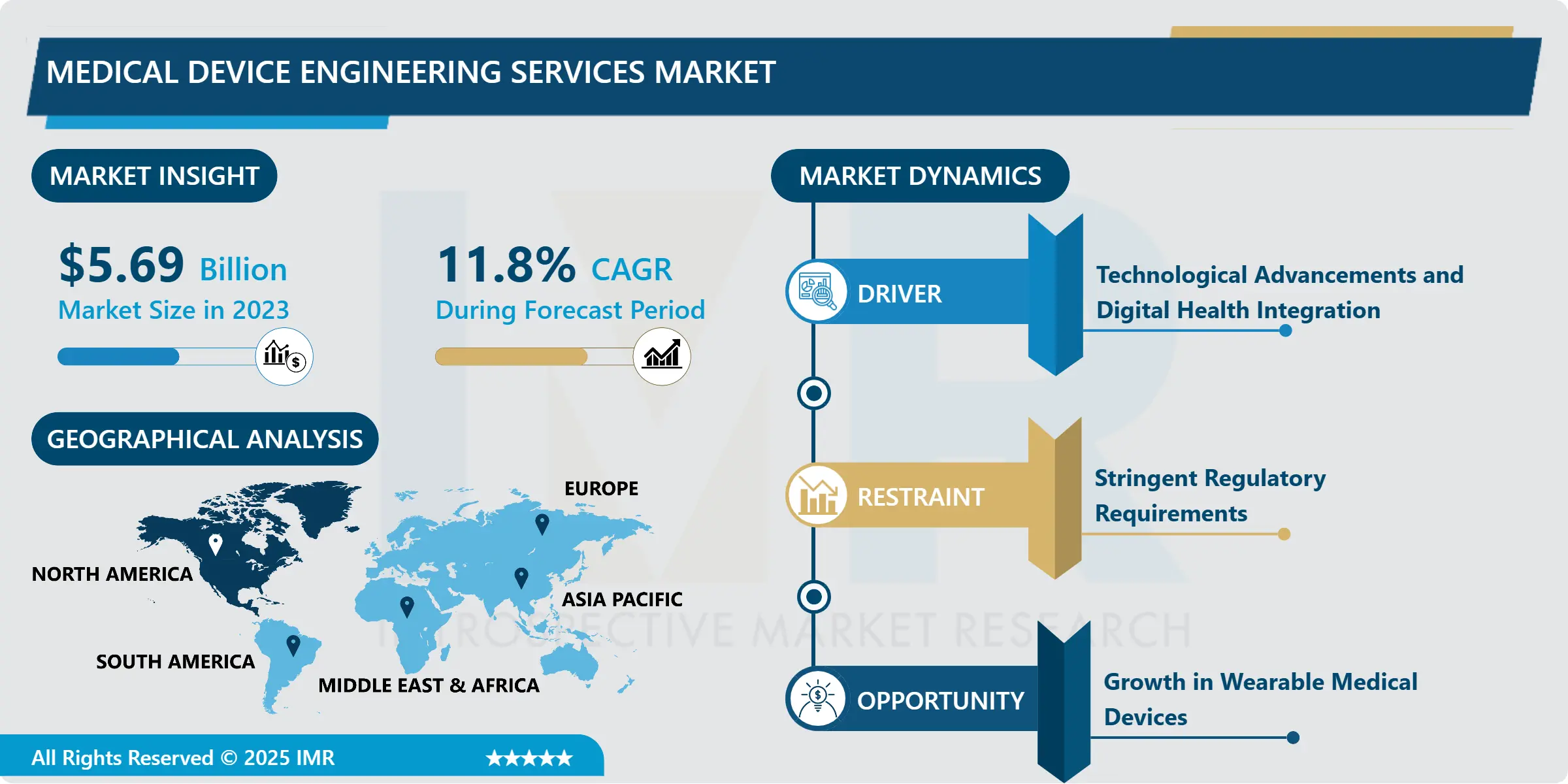

Medical Device Engineering Services Market Size Was Valued at USD 5.69 Billion in 2023, and is Projected to Reach USD 15.53 Billion by 2032, Growing at a CAGR of 11.8% From 2024-2032.

The Medical Device Engineering Services market is specialized services rendered by engineering firms to assist in designing, developing, testing, and manufacturing medical devices. The scope of services would include product design, prototyping, regulatory support testing, validation, and manufacturing support toward making the medical device safe, compliant to requirements, and efficient for healthcare application.

The Medical Device Engineering Services Market therefore has grown over the past decade because of increased demand for novel medical devices. Today, the demand for advanced medical devices has emerged through the rising rate of chronic diseases, an aging population, and the newfangled technologies that include AI, IoT, and 3D printing. Medical device engineering services have emerged as an integral component in the design and development of devices capable of meeting the needs of patients to improve health systems and hence the fulfillment of regulatory requirements, in view of the increasing technology intensity of the healthcare industry.

Further fuelled into the innovation process by medical device engineering is continued emphasis on personalized medicine and patient-centric solutions. The increasing complexity of devices and the following need for custom device solutions for target patient groups make companies search for advanced prototyping and design services. Besides this, the increasing complexity that medical equipment manufacturers are facing in maintaining the safety of their products under regulatory requirements and cost forces has made the practice of outsourcing engineering services pretty trendy among companies manufacturing medical devices.

Other regulatory factors at play in such markets have been the regulatory environment. FDA, EMA, and regional authorities have maintained strict standards for the approval of medical devices, which calls for special kind of engineering services to check whether the devices were up to the mark. Even more digital health solutions, and devices on remote monitoring along with wearable medical technologies call for engineering services to complex systems and their integration with digital platforms.

The market for medical device engineering services would still expand, encouraged by healthcare providers, manufacturers, and regulatory agencies to innovate with respect to safety and compliance. The introduction of AI and machine learning technologies in the device design and testing processes would ensure that available medical devices were more efficient and more precise for the ever-growing patient population base.

Medical Device Engineering Services Market Trend Analysis:

Advancements in AI and Automation for Design and Testing

- As the pace of artificial intelligence and automation continues to evolve, manufacturers of medical devices will find themselves more and more relying on the capabilities of these technologies to enhance the design and test processes. AI and machine learning speed up so much about the time it takes to design and prototype products by automating lots of routine tasks and freeing engineers to concentrate on more complex aspects of device creation. AI-driven simulations and predictive modeling enable fast testing of devices that do not need to proceed on the prototype testing phase as costs and time efficiency are guaranteed in such modeling.

- AI-powered automation has also made tremendous strides in medical accuracy through automation and precision tests in prototypes and finished products before and after manufacturing to ensure that these will pass stringent regulatory standards. This technological change does not only accelerate the process of development but also helps identify design flaws early in the cycle, ultimately resulting in more quality products. Being on the path where improvements are being made to AI and automation, the medical device engineering sector will also have to perceive further innovation in design, testing, and validation, promising vast efficiency, accuracy, and cost-effectiveness benefits.

Growth in Wearable Medical Devices

- Wearable medical devices is one of the promising opportunities in the medical device engineering services market. In this, health monitoring devices include fitness trackers, heart rate monitors, and continuous glucose monitors for generating real-time data and tracking vital signs. These will continue to gain traction because of trends like preventive healthcare, personalized medicine, and rising adoption of digital health technologies.

- This affords the possibility of creating much more complex wearable devices with better functionalities, much higher levels of accuracy, and greater integration into other healthcare technologies. In this space, the engineering services form key roles when it comes to the support of designing, prototyping, and testing these devices for consumer needs as well as health service providers. More and more consumers and healthcare institutions are incorporating wearable technologies into their systems. For this reason, the scope for demand in engineering services about wearables should be expanding and constantly growing. This brings a massive chance to be an innovation partner with service providers to help shape the future of wearable medical devices towards better patient outcomes.

Medical Device Engineering Services Market Segment Analysis:

Medical Device Engineering Services Market is Segmented on the basis of Service Type, Application, End User, and Region.

By Service Type, Product Design & Development segment is expected to dominate the market during the forecast period

- The services provided in the medical device engineering services market differ from one stage to the other for the product development cycle. Although holding the highest service, product design & development remains an essential one as it forms the foundation of a successful medical device. This stage includes conceptualizing and designing, along with prototyping for functional yet user-friendly devices. Prototyping services are therefore considered critical in evolving ideas into models that allow manufacturers to test and perfect designs before stepping into production.

- Testing & validation services are also pretty vital for the devices to adhere to the regulatory requirements and standards set for safety. That would include functional and compliance testing to ensure the proper functioning of the device and there is no hazard involved. This portion ensures compliance in "regulatory support" so that manufacturers do not face confusion while obtaining the approval from "regulatory agencies" for the medical devices produced and meet the national as well as international standards. Manufacturing support includes assisting the business in scaling up the production process while meeting standards for product quality and cost effectiveness. Other services include supply chain management, post-market surveillance, and device lifecycle management, which provide medical device manufacturers with ongoing support.

By Application, Diagnostic Devices segment expected to held the largest share

- Starting from medical into industrial processes, there exists a wide range of applications using medical devices, thus demanding various kinds of engineering services. Diagnostic devices play an important role in disease or conditions detection and monitoring. The pace at which personalized medicine is advancing reflects growing demand in the market for diagnostic equipment, mainly imaging equipment, laboratory devices, and IVD devices. These are devices that call for precision engineering towards the reduction of error margins for results as well as for reliability in clinical settings.

- The therapeutic ones serve in the treatment of various medical conditions and include drug delivery, infusion pumps, and surgery instruments, among others. Their complexity along with technical requirements necessitate an appreciation for specialized engineering services guaranteeing their effectiveness, safety, and case of use. Wearable devices, which are being increasingly adopted in the healthcare sector, need sophisticated engineering in terms of functionality, comfort, and constant monitoring. Future demands for wearable devices will surge as digital health technologies merge with medical devices, and, hence, wholesome scope for service providers of engineering will surface.

Medical Device Engineering Services Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is the largest market for medical device engineering services, driven by robust healthcare infrastructure, major investments in healthcare technology, and favorable regulatory environments. The US is at the forefront of innovations in medical devices manufacturing around the world. Major medical device companies thrive in the region, which has going on requirements for advanced medical technologies to boost this growth of engineering services.

- As growing awareness for digital health and telemedicine gains grounds in North America, the demand for advanced medical devices will be that much more enhanced. With the specific focus of the region being on personalized medicine and preventive care, engineering services are going to be core to the development of devices that respond to the dynamic needs of healthcare providers and patients. With the use of connected devices and AI-driven technologies, there is assurance in engineering firms further opening up opportunities for broadening services that are offered to enhance innovation in healthcare.

Active Key Players in the Medical Device Engineering Services Market:

- Medtronic (Ireland)

- GE Healthcare (United States)

- Philips Healthcare (Netherlands)

- Siemens Healthineers (Germany)

- Boston Scientific (United States)

- Stryker Corporation (United States)

- Becton Dickinson (United States)

- Abbott Laboratories (United States)

- Thermo Fisher Scientific (United States)

- Johnson & Johnson (United States)

- Cognizant Technology Solutions (United States)

- Tata Consultancy Services (India)

- Other Active Players

Key Industry Developments in the Medical Device Engineering Services Market:

- In May 2024, Infosys Limited (India) made a strategic move by acquiring InSemi Technology Services Pvt Ltd. (India). This acquisition underscores Infosys' commitment to enhancing the semiconductor ecosystem and significantly boosts its expertise in Engineering R&D services. The integration of InSemi aims to provide comprehensive end-to-end product development solutions tailored for global clients, thereby strengthening Infosys' competitive edge in the market.

- In November 2023, L&T Technology Services Limited (LTTS) (India) formed a collaboration with NVIDIA Corporation (US) to develop innovative software-defined architectures for medical devices. This partnership focuses on endoscopy applications, aiming to enhance image quality and scalability. By leveraging NVIDIA's advanced technologies, LTTS seeks to improve the functionality and performance of medical devices, positioning itself at the forefront of the healthcare technology sector

- In October 2023, Alten Group (France) expanded its global presence by acquiring East Japan Institute of Technology Co., Ltd. (Japan). This strategic acquisition aligns with ALTEN's goal of enhancing its engineering capabilities in Japan and achieving critical mass in the region. By establishing a strong foothold, ALTEN aims to position itself as a leading provider of engineering services in the competitive Japanese market.

|

Medical Device Engineering Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.69 Billion |

|

Forecast Period 2024-32 CAGR: |

11.8% |

Market Size in 2032: |

USD 15.53 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Device Engineering Services Market by Service Type

4.1 Medical Device Engineering Services Market Snapshot and Growth Engine

4.2 Medical Device Engineering Services Market Overview

4.3 Product Design & Development

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Product Design & Development: Geographic Segmentation Analysis

4.4 Prototyping

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Prototyping: Geographic Segmentation Analysis

4.5 Regulatory Support

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Regulatory Support: Geographic Segmentation Analysis

4.6 Testing & Validation

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Testing & Validation: Geographic Segmentation Analysis

4.7 Manufacturing Support

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Manufacturing Support: Geographic Segmentation Analysis

4.8 Others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Others: Geographic Segmentation Analysis

Chapter 5: Medical Device Engineering Services Market by Application

5.1 Medical Device Engineering Services Market Snapshot and Growth Engine

5.2 Medical Device Engineering Services Market Overview

5.3 Diagnostic Devices

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Diagnostic Devices: Geographic Segmentation Analysis

5.4 Therapeutic Devices

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Therapeutic Devices: Geographic Segmentation Analysis

5.5 Monitoring Devices

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Monitoring Devices: Geographic Segmentation Analysis

5.6 Surgical Devices

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Surgical Devices: Geographic Segmentation Analysis

5.7 Wearable Devices

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Wearable Devices: Geographic Segmentation Analysis

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Geographic Segmentation Analysis

Chapter 6: Medical Device Engineering Services Market by End User

6.1 Medical Device Engineering Services Market Snapshot and Growth Engine

6.2 Medical Device Engineering Services Market Overview

6.3 Medical Device Manufacturers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Medical Device Manufacturers: Geographic Segmentation Analysis

6.4 Healthcare Providers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Healthcare Providers: Geographic Segmentation Analysis

6.5 Research Institutes

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Research Institutes: Geographic Segmentation Analysis

6.6 Contract Manufacturing Organizations (CMOs)

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Contract Manufacturing Organizations (CMOs): Geographic Segmentation Analysis

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Medical Device Engineering Services Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MEDTRONIC (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GE HEALTHCARE (UNITED STATES)

7.4 PHILIPS HEALTHCARE (NETHERLANDS)

7.5 SIEMENS HEALTHINEERS (GERMANY)

7.6 BOSTON SCIENTIFIC (UNITED STATES)

7.7 STRYKER CORPORATION (UNITED STATES)

7.8 BECTON DICKINSON (UNITED STATES)

7.9 OTHER ACTIVE PLAYERS

Chapter 8: Global Medical Device Engineering Services Market By Region

8.1 Overview

8.2. North America Medical Device Engineering Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Service Type

8.2.4.1 Product Design & Development

8.2.4.2 Prototyping

8.2.4.3 Regulatory Support

8.2.4.4 Testing & Validation

8.2.4.5 Manufacturing Support

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Diagnostic Devices

8.2.5.2 Therapeutic Devices

8.2.5.3 Monitoring Devices

8.2.5.4 Surgical Devices

8.2.5.5 Wearable Devices

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Medical Device Manufacturers

8.2.6.2 Healthcare Providers

8.2.6.3 Research Institutes

8.2.6.4 Contract Manufacturing Organizations (CMOs)

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Medical Device Engineering Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Service Type

8.3.4.1 Product Design & Development

8.3.4.2 Prototyping

8.3.4.3 Regulatory Support

8.3.4.4 Testing & Validation

8.3.4.5 Manufacturing Support

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Diagnostic Devices

8.3.5.2 Therapeutic Devices

8.3.5.3 Monitoring Devices

8.3.5.4 Surgical Devices

8.3.5.5 Wearable Devices

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Medical Device Manufacturers

8.3.6.2 Healthcare Providers

8.3.6.3 Research Institutes

8.3.6.4 Contract Manufacturing Organizations (CMOs)

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Medical Device Engineering Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Service Type

8.4.4.1 Product Design & Development

8.4.4.2 Prototyping

8.4.4.3 Regulatory Support

8.4.4.4 Testing & Validation

8.4.4.5 Manufacturing Support

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Diagnostic Devices

8.4.5.2 Therapeutic Devices

8.4.5.3 Monitoring Devices

8.4.5.4 Surgical Devices

8.4.5.5 Wearable Devices

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Medical Device Manufacturers

8.4.6.2 Healthcare Providers

8.4.6.3 Research Institutes

8.4.6.4 Contract Manufacturing Organizations (CMOs)

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Medical Device Engineering Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Service Type

8.5.4.1 Product Design & Development

8.5.4.2 Prototyping

8.5.4.3 Regulatory Support

8.5.4.4 Testing & Validation

8.5.4.5 Manufacturing Support

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Diagnostic Devices

8.5.5.2 Therapeutic Devices

8.5.5.3 Monitoring Devices

8.5.5.4 Surgical Devices

8.5.5.5 Wearable Devices

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Medical Device Manufacturers

8.5.6.2 Healthcare Providers

8.5.6.3 Research Institutes

8.5.6.4 Contract Manufacturing Organizations (CMOs)

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Medical Device Engineering Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Service Type

8.6.4.1 Product Design & Development

8.6.4.2 Prototyping

8.6.4.3 Regulatory Support

8.6.4.4 Testing & Validation

8.6.4.5 Manufacturing Support

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Diagnostic Devices

8.6.5.2 Therapeutic Devices

8.6.5.3 Monitoring Devices

8.6.5.4 Surgical Devices

8.6.5.5 Wearable Devices

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Medical Device Manufacturers

8.6.6.2 Healthcare Providers

8.6.6.3 Research Institutes

8.6.6.4 Contract Manufacturing Organizations (CMOs)

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Medical Device Engineering Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Service Type

8.7.4.1 Product Design & Development

8.7.4.2 Prototyping

8.7.4.3 Regulatory Support

8.7.4.4 Testing & Validation

8.7.4.5 Manufacturing Support

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Diagnostic Devices

8.7.5.2 Therapeutic Devices

8.7.5.3 Monitoring Devices

8.7.5.4 Surgical Devices

8.7.5.5 Wearable Devices

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Medical Device Manufacturers

8.7.6.2 Healthcare Providers

8.7.6.3 Research Institutes

8.7.6.4 Contract Manufacturing Organizations (CMOs)

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Medical Device Engineering Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.69 Billion |

|

Forecast Period 2024-32 CAGR: |

11.8% |

Market Size in 2032: |

USD 15.53 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||