LFP Battery for Electric Vehicle Market Synopsis

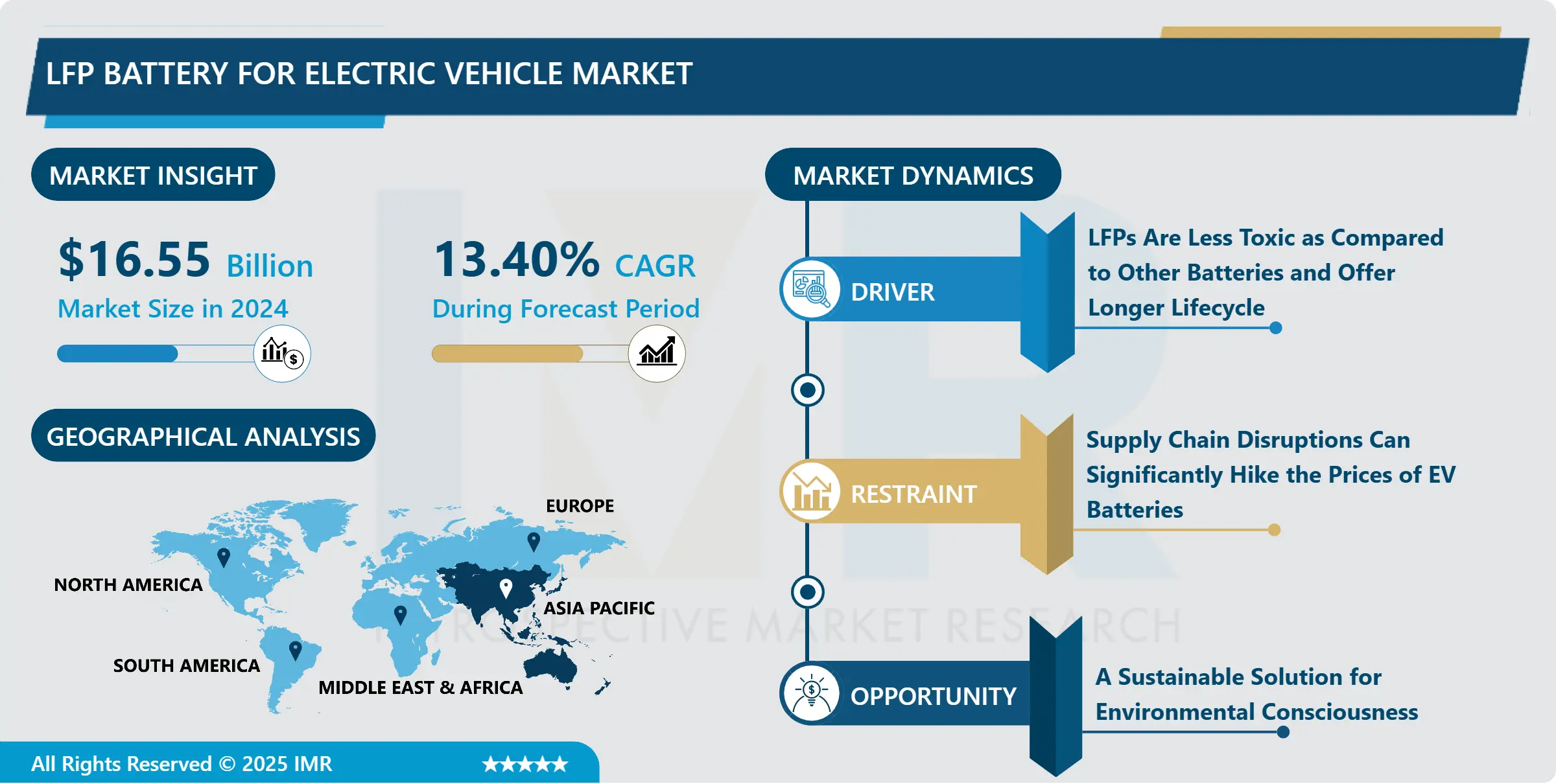

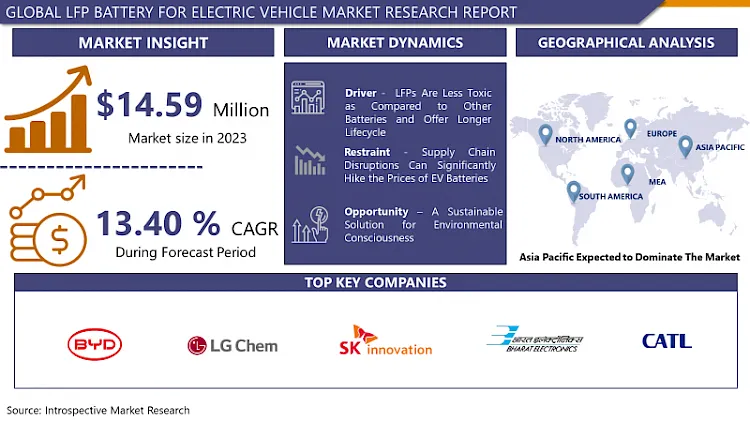

LFP Battery for Electric Vehicle Market Size Was Valued at USD 16.55 Billion in 2024, and is Projected to Reach USD 45.26 Billion by 2032, Growing at a CAGR of 13.40% From 2025-2032.

Due to their safer lithium chemistry, 'LiFePO4' or 'LFP' batteries are more robust than other commonly used EV batteries such as NMC, providing better thermal and structural stability. They also outperform other commonly used Li-ion batteries in terms of cycle life and safety. LFPs have a low self-discharge rate, which allows for a greater range and a longer life cycle. LFP chemistry has three times longer lifecycles.

Automotive and transportation are major contributors to global carbon emissions today. Private ownership has increased due to the trend of everyone in the household owning one, resulting in more vehicles on the road.

Governments around the world are putting more emphasis than ever before on seamlessly transitioning from conventional vehicles to EVs to meet the goal of lowering carbon emissions.

Furthermore, a slew of lithium-iron-phosphate (LFP) chemistries is set to expire in 2022, which could change the face of battery production across the globe.

With the increasing demand for sustainable battery solutions, the LFP battery for the electric vehicle market is anticipated to develop at a significant growth rate over the forecasted period.

LFP Battery for Electric Vehicle Market Trend Analysis

The Growing Role of LFP Batteries in Driving Global Electric Vehicle Adoption

- The global electric vehicle (EV) market is experiencing a remarkable surge, buoyed by escalating environmental concerns, governmental incentives, and notable strides in battery technology. This surge is reshaping the automotive industry as consumers increasingly prioritize sustainable transportation options. Amidst this transformation, Lithium-Ion Phosphate (LFP) batteries have emerged as a favoured solution for EV manufacturers seeking reliable and cost-effective energy storage. LFP batteries offer superior energy density, extended lifespan, and enhanced safety features, addressing key concerns of both consumers and regulators.

- Their growing prominence underscores a pivotal shift towards cleaner and more efficient mobility solutions, with LFP technology playing a central role in driving the widespread adoption of electric vehicles on a global scale.

A Sustainable Solution for Environmental Consciousness

- The global demand for electric vehicles (EVs) is on a steady rise, primarily propelled by mounting environmental consciousness and the urgent need to mitigate climate change. Governments around the world are increasingly implementing stringent regulations aimed at reducing carbon emissions from the transportation sector, which is one of the largest contributors to greenhouse gas emissions. As a result, consumers are becoming more aware of the environmental impact of their vehicles and are actively seeking cleaner alternatives. This growing awareness and demand for sustainable transportation solutions create a fertile ground for the expansion of Lithium-Ion Phosphate (LFP) battery technology in the EV market.

- LFP batteries, renowned for their high energy density and extended lifespan, are well-suited to meet the evolving needs of consumers and regulators alike. Their ability to store more energy in a compact space allows electric vehicles to achieve longer driving ranges on a single charge, addressing one of the primary concerns known as "range anxiety" among potential EV buyers. Furthermore, the durability and longevity of LFP batteries offer reassurance to consumers concerned about the long-term performance and maintenance costs of electric vehicles. As the appeal of EVs equipped with LFP batteries continues to grow in tandem with the increasing demand for sustainable transportation options, the market opportunity for LFP battery technology in the electric vehicle sector becomes even more promising.

LFP Battery for Electric Vehicle Market Segment Analysis:

LFP Battery for Electric Vehicle Market Segmented based on By Battery Type, Voltage Capacity, Applications, and Region.

By Battery Type, Cylindrical segment is expected to dominate the market during the forecast period

- Cylindrical batteries have emerged as a preferred choice in applications where durability and thermal management are paramount, notably in heavy-duty and commercial vehicles. Their tubular design allows for efficient heat dissipation, crucial for maintaining optimal operating temperatures, especially during high-demand scenarios such as heavy loads or extended driving periods.

- This inherent cooling capability not only enhances the longevity of the batteries but also ensures consistent performance under challenging conditions, making cylindrical batteries the go-to option for industries where reliability is non-negotiable.

- Furthermore, the structural integrity of cylindrical batteries reinforces their dominance in heavy-duty and commercial vehicle applications. The cylindrical form factor inherently lends itself to sturdy construction, capable of withstanding mechanical stresses and vibrations commonly encountered in rugged operating environments. This robustness translates to enhanced safety and reduced maintenance costs, factors of utmost importance in fleet operations where downtime can result in significant financial losses.

- As a result, cylindrical batteries continue to be the preferred choice for powering heavy-duty vehicles, ensuring both performance and durability in demanding usage scenarios.

By Voltage Capacity, 72V segment held the largest share in 2024

- The 72V and above segment stands out as the cornerstone of the electric vehicle battery market, particularly in heavy-duty and commercial vehicle applications. These vehicles demand substantial power to propel their operations effectively, requiring larger battery packs with higher voltage configurations to meet their energy requirements.

- The adoption of higher voltage systems is driven by the need to deliver sufficient power for extended operation cycles, ranging from long-haul transportation routes to intensive cargo handling in commercial settings. In heavy-duty vehicles like trucks and buses, where payloads and distances are significant, the reliance on higher voltage battery systems becomes indispensable to ensure adequate propulsion and operational efficiency.

- Moreover, the prevalence of higher voltage configurations in heavy-duty and commercial vehicles reflects the industry's strategic approach to balancing power output with space and weight constraints. By opting for higher voltage battery packs, manufacturers can achieve greater energy density without dramatically increasing the physical footprint or weight of the battery system.

- This optimization is crucial in heavy-duty applications where payload capacity and overall vehicle efficiency are paramount considerations. Additionally, higher voltage systems enable faster charging capabilities, a critical factor for commercial fleets where downtime directly impacts productivity and profitability. As such, the dominance of the 72V and above segment in heavy-duty and commercial vehicle applications underscores its pivotal role in driving the electrification of transportation and shaping the future of sustainable mobility.

LFP Battery for Electric Vehicle Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- In the Asia-Pacific region, China dominates the LFP battery market for EVs, fueled by aggressive government initiatives to curb pollution and promote clean transportation solutions.

- The country's vast manufacturing capabilities, coupled with significant investments in research and development, have propelled China to the forefront of the global electric vehicle market.

- Furthermore, other emerging economies in the region, such as India and South Korea, are increasingly prioritizing electrification efforts, creating new opportunities for LFP battery manufacturers.

Active Key Players in the LFP Battery for Electric Vehicle Market

- BYD Company Ltd.

- LG Chem

- SK Innovation Co. Ltd.

- Bharat Electronics Limited

- Contemporary Amperex Technology Co. Ltd. (CATL)

- Panasonic Corporation

- Samsung SDI

- Morrow batteries

- BAK Group

- Toshiba Corporation

- Hitachi

- Clarios

- RELion Batteries

- Other Active Players.

|

Global LFP Battery for Electric Vehicle Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.55 Bn. |

|

Forecast Period 2025-32 CAGR: |

13.40% |

Market Size in 2032: |

USD 45.26 Bn. |

|

Segments Covered: |

By Battery Type

|

|

|

|

By Voltage Capacity |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: LFP Battery for Electric Vehicle Market by Battery Type (2018-2032)

4.1 LFP Battery for Electric Vehicle Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Prismatic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cylindrical

Chapter 5: LFP Battery for Electric Vehicle Market by Voltage Capacity (2018-2032)

5.1 LFP Battery for Electric Vehicle Market Snapshot and Growth Engine

5.2 Market Overview

5.3 24-48V

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 48-72V

5.5 72V & above

Chapter 6: LFP Battery for Electric Vehicle Market by Applications (2018-2032)

6.1 LFP Battery for Electric Vehicle Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Passenger Cars

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Heavy Duty Vehicles

6.5 Commercial Vehicles

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 LFP Battery for Electric Vehicle Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 LEAR CORPORATION (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 JOHNSON CONTROLS INTERNATIONAL (U.S.)

7.4 PLASTICOM INTERNATIONAL (U.S.)

7.5 GENTEX CORPORATION (U.S.)

7.6 MAGNA INTERNATIONAL (CANADA)

7.7 CONTINENTAL AG (GERMANY)

7.8 BROSE FAHRZEUGTEILE GMBH & CO. KG (GERMANY)

7.9 TSG HOLDING GMBH (GERMANY)

7.10 COVESTRO AG (GERMANY)

7.11 SAINT-GOBAIN (FRANCE)

7.12 PLASTIC OMNIUM (FRANCE)

7.13 PIRELLI & C. S.P.A. (ITALY)

7.14 ADIENT PLC (IRELAND)

7.15 HUAYU AUTOMOTIVE GROUP (CHINA)

7.16 YANFENG AUTOMOTIVE TRIM SYSTEMS (CHINA)

7.17 MOTHERSON SUMI SYSTEMS LIMITED (INDIA)

7.18 YAZAKI CORPORATION (JAPAN)

7.19 SUMITOMO ELECTRIC INDUSTRIES (JAPAN)

7.20 DENSO CORPORATION (JAPAN)

7.21 SEKISUI CHEMICAL COLTD. (JAPAN)

7.22 MARELLI HOLDINGS COLTD. (JAPAN)

7.23 OTHER MAJOR PLAYERS

7.24

Chapter 8: Global LFP Battery for Electric Vehicle Market By Region

8.1 Overview

8.2. North America LFP Battery for Electric Vehicle Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Battery Type

8.2.4.1 Prismatic

8.2.4.2 Cylindrical

8.2.5 Historic and Forecasted Market Size by Voltage Capacity

8.2.5.1 24-48V

8.2.5.2 48-72V

8.2.5.3 72V & above

8.2.6 Historic and Forecasted Market Size by Applications

8.2.6.1 Passenger Cars

8.2.6.2 Heavy Duty Vehicles

8.2.6.3 Commercial Vehicles

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe LFP Battery for Electric Vehicle Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Battery Type

8.3.4.1 Prismatic

8.3.4.2 Cylindrical

8.3.5 Historic and Forecasted Market Size by Voltage Capacity

8.3.5.1 24-48V

8.3.5.2 48-72V

8.3.5.3 72V & above

8.3.6 Historic and Forecasted Market Size by Applications

8.3.6.1 Passenger Cars

8.3.6.2 Heavy Duty Vehicles

8.3.6.3 Commercial Vehicles

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe LFP Battery for Electric Vehicle Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Battery Type

8.4.4.1 Prismatic

8.4.4.2 Cylindrical

8.4.5 Historic and Forecasted Market Size by Voltage Capacity

8.4.5.1 24-48V

8.4.5.2 48-72V

8.4.5.3 72V & above

8.4.6 Historic and Forecasted Market Size by Applications

8.4.6.1 Passenger Cars

8.4.6.2 Heavy Duty Vehicles

8.4.6.3 Commercial Vehicles

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific LFP Battery for Electric Vehicle Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Battery Type

8.5.4.1 Prismatic

8.5.4.2 Cylindrical

8.5.5 Historic and Forecasted Market Size by Voltage Capacity

8.5.5.1 24-48V

8.5.5.2 48-72V

8.5.5.3 72V & above

8.5.6 Historic and Forecasted Market Size by Applications

8.5.6.1 Passenger Cars

8.5.6.2 Heavy Duty Vehicles

8.5.6.3 Commercial Vehicles

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa LFP Battery for Electric Vehicle Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Battery Type

8.6.4.1 Prismatic

8.6.4.2 Cylindrical

8.6.5 Historic and Forecasted Market Size by Voltage Capacity

8.6.5.1 24-48V

8.6.5.2 48-72V

8.6.5.3 72V & above

8.6.6 Historic and Forecasted Market Size by Applications

8.6.6.1 Passenger Cars

8.6.6.2 Heavy Duty Vehicles

8.6.6.3 Commercial Vehicles

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America LFP Battery for Electric Vehicle Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Battery Type

8.7.4.1 Prismatic

8.7.4.2 Cylindrical

8.7.5 Historic and Forecasted Market Size by Voltage Capacity

8.7.5.1 24-48V

8.7.5.2 48-72V

8.7.5.3 72V & above

8.7.6 Historic and Forecasted Market Size by Applications

8.7.6.1 Passenger Cars

8.7.6.2 Heavy Duty Vehicles

8.7.6.3 Commercial Vehicles

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global LFP Battery for Electric Vehicle Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.55 Bn. |

|

Forecast Period 2025-32 CAGR: |

13.40% |

Market Size in 2032: |

USD 45.26 Bn. |

|

Segments Covered: |

By Battery Type

|

|

|

|

By Voltage Capacity |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||