Electric Vehicle Drive System Market Synopsis

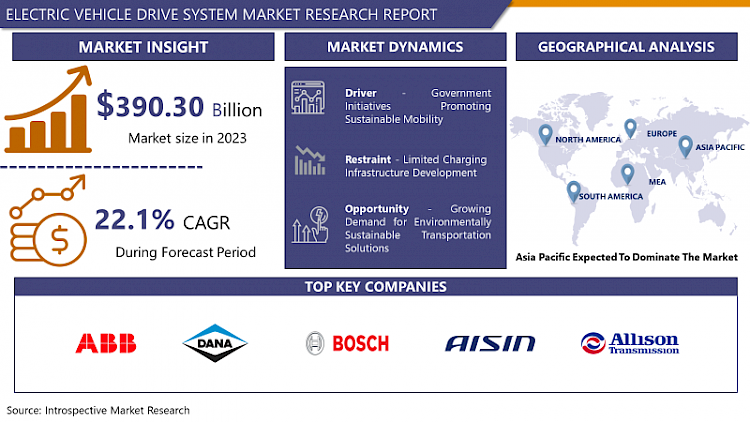

Electric Vehicle Drive System Market Size Was Valued at USD 390.30 Billion in 2023, and is Projected to Reach USD 2,354.2 Billion by 2032, Growing at a CAGR of 22.1 % From 2024-2032.

- An EV drive system is a subsystem that comprises the components that are used to power an electric vehicle. It usually comprises an electric motor, power electronics (inverters/converters), a battery pack for energy storage, and a transmission mechanism. The electric motor propels the vehicle by transforming electrical energy from the battery into mechanical energy. Power electronics regulate the power transfer between the battery and the motor. These components are at the core of an EV and are responsible for delivering propulsion in a clean and efficient manner without the use of internal combustion engines.

- The EV drive system market has witnessed significant growth in recent years due to factors like rising environmental pollution, government subsidies/fiscal policies to support electric vehicles, and progress in battery technology. This market includes a variety of components such as electric motors, power electronics, and transmission systems that are all essential to the functioning of EVs. The growing popularity of EVs globally has also led to increased competition among automobile manufacturers and technology firms to provide effective drive system solutions to improve vehicle performance, increase range, and lower costs for consumers.

- The demand for sustainability and strict emissions standards are fueling R&D to further increase the efficiency and innovation of EV drive systems. The EV drive system market looks promising due to the increasing electrification of the automotive industry.

- Other growth factors The EV drive system market is also shaped by the increasing number of charging stations for electric vehicles. Governments and private businesses invest in infrastructure to construct both charging stations and networks; range anxiety decreases, enticing consumers to purchase electric vehicles.

- The future development of autonomous driving technology is influencing the development of EV drive systems because these systems need more powerful and effective powertrains to support the advanced functions of EVs. Strategic partnerships among carmakers, tech companies, and utilities are emerging and advancing the development and connectivity of the EV value chain.

- The shift towards decarbonization and addressing climate change is accelerating the focus on electric mobility – both in terms of legislation requirements and rising customer demand.

Electric Vehicle Drive System Market Trend Analysis

Integration of Electric Drive Systems with Vehicle-to-Grid (V2G) Technology

- Electric Drive Systems with V2G: The Vehicle-to-Grid Revolution in Sustainable Transportation and Energy Management. This unique collaboration enables EVs not only to charge from the grid but also to discharge electricity back into it when required – thus making them ‘mobile batteries’. With V2G functionalities, EVs can support grid stability through demand shaping, energy time-shifting, and load shifting. This integration has great potential to improve the grid’s ability to withstand disturbances, lower greenhouse gas emissions, and better manage energy use.

- This creates new opportunities for EV owners to earn additional income by taking part in demand response programs and energy markets. The potential of V2G technology and the role of Electric Drive Systems in its implementation are expected to significantly contribute to the development of the transportation and energy sectors in the future.

- Electric Drive Systems with Vehicle-to-Grid (V2G) offers not only the potential to transform the transportation and energy industries but also provides several avenues for addressing critical issues like climate change and grid instability. In addition to its application in grid regulation and energy management, V2G integration contributes to the creation of a more responsive and sustainable energy system by enabling the connection of distributed renewable energy systems to the grid. This relationship between EVs and the grid allows for more efficient utilization of renewable energy resources by utilizing excess generation and storing it in EV batteries for future use, addressing the intermittency challenges of renewables.

- The ability to supply energy from the car to the grid makes consumers of the electricity market and gives the opportunity to reduce electricity prices not only for an individual owner of the car but also for the entire community. As more infrastructure for V2G is developed and the use of EVs grows exponentially, the integration of Electric Drive Systems and V2G will become a driving force behind the shift towards renewable and distributed energy systems.

Increasing Need for Sustainable Mobility

- The shift towards cleaner and more sustainable mobility has led to a major increase in the EV drive system market. Due to rising concerns about climate change and air pollution, many governments, consumers, and industries are switching to the use of electric vehicles to replace traditional internal combustion engine cars. This shift is not only due to increased environmental awareness but also due to the development of EV technology such as more efficient batteries, more charging stations, and better overall performance.

- The government policies and incentives favoring EV adoption also help to further expand the market. Consequently, manufacturers and suppliers within the electric vehicle drive system market are facing increased demand, which is bringing innovation and investment in the production of further efficient and cost-effective electric drive systems to respond to the growing needs of the global transportation market.

- Other factors such as the governmental policies and technological advancements also contribute to the increasing demand for electric vehicle drive systems. High fuel and oil prices encourage consumers to opt for EVs because they cost less to operate and maintain over their entire life cycle.

- The growing number of electric vehicle options with different price ranges and body styles widens the customer base by attracting a broader range of potential buyers. Strategic partnerships between auto makers, tech firms and energy utilities also support market development, promote innovation and reduce barriers to the incorporation of EVs into conventional systems. In addition, the increasing emphasis on sustainability and corporate social responsibility among companies and fleet owners further promotes the development of EVs and the consumption of high-performance ED systems.

Electric Vehicle Drive System Market Segment Analysis:

Electric Vehicle Drive System Market is Segmented on the basis of Vehicle type and application.

By Type, Hybrid Electric Vehicles (HEVs) segment is expected to dominate the market during the forecast period

- Hybrid Electric Vehicles (HEVs):HEVs utilize both an ICE drivetrain and an electric drivetrain. It helps the internal combustion engine in driving the vehicle and enhances fuel economy and emissions. An HEV does not require being plugged into charge the battery as the regenerative braking and the ICE charge the battery.

- Plug-in Hybrid Electric Vehicles (PHEVs):Some PHEVs also have an internal combustion engine and an electric motor. Yet, PHEVs have larger battery packs than HEVs and can be charged by connecting to an external source. They provide higher all-electric range and longer periods of pure electric driving before the internal combustion engine is utilized.

By Application, E-Axle segment held the largest share in 2023

- E-Axle: This refers to an electric drive that incorporates the motor, power electronics and transmission components into a single assembly which is usually mounted on the axle of the vehicle. E-Axles are the emerging solution for electric vehicles because of their compactness, enhanced efficiency, and straightforward adaptability to conventional vehicle architectures. They are a convenient solution for car manufacturers who want to add electric vehicles to their fleet without major changes in design.

- E-Wheel Drive: In contrast to E-Axle, E-Wheel Drive implies the use of a separate electric motor in every wheel of the car. The following are some of the benefits of this configuration; better traction control, handling, and possibly efficiency through the right degree of torque vectoring. E-Wheel Drive systems may be coupled with all-wheel-drive (AWD) or four-wheel-drive (4WD) and enhance the vehicle performance in different driving situations..

Electric Vehicle Drive System Market Regional Insights:

The Asia-Pacific region is currently leading the charge in the electric vehicle drive system market.

- Asia-Pacific EV Drive System Market: Emerging as the Global Leader. Countries such as China, Japan, and South Korea are at the forefront, and the region has a well-established ecosystem with technological advances, favorable government policies, and growing EV consumer markets. China for instance has established itself as one of the leading manufacturers not only of EVs but also of other crucial components such as batteries and electric motors.

- Japan and South Korea have emerged as pioneers in the innovation of advanced automotive technologies that have attracted major investments in EV infrastructure and research. This regional leadership signifies the commitment of the Asia-Pacific to cut carbon emissions and promote clean energy for sustainable mobility.

- Other countries in the Asia-Pacific region such as China and Japan along with South Korea are also making great progress in the electric vehicle drive system market. For example, India is experiencing a significant growth in the EV market due to the government’s initiatives for promoting environmentally-friendly transportation and energy independence.

- Countries in Southeast Asia are gradually acknowledging the economic and environmental advantages of adopting electric vehicles and are thus putting in place favorable policies and building charging stations. Industrial might, technological advancements, and changes in customer preferences have led to considerable opportunities for the growth of the EV drive system market in the Asia-Pacific region and consolidated its position as a global leader in sustainable mobility. With further investments in research and development and manufacturing facilities, this region has the potential to define the future of the automotive industry globally.

Active Key Players in the Electric Vehicle Drive System Market

- ABB

- Aisin Corporation

- Allison Transmission

- Borgwarner, Bosch, Continental Ag

- Dana

- Denso

- GKN (Melrose)

- Hexagon AB

- Hitachi

- Huayu Automotive Electric System

- Hyundai Mobis

- Infineon Technologies

- Jatco

- Jing-Jin Electric Technologies

- LG Electronics

- Magna International

- Mahle

- Meidensha Corporation

- Meritor

- Nidec Corporation

- Shanghai Automotive Smart Electric Drive

- Siemens AG

- Smesh E-Axle

- ZF Group

- Other Key Players

Key Industry Developments in the Electric Vehicle Drive System Market:

- At CES 2024 in January of 2024, Magna has revealed its latest 800V eDrive solution and has announced the arrival of a product on the market which, according to the company itself, sets a range of new standards for efficiency, power-to-weight ratio, and torque density.

|

Global Electric Vehicle Drive System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 476.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.1 % |

Market Size in 2032: |

USD 2,354.2 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC VEHICLE DRIVE SYSTEM MARKET BY TYPE (2017-2032)

- ELECTRIC VEHICLE DRIVE SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HYBRID ELECTRIC VEHICLES (HEVS)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

- ELECTRIC VEHICLE DRIVE SYSTEM MARKET BY APPLICATION (2017-2032)

- ELECTRIC VEHICLE DRIVE SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- E-AXLE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- E-WHEEL DRIVE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Electric Vehicle Drive System Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ABB

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AISIN CORPORATION

- ALLISON TRANSMISSION

- BORGWARNER, BOSCH, CONTINENTAL AG

- DANA

- DENSO

- GKN (MELROSE)

- HEXAGON AB

- HITACHI

- HUAYU AUTOMOTIVE ELECTRIC SYSTEM

- HYUNDAI MOBIS

- INFINEON TECHNOLOGIES

- JATCO

- JING-JIN ELECTRIC TECHNOLOGIES

- LG ELECTRONICS

- MAGNA INTERNATIONAL

- MAHLE

- MEIDENSHA CORPORATION

- MERITOR

- NIDEC CORPORATION

- SHANGHAI AUTOMOTIVE SMART ELECTRIC DRIVE

- SIEMENS AG

- SMESH E-AXLE

- ZF GROUP

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC VEHICLE DRIVE SYSTEM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Vehicle Drive System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 476.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.1 % |

Market Size in 2032: |

USD 2,354.2 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC VEHICLE DRIVE SYSTEM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC VEHICLE DRIVE SYSTEM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC VEHICLE DRIVE SYSTEM MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC VEHICLE DRIVE SYSTEM MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC VEHICLE DRIVE SYSTEM MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC VEHICLE DRIVE SYSTEM MARKET BY VEHICLE TYPE

TABLE 008. HYBRID ELECTRIC VEHICLES (HEVS) MARKET OVERVIEW (2016-2028)

TABLE 009. PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS) MARKET OVERVIEW (2016-2028)

TABLE 010. ELECTRIC VEHICLE DRIVE SYSTEM MARKET BY APPLICATION

TABLE 011. E-AXLE MARKET OVERVIEW (2016-2028)

TABLE 012. E-WHEEL DRIVE MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 014. NORTH AMERICA ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 015. N ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 017. EUROPE ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 018. ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 020. ASIA PACIFIC ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 021. ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 024. ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 026. SOUTH AMERICA ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 027. ELECTRIC VEHICLE DRIVE SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 028. ABB: SNAPSHOT

TABLE 029. ABB: BUSINESS PERFORMANCE

TABLE 030. ABB: PRODUCT PORTFOLIO

TABLE 031. ABB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. AISIN CORPORATION: SNAPSHOT

TABLE 032. AISIN CORPORATION: BUSINESS PERFORMANCE

TABLE 033. AISIN CORPORATION: PRODUCT PORTFOLIO

TABLE 034. AISIN CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. ALLISON TRANSMISSION: SNAPSHOT

TABLE 035. ALLISON TRANSMISSION: BUSINESS PERFORMANCE

TABLE 036. ALLISON TRANSMISSION: PRODUCT PORTFOLIO

TABLE 037. ALLISON TRANSMISSION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. BORGWARNER: SNAPSHOT

TABLE 038. BORGWARNER: BUSINESS PERFORMANCE

TABLE 039. BORGWARNER: PRODUCT PORTFOLIO

TABLE 040. BORGWARNER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. BOSCH: SNAPSHOT

TABLE 041. BOSCH: BUSINESS PERFORMANCE

TABLE 042. BOSCH: PRODUCT PORTFOLIO

TABLE 043. BOSCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. CONTINENTAL AG: SNAPSHOT

TABLE 044. CONTINENTAL AG: BUSINESS PERFORMANCE

TABLE 045. CONTINENTAL AG: PRODUCT PORTFOLIO

TABLE 046. CONTINENTAL AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. DANA: SNAPSHOT

TABLE 047. DANA: BUSINESS PERFORMANCE

TABLE 048. DANA: PRODUCT PORTFOLIO

TABLE 049. DANA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. DENSO: SNAPSHOT

TABLE 050. DENSO: BUSINESS PERFORMANCE

TABLE 051. DENSO: PRODUCT PORTFOLIO

TABLE 052. DENSO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. GKN (MELROSE): SNAPSHOT

TABLE 053. GKN (MELROSE): BUSINESS PERFORMANCE

TABLE 054. GKN (MELROSE): PRODUCT PORTFOLIO

TABLE 055. GKN (MELROSE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. HEXAGON AB: SNAPSHOT

TABLE 056. HEXAGON AB: BUSINESS PERFORMANCE

TABLE 057. HEXAGON AB: PRODUCT PORTFOLIO

TABLE 058. HEXAGON AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. HITACHI: SNAPSHOT

TABLE 059. HITACHI: BUSINESS PERFORMANCE

TABLE 060. HITACHI: PRODUCT PORTFOLIO

TABLE 061. HITACHI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. HUAYU AUTOMOTIVE ELECTRIC SYSTEM: SNAPSHOT

TABLE 062. HUAYU AUTOMOTIVE ELECTRIC SYSTEM: BUSINESS PERFORMANCE

TABLE 063. HUAYU AUTOMOTIVE ELECTRIC SYSTEM: PRODUCT PORTFOLIO

TABLE 064. HUAYU AUTOMOTIVE ELECTRIC SYSTEM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. HYUNDAI MOBIS: SNAPSHOT

TABLE 065. HYUNDAI MOBIS: BUSINESS PERFORMANCE

TABLE 066. HYUNDAI MOBIS: PRODUCT PORTFOLIO

TABLE 067. HYUNDAI MOBIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. INFINEON TECHNOLOGIES: SNAPSHOT

TABLE 068. INFINEON TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 069. INFINEON TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 070. INFINEON TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. JATCO: SNAPSHOT

TABLE 071. JATCO: BUSINESS PERFORMANCE

TABLE 072. JATCO: PRODUCT PORTFOLIO

TABLE 073. JATCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. JING-JIN ELECTRIC TECHNOLOGIES: SNAPSHOT

TABLE 074. JING-JIN ELECTRIC TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 075. JING-JIN ELECTRIC TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 076. JING-JIN ELECTRIC TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. LG ELECTRONICS: SNAPSHOT

TABLE 077. LG ELECTRONICS: BUSINESS PERFORMANCE

TABLE 078. LG ELECTRONICS: PRODUCT PORTFOLIO

TABLE 079. LG ELECTRONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. MAGNA INTERNATIONAL: SNAPSHOT

TABLE 080. MAGNA INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 081. MAGNA INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 082. MAGNA INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. MAHLE: SNAPSHOT

TABLE 083. MAHLE: BUSINESS PERFORMANCE

TABLE 084. MAHLE: PRODUCT PORTFOLIO

TABLE 085. MAHLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. MEIDENSHA CORPORATION: SNAPSHOT

TABLE 086. MEIDENSHA CORPORATION: BUSINESS PERFORMANCE

TABLE 087. MEIDENSHA CORPORATION: PRODUCT PORTFOLIO

TABLE 088. MEIDENSHA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. MERITOR: SNAPSHOT

TABLE 089. MERITOR: BUSINESS PERFORMANCE

TABLE 090. MERITOR: PRODUCT PORTFOLIO

TABLE 091. MERITOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. NIDEC CORPORATION: SNAPSHOT

TABLE 092. NIDEC CORPORATION: BUSINESS PERFORMANCE

TABLE 093. NIDEC CORPORATION: PRODUCT PORTFOLIO

TABLE 094. NIDEC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. SHANGHAI AUTOMOTIVE SMART ELECTRIC DRIVE: SNAPSHOT

TABLE 095. SHANGHAI AUTOMOTIVE SMART ELECTRIC DRIVE: BUSINESS PERFORMANCE

TABLE 096. SHANGHAI AUTOMOTIVE SMART ELECTRIC DRIVE: PRODUCT PORTFOLIO

TABLE 097. SHANGHAI AUTOMOTIVE SMART ELECTRIC DRIVE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. SIEMENS AG: SNAPSHOT

TABLE 098. SIEMENS AG: BUSINESS PERFORMANCE

TABLE 099. SIEMENS AG: PRODUCT PORTFOLIO

TABLE 100. SIEMENS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. SMESH E-AXLE: SNAPSHOT

TABLE 101. SMESH E-AXLE: BUSINESS PERFORMANCE

TABLE 102. SMESH E-AXLE: PRODUCT PORTFOLIO

TABLE 103. SMESH E-AXLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. ZF GROUP: SNAPSHOT

TABLE 104. ZF GROUP: BUSINESS PERFORMANCE

TABLE 105. ZF GROUP: PRODUCT PORTFOLIO

TABLE 106. ZF GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 107. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 108. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 109. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC VEHICLE DRIVE SYSTEM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC VEHICLE DRIVE SYSTEM MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 012. HYBRID ELECTRIC VEHICLES (HEVS) MARKET OVERVIEW (2016-2028)

FIGURE 013. PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS) MARKET OVERVIEW (2016-2028)

FIGURE 014. ELECTRIC VEHICLE DRIVE SYSTEM MARKET OVERVIEW BY APPLICATION

FIGURE 015. E-AXLE MARKET OVERVIEW (2016-2028)

FIGURE 016. E-WHEEL DRIVE MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA ELECTRIC VEHICLE DRIVE SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE ELECTRIC VEHICLE DRIVE SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC ELECTRIC VEHICLE DRIVE SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA ELECTRIC VEHICLE DRIVE SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA ELECTRIC VEHICLE DRIVE SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Vehicle Drive System Market research report is 2024-2032.

ABB,Aisin Corporation,Allison Transmission,Borgwarner, Bosch, Continental Ag, Dana, Denso, GKN (Melrose), Hexagon AB,and Other Major Players.

The Electric Vehicle Drive System Market is segmented into Vehicle Type, Application and region. By Vehicle Type, the market is categorized into Hybrid electric vehicles (HEVs),Plug-in hybrid electric vehicles (PHEVs). By Application , the market is categorized into E-Axle , E-Wheel Drive. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An electric vehicle (EV) drive system is the combination of components responsible for propelling an electric vehicle. It typically includes an electric motor, power electronics (such as inverters and converters), a battery pack for energy storage, and a transmission system. The electric motor converts electrical energy from the battery into mechanical energy to drive the vehicle. Power electronics manage the flow of electricity between the battery and the motor, ensuring efficient operation. Together, these components form the heart of an EV, providing clean and efficient propulsion without the need for traditional internal combustion engines.

Electric Vehicle Drive System Market Size Was Valued at USD 390.30 Billion in 2023, and is Projected to Reach USD 2,354.2 Billion by 2032, Growing at a CAGR of 22.1 % From 2024-2032.