Electric Vehicle Cooling Systems Market Synopsis

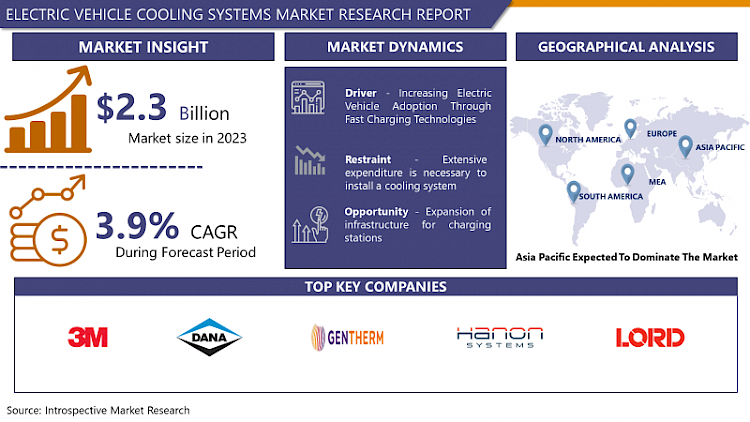

Electric Vehicle Cooling Systems Market Size Was Valued at USD 2.3 Billion in 2023, and is Projected to Reach USD 3.2 Billion by 2032, Growing at a CAGR of 3.9% From 2024-2032.

- The refrigeration system is the subsystem responsible for ensuring the battery’s temperature is regulated in the vehicle. An electric automobile operates on batteries that are both rechargeable. It involves heat generation inside EV batteries as the vehicles power the actuators. As such the battery temperature must be maintained within the required levels; hence a thermal management system is required. Battery cooling system is one of the thermal management systems in an electric vehicle that is used to regulate the temperature of the battery and the other components in the vehicle. The primary factor behind a quick deterioration of batteries in EVs is a heat event.

- During the period, the battery will have a decrease in the efficiency in every exertion due to more heat produced in it. A battery is stressed when a rapid full direct current charge is applied to it which is not good for the health of the battery. The high temperature of the battery causes the evaporation of the battery liquid that eventually results in the permanent damage to the battery itself. An additional temperature results in decreased battery life, reduced vehicle performance, and decreased fuel economy. It is necessary for electric cars to equipping a cooling system of battery that can control the temperature of the battery and enhance the ability and lifetime of battery. Increased number of quick charging stations has resulted in increasing demands for electric vehicles by the consumer market which is responsible for the growth of the market for EV cooling systems.

- Likewise, the EV technology gets little by little acknowledge in the automotive trade, the desire for cooling systems which are effective and powerful likewise increases. Apart from the issue of enhancing the durability of batteries, these cooling systems are the assurance of quality and safety applications of EVs. For example, under the technological segment, there are several mechanisms and systems that are being installed, regarding cooling techniques and smart thermal management, which are being implemented, and this presents an opportunity for EV makers to offer vehicles that will not only meet, but also exceed customer expectations.

- Also, the introduction of the renewable resources of energy such as solar in the charging infrastructure can help reduce the environmental effects of automobiles on electric cars and, thus, enhance their sustainability and marketability. The increased demand for environment-friendly cars with less or zero emission has shifted the automotive sector from the traditional combustion to electrification technology Hence, the role of cooling systems is paramount in future vehicles.

Electric Vehicle Cooling Systems Market Trend Analysis

Integration of advanced materials and technologies for enhanced thermal management

- Manufacturers are investing in research and development to create cooling systems that are lighter, more efficient, and capable of handling higher power densities. This includes the utilization of innovative materials with superior thermal conductivity properties, such as graphene and carbon nanotubes, as well as the implementation of sophisticated thermal management solutions like phase change materials and thermoelectric cooling.

- Additionally, there is a growing focus on the development of modular and adaptable cooling systems that can be tailored to meet the specific requirements of different EV models and battery chemistries. This trend reflects the diverse needs of EV manufacturers and consumers, ranging from compact city cars to high-performance electric sports vehicles, each with unique cooling demands.

- Furthermore, the rise of autonomous driving technologies is driving demand for advanced thermal management solutions capable of maintaining optimal operating temperatures for sensors, processors, and other electronic components essential for autonomous functionality. This integration of cooling systems with autonomous vehicle platforms represents a significant opportunity for market growth and innovation in the coming years.

- Overall, the electric vehicle cooling systems market is witnessing a shift towards more efficient, adaptable, and technologically advanced solutions to meet the evolving demands of the electric vehicle industry.

Expansion of infrastructure for charging stations

- As the adoption of electric vehicles continues to grow, there is a corresponding need to build more charging stations to support these vehicles' charging requirements. With the proliferation of rapid charging stations, there is an increased demand for efficient cooling systems to ensure the longevity and performance of EV batteries during rapid charging cycles.

- Furthermore, as automotive manufacturers strive to extend the driving range of electric vehicles, there is a growing need for advanced thermal management solutions that can effectively regulate the temperature of EV batteries. This presents an opportunity for companies specializing in innovative cooling technologies to develop and supply cutting-edge solutions that meet the evolving demands of the market.

- Moreover, the rise of autonomous driving technology is expected to further drive the demand for electric vehicles. Autonomous vehicles often require high-power computing systems, which generate additional heat that needs to be managed efficiently. Electric vehicle cooling systems that can effectively dissipate heat generated by both the battery and onboard electronics will be in high demand to ensure the safe and reliable operation of autonomous electric vehicles.

- Additionally, with increasing environmental concerns and stringent regulations aimed at reducing greenhouse gas emissions, there is a growing emphasis on developing sustainable solutions for transportation. Electric vehicles offer a cleaner and more environmentally friendly alternative to traditional internal combustion engine vehicles. The adoption of electric vehicles is likely to accelerate in the coming years, presenting a significant opportunity for companies involved in the electric vehicle cooling systems market to capitalize on the growing demand for sustainable transportation solutions.

Electric Vehicle Cooling Systems Market Segment Analysis:

Electric Vehicle Cooling Systems Market Segmented on the basis of System Type and Vehicle Type.

By System Type, Air Cooling System segment is expected to dominate the market during the forecast period

- The dominance of the air-cooling system segment in the electric vehicle cooling systems market during the forecast period underscores the industry's emphasis on cost-effectiveness and simplicity. Air cooling systems utilize ambient air to dissipate heat generated by electric vehicle components, offering a relatively straightforward and efficient solution for thermal management. This approach aligns with the automotive industry's efforts to streamline manufacturing processes and reduce overall vehicle costs, making air cooling systems a preferred choice for many electric vehicle manufacturers.

- Furthermore, air cooling systems boast inherent advantages such as lighter weight and fewer mechanical components, contributing to improved vehicle efficiency and driving range. With the increasing demand for electric vehicles worldwide, the scalability and affordability of air-cooling systems make them an attractive option for both mainstream and niche electric vehicle models. As technology continues to evolve, innovations in air cooling system design and implementation are expected to further enhance their performance and efficiency, solidifying their position as the dominant solution in the electric vehicle cooling systems market.

By Vehicle Type, Battery Electric Vehicle segment held the largest share

- The dominance of the Battery Electric Vehicle (BEV) segment in the electric vehicle cooling systems market underscores the pivotal role of cooling technology in ensuring the efficient operation of these vehicles. BEVs rely solely on battery power for propulsion, making the management of battery temperature critical for performance and longevity. As BEVs continue to gain prominence in the automotive market, driven by factors like environmental consciousness and government incentives, the demand for advanced cooling systems tailored to the unique needs of electric propulsion is poised for substantial growth.

- The preference for BEVs among consumers is fueled by their zero-emission nature and lower operating costs compared to traditional internal combustion engine vehicles. With automakers increasingly investing in the development of BEV platforms and expanding their electric vehicle offerings, the demand for sophisticated cooling solutions designed specifically for BEVs is expected to surge. This trend highlights the strategic importance for cooling system manufacturers to focus their efforts on catering to the evolving requirements of the Battery Electric Vehicle segment to capitalize on the burgeoning opportunities in the electric vehicle cooling systems market.

Electric Vehicle Cooling Systems Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to dominate the electric vehicle cooling systems market over the forecast period, driven by several key factors. With rapidly expanding economies like China and India leading the charge towards electric mobility, there is a significant push for the adoption of electric vehicles across the region. This surge in demand for electric vehicles is expected to fuel the need for efficient cooling systems to ensure optimal performance and longevity of batteries, especially in the context of the region's diverse climates and traffic conditions.

- Furthermore, government initiatives and supportive policies aimed at promoting electric vehicle adoption, coupled with increasing environmental awareness, are propelling the growth of the electric vehicle market in the Asia Pacific region. As a result, manufacturers and suppliers of electric vehicle cooling systems are likely to witness a surge in demand from this region, creating lucrative opportunities for expansion and innovation in the coming years.

Active Key Players in the Electric Vehicle Cooling Systems Market

- 3M (United States)

- Dana Incorporated (United States)

- Gentherm Incorporated (United States)

- Grayson (Washington, DC)

- Hanon Systems (Daejeon, South Korea)

- Lord Corporation (North Carolina, United States)

- Mahle GmbH (Stuttgart, Germany)

- Polymer Science Inc. (Monticello, IN)

- Robert Bosch GmbH (Gerlingen, Germany)

- Valeo (Paris, France)

- Voss Automotive GmbH (Germany)

- BorgWarner Inc. (United States)

- Continental AG (Germany)

- Denso Corporation (Japan)

- Johnson Electric Holdings Limited (Hong Kong)

- Kongsberg Automotive (Norway)

- Other key Players

Key Industry Developments in the Electric Vehicle Cooling Systems Market:

- In April 2024, Bounce Infinity launched a portable liquid-cooled battery for e-scooters in collaboration with Clean Electric. It was touted as India's first of its kind, marking a milestone in electric vehicle (EV) technology. The innovation promised extended range, rapid charging capabilities, and an enhanced battery lifespan, representing a significant leap forward in EV performance.

- In January 2024, Hitachi Energy finalized its acquisition of COET, enhancing its global standing in sustainable energy solutions. The acquisition, completed today, involved COET, a prominent developer and producer of power equipment for electric mobility, rail, and industrial sectors in the greater Milan region of Italy. This move bolsters Hitachi Energy's capabilities in high-power electric vehicle charging infrastructure, power electronics, and advancements in grid-edge technologies.

|

Global Electric Vehicle Cooling Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.9 % |

Market Size in 2032: |

USD 3.2 Bn. |

|

Segments Covered: |

By System Type |

|

|

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- SEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC VEHICLE COOLING SYSTEMS MARKET BY SYSTEM TYPE (2017-2032)

- ELECTRIC VEHICLE COOLING SYSTEMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AIR COOLING SYSTEM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LIQUID COOLING SYSTEM

- ELECTRIC VEHICLE COOLING SYSTEMS MARKET BY VEHICLE TYPE (2017-2032)

- ELECTRIC VEHICLE COOLING SYSTEMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BATTERY ELECTRIC VEHICLE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HYBRID ELECTRIC VEHICLE

- PLUG-IN-HYBRID ELECTRIC VEHICLE

- FUEL CELL ELECTRIC VEHICLE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- ELECTRIC VEHICLE COOLING SYSTEMS Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- 3M (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- DANA INCORPORATED (UNITED STATES)

- GENTHERM INCORPORATED (UNITED STATES)

- GRAYSON (UNITED STATES)

- LORD CORPORATION (UNITED STATES)

- POLYMER SCIENCE INC. (UNITED STATES)

- ROBERT BOSCH GMBH (GERMANY)

- VOSS AUTOMOTIVE GMBH (GERMANY)

- MAHLE GMBH (GERMANY)

- VALEO (FRANCE)

- HANON SYSTEMS (SOUTH KOREA)

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC VEHICLE COOLING SYSTEMS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By System Type

- Historic And Forecasted Market Size By Vehicle Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors and Opportunities

- Key Manufacturers

- Historic and Forecasted Market Size By Segments

- Historic and Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Vehicle Cooling Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.9 % |

Market Size in 2032: |

USD 3.2 Bn. |

|

Segments Covered: |

By System Type |

|

|

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC VEHICLE COOLING SYSTEMS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC VEHICLE COOLING SYSTEMS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC VEHICLE COOLING SYSTEMS MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC VEHICLE COOLING SYSTEMS MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC VEHICLE COOLING SYSTEMS MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC VEHICLE COOLING SYSTEMS MARKET BY SYSTEM TYPE

TABLE 008. AIR COOLING SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 009. LIQUID COOLING SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 010. ELECTRIC VEHICLE COOLING SYSTEMS MARKET BY VEHICLE TYPE

TABLE 011. BATTERY ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 012. HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 013. PLUG-IN-HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 014. FUEL CELL ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY SYSTEM TYPE (2016-2028)

TABLE 016. NORTH AMERICA ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 017. N ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY SYSTEM TYPE (2016-2028)

TABLE 019. EUROPE ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 020. ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY SYSTEM TYPE (2016-2028)

TABLE 022. ASIA PACIFIC ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 023. ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY SYSTEM TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 026. ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY SYSTEM TYPE (2016-2028)

TABLE 028. SOUTH AMERICA ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 029. ELECTRIC VEHICLE COOLING SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 030. ROBERT BOSCH GMBH: SNAPSHOT

TABLE 031. ROBERT BOSCH GMBH: BUSINESS PERFORMANCE

TABLE 032. ROBERT BOSCH GMBH: PRODUCT PORTFOLIO

TABLE 033. ROBERT BOSCH GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. GENTHERM INCORPORATED: SNAPSHOT

TABLE 034. GENTHERM INCORPORATED: BUSINESS PERFORMANCE

TABLE 035. GENTHERM INCORPORATED: PRODUCT PORTFOLIO

TABLE 036. GENTHERM INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. VALEO: SNAPSHOT

TABLE 037. VALEO: BUSINESS PERFORMANCE

TABLE 038. VALEO: PRODUCT PORTFOLIO

TABLE 039. VALEO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. DANA INCORPORATED: SNAPSHOT

TABLE 040. DANA INCORPORATED: BUSINESS PERFORMANCE

TABLE 041. DANA INCORPORATED: PRODUCT PORTFOLIO

TABLE 042. DANA INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. MAHLE GMBH: SNAPSHOT

TABLE 043. MAHLE GMBH: BUSINESS PERFORMANCE

TABLE 044. MAHLE GMBH: PRODUCT PORTFOLIO

TABLE 045. MAHLE GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. HANON SYSTEMS: SNAPSHOT

TABLE 046. HANON SYSTEMS: BUSINESS PERFORMANCE

TABLE 047. HANON SYSTEMS: PRODUCT PORTFOLIO

TABLE 048. HANON SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. VOSS AUTOMOTIVE GMBH: SNAPSHOT

TABLE 049. VOSS AUTOMOTIVE GMBH: BUSINESS PERFORMANCE

TABLE 050. VOSS AUTOMOTIVE GMBH: PRODUCT PORTFOLIO

TABLE 051. VOSS AUTOMOTIVE GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. 3M: SNAPSHOT

TABLE 052. 3M: BUSINESS PERFORMANCE

TABLE 053. 3M: PRODUCT PORTFOLIO

TABLE 054. 3M: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. GRAYSON: SNAPSHOT

TABLE 055. GRAYSON: BUSINESS PERFORMANCE

TABLE 056. GRAYSON: PRODUCT PORTFOLIO

TABLE 057. GRAYSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. POLYMER SCIENCE INC.: SNAPSHOT

TABLE 058. POLYMER SCIENCE INC.: BUSINESS PERFORMANCE

TABLE 059. POLYMER SCIENCE INC.: PRODUCT PORTFOLIO

TABLE 060. POLYMER SCIENCE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. LORD CORPORATION: SNAPSHOT

TABLE 061. LORD CORPORATION: BUSINESS PERFORMANCE

TABLE 062. LORD CORPORATION: PRODUCT PORTFOLIO

TABLE 063. LORD CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 064. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 065. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 066. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC VEHICLE COOLING SYSTEMS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC VEHICLE COOLING SYSTEMS MARKET OVERVIEW BY SYSTEM TYPE

FIGURE 012. AIR COOLING SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 013. LIQUID COOLING SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 014. ELECTRIC VEHICLE COOLING SYSTEMS MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 015. BATTERY ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 016. HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 017. PLUG-IN-HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 018. FUEL CELL ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA ELECTRIC VEHICLE COOLING SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE ELECTRIC VEHICLE COOLING SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC ELECTRIC VEHICLE COOLING SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA ELECTRIC VEHICLE COOLING SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA ELECTRIC VEHICLE COOLING SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Vehicle Cooling Systems Market research report is 2024-2032.

3M (United States),Dana Incorporated (United States),Gentherm Incorporated (United States),Grayson (Washington, DC),Hanon Systems (Daejeon, South Korea),Lord Corporation (North Carolina, United States),Mahle GmbH (Stuttgart, Germany),Polymer Science Inc. (Monticello, IN),Robert Bosch GmbH (Gerlingen, Germany),Valeo (Paris, France),Voss Automotive GmbH (Germany),BorgWarner Inc. (United States),Continental AG (Germany),Denso Corporation (Japan),Johnson Electric Holdings Limited (Hong Kong),Kongsberg Automotive (Norway),Other key Players

The Electric Vehicle Cooling System Market is segmented into System Type, Vehicle Type, and region. By System Type, the market is categorized into Air Cooling System, Liquid Cooling System. By Vehicle Type, the market is categorized into Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-in-Hybrid Electric Vehicle, Fuel Cell Electric Vehicle. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The cooling system is the system required the maintain the temperature of the battery of the electric vehicle. For mobility, electric vehicles depend on rechargeable batteries. Batteries in electric vehicles generate heat as they provide electricity to the motors, the thermal management system is required the maintain the temperature of the battery.

Electric Vehicle Cooling Systems Market Size Was Valued at USD 2.3 Billion in 2023, and is Projected to Reach USD 3.2 Billion by 2032, Growing at a CAGR of 3.9% From 2024-2032.